The Housing Development Finance Corporation Ltd.

Company Overview

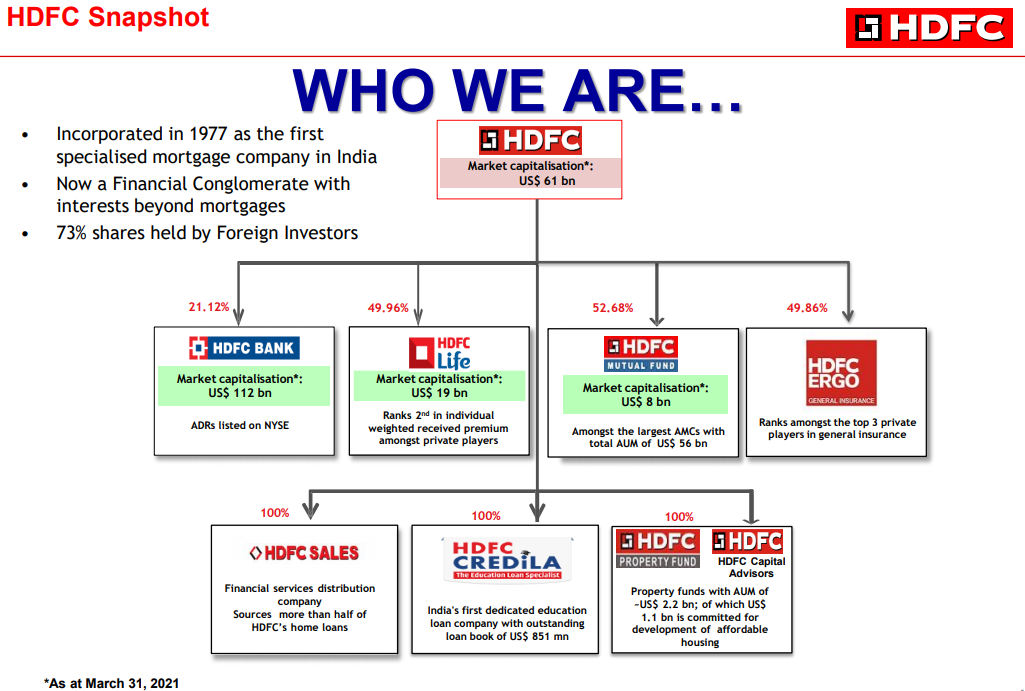

The Housing Development Finance Corporation Limited (NSE: HDFC) is a name that has been associated with the Indian housing sector for the last four decades. As pioneers in housing mortgages, it is a brand name that has been characterised by trust, solidity, both financial and managerial and sound principles. Since the day of its incorporation in 1977, HDFC has defined and set high standards in the housing finance sector. 1

HDFC’s founder, Mr. H T Parekh had a vision of a dynamic organisation, one that served the customer first. This vision has also enabled HDFC to grow from a humble beginning to one of the biggest players in the housing finance industry.

HDFC’s wide spread network of interconnected offices across India and outreach programs in several towns and cities, ensures a seamless experience for home buyers and existing customers. To cater to Non Resident Indians, HDFC has representative offices in London, Dubai and Singapore and service associates in the Middle East.

Over the last four decades, HDFC has grown to become a multi-product financial conglomerate, diversifying itself into banking, life insurance, general insurance, asset management, real estate venture funding and education loans.

Product and services

Housing Loans

- Home Loans

- Plot Loans

- Rural Housing Loans

Other Home Loan Products

- House Renovation Loans

- Home Extension Loans

- Top Up Loans

Non Housing Loans

- Loan Against Property

- Commercial Property Loans

- Commercial Plot Loans

Affordable Housing

- HDFC Reach Loans

- Pradhan Mantri Awas Yojana

Refinance

- Balance Transfer

Industry Overview

Indian Macroeconomic

Successive quarters in FY20 has seen India’s GDP growth slide down. GDP growth for FY20 is estimated at sub 5% as against 6.1% in the previous year. What started out as an investment led slowdown slowly broadened into a weakening of consumption as well. Increased financial stress amongst rural households, sluggish manufacturing sector, lack of growth in new job creation and risk averseness in lending, especially to the micro, small and medium scale enterprises were some of the reasons for the overall slowdown in the economy. 2

A large part of financing, particularly niche and retail lending in India is done by non-banking financial companies (NBFCs). However, with a large number of NBFCs’ access to credit getting squeezed as banks and mutual funds became more wary of lending to the sector, credit growth began to wane as well. Lending to the NBFC sector remained largely restricted to the higher rated entities.

