Petronet LNG Ltd

Summary

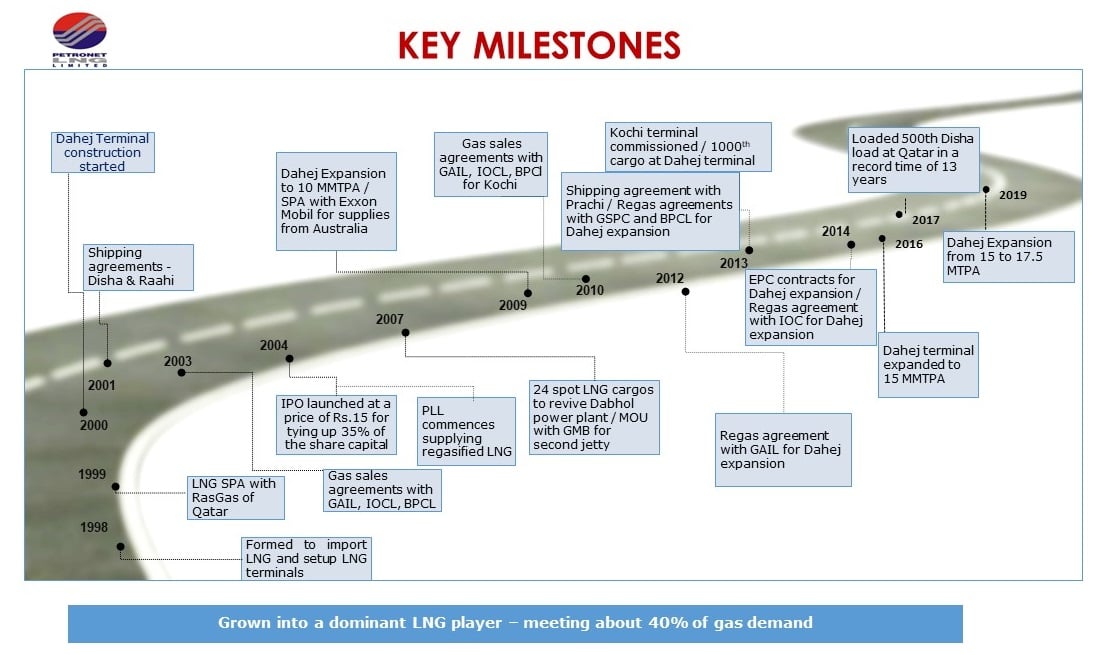

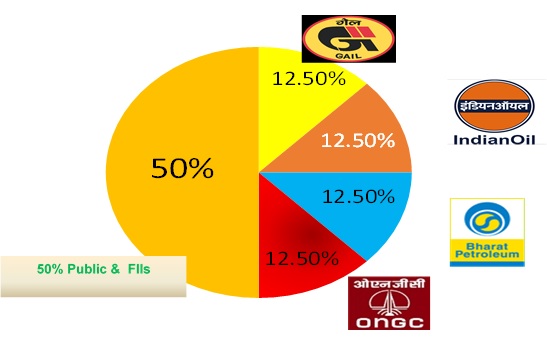

- Petronet LNG Limited (PLL) formed on April 2, 1998 as Joint Venture Company (JVC) having 50% shareholding of leading 4 Oil & Gas PSUs.

- Participation of Public Sector to the extent of 50%, balance 50% equity is being held by Public, FIIs, FPIs, Mutual Funds etc.

- Dahej Terminal has a nominal capacity of 17.5 MMTPA, and Kochi Terminal has a capacity of 5 MMTPA

- Petronet LNG is expanding business in Bangladesh and Sri Lanka by setting up LNG terminals there.

Company Overview

Petronet LNG Limited (NSE:PETRONET), one of the fastest growing world-class companies in the Indian energy sector, has set up the country’s first LNG receiving and regasification terminal at Dahej, Gujarat and another terminal at Kochi, Kerala. While the Dahej Terminal has a nominal capacity of 17.5 MMTPA, the Kochi Terminal has a capacity of 5 MMTPA. Petronet’s Terminals today account for around 40% gas supplies in the country and handle around 75% of LNG imports in India. 1

Petronet LNG is at the forefront of India’s all-out national drive to ensure the country’s energy security in the years to come. Formed as a Joint Venture Company by the Government of India to import LNG and set up LNG terminals in the country, it involves India’s leading oil and natural gas industry players. The company's promoters are GAIL (India) Limited (GAIL), Oil & Natural Gas Corporation Limited (ONGC), Indian Oil Corporation Limited (IOCL) and Bharat Petroleum Corporation Limited (BPCL). The authorized share capital of the Company is Rs. 3000 Crore.

