TC Energy

Summary

- TC Energy is a leader in responsible energy infrastructure. With one of North America’s largest energy infrastructure portfolios, no one powers day-to-day life like TC Energy.

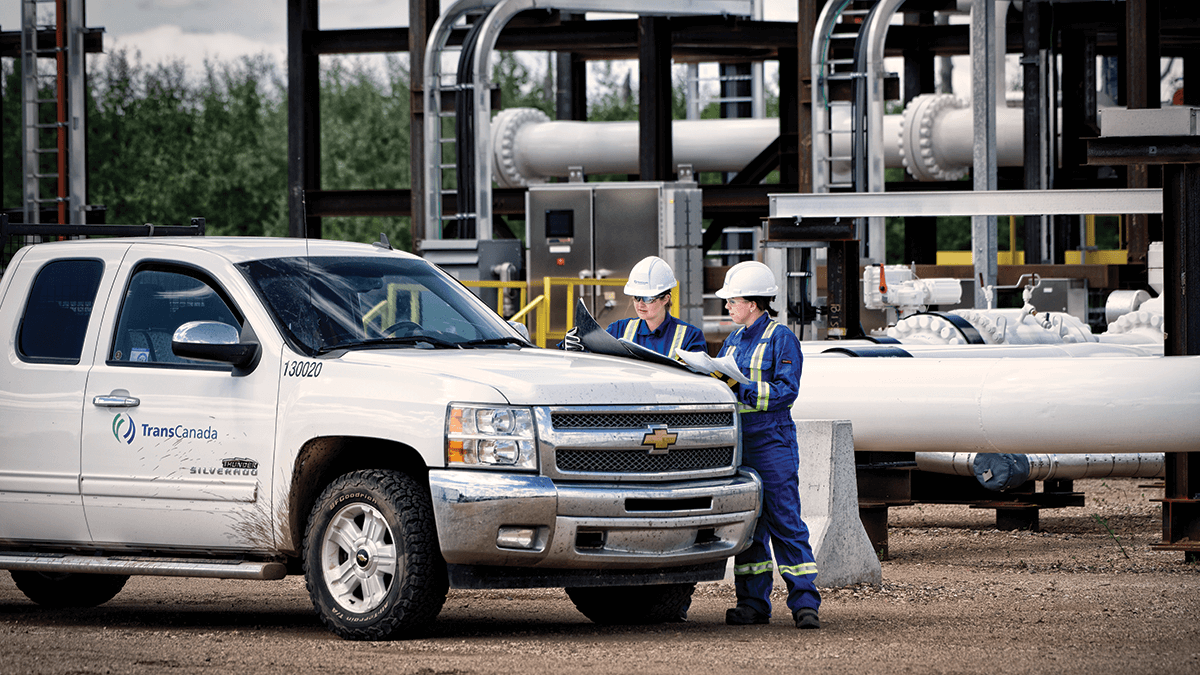

- TC Energy has a team of more than 7,500 experts.

- The company own or have interests in seven power-generation facilities with a combined capacity of about 4,200 megawatts

