TFI International

Summary

- TFI International is a North American leader in logistics and transportation.

- TFI International has become a trusted solution for over-the-road and intermodal LTL services across Canada, the US and Mexico.

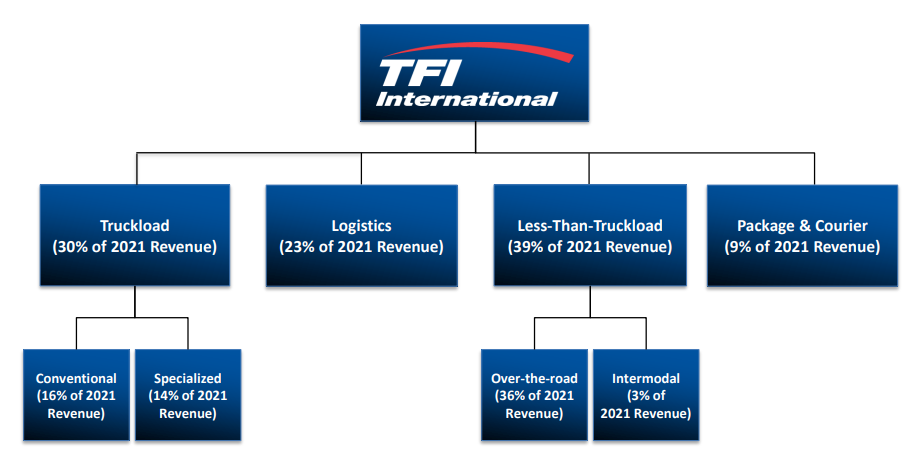

- The comapny diversified across multiple geographies, industry verticals and business segments, including Package and Courier, Less-Than-Truckload, Truckload and Logistics.

- TFI has integrated network of over 80 operating companies and more than 29,000 employees

Company Overview

TFI (NYSE:TFII, TSX:TFII) is a recognized North American transportation and logistics leader, partnering with a diverse group of customers in the US, Canada and Mexico. The company's vast e-commerce network spans more than 80 North American cities.1

Through its operating companies, the company provide the full complement of transportation and logistics services. The company's safe and effective solutions are engineered to minimize costs, risks and time-consuming activities. As the company continually enhance its logistical network, the company strive to add value and functionality for its partners.

The company's integrated network is driven by the power of over 80 operating companies and more than 29,000 employees working alongside independent contractors – each with rich industry experience. Working in concert, the company help customers across a broad range of verticals, from retail to energy, to food and beverage and much more.

Services

TFI International consists of four business segments, serviced through more than 80 wholly-owned subsidiaries operating under their own brands.2

The company's service structure allows it to simultaneously reap the benefits of specialization and economies of scale, efficiently allocate resources, and capitalize on market opportunities. With this differentiated approach, TFI International is uniquely positioned to create shareholder value and deliver quality service.

Package and Courier

The Package and Courier segment of its business includes respected brands spanning Canada. It provides seamless door-to-door service by incorporating time-definite parcel delivery.

The company's edge stems from its vertical focus and ability to optimize processes through technology. While focusing on high quality revenues, its team is consistently implementing measures to enhance network utilization and improve efficiency.

Less-Than-Truckload

TFI International has become a trusted solution for over-the-road and intermodal LTL services across Canada, the US and Mexico.

The company's innovative systems are designed to facilitate on-time and damage-free transportation of customer freight. With an impeccable track record, TFI International is now recognized as a delivery service you can depend on to satisfy your every need.

Truckload

TFI International is a leading North American provider of conventional and specialized truckload services, including flatbed, tanks, dumps, and oversized. The company's robust network and knowledgeable experts provide valuable and timely solutions for industries with specific transportation needs.

TFI International’s operating companies can help you obtain the ultimate advantage in price, service, and control of your supply chain.

Logistics

Regardless of a shipment’s point of origin, destination or dimensions, the company offer reliable and effective transportation solutions. Through its Logistics segment, TFI International is able to extend same day parcel services to every major US and Canadian city.

