SSR Mining

Summary

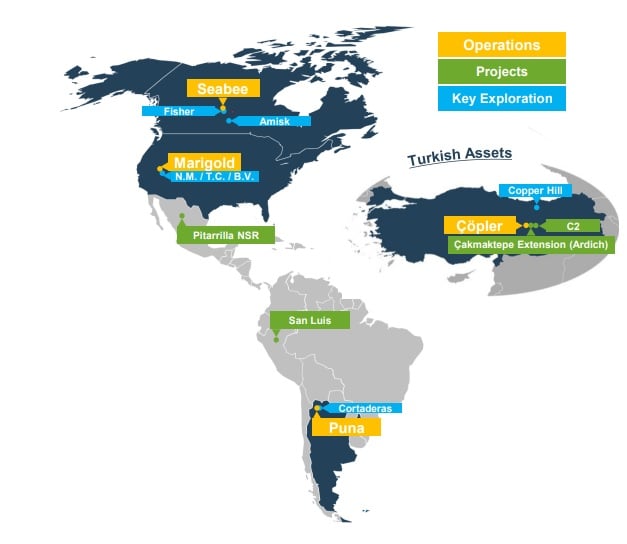

- SSR Mining Inc. is a leading, free cash flow focused intermediate gold company with four producing assets located in the USA, Turkey, Canada, and Argentina,

- The company has a global pipeline of high-quality development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada.

- SSR Mining has Çöpler mine along the Tethyan belt in Turkey; the Marigold mine along the Battle Mountain-Eureka trend in Nevada, US

Company Overview

SSR Mining Inc. (NASDAQ:SSRM, TSX:SSRM, ASX:SSR) is a leading, free cash flow focused intermediate gold company with four producing assets located in the USA, Turkey, Canada, and Argentina, combined with a global pipeline of high-quality development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. In 2020, the Company’s four operating assets produced over 711,000 gold-equivalent ounces.1

SSR Mining’s diversified asset portfolio is comprised of high margin, long-life assets along several of the world’s most prolific precious metal districts including the Çöpler mine along the Tethyan belt in Turkey; the Marigold mine along the Battle Mountain-Eureka trend in Nevada, USA; the Seabee mine along the Trans-Hudson Corridor in Saskatchewan, Canada; and the Puna mine along the Bolivian silver belt in Jujuy, Argentina. SSR Mining has an experienced leadership team with a proven track record of value creation. Across the Company SSR Mining has expertise in project construction, mining (open pit and underground), and processing (pressure oxidation, heap leach, and flotation), with a strong commitment to health, safety and environmental management.

SSR Mining Inc. is listed under the ticker symbol SSRM on the NASDAQ Capital Markets and the Toronto Stock Exchange, and SSR on the Australian Stock Exchange.

Operations

Çöpler - Turkey

The Çöpler Mine (80% SSRM owned) is part of the Çöpler District located in east-central Turkey in the Erzincan Province, approximately 1,100 km southeast from Istanbul and 550 km east from Ankara, Turkey’s capital city. The Çöpler Mine has been operating since 2010 and is currently processing ore through two producing plants – the oxide and sulfide plants. The oxide ore is processed via heap leach and the sulfide ore is processed using pressure oxidation. The current estimated mine life is over 20 years.2

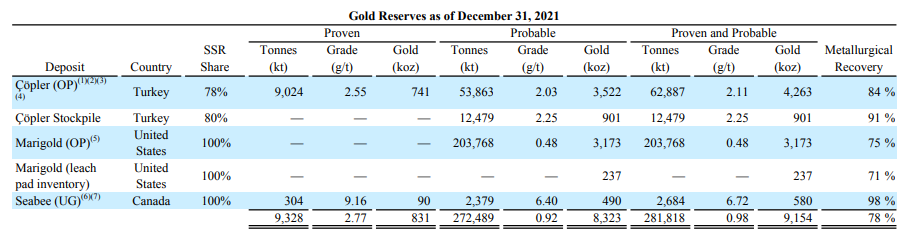

Proven and Probable Mineral Reserves of 62.9 million tonnes at an average grade of 2.11 g/t or 4.3 million ounces of contained gold, excluding stockpiles, as at December 31, 2021.

