Suncor Energy

Summary

- Suncor is a globally competitive integrated energy company.

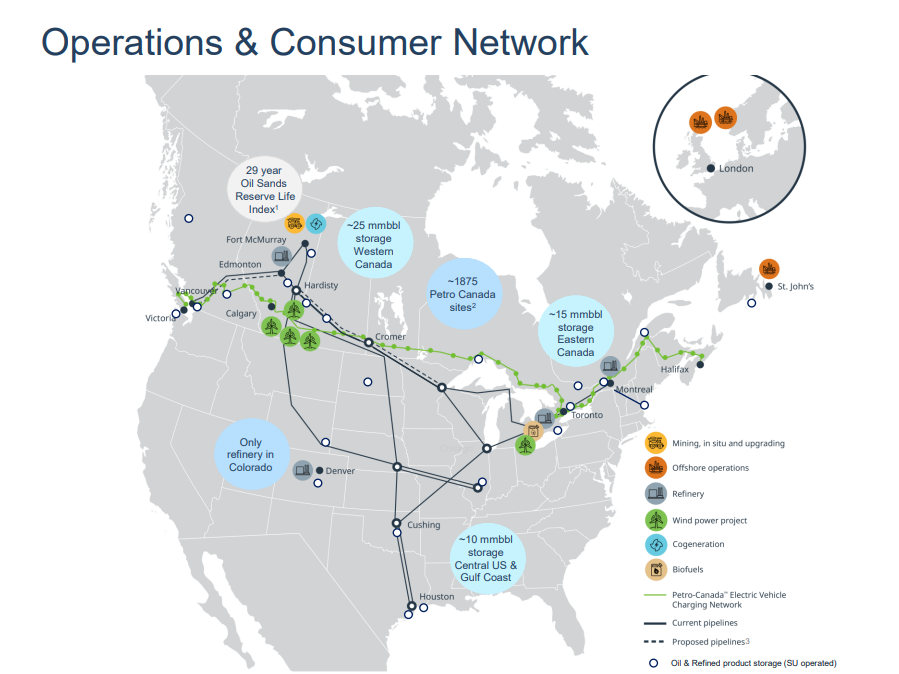

- Suncor operations include oil sands development, production and upgrading; offshore oil and gas; petroleum refining in Canada and the US; and our national Petro‑Canada™ retail distribution network (now including our Electric Highway network of fast-charging EV stations).

- Suncor Energy is headquartered in Calgary, Alberta, Canada, and we have a global team of over 30,000 people.

Company Overview

Suncor (NYSE:SU, TSX:SU) is a globally competitive integrated energy company.

Suncor Energy is headquartered in Calgary, Alberta, Canada, and Suncor Energy has a global team of over 30,000 people. The company's operations include oil sands development, production and upgrading; offshore oil and gas; petroleum refining in Canada and the US; and its national Petro‑Canada retail distribution network (now including its Electric Highway network of fast-charging EV stations). The company care about responsibly developing its petroleum resources, while profitably growing a renewable energy portfolio and advancing the transition to a low-emissions future.1

Business Segments

The company produce and provide energy 2

Oil sands

Suncor Energy was the first company to commercially develop the oil sands in northern Alberta, creating an industry that is now a key contributor to Canada’s prosperity.

Oil sand is a mixture of bitumen, sand, clay and water. Because it does not flow like conventional crude oil which isa liquid, it must be mined or heated underground before it can be processed.

Once the bitumen has been extracted, the company upgrade it into higher-value synthetic crude oil, diesel fuel and otherproducts.

Suncor extracts bitumen in two ways: mining and in situ.

Exploration and production

The company's Exploration and Production (E&P) business consists of offshore operations off the east coast of Canada and in the North Sea, the Norwegian Sea and onshore assets in Libya and Syria.

