Quess Corp Ltd

Summary

Quess Corp provide a host of technology enabled staffing and managed outsourcing services across processes

Quess today has unmatched geographic presence and scale with more than 64 locations across India, South East Asia & North America.

In the middle east Quess has over 10,000 contract employees and the company serve over 100 clients in more than 9 sectors.

Quess operates in 10 countries with more than 3000 employees in North America, the Middle East, and Southeast Asia regions.

Company Overview

Established in Bengaluru in 2007, Quess Corp Limited (NSE:QUESS) is India’s leading business services provider, leveraging its extensive domain knowledge and future-ready digital platforms to drive client productivity through outsourced solutions.1

The company provide a host of technology enabled staffing and managed outsourcing services across processes such as sales & marketing, customer care, after sales service, back office operations, manufacturing operations, facilities and security management, HR & F&A operations, IT & mobility services, etc.

The company's passion for delivering exceptional services, augmented by proprietary digital platforms, has strongly established its credentials as India’s largest employer in the private sector and the biggest integrated business services provider in the country. Quess is proud to achieve this success as a 14-year old start-up.

A core value driving its business is constantly making the workforce more productive. The company's business strategy is aligned to this, including training and skill development for better employability, helping job seekers easily find employment opportunities, digitising workflows, and providing social security benefits to a wider employable population.

Established in 2007 and headquartered in Bengaluru, Quess today has unmatched geographic presence and scale with more than 64 locations across India, South East Asia & North America, backed by technology-intensity and domain specialization to create unmatched service experiences.

International operation

Quess is an integrated services provider who dares to reimagine business in the digital age. Quess has operations in Singapore, Malaysia, Philippines, Cebu, Vietnam, and Sri Lanka, and disrupted the market by enabling clients with state-of-the-art solutions and managing the entire People System from Resource Hiring to Exit Management. Quess has an extensive partner network in Thailand, Indonesia, Hong Kong, China, Burma, Japan, and Bangladesh. In its middle east geography, Quess has over 10,000 contract employees and the company serve over 100 clients in more than 9 sectors. The company's strong diversified portfolio in the areas of Workforce Management, Operating Asset Management and Global Technology Solutions facilitate functioning in cross-level and cross-functional roles. Quess operates in 10 countries with more than 3000 employees in North America, the Middle East, and Southeast Asia regions and assisting clients from Telecom, BFSI, Retail, FMCG, Manufacturing, Technology, and Outsourcing industries.2

Quess Asia Pacific

Quess offers an expansive and impressive set of services across the APAC region with its presence in Malaysia, Sri Lanka, Philippines, Singapore, and Vietnam. It serves over 1700+ customers across Workforce Management, Operating Asset Management and Global Technology Solutions. The company's commitment to excellence, technological superiority, and excellent service to customers have always been the trademark of its successes and have made its foothold strong in the APAC regions.

Quess Middle East

Quess’ presence in the Middle East is solidified through Quess Management Consultancy, previously known as Styracorp Management Services. From an all-encompassing Staffing Solutions to Permanent Recruitment and IT Staffing, the company provides quality services to customers, ensuring complete satisfaction. The Quess name has always inspired confidence in its stakeholders, and with this promise, the company’s further plans of expansion in the region remain strong. For more than 12 years, Quess ME has successfully completed 500+ projects and deployed 10,000+ professionals in UAE market. With 10,000 contract employees, the company serve over 100 clients in more than 9 sectors.

Quess North America

Quess is known through its brand, Quess GTS (formerly MFX), in the US. Quess GTS is the P&C insurance industry’s premier digital transformation partner that helps in the adoption of digital and cloud technologies to keep Opex down, cash-flows predictable and customer experience more meaningful. Through the integration of disparate data streams, the company provide intelligence on claims patterns and helps create new products that map to the changing business climate. In addition to insurance, Quess has a host of solutions such as robotics solutions, mobility solutions for any time anywhere transactions, and system integration services. Today, Quess is one of the largest providers of integrated services through PaaS, IaaS, ADM, BPO, Analytics and GRC.

Services

Workforce Management Services

The workforce is the lifeblood of any organization, and with the right people, you can transform businesses. At Quess, the company aim to do just that – equip companies with world-class workforce management solutions to help them succeed.3

As a globally recognized workforce management services provider, the company offer end-to-end HRO services that are aimed at solving complex HR challenges. From customized staffing services, expert talent acquisition, search and recruitment, payroll compliance, training and skill development, to managed workforce solutions, Quess provides all the tools necessary to drive your business growth.

