Supreme Industries

Summary

- Founded in 1942, Supreme is an leader of India's plastics industry.

- Supreme Industries is the country's largest plastics processors with volumes of over 3,20,000 tonnes of polymers annually

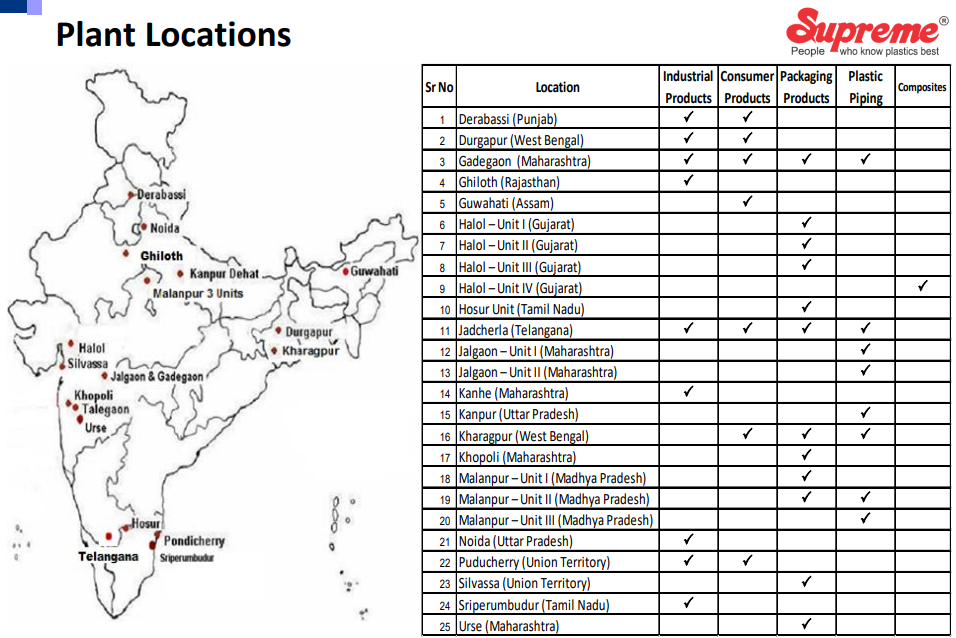

- With 25 plants spread over the country the company has wide geographical and economical advantage.

Company Overview

Founded in 1942, Supreme (NSE:SUPREMEIND) is an acknowledged leader of India's plastics industry. Handling volumes of over 3,20,000 tonnes of polymers annually effectively makes the country's largest plastics processors. 1

Not surprisingly, the company also offer the widest and most comprehensive range of plastic products in India.

The company's 25 advanced plants are powered by technology from world leaders, and complement its extensive facilities for R & D and new product development. In fact, Supreme is credited with pioneering several products in India. These include Cross- Laminated Films, HMHD Films, Multilayer Films, SWR Piping Systems and more.

Supreme Industries Limited is India's leading plastic processing company with seven business divisions. The company has forayed into different types of plastic processing in Injection Moulding, Rotational Moulding (ROTO), Extrusion, Compression Moulding, Blow Moulding etc.

Supreme Industries limited offers wide range of plastic products with a variety of applications in Moulded Furniture, Storage & Material Handling Products, XF Films & Products, Performance Films, Industrial Moulded Products, Protective Packaging Products, Composite Plastic Products, Plastic Piping System & Petrochemicals.