Yet, the broader macro fundamentals of the Indian economy remained intact. India’s forex reserves as at March 31, 2020 stood at US$ 476 billion, sufficient to cover over a year’s imports, the current account deficit is likely to be under 1% of GDP, the average inflation rate for FY20 remained within the Reserve Bank of India’s (RBI) comfort zone and lower global oil prices benefitted India as the country imports over 80% of its crude oil requirements.

India is a domestic consumption driven economy. Based on the IMF’s initial assessment of the impact of COVID-19, India would be the fastest growing economy amongst G-20 countries in 2020, with a projected GDP growth of 1.9%. Other estimates of GDP growth for India are pegged lower or even forecast a contraction. The forecasts vary widely depending on assumptions made based on the extent and duration of the lockdown.

In response to the COVID-19 crisis, the Indian government, despite its extant constraints on fiscal finances, announced a wide-sweeping stimulus package ranging from humanitarian measures such as distribution of food and direct benefit transfers to the most vulnerable segments of society, sector specific measures for businesses sharply impacted by the lockdown, guarantee schemes, tax concessions and a slew of policy measures and structural reforms to help revive economic growth and improve the ease of doing business in India.

Housing and Real Estate Markets

Given the shortage of housing, the demand for affordable residential homes in FY20 continued to remain strong. During the year, new launches of residential units which received favourable response from homebuyers largely met four key criteria -- 1) reputed developer with a strong past track record of delivery; 2) projects with financial closure through stable financial partners; 3) right sized units; and 4) right priced units which was affordable by end users.

The demand for high end luxury residential housing remained subdued. A key hindrance for the real estate sector has been the overhang of unsold inventory. According to JLL India, across the top 7 cities, the unsold inventory was estimated to be worth over ` 3.7 lac crore as at March 31, 2020.

The Indian commercial real estate sector has attracted considerable interest from large foreign private equity investors in the recent period and continued to do so during the year under review. Demand for grade A commercial real estate was mainly from banking, financial services and insurance, IT & IT-enabled services, e-commerce and other professional services. With the logistics and warehousing sector getting more organised and tech enabled, this segment too gained traction.

During the year, many developers were under increased financial strain in an environment that had become more risk averse in lending. Several developers were over leveraged and with insufficient cashflows owing to lack of sales and high unsold inventories, the difficulties got compounded.

The lockdown due to COVID-19 resulted in the construction sector coming to a grinding halt. The most vulnerable segment has been the migrant labourers who are daily wage earners. Migrant workers comprise 80% of the 55 million workforce in the construction sector, many of whom have returned to their villages. Getting migrant workers to resume work will need specific incentives such as reimbursing transportation costs and enhanced insurance protection, along with firm assurances of maintenance of hygiene protocols and provision of personal protective equipment at the construction sites.

Opportunities and Challenges

The housing sector has benefitted from the government’s flagship housing programme, Pradhan Mantri Awas Yojana (PMAY). According to the Ministry of Housing and Urban Affairs, under the PMAY, over one crore homes have been sanctioned, of which 33.5 lac houses have been completed and 64 lac units are already under construction. The Credit Linked Subsidy Scheme (CLSS) -- a component under the PMAY has also enabled several households to become homeowners owing to the upfront subsidy given to eligible beneficiaries.

The government has been cognisant of several homebuyers who have not been able to get delivery of their homes due to delays by cashstrapped developers who are unable to complete construction of the housing units.

Towards this end, during the year, the government took the initiative to set up an alternative investment fund to provide last mile funding for incomplete affordable housing projects. The fund is called Special Window for Completion of Construction of Affordable and MidIncome Housing Projects (SWAMIH Investment Fund).

The government estimated that this fund could help complete 4.58 lac housing units across 1,509 projects and most of these are concentrated in the top 8 cities in India. The fund restricts itself to middle and low budget homes. The projects have to be registered with the respective state real estate regulatory authority and must be net worth positive.

As the fund provides last mile funding, it comes in as a senior lender and existing creditors cede charge, becoming junior lenders.

