Oberoi Realty Ltd

Summary

- The Company develops residential, commercial, retail and social infrastructure projects

- The Company sold nearly 10,64,563 sq.ft. RERA carpet area in FY 2020-21.

- Total area booked for Q1FY22 was 0.92 lakh sq. ft. as against 0.12 lakh sq. ft. booked.

Company Overview

Oberoi Realty Ltd (NSE: OBEROIRLTY) is primarily engaged in the activities of Real Estate Development. The Company develops residential, commercial, retail and social infrastructure projects.

Projects

Residential

Andheri (E) 1

- Maxima by Oberoi Realty

- Oberoi Splendor

- Oberoi Splendor Grande

- Prisma by Oberoi Realty

Andheri (W)

- Oberoi Sky Heights

- Oberoi Springs

Borivali (E)

- Sky City by Oberoi Realty

Goregaon (E)

- Elysian by Oberoi Realty

- Esquire by Oberoi Realty

- Exquisite by Oberoi Realty

- Oberoi Seven

- Oberoi Woods

Juhu

- Beachwood House

Kandivali (E)

- Oberoi Parkview

- Oberoi Sky Gardens

Khar (W)

- Oberoi Crest

Mulund (W)

- Enigma by Oberoi Realty

- Eternia by Oberoi Realty

Santacruz (W)

- Priviera by Oberoi Realty

Worli

- Three Sixty West

Commercial

Andheri (W)

- Oberoi Chambers

Goregaon (E)

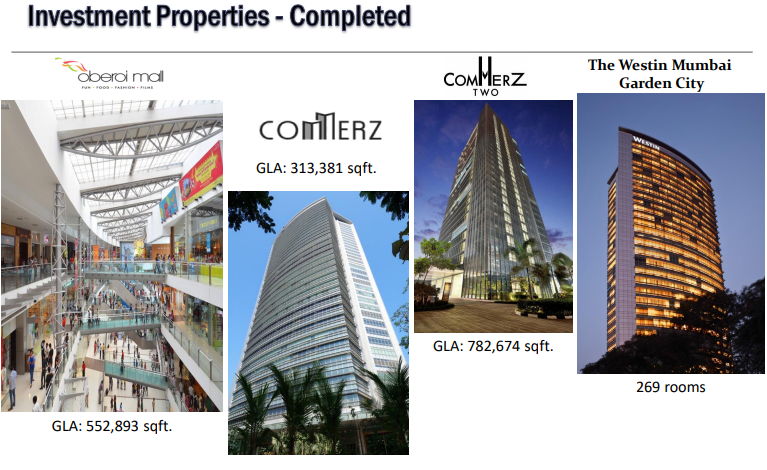

- Commerz

- Commerz II

Retail

Goregaon (E)

- Oberoi Mall

Social Infrastructure

Andheri (E)

- Oberoi International School – JVLR Campus

Goregaon (E)

- Oberoi International School – OGC Campus

Hospitality

Goregaon (E)

- The Westin Mumbai Garden City

Industry Overview

The real estate sector is one of the most globally recognized sectors. The real estate sector comprises four sub sectors - housing, retail, hospitality and commercial. The growth of this sector is well complemented by the growth of the corporate environment and the demand for office space as well as urban and semi-urban accommodations. The construction industry ranks third among the 14 major sectors in terms of direct, indirect and induced effects in all sectors of the economy. 2

By 2040, real estate market will grow to Rs 65,000 crore from Rs 12,000 crore in 2019. Real estate sector in India is expected to reach a market size of US$ 1 trillion by 2030 from US$ 120 billion in 2017 and contribute 13% to the country’s GDP by 2025. Retail, hospitality and commercial real estate are also growing significantly, providing the much-needed infrastructure for India’s growing needs. Indian real estate is expected to increase by 19.5% CAGR from 2017 to 2028.

After the unlocking process was initiated in the third quarter of 2020, both the residential and office markets started showing promising signs of revival. As business activities resumed with the gradual opening of the economy in the third quarter of 2020, the office market witnessed green shoots of recovery. Sentiments improved further in the last quarter of 2020 with the news of potential vaccine development and the office market continued its recovery momentum. Net absorption increased by 52%, while new completions grew by 39% when compared to the preceding quarter.

Home sales volume across eight major cities in India jumped by 2.5x to 33,403 units from July 2020 to September 2020, compared with 9,632 units in the previous quarter, signifying healthy recovery post the strict lockdown imposed in the second quarter due to the spread of COVID-19 in the country.

