Thomson Reuters

Summary

- Thomson Reuters is a leading provider of business information services.

- Founded in 1851 and powered by 2,500 journalists around the world, Reuters News has a reputation for speed, impartiality and insight.

- In 2020, Reuters delivered approximately 4 million unique news stories, 900,000 pictures and images and 130,000 video stories, alongside industry events.

Company Overview

Thomson Reuters (NYSE:TRI, TSX:TRI ) is a leading provider of business information services. The company's products include highly specialized information-enabled software and tools for legal, tax, accounting and compliance professionals combined with the world’s most global news service

Thomson Reuters is one of the world’s most trusted providers of answers, helping professionals make confident decisions and run better businesses. The company's customers operate in complex arenas that move society forward — law, tax, compliance, government, and media – and face increasing complexity as regulation and technology disrupts every industry.1

The company help them reinvent the way they work. The company's team of experts brings together information, innovation and authoritative insight to unravel complex situations, and its worldwide network of journalists and editors keep customers up to speed on global developments that are relevant to them.

Properties and Facilities

The company own and lease office space and facilities around the world to support its businesses. The company believe that its properties are in good condition and are adequate and suitable for its present purposes. The following table provides summary information about its principal properties as of December 31, 2020.

| Facility | Approx. Sq. Ft. | Owned/Leased | Principal Use |

| 610 Opperman Drive,Eagan, Minnesota, United States | 2,792,000 | Owned | Legal Professionals headquarters and operating facilities |

| 2395 Midway Road,Carrollton, Texas, United States | 409,150 | Owned | Tax & Accounting Professionals and Corporates headquarters and operating facilities |

| 6300 Interfirst Drive,Ann Arbor, Michigan,United States | 247,250 | Owned | Tax & Accounting Professionals operating facility |

| 5 Canada Square,London, United Kingdom | 165,000 | Subleased | Legal Professionals, Tax & Accounting Professionals and Reuters News operating facility |

| 3 Times Square,New York, New York,United States | 112,000 | Owned/subleased | Corporates and Reuters News operating facility |

| 333 Bay Street,Toronto, Ontario, Canada | 59,250 | Leased | Thomson Reuters headquarters and Legal Professionals operating facilities |

| Landis & Gyr 3,Zug, Switzerland | 50,250 | Leased | Enterprise Centre |

Business Segments

Thomson Reuters is organized in five reportable segments supported by a corporate center:2

Legal Professionals

Serves law firms and governments with research and workflow products, focusing on intuitive legal research powered by emerging technologies and integrated legal workflow solutions that combine content, tools and analytics.

Legal Professionals’ primary global competitors are LexisNexis (which is owned by RELX Group) and Wolters Kluwer. Legal Professionals also competes with Bloomberg Industry Group and other companies that provide legal and regulatory information, as well as Aderant and other companies that provide practice and matter management software. Legal Professionals also competes with client development providers and other service providers and start-ups that support legal professionals.

Corporates

Serves corporate customers from small businesses to multinational organizations, including the seven largest global accounting firms, with its full suite of content-enabled technology solutions for in-house legal, tax, regulatory, compliance and IT professionals.

Corporates’ primary global competitors are Wolters Kluwer, Bloomberg and LexisNexis. Corporates also competes with focused software providers such as Avalara, MitraTech, Vertex and Sovos and at times with large technology companies such as SAP, as well as the largest global accounting firms.

Tax & Accounting Professionals

Serves tax, accounting and audit professionals in accounting firms (other than the seven largest, which are served by its Corporates segment) with research and workflow products, focusing on intuitive tax offerings and automating tax workflows.

Tax & Accounting Professionals’ primary competitor is the CCH business of Wolters Kluwer. Other competitors include Bloomberg Industry Group in tax research, and Intuit, Drake Software, CaseWare and Sage in professional software and services. Tax & Accounting Professionals also competes with software start-ups that serve tax, accounting and audit professionals.

Reuters News

Supplies business, financial, national and international news to professionals via desktop terminals, including through Refinitiv, the world’s media organizations, industry events and directly to consumers.

Reuters is the world’s largest international multimedia news provider, reaching billions of people every day. It provides trusted global news and intelligence through desktop terminals, the world’s media organizations, and directly to professionals via Thomson Reuters solutions, Reuters.com, the Reuters News app and Reuters Events. In 2020, Reuters delivered approximately 4 million unique news stories, 900,000 pictures and images and 130,000 video stories, alongside industry events.