SWAMIH Investment Fund is envisaged to create a Rs 25,000 crore corpus, with the government committing up to Rs 10,000 crore and the balance would be contributions from public sector banks, Life Insurance Corporation of India, amongst others investors. As the Corporation was involved and consulted in setting up this fund, it has also committed ` 250 crore. The objective of the Corporation’s investment was to support the sector and enable individuals to get possession of their homes. The fund announced its first fund close in December 2019 with an initial corpus of ` 10,530 crore.

Loan Moratorium

In accordance with the RBI guidelines relating to COVID-19 Regulatory Package dated March 27, 2020 and April 17, 2020, the RBI allowed commercial banks, co-operative banks, financial institutions and NBFCs to grant a 3-month moratorium on payment of instalments of all term loans which were standard assets as at February 29, 2020. The objective was to help alleviate the hardship of borrowers which was brought on by the national lockdown. The initial moratorium period was for payments between March 1, 2020 and May 31, 2020. On May 22, 2020, the RBI permitted an extension of the moratorium period by 3 months i.e. up to August 31, 2020.

Interest shall continue to accrue on the outstanding portion of the loan during the moratorium period. For all accounts where the moratorium is granted, the ageing of accounts shall remain stand still during the moratorium period.

Lenders were required to get board approval prior to offering their customers the moratorium. Lenders have adopted different methods in offering the moratorium -- either an ‘opt-in’ or ‘opt-out’ structure.

The Corporation has adopted an ‘optin’ structure for the moratorium. As of date, approximately 26% of the Corporation’s loans under management have opted for the moratorium. Of this, individual loans account for 21% of the individual loan portfolio.

Impact of Covid-19

As is the case globally, in India, there continues to be a high degree of uncertainty on the duration of the lockdown, the possibility of second waves emerging, the effectiveness of measures taken to contain the spread of infection or mitigate its impact and the time horizon required for life, businesses and the overall economy to be restored to normalcy.

Accordingly, the extent to which the COVID-19 pandemic will impact the Corporation’s business and financial results will necessarily depend on future developments, which entail a high degree of uncertainty.

Financial Overview

The total income for the year ended March 31, 2020 stood at Rs 58,763 crore compared to Rs 43,378 crore in the previous year, representing a growth of 35%. Total expenses stood at Rs 38,412 crore compared to Rs 30,259 crore in the previous year, representing a growth of 27%.

The reported profit before tax for the year ended March 31, 2020 stood at Rs 20,351 crore compared to Rs 13,119 crore in the previous year.

After providing for tax of Rs 2,581 crore (previous year: Rs 3,486 crore), the profit after tax before other comprehensive income for the year ended March 31, 2020 stood at Rs 17,770 crore compared to Rs 9,633 crore in the previous year.

In January 2019, the board of directors of GRUH and Bandhan approved a scheme of amalgamation for the merger of GRUH into and with Bandhan. The share exchange ratio was 568 equity shares of face value Rs 10 each of Bandhan for every 1,000 fully paid-up equity shares of face value Rs 2 each of GRUH.

With effect from October 17, 2019, GRUH merged into and with Bandhan. The Corporation was allotted 15,93,63,149 shares aggregating 9.90% of the total issued share capital of Bandhan. Accordingly, on derecognition of the investment in GRUH, the Corporation has recorded a fair value gain of Rs 9,020 crore on the investment in GRUH.

The total comprehensive income for the year ended March 31, 2020 stood at Rs 11,117 crore compared to Rs 9,501 crore in the previous year.

Spread on Loans

The average yield on loan assets during the year was 10.18% per annum compared to 10.29% in the previous year. The average all-inclusive cost of funds was 7.91% per annum as compared to 7.99% in the previous year. The spread on loans over the cost of borrowings for the year was 2.27% per annum as against 2.30% in the previous year. Spread on individual loans for the year was 1.92% and on non-individual loans was 3.14%.

Lending Operations

Individual loan approvals grew by 14% in number terms and 12% in value terms during the year. The average size of individual loans stood at Rs 27 lac during the year, the same as the previous year. Based on loans disbursed during the year, 82% were salaried customers, while 18% were self-employed (including professionals). In terms of the acquisition mode, of the loans disbursed during the year, 53% were first-purchase homes i.e. directly from the builder, 9% selfconstruction and 38% were through resale.