Çakmaktepe

The Çakmaktepe Mine (50% SSRM owned) is located approximately 5 km from the existing Çöpler Mine infrastructure and the Çakmaktepe ore can be processed through the existing Çöpler facilities. Mining operations commenced in September 2018 and production of Çakmaktepe phase one oxide ore was completed in 2019. As exploration advances and the geological understanding of the Çakmaktepe and Ardich deposits increases, it appears that there is probable structural connectivity between the areas, potentially creating an expanded “Greater Çakmaktepe” development pathway.

Çöpler Copper-Gold (C2)

The Çöpler Copper Gold (C2) project consists of copper gold sulfide mineralization below and adjacent to existing resource pits at the Çöpler Mine (80% SSR Mining owned). A positive Initial Assessment Case (“IAC”) was included in the CDMP21, which showcased ~1Moz of gold production for $218 million of capital expenditures and an IRR of ~60%. SSR Mining will look to advance Copler Copper Gold towards first production in 2025. The IAC development scenario outlined in the CDMP21 expands on the life of mine production plan highlighted in both the CDMP21 Reserve Case and the 2020 Ҫӧpler District Master Plan (“CDMP20”) PEA Case with the construction of a Copper Concentrator to recover copper from the Sulfide Mineral Resource.

Marigold - United States

Marigold is located in Humboldt and Lander County, Nevada, United States on the Battle Mountain-Eureka trend. SSR Mining completed the acquisition of Marigold on April 4, 2014 and published an updated technical report in July 2018.

In production since 1989, Marigold is a large run-of-mine heap leach operation with several open pits, waste rock stockpiles, leach pads, a carbon absorption facility, and a carbon processing and gold refining facility. Currently the mine utilizes a fleet of 290-tonne haul trucks and three loading units. The gold doré bars produced at the mine are shipped to a third party refinery.

Probable Mineral Reserves of 3.2 million ounces of gold at an average grade of 0.48 g/t and 0.2 million ounces of gold in leach pad inventory, as at December 31, 2021.

Seabee - Canada

Seabee is located in Northern Saskatchewan, Canada approximately 125 kilometers northeast of the town of La Ronge. The Santoy underground mine has been in continuous commercial production since 2014. Commercial production at the Seabee underground mine commenced in 1991 and exhausted Mineral Resources in 2018. All ore is processed at the Seabee mill facility, which has been in operation since 1991. The Seabee mill facility produces gold doré bars that are shipped to a third party refinery. Access to the mine site is by fixed wing aircraft to a 1,275-meter airstrip located on the property. Equipment and large supplies are transported to the site via a 60-kilometer winter ice road, which is typically in use from January through March.

SSR Mining acquired Seabee on May 31, 2016 as a result of its acquisition of Claude Resources Inc. On April 14, 2022, SSR Mining expanded its existing exploration platform at Seabee through the acquisition of Taiga Gold. The Company’s properties in Saskatchewan now cover an area of approximately 131,150 hectares. SSR Mining’s growth and development strategy has been to increase production by optimizing the milling and mining processes and exploring new mill feed sources.

Proven and Probable Mineral Reserves of 580,000 ounces of gold at an average grade of 6.72 g/t as at December 31, 2021.

Puna - Argentina

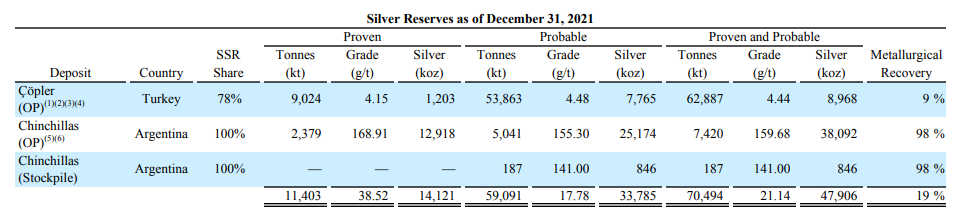

Puna (100% SSR owned) is comprised of the Chinchillas mine and the Pirquitas property, which includes the Pirquitas processing facilities. Puna is located in the Jujuy Province, Argentina.

The Chinchillas mine is a silver-lead-zinc deposit, which achieved commercial production in December 2018. It is expected to supply ore to the Pirquitas processing facilities over an 8-year active mining period. Open pit mining is conducted using conventional drill, blast, truck and loading operations. The ore is transported 40 kilometers to the Pirquitas processing facilities, which produce a silver-lead concentrate and a zinc concentrate that are shipped to international smelters.

