Tech Mahindra Ltd

Summary

- Tech Mahindra is part of the Mahindra Group, founded in 1945, one of the largest and most admired multinational federation of companies.

- With over 1,21,000 employees across 90+ countries, Tech Mahindra is serving 1,000+ clients including several Fortune 500 companies.

- Tech Mahindra has consistently emerged as a leader in sustainability and is recognized amongst the ‘2021 Global 100 Most sustainable corporations in the World.

Company Overview

Tech Mahindra (NSE:TECHM) offers innovative and customer-centric digital experiences, enabling enterprises, associates and the society to Rise. Tech Mahindra is a USD 5.1 billion organization with 126,200+ professionals across 90 countries helping 1058 global customers, including Fortune 500 companies. Tech Mahindra is focused on leveraging next-generation technologies including 5G, Blockchain, Cybersecurity, Artificial Intelligence, and more, to enable end-to-end digital transformation for global customers. Tech Mahindra is one of the fastest growing brands and amongst the top 15 IT service providers globally. Tech Mahindra has consistently emerged as a leader in sustainability and is recognized amongst the ‘2021 Global 100 Most sustainable corporations in the World’ by Corporate Knights. With the TechM NXT.NOW framework, Tech Mahindra aims to enhance ‘Human Centric Experience’ for its ecosystem and drive collaborative disruption with synergies arising from a robust portfolio of companies. Tech Mahindra aims at delivering tomorrow’s experiences today, and believes that the ‘Future is Now’.1

Tech Mahindra is part of the Mahindra Group, founded in 1945, one of the largest and most admired multinational federation of companies with 260,000 employees in over 100 countries. It enjoys a leadership position in farm equipment, utility vehicles, information technology and financial services in India and is the world’s largest tractor company by volume. It has a strong presence in renewable energy, agriculture, logistics, hospitality and real estate. The Mahindra Group has a clear focus on leading ESG globally, enabling rural prosperity and enhancing urban living, with a goal to drive positive change in the lives of communities and stakeholders to enable them to Rise.

Recent acquisitions

CERIUM

The Company on April 9, 2020 acquired 51% of the share capital of Cerium Systems Private Limited (Cerium). The enterprise value of Cerium is Rs 2,450 million. Cerium is an integrated circuit and embedded software design service provider that is expected to help bolster Tech Mahindra’s capabilities in the areas of semiconductor design and testing, embedded software development / testing and product engineering. The remaining 49% to be acquired over the next three years at a valuation linked to the financial performance of Cerium. During the year, the Company acquired a further 6% stake thereby taking the total shareholding to 57%. 2

ZEN3

The Company on April 9, 2020, acquired 100% of the share capital of Zen3 for a cash consideration of USD 64 million, out of which USD 35 million was paid upfront, USD 4 million will be paid over two years and maximum upto USD 25 million will be paid over three years linked to financial performance. Zen3 is leading software solution group with strong capabilities in AI enablement services, AI speech solutions, cloud engineering, software product engineering and DevOps. Zen3 has more than 1,300 employees across offices in Seattle, Dublin, Bengaluru, Hyderabad and Vishakhapatnam.

TENZING

The Company acquired 100% of the share capital of Tenzing Ltd and Tenzing Australia Ltd (Tenzing Group) through its wholly owned subsidiary Tech Mahindra (Singapore) Pte Ltd at a consideration of USD 29.5 million including earnouts. The Company is headquartered in Auckland, New Zealand and is engaged in the business of Management Consulting, Digital Transformation and Technology services. It has 145 employees and a turnover of USD 27.4 million. The acquisition will bring strong capabilities primarily in the Insurance vertical along with expanding footprint in the Australia and New Zealand (ANZ) market. The acquisition was completed on December 1, 2020.

MOMENTON

Momenton Pty. Ltd. (“Momenton”) was acquired by the Company through its wholly owned subsidiary viz., Tech Mahindra (Singapore) Pte Limited at a consideration upto AUD 14.3 million including earnouts. The company is headquartered in Melbourne, Australia and has approximately 55 employees. Turnover for the financial year ended 30th June 2020, was AUD 10.8 million. Momenton is a cloud and engineering services provider with a Banking and Financial Services (BFS) focus. The acquisition will enhance Tech Mahindra’s digital transformation capabilities and provide Tech Mahindra a scaled-up presence in the Australian BFS market. This acquisition was completed on 12th February 2021.