Founded in 1851 and powered by 2,500 journalists around the world, Reuters News has a reputation for speed, impartiality and insight. It is dedicated to upholding the Thomson Reuters Trust Principles and preserving integrity, independence and freedom from bias in the gathering and dissemination of news. For more information on the Thomson Reuters Trust Principles, please see the “Additional Information – Material Contracts – Thomson Reuters Trust Principles and Thomson Reuters Founders Share Company” section of this annual report

Global Print

Provides legal and tax information primarily in print format to customers around the world. The company's corporate center centrally manages commercial and technology operations, including those around its sales capabilities, digital customer experience and product and content development. The company's corporate center also centrally manages functions such as finance, legal and human resources.

Global Print is a leading provider of information, primarily in print format, to legal and tax professionals, government (including federal, state, and local government lawyers and judges), law schools and corporations. The business serves customers in the United States, Canada, the United Kingdom, Europe, Australia, Asia and Latin America. Global Print’s primary global competitors are LexisNexis and Wolters Kluwer.

Financial Highlights

In 2020, the company earned 79% of its revenues in the U.S. The company also operate regional teams outside of the U.S., including in emerging markets, where the company serve regional customers by either modifying existing products and services for their needs or developing specific products for the local market. Changes in foreign currency exchange rates relative to its business outside the U.S. may cause variation in its revenue performance from period to period. In 2020, changes in foreign exchange rates decreased its revenues by 1% compared to the prior year.

The company began 2020 with momentum, having completed its first full year re-positioned into its customer-focused segments after completing the F&R transaction in 2018. In March 2020, however, the global COVID-19 pandemic created unprecedented health risks to its employees, customers and suppliers, and containment measures intended to mitigate the impact of the pandemic resulted in a global economic crisis and ongoing uncertainty.

In response to the pandemic, the company immediately transitioned most of its staff to a virtual work environment. At the same time, the company worked with its approximately 500,000 customers to ensure continued access to its products and services. To mitigate the expected reduction in its revenues due to the economic crisis, the company implemented a cost savings program. The company's 2020 performance reflected the resiliency of its markets and its business. The company achieved 1% organic revenue growth, increased adjusted EBITDA by 32%, expanded adjusted EBITDA margin to 33%, and achieved free cash flow of $1.3 billion. Each of these metrics met or exceeded the updated outlook that the company provided in November 2020 in conjunction with its third quarter report.

Consolidated Results

| Year ended December 31, | Change | |||

| (millions of U.S. dollars, except per share amounts and margins) | 2020 | 2019 | Total | Constant Currency |

| IFRS Financial Measures | ||||

| Revenues | 5,984 | 5,906 | 1% | |

| Operating profit | 1,929 | 1,199 | 61% | |

| Diluted EPS | $2.25 | $3.11 | -28% | |

| Cash flow from operations | 1,745 | 702 | 148% | |

| Non-IFRS Financial Measures | ||||

| Revenues | 5,984 | 5,906 | 1% | 2% |

| Organic revenue growth | 1% | |||

| Adjusted EBITDA | 1,975 | 1,493 | 32% | 32% |

| Adjusted EBITDA margin | 33.00% | 25.30% | 770bp | 760bp |

| Adjusted EPS | $1.85 | $1.29 | 43% | 43% |

| Free cash flow | 1,330 | 159 | 735% | |

Revenues increased 1% in total and 2% in constant currency. On an organic basis, revenues increased 1%, as 4% growth in recurring revenues (80% of total revenues) more than offset declines in transactions and Global Print revenues.

Revenues for its “Big 3” segments (79% of total revenues) grew 3% in total and 4% on both a constant currency and organic basis. The organic increase was driven by 5% growth in recurring revenues (88% of “Big 3” revenues), which more than offset a decline in transactions revenues.

Operating profit increased 61% reflecting lower costs, a significant gain from the sale of an investment and a gain from an amendment to a pension plan. These items more than offset higher depreciation and amortization and a lower benefit from the revaluation of warrants that the company held in Refinitiv prior to its sale to LSEG. Higher revenues also contributed. Adjusted EBITDA and the related margin, which excludes the gain on sale of the investment, the impact of the warrant revaluation, and the gain from the pension plan amendment among other items, also increased reflecting lower costs and higher revenues. Lower costs reflected the completion of the repositioning of its company in 2019 following the separation from Refinitiv as well as lower expenses from its COVID-19 related cost mitigation efforts.