The Pirquitas processing facilities have been in commercial production since 2009, processing ore from the San Miguel open pit, which concluded mining activities in January 2017 and currently hosts the tailings deposit facility.

Proven and Probable Mineral Reserves of 38.9 million ounces of silver at an average grade of 159.3 g/t as at December 31, 2021.

Development

Çakmaktepe Extension

The Çakmaktepe Extension (80% owned), also referred to as the Ardich deposit, was discovered in 2017. It is part of the Çöpler District and is located approximately 1.5km north of the Çakmaktepe mine and 6km northeast of the Çöpler Mine, allowing future development to leverage existing oxide and sulfide processing infrastructure.

A maiden Mineral Resource was announced in December 2018, and a preliminary economic analysis (“PEA”) for the project was included in the 2020 Çöpler District Master Plan (“CDMP20”). In 1Q 2022, the company released the results of the independently prepared Çöpler District Master Plan TRS (“CDMP21”). CDMP21 included a Mineral Reserve Case incorporating maiden Mineral Reserves from the Çakmaktepe Extension that extends and expands upon the production profile outlined in the CDMP20. Incorporation of Mineral Reserves at Çakmaktepe Extension (Ardich) adds an additional 1.2 million ounces of gold production into the life of mine profile beginning in 2023 for total development capital of $69 million.

San Luis Peru

San Luis is a 100% owned project, located in the Ancash Department, central Peru. The project is centered on a high-grade, gold-silver vein, the Ayelén vein, which was discovered in 2005.

Mineral Resources of 9.0 million ounces of silver at an average grade of 578 g/t and 0.35 million ounces of gold at a grade of 22.40 g/t. Inferred Mineral Resources of 0.2 million ounces of silver at an average grade of 272 g/t. Mineral Resources are as at December 31, 2020.

Expected Capital expenditures is $90.4 million (+/- 15%) for a 400 tonne/day underground mine.

Pitarrilla Mexico

The Pitarrilla project is a 100% owned grassroots discovery made by SSR Mining in 2002, located approximately 160 kilometres north-northwest of the city of Durango within the State of Durango, Mexico. A paved roadway extends to within 47 kilometres of the plant site. Pitarrilla is a silver, lead, and zinc project, which will consist of a large open-pit mainly recovering oxidized ores in the early years of production and then predominantly sulfide ores from the deeper parts of the deposit.

Measured and Indicated Mineral Resources of 496.5 million ounces of silver at an average grade of 97 g/t and 28.8 million ounces of silver at a grade of 165 g/t at Pitarrilla Underground. Inferred Mineral Resources of 21.2 million ounces of silver at an average grade of 77.4 g/t and 5.5 million ounces of silver at a grade of 138.1 g/t at Pitarrilla Underground. Mineral Resources are as at December 31, 2020.

A 32-year project producing an average of 15 million ounces of silver per year during the first 18 years of production.

Exploration

Amisk Canada

Amisk (100% SSRM owned) is a gold-silver project located on the Flin Flon greenstone belt in Saskatchewan, Canada, approximately 20 kilometers southwest of Flin Flon, Manitoba and approximately 140 Kilometers southeast of SSR Mining’s Seabee operation. SSR Mining acquired the Amisk project on May 31, 2016 as a result of its acquisition of Claude Resources Inc.

Indicated Mineral Resources of 0.83 million ounces of gold at an average grade of 0.85 g/t and 6.0 million ounces of silver at a grade of 6.2 g/t. Inferred Mineral Resources of 0.59 million ounces of gold at an average grade of 0.64 g/t and 3.7 million ounces of silver at a grade of 4.0 g/t. Mineral Resources are as at December 31, 2019.

Sunrise Lake Canada

Sunrise Lake (100% SSRM owned) is located in the Northwest Territories, 130 kilometers northeast of Yellowknife, and hosts silver-gold and base metal mineralization outlined by 21,774 meters of surface diamond drilling since discovery in 1987. The Sunrise Lake deposit is a typical volcanogenic sulphide deposit comprising a steeply dipping lens three-to-four meters thick, 120 meters wide and 190 meters long. Underlying the mineralization is lower grade disseminated mineralization up to about 50 meters in thickness.

