Teck Resources

Summary

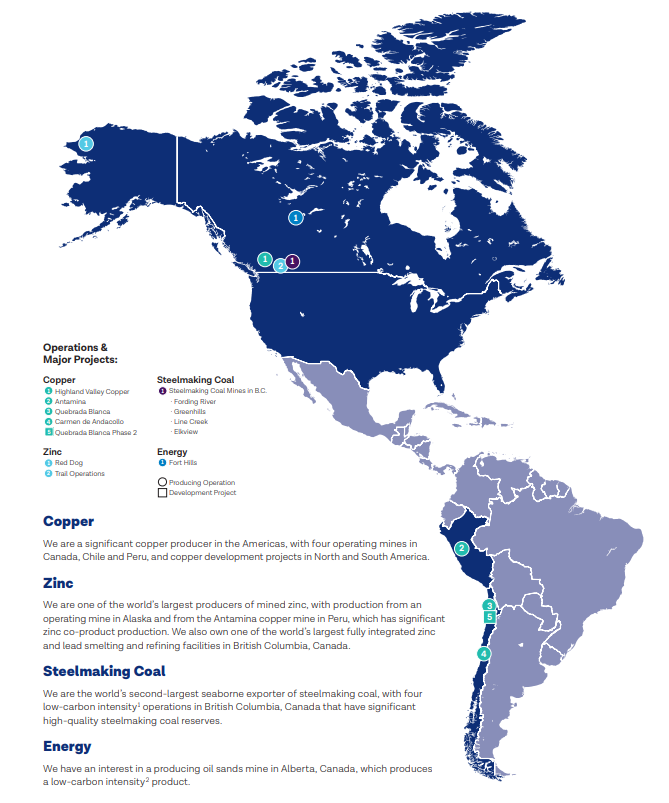

- Teck is one of Canada’s leading mining companies with operations and projects in Canada, the United States, Chile and Peru.

- Teck focused on copper, zinc, steelmaking coal, and energy.

- The company own or have interests in 10 operating mines, a large metallurgical complex, and several major development projects in the Americas.

Company Overview

Teck Resources (NYSE:TECK, TSX:TECK) is one of Canada’s leading mining companies with operations and projects in Canada, the United States, Chile and Peru.1

Teck is a diversified resource company committed to responsible mining and mineral development with business units focused on copper, zinc, steelmaking coal, and energy. Headquartered in Vancouver, British Columbia (B.C.), Canada, the company own or have interests in 10 operating mines, a large metallurgical complex, and several major development projects in the Americas. Teck Resources has expertise across a wide range of activities related to exploration, development, mining and minerals processing, including smelting and refining, health and safety, environmental protection, materials stewardship, recycling and research.

Company History

Teck has grown over more than 100 years to become a leading diversified natural resource company, committed to responsible mining and mineral development.2

| Year | Milestone |

| 1913 | Teck-Hughes Gold Mines Ltd. formed to develop a gold discovery in Teck Township on the shores of Kirkland Lake, Ontario; the mine produces gold for a half century until 1968. |

| 1935 | Second gold mine developed at Lamaque, which also produces for 50 years. |

| 1954 | High-grade copper discovery at Temagami put into production; Temagami Mining subsequently acquires control of Teck-Hughes and its affiliate Lamaque Mines. |

| 1962 | Teck-Hughes, Lamaque and Canadian Devonian Petroleums merge to form Teck Corporation. |

| 1969 | Teck acquires Beaverdell mine in British Columbia, a silver mine that was first explored in 1898, and remained in production until 1991. |

| 1975 | 1975-1986. Major mine development thrust includes seven new mines producing zinc in Newfoundland, niobium in Quebec, copper and coal in British Columbia and gold in Ontario. |

| 1986 | Construction starts on Red Dog mine which was developed under an innovative operating agreement with NANA Regional Corporation, Inc. (NANA), a Regional Alaska Native corporation owned by the Iñupiat people of Northwest Alaska |