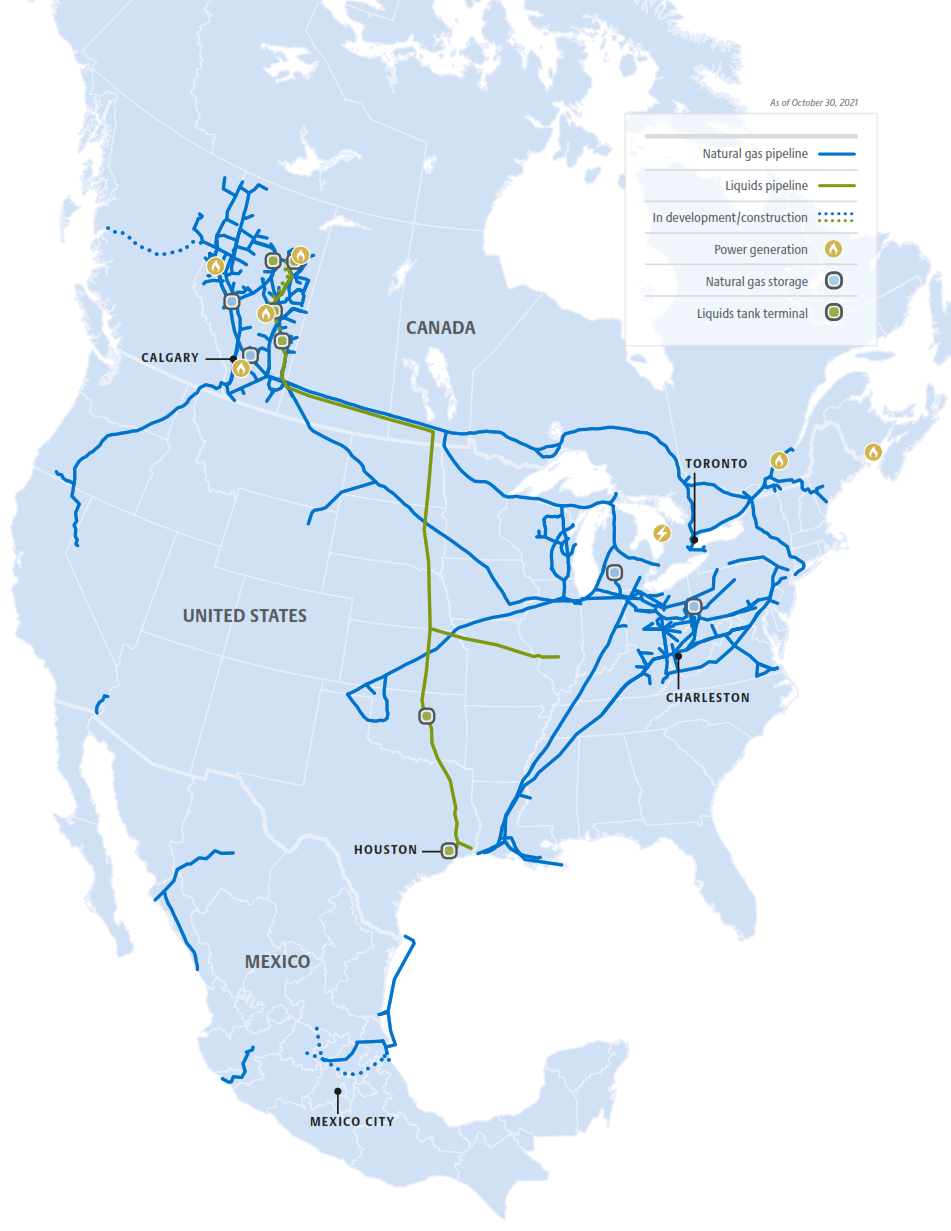

- The company build and operate safe and reliable energy infrastructure with 93,300 km (57,900 miles) network of natural gas pipelines and approximately 4,900 km (3,000 miles) oil & liquids pipeline.

Company Overview

TC Energy (NYSE:TRP, TSX:TRP) is more than a pipeline company. Approximately 7,500 people strong, TC Energy is a vital part of modern life. Thanks to a safe, stable network of natural gas and crude oil pipelines, along with nuclear power facilities.1

Business Overview

TC Energy is a leader in responsible energy infrastructure. With one of North America’s largest energy infrastructure portfolios, no one powers day-to-day life like TC Energy. The company share technical, stakeholder and operating expertise across all of its operations.2

Energy Solutions

Whether it's renewable energy, carbon offsets or other carbon-free energy and energy services, the company will utilize the size and scale of its energy network and trading platform to deliver complete solutions to meet its customers’ needs. The company aim to leverage the size and scale of its energy network and trading platform to be the most trusted and reliable source of carbon-free energy for the North American industrial, natural gas and oil sectors.

The company own or have interests in seven power-generation facilities with a combined capacity of about 4,200 megawatts – enough to power more than four million homes. About 75 percent of its power capacity is emission-less. TC Energy is one of North America’s largest purchasers of electricity for its assets.

Natural Gas

The company build and operate safe and reliable energy infrastructure. This includes its 93,300 km (57,900 miles) network of natural gas pipelines, which supplies more than 25 per cent of the clean-burning natural gas consumed daily across North America to heat homes, fuel industries and generate power.

Oil & Liquids

The company's existing oil & liquids pipeline infrastructure, approximately 4,900 km (3,000 miles), connects Alberta crude oil supplies to U.S. refining markets in Illinois, Oklahoma, Texas and the U.S. Gulf Coast.

The Keystone Pipeline System, its largest liquids pipeline asset, moves approximately 20 per cent of western Canadian crude oil export to key refining markets. The Grand Rapids and Northern Courier pipelines, two intra-Alberta liquids pipelines, provide transportation solutions for producers in northern and western Athabasca regions.