- Staffing Solutions

- IT Staffing

- Skilling and Learning Solutions

- Digital Compliance Solutions

Operating Asset Management

Expert management of a company’s operating assets is integral to its seamless and smooth functioning. Be it pest control or the more complex ERP services, Quess handles all your end-to-end non-core operational requirements.4

Asset management services are essential to ensure reliable and efficient operations across the enterprise. The company's expertise in the different aspects of operating asset management, such as integrated facility management, industrial operation and maintenance, and cellular services, enables it to deliver the best for your business.

- Integrated Facility Management Services

- Food Services

- Security Services

- Industrial Services

- Telco Network Services

Global Technology Solutions

At Quess, the company think future-forward. The company realize that technology is the bedrock of innovation and what drives tomorrow. So, the company harness the power of technology to drive productivity and optimal efficiency into your business processes.5

Through its range of technology solutions that include BPO services, CLM, After Sales services, and Digital Transformation services, the company strive to deliver excellence across various facets of the enterprise.

- Domestic CLM and BPO

- International CLM and BPO

- Domestic IT Services

- Monster Jobs

- Product Installation & Servicing Solutions

- Heptagon

Industry Overview

Employment Trends in India

Employment in India is going through a tectonic shift in both composition and focus, providing massive economic tailwinds to the formal outsourcing industry.6

Growing labour market: India is a very young country with a median age of 28 years, making it one of the largest labour forces in the world at ~493 million, growing at 5.7% CAGR (2015- 20). To generate work opportunities that tap into this base, the Government of India has announced a number of schemes including ‘AatmaNirbhar Bharat’, Prime Minister Employment Generation Programme (PMEGP) and Production Linked Incentive (PLI) Scheme. PLI, specifically, has the potential double the workforce engaged in production and manufacturing activities.

Evolving legal landscape: By simplifying the legal landscape, the newly legislated labour codes will likely accelerate formalisation and compliance. This shift should be positive for outsourcing players. The new labour laws also address the formalisation of the gig economy, which is estimated by BCG to create ~90 million jobs and contribute an incremental 1.25% to the country’s GDP. This will provide additional opportunities for technology-enabled outsourcing players.

Increasing formalisation: Goldman Sachs estimates that formalisation will increase to 30.3% by 2025 and 38.3% by 2030 from 20.8% currently. Formalization has already picked up pace as evident in ~42 million new PF subscribers and ~50 million new ESIC subscribers in the last 3 years, and the increase in GST registered firms to over 12 million from 7.5 million in 2017.

Greater outsourcing penetration: India has a low base of outsourcing in the formal sector. For example, according to the Indian Staffing Federation, flexi-staffing penetration in India is 0.7% compared to ~3% in the most developed markets. As the focus on compliance and costs increase, large Indian companies are increasingly exploring outsourcing to drive productivity and flexibility.