| 1986 | Teck acquires initial interest in Cominco from CP Ltd., eventually acquiring 100% in 2001 |

| 1989 | 1989–1992. Three more new mines developed: zinc in Alaska, copper-zinc in Quebec and copper in Chile. |

| 1992 | Teck participates in the Rio Earth Summit, the first global conference on sustainable development. CESL Limited is created, a technology group focused on commercializing a hydrometallurgical technology for treating concentrates. |

| 1998 | Teck acquires partnership interest in Antamina copper-zinc development project in Peru, jointly with Noranda and Rio Algom; production achieved in 2001. |

| 2003 | Teck and Fording Coal combine six coal mines into Elk Valley Coal Partnership, operated by Teck. |

| 2007 | Teck purchases Aur Resources to bring new copper mines at Quebrada Blanca and Carmen de Andacollo in Chile. |

| 2008 | Teck purchases the remainder of the Elk Valley Partnership from Fording Trust. |

| 2010 | Teck provides recycled metals for the Vancouver 2010 Olympic and Paralympic Winter Games' medals. |

| 2010 | Teck is named to the Dow Jones Sustainability World Index. |

| 2015 | Teck and Goldcorp announce an agreement to combine their respective El Morro and Relincho projects, located approximately 40 kilometres apart in the Huasco Province in the Atacama region of Chile, into a single project called NuevaUnion Project. |

| 2015 | Teck partners with the City of Kimberley to develop the SunMine; the first solar power facility built on a reclaimed mine site. |

| 2016 | Teck becomes the first mining company to use sensors mounted on a shovel bucket to distinguish ore from waste rock. |

| 2018 | Teck sanctions the start of construction for Quebrada Blanca Phase 2, a high quality, a low-cost, long-life operation with significant expansion potential that will substantially increase Teck’s copper production and generate considerable value for many years. |

| 2019 | Teck recognized as one of the Global 100 Most Sustainable Corporations by Corporate Knights. |

| 2020 | Teck partners to test germ-killing copper on Vancouver transit |

Operations

Teck is one of Canada's leading mining companies committed to responsible mining and mineral development with major business units focused on copper, zinc and steelmaking coal, as well as investments in energy assets.3

Canada

Elkview

Elkview Operations is located approximately three kilometres east of Sparwood in southeastern British Columbia. It is one of its four steelmaking coal operations in the Elk Valley.

Teck has a 95% partnership interest in Elkview. The remaining 5% is indirectly held equally by Nippon Steel & Sumitomo Metal Corporation, a Japanese steel producer, and POSCO, a Korean steel producer, each of which acquired a 2.5% interest in 2005.

Elkview produces steelmaking coal – also called metallurgical coal or coking coal — which is used to make steel. The company export the processed coal by sea to the Asia-Pacific region and elsewhere. This involves the shipment of the steelmaking coal from the mine site to bulk port terminals in Vancouver by rail. It is then loaded on to larger seagoing vessels, which carry it to its target markets.

Elkview Operations set a new production record in 2021, with its first full year of operations since its plant expansion to a capacity of 9.0 million tonnes per annum. Proven and probable reserves at Elkview are projected to support mining for a further 30 years.

Fording River

Fording River Operations is located approximately 29 kilometres northeast of the community of Elkford, in southeastern British Columbia. It is one of its four steelmaking coal operations in the Elk Valley.

Fording River produces steelmaking coal – also called metallurgical coal or coking coal —which is used to make steel. The company export the processed coal by sea to the Asia-Pacific region and elsewhere. This involves the shipment of the steelmaking coal from the mine site to bulk port terminals in Vancouver by rail. It is then loaded on to larger seagoing vessels, which carry it to its target markets.

The current annual production capacities of the mine and preparation plant are approximately 9.0 million and 9.5 million tonnes of clean coal, respectively. Proven and probable reserves at Fording River are projected to support mining for a further 38 years.

Greenhills

Greenhills Operations is located approximately eight kilometres northeast of the community of Elkford, in southeastern British Columbia. It is one of its four steelmaking coal operations in the Elk Valley.