Mumbai Real Estate

Home sales in India’s eight prime residential markets increased by 12% in the January-March quarter compared to OctoberDecember quarter of 2020. Average value of property sold also rose 14% to Rs 66 lakh. The past few months have re-laid the foundation of the real estate sector, not just in the Mumbai Metropolitan Region but entire Maharashtra, largely owing to measures taken by the state to boost demand during the pandemic. MMR and Pune accounted for 53% of total sales in top seven Indian cities in the fourth quarter of 2020-21.

Property markets of Mumbai Metropolitan Region (MMR) and Pune are driving the most housing sales among the country’s top seven cities as indicated by the rising contribution of these markets in total sales led by reduction in stamp duty, discounts and appropriate product strategies of developers. The stamp duty cut is effective till March and while it rose from 2% to 3% starting January, it is still lower than 5% prior to the pandemic. The state had slashed the levy to aid the housing sector that was grappling with a prolonged slump even prior to the pandemic. That, coupled with record-low lending rates, aided demand as the city’s wealthy, including Bollywood stars to bankers buying homes.

The city’s real estate market has bounced back from the brief slump with a roar owing to sharp sales jumps and affordability showing an improvement by 32% since 2010.

Registration of property transactions in Mumbai, the country’s biggest and costliest realty market, continued to grow at a rapid pace for the seventh successive month in March driven by record-low home loan rates, discounts and reduction in stamp duty charges.

Mumbai Metropolitan Region (MMR) has emerged as one of the most buoyant residential property markets in the country in the first quarter of 2021 with seven-year high decline in unsold units led by sales momentum despite new launches.

Maharashtra government’s decision to reduce real estate premiums by 50% is expected to generate economic activity worth Rs 10 lakh crores in the Mumbai Metropolitan Region (MMR), said the realty developers’ body CREDAI MCHI. This is primarily owing to the significant multiplier effect of the real estate industry on the economy, with over 250 allied industries directly or indirectly dependent on the sector.

Business Overview

Despite the subdued performance of overall sector, the company was able to sell nearly 10,64,563 sq.ft. RERA carpet area in FY 2020-21 as compared to approximately 4,01,914 sq.ft. of RERA carpet area in FY 2019-20.

Oberoi Garden City (Goregaon)

Oberoi Garden City is the flagship mixed-use development of the company. It is an integrated development on approximately 83 acres of land in Goregaon (East), in the western suburbs of Mumbai, adjacent to the arterial Western Express Highway and overlooking Aarey Milk Colony. The development is approximately 8 kilometers from Mumbai’s domestic airport and approximately 5 kilometers from the international airport.

Mulund (West)

The company is developing 2 land parcels (adjacent to each other) of approximately 9 acres each situated at Mulund (West), Central suburbs, Mumbai.

The project comprises of 2 premium high storey residential towers namely, Eternia and Enigma. The project site is situated on LBS Marg, overlooking Yeoor Hills and Borivali National Park to the west and Eastern Express Highway to the east. The project is the company’s first development in the eastern suburbs of Mumbai and it offers configurations in various sizes of 3 BHK and 4 BHK. The pricing sets the target audience to include Upper Middle class and NRIs.

