Thermax Ltd

Overview

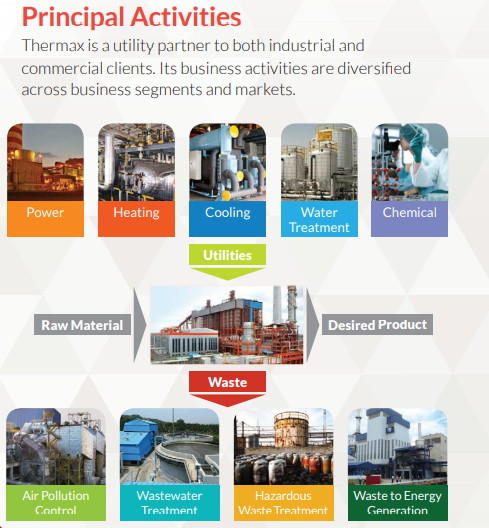

Thermax (NSE:THERMAX) is an INR 5,831 Cr. (822 Million US$) company headquartered in Pune, India. Its business portfolio includes products for heating, cooling, water and waste management, and specialty chemicals. The company also designs, builds and commissions large boilers for steam and power generation, turnkey power plants, industrial and municipal wastewater treatment plants, waste heat recovery systems and air pollution control projects.1

The systems, products and services developed by Thermax help industry achieve better resource productivity and improve bottom lines, while maintaining a cleaner environment. Even as the company convert costs to profits, the company help to protect the environment in its own limited ways. A win-win for industry and the society at large.

The company operate globally through 29 international offices and 14 manufacturing facilities – 10 of which are in India and 4 overseas.

The company's presence spans 88 countries and supports customers through an extensive sales & service network spread over Asia, South East Asia, Middle East, Africa, Europe and the Americas.

The group consists of 7 wholly owned domestic subsidiaries and 21 wholly owned overseas subsidiaries.

Plant Location

Domestic

- Pune

- Chinchwad, Pune, Maharashtra.

- Bhosari,Pune, Maharashtra.

- Chinchwad, Pune,Maharashtra.

- Solapur,Maharashtra.

- Paudh,Maharashtra.

- Savli,Gujarat.

- Mundra SEZ,Gujarat.

- Jhagadia,Gujarat.

- Dahej,Gujarat.

- Sri City,Andhra Pradesh

International

- Indonesia

- Denmark

- Germany

- Poland

Subsidiaries

- Thermax Babcock and Wilcox Energy Solutions Pvt. Ltd.

- Danstoker A/S (Denmark)

- Boilerworks A/S (Denmark)

- Danstoker Poland Społka Z Ograniczona Odpowiedzialnoscia (DSPL)

- PT Thermax International, Indonesia (PT TII)

- Thermax (Zhejiang) Cooling & Heating Engineering Co. Limited, China (TZL)

- Thermax Onsite Energy Solutions Limited (TOESL)

- Thermax Inc. (USA)

Product and Services

Thermax is a leader in delivering water treatment plants for the diverse needs of industries. With 50 years of experience in designing, building and managing the construction of water treatment projects, the company create and implement tailored or standardised industrial water treatment solutions.2

Solutions

- Water Treatment

- Wastewater Treatment

- Zero Liquid Discharge

- Desalination

Products

- Water Treatment

- Sewage Treatment

- Effluent Treatment

- Pharmaceutical Ro

- Solid Waste Management

Services

- Plant Upgrade & Improvement

- Plant Management Services

- Spare Parts Management

- Plant Audit & Evaluation

- Characterisation & Treatability Test

- Membrane Integrity, Autopsy

- Outsourced Utility Services

Industry Overview

the macro conditions remained weak due to factors such as non-banking financial sector crisis, liquidity crunch, lower GST collections and strain on fiscal deficit. Key economic parameters like consumption, investment and export plunged significantly over the year, bringing down the total growth. The already stressed economy was battered by the coronavirus pandemic in Q4, as India enforced a nationwide lockdown, one of the strictest in the world. The economy expanded by 3.1% in Q4 and dragged the full year FY2019-20 GDP growth to 4.2%, weakest since the financial crisis hit more than a decade back. India’s industrial output in FY2019-20 contracted 0.7% over FY2018-19, which was primarily driven by a severe fall of 16.7% in March, because of the closure of a large number of factories during the lockdown. All major sectors registered a considerable degrowth year-on-year. 3