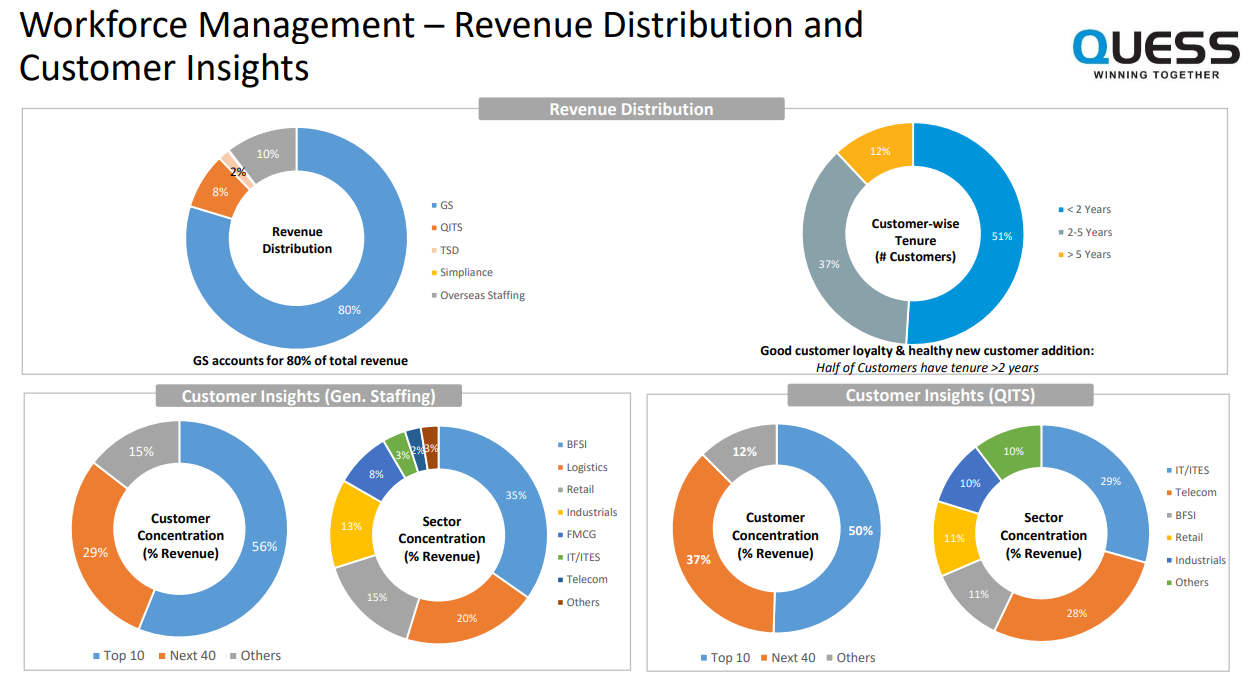

Workforce Management

The general staffing industry provides manpower augmentation services across blue and grey collar roles. The Indian general staffing market is poised for rapid growth in the years ahead. As alluded earlier, formalisation is estimated to increase to 30.3% by 2025 and 38.3% by 2030 from 20.8% currently. With one of the largest flexible staffing workforces in the world, India’s temporary workforce is expected to grow to 10% of formal sector employment by 2025. According to Goldman Sachs, the staffing industry is therefore poised to grow 6 times in the coming decade to $60 billion.

Larger players are likely to benefit disproportionately from this growth, especially as technology investments play a larger role in enabling remote hiring, driving down payrolling and compliance costs, and managing employees remotely.

Operating Asset Management in India

The Indian facilities management industry was valued at $150 billion in 2020. Outsourcing of non-core operations and expansion of the real estate sector is driving growth of this industry in India. The commercial sector in India is the most common end-use industry, followed by manufacturing and other industries. Corporate offices, such as those in IT, BPO and Banking, Financial Services and Insurance (BFSI) sectors are continuously opting for outsourced services, resulting in the growth of the integrated facilities management sector in India. While COVID has created a temporary disruption in office-going, the industry is projected to expand at a healthy CAGR of 20% between 2021 and 2026 to reach $406 billion by 2026.

The Private Security Industry (PSI) has been growing at a CAGR of 20% for over a decade16.After agriculture, PSI is the second largest employer in India. As of December 2020, the Indian PSI is estimated to be around H 990 billion and it is projected to be valued at H 1.5 trillion by 2022.

Industrial Operation and Maintenance Services (O&M) is an important non- core activity for power, steel, and cement plants. Rising concerns about productivity, increased digitization and rising investments for maintenance operations are driving the growth of the industry in India. Companies increasingly outsource O&M services to improve equipment uptime, increase operational excellence and reduce maintenance costs.

Global Technology Solutions

The Indian Information TechnologyBusiness Process Management (IT-BPM) sector accounts for 55% of the overall global outsourcing market. The industry accounts for 8% of India’s GDP and is the largest employer within the private sector, employing around 3.9 million people.

The BPM industry is poised for an era of accelerated growth, driven by BPM 4.0 which will be characterised by an increased penetration of Robotics Process Automation (RPA), Adaptive Case Management, and increasing demand for no-code or lowcode BPM and Artificial Intelligence (AI). BPM will also be deeply domain-focused and will provide increased depth as well as an amalgamation of process-based, industry-oriented, and technology-based domain expertise.

Globally, payroll outsourcing is one of the fastest-growing segments of the human resource outsourcing (HRO) market. The global payroll market is expected to reach $23 billion by 2027 from $18 billion in 2020. Payroll outsourcing services can be availed for Accounting and Finance (A&F), human capital management (HCM), and shared service centres.

The IT services market in India was at $13.4 billion in 2020 and is expected to grow at a CAGR of 7.2% 2020-2025 to touch nearly $19 billion by the end of 2025 on the back of increased spending in areas like cloud and artificial intelligence. The Indian public cloud services (PCS) market, including infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) solutions, and software-as-a-service (SaaS), touched $1.6 billion for the first half of 2020. The overall Indian public cloud services market is likely to touch $7.4 billion by 2024 growing at a CAGR of 22.2% for 2020-24. Similarly, India’s cyber security market is expected to grow to $3.05 billion by 2022 from $1.97 billion in 2019 at a CAGR of 15.6%, providing boost to its SOC-based cyber security monitoring business.