Promoters

- Bharat Petroleum Corporation Limited (BPCL)

- GAIL (India) Limited (GAIL)

- Indian Oil Corporation Limited (IOCL)

- Oil and Natural Gas Corporation Limited (ONGC)

DAHEJ LNG Terminal

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country.2

The terminal has two LNG Jetties at Dahej. While the first jetty can handle berthing of up to Q-Flex vessels, the second jetty can handle berthing of up to Q-Max vessels.

Dahej terminal has received more than 2200 cargoes. The terminal is also offering tolling services to Offtakers & Bulk customers. To cater the small customers who are not having gas pipeline connectivity, Dahej is supplying LNG to such customers which is transported through cryogenic trucks.

PLL Dahej is first terminal to start loading of LNG in trucks for supply of LNG to the areas where pipelines have not reached and today has 04 truck loading bays and hub for development of Small Scale LNG business.

KOCHI LNG Terminal

To cater the gas requirement of the Southern India, Petronet LNG Limited commissioned its second LNG receiving, storage and regasification terminal in Kochi with 5 MMTPA nameplate capacity. The terminal area is situated in the Special Economic Zone (SEZ) of Puthuvypeen near the entrance to Cochin Port. The jetty facility is designed to receive LNG tankers between 65,000 to 216,000 cubic metres (Q- Flex). Terminal has two full containment above ground LNG storage tanks. The Terminal has been commissioned in August, 2013.3

A long-term contract executed of about 1.4 mmtpa LNG from Exxon Mobil’s Gorgon Project (Australia). In the absence of required pipeline network to increase the terminal utilization, ancillary services such as storage & reloading, cool down, bunkering options are also being offered at Kochi terminal which makes Kochi a unique terminal on its own kind.

Kochi Terminal has so far handled 66+ Cargoes operations (including 24 Reload / Cool down Cargo operations and 2 bunkering).

The Terminal is also offering tolling services to the bulk customers. Under the brand name Taral, Kochi is also supplying LNG through LNG Trucks to various customers who are not connected with gas grid. PLL is also pursuing construction of Mangalore / Bangalore pipelines with GAIL. Post completion of these pipeline, the terminal utilization shall increase significantly.

Solid Cargo Port

A Solid Cargo Port through a Joint Venture company namely Adani Petronet (Dahej) Port Private Ltd., has already commenced its Phase 1 operations from August 2010 at Dahej Port. Solid Cargo Port Terminal would have facilities to import/export bulk products like coal, steel and fertilizer. PLL has 26% equity in this JV.

Business Overview

The financial year 2019-20 saw the Company operating its Dahej Terminal at 17.25 million tonnes throughput as compared to 15.97 Million tonnes in the previous year 2018-19. The demand for LNG was consistent throughout the year. During the financial year 2019-20, the Dahej Terminal handled 263 LNG Cargoes and supplied 885.06 Trillion BTU (TBtu) of RLNG as compared to 241 cargoes during financial year 2018-19 wherein supplies were 820.15 TBtu. During the financial year 2019-20, 2598 LNG Road Tankers were also loaded and dispatched from Dahej Terminal and 290 Trucks from Kochi Terminal. The utilization of Kochi Terminal remained low in the absence of pipeline network for gas evacuation. 12 Cargoes were handled at the Kochi Terminal during the financial year 2019-20 as compared to 9 Cargoes (including loading) during the year 2018-19. During the year 2019-20, Kochi terminal supplied 42.78 TBtus of RLNG as compared to 24.07 TBtus financial year 2018-19. 4

Shipping Arrangements

Three LNG ships, namely ‘Disha,’ ‘Raahi’ and ‘Aseem’ carry the entire LNG volumes from RasGas under a long-term contract to Dahej. Besides Japanese companies, Shipping Corporation of India (SCI) is also an equity partner in the ship-owning companies. All these ships are manned, managed, maintained and operated by SCI. The ships operate on a long-term time charter basis with Petronet as the charterer.

The fourth LNG vessel ‘Prachi’ was delivered on 30th November 2016. The duration of the charter is 19 years. Besides Japanese Companies NYK, MOL and K-Line, Shipping Corporation of India (SCI) is an equity partner in the ship-owning company. PLL has taken 26% equity in this LNG ship. As is the case with the above mentioned first three ships, the fourth ship is also being manned, managed, maintained and operated by SCI. Supply of LNG from Gorgon is now on delivered basis and “Prachi” has been novated to Exxon Mobil.