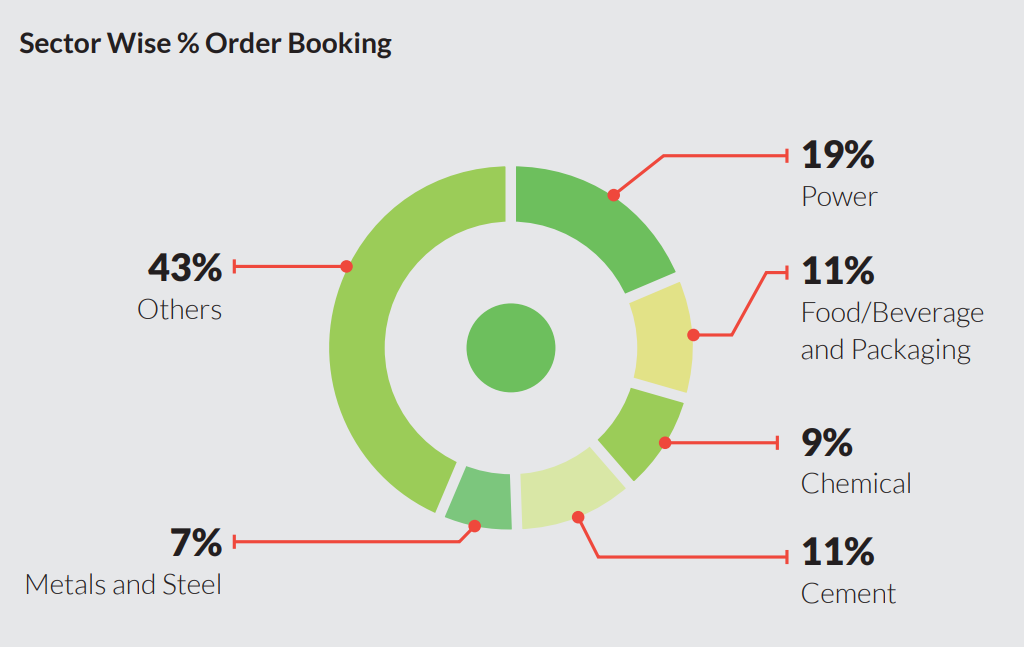

Capital goods being a derived demand sector, Thermax’s growth depends on the investments in core sectors of the economy. As shown below, the following sectors contributed to the order booking of the company during the year under review.

Power

Based on data from the Central Electricity Authority (CEA), India targets a power generation capacity of around 480 GW by the end of FY2021-22 from 370 GW as of March 31, 2020, and of this, renewables will contribute about 175 GW. As a signatory to the COP 21 agreement on climate change, India has pledged that by 2030, the greenhouse gas emission intensity of its GDP will be reduced by 33-35% below 2005 levels and 40% of its power capacity would be based on non-fossil fuel sources. The Union Budget 2020-21 allotted Rs. 2,516 crore for solar power - a 10.35% increase over the last Budget, apart from Central Financial Assistance for a capacity addition of 7,500 MW of solar power in FY2020-21. This strong government focus on renewables is expected to offer new opportunities for Thermax.

Compliance with new emission norms requires that existing thermal power plants be retrofitted with auxiliaries such as Flue Gas Desulphurisation (FGD) systems. To ensure uninterrupted power supply, the implementation is slated to be carried out in phases, covering around 160 GW of power plant capacity. The market size of FGDs is expected to be Rs. 650-800 bn over the next four years. This opportunity augurs well for the company, with the possibility to translate it into orders for FGD from customers operating thermal power plants and from select cement customers.

However, it is likely that in FY2020-21, private power distribution companies will revisit their capex plans. According to an estimate by Confederation of Indian Industry (CII), the nationwide lockdown could result in total demand compression of up to 36 billion units of electricity, implying a net revenue loss of around Rs. 30,000 crore at the discom level. The commercial and industrial sector in India consumes around 52% of electricity, followed by 24% by domestic households and 18% by the agriculture sector. The higher tariffs are borne by the commercial sector, thereby significantly denting the collections of discoms. Push towards energy efficiency is likely to spawn opportunities for cogeneration solutions, where power and steam are generated simultaneously.

