Oil & Natural Gas Corp Ltd

- Overview

- Company History

- Majour subsidiary and JVs

- ONGC Videsh Limited (OVL)

- Mangalore Refinery and Petrochemicals Ltd (MRPL)

- Hindustan Petroleum Corporation Limited (HPCL)

- Petronet MHB Ltd (PMHBL)

- ONGC Tripura Power Company Limited (OTPC)

- ONGC Petro-additions Limited (OPaL)

- Mangalore Special Economic Zone Limited (MSEZ)

- ONGC Mangalore Petrochemicals Limited (OMPL)

- Dahej SEZ Limited (DSL)

- ONGC TERI Biotech Limited

- Industry Overview

- Business Overview

- Financial Overview

- Recent developments

- References

Overview

Maharatna Oil & Natural Gas Corp Ltd (NSE:ONGC) is the largest crude oil and natural gas Company in India, contributing around 75 per cent to Indian domestic production. Crude oil is the raw material used by downstream companies like IOC, BPCL, and HPCL (subsidiary of ONGC) to produce petroleum products like Petrol, Diesel, Kerosene, Naphtha, and Cooking Gas-LPG.1

This largest natural gas company ranks 11th among global energy majors (Platts). It is the only public sector Indian company to feature in Fortune’s ‘Most Admired Energy Companies’ list. ONGC ranks 18th in ‘Oil and Gas operations’ and 220 overall in Forbes Global 2000. Acclaimed for its Corporate Governance practices, Transparency International has ranked ONGC 26th among the biggest publicly traded global giants. It is most valued and largest E&P Company in the world, and one of the highest profit-making and dividend-paying enterprise.

ONGC has a unique distinction of being a company with in-house service capabilities in all areas of Exploration and Production of oil & gas and related oil-field services. Winner of the Best Employer award, this public sector enterprise has a dedicated team of over 30,000 professionals who toil round the clock in challenging locations.

ONGC Videsh Limited, a Miniratna Schedule “A” Central Public Sector Enterprise (CPSE) of the Government of India under the administrative control of the Ministry of Petroleum & Natural Gas, is the wholly owned subsidiary and overseas arm of Oil and Natural Gas Corporation Limited (ONGC), the flagship national oil company (NOC) of India. The primary business of ONGC Videsh is to prospect for oil and gas acreages outside India, including exploration, development and production of oil and gas. ONGC Videsh owns Participating Interests in 37 oil and gas assets in 17 countries and produced about 30.3% of oil and 23.7% of oil and natural gas of India’s domestic production in 2019-20. In terms of reserves and production, ONGC Videsh is the second largest petroleum company of India, next only to its parent ONGC.

ONGC subsidiary Mangalore Refinery and Petrochemicals Limited (MRPL) is a schedule ‘A’ Miniratna, Central Public Sector Enterprise (CPSE) under the Ministry of Petroleum & Natural Gas. The 15.0MMTPA (Million Metric Ton per annum) Refinery has got a versatile design with complex secondary processing units and a high flexibility to process Crudes of various API, delivering a variety of quality products. MRPL, with its parent company Oil and Natural Gas Corporation Limited (ONGC), owns and operates ONGC Mangalore Petrochemicals Limited (OMPL), a petrochemical unit capable of producing 0.905 MMTPA of Para Xylene and 0.273 MMTPA of Benzene.

ONGC subsidiary HPCL is a Maharatna CPSE. HPCL has the second largest share of product pipelines in India with a pipeline network of more than 3370 kms for transportation of petroleum products and a vast marketing network consisting of 14 Zonal offices in major cities and 133 Regional Offices facilitated by a Supply & Distribution infrastructure comprising Terminals, Pipeline networks, Aviation Service Stations, LPG Bottling Plants, Inland Relay Depots & Retail Outlets, Lube and LPG Distributorships. Consistent excellent performance has been made possible by highly motivated workforce of over 9,500 employees working all over India at its various refining and marketing locations.

Core Business Expertise

- Exploration

- Drilling

- Production

- Applied R&D and Training

- Engineering & Construction

Company History

ONGC was set up under the visionary leadership of Pandit Jawahar Lal Nehru. Pandit Nehru reposed faith in Shri Keshav Dev Malviya who laid the foundation of ONGC in the form of Oil and Gas division, under Geological Survey of India, in 1955. A few months later, it was converted into an Oil and Natural Gas Directorate. The Directorate was converted into Commission and christened Oil & Natural Gas Commission on 14th August 1956.2

In 1994, Oil and Natural Gas Commission was converted in to a Corporation, and in 1997 it was recognized as one of the Navratnas by the Government of India. Subsequently, it has been conferred with Maharatna status in the year 2010.