Plant Locations

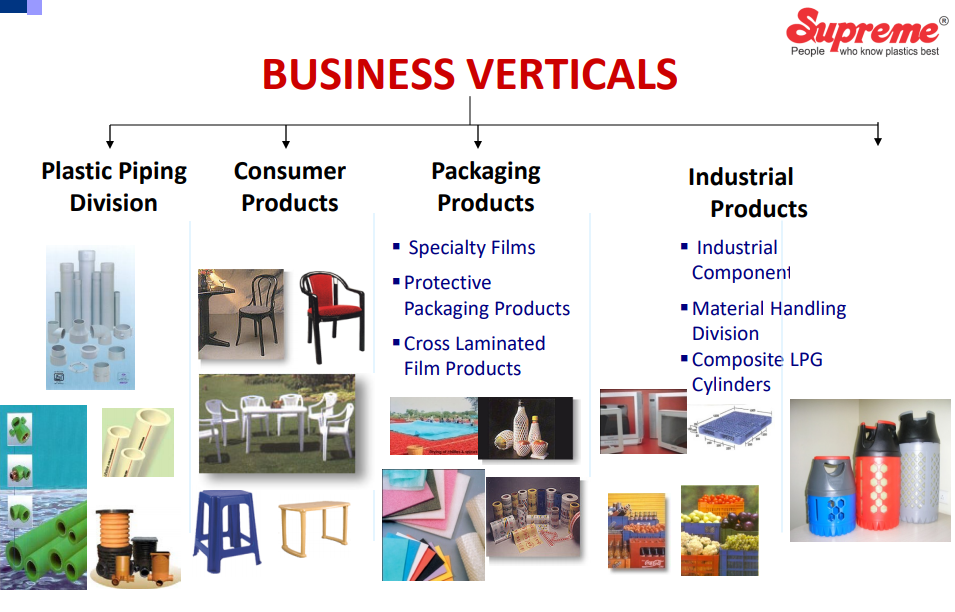

Products

Plastics Piping System

- uPVC Pipes

- Injection Moulded PVC fittings and handmade fittings

- Polypropylene Random Co-polymer pipe system

- HDPE Pipe Systems

- CPVC Pipes Systems

- Inspection Chambers, manholes

- Toilets Bath fittings

- Roto moulded Tanks and Fittings and Solvents

- Industrial Piping System

- DWC Pe Pipe System

- Fire Sprinkler System

Consumer products

- Furniture

Industrial Products

- Industrial Components

- Material handling System

- Pallets - Roto moulded crates, pallets and garbage bins

- Composite LPG Cylinders.

Packaging Products

- Flexible packaging film products

- Protective Packaging Products

- Cross Laminated Film products.

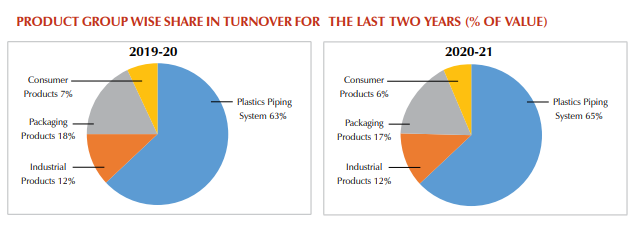

Business Segments

Plastics Piping Systems

The Company continues its objective to grow Plastic Pipe System business. The Company is leader in this segment as it has the largest portfolio of products, which is being continuously increased, to offer more systems as required in the economy.2

The Company during the year under review registered an overall revenue growth of about 18.5% in Plastic Piping System made from different plastic materials. Overall the Company sold 2,94,357 Tons of Pipe System compared to 3,00,772 Tons in the previous year.

In the previous year the business was affected severely due to complete lockdown in April 2020 and then gradual lifting of business in May 2020. The business was again affected in July 2020 due to intermittent regional lockdowns. This has led to de-growth in volume for the full year.

PVC is the predominant raw material in the Company’s Plastic Pipe business. The prices of PVC were in downward trend from 18th March 2020 till first half of May 2020. Overall prices of PVC had gone down by R 13.50 / kg during that time. Thereafter beginning 18th May 2020 prices of PVC started continuously increasing month after month upto April 2021. The prices have increased by approx. R.70 per kg upto 31st March 2021. This has affected country’s PVC consumption which has seed de-growth by around 16% in volume for the year. The Company also had a de-growth of around 3% in PVC piping system by volume. This steep increase in prices have led to de-growth in Agriculture Pipe segment. The increase in prices has also resulted in inventory gain of around R 180 crores for the full year in the Company’s working of Plastic Pipe system for the year.

The Company incurred Capex of R 225 crore in the year under review in its various plants to build more capacities and increase range. Majority of them have been put to use.

The Company with objective of making its footprint for manufacturing at South Zone, for Plastic Piping Division, has got 50 acres of land allotted at Jadcherla-District Mahaboobnagar at Telangana. The production of PVC Pipes, cPVC Pipes, Water & Septic Tanks at this location has started. The machinery installation work for PEX system and Olefins moulded fittings are getting completed. The Company will launch these products at this location in July’21-Sep’21 quarter.

has started necessary civil and machine ordering work for further increasing the capacity of HDPE and DWC Pipes at Kharagpur plant to cater to increased demand. The Company has also started manufacturing of Moulded Fittings at Kharagpur to service Eastern market cost effectively. Further capacity expansion of Moulded Fittings has been planned and civil work is complete. Plant will operate with full capacity by third quarter of 2021-22.

