TransEnterix

Overview

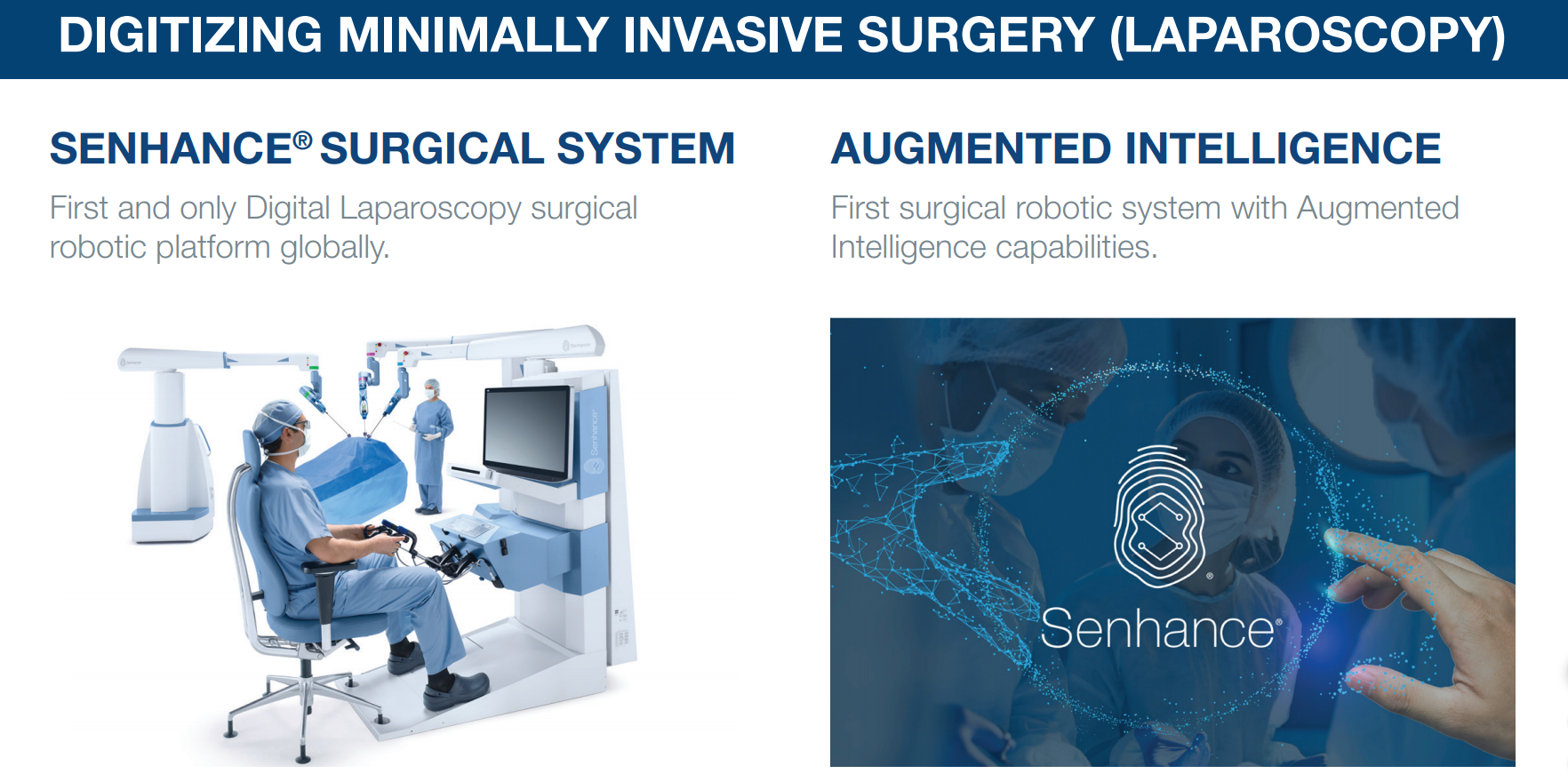

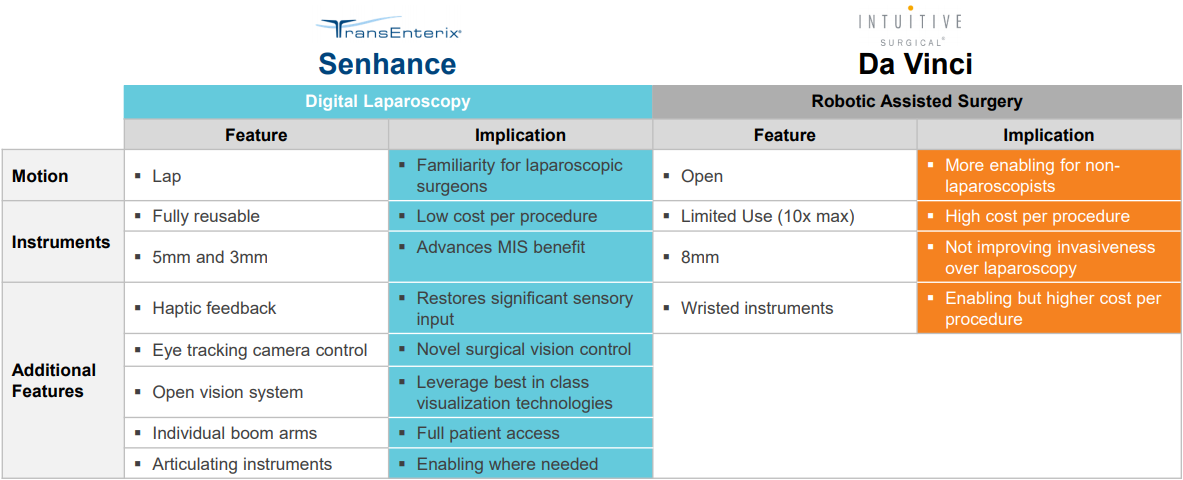

TransEnterix, Inc. (TRXC) – Founded in 2006 TransEnterix, enga digitizing the interface between the surgeon and the patient to improve minimally invasive surgery (MIS) through a new category of care called Digital Laparoscopy. Digitizing the interface enables the use of advanced capabilities like augmented intelligence, connectivity and robotics in laparoscopy, and allows it to address the current clinical, cognitive and economic shortcomings in surgery. The system features the first machine vision system for use in robotic surgery which is powered by the new Intelligent Surgical Unit™ (ISU™) that enables augmented intelligence in surgery. The Senhance Surgical System brings the benefits of Digital Laparoscopy to patients around the world while staying true to the principles of value-based healthcare. Now available for sale in the US, the EU, Japan, Russia, and select other countries.1

Previously, TransEnterix also developed the SPIDER device and the SurgiBot System.

The company believe that future outcomes of minimally invasive surgery will be enhanced through its combination of more advanced tools and robotic functionality, which are designed to:

- empower surgeons with improved precision, ergonomics, dexterity and visualization;

- offer high patient satisfaction and enable a desirable post-operative recovery; and