| The Company’s Evolution can be summarized as under: | |

| 1955 | Inception |

| 1958 | First Oil in Cambay |

| 1960 | Oil gas discovery in Gujarat |

| 1963 | Oil in Assam |

| 1965 | Concept of ONGC Videsh Operations |

| 1970 | first Offshore well |

| 1974 | Mumbai High discovered |

| 1976 | Bassein Gas field of Mumbai High |

| 1984 | GAIL formed out of ONGC |

| 1993 | ONGC a limited company |

| 1993 | Govt of India divest 2% share |

| 1994 | 2% share to employees |

| 1999 | Equity swap ONGC, IOC, GAIL |

| 2003 | Acquired Mangalore Refineries Petrochemicals Ltd from Birla Group |

| 2003 | Ist equity Oil & gas from Sudan / Vietnam |

| 2004 | Govt of India divests 10% |

| 2006 | Diversification – ONGC Petro additives Ltd and ONGC Mangalore Petro Ltd |

| 2007 | ONGC Energy Centre formed |

| 2010 | Coal Bed Methane Production |

| 2013 | Oil at Kazakhstan/Mozambique |

| 2014 | Top Energy Company of India; 5th in Asia, 21st globally: Platts |

| 2015 | ONGC Energy Center receives US Patent |

| 2016 | Forbes Global: ONGC 3rd largest in India |

| 2018 | 51.11% stake in Hindustan Petroleum Corporation Limited |

| 2019 | Invests Rs 83,000 crore in 25 projects; oil & gas gain over 180 MT |

| 2020 | ONGC bags 7 Blocks in Bid Round IV of OALP |

Majour subsidiary and JVs

ONGC Videsh Limited (OVL)

ONGC Videsh Limited, a Miniratna Schedule “A” Central Public Sector Enterprise (CPSE) of the Government of India under the administrative control of the Ministry of Petroleum & Natural Gas, is the wholly owned subsidiary and overseas arm of Oil and Natural Gas Corporation Limited (ONGC), the flagship national oil company (NOC) of India. The primary business of ONGC Videsh is to prospect for oil and gas acreages outside India, including exploration, development and production of oil and gas. ONGC Videsh owns Participating Interests in 37 oil and gas assets in 17 countries and produced about 30.3% of oil and 23.7% of oil and natural gas of India’s domestic production in 2019-20. In terms of reserves and production, ONGC Videsh is the second largest petroleum company of India, next only to its parent ONGC.3

ONGC Videsh has stake in 37 oil and gas projects in 17 Countries, viz. Azerbaijan (2 projects), Bangladesh (2 Projects), Brazil (2 projects), Colombia (7 projects), Iran (1 project), Iraq (1 project), Israel (1 project), Kazakhstan (1 project), Libya (1 project), Mozambique (1 Project), Myanmar (6 projects), Russia (3 projects), South Sudan (2 projects), Syria (2 projects), UAE (1 project), Venezuela (2 projects) and Vietnam (2 projects).

ONGC Videsh adopts a balanced portfolio approach and maintains a combination of producing, discovered, exploration and pipeline assets. Currently, ONGC Videsh has oil and gas production from 14 Assets, 4 Assets where hydrocarbons have been discovered and are at various stages of development, 16 Assets are under various stages of Exploration and 3 projects are pipeline projects.

Mangalore Refinery and Petrochemicals Ltd (MRPL)

ONGC subsidiary Mangalore Refinery and Petrochemicals Limited (MRPL) is a schedule ‘A’ Miniratna, Central Public Sector Enterprise (CPSE) under the Ministry of Petroleum & Natural Gas. MRPL is located in a beautiful hilly terrain, north of Mangaluru city, in Dakshina Kannada District of Karnataka State (India). The 15.0MMTPA (Million Metric Ton per annum) Refinery has got a versatile design with complex secondary processing units and a high flexibility to process Crudes of various API, delivering a variety of quality products.4

MRPL, with its parent company Oil and Natural Gas Corporation Limited (ONGC), owns and operates ONGC Mangalore Petrochemicals Limited (OMPL), a petrochemical unit capable of producing 0.905 MMTPA of Para Xylene and 0.273 MMTPA of Benzene.

Mangalore Refinery and Petrochemicals LtdBefore acquisition by ONGC in March 2003, MRPL, was a joint venture Oil Refinery promoted by M/s Hindustan Petroleum Corporation Limited (HPCL), a public sector company and M/s Indian Rayon and industries limited(IRIL) (AV Birla Group). MRPL was set up in 1988 with the initial processing capacity of 3.69 MMTPA that was later expanded to the present capacity of 15.0 MMTPA. The Refinery was conceived to maximize distillates, with capability to process light to heavy and sour to sweet Crudes with 24 to 46 API gravity. On 28th March 2003, ONGC acquired the total shareholding of A.V. Birla Group and further infused equity capital of Rs.600 crores thus making MRPL a majority held subsidiary of ONGC

Hindustan Petroleum Corporation Limited (HPCL)

ONGC subsidiary HPCL is a Maharatna CPSE. HPCL has the second largest share of product pipelines in India with a pipeline network of more than 3370 kms for transportation of petroleum products and a vast marketing network consisting of 14 Zonal offices in major cities and 133 Regional Offices facilitated by a Supply & Distribution infrastructure comprising Terminals, Pipeline networks, Aviation Service Stations, LPG Bottling Plants, Inland Relay Depots & Retail Outlets, Lube and LPG Distributorships. Consistent excellent performance has been made possible by highly motivated workforce of over 9,500 employees working all over India at its various refining and marketing locations.5

HPCL owns & operates 2 major refineries producing a wide variety of petroleum fuels & specialties, one in Mumbai (West Coast) of 7.5 Million Metric Tonnes Per Annum (MMTPA) capacity and the other in Visakhapatnam, (East Coast) with a capacity of 8.3 MMTPA. HPCL also owns and operates the largest Lube Refinery in the country producing Lube Base Oils of international standards, with a capacity of 428 TMT. This Lube Refinery accounts for over 40% of the India's total Lube Base Oil production.