To meet the increasing demand of HDPE Pipes in North India, the Company has put up the capacity in Malanpur Unit No.3. The commercial production of the same including expansion has started in full swing. Overall HDPE Pipe business had a de-growth of 5% by volume during this year.

The Company now manufactures Roto Moulded Products at all four geographies of country viz., North, South, East and West to service these market cost effectively. The Roto Moulded Business of the company has grown by 57% during the year under review. The Company has put plans in place to substantially increase the business of Water Tanks through different market strategy of servicing directly to retailers from the respective factories at many places. The same will be further acted upon this year to get the desired results. The Company is also going to start manufacturing of Roto Products at new locations to increase market share by cost effective servicing. The Company also launched Premium range of Water Tanks branded as “Weather Shield” with added features such as superior thermal insulation etc., from three locations with good market response.

The production of Double Wall Corrugated HDPE Pipes has started from Gadegaon and Kharagpur plants with BIS Certification. The Company is in process to educate various departments the benefits of putting in place a good quality DWC Pipes with latest technology and using virgin certified raw materials in terms of performance and longer life.

The Company introduced 154 nos. of variety of Injection Moulded Pipe fittings during 2020-21. They all have been well received in the market. The Company has plans of introducing further new items during the year as per system requirement. The total product portfolio in Plastic Pipe System has reached 8774 nos., thus adding 460 products to the range of various Plastic Piping System compared to previous year.

The Company manufactures the cPVC Pipes at four of its manufacturing locations and cPVC Fittings at two of its manufacturing locations. The production of cPVC pipes at Jadcherla plant is fully functional with necessary BIS certification. The cPVC system sales during the year under review grew by 13% in value over previous year.

The Company plans to start three new manufacturing units at new locations viz. Guwahati (Assam), Cuttack (Odisha) and Perundurai (Tamil Nadu) for Plastic Pipes, Water Tanks, Septic Tanks etc.. At Guwahati the Company will start production in rented premises. It is a green field project and entire construction is done as per Company’s specification. Factory is likely to start in 3rd quarter of this year. At Cuttack the Company has already taken 29 acres of land and are in the process of further taking 4-5 acres of land which are plots in between and after taking these plots the land will become contiguous. The Company has already awarded the Civil and PEB contracts for same and construction is likely to start in May 2021 this year. The Company plans to start the first phase production at Cuttack unit by December’21. At Perundurai (Tamilnadu) the Company has taken 32 acres of land from SIPCOT at their fully developed Industrial State. Various contracts will be finalized shortly.

The Company has started manufacturing variety of Specialized Valves such as Butterfly Valves, Swing Check Valves, Ball type non-return Valve etc. These Valves have been designed for different applications like Industrial, Agriculture and Plumbing segment. They are made of specialized materials to ensure reliability & longer life and also to meet best of global standards. The Company has received positive response from the market.

Consumer Products

Furniture

The Company’s furniture business declined by 5% in value terms over last year and 10% in volume terms due to lockdown which had a severe impact on the furniture business for 1st Quarter. The sales of 1st Quarter declined by a steep 70% over last year same period. However, the business started picking up from 2nd quarter and showed growth only from 3rd quarter onwards.

Furniture demand was adversely affected due to pandemic restrictions as a large part of furniture sales come from Schools, Colleges, Hotels, Restaurants, Decorators, Marriage Places etc and this segment had a severe impact on their business due to the pandemic. Even the Govt buying for furniture was restricted as the focus was on healthcare and most of the funds were diverted for the same. Some of the key markets remained partially closed during the 2nd & 3rd quarter with restricted activities. However, the Company could achieve similar sales in 2nd quarter as last year same period and had good growth in 3rd & 4th quarter indicating signs of growth for 2021-22.

The Company manufactures furniture made with all three different processes i.e Injection Moulding, Blow Moulding & Roto Moulding. The company has been manufacturing Injection Moulded furniture for 30 years and is a market leader in terms of it’s wide range & quality. Currently, the company manufactures injection moulded furniture at 6 locations viz Pondicherry (UT), Durgapur ( West Bengal), Guwahati (Assam), Gadegaon (Maharashtra), Lalru (Punjab) & Jadcherla (Telangana) to cater to customers effectively in different parts of the country. The Company’s Jadcherla plant is now well established and will be able to cater to adjoining markets cost efficiently.

