SBI Life Insurance Company Ltd

Summary

- SBI Life Insurance one of the most trusted life insurance companies in India,

- Indian life insurance industry is the 11th largest in the world in terms of total premium. India’s share in the global life insurance market was 2.73% in 2019.

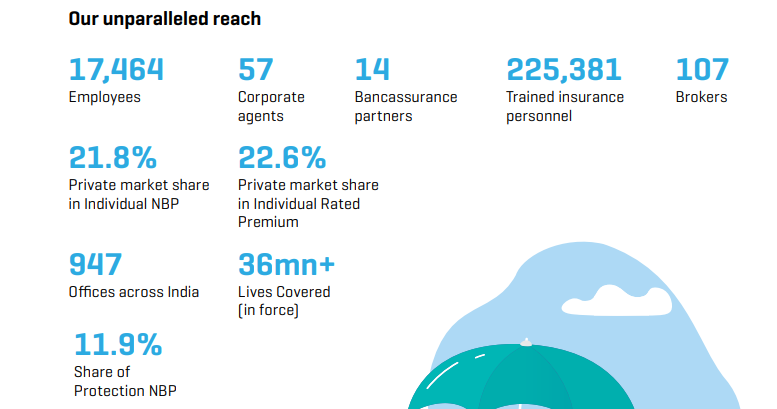

- SBI Life Insurance has extensive presence across the country through its 947 offices, 18,236 employees.

Company Overview

SBI Life Insurance (NSE:SBILIFE) one of the most trusted life insurance companies in India, was incorporated in October 2000 and is registered with the Insurance Regulatory and Development Authority of India (IRDAI) in March 2001. 1

Serving millions of families across India, SBI Life's diverse range of products caters to individuals as well as group customers through Protection, Pension, Savings and Health solutions.

Driven by 'Customer-First' approach, SBI Life places great emphasis on maintaining world class operating efficiency and providing hassle-free claim settlement experience to its customers by following high ethical standards of service. Additionally, SBI Life is committed to enhance digital experiences for its customers, distributors and employees alike.

SBI Life strives to make insurance accessible to all, with its extensive presence across the country through its 947 offices, 18,236 employees, a large and productive individual agent network of about 143,232 agents, 60 corporate agents, a widespread bancassurance network of 14 partners, more than 27,000 partner branches, 108 brokers and other insurance marketing firms.

In addition to doing what's right for the customers, the company is also committed to provide a healthy and flexible work environment for its employees to excel personally and professionally.

SBI Life strongly encourages a culture of giving back to the society and has made substantial contribution in the areas of child education, healthcare, disaster relief and environmental upgrade. In 2020-21, the Company touched over 4.30 lakh direct beneficiaries through various CSR interventions.

About State Bank of India:

State Bank of India (SBI) is the largest commercial bank in terms of assets, deposits, branches, customers, and employees. It is also the largest mortgage lender in the country. As on September 30, 2020, the bank has a deposit base of over Rs. 34 lakh crore with CASA ratio of more than 45% and advances of nearly Rs. 24 lakh crore. SBI commands a market share of a little over 34% in home loans and about 32% in the auto loans segment. The Bank has the largest network of almost 22,300 branches in India with an ATM / CDM network of close to 58,800 and total BC outlets of more than 66,500. The number of customers using internet banking facilities is nearly 81 million and mobile banking services stand a little more than 18 million. The integrated digital and lifestyle platform by SBI - YONO has crossed the landmark of 66 million downloads. YONO which has 28.5 million registered users, witnesses between 7.5 to 8 million logins per day. In October 2020 alone, SBI disbursed an average of over 3500 personal loans and around 9700 agri gold loans on a daily basis. The bank recently launched the YONO Global app in the UK and Mauritius and plans to cover 9 more countries by the end of 2020. On social media platforms, SBI has the highest number of followers on Facebook and Twitter amongst all banks worldwide.

Industry Overview

As per data published by Swiss Re Group, the Indian life insurance industry is the 11th largest in the world in terms of total premium. India’s share in the global life insurance market was 2.73% in 2019.2

Life insurance penetration

The measure of insurance penetration and density reflects the level of development of insurance sector in a country. While insurance penetration is measured as the percentage of insurance premium to GDP, insurance density is calculated as the ratio of premium to population (per capita premium). After the Insurance sector liberalization life insurance penetration has increased from 2.15% in 2001 to 2.82% in 2019. The life insurance density has also increased from USD 9.1 in 2001 to USD 58 in 2019.

As of FY 2020, the size of the Indian Life Insurance sector was Rs 5.73 trillion. Total premium growth was at CAGR of 14% between FY 2002 and FY 2020.