- provide a cost-effective robotic system, compared to existing alternatives today, for a wide range of clinical applications and operative sites within the healthcare system.

The company's strategy is to focus on the market development, commercialization and further development of the Senhance System.

During 2018 and 2019, the company successfully obtained FDA clearance and CE Mark for its 3 millimeter diameter instruments, its Senhance ultrasonic system, its 3 millimeter and 5 millimeter hooks, and the Senhance articulating system. The 3 millimeter instruments enable the Senhance System to be used for microlaparoscopic surgeries, allowing for tiny incisions. The ultrasonic system is an advanced energy device used to deliver controlled energy to ligate and divide tissue, while minimizing thermal injury to surrounding structures. The Senhance articulating system was launched in Europe in November 2019 and TransEnterix is evaluating its pathway forward to launch such a system in the United States with a planned submission for US clearance at the end of 2020.2

In January 2020, the company submitted an application to the FDA seeking clearance of the first machine vision system for its robotic surgery unit named Intelligent Surgical Unit (ISU™). Such Intelligent Surgical Unit was developed using the image analytics technology acquired from MST. The Company believes it is the first such FDA submission seeking clearance for machine vision technology in abdominal robotic surgery. On March 13, 2020, the Company announced that it has received FDA clearance for the Intelligent Surgical Unit.

