Shopify

Summary

- Shopify is a leading global commerce company help merchants to market and manage retail business of any size.

- The Company was incorporated on September 28, 2004 and change name to Shopify Inc. On April 12, 2013.

- The company offers merchants to easily display, manage, and sell their products across over a dozen different sales channels.

- As of December 31, 2020, Shopify has approximately 1,749,000 merchants from approximately 175 countries using our platform.

Company Overview

Shopify (NYSE:SHOP, TSX:SHOP) is a leading global commerce company, providing trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Headquartered in Ottawa, Canada, Shopify powers over one million businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Staples and many more.1

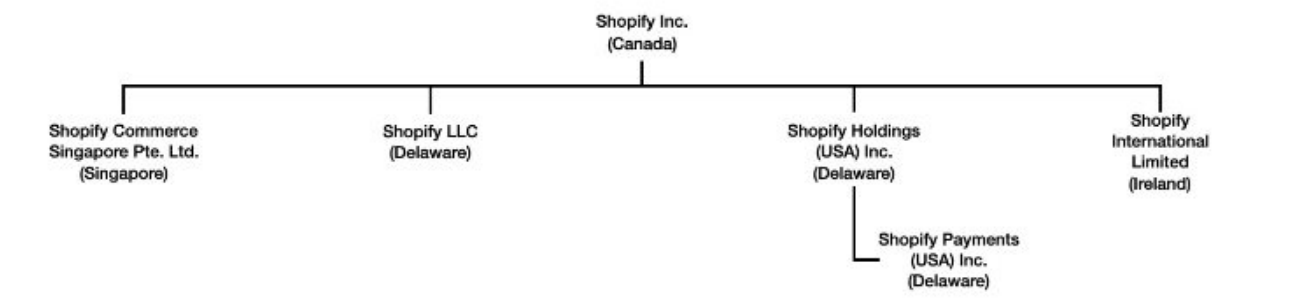

The Company was incorporated under the Canada Business Corporations Act (the "CBCA") on September 28, 2004 under the name 4261607 Canada Ltd. The company filed articles of amendment on January 19, 2006 to change its name to Jaded Pixel Technologies Inc., and again on November 30, 2011 to change its name to Shopify Inc. On April 12, 2013. The company's initial public offering occurred on May 20, 2015.

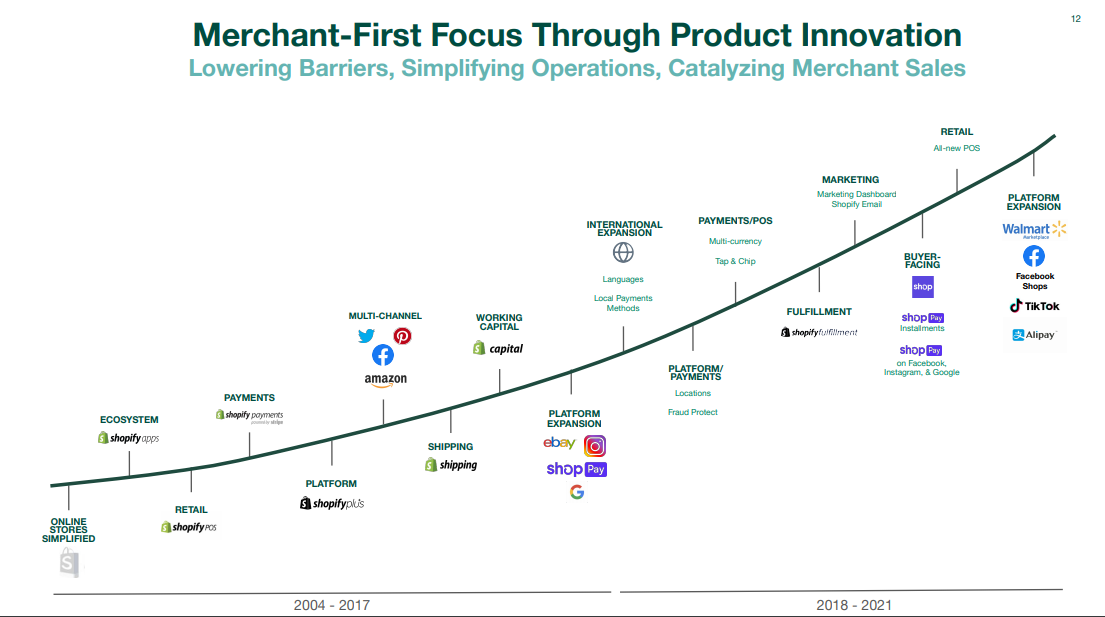

A multi-channel front end. The company's software enables merchants to easily display, manage, and sell their products across over a dozen different sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces. More than two-thirds of its merchants use two or more channels. The Shopify application program interface ("API") has been developed to support custom storefronts that let merchants sell anywhere, in any language.2

A single integrated back end. The company's software provides one single integrated, easy-to-use back end that merchants use to manage their business and buyers across these multiple sales channels. Merchants use their Shopify dashboard, which is available in 20 languages, to manage products and inventory, process orders and payments, fulfill and ship orders, discover new buyers and build customer relationships, source products, leverage analytics and reporting, and access financing.