Petronet MHB Ltd (PMHBL)

Petronet MHB Limited (PMHBL) was incorporated on 31 July 1998 on common carrier principle to provide petroleum product transportation facility from Mangalore Refinery at Mangalore to the Oil Marketing Company Terminals at Hassan & Devangonthi (Bangalore). It was a Joint Venture promoted by M/s Petronet India Ltd., and M/s Hindustan Petroleum Corp. Ltd. with 26% equity by each company. After PMHBL underwent corporate debt restructuring in 2006, HPCL & ONGC are holding 29% equity each, consortium of nationalized banks is holding 34% equity and Petronet India Ltd. is holding 8% equity in the Company.6

PMHBL pipeline was envisaged to transport the petroleum products such as MS commonly known as petrol, HSD commonly known as diesel, SKO commonly known as Kerosene, Naphtha and aviation turbine fuel to meet the needs of various districts viz. Hassan, Mysore, Mandya, Tumkur, Chikmangalore, Chitradurga, Shimoga, Kolar, Bellary, Raichur, Ramanagara, Bangalore Rural & Bangalore Urban districts of Karnataka State. The total cost of the project was Rs 640 crores. The main object was to transport petroleum product with high standard of quality measure and to render the best quality product to the customers through Oil Marketing Companies in order to reduce road / rail transportation and environmental pollution and also de-congestion of traffic in the highway.

PMHBL was incorporated to lay the pipeline as aforesaid which is first of its kind in transporting the petroleum product by underground pipeline in the state of Karnataka. The petroleum products are transported for a distance of 362.36 Km from Mangalore to Bangalore via Hassan.

ONGC Tripura Power Company Limited (OTPC)

Oil & Natural Gas Corporation Ltd. (ONGC), a Fortune 500 company of the Government of India, owns significant natural gas reserves in the North Eastern state of Tripura. However, these natural gas reserves were not developed commercially due to low industrial demand in the North-Eastern region.7

OTPC, a Joint Venture company of ONGCThe complexities of logistics and attendant costs limited the economic viability of transportation of gas to other parts of the country where gas is in deficit. In order to optimally utilize the gas available in Tripura and to supply power to the deficit areas of North Eastern States of India, ONGC along with Infrastructure Leasing and Financial Services Limited (IL&FS) and Government of Tripura (GoT) formed a Special Purpose Vehicle ONGC Tripura Power Company (OTPC) by entering into a Shareholders’ Agreement (SHA) on September 18, 2008 to implement a 726.6 MW Combined Cycle Gas Turbine (CCGT) thermal power plant at Palatana, Tripura.

ONGC Petro-additions Limited (OPaL)

ONGC Petro additions Limited (OPaL), a multibillion joint venture company was incorporated in 2006. OPaL is promoted by Oil and Natural Gas Corporation (ONGC) and co-promoted by GAIL and GSPC.8

OPaL has set up a grass root mega Petrochemical complex at Dahej, Gujarat in PCPIR/SEZ (Petroleum, Chemicals and Petrochemicals Investment Region/Special Economic Zone). The complex's main Dual Feed Cracker Unit has the capacity to produce 1100 KTPA Ethylene, 400 KTPA Propylene and the Associated Units consists of Pyrolysis Gasoline Hydrogenation Unit, Butadiene Extraction Unit and Benzene Extraction Unit. The Polymer plants of OPaL has 2X360 KTPA of LLDPE/HDPE Swing unit, 1X340 KTPA of Dedicated HDPE and 1x340 KTPA of PP. The project commenced its production after the inauguration by Prime Minister Narendra Modi in March 2017.

The demand for polymers in India is huge and is expected to further rise with the growth in GDP. India will continue to be in deficit of Polyethylene in the foreseeable future. Moreover, this also works as a perfect downstream integration for ONGC - the key promoter who supply the required feedstock Naphtha from its Hazira, Uran and Dahej facilities, which is essential to run the plant in full capacity.

Driven by innovation, OPaL intends to build a world class petrochemical enterprise unlocking potential of its people and offer differentiated products and services.

Mangalore Special Economic Zone Limited (MSEZ)

Mangalore Special Economic Zone Limited (MSEZL) is one of India’s vibrant and operational multi-product SEZs with investments exceeding US $2 billion so far. With exports of over US $ 400 million worth of goods from its units, MSEZL has emerged as a favored manufacturing destination in India.9

Spread across 1600 acres near Mangalore city, MSEZL is jointly promoted by Oil & Natural Gas Corporation (ONGC), a Fortune 500 Company and Infrastructure Leasing & Finance Services (IL&FS), one of India's leading infrastructure development and finance companies, Karnataka Industrial Area Development Board (KIADB) and Kanara Chamber of Commerce and Industry (KCCI). A unique combination of Government entities, a large financial institution and an apex chamber brings in the expertise to develop MSEZL with world-class industrial infrastructure.

