Titan Co Ltd

Summary

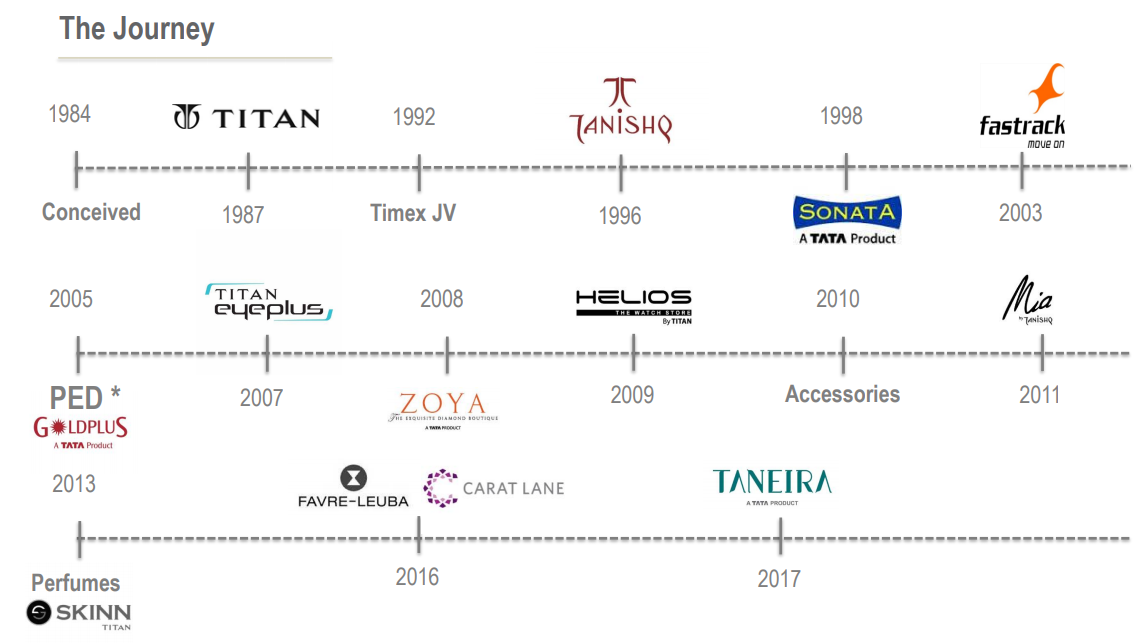

- Titan Company Limited a joint venture between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO), commenced its operations in 1984 under the name Titan Watches Limited.

- Titan is widely known for transforming the watch and jewellery industry in India.

- Titan is the fifth largest integrated own brand watch manufacturer in the world.

- Titan's other popular brands include Fastrack, Sonata and Raaga. It recently entered the perfume business with Skinn and launched Taneira, a destination for fine silk sarees.