The company remain committed to advancing its portfolio of commercially secured projects to connect growing Canadian and U.S. crude oil supply to key markets, maximizing the value from its existing assets, leveraging existing infrastructure and seeking new opportunities across the liquids pipelines value chain.

Power and Storage

TC Energy’s portfolio of high-quality, long-life energy infrastructure assets now includes investments in seven power generation facilities with a combined generating capacity of approximately 4,200 megawatts (MW) – enough to power more than 4 million homes. Approximately 75 per cent of its power capacity is emission-less and TC Energy is leaders in the development and operation of high-efficiency, natural gas-fired generating stations.

Operations Maps

Financial Highlights

Third quarter 2021 financial results

Nov. 05, 2021; TC Energy Corporation today announced net income attributable to common shares for third quarter 2021 of $779 million or $0.80 per share compared to net income of $904 million or $0.96 per share for the same period in 2020. Comparable earnings for third quarter 2021 were $1.0 billion or $0.99 per common share compared to $893 million or $0.95 per common share in 2020. TC Energy's Board of Directors also declared a quarterly dividend of $0.87 per common share for the quarter ending December 31, 2021, equivalent to $3.48 per common share on an annualized basis.3

"During the first nine months of 2021, its diversified portfolio of essential energy infrastructure assets continued to perform very well and reliably meet North America's growing demand for energy," said François Poirier, TC Energy’s President and Chief Executive Officer. "Comparable earnings of $3.21 per common share were five per cent higher compared to the same period last year while comparable funds generated from operations totaled $5.3 billion. Both amounts reflect the strong performance of its assets and the utility-like nature of its business together with contributions from projects that entered service in 2020 and 2021."

The company's results are underpinned by strong demand for its services along with a constant focus on operational excellence. Flows and utilization levels across many of its systems are higher than historical norms despite the ongoing impacts of COVID-19 and energy market volatility. Given the strong performance year-to-date, the company now expect full-year 2021 comparable earnings per share to be modestly higher than last year's record results.

"TC Energy is advancing its $22 billion secured capital program and working on a substantive number of other similarly high-quality opportunities," continued Poirier. "Importantly, all of its secured capital projects are underpinned by long-term contracts and/or regulated business models highlighting the fundamental need for this critical new infrastructure while at the same time giving it visibility to the earnings and cash flow they will generate as they enter service."

Looking forward, TC Energy expects its industry leading portfolio of secured capital projects to grow substantially in the coming years as it continues to expand, extend and modernize its existing natural gas pipeline network, advances the Bruce Power life extension program and progresses plans to use renewable energy to power certain of its proprietary energy loads. The Company is also working on numerous other renewable energy projects – from pumped hydro storage to solar to wind and progressing new initiatives in carbon transportation and sequestration as well as large-scale hydrogen production hubs. Success in advancing its current slate of secured projects and various other growth initiatives is expected to support long-term growth in earnings before interest, taxes, depreciation and amortization, or EBITDA, as well as earnings and cash flow per share. Given the capital required to prudently fund this program, TC Energy is modifying its dividend growth outlook.

“TC Energy is in the midst of an unprecedented period that is providing a significant number of investment opportunities driven by both the growing demand for energy and the transition to a cleaner energy future,” added Poirier. “The company expect to sanction approximately $7 billion of new projects in 2021 with a risk-adjusted return profile that is consistent with previous investments and anticipate annual amounts of more than $5 billion will be added to its secured projects portfolio in each of the next several years.”

“In order to judiciously fund its attractive suite of growth opportunities, maintain a strong financial position and enhance its already conservative, utility-like dividend payout ratios, TC Energy has modified its near-term dividend growth outlook,” continued Poirier. “The company now expect to increase its common share dividend at an average annual rate of three to five per cent. While its previous outlook remains affordable and supported by the strong underlying performance of its business, the company believe a modest change is prudent given its vast opportunity set. It will allow it to fund a larger portion of its future capital programs through internally generated cash flow, moderate its leverage and continue to deliver superior long-term total shareholder returns.”