Diluted EPS of $2.25 declined from $3.11 in the prior year despite higher operating profit because the prior year included a $1.2 billion non-cash deferred tax benefit associated with the reorganization of certain foreign operations. Adjusted EPS, which excludes the tax benefit as well as other adjustments, increased to $1.85 per share from $1.29 per share due to higher adjusted EBITDA, which more than offset higher depreciation and amortization of computer software and higher income tax expense.

Cash flow from operations increased primarily because the prior year included a $167 million pension contribution as well as significantly higher costs and investments to reposition its company following the separation from Refinitiv. 2020 included savings from its COVID-19 related cost mitigation efforts and lower tax payments. Free cash flow increased for the same reasons, as well as from proceeds from the sale of real estate.

Second-Quarter 2021 Results

August 5, 2021 – Thomson Reuters reported results for the second quarter ended June 30, 20213

“The strong results that the company achieved in the first quarter accelerated in the second quarter. The company's performance was consistent across the company, above its expectations, and positions it well for the rest of the year and 2022. These results reflect the confidence of its customers – in both an improving economic environment and in their prospects. This dynamic presents it with a tailwind as customers are spending on products and solutions that fit their workflows and improve their professional lives, which are rapidly evolving,” said Steve Hasker, president and CEO of Thomson Reuters.

Mr. Hasker added, “Based on the strong first-half performance and its confidence in the trajectory of the business for second half of the year, Thomson Reuters has increased its full-year 2021 guidance.”

Consolidated Financial Highlights - Three Months Ended June 30

| (Millions of U.S. dollars, except for adjusted EBITDA margin and EPS) - (unaudited) | ||||

| IFRS Financial Measures | 2021 | 2020 | Change | Change at Constant Currency |

| Revenues | $1,532 | $1,405 | 9% | |

| Operating profit | $316 | $365 | -14% | |

| Diluted earnings per share (EPS) | $2.15 | $0.25 | n/m | |

| Cash flow from operations | $462 | $422 | 10% | |

| Non-IFRS Financial Measures | ||||

| Revenues | $1,532 | $1,405 | 9% | 7% |

| Adjusted EBITDA | $502 | $479 | 5% | 5% |

| Adjusted EBITDA margin | 32.70% | 34.10% | -140bp | -70bp |

| Adjusted EPS | $0.48 | $0.44 | 9% | 9% |

| Free cash flow | $379 | $305 | 25% | |

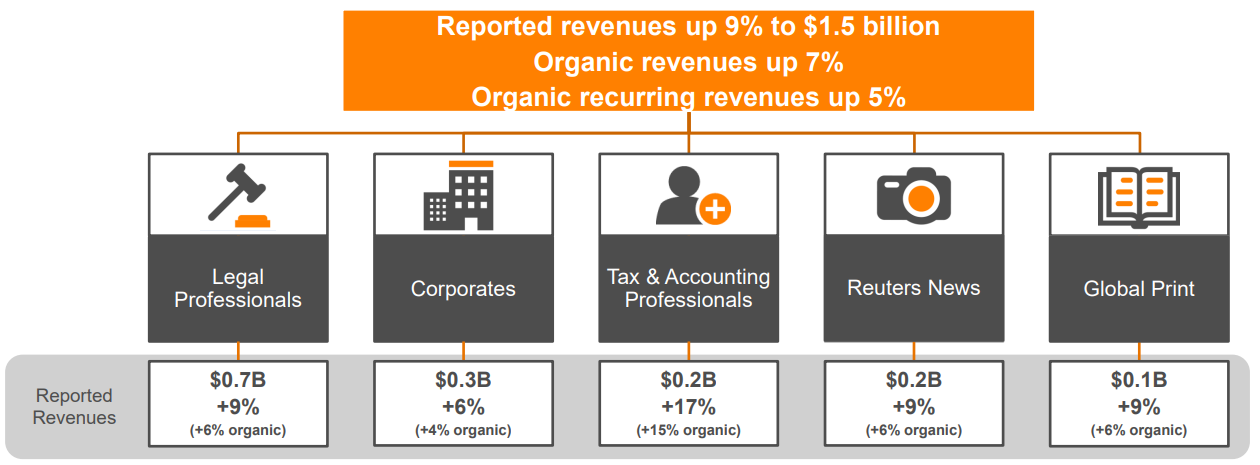

Revenues increased 9%, driven by growth across all of the company’s customer segments and a 2% favorable impact from foreign currency.