Company Overview

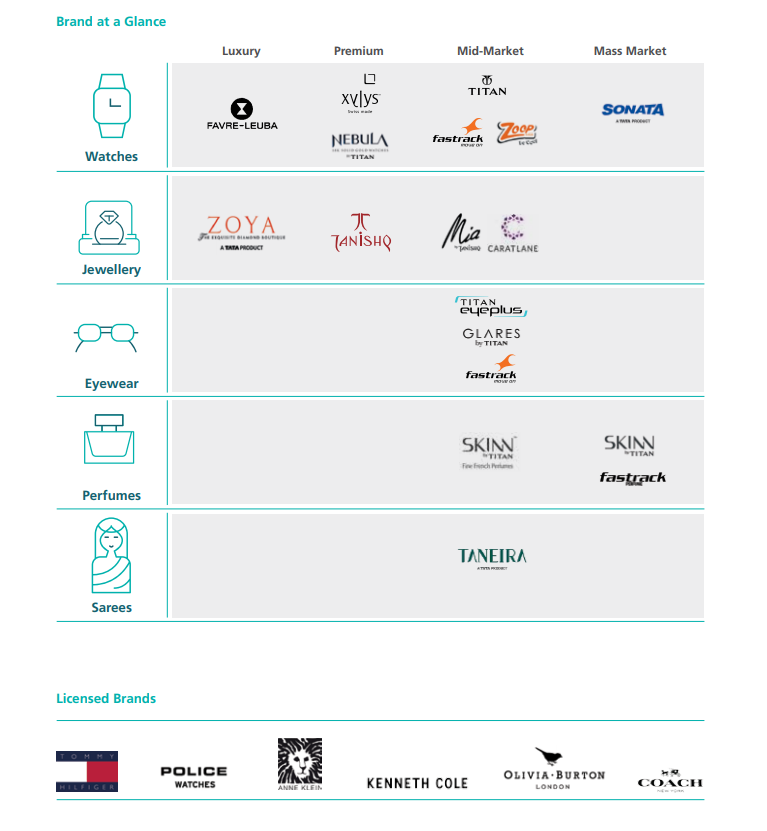

Titan Company Limited (Titan), (NSE:TITAN) a joint venture between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO), commenced its operations in 1984 under the name Titan Watches Limited. Titan is the fifth largest integrated own brand watch manufacturer in the world. Over the last three decades, Titan has expanded into underpenetrated markets and created lifestyle brands across different product categories. Titan is widely known for transforming the watch and jewellery industry in India and for shaping India's retail market by pioneering experiential retail. 1

Titan Company is one of India’s prominent lifestyle companies. It is a leading player in the Jewellery, Watches and Eyewear categories with several successful brands. It is the fifth largest integrated own brand watch manufacturer in the world.2

The company’s Tanishq brand of jewellery is today one of the most trusted and respected lifestlye brands in India. Titan also operates its eyewear business through its Titan eyeplus stores.

Titan's other popular brands include Fastrack, Sonata and Raaga. It recently entered the perfume business with Skinn and launched Taneira, a destination for fine silk sarees.

Plant Locations

The Company’s plants are located at:

- Watches : Roorkee, Pantnagar, Hosur, Coimbatore and Sikkim.