PERIGORD

The Company acquired 70% of Perigord Asset Holdings Limited (“Perigord”) through its wholly owned subsidiary Mahindra Engineering Services (Europe) Ltd at a consideration of EUR 21 Million and the remaining 30% will be acquired over the next four years at a valuation linked to financial performance of the company. Perigord is headquartered in Dublin, Ireland with a presence in Germany, USA and India with 380 employees. For the financial year ending 31st December 2020, the company had revenue of EUR 19.5 million The Indian subsidiaries of Perigord were acquired by the Company directly.

Perigord specialized in end to end packaging supply chain solutions to the life sciences industry with services such as packaging artwork & labelling services, strategic consultancy, creative and digital, strategic outsourcing, managed services and software solutions. The acquisition was completed on 15th March, 2021.

Payments Technology Services Limited

The Company announced the acquisition of Payments Technology Services Limited, Hongkong on 12th January 2021 at a consideration of USD 9 million. The company is headquartered in Hong Kong and has approximately 109 employees. Turnover of the Company for the financial year ended 31st December 2019 was USD 5.4 million.

The Payments Technology Services entity is a stepdown subsidiary of Fidelity Information Services (FIS). The acquired capabilities in the payments space will give it access to IPs and licenses for two products, which is consistent with the strategy of pivoting the business towards products and platform implementations as well as participating in the banking transformation programs. This acquisition will open up other opportunities for Tech Mahindra across a number of areas in partnership with FIS.

DIGITALONUS

The Company announced the acquisition of DigitalOnUs, Inc. (“DigitalOnUs”) on 19th April 2021 at an enterprise value of USD 120 million through its wholly owned subsidiary, Tech Mahindra (Americas) Inc. The company is headquartered in San Jose, California, USA. DigitalOnUs is focused on Cloud Native Development and Hybrid Cloud Automation services. The acquisition of DigitalOnUs will enhance Tech Mahindra’s capability in cloud native engineering and position it to develop cutting-edge digital solutions for its customers. DigitalOnUs has more than 380 employees. For the financial year ending 31st December 2020, the company had revenue of USD 30.6 million. The Indian subsidiary of DigitalOnUs namely DigitalOps Technology Private Limited has been acquired by the Company

EVENTUS

The Company announced the acquisition of Eventus Solutions Group, LLC. (“Eventus”) on April 26, 2021 through its wholly owned subsidiary Tech Mahindra (Americas) Inc. at a consideration of USD 44 million. Eventus provides end-to-end customer engagement solutions, such as strategy consulting, cloud based tools and automation services and managed services. The company is headquartered in Denver, Colorado. It has a turnover of USD 33.2 million in CY2020, with an employee base of around 100 spread across various states in the US.

Industry Overview

FY21 was a year most frequently described as “unprecedented”. It generated an extraordinary set of challenges for the global economy. From lockdowns that crippled small businesses and supply chains, putting Millions out of work, to shrinking budgets and worsening economic growth rates, the pandemic has tested the resilience of the businesses across the globe.

While the intensity of the impact differs from sector to sector, there are few sectors like Aviation, travel & tourism, automobile, hospitality that have been hit the most and might continue to suffer until life turns back to normal. The major setback was to the informal sector, which is a major employment provider in India and globally. All the major economies except for China, saw a decline in GDP in 2020.