Reverse Stock Split

The company's common stock began trading on a split-adjusted basis on NYSE American on the morning of December 12, 2019. No fractional shares were issued in connection with the Reverse Stock Split. Instead, the company rounded up each fractional share resulting from the reverse stock split to the nearest whole share. As a result of the Reverse Stock Split, its outstanding common stock decreased from approximately 261.9 million shares to approximately 20.2 million shares (without giving effect to the rounding up for each fractional share).

Restructuring

Under the restructuring plan, the company reduced headcount primarily in the sales and marketing functions and determined that the carrying value of its inventory exceeded the net realizable value due to a decrease in expected sales. The restructuring charges amounted to $8.8 million, of which $7.4 million was an inventory write down and was included in cost of product revenue and $1.4 million related to employee severance costs and was included as restructuring and other charges in the consolidated statements of operations and comprehensive loss, during the fourth quarter of 2019. Future payments under the restructuring plan are expected to conclude in 2020.

During March 2020, the company continued its restructuring with additional headcount reductions which resulted in $0.8 million related to severance costs which are expected to be paid in 2020 and 2021.

2019 Offerings

On August 12, 2019, the Company entered into a Controlled Equity Offering Sales Agreement (the “2019 Sales Agreement”) with Cantor Fitzgerald & Co. (“Cantor”) pursuant to which the Company may sell from time to time, at its option, up to an aggregate of $25.0 million shares of the Company’s common stock, through Cantor, as sales agent (the “2019 ATM Offering”). Pursuant to the 2019 Sales Agreement, sales of the common stock were made under the Company’s previously filed Registration Statement on Form S-3, which registration statement expired in May 2020. The aggregate compensation payable to Cantor was 3.0% of the aggregate gross proceeds from each sale of the Company’s common stock. The Company raised gross proceeds of $7.2 million under the 2019 ATM Offering and net proceeds of $7.0 million during the year ended December 31, 2019, and an additional $11.6 million of gross proceeds and $11.2 million of net proceeds as of May 2020. The 2019 ATM Offering terminated upon expiration of the shelf registration statement in May 2020.3

On September 4, 2019, the Company entered into an Underwriting Agreement (the “2019 Underwriting Agreement”) with Cantor. Subject to the terms and conditions of the 2019 Underwriting Agreement, the Company sold to Cantor, in a firm commitment underwritten offering, 2,153,846 shares of the Company’s common stock, or the Firm Commitment Offering. The Company raised $18.8 million in gross proceeds under this offering. The shares were offered and sold under the 2019 Underwriting Agreement pursuant to the Company’s previously filed Registration Statement on Form S-3.

2020 Public Offerings

On March 10, 2020, the Company closed an underwritten public offering (the "March 2020 Public Offering") with Ladenburg Thalmann & Co. Inc. (“Ladenburg”) as underwriter and sold an aggregate of 14,121,766 Class A Units at a public offering price of $0.68 per Class A Unit and 7,937,057 Class B Units at a public offering price of $0.68 per Class B Unit. Each Class A Unit consists of one share of the Company’s common stock, one warrant to purchase one share of common stock that expires on the first anniversary of the date of issuance (the "Series C Warrants"), and one warrant to purchase one share of common stock that expires on the fifth anniversary of the date of issuance (the "Series D Warrants"). Each Class B Unit consists of one share of Series A Convertible Preferred Stock, par value $0.01 per share (the "Series A Preferred Stock"), convertible into one share of common stock, a Series C Warrant to purchase one share of common stock and a Series D Warrant to purchase one share of common stock. The Class A Units and Class B Units have no stand-alone rights and were not certificated or issued as stand-alone securities. The shares of common stock, Series A Preferred Stock, Series C Warrants and Series D Warrants are immediately separable. In addition, the underwriter for the public offering exercised an overallotment option and purchased 3,308,823 additional Series C Warrants and 3,308,823 additional Series D Warrants at the closing.

Each Series C Warrant included in the Class A Units has an exercise price of $0.68 per share, and each Series D Warrant included in the Class B Units has an exercise price of $0.68 per share. The Series C Warrants and the Series D Warrants are exercisable at any time on or after the date of issuance until their respective expiration dates.

All shares of Series A Preferred Stock were converted into 7.9 million shares of common stock prior to June 30, 2020. Approximately 4.9 million Series C Warrants were exercised during the nine months ended September 30, 2020, generating net proceeds of $3.3 million.