- Jewellery : Hosur, Pantnagar and Sikkim Prescription

- Eyewear : Chikkaballapur, Kolkata and Noida

Subsidiaries

| Name | Relationship |

| Favre Leuba AG, Switzerland | Subsidiary |

| Titan Watch Company Limited,Hong Kong | Step-down Subsidiary |

| Titan Engineering & Automation Limited | Subsidiary |

| CaratLane Trading Private Limited | Subsidiary |

| Green Infra Wind Power Theni Limited | Associate |

| Titan Holdings International FZCO, Dubai | Subsidiary |

| Titan Global Retail LLC, Dubai | Subsidiary |

| Titan Commodity Trading Limited | Step-down Subsidiary |

| StudioC Inc. USA | Step-down Subsidiary |

Retail Stores

Number of stores as on 31st March 2020 | Number of towns where present | |

| Tanishq | 327 | 204 |

| Zoya | 4 | 3 |

| CaratLane | 92 | 33 |

| Mia | 38 | 19 |

| World of Titan | 499 | 221 |

| Fastrack | 183 | 85 |

| Helios | 92 | 42 |

| Titan EyePlus | 584 | 223 |

| Taneira | 12 | 5 |

Brands

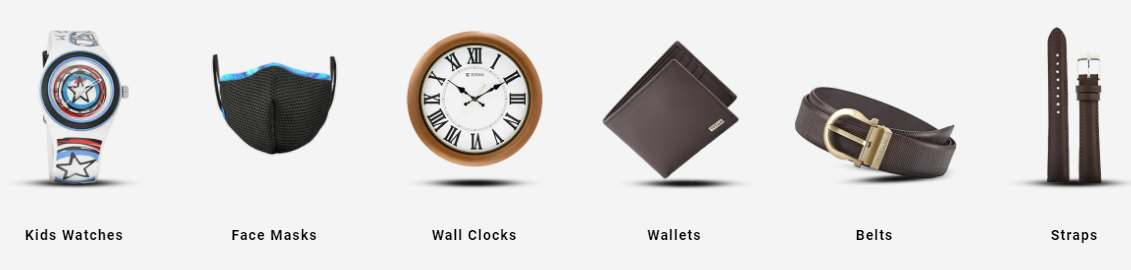

Watches & Wearables Division

- Titan

- Titan Clock

- Fastrack

- Sonata

- Zoop

- Octane

- Xylys

- Helios

- Titan Raga

- Favre-Leuba

- Nebula

- Sf

Jewellery Division

- Tanishq

- Mia

- Zoya

- Caratlane

Eyewear Division

- Titan Eyeplus

New Business

- Skinn

- Taneira

Business Segments

The financial year 2020-21 was the most challenging year for the corporate world in living memory. In one sense, it was even more challenging for the Company, given the kind of products it makes, which are by and large discretionary in nature. 3

Watches & Wearables Division

Watches

The Management is convinced that the opportunity for “Watch as an Accessory” is timeless and is committed to capitalize on it. While the investment in design and new product development has happened consistently over the last 3-4 years, considerable focus is now being given to reimagining the World of Titan channel, transformation of the Multi-Brand watch outlet, marketing communication investments and ratcheting up the omni-channel play

Wearables

The Company significantly increased its capability for this domain through the acquisition of HUG Innovations in Financial Year 2019-20, while simultaneously improving its product and app design capabilities as well. The result is a steady pipeline of exciting new products, services and ecosystems starting as early as in 2021. Reflex 3, the Fastrack wrist band launched in February 2021 on the Company’s own proprietary platform, is a sign of things to come.

International Business

The recovery of the Watches category in Titan’s international market has been a bit slow. But, the newly created business division (now 2 years old) is focusing on the intrinsic opportunity for the Company’s brands and is currently building a customer-up strategy for growing in sales, profits and prestige in the next 5 years and a good addition to the domestic Watches and Wearables business.

Jewellery Division

The opportunity for the Jewellery Division during Financial Year 2022-23 as well as in the medium term is excellent. Apart from the low market share and the increasing competitive advantage and brand preference, the Division is continuing to push many levers for growth. Multi-pronged efforts within the wedding market (including a new Engagement Rings focus), a “Many Indias” programme to increase state-level relevance, keeping the momentum behind the Gold Exchange and Golden Harvest opportunities, keeping the “Middle India” network expansion effort going.

The Zoya and Mia brands will also be riding firm on the momentum generated during Financial Year 2021-22 towards their exciting future.

The Division has also created a well-oiled process to keep the total inventory and capital employed in check, which has become embedded and sustainable.

CaratLane has had a scorching growth in Financial Year 2021- 22 and reported a profit for the first time. The powerful omnichannel approach, very high technology capability, innovative product lines and the new-age employee culture have combined exceptionally well. The Company is very confident that CaratLane has all the ingredients for creating history and substantial stakeholder value in the next few years.

International Business

The much-awaited launch of Tanishq in Dubai has been very successful, with customers giving a big thumbs-up for the excellent products and collections, the exquisite store and the superlative customer experience. The expansion into more stores in the UAE and the GCC countries is on the cards. The NRI/PIO jewellery opportunity is very large and the Company is committed to making this a meaningful part of its portfolio in the next 5 years.

Eyewear Division

The Eyewear Division transformed itself during Financial Year 2021-22 by unlocking substantial value from its operations: discount reduction, channel-mix improvement, product-mix improvement, in-house production enhancement, store and lab closures, other fixed cost management, all of these have contributed to a new platform of profitability that is quite sustainable. The Division is now all poised to grow in sales in the medium term and leverage this foundation.

The Division has also worked substantially on product innovations in lenses (Antifog, Clearsight, Neo progressives) and frames (Indifit, Signature, Glam, etc.) as well as channels (Ecolight low cost stores), all of which significantly improved the Division’s competitive advantage.

The overall opportunity in this market is vast on account of three things. The low market share that the Division has, the millions of people in the country with unaddressed refractive error and the new lifestyle (excessive screen time) that is accelerating the need for vision correction among the youth.