TFI International has the infrastructure and expertise to provide consistent excellence in service, taking every detail into consideration. The company's systems allow customers to focus less on managing freight movements and more on core business objectives.

Recent acquisitions

On January 29, 2021, TFI International acquired Fleetway Transport Inc. (“Fleetway”). Based out of Brantford, Ontario, Fleetway is a full service provider of truckload and heavy-haul transportation solutions and logistics services.

On April 30, 2021, TFI International completed the acquisition of UPS Ground Freight, Inc.’s (“UPS Freight”) the less-than-truckload (LTL) and dedicated truckload (TL) divisions of United Parcel Service, Inc. (NYSE: UPS). The LTL business, representing approximately 90% of the acquired business now independently operates under the new name of “TForce Freight”.

On June 1, 2021, TFI International acquired Procam International (“Procam”). Based in Quebec, Procam provides bulk transportation services primarily in the northeastern region of Canada and the United States.

On July 2, 2021, TFI International acquired Driving Force Decks International Ltd (“Driving Force”). Based in Abbotsford, British Columbia, Driving Force provides flat deck services through their asset-light, scalable model.

On July 16, 2021, TFI International acquired Tombro Trucking Limited (“Tombro”). Based out of Milton, Ontario, Tombro provides flat deck services primarily hauling freight such as brick, block, and precast.

On October 1, 2021, TFI International acquired Gunter Transportation Ltd. (“Gunter”). Based out of Woodstock, Ontario, Gunter provides flatbed trucking serving wood products, pre-cast concrete, metals, equipment and specialty products.

On October 3, 2021, TFI International acquired SGT 2000 Inc. (“SGT”). Based in Quebec, SGT provides truckload, logistics, warehousing and vehicle rental services throughout North America.

On November 26, 2021, TFI International acquired D&D Sexton (“D&D”). Based in Carthage, Missouri, D&D specializes in refrigerated transportation providing both long-haul over-the-road services as well as local and shuttle operations.

On November 26, 2021, TFI International acquired Laser Transport Inc. (“Laser”). Based out of Windsor, Ontario, Laser provides truckload, warehousing and distribution services.

On December 10, 2021, TFI International acquired F.K.D. Contracting (Alta) Ltd. (“FKD”). Based out of western Canada, F.K.D. offers bulk tank transportation.

Financial Highlights

For the year ended December 31, 2021, total revenue was $7.22 billion, up 91%, or $3.44 billion, from 2020. The increase was mainly attributable to the contribution from business acquisitions of $3.11 billion and from an increase of $334.2 million from existing operations, which included an increase in fuel surcharge revenue of $144.0 million.3

For the three months ended December 31, 2021, personnel expense increased 144% to $598.6 million from $245.4 million in Q4 2020. The increase is attributed almost entirely to the impact from business acquisitions of $338.0 million.

For the year ended December 31, 2021, the Company’s operating expenses increased by $2.97 billion from $3.36 billion in 2020 to $6.33 billion in 2021. The increase is mainly attributable to $2.69 billion from business acquisitions. The operating expenses from existing operations as a percentage of total revenue decreased from 89.6% to 88.1%. The decrease is due to operating improvements, better fleet utilization and lower material and service expenses in the Company’s existing operations, and one time reductions to the pension costs of $15.1 million, despite a mark-to-market expense on DSUs of $22.9 million, a reduction in the contribution from the Canada Emergency Wage Subsidy Program of $40.0 million, and business acquisition transaction costs of $8.7 million.

For the year ended December 31, 2021, TFI International’s operating income rose by $472.6 million to $889.2 million as compared to $416.6 million in 2020. The increase is primarily attributable to the impact from business acquisitions $411.7 million, which includes a $193.5 million bargain purchase gain. The operating margin as a percentage of revenue before fuel surcharge of 13.7% increased compared to 12.0% in the prior year.

Interest expense on long-term debt for the three-month period ended December 31, 2021 was $5.1 million higher than the same quarter last year. The increase is mainly attributable to a higher average debt level, based on the month-end debt levels, of $1.58 billion for Q4 2021 compared to an average debt level of $0.94 billion in Q4 2020.