MSEZL is located 15 kms from Mangalore city center, off Cochin Mumbai NH 17, 5 kms from International Airport and 8 kms from all-weather deep draft sea port. Since MSEZL is well connected by Air, Sea, Rail and Road, it offers excellent national and international logistics connectivity. Mangalore has been ranked 13th best business destination in India based on a study by Global Initiative for Restructuring Environment and Management (GIREM).

ONGC Mangalore Petrochemicals Limited (OMPL)

ONGC Mangalore Petrochemicals Limited (OMPL), a green field petrochemicals project, is promoted by Oil and Natural Gas Corporation Ltd (ONGC) – India's Most Valuable Public Sector Enterprise and Mangalore Refinery and Petrochemicals Limited (MRPL) a subsidiary of ONGC. OMPL was incorporated on 19 December 2006.10

The Complex is the largest single stream unit in Asia to produce 914 KTPA Para-xylene and 283 KTPA Benzene.

This Aromatic Complex is situated in 442 Acres of land in the Mangalore Special Economic Zone (MSEZ), and is fully integrated with MRPL. At 100% operational load, the complex shall produce 914 KTPA Para-xylene and 283 KTPA Benzene.

Dahej SEZ Limited (DSL)

Dahej SEZ Limited (DSL) is a company registered under the companies act, 1956 and is promoted jointly by Gujarat industrial development corporation (GIDC) and Oil & Natural Gas Corporation (ONGC) for development of Special Economic Zone (SEZ). DSL is developing a Multi-Product SEZ at Dahej in Vagra Taluka of Bharuch district in Gujarat, India.11

ONGC TERI Biotech Limited

TERI, a leader in the field of bioremediation of oil spill sites, has been providing such services to ONGC. To use bioremediation technology as well as other biotechnology solutions such as Microbial Enhanced Oil Recovery (MEOR) and Wax Deposition Prevention (WDP) on a large scale in oilfield installations, a joint venture “OTBL” was formed between TERI and ONGC. The share of ONGC in this partnership is 49.98% and that of TERI is 48.02%.12

OTBL today is providing large-scale bioremediation solutions, by application of ‘OILZAPPER’ for cleaning up oil spills, undertaking MEOR and WDP/PDB jobs for the prevention of paraffin deposition in oil well tubing and surface flow lines, to oil companies in India and abroad, especially in the Middle East.

Oil and Natural Gas Corporation Limited (ONGC) and The Energy and Resources Institute (TERI) have a prolific association in the field of microbial biotechnology since 1996. The persistent efforts put in by scientists in microbiology laboratories of both ONGC and TERI for finding ways for enhanced oil recovery resulted in promising collaborative research. A long success story of the collaboration between ONGC and TERI culminated in the formation of ONGC TERI Biotech Limited (OTBL) in 2. Thus, from laboratory scale to pilot to successful field application through OTBL—summarizes the progress of collaborative efforts of microbial-enhanced oil recovery between ONGC and TERI so far.

Industry Overview

Global Energy Sector

For a long time now, fossil fuels – viz, coal, oil and natural gas have played a predominant role in the energy basket. In 2019, the three together combined for over 80 percent of the total global energy demand. However, the rapid growth of renewables, spurred by a global consensus on a cleaner energy ecosystem, particularly post the historic COP-21 agreement in Paris in 2015, and rapid technology advances, is expected to eat into the share of fossil fuels. This is what the industry calls the ‘Energy Transition’. But, fossil fuels are still expected, as per most industry and independent estimates, to be relied upon significantly for catering to a majority of the planet’s energy needs.13

Global Economy Basket

As per BP Statistical Review of World Energy 2020, energy demand growth slowed down to 1.3 percent, less than half of what was registered in 2018 (2.8 percent). China was by far the biggest driver of this growth, accounting for more than three quarters of net global growth. India and Indonesia were the next largest contributors to growth, while the US and Germany posted the largest declines. Carbon emissions also declined in step with energy consumption – growing at 0.5 percent, significantly less than the over 2 percent growth in 2018.

Within the energy basket, increase in energy consumption was driven by renewables and natural gas, which together contributed three quarters of the expansion. All fuels grew at a slower rate than their 10-year averages, apart from nuclear. Oil demand growth was 0.9 Million BPD (0.9 percent) while Natural gas consumption increased by 78 billion cubic metres (BCM), or 2 percent, much below the exceptional growth seen in 2018 (5.3%). Share of gas in the mix rose to a record high of over 24 percent. Renewable energy (including biofuels) posted a record increase of 12.2 percent in 2019 (~76.4 MMTOE), the largest increment for any source of energy in 2019. Wind provided the largest contribution to renewables growth followed closely by solar.

Crude Oil Demand and Supply

Global oil demand was already on a downward trend, even before COVID-19. In 2019 total liquids demand growth slid down to 0.9 Million bpd, a steep drop-off of 600,000 bpd from the 1.5 Million bpd growth registered in 2018, as per IHS-Markit. The first sub-Million bpd average annual demand growth since 2012 came on the back of a broad-based global economic slowdown, a contraction in global trade and manufacturing, and escalation in the global trade war(s). The demand outlook is dismal for 2020: IEA projects a decline of 9.3 Million bpd. India’s crude demand growth for 2019 was a mere 100,000 bpd – a reflection of a broadbased economic slowdown, which affected the auto and industrial sectors particularly badly.