During the year, the Company’s sale of Blow Moulded table range grew by 24% over last year driven by good demand of compact folding tables for ‘Work From Home’ and sales through E-commerce. The company’s range of Blow Moulded tables is now well established and poised for good growth. The company’s plan for adding 2 new models in this segment was delayed due to pandemic and are likely to be introduced in first half of 2021-22.

The Company had started manufacture of Roto Moulded Furniture in Feb 2020 and thereafter due to lockdown this segment could not be properly marketed as Kindergarten Schools which is one of the largest customers of the product launched were closed all through the year due to the pandemic. The Company plans to launch variety of models in Roto Moulded Furniture catering to different segments and is in the process of identifying suitable furniture which can be made through Roto Moulding.

The Company’s furniture range is sold on various e commerce portals through a few dedicated channel partners. It grew by 100% during the year and the biggest spurt in sales was seen post lockdown when the markets were not fully functional and most of the people were operating from home. The consumer behaviour during the year showed a major shift towards online shopping and the company along with its channel partners geared up its infrastructure to meet the sudden rising demand. The company is focused on increasing its online presence and product offerings and sees this as a future growth driver.

The company’s export business grew by 27% over last year in spite of very high shipping costs, low availability of containers and overall increase in freight costs . The growth was majorly attributed to acceptance of its product by a leading retailer from USA as well as middle east. The company will continue to focus on acquiring more customers and already in dialogue with some other leading retailers. However, due to very steep increase in sea freights and furniture being a voluminous item, the retailers are holding on to their decision for the time being.

Industrial Products

Industrial Components

The year 2020-21 started with already imposed country wide lockdown for containment of Covid-19 Pandemic. Obviously, there was no good news on economic front. The Division mainly caters to Appliance and Automotive sectors and both these sectors not being Priority or Essential category, were not given any relaxation, thereby, these sectors were badly affected during first quarter with negligible sales revenue. Although, from latter part of May’20, relaxations in lockdown were gradually eased in phased manner, it took long time to stabilize the Supply Chain of its customers, resulting in massive de-growth of nearly 40% in both Value and Volume terms, during first half of the financial year.

Until second half of March’21, the Outlook for FY 21-22 was looking bright with the momentum which had already picked up in Q4 of FY 20-21. Things have become uncertain within a month with huge surge in Covid caseload in the country necessitating to put across stringent curbs by various state Govts. As it stands in short term, the situation is not very clear on Business outlook. However, company feels that Business scenario remains bullish in medium and long term with business friendly policies by the Govt. Company has planned need based Capacity Augmentation to handle the projected increased demand going forward. The new machines being planned are with the latest Technology, Energy efficient, and Robust Design for Excellent Quality and Repeatability. Company is also working on cost efficient Automation.

Material Handling Products

The most contributing sectors to this Material Handling Division were not operational due to lock down. The division took an aggressive approach and started focusing on sectors which were open under essential commodities, retail, FMCG etc. The efforts made in the initial periods of lock down paid off immensely as a result, the Division has grown by 12% in volume and 10% in revenue terms. The most heartening things have been the performance in sectors where the division was not doing well in the past.

Company keeps strong focus on Fisheries Jumbo Crates. For last few years, Company has been aggressively working to gain the market shares in Fisheries Jumbo Crates. This year there has been a growth of 20%. Aggressive efforts will continue in this sector and for that the Company has started production of Jumbo Crates at it’s Jadcherla Unit in this year.

The Roto moulded Crates and Dustbins have seen decline this year. There has been good demand for Injection moulded Dustbins by Institutions and Corporates. Encouraged by this, Company has decided to introduce many new models of Dustbins in the next year.

The Company explored opportunities for export of it’s Crates, Pallets, Silpack etc. The Company has achieved reasonable success and Company will aggressively pursue to further enhance exports in the current Year.

The Company has opened Fabrication facility at Chennai which is functional and serving the Automobile and Industrial sector customers in vicinity of Chennai timely and efficiently hoping to double its turnover next year.

Composite LPG Cylinder

The updated component design and improved plant processes following Poka-yoke system have yielded excellent results with no customer complaints received since Q3 2019. Repeated orders from multiple existing as well as new customers stood testimony to the excellent quality of the current product offering

The Company continued its current business in Maldives and Somalia. New customer footprints have now been established in Western & Central Africa, Taiwan and the Caribbean islands. Composite Cylinders fall under direct sales category. New customers could not visit India because of restrictions in travel due to Covid-19 which hampered its sales volume.