Emerging Business Industry Overview

Online Recruitment

In 2019, India was the world’s secondlargest online market, behind only China. The number of internet users is rising in both urban and rural areas, indicating a rapid increase in online access. Both blue collar and white collar hiring has firmly moved to online platforms. Further, online platforms are enabling multiple modes of engagement between companies and candidates – full time, flexi-time and gig. Improvements in AI-driven algorithms and automation of the hiring process is leading to a larger role for companies in online recruitment business.

After Sales Support Services

The after-sales segment is growing rapidly in India as companies continue to provide after-sales service to boost customer satisfaction The pandemic accelerated the proliferation of consumer devices and with it the demand for after-sales service and support. Customer requirements as well as expectation of quality of service are going up with every passing year. This augurs well for technology-based service providers. Moreover, use of Artificial Intelligence (AI), Internet of Things (IoT), and Virtual Reality (VR) has helped brands to improve their product offerings and shape the overall customer experience. Therefore, technology is playing a pivotal role in driving change in the after-sales service industry in India.

Financial Highlights

The company’s consolidated revenue registered a marginal drop of 1.4% to reach Rs 108.37 billion as compared to Rs 109.91 billion in FY20. The company saw 19.5% de-growth in Q1, resurgence of growth in H2 ensured that revenue closed flat for the year over FY20.

Employee headcount dropped to 3,63,000 in FY21 from a historic high of 3,84,000 in FY20, a fall of 5.5% due to COVID and resulting lockdowns across the country.

Consolidated EBITDA reached Rs 4.58 billion, registering a drop of 30% over FY20, driven by Rs 1.19 billion provision taken towards legacy government business.

Lockdown related negative impact on its education and food business was approximately Rs 980 million.

EBITDA margins stood at 4.23% for the year against 5.99% in FY20, down 176 bps due to one-time provision on legacy government business and lockdown impact on its high margin education and food business mainly in IT/ITES and education sector. Normalized EBITDA margins stood at 6.23% for the year.

Cost of materials and stores and spare parts consumed dropped 25% year on year to Rs 2 billion in FY21 from Rs 2.67 billion in FY20 due to the effect of the lockdown on the food business, within its integrated facility management business.

Other expenses include Rs 1.19 billion provision taken towards legacy government business. Adjusted for this, other expenses have reduced by 24% YOY. The company closed the year with lower operating expenses due to lockdown across travel and conveyance (H 840 million), recruitment and training (H 360 million) with lockdown related impact in training business and business promotion and advertisement (H 340 million). Quess has made great strides during the year in driving its cost lower with operational efficiencies, rationalization and automation. The company's SG&A cost has reduced to 6% of revenue during the year against 7% in FY20.

Finance cost for the year was Rs 1.11 billion against Rs 1.67 billion for the previous year, a decrease of 32.9%. Decrease in finance cost is mainly due to lower debt during the year through focused collections and interest rate reductions.

The gross debt decreased Rs 5.16 billion in FY21 from Rs 11.47 billion in FY20, a decrease due to repayment of Rs 6.31 billion during the year Finance cost includes impact of NonControlling Put Option (NCI Put Option) to the tune of Rs 126.87 million in FY21 and Rs 208.74 million in FY20. NCI Put Option is a non-operating and non-cash charge to the P&L which was to consider Quess’ obligation to acquire balance equity shares in its subsidiaries, mainly Conneqt, for an exercise price specified in the share purchase agreement. This Option was exercised in April this year for Rs 2.08 billion.

The Consolidated Depreciation & Amortization (D&A) Expenses decreased 8% to Rs 2.29 billion in FY21 from Rs 2.49 billion in FY20.

Decrease is mostly in intangible amortization which fell to Rs 240 million in FY21 from Rs 440 million in FY20, mainly due to intangible impairment of Allsec, Manipal, Vedang and Greenpiece during March 2020.

Increase in tax expenses mainly due to DTL on goodwill recognized for Rs 519.61 million as the tax base of goodwill became NIL consequent to the amendment in the Finance Act, 2021 wherein goodwill will not be considered as a depreciable asset and depreciation on goodwill will not be allowed as deductible expenditure effective 1 April 2020.

References

- ^ https://www.quesscorp.com/about/company-profile/

- ^ https://www.quesscorp.com/quess-worldwide/

- ^ https://www.quesscorp.com/workforce-management/

- ^ https://www.quesscorp.com/operating-asset-management/

- ^ https://www.quesscorp.com/global-technology-solutions/

- ^ https://www.quesscorp.com/investor/dist/images/pdf/Quess-Annual-Report-2020-2021.pdf