Interest expense on long-term debt for the three-month period ended December 31, 2021 was $5.1 million higher than the same quarter last year. The increase is mainly attributable to a higher average debt level, based on the month-end debt levels, of $1.58 billion for Q4 2021 compared to an average debt level of $0.94 billion in Q4 2020.

For the year ended December 31, 2021, TFI International’s net income was $664.4 million as compared to $275.7 million in 2020. The Company’s adjusted net income1 , a non-IFRS measure, which excludes items listed in the above table, was $498.3 million as compared to $299.8 million in 2020, an increase of 141% or $388.7 million. Adjusted EPS, fully diluted, increased by $1.93 to $5.23 from $3.30 in 2020.

2022 First Quarter Results

April 28, 2022; TFI International Inc announced its results for the first quarter ended March 31, 2022. All amounts are shown in U.S. dollars.4

“The year is off to a strong start for TFI International as the company capitalize on favorable trends across its highly diverse end markets and its own internal opportunities to drive synergies and operational enhancements,” said Alain Bédard, Chairman, President and Chief Executive Officer. “During the first quarter, the company more than doubled both its operating income and adjusted diluted EPS, with favorable contributions from all four of its business segments thanks to the focus and dedication of its talented team across North America. Through adherence to TFI’s longstanding operating principles that emphasize continual focus on the customer, an asset-light approach, and ‘freight that fits’, TFI International is confident in its ability to navigate uncertain economic times, while also executing on multiple opportunities to streamline operations and drive further synergies related to the ongoing successful integration of TForce Freight. During the quarter the company also further bolstered its very solid balance sheet, even while investing in its fleet and returning capital to shareholders, which furthers its financial flexibility and opportunities to enhance long-term growth through attractive acquisitions.”

Total revenue of $2.19 billion was up 91% and, net of fuel surcharge, revenue of $1.89 billion was up 79% compared to the prior year period.

Operating income grew 116% to $219.8 million from $101.7 million the prior year period. The increase was driven by business acquisitions and organic growth across the company.

Net income grew 121% to $147.7 million from $66.9 million the prior year period, and net income of $1.57 per diluted share was up relative to $0.70 the prior year period. Adjusted net income, a non-IFRS measure, was $157.6 million, or $1.68 per diluted share, up 114% from $73.6 million, or $0.77 per diluted share, the prior year period.

For the Package and Courier segment, revenue before fuel surcharge decreased 5% to $124.6 million and operating income increased 42% to $26.1 million.

For the Less-Than-Truckload segment, revenue before fuel surcharge increased 535% to $835.4 million and operating income increased 328% to $94.8 million.

For the Truckload segment, revenue before fuel surcharge increased 22% to $515.9 million and operating income increased 42% to $71.0 million, including a $19.3 million gain ($3.5 million gain in the prior year period) on the sale of rolling stock and equipment.

For the Logistics segment, revenue before fuel surcharge increased 15% to $435.4 million and operating income increased 20% to $34.9 million.

Net cash from operating activities was $137.7 million during Q1 compared to $155.2 million the prior year period. The decrease was due working capital requirements primarily related to fuel surcharges on increased sales of $175.4 million offset by increased contributions from net income of $80.8 million, net income tax impact of $36.0 million, and increased depreciation adjustments of $32.0 million. The Company returned $99.0 million to shareholders during the quarter, of which $24.9 million was through dividends and $74.0 million was through share repurchases.

Cash used for the purchase of property and equipment was $90.4 million during Q1 2022 versus $37.4 million the prior year quarter. The increase in additions in 2022 is primarily due to the fleet renewals for acquired companies, primarily for TForce Freight. In addition, procurement of equipment was difficult in 2021 as manufacturing and supply chain challenges resulted in delays.

On March 15, 2022, the Board of Directors of TFI International declared a quarterly dividend of $0.27 per outstanding common share paid on April 18, 2022, representing a 17% increase over the $0.23 quarterly dividend declared in Q1 2021.