Notwithstanding the medium and long-term prospects, renewable energy capacity addition is likely to be impeded by the COVID-19 crisis. Solar projects, largely dependent on imported modules from China and Malaysia, will be impacted due to raw material shortage, production delays, supply chain disruption and the recent standoff with China. As per industry reports, India is expected to add only 5,000 MW of solar capacity in the year 2020, nearly 32% lower than 2019, due to extended project timelines. Additionally, inconsistencies in net metering policy across different states pose significant challenges for rooftop solar.

Food, Beverage and Packaging

The fast moving consumer goods (FMCG) sector is also currently facing challenges. High unemployment, rising inflation rates and a minimal uptick in income levels are taking a toll on urban demand. With domestic consumption contributing to almost 60% of India’s GDP, steps are being taken by the government to revive consumption. The Union Budget 2020-21 announced reforms such as a change in the income tax slab to ensure more free income in the hands of the new earners. This, along with an emphasis on targeted measures for boosting the rural economy, is expected to have a twin positive impact on consumption. Budgetary incentives to boost investments in the dairy industry are also expected to support revival of the rural economy and domestic consumption. Till the onset of COVID-19, expected consumption growth was likely to stimulate investments in capital goods by FMCG, food processing and dairy sectors. However, limited mobility to prevent the COVID-19 spread and rising unemployment may derail sales, leading to the postponement of capex plans by consumer-facing companies.

Chemicals

The chemical industry has witnessed a positive momentum, maintaining a CAGR of 17% between 2016 and 2019, even when India’s economy faced headwinds. Thermax’s chemical business was a beneficiary of this growth with opportunities predominantly for its performance chemicals in the developed markets. The growth is likely to continue despite the economic challenges that caused India’s GDP growth rate to drop substantially. Chemical companies can also benefit from rising domestic demand in chemical end-use sectors, many of which fall under the ‘essential goods’ category which is expected to be less impacted by the economic slowdown and COVID-19 crisis. India’s attractiveness as a manufacturing destination, given the trade conflicts, especially among China, the United States, and Western Europe and its improved ease of doing business, are some of the other positive factors.

Cement, Metal and Steel

The infrastructure sector has been the biggest focus area for the government. The National Infrastructure Pipeline has lined up 6,500 projects across key sectors while the Union Budget 2020-21 has proposed the development of 2,500 km access control highways, 9,000 km of economic corridors, 2,000 km of coastal and land port roads and 2,000 km of strategic highways. The thrust on road construction has fuelled demand for the company’s waste heat recovery based captive power plants from the cement industry. Infrastructure development also generated enquiries for capital goods from the sponge iron industry. While the demand from the steel industry remained muted due to stressed balance sheets of several steel companies, supply constraints from China could result in an uptick of domestic demand. However, the lockdown has resulted in various infrastructure project sites staring at closure owing to labour shortage and supply chain disruptions. The existing grave fiscal situation in the construction sector for both the Centre and states further implies that continued funding of infrastructure capital expenditure will be a challenge in the near future. Additionally, as focus shifts towards rolling out of relief packages to help overcome the loss of income due to the crisis, it may undermine the government’s ability to spend on infrastructure projects over the next one or two years.

Business Segments

Energy Segment

The Thermax Energy segment comprises Process Heating, Absorption Cooling and Heating, Boiler and Heater and Power (EPC and Solar) businesses and related services. Under the Process Heating business, the company offers packaged boilers, thermal oil heaters, heat recovery boilers and hot water generators. Thermax is among the leaders in vapour absorption cooling and heating systems, with its chillers used worldwide for industrial refrigeration, air conditioning, process cooling and heating. Thermax Cooling Solutions Limited (TCSL), a wholly owned subsidiary, offers a range of wet and dry cooling solutions for energy efficient heat removal from process and manufacturing industries. TBWES, a 100% subsidiary of Thermax, provides steam generation solutions for process and power needs, and offers renovation and modernisation services for old boilers and process furnaces. The company has domain experience in setting up captive power, cogeneration and trigeneration plants on an EPC basis, with an installed base of more than 3,300 MW. The company is leveraging this capability for solar installations across various industries. Investments in digital capabilities and R&D have been increased for driving sustainable solutions across its growing portfolio of products and services. Thermax and its group companies have supplied global markets with heating and cooling systems and power plants generating energy from renewable sources such as biomass, waste heat from industrial plants and solar energy.