Supplies declined by 300,000 BPD in 2019. On the growth side, US was, by far, the largest producer with a cumulative output of 12.2 Million BPD, growing by 1.2 Million BPD over 2018 volumes. But this growth was negated by the production cuts engineered by the OPEC+ group, led by Saudi Arabia, as well as the Iranian barrels that did not enter the market due to US sanctions. Iran’s crude output declined by 1.2 Million BPD and Saudi Arabia reduced production by 500,000 BPD in 2019. Crude Supply in 2020 is expected to be vastly lower – by about 9.2 Million BPD as per IHS-Markit – in view of dismal demand scenario in the wake of COVID-19.

US tight oil, the largest contributor to global supply growth over the last decade, will have tough time surviving in the current price environment. As per IHS-Markit analysis, at WTI under $35/bbl, US oil output falls to 9.3 Million BPD by December 2020, from 12.8 Million BPD in December 2019.

Exploration

2019 was a solid year for global exploration. Exploration & Appraisal Spends globally totalled just over USD 33 billion, compared to USD 41 billion in 2018 – yet discovered volume of 21.2 billion boe , was more than double than that of 2018, as per Wood Mackenzie. It reflects the capital discipline and high-grading of exploratory efforts (prospects) deployed by the industry since the 2014 price crash, resulting in lower discovery costs per boe as well a higher percentage of commercially viable finds. It also marked the third year in a row that conventional exploration has been profitable.

Many explorers are targeting gas. Nearly twothirds of 2019 discovered volumes were gas (82 tcf ). Three quarters of volumes concentrated in the top 20 finds. Although, liquids still offer higher economics and contribute to 50 percent of initially-estimated development value.

Just as in the previous price downturn, exploration budgets will be pared in 2020 as the oil sector reacts to the huge ramifications of the COVID-19 outbreak – this means already lean exploration budgets will become leaner still. Wood Mackenzie expects cuts of around 25 percent. Frontier exploration that was already cut post-2014 will be relegated further while exploration continues shift decisively towards maturing Basins.

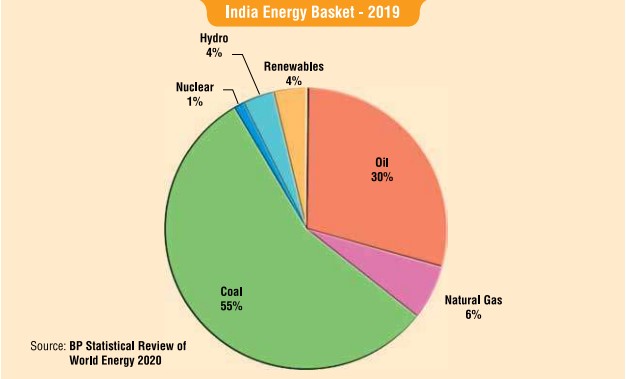

India Energy Snapshot

With an economy that has grown consistently over the past two decades, underpinned by robust domestic demand, world’s largest youth population and increasing urbanization, India remains vitally important to global energy markets. In step with its economic heft, the country’s energy demand graph has also charted a similar course – in the past decade, energy demand has grown at a pace of 5.3 percent CAGR versus a world average of 1.6 percent. As per the IEA World Energy Outlook 2019, the country will be the hub of global energy demand growth for the next two decades. The country’s primary energy demand grows from a level of 916 MMTOE in 2018 to 1841 MMTOE in 2040, under the Stated Policies Scenario, contributing over 27 percent of the energy demand growth during the period. Despite the healthy outlook for renewables the energy mix, fossil fuels still account for 75 percent of the energy basket in 2040, with the share of oil and gas share at 32 percent (oil 23 percent and gas 9 percent).

Oil import reliance has become a problem area for the country’s energy strategy. Cumulative forex outgo on account of crude imports have exceeded USD 1 trillion over the past decade. In FY’20, import dependency touched 85 percent, based on domestic consumption of petroleum products. The country does therefore benefit during a low price period as prevailing now. That being said, increasing domestic output remains key to better mitigating the external supply risks and price volatility. The Government is also bullish on long-term prospects of gas and has set a clear mandate of achieving a 15 percent share for gas in energy mix by 2030. The upstream sector, thus, assumes critical significance in expanding the country’s domestic resource availability while generating significant employment opportunities and industrial activity.

Crude Oil & Natural Gas Production

As per Petroleum Planning and Analysis Cell (PPAC) data, Domestic crude oil production in FY’20 stood at 32.20 Million Metric Tonnes (MMT) versus 34.20 MMT during FY’19. ONGC’s standalone production was 20.71 MMT vs 21.11 MMT in FY’19. Production from Oil India Ltd and PSC/JVs was 3.10 MMT and 8.40 MMT respectively.

Natural Gas output in FY’20 was 31.80 Billion Cubic Metres (BCM), versus 32.87 BCM in FY’19. ONGC’s standalone domestic output stood at 23.85 BCM. Oil India produced 2.67 BCM and other private operators 4.67 BCM.