Business Overview

SSR Mining is a precious metals mining company with four producing assets located in the United States, Turkey, Canada and Argentina. The Company is primarily engaged in the operation, acquisition, exploration and development of precious metal resource properties located in Turkey and the Americas. The Company produces gold doré as well as copper, silver, lead and zinc concentrates. SSR Mining's diversified asset portfolio is comprised of high-margin, long-life assets located in some of the world's most prolific metal districts.3

On September 16, 2020, the Company completed the business acquisition of Alacer Gold Corp. ("Alacer"). The Company acquired all of the issued and outstanding common shares of Alacer for total consideration of $2,180 million. The financial information included in the following discussion and analysis of financial condition and results of operations for the year ended December 31, 2020, compared to the same periods in 2019, includes the results of the Çöpler operation since September 16, 2020. For further information, see Note 3 to the Consolidated Financial Statements.

On October 21, 2021, the Company completed the sale of a portfolio of 16 royalties and various deferred consideration interests in Turkey and the Americas (the "Royalty Portfolio") to EMX Royalty Corporation (“EMX”). The Company received total consideration of $33.0 million in cash and $34.5 million in equity (12.3 million common shares at $2.80 per share). In addition, the Company will receive up to $34.0 million in contingent cash payments payable upon completion of certain milestones related to the Yenipazar project. For further information, see Note 3 to the Consolidated Financial Statements.

On January 12, 2022, the Company entered into an agreement with Endeavour Silver Corp. ("Endeavour Silver") to sell its Pitarrilla project in Durango, Mexico for consideration consisting of $35.0 million in common shares of Endeavor Silver, $35.0 million in cash, and a 1.25% net smelter returns royalty on the Pitarilla property. The transaction is expected to close in the first half of 2022. Until closing, Pitarrilla will be included in the Company's Exploration, evaluation and development properties segment.

Financial Highlights

For the year ended December 31, 2021, revenue increased by $621.1 million, or 72.8%, to $1,474.2 million as compared to $853.1 million the year ended December 31, 2020. The increase was mainly due to an increase in gold equivalent ounces sold by 71.4%, partially offset by a 0.6% decrease in average realized gold prices. Changes in sales across the Company's operations were as follows: ( i ) gold sales at Çöpler increased $402.4 million, (ii) metal sales at Puna increased $123.5 million, (iii) gold sales at Seabee increased $78.6 million and (iv) gold sales at Marigold increased $16.6 million. At Çöpler, gold sales were 195.8% higher in 2021 due to a full year of operations and the results for the year ended December 31, 2020 represent only the results from September 16, 2020 to December 31, 2020, the period for which the Company was entitled to the economic benefits of Çöpler following the Company's acquisition of Alacer. At Seabee and Puna, the increase in revenues in 2021 was due to the impact of the temporary suspensions of operations related to COVID-19 during the year ended December 31, 2020. At Marigold, revenues remained relatively consistent for the year ended December 31, 2021 as compared to the year ended December 31, 2020.

Production costs increased by $226.8 million, or 51.0%, to $671.4 million for the year ended December 31, 2021, as compared to $444.5 million for the year ended December 31. 2020. The increase was primarily due to an additional $143.3 million in production costs at Çöpler during 2021, a 117.8% increase, reflecting a full year of operations during the year ended December 31, 2021 as compared to partial year costs recorded in 2020 from September 16, 2020 through December 31, 2020, following the acquisition of Alacer. The remaining increase is due to higher production costs of $25.8 million at Seabee, $55.1 million at Puna and $2.7 million at Marigold. At Seabee and Puna, production costs increased in 2021 as the sites did not shut down or temporarily suspend operations as the result of COVID-19 as had happened in the year ended December 31, 2020. At Marigold, production costs remained relatively consistent for the year ended December 31, 2021 as compared to the year ended December 31, 2020.

Depreciation, depletion, and amortization expense increased by $118.7 million, or 108.6%, to $228.0 million for the year ended December 31, 2021 as compared to $109.3 million for the year ended December 31, 2020. At Çöpler, the increase of $91.4 million reflected a full year of operations being included in the results for the year ended December 31, 2021 as compared to the period from September 16, 2020 to December 31, 2020, following the acquisition from Alacer. At Seabee and Puna, depreciation, depletion, and amortization increased primarily due to the impact of the temporary suspensions of operations related to COVID-19 during the year ended December 31, 2020.