Financial Highlights

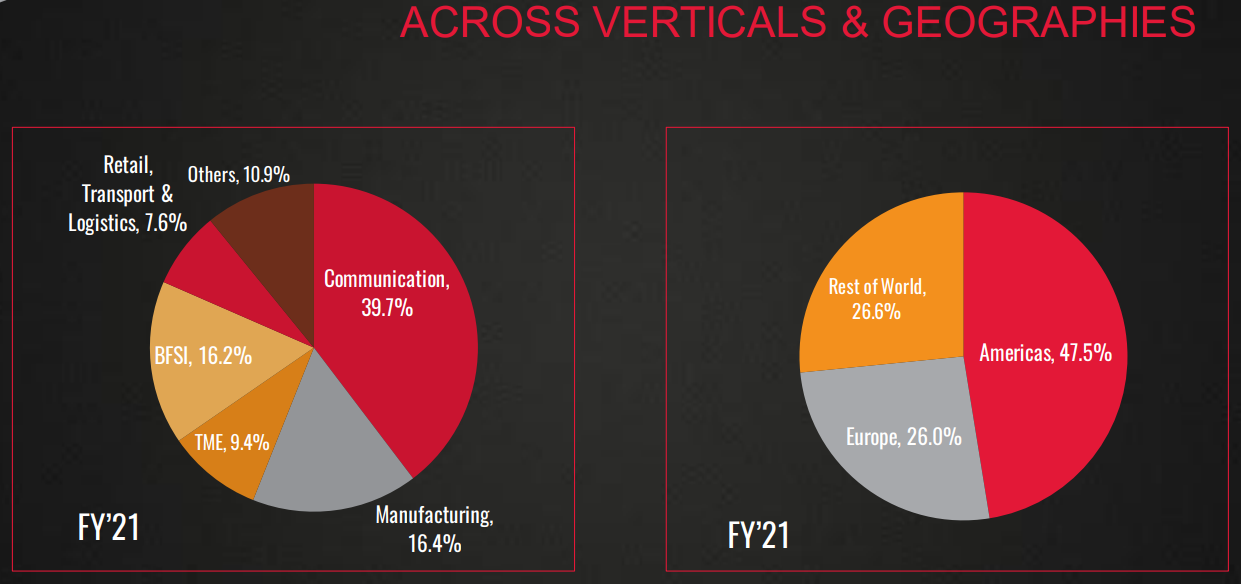

During the Financial Year 2020-21, the Company’s consolidated revenues increased to Rs 378,551 million from Rs 368,677 million in the previous year, a growth of 2.7%. The geographic split of revenue is 47.5% from the Americas, 26% from Europe and 26.5% from the Rest of the World.

The consolidated Profit (including other income) before Interest, Depreciation and Tax was at Rs 75,846 million, against Rs 66,955 million in the previous year.

The consolidated Profit after Tax amounted to Rs 43,530 million as against Rs 38,974 million in the previous year.

Tech Mahindra Q1’22 Results

July 29th, 2021; Tech Mahindra Ltd. announced the audited consolidated financial results for its quarter ended June 30, 2021. 3

Financial highlights for the quarter (₹)

- Revenue at ₹ 10,198 crores; up 4.8% QoQ and 12.0% YoY

- EBITDA at ₹ 1,876 crores; down 3.7% QoQ, up 44.3% YoY

- PAT at ₹ 1,353 crores; up 25.1% QoQ and 39.2% YoY

CP Gurnani, Managing Director & Chief Executive Officer, Tech Mahindra, said,

Tech Mahindra has witnessed an all rounded performance this quarter with growth across its key markets and industry sectors. The company continue to see strong traction in large deal wins as Tech Mahindra is helping its customers in integrated digital transformation. The company's focus on key technology pillars wrapped around experience-led approach with TechM Nxt. Now will help it to capitalize on the strong demand momentum.

Milind Kulkarni, Chief Financial Officer, Tech Mahindra, said,

The company continue to build on its profitability journey and have reported highest ever quarterly Revenue and Profit After Tax this quarter. Delivery Excellence will be a cornerstone in improving its operational and financial metrics, as the company look to capitalize on the incremental digital spends over the course of the year.

Key Wins

- Tech Mahindra has won a deal with a leading UK telecom company for end to end customer experience for both consumer and enterprise businesses.

- Tech Mahindra has been engaged by one of the largest private healthcare systems in US as a managed service partner for technology transformation.

- Won a strategic digital assurance deal with an Am erican technology company.

- Tech Mahindra has been chosen by a Tier 1 US Telco in the data and analytics space for data platform modernization and cloud migration.

- Tech Mahindra has been chosen by Tier 1 automotive equipment supplier for managed security services and greenfield service desk implementation.

- Engaged by world's Largest Public Funded Healthcare Program for establishing and managing contact centre operations for COVID vaccination programs.

- Tech Mahindra has been chosen by an Australian government division as a digital transformation partner.

- Tech Mahindra has won a deal with one of the largest railroad company in North America for strategic IT modernization leveraging the digital and analytics expertise.

- Tech Mahindra has been selected by an Asia Pacific energy company for end to end transformation including infrastructure, cloud, cybersecurity services.

- Tech Mahindra has been engaged by a large bank in Africa for core banking transformation.