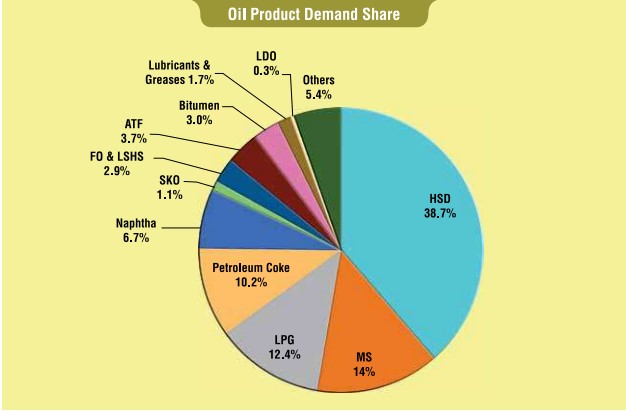

Consumption of Petroleum Products

According to PPAC figures, Domestic petroleum products consumption in FY’20 totalled 213.7 MMT, growing by just a measly 0.2 percent from FY’19, recording its worst ever growth. The downtrend in consumption was largely attributable to the countrywide lockdown measurers implemented in late-March to contain the spread of Coronavirus resulting in significant demand cutbacks in large segments of the economy, especially in transportation and industry. Consumption of petroleum products during March 2020 was 16.1 MMT as against 19.6 MMT in March last year. Consumption growth was slowing down even before COVID-19. For the 11-month period till February demand grew at just 2 percent relative to the corresponding period in FY’19. Compare this sluggish pace with the average decadal annual growth rate of 4.7 percent, and it indicates the negative demand impact arising out of a broader slowdown in the economy. Further, the current demand slump is counter-cyclical as crude oil prices have trended lower through FY’20.

Looking ahead as per CRISIL Research, domestic petroleum product demand is expected to grow at 3.0-3.5 percent CAGR in the next five years to close to 250 MMT. This is against the robust growth of 5.6 percent in the past five years.

Import and Export

Growth in crude oil imports also stalled in FY’20 – 226.95 MMT versus 226.49 MMT in FY’19, a historic low growth, as per PPAC data. So, the overall import growth decline is reflective of unenthusiastic demand within the economy throughout the year. Import outlook for 2020 remains largely stagnant at 4.4 Million BPD, as per IHS-Markit, with definite downside risks due to COVID-19. Petroleum product export for FY’20 stood at 65.66 MMT, against 61.09 MMT in FY’19.

The drop in crude prices had a positive impact on the country’s import bill. Crude import bill for FY’20 was ` 7,166.27 billion (USD 101.38 billion) against ` 7,831.83 billion (USD 111.91 billion) during FY’19. With crude prices expected to stay low through 2020-21 (USD 34/bbl in 2020 and USD 44/bbl in 2021 as per IHS-Markit), a direct fallout of COVID-19 pandemic, the country stands to gain in terms of its trade as well as fiscal deficit.

Business Overview

Crude oil and natural gas production by the Company, including its share in Joint Ventures (PSC JVs) during FY’20 was 48.25 MMTOE (Million Tons of Oil Equivalent) which is about 3.6 per cent less than the production during FY’19 (50.04 MMTOE). The company has been making all efforts to arrest the decline in the production from its matured fields through various measures like Improved Oil Recovery (IOR) and Enhanced Oil Recovery (EOR) methods and other production enhancement methods. Further, the company has made commendable performance in the core area of exploration by registering Reserve Replacement Ratio of 1.19. All efforts are being made to enhance production.

During FY’20, the accretion to In-place Hydrocarbons from Company operated domestic fields has been 100.22 MMTOE in 2P and Estimated Ultimate Reserve (EUR) was 53.21 MMTOE in 2P. In terms of 3P category, in-place hydrocarbon accretion was 98.99 MMTOE and EUR was 40.74 MMTOE on account of exploratory efforts from the Company-operated areas in India.

The company’s share in In-place volume of accretion in the Joint Venture (JV) fields in India, where it is not the operator, have been estimated to the extent of 7.14 MMT O+OEG (3P) and 1.59 MMT O+OEG in EUR (3P).

Award of E&P Blocks

The company was awarded 15 Blocks under OALP Rounds (OALP-II, OALP-III, and OALPIV), with an area of 32,117 Km2 of exploration acreage in different sedimentary basins of the country - 23,732 Km2 of the acreage in onshore while 8,385 Km2 in offshore (Shallow Water (SW): 5,894 Km2 ; Deep Water (DW): 2,491 Km2 ). The company has already started exploratory activities in few of the awarded blocks and has acquired 1,432.14 Square Kilometer (SKM) of 3D data in MN-DWHP-2018/1 block (Mahanadi deep-water) and 310 Line Kilometer (LKM) of 2D and 88.22 SKM of 3D seismic data in MBOSHP-2018/1 block (Mumbai Offshore-SW).

Reserve Position and Reserve Accretion

The company adopted Petroleum Resource Management System (PRMS) for estimation of hydrocarbon reserves. With this approach, as on 01.04.2020, accretion of In-Place Hydrocarbons (3P) from the Company operated fields stood at 98.99 MMTOE due to exploratory efforts, out of which 56 per cent accretion were on account of New Discoveries.

Total In-Place Reserve Accretion during FY’20 in domestic basins was 106.14 MMTOE, including 7.14 MMTOE from the Company’s share in PSC JVs.