The company's Exploration and production (E&P) business consists of offshore operations off the east coast of Canada and in the North Sea, the Norwegian Sea and onshore assets in Libya and Syria. The exploration and production business provides portfolio diversity with low-cost conventional production, which helps balance against higher cost oil sands production, particularly when crude prices are low.

Refining

Suncor Energy’s refining and marketing operations provide a vital link between its large Canadian resource base and the growing North American energy market. The company process oil sands crude into the high-quality refined products that consumers demand.

Suncor operates refineries in Alberta, Ontario and Quebec, Canada, and in Colorado, USA.

- Edmonton, Alta.: 142,000-barrel-per-day refinery runs entirely on oil sands-based feedstocks and produces a high yield of light oils

- Montreal, Que.: 137,000-barrel-per-day refinery produces gasoline, distillates, asphalts, heavy fuel oil, petrochemicals, solvents and feedstock for lubricants. A nearby sulphur processing plant ensures environmental compliance

- Commerce City, Colo.: 98,000-barrel-per-day refinery produces gasoline, diesel fuel and paving-grade asphalt

- Sarnia, Ont.: 85,000-barrel-per-day refinery produces gasoline, kerosene, jet and diesel fuels

Low-carbon power

The company continue to increase its low-carbon power production through cogeneration and its investments in wind. Suncor Energy is also evaluating the potential for solar power.

All of its oil sands facilities use cogeneration which is a natural gas-fueled process that produces both industrial steam and electricity. Cogeneration has the lowest GHG emissions of hydrocarbon-based power generation.

Suncor has been in the wind power business for more than 20 years. Suncor Energy has interests in four wind farms located in Ontario and western Canada. We’re also looking at solar power projects as an additional low-carbon power development – all of these are part of its low-carbon future.

Combined, its investments in cogeneration and wind power make it the fifth largest and one of the most carbon-competitive independent power producers in Alberta by generation capacity. Across its operations, Suncor Energy has working interest in approximately 1,400 megawatts (MW) of renewable and cogeneration capacity and provide approximately 500 MW to regional grids, increasing its revenue and providing low-carbon energy to consumers.

Low-carbon fuels

Since 2006, Suncor has been a part of Canada’s renewable liquid fuels industry.

Ethanol from its St. Clair, Ont. plant gets blended into its Petro‑Canada gasoline today and we’re researching even lower-carbon intensity ethanol for the future.

We’re advancing a portfolio of projects with universities and companies aimed at developing pathways to produce advanced renewable liquid fuels from waste, forestry and agricultural excess biomass, and refinery gases. These fuels have the potential to significantly reduce GHG emissions.

Supply and trading

Suncor Energy Inc.’s commercial centre of excellence for sales and marketing of selected energy products and services. With offices in Calgary, Alta., Denver, Colo., and London, England, the company market to various regional North American and global energy markets.

Supply & Trading is organized around four main commodity groups:

- Crude Oil

- Natural Gas

- Sulphur

- Petroleum Coke

Each commodity group provides value to customers through innovative commodity supply, transportation and pricing solutions.

The company's customers include mid- to large-sized commercial/industrial consumers, utility companies and energy producers that demand specialized solutions to meet unique energy requirements.

Petro‑Canada

Proudly owned by Suncor, Petro‑Canada, has a network of more than 1,800 retail and wholesale locations across Canada, providing customers with a wide variety of fuel and service offerings including low-carbon fuel options.

Petro‑Canada is driven by its people, its associates and you, its guests and neighbours. Petro‑Canada operates more than 1,500 retail stations and 300 Petro‑Pass wholesale locations nationwide, including almost 60 marketing arrangements with Indigenous communities.

In 2019, Petro‑Canada opened Canada’s Electric Highway™, the first coast-to-coast network of electric vehicle chargers in Canada. Through its retail loyalty program, Petro‑Points™, the company provide Canadians with the opportunity to earn and redeem rewards.

Petro‑Canada is proud to be a National Partner of the Canadian Olympic and Paralympic committees, supporting Canadian athletes, coaches and their families for more than 25 years.