There was no progress in South Korean business as representatives of Korean Inspection Agency could not visit India. The company's customer is setting up Testing Facility in Korea so that Korean Inspectors visit to India for quality checks will be obviated. Owing to the very high rejections of steel cylinders on account of human safety issues, marketing reports have forecasted a very bright future for composite LPG cylinders in Korea. The Company expects good business in current year after restrictions on travel eases.

The largest Indian Oil Marketing Company, M/s Indian Oil Corporation Limited, purchased small quantity of Composite Cylinders in March 2021 for marketing trials in 4 cities of India. This augurs well for the long awaited introduction of Composite Cylinders in Indian market.

Owing to the various favourable developments, the overall prospects for Composite Cylinders in the current year are significantly more promising for the Company.

Packaging Products

Packaging Films

Performance Films Division

The Performance Films Division has recorded 1.5% growth in Volume. The Total sale achieved was 7,816 MT as against 7,722 MT in the last year.

The Domestic markets, had a growth of around 15%, particularly in the dairy & oil industry. The addition of New Value added Product in Dairy industry with the Lamination capability has enabled the Division to grow in many different applications. This also helped the Company in adding value added products to its portfolio. Continuous efforts to develop new products will help the division grow better this year

Exports have declined. Sales were only 1,343 tons as against 1,451 tons in the previous year, mostly because of the Covid situation all over. Till travel becomes normal, there may not be good growth in exports. However the division is committed to work on building its export portfolio.

Protective packaging division

PPD Sales turnover was 3.2% lower at Rs 530 Crs in FY2020-21 vs. Rs 547.50 Crs in FY2019-20. Volume was lower by 7.6%. COVID played a spoiler in QI & part QII of last year but a consolidated team effort across functions in Sales/Marketing & Manufacturing & improved demand, the division was able to recover some lost ground in QIII & QIV.

Packaging vertical had de-growth of 2.3% in value with business of Rs 395 Crs in current year as against Rs 404.50 Crs last year and had de-growth of 8% in volume. Several new packaging applications were developed, resulting in a smart increase of business in fabricated products with increase value addition. This augurs well in the coming year

Civil business had a growth of 4.4% in value with sales of Rs 56 Crs in current year as against Rs 53.70 Crs last year. Volume growth was 9% primarily due to export of civil products which clocked a growth of 140%. This is expected to further increase, as Company’s products find greater acceptance in several international markets.

Insulation business had a de-growth of 19% value with Business of Rs 65.89 Crs this year against Rs 81.17 Crs. in the previous year

Several new variants of yoga mats were introduced this year. Along with an ever increasing network, CPD achieved a sale Rs 10.57 Crs @160% growth for FY2020-21 as against Rs 4.08 Crs for FY2019-20. Company’s FITSPREE brand of Yoga mats and allied products have been well accepted. The division added 74 new distributors & 3020 new retailers in the year under review. Moreover, the division started doing business with CPC (Central Police Canteen) and also expect to get an initial breakthrough with Canteen Stores department (CSD) with 4 products approvals.

From Rs 12.29 Crs exports last year, Division achieved exports of Rs 18.88 Crs. The Division has developed & is developing several new products for the export market. With the development of several new products, the Company expects significant growth in exports during 2021-22.

Financial Highlights

The Company sold 409109 MT of Plastic goods and achieved net product turnover of Rs 6177 Crores during the year ended 31 March 2021 against sales of 411521 MT and net product turnover of Rs 5408 crores in the previous year having nominal volume de-growth about 1% and product value growth about 14%, respectively.

Total Income and Operating Profit for the year under review amounted to Rs 6373 crores and Rs 1300 crores respectively as compared to Rs 5530 crores and Rs 854 crores, in the previous financial year.

The Profit before Tax and Profit after Tax for the year under review amounted to Rs 1078 crores and Rs 801 crores respectively as compared to Rs 628 crores and Rs 496 crores, in the previous financial year.

The Company exported goods worth US$ 18.35 million as against US$ 18.29 million during the corresponding period of the previous year. Profit before interest, depreciation and exceptional items and taxes during the period under review have been at Rs 1300 Crores as against Rs 854 Crores during the previous year.

June 2021 Result

July 22, 2021 Reported Consolidated quarterly numbers for Supreme Industries are: 3

- Net Sales at Rs 1,342.08 crore in June 2021 up 27.35% from Rs. 1,053.89 crore in June 2020.