Fragrance Division

The Division has succeeded in creating a wide range of “Exceptional Quality, Affordable Price” Eau de Parfum variants: ‘Tales’ at ` 1595 to ‘Amalfi Bleu’ at ` 2495 and many in between, and through this created a broad aspirational category for millions of aspiring Indians who find international choices out of their reach. This platform will come in very handy in the next few years as India’s per capita GDP jumps significantly making this business start contributing meaningfully to the Company’s revenues and profits.

Indian Dress Wear Division

Ethnic Wear

The market for sarees is very large. While lifestyle changes are influencing the frequency of saree wearing, the opportunity for special occasion sarees, where the Company has chosen to play, is significant and growing. The Division has succeeded in establishing a very strong customer value proposition, a systematic product and store assortment creation process, a healthy gross contribution profile and a unique and special store experience. The next couple of years will see the Division scale up its efforts in network expansion and franchising as well as building a good sourcing and supply chain foundation. The huge advantage that this Division has is the ready member base of the Company’s Encircle loyalty program and the franchise network.

Financial Highlights

Financial highlights for the year ended 31st March 2021

Standalone Numbers

During the year under review, the Company’s total revenue grew by 3% to Rs 20,602 crore compared to Rs 20,010 crore in the previous year.

Profit before tax declined by 41% to Rs 1,233 crore and the net profit decreased by 42% to Rs 877 crore.

Consolidated Numbers

At the consolidated level, the revenue stood at Rs 21,644 crore as against Rs 21,052 crore in the previous year. The details of the performance of the Company’s subsidiaries are covered below in point 17 of this Report.

Q1 FY 2021-22

4 August 2021: Titan Company's revenue grew by 122% (excluding bullion sale) in Ql FY22 compared to Q 1 FY2 l, primarily driven by base effect of zero sales in Apr'20 last year. Most of the sales of May month were lost in both the years. Sales in Jun'21 were marginally ahead of sales in Jun'20 despite lower store operational days. Total income for the quarter was Rs. 3,314 crores, including bullion sale of Rs. 424 crores, a growth of 74% compared to Ql FY2 l's total income of Rs. 1,901 crores that included bullion sale of Rs. 601 crores.4

The Jewellery division is gaining good traction in new customers and its mix in total buyers has reached the pre-pandemic levels. It recorded an income of Rs. 2,467 crores for the quarter as compared to Rs. 1,182 crores same period last year (excluding bullion sale in both the years). The Watches and Wearables business recorded an income of Rs. 292 crores in the quarter against Rs. 75 crores in the same period previous year. The Eyewear business recorded an income of Rs. 67 crores in the quarter as against Rs. 30 crores same period last year. The other segments of the Company comprising Indian dress wear and accessories recorded an income of Rs. 14 crores this quarter compared to Rs. 4 crores in the quarter of the previous year.

Despite a lockdown induced by the second wave of the pandemic in various parts of the country, Company's better preparedness compared to same period last year helped achieve profit before tax of Rs. 82 crores this quarter compared to a loss ofRs.335 crores last year. The Jewellery division achieved Earnings Before Interest and Tax (EBIT) of Rs. 207 crores for the quarter compared to the loss of Rs. 54 crores in the previous year same quarter. The Watch and Wearables division reported a loss of Rs. 56 crores for Ql FY22 compared to a loss of Rs. 164 crores in Ql FY21. The Eyewear division reported a loss of Rs. 13 crores this quarter compared to a loss of Rs. 31 crores same period in the previous year.

The Company's retail chain (including CaratLane), is spread across 1,922 stores in 297 towns having an area exceeding 2.5 million sq. ft. The Company added a net of 13 stores in this quarter - 4 in Jewellery, 6 in Eyeplus, 4 in CaratLane and reduction of l in Watches respectively.

Of the principal subsidiaries of the Company, Titan Engineering & Automation Ltd (TEAL) got impacted due to supply chain disruptions caused by the second wave of the pandemic. It recorded revenues of Rs. 66 crores for the quarter (decline of 14%) and loss of Rs. 1 crore compared to quarterly profit before tax of Rs. 7 crores previous year. CaratLane continues to do well in both online and offline channels and has emerged as a strong omni player. It ended the quarter with revenues of Rs. 157 crores registering a growth of274% and loss of Rs. 9 crores compared to the quarterly loss of Rs. 19 crores previous year.