As Canadians, the company care for each other – without being asked, because it’s the right thing to do. It’s who Suncor Energy is, and it makes its communities stronger. The Petro‑Canada CareMakers Foundation™ will support Canadian caregivers, helping create a future where caregiving is seen and appreciated.

Plant Locations

| FACILITY NAME | LOCATION | COUNTRY | BUSINESS AREAS |

| Adelaide Wind Power Project | Strathroy, Ont. | Canada | Low-carbon power |

| Base Mine Extension (proposed) | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands |

| Base Plant (Millennium & North Steepbank) | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands |

| Burrard Terminal | Burnaby or Port Moody, B.C. | Canada | Refining |

| Chin Chute | Taber, Alta. | Canada | Low-carbon power |

| Commerce City Refinery | Commerce City, Col. | USA | Refining |

| Commodity Supply and Trading | Various | Canada, U.S.A., England | Supply and trading |

| Edmonton Refinery | Sherwood Park, Alta. | Canada | Refining |

| Firebag | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands (in situ) |

| Fort Hills | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands |

| Forty Mile Low-carbon Power Project | Forty Mile County, Alta. | Canada | Low-carbon power |

| Head office | Calgary, Alta. | Canada | Corporate |

| Lewis (proposed) | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands (in situ) |

| Libya (on hold) | Libya | Exploration and production | |

| MacKay River | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands (in situ) |

| Magrath | Magrath, Alta. | Canada | Low-carbon power |

| Meadow Creek East (proposed) | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands (in situ) |

| Montreal Refinery | Montreal, Que. | Canada | Refining |

| Montreal Sulphur Plant | Montreal, Que. | Canada | Refining |

| Newfoundland (Terra Nova, Hibernia, White Rose, Hebron) | St. John’s, N.L. | Canada | Exploration and production |

| Norway (Oda, Fenja, Norwegian Petroleum Products, Beta) | Stavanger | Norway | Exploration and production |

| Rimouski Terminal | Rimouski, Que. | Canada | Refining |

| Sarnia Refinery | Sarnia, Ont. | Canada | Refining |

| St. Clair Ethanol Plant | Sarnia-Lambton, Ont. | Canada | Low-carbon fuels |

| SunBridge | Gull Lake, Sask. | Canada | Low-carbon power |

| Syncrude | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands |

| Syncrude Mildred Lake Extension (proposed) | Fort McMurray-Wood Buffalo, Alta. | Canada | Oil sands |

| Syria (on hold) | Syria | Exploration and production | |

| United Kingdom | Aberdeen | Canada | Exploration and production |

Industry Overview

In 2021, crude oil and crack spread benchmarks improved compared to 2020, which was significantly impacted by an unprecedented decline in transportation fuel demand due to the impacts of the COVID-19 pandemic.3

Suncor’s sweet SCO price realizations are influenced primarily by the price of WTI at Cushing and by the supply and demand for sweet SCO from Western Canada. Sweet SCO price realizations were favourably impacted in 2021 and reflected an increase in WTI at Cushing, which averaged US$67.95/bbl compared to US$39.40/bbl in the prior year. Suncor also produces sour SCO, the price of which is influenced by various crude benchmarks, including, but not limited to, MSW at Edmonton and WCS at Hardisty, and which can also be affected by prices negotiated for spot sales. Prices for MSW at Edmonton increased to $80.30/bbl in 2021 compared to $45.60/bbl in 2020, and prices for WCS at Hardisty increased to US$54.90/bbl in 2021, from US$26.85/bbl in 2020.

Suncor’s sweet SCO price realizations are influenced primarily by the price of WTI at Cushing and by the supply and demand for sweet SCO from Western Canada. Sweet SCO price realizations were favourably impacted in 2021 and reflected an increase in WTI at Cushing, which averaged US$67.95/bbl compared to US$39.40/bbl in the prior year. Suncor also produces sour SCO, the price of which is influenced by various crude benchmarks, including, but not limited to, MSW at Edmonton and WCS at Hardisty, and which can also be affected by prices negotiated for spot sales. Prices for MSW at Edmonton increased to $80.30/bbl in 2021 compared to $45.60/bbl in 2020, and prices for WCS at Hardisty increased to US$54.90/bbl in 2021, from US$26.85/bbl in 2020.