On July 6, 2020, the Company completed an underwritten public offering with Ladenburg as underwriter and sold an aggregate of 42,857,142 shares of its common stock, including the underwriter’s full exercise of an over-allotment option, at the public offering price per of $0.35 per share, generating net proceeds of approximately $13.6 million after deducting underwriter discounts, commissions and expenses (the “July 2020 Public Offering”). The offer and sale of shares of common stock under the July 2020 Public Offering was made under the Company’s currently effective shelf Registration Statement on Form S-3.

Acquisitions and Asset Sale

Senhance Acquisition

On September 21, 2015, the Company announced that it had entered into a Membership Interest Purchase Agreement, dated September 18, 2015, or the Purchase Agreement, with Sofar S.p.A., or Sofar, as the Seller, Vulcanos S.r.l., as the acquired company, and TransEnterix International, Inc., a wholly owned subsidiary of the Company as the Buyer. The closing of the transactions contemplated by the Purchase Agreement occurred on September 21, 2015. The Buyer acquired all of the membership interests of the acquired company from Sofar, and changed the name of the acquired company to TransEnterix Italia S.r.l. On the closing date, pursuant to the Purchase Agreement, the Company completed the strategic acquisition from Sofar of all of the assets, employees and contracts related to the advanced robotic system for minimally invasive laparoscopic surgery now known as the Senhance System, or the Senhance Acquisition.

MST Acquisition

On October 31, 2018, the Company acquired the assets, intellectual property and highly experienced multidisciplinary personnel of MST Medical Surgical Technologies, Inc., or MST, an Israeli-based medical device company. Through this acquisition, the Company acquired MST’s AutoLap™ technology, one of the only image-guided robotic scope positioning systems with FDA clearance and CE Mark. The Company believes MST’s image analytics technology will accelerate and drive meaningful Senhance System developments, and allow it to expand the Senhance System to add augmented, intelligent vision capability.

Sale of AutoLap Assets

On July 3, 2019 the Company entered into a System Sale Agreement with GBIL to sell certain assets related to the AutoLap technology. On October 15, 2019, the Company amended the prior AutoLap Sale Agreement with GBIL. Pursuant to the amended agreement the Company sold the AutoLap laparoscopic vision system, or AutoLap, and related assets to GBIL. The assets include inventory, spare parts, production equipment, testing equipment and certain intellectual property specifically related to the AutoLap. The purchase price was $17.0 million, all of which was received in 2019 in the form of $16 million in cash and a commitment by GBIL to pay $1.0 million to settle certain Company obligations in China. GBIL subsequently paid the obligation. Under the amended AutoLap Agreement, the Company entered into a cross-license agreement with GBIL to retain rights to use any AutoLap-related intellectual property sold to GBIL, and to non-exclusively license additional intellectual property to GBIL. The Company recorded a $16.0 million gain on the sale of the AutoLap assets during the year ended December 31, 2019, which represented the proceeds received in excess of the carrying value of the assets, less contract costs.

Facilities

Principal corporate office - located at 635 Davis Drive, Suite 300, Morrisville, North Carolina

Italian - research and development and demonstration facilities are located at Viale dell'Innovazione 3, 20126 Milan, Italy consist of 11,273 square feet

Israeli - research and development facilities are located at Ha-Tsmikha Street 1, Yokne'am Illit, Israel consist of 5,597 square feet

Japanese - office is located at 1-3-5 Kojimachi Chiyoda-ku, Mikuni Building, 5th Floor, Tokyo, Japan consists of 737 square feet

Swiss - administrative office is located at Via Serafino Balestra 12, Lugano, Switzerland consists of 3,208 square feet

Products

TransEnterix is addressing the challenges in laparoscopy and robotic-assisted surgery with technologically advanced products and product candidates that leverage the best features of both approaches to minimally invasive surgery, or MIS.

The Senhance Surgical System

The Senhance System is a multi-port robotic surgery system that allows up to four arms to control robotic instruments and a camera. The system builds on the success of laparoscopy by enhancing the traditional features that surgeons have come to expect from existing products and by addressing some of the limitations associated with robotic surgery systems for laparoscopic procedures. The Senhance System also offers responsible economics to hospitals through its robotic technology coupled with reusable standard instruments that yield minimal additional costs per surgery when compared to laparoscopy. The Senhance System has a CE Mark in Europe for laparoscopic abdominal and pelvic surgery, as well as limited thoracic operations excluding cardiac and vascular surgery.