General and administrative expense for the year ended December 31, 2021 was $56.6 million as compared to $33.6 million for the year ended December 31, 2020. General and administrative expenses increased primarily due to a larger combined organization following the acquisition of Alacer that covers more locations and jurisdictions, partially offset by the decrease in stock-based compensation expense primarily related to mark-to-market adjustments for cash-settled units due to changes in the Company's common share price. Further, the insurance market has hardened in 2021 across almost all insurance policy types and the Company is experiencing increased rates as a result of the pricing change in the market.

Exploration, evaluation, and reclamation costs for the year ended December 31, 2021 were $42.4 million as compared to $27.0 million for the year ended December 31, 2020. Exploration and evaluation activity in the year ended December 31, 2020 was restricted by COVID-19. The expenditures incurred during the year ended December 31, 2021 mainly relate to brownfield exploration work at Çöpler, particularly around the Saddle target and Ardich, in addition to work at the Trenton Canyon property of Marigold and work at Seabee. The expenditures incurred during the year ended December 31, 2020 mainly related to greenfield exploration work performed at the Trenton Canyon property of Marigold and Seabee.

Interest expense for the year ended December 31, 2021 was $19.1 million as compared to $13.9 million for the year ended December 2020. The increase is mainly due to the addition of a full year of interest expense incurred in 2021 associated with the Term Loan and the Air Liquide oxygen plant at Çöpler which were assumed as part of the acquisition of Alacer.

First Quarter 2022 Results

May 3, 2022; SSR Mining Inc. reports consolidated financial results for the first quarter ended March 31, 2022. In addition, the Board of Directors declared a quarterly cash dividend of $0.07 per common share payable on June 9, 2022 to holders of record at the close of business on May 13, 2022.4

Rod Antal, President and CEO said, "The first quarter of 2022 continued SSR Mining’s proud track record of operational outperformance, as the company delivered gold equivalent production of 173,675 ounces at AISC of $1,093/oz, positioning the Company well against full year guidance. In particular, the company reported record quarterly production of 52,582 ounces at Seabee as the company accessed a continuation of a high-grade zone outside of the Mineral Reserve that was first mined in the second quarter of 2021. Similarly at Çöpler, the ramp up of the flotation circuit is well underway, allowing it to process a record number of tonnes through the sulfide plant in the quarter. Across the remainder of the portfolio, the company continue to expect stronger production in the quarters ahead, in line with its previously announced guidance of 700,000 to 780,000 gold equivalent ounces at AISC of $1,120 to $1,180 per gold equivalent ounce.

From a financial perspective, the company increased its quarterly dividend payment by 40% to $0.07 per share within the first quarter. The company continue to expect free cash flow to be weighted to the second half of 2022, and the company will work to ensure that its capital returns initiatives appropriately reflect its robust free cash flow generation. Finally, its high-return growth initiatives continue to advance on schedule with Çakmaktepe Extension and C2 targeting first production in 2023 and 2025, respectively. The company expect to release a number of exploration updates across its asset base through the second half of the year and will look to incorporate those results into updated technical reports in 2023 that build on the strong base-line established earlier this year.”

- Robust quarterly operating performance: Delivered first quarter production of 173,675 gold equivalent ounces at AISC of $1,093/oz. Previously announced full year guidance of 700,000 – 780,000 gold equivalent ounces at AISC of $1,120 to $1,180 per gold equivalent ounce is unchanged and remains weighted to the second half of the year

- Continued delivery of cash flow: Generated cash flows from operating activities of $62.2 million and free cash flow of $27.7 million in the first quarter. As previously guided, free cash flow was impacted by increased tax and royalty payments, as well as increased working capital outlays, in the first quarter and remains significantly second half weighted. Attributable net income in the first quarter was $67.6 million, or $0.31 per diluted share, and adjusted attributable net income was $65.9 million, or $0.30 per diluted share. (

- Dividend increased as part of capital returns commitment: During the first quarter, the Board declared a quarterly cash dividend of $0.07 per share, a 40% increase over the prior quarter, which was paid on April 4, 2022. The Normal Course Issuer Bid (“NCIB”), first announced on April 19, 2021, remained active during the quarter.