A data advantage. The company's software is delivered to merchants as a service, and operates on a shared infrastructure. With each new transaction processed, the company grow its data proficiency. This cloud-based infrastructure not only relieves merchants from running and securing their own hardware, it also consolidates data generated by the interactions between buyers and merchants’ shops, as well as those of its merchants on the Shopify platform, providing rich data to inform both its own decisions as well as those of its merchants.

Merchants

The company's mission is to make commerce better for everyone, and the company believe the company can help merchants of nearly all retail verticals and sizes, from aspirational entrepreneurs to large enterprises, realize their potential at all stages of their business life cycle. The company's marketing efforts primarily focus on selling to small and medium-sized businesses (“SMBs”) and entrepreneurs while its direct sales team addresses the needs of large merchants. The large majority of its merchants are on subscription plans that cost less than $50 per month, which is in line with its focus on providing cost-effective solutions for early stage businesses.

As of December 31, 2020, the company had approximately 1,749,000 merchants from approximately 175 countries using its platform, geographically dispersed as follows: 56% North America (50% in the United States and 6% in Canada), 25% Europe Middle East and Africa (8% in the United Kingdom), 15% Asia Pacific, Australia and China (6% in Australia) and 4% in Latin America (Mexico and South America).

Offerings

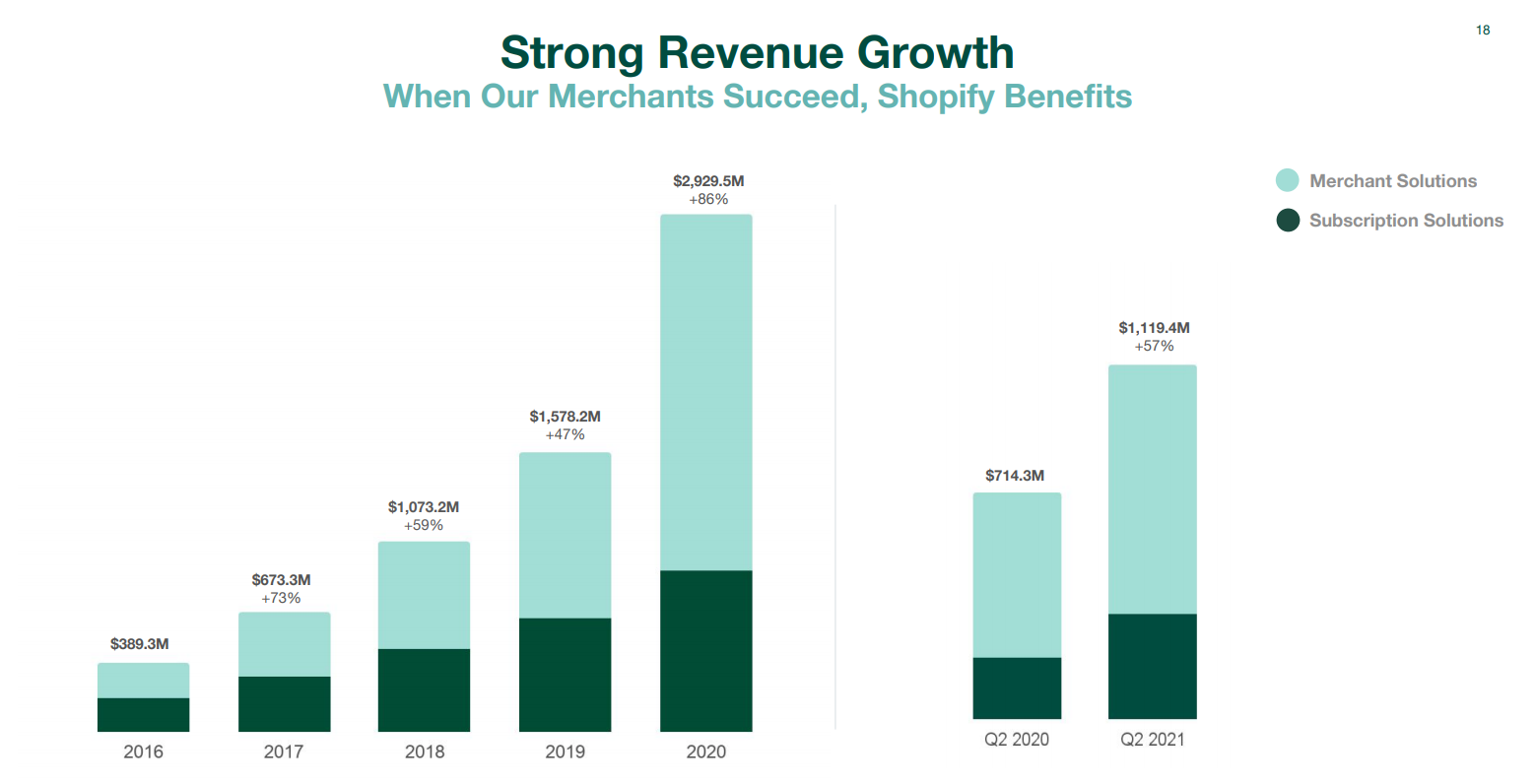

The company's business model has two revenue streams: a recurring subscription component the company call subscription solutions, and a merchant success-based component the company call merchant solutions.

Subscription Solutions

The company generate subscription solutions revenues primarily through the sale of subscriptions to its platform, including variable platform fees, as well as through the sale of subscriptions to its Point-of-Sale ("POS") Pro offering, the sale of themes, the sale of apps, and the registration of domain names.

Merchant Solutions

The company offer a variety of merchant solutions to augment those provided through a subscription to address the broad array of functionality merchants commonly require, including accepting payments, shipping and fulfillment, and securing working capital. The company believe that offering merchant solutions creates additional value for merchants, saving them time and money by making additional functionality available within a single centralized commerce platform, and creates additional value for Shopify by increasing merchants’ use of its platform.