Organic revenues increased 7%, driven by 5% growth in recurring revenues (79% of total revenues), as well as growth in transactions, Reuters News and Global Print revenues, which benefited from a favorable comparison to the second quarter of 2020 when the early stages of the COVID-19 pandemic negatively impacted results.

The company’s “Big 3” segments (Legal Professionals, Corporates and Tax & Accounting Professionals), which collectively comprised 80% of total revenues, reported organic revenue growth of 7%.

Operating profit decreased 14% as the prior-year period included a significant benefit from the revaluation of warrants that the company previously held in Refinitiv, which was sold to London Stock Exchange Group (LSEG) in January 2021.

Diluted EPS increased to $2.15 per share from $0.25 per share in the prior-year period due to an increase in the value of the company’s LSEG investment. Adjusted EPS, which excludes the increase in value of the company’s LSEG investment, as well as other adjustments, increased to $0.48 per share from $0.44 per share in the prior-year period, primarily due to higher adjusted EBITDA.

Cash flow from operations increased as higher revenues and favorable movements in working capital more than offset higher tax payments and expenses, which included Change Program costs. Free cash flow increased due to higher cash flows from operations and a dividend of $51 million paid by LSEG in the second quarter.

Legal Professionals

Revenues increased 7% (6% organic) to $673 million.

Adjusted EBITDA increased 12% to $285 million.

Corporates

Revenues increased 4% (all organic) to $348 million, primarily due to strong recurring revenue growth, including strong growth from legal solutions and the company’s Latin America and Asia businesses.

Adjusted EBITDA increased 10% to $130 million.

Tax & Accounting Professionals

Revenues increased 15% (all organic) to $197 million, reflecting transactions revenue growth of 43% related to the 2021 extension of the U.S. federal tax filing deadline. Additionally, revenue growth benefited from a similar shift in 2020 when transactions revenues moved from the second quarter to the third quarter after the U.S. federal tax filing deadline was extended from April to July. Normalizing for the shift in the U.S. federal tax filing deadline, organic revenues grew 10%.

Adjusted EBITDA increased 32% to $72 million.

Reuters News

Revenues of $168 million increased 6%, all organic, primarily due to the segment’s professional business, which had strong growth from Reuters Events, whose performance was negatively impacted by COVID-19 in 2020.

Adjusted EBITDA increased 45% to $35 million, primarily due to revenue growth.

Global Print

Revenues increased 6% to $147 million, driven by higher third-party revenues for printing services and an increase in shipments, reflecting a gradual return to office by large and mid-sized law firms. The quarter’s performance also reflected a favorable comparison to the second quarter of 2020 when shipments were delayed at the beginning of the COVID-19 pandemic.

Adjusted EBITDA increased 2% to $56 million.

Recent developments

Thomson Reuters launches $100 mln venture capital fund 4

October 14, 2021; Thomson Reuters Corp is launching a $100 million venture capital fund to invest in early stage companies that serve professional audiences in the legal, tax and accounting, and news media business.

The fund, named "Thomson Reuters Ventures," is part of Chief Executive Steve Hasker's plan to transform the provider of news and information to professionals into what it calls a "content-driven technology business."

The fund will focus on companies in their Series A and Series B investment rounds.

Thomson Reuters wants to identify companies than can help its customers "deliver more value" to their customers - whether that be machine learning for better prediction, or automating for better efficiency, said Pat Wilburn, Chief Strategy Officer at Thomson Reuters.

Wilburn will serve as executive director of the fund.

Thomson Reuters said in August that at the end of the second quarter $700 million remained from a $2 billion mergers and acquisitions budget. It said it had a "robust" pipeline of targets in areas such as automation and small-to-medium cloud-based and software-as-services businesses.

References

- ^ https://www.thomsonreuters.com/en/about-us.html

- ^ https://ir.thomsonreuters.com/static-files/97aa3f7b-64d6-4a15-84a4-fad545746ab4

- ^ https://www.thomsonreuters.com/en/press-releases/2021/august/thomson-reuters-reports-second-quarter-2021-results.html

- ^ https://www.reuters.com/business/media-telecom/thomson-reuters-launches-100-mln-venture-capital-fund-2021-10-14/