Teck has an 80% partnership interest in Greenhills. The remaining 20% is held by POSCO Canada Limited (POSCAN) and POSCAN’s parent, POSCO, a Korean steel producer.

Greenhills produces steelmaking coal – also called metallurgical coal or coking coal — which is used to make steel. The company export the processed coal by sea to the Asia-Pacific region and elsewhere. This involves the shipment of the steelmaking coal from the mine site to bulk port terminals in Vancouver by rail. It is then loaded on to larger seagoing vessels, which carry it to its target markets.

The current annual production capacities of the mine and preparation plant (on a 100% basis) are 5.9 million and 5.4 million tonnes of clean coal, respectively. Proven and probable reserves at Greenhills are projected to support mining for a further 40 years, or less depending on the extent of Greenhills’ raw coal processed at Fording River.

Highland Valley Copper

Highland Valley Copper (HVC) Operations is located approximately 17 kilometres west of Logan Lake and about 50 kilometres southwest of Kamloops in British Columbia. Teck has a 100% interest in HVC.

HVC produces both copper and molybdenum concentrates through autogenous and semi-autogenous grinding and flotation. Once processed, the metal concentrates are exported overseas, where the majority is sold under long-term sales contracts to smelters.

Copper production in 2022 is anticipated to be between 127,000 and 133,000 tonnes, with a relatively even distribution throughout the year. Copper production from 2023 to 2025 is expected to be between 130,000 and 160,000 tonnes per year.

Line Creek

Line Creek Operations is located approximately 25 kilometres north of Sparwood in southeastern British Columbia.

Line Creek produces steelmaking coal – also called metallurgical coal or coking coal — which is used to make steel. The company export the processed coal by sea to the Asia-Pacific region and elsewhere. This involves the shipment of the steelmaking coal from the mine site to bulk port terminals in Vancouver by rail. It is then loaded on to larger seagoing vessels, which carry it to its target markets.

The current annual production capacities of the mine and preparation plant are approximately 4.0 million tonnes of clean coal. Proven and probable reserves at Line Creek are projected to support mining for a further 12 years.

Trail Operations

Teck’s Trail Operations, located in the community of Trail in British Columbia, is one of the world’s largest fully integrated zinc and lead smelting and refining complexes. The metallurgical operations produce refined zinc and lead, a variety of precious and specialty metals, chemicals and fertilizer products.

The Waneta Dam provides low-cost, clean and renewable power to the metallurgical operations.

Fort Hills

The Fort Hills oil sands mine is located in northern Alberta. The company hold a 21.3% interest in the Fort Hills Energy Limited Partnership (Fort Hills Partnership), which owns the Fort Hills oil sands mine, with Total E&P Canada Ltd. (Total) and Suncor Energy Inc. (Suncor) holding the remaining interest. An affiliate of Suncor is the operator of the project.

The company's gross loss from Fort Hills was $133 million in 2021, compared with a gross loss of $326 million in 2020 and a $10 million gross profit in 2019. The gross loss in 2021 decreased primarily due to an increase in global benchmark crude oil prices, including Western Canadian Select (WCS), partially offset by higher operating costs.

The company's 21.3% share of bitumen production from Fort Hills was 19,935 barrels per day in 2021. This compares to 22,875 barrels per day produced in 2020.

United States

Red Dog

Red Dog Operations is one of the world's largest zinc mines, located about 170 kilometres north of the Arctic Circle in northwest Alaska, near Kotzebue.

In 1989, Red Dog Operations was developed through an innovative operating agreement between the operator Teck and the land-owner NANA, a Regional Alaska Native corporation owned by the Iñupiat people of northwest Alaska. The mine and concentrator properties are leased from, and were developed under the agreement with NANA.

Red Dog is an open-pit truck-and-loader operation, using conventional drill and blast mining methods. Concentrates produced at Red Dog are shipped to its metallurgical facilities in Trail, British Columbia, and to customers in Asia and Europe.