Mr.CK Venkataraman, Managing Director of the Company stated that:

"While the company started the quarter with strong business momentum, the second wave of the pandemic severely disrupted it and the company quickly shifted its priorities to health and safety of its employees, business associates and customers. The learnings and experience of the past year helped it navigate this quarter's turbulence much more efficiently. As the lockdowns started getting relaxed in different parts of the country in the month of June, and with the rising vaccination level, the company saw demand coming back steadily. Given the challenging economic backdrop during the quarter, I believe Titan delivered a satisfactory financial performance. With the strengthened digital presence and high percentage of vaccinated employees and associates making its retail store a safe place, Titan is optimistic about the overall performance of the Company."

Quarterly Update

The Company entered the quarter with a good sales momentum. The sales were hit only to a small extent until third week of April, from the rapidly rising second wave of pandemic, primarily due to the temporary store closures in some important states. Thereafter, most stores were shut within a short span of time and could re-open gradually in June only, with several restrictions on operating hours and days of the week. Sale from stores that stayed open in May was muted. The Company’s focus was back on keeping everyone safe and few stores were proactively closed in the highly impacted towns. The initiative of customer outreach that brought in sales last year was also not undertaken this time considering that humanitarian impact on consumers was severe and widespread this time. The sales recovery is gradually improving across the businesses, along with the increase in the store operational days. This year, Watches & Wearables and Eyewear segments have also witnessed rapid recovery in walk-ins with the re-opening of stores, which was seen in only Jewellery division last year. The Company recorded revenue growth of ~117% (excluding bullion sales) in Q1’22, with revenue contribution of approx. 50%, 10% and 40% coming from April, May and June months respectively.5

The Company has been driving vaccination campaigns as the top priority and almost all the store staff and employees got at least their first dose, which is an important step towards bringing back the normalcy.

TCL North America Inc. and TEAL USA Inc. were incorporated as a wholly owned subsidiary, of Titan Company and TEAL respectively, in the month of April 21 with the objective of carrying on the business of jewelry retailing and business development for Aerospace & Automation Solutions respectively. Titan Commodity Trading Limited has started the operations during the quarter for the hedging of the Gold.

For the quarter ended on 30th June, the division grew by ~107% (excluding bullion sales), compared to last year, primarily due to zero sales in April of last year. Most of the sales of May month was lost in both the years. Despite the lower number of store operational days in the month of June ’21 (since large states of Tamil Nadu and Karnataka markets were under lockdown for almost all of June’21), sale for June’21 is marginally ahead of the sale in June’20. Total store operational days were at 73%, 10% and 5 8% for the April, May and June month respectively and 47% for the quarter.

The division is gaining good traction in new customers and its mix in total buyers has reached the pre- pandemic levels. Golden Harvest fresh enrolments, while adversely impacted due to the lockdowns, still showed a growth over last year same period and refund requests have been quite low and comparable to pre-pandemic levels.

90%+ of stores are now open. Amongst these, around a third are shut on weekends, in line with local restrictions. 96% of staff is vaccinated across all stores (including housekeeping & security), while 00% of open stores have only staff vaccinated with one dose or have recently recovered from Covid and not yet due for vaccination.

The government has started the phased implementation of mandatory hallmarking of gold jewellery with effect from June 16, 2021, which is an important step for the development of the industry and safeguarding the consumer’s interest. All of its stores have the hallmarking license and 100% of Tanishq, Mia, Zoya jewellery is hallmarked.

Mia launched ‘Smolitaire’ and ‘Romani’ collections during the quarter. Zoya has launched ‘Samave’ collection towards the end of June.

Network expansion plans got delayed due to the lockdowns. The division added 5 Tanishq stores on a net basis in the quarter, with the retail space addition being ~20K sq. ft.