The domestic life insurance industry registered growth of 7.5% for new business premium in FY 2021. Private players grew by 16.3% while Life Insurance Corporation (LIC) grew by 3.5%. More than 28 million policies were sold in FY 2021 by all insurance players including LIC. While LIC grabbed a market share of 66.2% of total new business premium, the private players took a share of 33.8% in FY 2021. In terms of individual rated premium, private players have fared better, capturing a market share of 59.7% while LIC held a share of 40.3% in FY 2021.

The product mix for LIC has remained consistent in the recent years. LIC focuses more on traditional products and its share in ULIPs is negligible while private players have a well balanced mix of traditional and ULIP products. For private players, share of traditional products has increased from 58% in FY 2017 to 66% in FY 2020 while share of ULIPs has decreased from 42% in FY 2017 to 34% for FY 2020.

In terms of distribution mix of individual new business premium, private players are strengthening their presence through the bancassurance channel in the recent years. However, agency channel continues to be the predominant channel for LIC with a share of 95% in Individual new business premium in FY 2020. Share of agency channel in individual new business premium of private players has reduced from 30% in FY 2017 to 25% in FY 2020 while bancassurance share has been stable at 53% from FY 2017 to FY 2020.

Financial Highlights

Participating segment: Profits from participating business depend on the total bonuses declared to policyholders on an annual basis. Bonus declared as per regulatory provisions has increased from Rs 13.72 billion in FY 2020 to Rs 14.85 billion in FY 2021. The amount transferred to shareholders increased to Rs 1.65 billion in FY 2021 from Rs 1.52 billion in FY 2020.

Non Participating segment: In case of Non-participating business, profit arises primarily from premium and investment income net of expenses, claims and policyholder liabilities. Profit in non-participating segment has decreased from Rs 2.56 billion in FY 2020 to Rs (2.88) billion in FY 2021 on account of New business strain and higher death claims due to COVID 19 pandemic.

Unit Linked (ULIP) segment: In case of unit linked business, profit arises only from the charges (net of expenses) levied on policyholders. Under unit linked business, AUM has increased by 48% on account of better market performance, also total business from linked segment has increased by 21.0%. This has led to an increase in profit from Rs 5.78 billion in FY 2020 to Rs 9.77 billion in FY 2021.

Investment income and other income under shareholder portfolio have increased by Rs 2.44 billion from Rs 4.75 billion in FY 2020 to Rs 7.19 billion in FY 2021 is mainly due to booking of profit on sale of investment. Other Income represents rental income from let-out property, interest on tax refund and Foreign exchange gain.

Expenses other than those directly related to the insurance business have decreased by 35.4% from Rs 0.48 billion to Rs 0.31 billion in FY 2021.

Profit before tax has increased from Rs 14.14 billion in FY 2020 to Rs 15.43 billion in FY 2021. Tax expense for shareholders has increased from Rs (0.09) billion in FY 2020 to Rs 0.87 billion in FY 2021. Profit after tax has increased by 2.4% from Rs 14.22 billion in FY 2020 to Rs 14.56 billion in FY 2021.

FY22Q2 Results

SBI Life Q2 net profit falls as claims increase

SBI Life Insurance reported an 18 per cent fall in net profit year on year due to a sharp rise in claims and higher provisions as the company continued to grapple with the after-effects of the Covid 19 pandemic.3

Net profit fell to Rs 247 crore in the quarter ended September 2021 from Rs 300 crore a year ago mainly as benefits paid including bonuses doubled to Rs 12,702 crore in September 2021 from Rs 6,426 crore a year earlier.

Provisions on doubtful debts including write off increased to Rs 29 crore from Rs 4 crore a year earlier.

The fall in profit was despite a healthy rise in net premium income and investment income year on year. Net premium income increased 14 per cent to Rs 14,661 crore in September 2021 from Rs 12,858 crore a year ago. Investment income almost doubled to Rs 10,734 crore from Rs 5,590 crore a year earlier.

New business premium increased to Rs 10,288 crore in the first half of the fiscal from Rs 8,998 crores in the period ended September 2020. The regular premium has increased by 47 per cent over the corresponding period ended on 30th September 2020.

Gross written premium (GWP) grew by 11 per cent to Rw 23,100 crore in the first half of the current fiscal mainly due to 47 per cent growth in first-year premium and 9 per cent growth in renewal premium.

Total assets under management increased 31 per cent to Rs 2.44 lakh crores as of September 30, 2021 from Rs 1.86 lakh crores a year earlier, with a debt-equity mix of 70:30.