The current mine life, based on existing developed deposits, is expected to extend through to 2031.

Peru

Antamina

The Antamina mine is a large copper and zinc mine, located in the Andes mountain range, 270 kilometres north of Lima, Peru. The deposit is located at an average elevation of 4,200 metres.

Teck Resources has a 22.5% interest in the mine. The company's partners are BHP plc (33.75%), Glencore plc (33.75%) and Mitsubishi Corporation (10%).

The mine is an open pit, truck/shovel operation. A 302 kilometre slurry concentrate pipeline transports copper and zinc concentrates to the port for shipment to smelters and refineries world-wide.

Antamina has entered into long-term copper and zinc concentrate off-take agreements with affiliates of the Antamina shareholders on market terms. The company sell its share of Antamina’s copper and zinc concentrates to major smelting and refining companies.

Chile

Quebrada Blanca

The Quebrada Blanca mine is located in Tarapacá Region of northern Chile at an elevation of 4,400 metres, approximately 240 kilometres southeast of the city of Iquique and 1,500 kilometres from Santiago.

Teck holds an indirect 60% interest in the mine. Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation together have a collective 30% indirect interest in the mine. ENAMI, a Chilean state agency, has a 10% non-funding interest.

Quebrada Blanca is an open pit operation, which leaches the ore to produce copper cathodes via processing in an SX-EW plant. Copper cathode is trucked to Iquique for shipment to purchasers. Mine personnel live in a camp facility, and the majority commute from large population centres, including Iquique, Arica and Santiago.

Mining operations ceased in the fourth quarter of 2018, and mining equipment and personnel have been redeployed to the Quebrada Blanca Phase 2 (QB2) project. The operation is now focused on secondary copper extraction from previous leach piles.

Quebrada Blanca produced 11,500 tonnes of copper cathode in 2021, compared to 13,400 tonnes in 2020.

Carmen de Andacollo

The Quebrada Blanca mine is located in Tarapacá Region of northern Chile at an elevation of 4,400 metres, approximately 240 kilometres southeast of the city of Iquique and 1,500 kilometres from Santiago.

Teck holds an indirect 60% interest in the mine. Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation together have a collective 30% indirect interest in the mine. ENAMI, a Chilean state agency, has a 10% non-funding interest.

Quebrada Blanca is an open pit operation, which leaches the ore to produce copper cathodes via processing in an SX-EW plant. Copper cathode is trucked to Iquique for shipment to purchasers. Mine personnel live in a camp facility, and the majority commute from large population centres, including Iquique, Arica and Santiago.

Mining operations ceased in the fourth quarter of 2018, and mining equipment and personnel have been redeployed to the Quebrada Blanca Phase 2 (QB2) project. The operation is now focused on secondary copper extraction from previous leach piles.

Quebrada Blanca produced 11,500 tonnes of copper cathode in 2021, compared to 13,400 tonnes in 2020.

