RELX

Summary

- RELX is a global provider of information-based analytics and decision tools for professional and business customers.

- RELX serves customers in more than 180 countries and has offices in about 40 countries.

- RELX operate in four major market segments: Risk; Scientific, Technical & Medical; Legal; and Exhibitions

Company Overview

RELX (NYSE:RELX, LSE:REL) is a global provider of information-based analytics and decision tools for professional and business customers. RELX serves customers in more than 180 countries and has offices in about 40 countries. It employs more than 33,000 people over 40% of whom are in North America.1

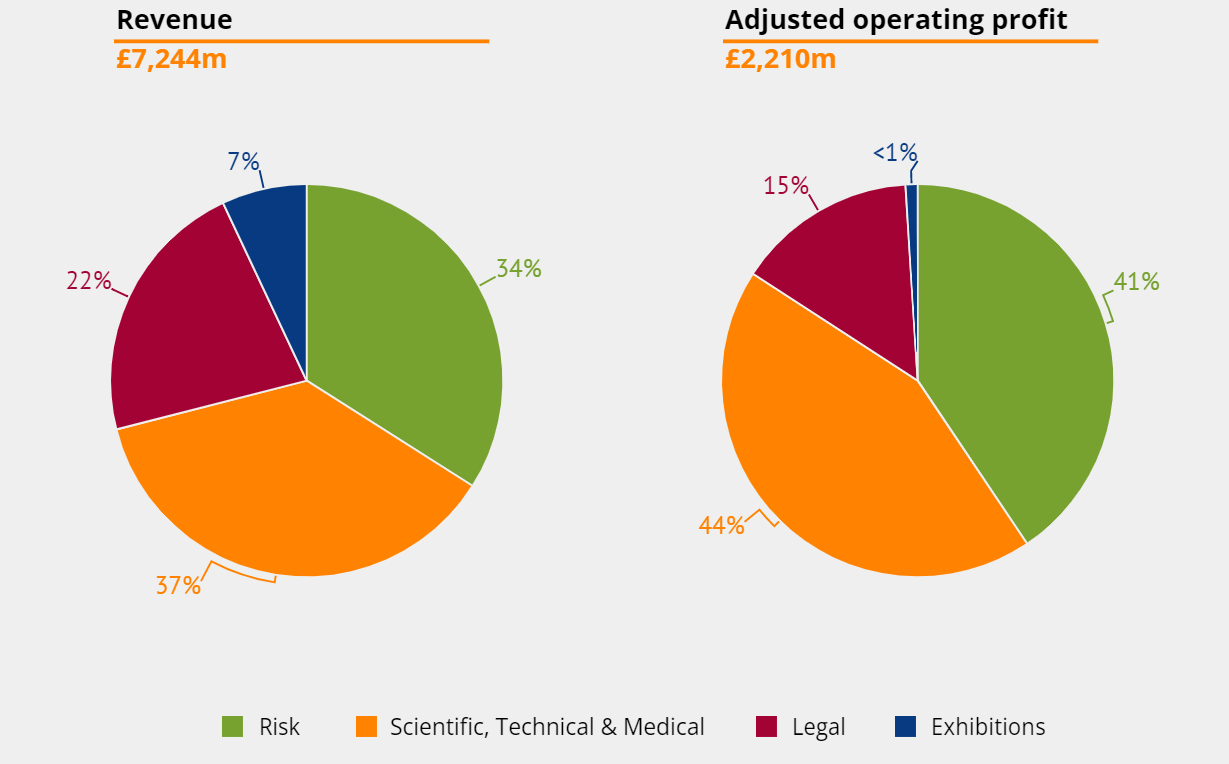

The company operate in four major market segments: Risk; Scientific, Technical & Medical; Legal; and Exhibitions.

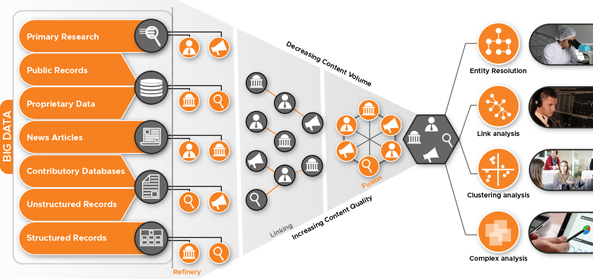

- Risk provides information-based analytics and decision tools that combine public and industryspecific content with advanced technology and algorithms to evaluate and predict risk and enhance operational efficiency

- Scientific, Technical & Medical provides information and analytics for institutions and professionals progress science, advance healthcare and improve performance.

- Legal provides legal, regulatory and business information and analytics.

- Exhibitions combines industry expertise with data and digital tools to connect digitally and face-to-face, learn about markets, source products and complete transactions.

Financial Highlights

Reported revenue for the year ended December 31, 2021 was £7,244 million (2020: £7,110 million), up 2% (2020: down 10%). Underlying revenue growth was up 7% (2020: down 9%) reflecting good growth in electronic and face-to-face revenues, partially offset by print revenue declines. Acquisition and exhibition cycling effects both had a small positive impact on revenue, and disposals had a small negative impact.2

Reported operating costs, which comprises cost of sales, selling and distribution costs, and administration and other expenses, were £5,389 million (2020: £5,600 million), down 4% (2020: down 4%). Cost of sales were £2,562 million (2020: £2,487 million), up 3% (2020: down 10%) compared to 2020. Selling and distribution costs were £1,197 million (2020: £1,212 million), down 1% (2020: down 6%) and administration and other expenses were £1,630 million (2020: £1,901 million), down 14% (2020: up 8%).