TC Energy remains committed to the sustainable development of its business. To be truly sustainable, the company will continue to evolve and innovate by finding creative ways to deliver the energy people need while being positive agents of change within its society. Modernizing its existing systems and assets, decarbonizing its own energy consumption, and driving digital solutions and technologies are some of the areas TC Energy is focused on while also seeking opportunities to invest in low-carbon energy and infrastructure. The company recently released its 2021 Report on Sustainability which includes targets for all its sustainability commitments. Notably TC Energy has set Scope 1 and Scope 2 GHG reduction targets, including reducing the emissions intensity from its operations 30 per cent by 2030 and positioning to achieve net zero emissions from its operations by 2050. TC Energy is advancing numerous renewable energy projects and proceeding with new ventures, like its partnerships with Pembina Pipeline Corporation to jointly develop a carbon transportation and sequestration system in Alberta, Irving Oil to jointly develop clean energy projects in eastern Canada, and Nikola Corporation to co-develop large-scale hydrogen production facilities in the United States and Canada, while remaining committed to important projects like Bruce Power’s multi-billion dollar life extension and uprate programs which will continue to be a source of significant emission-less power in Ontario for decades to come.

In all its operations and projects, the company remain focused on managing and reducing its GHG emissions and building constructive, enduring relationships with its communities and stakeholders. The company believe its creativity, technical strength and unparalleled market connectivity provide it the ability to prosper regardless of the pace and direction of energy transition.

Highlights

(All financial figures are in Canadian dollars)

- Third quarter 2021 financial results

- Net income attributable to common shares of $779 million or $0.80 per common share

- Comparable earnings of $1.0 billion or $0.99 per common share

- Comparable EBITDA of $2.2 billion

- Net cash provided by operations of $1.7 billion

- Comparable funds generated from operations of $1.6 billion

- Declared a quarterly dividend of $0.87 per common share for the quarter ending December 31, 2021

- Continued to advance its $22 billion secured capital program by investing $1.7 billion in various growth projects

- Began construction on the 2022 NGTL System Expansion Program

- Continued to actively develop projects on its U.S. Natural Gas Pipeline network that will replace and upgrade certain facilities while reducing emissions including the US$0.8 billion WR project on ANR

- Uncontested GTN rate settlement filed with FERC which would set new recourse rates for GTN effective January 1, 2022

- Filed Columbia Gas rate settlement with FERC in October which includes continuation of its modernization program with approval expected in early 2022

- Executed a 15-year Power Purchase Agreement (PPA) in September for 100 per cent of the power produced and the rights to all environmental attributes from the 297 MW Sharp Hills Wind Farm

- Advanced the Bruce Power Unit 6 MCR program on budget and on schedule

- Project 2030 launched by Bruce Power with the goal of achieving a site peak output of 7,000 MW by 2030 in support of climate change targets and future clean energy needs

- Continued to develop a 1,000 MW pumped hydro storage project in Meaford, Ontario which is designed to provide emission-free electricity to the province while reducing greenhouse gas emissions

- Signed a memorandum of understanding in August with Irving Oil to explore the joint development of a series of proposed energy projects focused on reducing greenhouse gas emissions and creating new economic opportunities in New Brunswick and Atlantic Canada

- Partnered with Nikola Corporation in October to collaborate on developing, constructing, operating and owning large-scale hydrogen production facilities in the United States and Canada

- Issued US$1.25 billion of 3-year and US$1.0 billion of 10-year fixed rate Senior Unsecured Notes in October

- Released its 2021 Report on Sustainability in October which includes targets for its sustainability commitments, including reducing the emissions intensity from its operations 30 per cent by 2030 and positioning to achieve net zero emissions from its operations by 2050.

Recent developments

Canadian Natural Gas Pipelines

Coastal GasLink: As a result of scope changes, previous permit delays compared to the original construction schedule and the impacts from COVID-19, including a British Columbia provincial health order, the company continue to expect project costs to increase significantly along with a delay to project completion compared to the original project cost and schedule. Coastal GasLink has sought and will continue to mitigate cost increases and schedule delays. Coastal GasLink expects incremental costs will be included in the final pipeline tolls, subject to certain conditions.

Coastal GasLink is in dispute with LNG Canada with respect to the recognition of certain costs and the impacts on schedule. Construction activities continue and, at this time, the company do not expect any suspension of these activities while the parties work toward a resolution. During this time, construction is being funded in part by a subordinated demand revolving facility with TC Energy which provides the project with additional short-term funding and financial flexibility and, on which, $840 million was drawn at September 30, 2021. In October 2021, this amount was fully repaid and further draws were made which resulted in an outstanding balance of $175 million at October 29, 2021. As a further interim measure, TC Energy has committed to providing additional temporary financing to the project, if necessary, of up to $3.3 billion as a bridge to a required increase in project-level financing to fund incremental costs. This financing is expected to be provided at market-based returns. While the company do not anticipate its future equity contributions will increase significantly, the portion of this temporary financing that will ultimately be required to be contributed as equity by Coastal GasLink LP partners, including it, will be determined by the substance of a resolution with LNG Canada.