The Corporation has the largest number of home loan customers – of approximately 1.73 lac who have availed benefits under the Credit Linked Subsidy Scheme (CLSS). As at March 31, 2020, cumulative loans disbursed by the Corporation under CLSS stood at Rs 29,026 crore and the cumulative subsidy amount stood at Rs 3,855 crore.

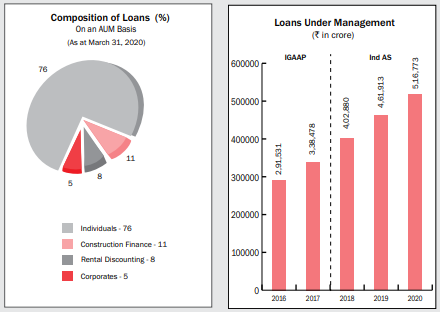

The Assets Under Management (AUM) as at March 31, 2020 amounted to Rs 5,16,773 crore as compared to Rs 4,61,913 crore in the previous year.

On an AUM basis, the growth in the individual loan book was 14% and the non-individual loan book was 6%. The growth in the total loan book on an AUM basis was 12%.

During the year, the Corporation’s loan book increased from Rs 4,06,607 crore to Rs 4,50,903 crore as at March 31, 2020. In addition, total loans securitised and/or assigned by the Corporation and outstanding as at March 31, 2020 amounted to Rs 65,870 crore.

The net increase in the loan book during the year, (after removing the loans that were sold) stood at Rs 44,296 crore.

Principal loan repayments stood at Rs 90,223 crore compared to Rs 1,03,914 crore in the previous year after excluding loans written off during the year amounting to Rs 995 crore (Previous Year: Rs 657 crore).

Prepayments on retail loans stood at 10.9% of the opening balance of individual loans compared to 10.7% in the previous year. 61% of these prepayments were full prepayments.

Sale of Loans

During the year, the Corporation, sold individual loans amounting to Rs 24,127 crore (Previous Year: Rs 25,150 crore). All the loans assigned during the year were to HDFC Bank pursuant to the buyback option embedded in the home loan arrangement between the Corporation and HDFC Bank. Of the total loans sold during the year, Rs 4,947 crore qualified as priority sector advances for banks.

As at March 31, 2020, individual loans outstanding in respect of all loans assigned/securitised stood at Rs 65,695 crore. HDFC continues to service these loans.

Asset Quality

In accordance with NHB norms, gross non-performing loans outstanding amounted to Rs 8,908 crore as at March 31, 2020, constituting 1.99% of the loan portfolio. The principal outstanding in respect of individual loans where the instalments were in arrears constituted 0.95% of the individual portfolio and the corresponding figure was 4.71% in respect of the non-individual portfolio

As per the prudential norms prescribed by NHB, the Corporation is required to carry a provision of Rs 4,198 crore, of which Rs 2,267 crore is on account of non-performing assets and the balance is in respect of standard loans. The actual provisions carried stood at Rs 10,988 crore.

On a gross basis, the Corporation has written off loans aggregating to Rs 995 crore during the year. On loans that have been written off, the Corporation will continue making efforts to recover the money. The Corporation has, since inception, written off loans (net of subsequent recovery) aggregating to Rs 2,001 crore. Thus, as at March 31, 2020, the total loan write offs stood at 14 basis points of cumulative disbursements since inception of the Corporation.

The Corporation’s capital adequacy ratio (CAR) stood at 17.6%, of which Tier I capital was 16.5% and Tier II capital was 1.1%. The investment in HDFC Bank has been considered as a deduction in the computation of Tier I capital. As at March 31, 2020, the risk weighted assets stood at around Rs 3,93,000 crore.

Financial Results

Financials for the quarter ended March 31, 2021 3

The profit before tax for the quarter ended March 31, 2021 stood at ₹ 3,924 crore compared to ₹ 2,692 crore in the corresponding quarter of the previous year, representing a growth of 46%.

After providing for tax of ₹ 744 crore, the profit after tax stood at ₹ 3,180 crore compared to ₹ 2,233 crore in the previous year, representing a growth of 42%.

For the quarter ended March 31, 2021, the consolidated profit after tax stood at ₹ 5,669 crore compared to ₹ 4,342 crore in the corresponding quarter of the previous year, reflecting a growth of 31%.