Suncor’s sweet SCO price realizations are influenced primarily by the price of WTI at Cushing and by the supply and demand for sweet SCO from Western Canada. Sweet SCO price realizations were favourably impacted in 2021 and reflected an increase in WTI at Cushing, which averaged US$67.95/bbl compared to US$39.40/bbl in the prior year. Suncor also produces sour SCO, the price of which is influenced by various crude benchmarks, including, but not limited to, MSW at Edmonton and WCS at Hardisty, and which can also be affected by prices negotiated for spot sales. Prices for MSW at Edmonton increased to $80.30/bbl in 2021 compared to $45.60/bbl in 2020, and prices for WCS at Hardisty increased to US$54.90/bbl in 2021, from US$26.85/bbl in 2020.

Suncor’s refining and marketing gross margins are primarily influenced by 2-1-1 benchmark crack spreads, which are industry indicators approximating the gross margin on a barrel of crude oil that is refined to produce gasoline and distillates. Market crack spreads are based on quoted near-month contracts for WTI and spot prices for gasoline and diesel and do not necessarily reflect the margins at a specific refinery. Suncor’s realized refining and marketing gross margins are Suncor’s refining and marketing gross margins are primarily influenced by 2-1-1 benchmark crack spreads, which are industry indicators approximating the gross margin on a barrel of crude oil that is refined to produce gasoline and distillates. Market crack spreads are based on quoted near-month contracts for WTI and spot prices for gasoline and diesel and do not necessarily reflect the margins at a specific refinery. Suncor’s realized refining and marketing gross margins are

Financial Highlights

Suncor’s net earnings in 2021 were $4.119 billion, compared to a net loss of $4.319 billion in 2020

Suncor’s consolidated adjusted operating earnings increased to $3.805 billion in 2021, compared to an adjusted operating loss of $2.213 billion in the prior year. In 2021, crude oil and refined production realizations increased significantly compared to the prior year, which was significantly impacted by the COVID-19 pandemic and an increase in OPEC+ crude supply. The improving business environment in 2021 also resulted in a net favourable inventory valuation change on crude feedstock costs. Adjusted operating earnings in 2021 were also favourably impacted by higher overall crude production and refinery throughput.

Oil Sands delivered record annual adjusted funds from operations of $6.846 billion, driven by improved crude oil prices and strong reliability across its assets in 2021, compared to $1.986 billion in the prior year.

The Oil Sands segment had adjusted operating earnings of $2.151 billion in 2021, compared to an adjusted operating loss of $2.265 billion in 2020. The increase was primarily due to higher realized crude prices, as crude benchmarks were significantly impacted in the prior year as a result of the COVID-19 pandemic and OPEC+ supply issues, and increased production, partially offset by higher royalties associated with higher crude price realizations and increased operating expenses.

Oil Sands net earnings were $2.147 billion in 2021, compared to a net loss of $3.796 billion in 2020. In addition to the factors impacting adjusted operating earnings (loss) described above, net earnings for 2021 included a $5 million ($4 million after-tax) unrealized loss on risk management activities, compared to a loss of $18 million ($13 million after-tax) in 2020. 2020 net earnings also included the impact of a non-cash impairment charge of $1.821 billion ($1.376 billion after-tax) on its share of the Fort Hills assets due to a decline in forecasted crude oil prices in 2020 as a result of decreased global demand due to the COVID-19 pandemic and changes to its capital, operating and production plans. In 2020, the company also recorded a provision to transportation expense for $186 million ($142 million after-tax) related to the Keystone XL pipeline project.