PLL imports 7.5 MMTPA of LNG from Ras Laffan, Qatar on FOB basis through its long term chartered LNG vessels Disha, Raahi and Aseem. The duration of the charter is 25 years for each vessel. These vessels are owned by a consortium of M/s NYK Line, M/s K-Line, M/s MOL and M/s SCI Ltd. The technical management, manning and operations are carried out by M/s SCI Ltd.

Supply of LNG from Gorgon, Australia is now on DES basis and under this agreement its fourth long term chartered LNG vessel “Prachi” has been novated to Exxon Mobil. Prachi is owned by a consortium of M/s NYK Line, M/s K-Line, M/s MOL and M/s SCI Ltd including PLL with 26% equity. The technical management, manning and operations of Prachi is also carried out by M/s SCI Ltd.

During FY 2019-20, the overall shipping operations have run smoothly and the jetty utilization has been optimized without any downtime. LNG vessel Aseem had a contact damage in the month of March 2019 and was not in service for a period of about two & half months. LNG vessel Disha was not in service for a period of about two months due to a breakdown. Cargoes of these vessels were transported by hiring substitute LNG vessels from market without incurring any downtime or commercial loss to PLL.

New Business Initiatives

LNG Terminal At Bangladesh Project

The company has submitted an Expression of Interest to the REOI (request for expression of interest) floated by Rupantarita Prakritik Gas Company Limited (RPGCL), a subsidiary of Petrobangla for construction of Land-based LNG Re-gasification Terminal at Matarbari, Cox’s Bazar, Bangladesh on build, own, operate and transfer basis. RPGCL is currently in the process of shortlisting the Expression of Interest (s) received from international companies.

LNG Terminal & RLNG Supply In South Andaman

The company has completed pre-project studies for a floating storage & regasification (FSRU) terminal in South Andaman. Based on the studies a Detailed Feasibility Report (DFR) was prepared & submitted to Andaman & Nicobar Administration.

As Ministry of Power has awarded the 50MW RLNG based power plant to NTPC on nomination, the company is planning to bid for their Gas supply tender (issued in Sept' 2019), bid submission is expected in the next financial year.

LNG Terminal In Sri Lanka

The company has completed the Pre-Feed studies along with Japanese Consortium and Sri Lanka Gas Terminal Company Limited for setting up a Floating Storage & Regasification Terminal at Colombo, Sri Lanka. The Company is now conducting the FEED studies. The Environmental Clearance for the project is also progressing and public comments are responded. Discussion on definitive agreement such as terminal use agreement, LNG sale and purchase agreement, implementation agreement, etc. regarding the project have started.

Financial Highlights

During the financial year 2019-20, the company achieved a turnover of Rs. 35,452 Crore as against Rs. 38,395 Crore in 2018-19. The net profit during the year stood at Rs. 2,698 Crore as against Rs. 2,155 Crore in the previous year.

Q4 2020-21 Financial Results

9 June, 2021; During the FY 2020-21 (current year), Dahej terminal processed 849 TBTU of LNG as against 885 TBTU processed during the previous year. The overall LNG volume processed by the Company in the current year was 896 TBTU, as against the LNG volume processed in the previous year of 927 TBTU.5

- Highest ever PBT of Rs 3,968 Cr and PAT of Rs 2,949 Cr in a financial year.

- Growth in Profit Before Tax (PBT) of FY 2020-21 over PBT of FY 2019-20 by 28%

- Growth in Profit After Tax (PAT) of FY 2020-21 over PAT of FY 2019-20 by 9%

During the quarter ended 31st March, 2021 (current quarter), Dahej terminal processed 204 TBTU of LNG, as against 206 TBTU processed during the corresponding quarter (Q4, FY 2019-20). In the previous quarter (Q3, FY 2020-21), 222 TBTU of LNG was processed. The overall LNG volume processed by the Company in the current quarter was 218 TBTU, as against 219 TBTU processed in the corresponding quarter. In the previous quarter, LNG volume processed was 235 TBTU.

The Company has reported highest ever PBT of Rs 3,968 Crore in the financial year ending 31st March, 2021 (current year), as against Rs 3,111 Crore in the previous year. The PAT for the current year was reported at Rs 2,949 Cr as against the PAT of the previous year of Rs 2,698 Crore.

The Company has reported PBT of Rs 856 Crore in the current quarter, as against Rs 486 Crore in the corresponding quarter. In the previous quarter, PBT was Rs 1,172 Crore. PAT for the current quarter was reported at Rs 623 Cr as against PAT of the corresponding quarter which stood at Rs 359 Crore. PAT of the previous quarter was Rs 878 Crore.

The Board of Directors have recommended a final dividend of 35% on equity for approval of the shareholders in the AGM.