Financial Highlights

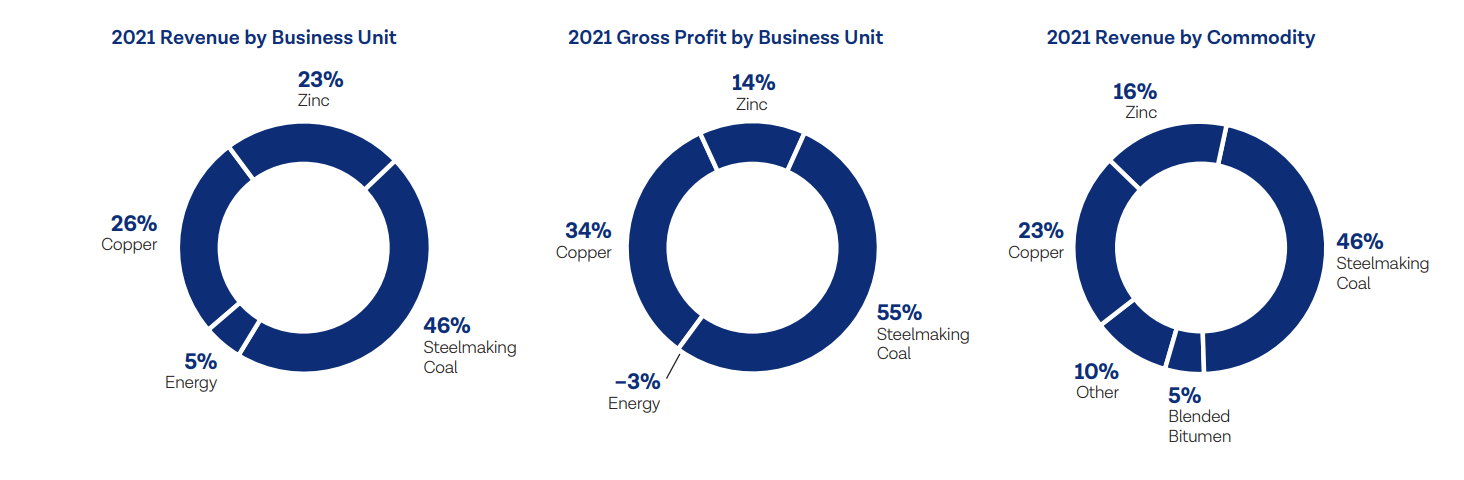

The company's revenue was a record $13.5 billion in 2021, compared with $8.9 billion in 2020 and $11.9 billion in 2019. The increase in 2021 revenue from 2020 was primarily due to substantially higher prices for its principal products and increased sales volumes of steelmaking coal. These increases were partially offset by a decrease in sales volumes of refined zinc and zinc in concentrate and by the strengthening of the Canadian dollar. The decrease in 2020 revenue from 2019 revenue was primarily due to the impact of COVID-19 on prices for its products, most significantly steelmaking coal, zinc and blended bitumen. Revenue was also negatively impacted in 2020 by significantly lower sales volumes for steelmaking coal due to the impact of COVID-19 on demand, logistics chain issues early in the year and the planned shutdown at Neptune. These decreases were partially offset by an increase in copper prices.4

Average prices for copper, zinc, steelmaking coal and blended bitumen were 51%, 32%, 85% and 108% higher in 2021 than in 2020.

The company's principal commodities are copper, zinc, steelmaking coal and blended bitumen, which accounted for 23%, 16%, 46% and 5% of revenue, respectively, in 2021. Silver and lead are significant by-products of its zinc operations, accounting for 7% of its 2021 revenue. The company also produce a number of other by-products, including molybdenum, various specialty metals, and chemicals and fertilizers, which in total accounted for 3% of its revenue in 2021.

The company's cost of sales was $8.4 billion in 2021, compared with $7.6 billion in 2020 and $8.6 billion in 2019. The increase in cost of sales in 2021 compared to 2020 was primarily due to an increase in production volumes during the year. Depreciation and amortization increased by $73 million compared to 2020 as a result of higher production volumes.

The company's exploration expenses in 2021 of $65 million were focused on copper, zinc and gold and were higher than expenditures in 2020 of $45 million, primarily due to the recommencement of drilling programs across its portfolio.

In 2020, non-operating income (expense) included a gain of $56 million on the revaluation of the financial liability for the preferential dividend stream relating to ENAMI’s interest in QBSA. This was partially offset by an $11 million loss on the purchase of US$268 million aggregate principal amount of its outstanding notes. In 2019, non-operating expenses included a $224 million loss on the redemption of its 8.5% notes due in 2024 and foreign exchange losses of $4 million.

These losses were partially offset by a $105 million gain on the debt prepayment option in the 8.5% 2024 notes up to the date of redemption and a gain of $37 million on the revaluation of the financial liability for the preferential dividend stream relating to ENAMI’s interest in QBSA.

Provision for income and resource taxes was $1.6 billion, or 36% of pre-tax profit. This rate is higher than the Canadian statutory income tax rate of 27% due generally as a result of resource taxes and higher taxes in some foreign jurisdictions.