The Energy segment contributed 80.4% (79.4%) of the group’s gross operating revenue in FY2019-20. Operating revenue (net) at the group level stood at Rs. 4,677 crore (Rs. 4,799 crore) for the year, while segment profits for the same period stood at Rs. 249 crore (Rs. 322 crore). The order booking for FY2019-20 stood at Rs. 3,280 crore, lower than the previous year’s figures of Rs. 4,476 crore. Despite opening the year on a promising order book, the revenue recognition was impacted severely due to the onset of the pandemic in the crucial last month of the financial year. Muted enquiries from the core sectors during the year resulted in no major project orders being concluded. The FY2020-21 outlook for the segment continues to be challenging.

Environment Segment

Environmental norms for processdriven industrial sectors are getting stricter and more closely regulated, with serious concerns over air pollution and effluent management. Thermax’s solutions for controlling emission and for minimising waste discharge and maximising recycling are a strategic fit in helping customers reduce their impact on the environment. Thermax offers air pollution control systems for both particulate and gaseous emissions to a wide range of industries – cement, steel and ferrous metals, power generation, chemical, fertilisers, etc. The Water and Waste Solutions (WWS) business supports industrial and commercial establishments to treat water for their process requirements and to clean sewage and effluent; often recycling the water, especially where there is a shortage of water. Led by its expertise in handling various pollutants and fuel firing conditions, the company’s Enviro business has garnered sizeable market share in India and completed marquee projects in South East Asia which it plans to develop as a second domestic home market. The WWS business includes water treatment, wastewater treatment/recycling, zero liquid discharge solutions, sewage treatment/recycling and desalination plants. The business has to date completed over 20,000 installations. The growth of the Environment segment has been underpinned by the company’s technological knowhow and customised solutions.

The segment accounted for 12.4% (13.7%) of the group’s gross operating revenues in FY2019-20. Operating revenue (net) at the group level stood at Rs. 722 crore (Rs. 828 crore) for the year, while segment profits for the same period stood at Rs. 38 crore (Rs. 57 crore). As in case of the Energy segment, the Environment segment faced a similar challenge of revenue recognition in the last month. The order booking for FY2019-20 stood at Rs. 1,777 crore, higher than the previous year’s figures of Rs. 741 crore. The order booking for the segment surpassed the Rs. 1,500 crore mark for the first time on the back of the two major FGD orders bagged during the year. Opening the year with a promising order carry forward, complemented with increased enforcement of emission norms and regulatory discharge norms are likely to augur the growth of the segment in the coming year.

Chemical Segment

The Chemical segment manufactures and markets a wide range of specialty chemicals to help improve processes across a spectrum of industries. It comprises the following: microporous resins, performance chemicals, paper chemicals, construction chemicals and oil field chemicals.

Thermax is recognised as Asia’s leading manufacturer and exporter of ion exchange resins and is a pioneer in water and wastewater treatment chemicals. The company’s specialty chemicals serve a number of industrial sectors, with clients spread across the world.

The chemical manufacturing facilities are located at Paudh (Maharashtra), Jhagadia and Dahej (Gujarat). The facilities at Gujarat are established at par with global standards, which will help the company expand its business in promising international markets, supported by its well-earned reputation for customised and cost-effective solutions.

In FY2019-20, the Chemical segment accounted for 7.2% (6.9%) of the group’s gross operating revenue. The Chemical business segment posted operating revenue of Rs. 421 crore (Rs. 415 crore). The profit for the segment was Rs. 78 crore as compared to Rs. 62 crore in the previous fiscal. The profitability of the Chemical segment has improved due to the increase in capacity utilisation, efficient sourcing and lower cost of key raw materials. Order booking for the segment in FY2019-20 stood at Rs. 441 crore. The Chemical business achieved growth in revenue, attributed to a healthy order booking from domestic and international customers in FY2019-20. The business is expected to continue its growth momentum in the coming year on account of demand from the US and European markets providing essential goods and services and growth in the pharmaceutical and food & beverage sectors in the domestic market.