Financials for the year ended March 31, 2021

The reported profit before tax for the year ended March 31, 2021 stood at ₹ 14,815 crore.

The profit numbers for the year ended March 31, 2021 are not comparable with that of the previous year. In the previous year, the Corporation had recorded a fair value gain consequent to the merger of GRUH Finance Limited (GRUH) with Bandhan Bank Limited amounting to ` 9,020 crore.

The profit numbers are also not comparable due the profit on sale of investments which was lower at ` 1,398 crore during the year compared to ` 3,524 crore in the previous year.

Further, dividend income received during the year was lower at ` 734 crore (no dividends were received from HDFC Bank Limited and HDFC Life Insurance Company Limited) as compared to ` 1,081 crore in the previous year. In the first half of the year under review, the regulators for banks and insurance companies did not permit payment of dividends from the profits pertaining to the financial year ended March 31, 2020 owing to uncertainties due to COVID-19.

To facilitate a like-for-like comparison of the financials, after adjusting for profit on sale of investments, dividend, fair value adjustments, income on assigned loans, charge for employee stock options and provisions, the adjusted profit before tax for the year ended March 31, 2021 stood at ₹ 13,823 crore compared to ₹ 11,586 crore in the previous year, representing a growth of 19%.

After providing for tax of ₹ 2,788 crore, the reported profit after tax for the year ended March 31, 2021 stood at ₹ 12,027 crore.

Total comprehensive income for the year ended March 31, 2021 stood at ₹ 13,762 crore.

Lending Operations

The demand for home loans continued to remain strong owing to low interest rates, softer property prices, concessional stamp duty rates in certain states and continued fiscal incentives on home loans.

During the quarter ended March 31, 2021, individual loan disbursements grew by 60% over the corresponding quarter of the previous year. The month of March 2021 witnessed the highest levels in terms individual receipts, approvals and disbursements. Growth in home loans was seen in both, the affordable housing segment as well as high-end properties.

Individual disbursements in the first half of the financial year was 35% lower compared to the corresponding period in the previous year. This was on account of the strict national lockdown that was imposed up to early June 2020. In the second half of the financial year, individual disbursements were 42% higher compared to the corresponding period in the previous year. Consequently, during the year ended March 31, 2021, individual loan disbursements reported a growth of 3% compared to the previous year.

The pandemic has given a strong fillip to various digital initiatives offered by the Corporation. Approximately 81% of new borrowers opted for the digital mode.

During the year ended March 31, 2021, 33% of home loans approved in volume terms and 16% in value terms were to customers from the Economically Weaker Section (EWS) and Low Income Groups (LIG).

The average home loan to the EWS and LIG segment stood at ₹ 10.8 lac and ₹ 18.6 lac respectively.

The average size of individual loans disbursed during the year ended March 31, 2021 stood at ₹ 29.5 lac compared to ₹ 27.0 lac in the previous year. There was an uptick in the average ticket size during the quarter ended March 31, 2021 to ₹ 31.4 lac, attributable to the demand for higher end properties, especially in the metro cities.

As at March 31, 2021, the loans on an assets under management (AUM) basis stood at ₹ 5,69,894 crore as against ₹ 5,16,773 crore in the previous year.

As at March 31, 2021, individual loans comprise 77% of the Assets Under Management (AUM).

As at March 31, 2021, the individual loan book on an AUM basis grew 12% and the nonindividual loan book grew by 4%. The growth in the total AUM was 10%.

Non-Performing Assets & Provisioning

Overall collection efficiency ratios for individual loans have improved, nearing pre-COVID levels. The collection efficiency for individual loans in the month of March 2021 stood at 98.0% compared to 96.3% in the month of September 2020.

The provisions as at March 31, 2021 stood at ₹ 13,025 crore. The provisions carried as a percentage of the Exposure at Default (EAD) is equivalent to 2.62%.

The Corporation’s Expected Credit Loss charged to the Statement of Profit and Loss for the year ended March 31, 2021 stood at ₹ 2,948 crore.

Spread and Margin

The spread on loans over the cost of borrowings for the year ended March 31, 2021 was 2.29%. The spread on the individual loan book was 1.93% and on the non-individual book was 3.22%.

Net Interest Margin for the year ended March 31, 2021 stood at 3.5%.