NGTL System: In the nine months ended September 30, 2021, the NGTL System placed approximately $0.5 billion of capacity projects in service.

Construction activities began in September 2021 for the 2022 NGTL System Expansion Program which received federal approval in second quarter 2021. With an estimated capital cost of $1.1 billion, the program will provide incremental capacity to meet firm-receipt and intra-basin delivery requirements and consist of approximately 166 km (103 miles) of new pipeline, one new compressor unit and associated facilities. Anticipated in-service dates commence in fourth quarter 2022.

U.S. Natural Gas Pipelines

Delivery Market Projects: TC Energy is actively developing projects that will replace and upgrade certain facilities while reducing emissions along portions of its pipeline systems in principal delivery markets. The enhanced facilities will improve reliability of the systems and allow for additional transportation services to address growing demand under long-term contracts while reducing direct carbon dioxide equivalent (CO2e) emissions. Consistent with this initiative, the VR project on Columbia Gas has been sanctioned, subject to customary conditions precedent and normal-course regulatory approvals. This project represents an approximate US$0.7 billion capital investment and is targeted to be placed in service during the second half of 2025. In addition, the WR project on ANR has also been sanctioned and will serve markets in the midwestern U.S. This project has an estimated capital cost of approximately US$0.8 billion and is expected to be placed in service in fourth quarter 2025.

GTN Rate Case Settlement: On September 29, 2021, GTN filed an uncontested rate settlement which would set new recourse rates for GTN effective January 1, 2022 and institute a rate moratorium through December 31, 2023. The revised rates are not expected to have a significant impact on its U.S. Natural Gas Pipelines segment comparable earnings. In addition, GTN must file for new rates no later than April 1, 2024.

Columbia Gas Section 4 Rate Case: Columbia Gas filed a Section 4 Rate Case with FERC in July 2020 requesting an increase to its maximum transportation rates effective February 1, 2021, subject to refund upon completion of the rate proceeding. On July 28, 2021, Columbia Gas notified FERC that it reached a settlement-in-principle with its customers addressing all remaining issues in the case, including but not limited to the resolution of rates and continuation of Columbia Gas's modernization program. On October 29, 2021, Columbia Gas filed its settlement with FERC, and is now awaiting Commission approval, with 2021 revenues expected to be generally consistent with estimates recorded to date. The company expect FERC approval of the settlement in early 2022.

Mexico Natural Gas Pipelines

Tula and Villa de Reyes: The CFE initiated arbitration in June 2019 for the Tula and Villa de Reyes projects, disputing fixed capacity payments due to force majeure events. Arbitration proceedings are currently suspended through December 31, 2021 while management advances settlement discussions with the CFE.

Liquids Pipelines

Northern Courier: On September 16, 2021, the company announced the sale of its remaining 15 per cent equity interest in Northern Courier Pipeline to Astisiy Limited Partnership, comprised of Suncor and eight Indigenous communities in the Regional Municipality of Wood Buffalo, for gross proceeds of approximately $30 million before post-closing adjustments. The transaction is anticipated to close in fourth quarter 2021, subject to customary closing conditions and the receipt of the required regulatory approvals.

Power and Storage

Bruce Power Life Extension: The Unit 6 MCR program continues on budget and on schedule. The program is nearing the end of the Inspection Phase and is about to enter the Installation Phase. Preparation of the Unit 3 MCR program, which is the next scheduled MCR outage, continues and Bruce Power expects to submit its final cost and schedule duration estimate to the IESO in fourth quarter 2021.

Bruce Power Uprate Initiative: Bruce Power recently launched Project 2030 with the goal of achieving a site peak output of 7,000 MW by 2030 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovation and leveraging new technology, which could include integration with storage and other forms of energy, to increase the site peak output at Bruce Power.

Bruce Power Outage: As part of the planned inspections, testing, analysis and maintenance activities at Bruce Power during the current Unit 6 MCR outage and the recently completed Unit 3 planned outage, higher than anticipated readings of hydrogen concentration in pressure tubes were detected. These readings were limited to a very small area of the respective pressure tubes and did not impact safety nor pressure tube integrity as concluded following an assessment of all of the Bruce Power units. On October 9, 2021, Unit 3 returned to service after the Canadian Nuclear Safety Commission approved Bruce Power's restart request following extensive inspections which demonstrated that safety and pressure tube integrity continued to meet regulatory requirements. Bruce Power will be incorporating additional inspections as part of their normal surveillance programs to address the new findings while progressing further programs that demonstrate fitness for service at elevated hydrogen concentration levels.