As on 01.04.2020, total In-Place Hydrocarbon Volume (3P) of the Company Operated and JV Fields stood at 9,997.22 MMTOE against 10,002.63 MMTOE as on 01.04.2019. The Estimated Ultimate Recovery (3P) at the end of FY’20 was assessed at 3,286.63 MMTOE against 3251.60 MMTOE estimated as on 01.04.2019.

During the year, the Estimated Ultimate Recovery (EUR) accretion in 2P category from the Company operated areas in India was 53.21 MMTOE.

Accretion of In-Place Hydrocarbons and Estimated Ultimate Recovery (EUR) by the Company in its operated areas and in NonOperated areas (JV Share) during FY’20 and position of In-Place Hydrocarbons and Estimated Ultimate Recovery (EUR) as on 01.04.2020 were as below:

| In-place Hydrocarbon volumes and Estimated Ultimate Recovery (EUR) | Units in MMTOE | ||||||

| Accretion during the year 2019-20 | Position as on 01.04.2020 | ||||||

| Reserve Type | Company Operated | JV Operated | Total | Company Operated | JV Operated | Total | |

| In-place Hydrocarbon | 2P | 100.22 | 2.71 | 102.93 | 8,150.16 | 667.82 | 8,817.98 |

| 3P | 98.99 | 7.14 | 106.14 | 9,305.04 | 692.18 | 9,997.22 | |

| EUR | 2P | 53.21 | 1.74 | 54.95 | 2,939.78 | 119.68 | 3,059.45 |

| 3P | 40.74 | 1.59 | 42.33 | 3,166.74 | 119.89 | 3,286.63 | |

| Position of Reserves and Contingent Resources as on 01.04.2020 | Units in MMTOE | |||

| As per PRMS# | Category | Company Operated | JV Operated | Total |

| Reserves | 2P | 751.72 | 20.64 | 772.35 |

| 3P | 810.38 | 20.85 | 831.23 | |

| Contingent Resources | 2C | 408.38 | - | 408.38 |

| 3C | 576.68 | - | 576.68 | |

| Note: # as per PRMS adopted w.e.f. 01.04. 2019 |

Drilling of Wells

The company drilled 500 wells during FY’20, including 5 exploratory and 10 development wells in KG deep-water block, as against 516 drilled during FY’19, as given under:

| Well Description | FY’19 | FY’20 |

| Exploratory (including shale) | 105 | 106 |

| Development | 373 | 357 |

| Side Tracks | 38 | 37 |

| Total | 516 | 500 |

Financial Overview

For FY’20, oil & gas production of ONGC Group, including PSC-JVs and from overseas Assets has been 63.21 MMTOE (against 64.88 MMTOE during FY’19). ONGC-operated domestic fields accounted for bulk of the oil and gas production – 63 percent and 80 percent respectively

Oil and gas production profile from domestic as well as overseas assets during last five years are as given below:

| Oil and Gas Production | FY’20 | FY’19 | FY’18 | FY’17 | FY’16 |

| Crude Oil Production (MMT) | 33.11 | 34.33 | 34.79 | 33.97 | 31.44 |

| ONGC | 20.71 | 21.11 | 22.31 | 22.25 | 22.36 |

| ONGC’s share in JV | 2.64 | 3.12 | 3.13 | 3.29 | 3.57 |

| ONGC Videsh | 9.76 | 10.1 | 9.35 | 8.43 | 5.51 |

| Natural Gas Production (BCM) | 30.12 | 30.55 | 29.42 | 27.64 | 25.94 |

| ONGC | 23.85 | 24.75 | 23.48 | 22.09 | 21.18 |

| ONGC’s share in JV | 1.04 | 1.06 | 1.13 | 1.18 | 1.35 |

| ONGC Videsh | 5.23 | 4.74 | 4.81 | 4.37 | 3.41 |

| Proved Reserves(MMTOE) | FY’20* | FY’19* | FY’18 | FY’17 | FY’16 |

| Estimated Net Proved O+OEG Reserves | 960.82 | 991.37 | 982.01 | 928.16 | 909.34 |

| ONGC | 602.55 | 625.52 | 683.46 | 696.47 | 691.28 |

| JV share | 17.82 | 20.07 | 11.42 | 14.46 | 18.59 |

| ONGC Videsh** | 340.45 | 345.78 | 287.13 | 271.23 | 199.47 |

Revenue from operations stood at Rs 962,136 Million against Rs 1,096,546 Million (restated) in FY’19.

Net profit was Rs 134,445 Million against Rs 267,646 Million during FY’19 (restated) mainly due to lower realisation on crude and exceptional item towards impairment.

The Operating Profit Margin Ratio for FY’20 was 29.20% against 38.78% in FY’19 i.e. decrease of 24.70% mainly due to substantial decrease in Operating Income Before Interest & Tax by 33.94%. The decrease in Operating Income Before Interest & Tax is mainly due to decrease in revenue from operations by 12.26%, increase in Depreciation, Depletion, Amortisation & Impairment by 20.45% and increase in Provisions and Write-offs by 15.13%.

The Net Profit Margin Ratio for FY’20 was 14% against 24.40% in FY’19 i.e. decrease of 42.62%, mainly on account of substantial decrease of 49.77% in Profit After Tax. The decrease in Profit After Tax is mainly due to decrease in Operating Income Before Interest & Tax by 33.94%, increase in finance cost by 13.31% and a charge of ` 48,990 Million towards an exceptional item - impairment during FY’20.