Financial Highlights

The company posted total income of Rs. 3,319 crore for the nancial year 2019-20, against last year’s income of Rs. 3,664 crore. On a consolidated level, the group income was at Rs. 5,831crore (Rs. 6,123 crore).

The energy segment contributed 80.4% (79.4%) to the group’s operating revenues in FY 2019-20.

On a standalone basis, revenue from exports was down by 28.5% at Rs. 759 crore (Rs. 1,061 crore) and the group international business was lower by 25.3% at Rs. 1,969 crore (Rs. 2,636 crore).

Consolidated order booking for FY 2019-20 reduced by 2.4% at Rs. 5,498 crore (Rs. 5,633 crore) with standalone order booking from continuing operations at Rs. 4,058 crore, an increase of 22.1% over the previous year of Rs. 3,325 crore. Group order booking in international markets at Rs. 1,470 crore was lower by 25.9% and accounted for 26.7% of the consolidated gure as compared to Rs. 1,984 crore last year (35.2%).

On a standalone basis, the exceptional item of expenditure of Rs. 15 crore (Rs. 48 crore) represents an impairment of investment in the subsidiary companies, Thermax (Zhejiang) Cooling & Heating Engineering Co. Limited (TZL) and First Energy Pvt. Ltd. (FEPL). Prot after tax and exceptional items from continuing operations stood at Rs. 161 crore, same as the previous year. EPS were at Rs. 13.54 (Rs. 13.51).

During the year, both global and domestic economies witnessed a slowdown in growth, impacting investor sentiments. Amidst the prevailing challenges globally, Thermax continued to focus on its strategy of selective internationalisation to combat volatility in the domestic capital expenditure cycle. New manufacturing facilities both, in Dahej, Gujarat and in Indonesia were stabilised. It also stabilised its operations at Sri City, Andhra Pradesh which was inaugurated in January 2019. Though the operations of Danstoker in Europe encountered difficulties during the year, the activities in its new Poland facility, after initial challenges, have recently picked up and positioned the business to capitalise on opportunities in Eastern Europe. The localisation process in Thermax’s new facility in Indonesia witnessed an encouraging response from the market.

During the year, the directors have approved payment of interim dividend of Rs. 7/- (350%) per equity share of face value Rs. 2/- each for distribution of the prots of the company for the quarter and nine months ended December 31, 2019, which had resulted in a payout of Rs. 101 crore including dividend distribution tax of Rs. 17 crore.

The total number of permanent employees on the rolls of the company as on March 31, 2020, was 3,325 compared to 4,110 employees in the previous year. The signicant reduction in number of employees is due to transfer of employees to subsidiaries of the company.

Thermax Consolidated December 2020 Net Sales at Rs 1,410.59 crore, up 0.04% Y-o-Y 4

February 05, 2021; Reported Consolidated quarterly numbers for Thermax are:

Net Sales at Rs 1,410.59 crore in December 2020 up 0.04% from Rs. 1,410.05 crore in December 2019.

Quarterly Net Profit at Rs. 83.26 crore in December 2020 down 2% from Rs. 84.96 crore in December 2019.

EBITDA stands at Rs. 175.81 crore in December 2020 up 26.54% from Rs. 138.94 crore in December 2019.

Thermax EPS has decreased to Rs. 7.39 in December 2020 from Rs. 7.54 in December 2019.

Thermax shares closed at 1,206.75 on February 04, 2021 (NSE) and has given 64.50% returns over the last 6 months and 16.79% over the last 12 months.

References

- ^ https://www.thermaxglobal.com/about-us/

- ^ https://www.thermaxglobal.com/water-waste-solutions/water-treatment/

- ^ https://www.thermaxglobal.com/wp-content/uploads/2020/12/Annual-Report-2020.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/thermax-consolidated-december-2020-net-sales-at-rs-1410-59-crore-up-0-04-y-o-y-2-6455031.html