Reported operating profit, which includes amortisation of acquired intangible assets and acquisition-related items, was £1,884 million (2020: £1,525 million), up 24% (2020: 27% decrease) reflecting lower amortisation expense on acquired intangible assets and there being no exceptional costs in Exhibitions (2020: £183 million).

Adjusted operating profit was £2,210 million (2020: £2,076 million), up 6% (2020: down 17%).

The reported operating margin was 26.0% (2020: 21.4%). The overall adjusted operating margin of 30.5% was 1.3 percentage points higher than in the prior year. On an underlying basis, including cycling effects, the margin improved by 1.6 percentage points with portfolio and currency effects reducing margins by 0.1 and 0.2 percentage points respectively.

Depreciation and amortisation of internally generated intangible assets increased to £347 million (2020: £341 million). Depreciation of right-of-use assets decreased to £80 million (2020: £88 million).

Reported profit before tax was £1,797 million (2020: £1,483 million) up 21% reflecting the improvement in reported operating profit, offset by smaller gains from disposals and other non-operating items of £55 million (2020: £130 million), mainly relating to disposal and revaluation gains in the ventures portfolio.

The reported net profit attributable to RELX PLC shareholders of £1,471 million (2020: £1,224 million) was up 20% (2020: down 19%). The adjusted net profit attributable to RELX PLC shareholders of £1,689 million (2020: £1,543 million) was up 9% (2020: down 15%).

In 2021 RELX spent £309 million (2020: £319 million) in respect of capitalised development costs. This reflects sustained investment in new products. This expenditure was mainly incurred in the United States, the United Kingdom and the Netherlands.

Capital Expenditure, Acquisitions and Disposals

Total cash spent on acquisitions in the three years ended December 31, 2021, was £1,573 million. Cash spent on acquisitions (including debt in acquired businesses) in 2021 was £262 million (2020: £874 million; 2019: £437 million) including deferred consideration of £19 million (2020: £5 million; 2019: £24 million) on past acquisitions and spend on venture capital investments of £8 million (2020: £2 million; 2019: £8 million).

Capital expenditure on property, plant, equipment and internally developed intangible assets principally relates to the development of electronic products and investment in systems infrastructure, computer equipment and office facilities. Total such capital expenditure, which was financed using cash flows generated from operations, amounted to £339 million in 2021 (2020: £364 million; 2019: £381 million). The majority of capital expenditure is incurred in the United States, the United Kingdom and the Netherlands.

Business Segments

Risk

Risk provides customers with information-based analytics and decision tools that combine public and industry-specific content with advanced technology and algorithms to assist them in evaluating and predicting risk and enhancing operational efficiency.3

LexisNexis Risk Solutions, headquartered in Alpharetta, Georgia, has principal operations in California, Florida, Illinois, New York and Ohio in North America as well as London and Paris in Europe, Sāo Paulo in Latin America and Beijing and Singapore in Asia Pacific. It has about 10,000 employees and serves customers in more than 180 countries.

Scientific, Technical & Medical;

Scientific, Technical & Medical helps researchers and healthcare professionals advance science by combining quality information and data sets with analytical tools to facilitate insights and critical decision-making.

Elsevier is headquartered in Amsterdam, with further principal sites in Boston, New York, Philadelphia, St. Louis and Berkeley in North America; London, Oxford, Frankfurt, Munich, Madrid and Paris in Europe; Beijing, Chennai, Delhi, Singapore and Tokyo in Asia Pacific, and Rio de Janeiro in South America. It has 8,700 employees and serves customers in over 180 countries.

Legal

Legal provides legal, regulatory and business information and analytics.

The company help lawyers in cases, manage their work more efficiently, serve their clients better and grow their practices. The company assist corporations in better understanding their markets and monitoring relevant news. The company partner with leading global associations and customers to help advance the Rule of Law across the world.

LexisNexis Legal & Professional is headquartered in New York and has further principal operations in Ohio, North Carolina and Toronto in North America, London and Paris in Europe, and cities in several other countries in Africa and Asia Pacific. It has 10,500 employees worldwide and serves customers in more than 150 countries.

Exhibitions

Exhibitions combines industry expertise with data and digital tools to connect digitally and face-to-face, learn about markets, source products and complete transactions.

The company's business leverages industry expertise, large data sets and technology to enable its customers to build their businesses by connecting face-to-face or digitally and generate billions of dollars of revenues for the economic development of local markets and national economies around the world.

RX has its headquarters in London and has further large offices in Paris, Vienna, Düsseldorf, Moscow, Norwalk (Connecticut), Mexico City, São Paulo, Beijing, Shanghai, Tokyo, Singapore and Sydney. RX has 3,500 employees worldwide and its portfolio of events serves 43 industry sectors.

Company History

RELX PLC was originally incorporated in 1903. In 1993, RELX PLC combined with RELX NV by contributing their respective businesses into two jointly owned companies. In 2015, the structure was simplified so that all of the businesses were owned by one jointly controlled company, RELX Group plc. In 2018, the structure was further simplified whereby RELX NV merged into RELX PLC to form a single parent company, RELX PLC. RELX PLC owns 100% of the shares in RELX Group plc, which in turn owns all of the operating businesses, subsidiaries and financing activities of the Group.