ONGC Q2 FY'21 results: Net profit falls 19% YoY to Rs 4,335 crore; revenue declines 18%

Oil and Natural Gas Corporation (ONGC) on Friday November 11, 2020; posted around 19 per cent year-on-year fall in consolidated net profit (attributable to owners of the company) at Rs 4,335.31 crore for the quarter ended September 30. The figure stood at Rs 5,349.20 crore for the corresponding quarter last year.14

Consolidated revenue from operations declined 17.70 per cent YoY to Rs 83,619.16 crore.

ONGC said it has considered possible effects of low crude oil and natural gas prices on the recoverability of its cash generating units. As a result, the company has recognised an exceptional item towards impairment loss of Rs 1,238 crore in Q2FY21 to factor into estimated future crude oil and natural gas prices.

“This impairment loss may be reversed in future as and when there is increase in crude oil and gas price,” ONGC said.

On the other hand, standalone net profit of the company dipped by 54.60 per cent YoY to Rs 2,878 crore.

In a release, ONGC said, “The revenue and PAT for Q2 and H1 of FY21 have declined as compared to corresponding period of FY20 mainly due to lower crude oil price realisation. Lower gas prices also contributed to lower topline and bottom line.”

Recent developments

ONGC signs contract for 7 oil and gas blocks.15

November 17,2020; ONGC signed contracts for seven oil and gas blocks it had won in the latest bid round that saw scant participation from the private sector.

Oil India Ltd signed up for the remaining four blocks awarded under the fifth bid round of Open Acreage Licensing Policy (OLAP).

Speaking at the signing ceremony, Oil Minister Dharmendra Pradhan said with the latest bid round, the government has in the last four years awarded 1.56 lakh square kilometre of acreage for finding and producing oil and gas.

This compares to 90,000 sq km of area awarded in nine rounds of New Exploration Licensing Policy (NELP) and pre-NELP awards in the previous two decades.

He, however, wanted explorers to expedite the hunt for oil and gas so as to make the nation self-reliant in energy. "You have to exponentially speed up," he said.

Red-tape and multiple permissions needed for exploring and producing oil and gas have in the past led to several slippages in the committed timelines.

"Tell it, if you need more help," Pradhan said asking explorers to give suggestions on improving the regulatory environment. "Business as usual cannot work."

The minister also wanted the data repository set up by his ministry''s upstream nodal agency, the Directorate General of Hydrocarbons (DGH), to be remodelled on lines of the National Geoscience Data Repository (NGDR) of the mines ministry.

He wanted the data repository, which houses geological data of Indian sedimentary basins, to become an independent profit centre.

The NGDR is a public-private initiative for all non-coal and non-fuel resources.

The government had offered 11 blocks for exploration and production of oil and gas in OLAP-V.

A total of 12 bids, including seven bids by ONGC and four by OIL, were received for the 11 blocks on offer at the close of bidding on June 30. Invenire Petrodyne Ltd was the only private bidder for one block.

While ONGC was the sole bidder for six blocks, OIL was the lone bidder in all the four blocks it bid for.

ONGC won all six blocks where it was the sole bidder and also the one block where Invenire Petrodyne had bid.

The previous bid round, OALP-IV, too had seen just eight bids coming in for seven blocks on offer. ONGC had walked away with all the seven oil and gas blocks on offer.

Prior to OALP-V, the government had awarded 94 blocks in four OALP bid rounds since 2017. These 94 blocks cover an exploratory area of about 1,36,790 sq km over 16 Indian sedimentary basins.

In the latest bid round, about 19,800 sq km of the area was offered for bidding, he said.

At the time of the launch of OALP-V, DGH had stated that the round is expected to "generate immediate exploration work commitment of around USD 400-450 million".

Of the 94 blocks awarded in the first four rounds of OALP, Vedanta has won the maximum at 51. Oil India Ltd has got 21 blocks and ONGC another 17.

After OALP-V, ONGC''s tally has gone up to 24 and that of OIL to 25.

Under OALP, companies are allowed to carve out areas they want to explore oil and gas in. Companies can put in an expression of interest (EoI) for any area throughout the year, but such interests are accumulated thrice in a year. The areas sought are then put on auction.

References

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/Our-Growth-Story/

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/subsidiaries/ongc-videsh-limited

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/subsidiaries/mrpl

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/subsidiaries/hpcl

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/subsidiaries/pmhbl

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/otpc/

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/opal

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/msez

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/ompl

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/dsl

- ^ https://www.ongcindia.com/wps/wcm/connect/en/about-ongc/jvs/otbl

- ^ https://www.ongcindia.com/wps/wcm/connect/31cce834-fb8f-49c1-a2c4-38df2f712f7c/ONGC_AR_2019-20.pdf

- ^ https://economictimes.indiatimes.com/markets/stocks/earnings/ongc-q2-results-net-profit-falls-19-yoy-to-rs-4335-crore-revenue-declines-18/articleshow/79213230.cms

- ^ https://www.moneycontrol.com/news/business/ongc-signs-contract-for-7-blocks-oil-4-blocks-6127421.html