- Balance sheet continues to support growth initiatives: At the end of the first quarter, the Company had a cash and cash equivalents balance of $999.0 million, after $17.8 million in scheduled debt repayments and $30.8 million in dividends to joint venture partners. Non-GAAP net cash totals $680.6 million as of March 31, 2022.

- Three-year guidance showcased stable production profile above 700,000 gold equivalent ounces: In the first quarter, SSR Mining announced its inaugural three-year production guidance highlighting annual production in excess of 700,000 gold equivalent ounces in 2022, 2023 and 2024 without requirements for material capital investment. In addition, updated technical report summaries for all four producing assets established a platform that the company expect will be capable of maintaining 700,000 gold equivalent ounces of production for at least the remainder of the decade.

- Increased gold Mineral Reserves by 14% to 9.2 million ounces: Mineral Reserve conversion at Ardich and Seabee’s Gap Hangingwall drove a 1.1 million ounce, or 14%, increase to total gold Mineral Reserves, net of depletion.

- Çöpler flotation circuit ramp-up well underway, Çakmaktepe Extension development progressing: Delivered gold production of 70,641 ounces in the first quarter at AISC of $955 per ounce. The sulfide plant treated a record of approximately 645,000 tonnes in the quarter. The Company continues to progress Çakmaktepe Extension towards first gold production in 2023. In the first quarter of 2022, the Company released an updated Çöpler District Master Plan (“CDMP21”) that showcased life of mine production of more than 1.2 million ounces of gold from Çakmaktepe Extension for $69 million in initial capital, and an Initial Assessment Case (“IAC”) for the C2 project that featured more than 1.0 million ounces of gold production for $218 million in initial capital and an IRR of approximately 60%.

- Marigold on track for full year production guidance: Delivered gold production of 33,788 ounces for the first quarter as the timing and grade of material stacked deferred some ounces into the second quarter. Full-year production remains second-half weighted as higher-grade ore is accessed later in the year.

- Seabee delivers record quarterly production: Produced 52,582 ounces of gold at AISC of $596 per ounce as processed grades of 17.8 g/t were well above plan. Mining accessed a continuation of a very high grade zone outside of the Mineral Reserve that was first mined in the second quarter of 2021. Exploration is underway in an attempt to further define extension of this high-grade zone, though grades are scheduled to return closer to plan of 9.2 g/t for the remainder of 2022. Operational excellence initiatives also improved underlying mine performance in the first quarter, including a quarterly record of nearly 103,000 tonnes mined (approximately 1,150 tonnes per day).

- Puna continues strong cost performance: Produced 1.3 million ounces of silver at cash costs of $13.06 per ounce in the first quarter and AISC of $14.67 per ounce. The mine remains on track to achieve its full-year guidance.

- 2021 ESG and Sustainability Report: On April 14, 2022, the Company published its fourth annual ESG and Sustainability Report. The report outlines SSR Mining’s approach to sustainability across a range of areas, including Health & Safety, environment, communities and diversity, as well as summarizes its 2021 ESG performance.

- Announced the sale of the Pitarrilla project: On January 13, 2022, the Company announced it had entered into a definitive agreement to sell its Pitarrilla silver project in Durango, Mexico to Endeavour Silver Corp. (“EXK”) for total consideration of up to $127 million. This consideration includes $35 million in cash, $35 million in EXK shares, and a 1.25% Net Smelter Return (“NSR”) royalty on the Pitarrilla property. (2) The transaction, which is subject to TSX and NYSE regulatory approvals, the approval of the Mexican Federal Economic Competition Commission and customary closing conditions, is expected to close in the second quarter of 2022.

- Closed the acquisition of Taiga Gold Corp.: Subsequent to the quarter’s end, on April 14, 2022, SSR Mining completed the previously announced plan of arrangement (the “Arrangement”) to acquire all of the issued and outstanding shares of Taiga Gold Corp. (CSE: TGC) (“Taiga Gold”). The transaction consolidated a 100% interest in the Fisher property contiguous to the Seabee mine, eliminated a 2.5% NSR royalty on the Fisher property, and added five new properties covering over 29,100 hectares to complement the Company’s existing exploration platform in the underexplored and geologically prospective Province of Saskatchewan. SSR Mining’s Saskatchewan assets now cover an area of approximately 131,150 hectares.