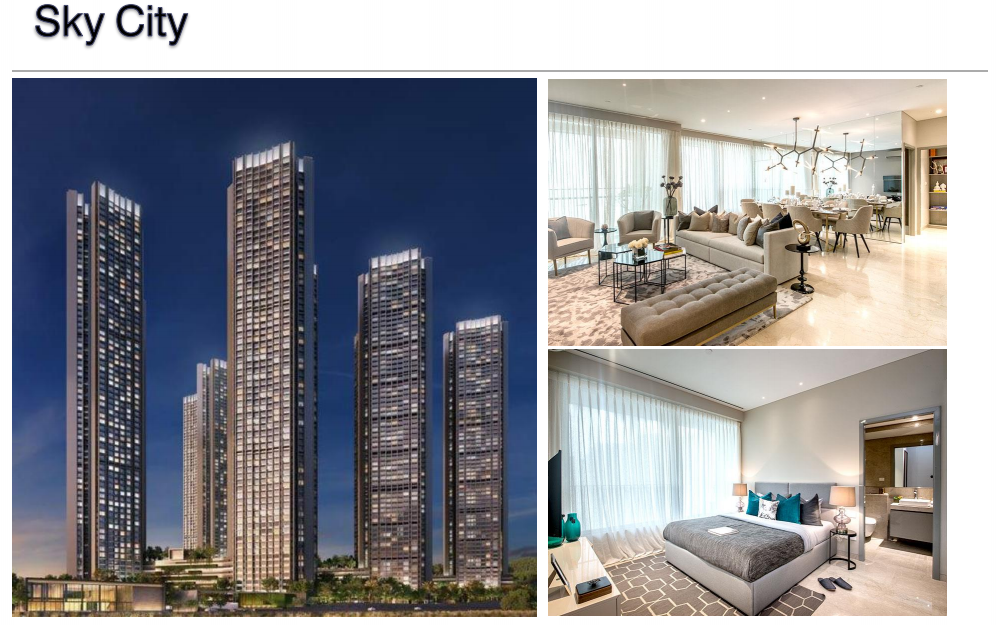

Sky City (Borivali East)

The company is developing approximately 25 acre land parcel at Borivali East with an estimated total carpet area of about 3.4 million sq.ft. The project site is situated at Borivali East, Off Western Express Highway overlooking Borivali National Park to the east. The surrounding infrastructure allows the site to be well connected to the rest of Mumbai.

JVLR (Andheri East)

The company has developed Prisma, a residential building with an estimated total carpet area of about 1,78,395 sq. ft., and Maxima, a residential building with an estimated total carpet area of about 2,38,623 sq. ft. which is a part of the ongoing projects within the Oberoi Splendor Complex. Both Prisma and Maxima are conveniently located on the arterial Jogeshwari Vikhroli Link Road in the Western suburbs of Mumbai and overlooking Aarey Milk Colony.

Three Sixty West (Worli)

Three Sixty West is being developed by a joint venture entity carrying out development of a mix use project in Worli, located on the arterial Annie Besant Road, consisting of 2 high-rise towers; The Ritz-Carlton, Mumbai and a residential tower, by the name Three Sixty West, to be managed by The Ritz-Carlton. This development which aims to be a global icon for Mumbai will mark the entry of The Ritz-Carlton into India’s financial capital. Strategically located in Worli, less than a kilometer from the prominent Bandra-Worli sea link, the development has been designed to be a luxury landmark adorning the Arabian Sea.

Financial Highlights

During the year under review, the company’s consolidated total revenue stood at Rs 2,09,058.65 lakh as compared to Rs 2,28,598.51 lakh for the previous year, representing a decrease of 8.55%; profit before tax stood at Rs 92,442.48 lakh for the year under review as compared to Rs 96,889.23 lakh for the previous year representing a decrease of 4.59%; and the total comprehensive income stood at Rs 74,154.22 lakh as compared to Rs 68,919.00 lakh for the previous year representing an increase of 7.60%.

Consolidated Financial results for Q1FY22

July 29th, 2021: Oberoi Realty Limited announced its results for the first quarter of FY22. The company has recorded Consolidated Revenues of Rs. 294.77 crore for Q1FY22 as against Rs. 126.86 crore for Q1FY21 and Rs. 800.87 crore for Q4FY21. 3

- The Consolidated Profit Before Tax for Q1FY22 was Rs. 109.63 crore as against Rs. 39.78 crore for Q1FY21 and Rs. 354.86 crore for Q4FY21.

- The Consolidated Profit After Tax for Q1FY22 was Rs. 80.81 crore as against Rs. 29.27 crore for Q1FY21 and Rs. 287.47 crore for Q4FY21.

- Total area booked for Q1FY22 was 0.92 lakh sq. ft. as against 0.12 lakh sq. ft. booked in Q1FY21 and the total value was Rs. 169.97 crore for Q1FY22 as against Rs. 24.79 crore for Q1FY21.

Commenting on the Q1FY22 results, Mr. Vikas Oberoi, Chairman & Managing Director, Oberoi Realty Limited said, “The real estate sector is undergoing major consolidation as very few developers have the financial stability to undertake large capital-intensive projects. Therefore, the market share of reputed brands with strong executional capabilities will continue to grow. This places Oberoi Realty in an exceptional position to leverage its strong financial governance and deliver value to all its stakeholders.

The company also have a robust pipeline of new launches with “first of a kind” design concept. These are specially created keeping in mind the new requirements of the homebuyer post the pandemic. The company believe that despite the pandemic, Oberoi Realty is resilient to perform, progress and deliver excellence. The company will continue to focus on customer centric designs, execution and delivery thus meeting all its commitments.”