Watches & Wearables

The division grew by ~280% over Q1'21 as sales were nil in April month of last year and moreover the recovery this year has been faster than that witnessed last year when footfalls in stores were very weak due to higher apprehension of covid. Total store operational days were at 70%, 24% and 51% for the April, May and June month respectively. Safety protocols in stores including the vaccination of staff has been appreciated by the customers on social media and store reviews.

Sales were strong in the E-commerce channel especially in the second half of April and May. Omnisales have been gaining traction along with the brand websites generating customer leads. North & West regions had recovered earlier, following the pattern of the pandemic wave in the country. Recovery in higher ticket products is much better compared to the recovery in lower priced products. Like last year, the recovery in smaller towns was better than the top 8 metros.

‘Edge Ceramics’ and ‘Raga Viva IV’ collections were launched for women under the Titan brand. Fastrack launched ‘Stunners 1.0’ and ‘Wear Your Look’ collections. Sonata launched 'Sleek', a series of contemporary workwear watches for men in a sleek and minimal form factor, which further entrench Sonata as the brand of choice for the trend-seeking, value-conscious consumer.

In Q1, the division closed 2 stores of WOT & Fastrack each and opened 3 Helios stores, on a net basis, reducing 5K sq. ft. of retail space.

Eye Wear

The division grew by ~117% over Q1’21 as sales were nil in April month of last year and also on back of rapid recovery in walk-ins in May and June months, compared to last year. Total store operational days were at 71%, 19% and 62% for the April, May and June month respectively. 90%+ of stores are now open.

The division accelerated its path on e-commerce and launched Titan Eyeplus's App. It also launched Neo Progressive lens and computer glasses, exclusively for E-commerce channel.

During the quarter, the division added 6 stores on a net basis, with addition of about 1.5 K sq. feet of retail space.

Other Businesses

Taneira

11 out of 14 existing Taneira stores reopened post lockdown following various local guidelines w.r.t. store timings, weekend lockdown, staff capacity, etc. On an average, Taneira stores were operational for about 30% of the total store days, in the quarter gone by. Brand started the quarter with campaigns around regional festivals, which shifted towards digital marketing and marketplace activities as the quarter progressed.

Fragrances & Accessories business in Q1 had a slow recovery, however grew by 3 times over the last year. Sales are recovering with second fortnight of June being better than the first. E-commerce channels recovered almost fully and grew 2.5 times over the last year.

Being highly discretionary, all categories got impacted due to low opportunities to step out of home for work, social gatherings or for attending schools & colleges. Fragrances recovery was relatively much better.

Brand Skinn launched Tales, a new collection celebrating “Happiness” where every fragrance is reminiscent of happy memories. This in continuation of Skinn Escapade launched earlier which created a world away in “Wild” for men seeking solo time with Nature.

Subsidiaries

Titan Engineering and Automation Limited (100% owned)

TEAL had a revenue decline of 15% in Q1. The business is seeing a strong comeback in the Automation Solutions Business over the last few months and the enquiries are very encouraging. With respect to the Aerospace & Defence Business, the business is seeing some signs of growth in the single aisle aircraft segment but it appears that the long haul segment will take more time to recover.

CaratLane (72.3% owned)

CaratLane grew by ~274% over Q1’21. Total store operational days were 41% for the quarter. Online continued to see strong growth momentum, growing at 210% for the quarter driven by strong domestic and international demand as well as demand coming from Shaya and CaratLane Live, the video assistance feature. During the quarter, CaratLane launched Kanak, its core collection for Akshaya Tritiya, inspired by the golden swaying fields of wheat. 100% of CaratLane jewellery is hallmarked. CaratLane opened 4 new stores during the quarter taking the total store count to 121.

References

- ^ https://www.titancompany.in/about-us

- ^ https://www.tata.com/business/titan

- ^ https://www.titancompany.in/sites/default/files/Titan%20Annual%20Report%202021_0.pdf

- ^ https://www.titancompany.in/sites/default/files/Titan%20Q1%20FY%2722%20Financial%20Results.pdf

- ^ https://www.titancompany.in/sites/default/files/Titan%20Q1%20FY22%20Update.pdf