The company principally generate merchant solutions revenues from payment processing fees from Shopify Payments. In addition to payment processing fees from Shopify Payments, the company also generate merchant solutions revenue from other transaction fees, referral fees from partners, advertising revenue on the Shopify App Store, Shopify Capital, Shop Pay Installments, Shopify Shipping, Shopify Fulfillment Network, the sale of POS hardware and collaborative warehouse fulfillment solutions, and Shopify Email.

Seasonality

The company's merchant solutions revenues are directionally correlated with the level of GMV that merchants facilitated through its platform. The company's merchants typically process additional GMV during the fourth quarter holiday season. As a result, Shopify has historically generated higher merchant solutions revenues in its fourth quarter than in other quarters. While the company believe that this seasonality has affected and will continue to affect its quarterly results, its rapid growth has largely masked seasonal trends to date, as has the impact of the COVID-19 pandemic in 2020. As revenue from its merchant solutions offerings has grown faster than revenue from subscription solutions, its business may become more seasonal in the future and historical patterns in its business may not be a reliable indicator of its future performance.

Financial Highlights

Shopify Second-Quarter 2021 Financial Results

July 28, 2021 announced strong financial results for the quarter ended June 30, 2021.3

“This past year has been one of great uncertainty for independent merchants. What used to be two completely distinct industries, the retail industry and the online commerce industry, are now just the commerce industry. In this new reality, its goal at Shopify is clearer than ever: the company want to give entrepreneurs around the world the best chance to create their own certainty, to reach for independence and to seize opportunity that they uniquely see. Shopify is building the essential infrastructure for this increasingly digital world to allow as many people as possible to participate,” said Tobi Lütke, Shopify's CEO at its recent Shopify Unite developer conference.

“Shopify fired on all cylinders in its second quarter, keeping its merchants well equipped to seize the opportunities presented in a post-pandemic retail era,” said Amy Shapero, Shopify’s CFO. “As consumer spending remained strong, its merchants thrived and extracted more value from its platform, contributing to its rapid growth. The company built on its momentum, making significant updates to its platform infrastructure, expanding strategic partnerships, and advancing its portfolio of growth initiatives to future-proof the success of tomorrow’s entrepreneurs.”

Second-Quarter Financial Highlights

- Total revenue in the second quarter was $1,119.4 million, up 57% year over year.

- Subscription Solutions revenue was $334.2 million, up 70% year over year, primarily due to more merchants joining the platform.

- Merchant Solutions revenue was $785.2 million, up 52%, driven primarily by the growth of Gross Merchandise Volume1 ("GMV").