The company’s net SCO production was 468,600 bbls/d in 2021 compared to 466,200 bbls/d in 2020, marking the secondbest year of SCO production in the company’s history. During 2021, the company achieved a combined upgrader utilization rate of 87% compared to 85% in the prior year, reflecting maintenance activities in both periods. In 2021, Suncor completed the largest annual planned maintenance program in the company’s history, including the significant five-year planned turnaround at Oil Sands Base plant Upgrader 2 and significant turnaround activities at Syncrude.

The company’s net SCO production was 468,600 bbls/d in 2021 compared to 466,200 bbls/d in 2020, marking the secondbest year of SCO production in the company’s history. During 2021, the company achieved a combined upgrader utilization rate of 87% compared to 85% in the prior year, reflecting maintenance activities in both periods. In 2021, Suncor completed the largest annual planned maintenance program in the company’s history, including the significant five-year planned turnaround at Oil Sands Base plant Upgrader 2 and significant turnaround activities at Syncrude.

SCO and diesel sales volumes were 465,700 bbls/d in 2021, compared to 467,900 bbls/d in 2020, reflecting a build of inventory in 2021, compared to a slight draw in the prior year.

Oil Sands operations cash operating costs per barrel in 2021 decreased to $25.90, compared to $28.20 in the prior year due to increased production, partially offset by higher operating, selling and general expenses, as detailed above. Total Oil Sands operations cash operating costs increased to $4.157 billion from $3.934 billion in the prior year.

Adjusted operating earnings were $890 million for E&P in 2021, compared to $13 million in the prior year, with the increase due to higher realized crude prices and lower DD&A and exploration expense, partially offset by lower production volumes and higher royalties. In 2021, crude oil and refined production realizations increased significantly compared to the prior year, which was significantly impacted by the COVID-19 pandemic and an increase in OPEC+ crude supply.

Net earnings for E&P were $1.285 billion in 2021, compared to a net loss of $832 million in 2020. In addition to the factors impacting adjusted operating earnings described above, net earnings in 2021 included a non-cash impairment reversal of $221 million ($168 million after-tax) against the company’s share of the Terra Nova assets and a gain of $227 million ($227 million after-tax) on the sale of the company’s interest in the Golden Eagle Area Development. Net earnings in 2020 included non-cash impairment charges of $1.119 billion ($845 million after-tax) against the company’s share of the White Rose and Terra Nova assets.

Adjusted funds from operations were $1.478 billion in 2021, compared to $1.054 billion in 2020. The increase was largely due to the same factors that impacted adjusted operating earnings described above, excluding the impacts of DD&A and exploration expense.

R&M contributed annual adjusted operating earnings of $2.170 billion in 2021, compared with $882 million in 2020. The increase was primarily due to a significant increase in crude and refined product benchmarks compared to the prior year, which resulted in a FIFO inventory valuation gain compared to a FIFO inventory valuation loss in the prior year and an increase in refining and marketing margins, partially offset by an increase in operating expenses.

Net earnings in 2021 were $2.178 billion compared to net earnings of $866 million in 2020, and were impacted by the same factors as adjusted operating earnings described above. In addition to the factors impacting adjusted operating earnings, net earnings in 2021 included a $10 million ($8 million after-tax) unrealized gain on risk management activities, compared to a $21 million ($16 million after-tax) loss in the prior year.

R&M achieved an annual adjusted funds from operations of $3.255 billion in 2021, compared to $1.708 billion in 2020.

Corporate incurred an adjusted operating loss of $1.262 billion in 2021, compared with an adjusted operating loss of $936 million in 2020, with the increased adjusted operating loss primarily due to a share-based compensation expense in 2021 versus a share-based compensation recovery in 2020. The adjusted operating loss in 2020 included favourable income tax settlements and relief provided under the CEWS program. Suncor capitalized $144 million of its borrowing costs in 2021, compared to $120 million in 2020, as part of the cost of major development assets and construction projects in progress.