The company's liquidity remained strong at $6.5 billion as at December 31, 2021, including $1.4 billion of cash, of which $88 million is in Chile for the development of the QB2 project and $38 million is held in Antamina. At December 31, 2021, the principal balance of its term notes was US$3.5 billion and the company maintained a US$4 billion undrawn revolving credit facility. As at December 31, 2021, US$2.3 billion was outstanding under its US$2.5 billion QB2 project financing facility. In July 2021, Antamina entered into a new US$1.0 billion loan agreement. The company's 22.5% share of the loan, if fully drawn, will be US$225 million. Proceeds from the loan have been used to repay the existing credit facilities and will be used to fund capital expenditures going forward. The loan is non-recourse to it and the other Antamina owners and matures in July 2026. Based on its strong financial position, the company expect to be able to maintain its operations and fund its development activities as planned.

The company's outstanding debt was $8.1 billion at December 31, 2021, compared with $6.9 billion at the end of 2020 and $4.8 billion at the end of 2019. The increase in 2021 is due to a draw of US$1.1 billion on the QB2 project financing facility and an increase in its share of Antamina loans, partially offset by the repayment of amounts drawn on its revolving credit facility.

First quarter 2022 results

April 26, 2022; Teck Resources Limited announced its unaudited first quarter results for 2022.5

“The company had an exceptional start to 2022 with continued high commodity prices driving record-setting financial results across its business. The company's intention to repurchase a further US$500 million in Class B subordinate voting shares demonstrates both its confidence in the outlook for its business and its commitment to balance growth with shareholder returns,” said Don Lindsay, President and CEO. “This is a transformational year for Teck as the company drive towards first copper at its QB2 project in the later part of the year, advance its copper growth strategy and further strengthen its existing high-quality assets through its RACE technology transformation program and sustainability strategy.”

Adjusted profit attributable to shareholders1 was a quarterly record $1.6 billion or $3.02 per share in Q1 2022 and more than four times higher than the same period last year.

Profit attributable to shareholders was a quarterly record at $1.6 billion or $2.93 per share in Q1 2022.

Adjusted EBITDA was a quarterly record at $3.0 billion in Q1 2022 and more than three times higher than the same period last year. Profit before tax was a record $2.5 billion in Q1 2022.

The company generated cash flows from operations of $2.3 billion in Q1 2022, redeemed US$150 million of its maturing 4.75% term notes and ended the quarter with a cash balance of $2.5 billion. The company's liquidity is $8.0 billion as at April 26, 2022.

The company returned $337 million to shareholders through dividends in Q1 2022 and in April the company completed $100 million in Class B subordinate voting share buybacks.

The company announced that the company intend to repurchase a further US$500 million in Class B subordinate voting shares and will continue to regularly consider additional buybacks in the context of market conditions at the time.

At QB2, the company now have more than 12,000 workers on site, the highest to date, evidencing the recovery from the impacts of the Omicron virus early in the quarter when absenteeism exceeded 20% at times. Steady progress has allowed it to surpass 82% complete, the company expect first copper in Q4 this year, and its capital cost guidance remains unchanged. Notably, QB2 has been named by Bechtel as their construction project of the year.

The company's copper business unit gross profit increased 23% from a year ago, supported by an average realized copper price of US$4.51 per pound and copper sales volumes of 69,300 tonnes.

The company's zinc business unit gross profit increased 98% from a year ago, supported by an average realized zinc price of US$1.65 per pound and quarterly zinc in concentrate sales volumes of 168,700 tonnes.

Realized steelmaking coal prices of US$357 per tonne drove a $1.6 billion gross profit increase in its steelmaking coal business unit.

While its underlying key mining drivers remain relatively stable, like others in the industry, the company continue to face inflationary cost pressures. Inflationary pressures have increased its operating costs by 13% compared to the same period last year, of which approximately half relates to an increase in diesel costs.