- Monthly Recurring Revenue ("MRR") as of June 30, 2021 was $95.1 million. Growth accelerated to 67% year-over-year with MRR up from $57.0 million as of June 30, 2020 as more merchants joined the platform and the number of retail locations using POS Pro increased. Shopify Plus contributed $25.2 million, or 26%, of MRR compared with 29% of MRR as of June 30, 2020 as a result of the significantly higher number of merchants on standard plans joining the platform in the past 12 months and new incremental revenue from its Retail POS Pro subscription offering

- GMV for the second quarter was $42.2 billion, an increase of $12.1 billion or 40% over the second quarter of 2020. Gross Payments Volume3 ("GPV") grew to $20.3 billion, which accounted for 48.0% of GMV processed in the quarter, versus $13.4 billion, or 45%, for the second quarter of 2020.

- Gross profit dollars grew 66% to $620.9 million in the second quarter of 2021, compared with $375.0 million for the second quarter of 2020.

- Adjusted gross profit4 dollars grew 64% to $627.0 million in the second quarter of 2021, compared with $381.4 million for the second quarter of 2020.

- Operating income for the second quarter of 2021 was $139.4 million, or 12% of revenue, versus income of $0.3 million, or 0% of revenue, for the comparable period a year ago.

- Adjusted operating income4 for the second quarter of 2021 was $236.8 million, or 21% of revenue, compared with adjusted operating income of $113.7 million or 16% of revenue in the second quarter of 2020.

- Net income for the second quarter of 2021 was $879.1 million, or $6.90 per diluted share, compared with net income of $36.0 million, or $0.29 per diluted share, for the second quarter of 2020. Q2 2021 net income includes a $778 million unrealized net gain on its equity investments.

- Adjusted net income4 for the second quarter of 2021 was $284.6 million, or $2.24 per diluted share, compared with adjusted net income of $129.4 million, or $1.05 per diluted share, for the second quarter of 2020.

- At June 30, 2021, Shopify had $7.76 billion in cash, cash equivalents and marketable securities, compared with $6.39 billion at December 31, 2020.

Outlook

The company's outlook for the remainder of 2021 is consistent with its assumptions in February. Shopify has seen an improvement in the overall economic environment through the first half of 2021, consumer spending beginning to rotate back to services and off-line retail, and ecommerce growing at a more normalized pace relative to 2020.

In view of these factors and Shopify’s performance for the six months ending June 30, 2021, the company continue to expect to grow revenue rapidly in 2021, but at a lower rate than in 2020.

For 2021, the company continue to anticipate stock-based compensation expenses and related payroll taxes of $425 million and amortization of acquired intangibles of $21 million.

Recent developments

The Most Flexible, Scalable, and High-Performing Shopify Ever: Major Platform Investments Unveiled at Unite 2021 Give Entrepreneurs Limitless Creative Power 4

June 29, 2021; Developers and merchants will now have even more potential to create unique experiences that will define the future of commerce on the internet

Shopify already powers commerce on the internet; in 2020, more than 450 million people checked out on Shopify, and the company processed nearly $120 billion in Gross Merchandise Volume (GMV). As the world’s commerce platform, the company keep innovating to give entrepreneurs endless possibilities to creatively present their brands and grow their businesses.

Today at Shopify Unite 2021, the company announced its largest set of platform investments to date. With a lens into the future where every merchant can tell their unique story, Shopify is reinventing the internet’s commerce infrastructure like never before and calling on developers to help it build that future together.

We’re not just betting on a world full of merchants, but on a world full of developers and technical entrepreneurs. The company's infrastructure updates—from Storefronts and Checkout to the Theme Store and its Partner Ecosystem—give developers and merchants even more power to create, customize, scale, and monetize on Shopify.

“The internet is the world’s largest city, and Shopify is building its commerce infrastructure,” said Tobi Lütke, CEO of Shopify. “Especially over the past year, the company saw independent businesses succeed by showing up creatively and uniquely in this city. The future of commerce on the internet relies on creative expression at every touchpoint. Together with developers, Shopify is building the infrastructure to make this possible.”

References

- ^ https://investors.shopify.com/resources/default.aspx#faq

- ^ https://s27.q4cdn.com/572064924/files/doc_financials/2020/ar/40-F.pdf

- ^ https://s27.q4cdn.com/572064924/files/doc_financials/2021/q2/Press-Release-Q2-2021.pdf

- ^ https://news.shopify.com/the-most-flexible-scalable-and-high-performing-shopify-ever-major-platform-investments-unveiled-at-unite-2021-give-entrepreneurs-limitless-creative-power-pjejqz