Sharp Hills Wind Power PPA: On September 20, 2021, the company executed a 15-year PPA for 100 per cent of the power produced and the rights to all environmental attributes from the 297 MW Sharp Hills Wind Farm located in eastern Alberta. The Sharp Hills Wind Farm is anticipated to be operational in 2023, subject to customary regulatory approvals and conditions.

Ontario Pumped Storage Project: As part of its strategy to capture opportunities that capitalize on the transition to a less carbon-intensive energy mix, TC Energy is developing a 1,000 MW pumped hydro storage project in Meaford, Ontario near Bruce Power. Once complete, this facility is designed to provide emission-free electricity to the province while reducing greenhouse gas emissions by an expected 490,000 tonnes and delivering more than $250 million in annual electricity savings to Ontario ratepayers. On July 28, 2021, the company reached an agreement with the Department of National Defence that, subject to conditions and regulatory approval, allows for the development of this project on the Meaford base. The company will continue to consult with the Saugeen Ojibway Nation, other Indigenous Rightsholders and communities along with other local stakeholders as the company continue to advance this project, which remains subject to a number of conditions and approvals, including approval of its Board of Directors.

Renewable Energy Requests For Information (RFI): Through an RFI process in second quarter 2021, the company announced that the company were seeking to identify potential contracts and/or investment opportunities in up to 620 MW of wind energy projects, 300 MW of solar projects and 100 MW of energy storage projects to meet the electricity needs of a portion of its U.S. pipeline assets. The project team is currently evaluating proposals, has commenced negotiations and expects to finalize contracts by the end of the year.

Other Energy Transition Developments

Irving Oil Decarbonization: On August 12, 2021, the company signed a memorandum of understanding to explore the joint development of a series of proposed energy projects focused on reducing greenhouse gas emissions and creating new economic opportunities in New Brunswick and Atlantic Canada. Together with Irving Oil, TC Energy has identified a series of potential projects for exploration focused on decarbonizing current assets and deploying emerging technologies to reduce overall emissions. The partnership’s initial focus will consider a suite of upgrade projects at Irving Oil’s refinery in Saint John, New Brunswick, with the goal of significantly reducing emissions through the production and use of low-carbon power generation.

Hydrogen Hubs: On October 7, 2021, the company announced a partnership with Nikola Corporation to collaborate on developing, constructing, operating and owning large-scale hydrogen production facilities (hubs) in the United States and Canada. TC Energy is actively collaborating to identify and develop projects to establish the infrastructure required to deliver low-cost and low-carbon hydrogen at scale in line with each company’s core objectives.

A key objective of the collaboration is to establish hubs producing 150 tonnes or more of hydrogen per day near highly traveled truck corridors to serve Nikola’s planned need for hydrogen to fuel its Class 8 fuel cell electric vehicles (FCEVs) within the next five years. The company's significant pipeline, storage and power assets can potentially be leveraged to lower the cost and increase the speed of delivery of these hubs. This may include exploring the integration of midstream assets to enable hydrogen distribution and storage via pipeline and/or to deliver carbon dioxide to permanent sequestration sites to decarbonize the hydrogen production process.

Corporate

Common share dividend: The company's Board of Directors declared a quarterly dividend of $0.87 per common share for the quarter ending December 31, 2021. The quarterly amount is equivalent to $3.48 per common share on an annualized basis.

Voluntary Retirement Program (VRP): In mid-2021, the company offered a one-time VRP to eligible employees. Participants in the program will retire by December 31, 2021 and receive a transition payment in addition to existing retirement benefits. For the three and nine months ended September 30, 2021, TC Energy has expensed a total of $89 million before tax, mainly related to the VRP transition payments, which was included in Plant operating costs and other. Of the total program costs, $71 million was excluded from comparable earnings and $18 million was recorded in Revenues related to costs that are recoverable through regulatory and tolling structures on a flow-through basis.

Issuance of long-term debt: On October 12, 2021, TCPL issued US$1.25 billion of Senior Unsecured Notes due in October 2024 bearing interest at a fixed rate of 1.00 per cent and US$1.0 billion of Senior Unsecured Notes due in October 2031 bearing interest at a fixed rate of 2.50 per cent.