- Quarterly Net Profit at Rs. 170.16 crore in June 2021 up 319.84% from Rs. 40.53 crore in June 2020.

- EBITDA stands at Rs. 214.58 crore in June 2021 up 82.81% from Rs. 117.38 crore in June 2020.

- Supreme Ind EPS has increased to Rs. 13.40 in June 2021 from Rs. 3.19 in June 2020.

Business Outlook

Mr. M. P. Taparia, Managing Director, The Supreme Industries Limited, said:4

During the first quarter of the current year the business was severely disrupted due to second wave of Covid-19. This time, the infection was quite widespread in rural areas. April and May are the peak season for PVC Pipe System for Agriculture application.

As the rural market was badly affected by the Pandemic, the Agricultural demand took a big hit resulting in huge volume loss of business in Piping segment The Company was thus required to carry forward the pipe inventory which was kept ready to meet large seasonal demand of Agricultural pipes. Plastic Piping System thus saw a volume de-growth of 36% compared to corresponding quarter in the previous year.

PVC prices have started going up now, after a drop of Rs. 19/- per kg since April 2021. The demand in Construction segment has now opened up. Company expects that the First quarter loss in volume in Piping System not only be recovered but will show a growth in full year.

The upcoming unit to make Plastic Pipe system at Guwahati will be operational by October 2021. The Company has taken in hand to put the plastic product complex in Orissa with an outlay of Rs. 121 Crores in the current year. The same may be operational in last quarter of 2021-22.

Total capex planned for the year has now increased to Rs. 521 Crores from earlier Rs. 400 Crores including carried forward commitments of previous year.

Compression Moulded Olefin fittings have gone into commercial production at Jadcherla since June to cater to the growing demand in "Nal-se-Jal" Scheme.

The Second wave of Pandemic and the resultant localized lockdown has adversely affected the demand supply chain during the first quarter, which is the peak demand period for Tarpaulins. The sales of Cross Limited Film products were down by 12.52 % in first quarter compared to the corresponding quarter in the previous year. The production has also taken a hit during the first quarter due to scarcity of labour on account of large infection in rural area. The silver lining is that the exports have gone up by around 50% in the quarter, compared to the first quarter of last year. With the waning of second wave, the labourers are back and the production is running at full capacity. The good run in exports is continuing.

The furniture business has shown a volume growth of 40 % in the quarter compared to previous year similar quarter. The value added products sales have gone up to Rs. 23.26 Crores compared to Rs. 13.41 crores in the same quarter of last year. This division is working on Digital campaign on several media sites such as Facebook, Youtube, Instagram for brand promotion. The business expects to have a decent growth in this year over previous year.

Business scenario remains bullish in Industrial Component Business barring the initial disruption during first quarter. Division is working with its existing customers for new business apart from developing new customers. Company is putting need based capital expenditure to meet increased business requirements.

Material Handling Products being intermediary to supply of essential products have done good business both in terms of value and volume. Division is working to introduce various new products/applications from Injection Moulding and Roto Moulding process. Expansion of capacities at its plant at Lalru (Punjab) and Gadegaon (Maharashtra)is nearing completion and shall be operational by July-August,2021.

In Composite LPG Cylinder division, repeated orders from existing as well as new customers are continuing. Domestic Oil Marketing Companies IOCL and BPCL have also floated enquiries for purchases which augurs well for the long awaited introduction of Composite Cylinders in the Indian market. Overall business scenario looks encouraging.

Protective Packaging Business has shown good improvement over corresponding quarter of previous year. New products for export market have been well received. Its retail division for fitness products is also picking up well. Division is focusing on customized solutions and value addition to its OE customers.

Beginning of the current year, all the Polymer prices have shown softening trend. However, after reduction between 13% to 16% during the quarter, prices have again started firming up and expected to remain range bound.

The Company is committed to increasingly meet its energy requirements from Renewable sources and investing a sum of Rs. 35 crores in the current year to install Roof top solar energy generation plants at its various plant locations. The same shall be operational by October-November, 2021.

References

- ^ https://www.supreme.co.in/aboutus.php

- ^ https://www.supreme.co.in/images/pdf/Supreme-ANNUAL-REPORT-2020-21.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/supreme-ind-consolidated-june-2021-net-sales-at-rs-1342-08-crore-up-27-35-y-o-y-2-7205521.html

- ^ https://www.supreme.co.in/images/pdf/Press-Release-2021.pdf