The Senhance System is available for sale in the United States, Europe, Japan, Taiwan and select other countries.

The Senhance System is manufactured for it by third party contract manufacturers. The company or its manufacturers acquire raw materials and components of the Senhance System from vendors, some of which are sole suppliers. The company believe its relationships with its vendors and manufacturing contractors are good. The company further believe that TransEnterix has the manufacturing capacity and inventory reserves to meet its anticipated Senhance System sales for the foreseeable future. TransEnterix is currently taking steps to develop redundant manufacturing and supply alternatives that will expand its manufacturing capacity to help meet future demand.

Instruments

During 2018 and 2019, the company successfully obtained FDA clearance and CE Mark for its 3 millimeter diameter instruments, its Senhance ultrasonic system, its 3 millimeter and 5 millimeter hooks, and the Senhance articulating system. The 3 millimeter instruments enable the Senhance System to be used for microlaparoscopic surgeries, allowing for tiny incisions. The ultrasonic system is an advanced energy device used to deliver controlled energy to ligate and divide tissue, while minimizing thermal injury to surrounding structures. The Senhance articulating system was launched in Europe in November 2019 and TransEnterix is evaluating a pathway to bring the instruments to the United States with a planned regulatory filing by the end of 2020. The company currently offer approximately 40 instruments and accessories in its portfolio. The company also have designed the Senhance System so that third-party manufactured instruments can be easily adapted for use.

SurgiBot System

The Company has also developed the SurgiBot System. The SurgiBot System is a single-port system designed to utilize flexible instruments through articulating channels controlled directly by the surgeon, with robotic assistance, while the surgeon remains patient-side within the sterile field. In December 2017, the company entered into an agreement with Great Belief International Limited, or GBIL, to advance the SurgiBot System towards global commercialization. The agreement transferred ownership of the SurgiBot System assets, while the Company retained the option to distribute or co-distribute the SurgiBot System outside of China. GBIL intends to have the SurgiBot System manufactured in China and obtain Chinese regulatory clearance from the China Food and Drug Administration while entering into a nationwide distribution agreement with China National Scientific and Instruments and Materials Company, or CSIMC, for the Chinese market. The agreement provided the Company with proceeds of at least $29 million, of which $15 million has been received to date. The remaining $14.0 million, representing minimum royalties, will be paid beginning at the earlier of receipt of Chinese regulatory approval or March 2023.

Products in Development

Instruments

The company continue to work on the development and regulatory clearance for articulating instruments for the Senhance System. In December 2018, the company submitted a 510(k) submission to the FDA related to wristed instruments for the Senhance System. That 510(k) submission was withdrawn in 2019 to provide it additional time to pursue development efforts and clinical trials. The company intend to submit a new 510(k) submission by the end of 2020.

MST Assets

On October 31, 2018, the company acquired the assets, intellectual property and highly experienced multidisciplinary personnel of Israel-based MST Medical Surgical Technologies, Inc., or MST. Through this acquisition the company acquired MST’s AutoLap™ technology, one of the only image-guided robotic scope positioning systems with FDA clearance and CE Mark. The AutoLap technology is a fully vetted technology used in over 1,500 surgeries in multiple specialties and accompanied by post-marketing publication and studies, a broad intellectual property portfolio and personnel with clinical, scientific and engineering experience. The company believe MST’s image analytics technology will accelerate and drive meaningful Senhance System developments and allow it to expand the Senhance System to add augmented, intelligent vision capability.

On July 3, 2019, the company entered into a System Sale Agreement with GBIL to sell certain assets related to the AutoLap technology. On October 15, 2019, the company entered into an Amended and Restated System Sale Agreement (the “Amended AutoLap Agreement”) with GBIL to restructure the previously announced sale of certain AutoLap assets. Pursuant to the Amended AutoLap Agreement, the Company sold the AutoLap laparoscopic vision system, or AutoLap, and related assets to GBIL for $17 million, all of which was received in 2019 in the form of $16 million in cash and a payment by GBIL of $1.0 million to settle certain Company obligations in China. The assets include inventory, spare parts, production equipment, testing equipment and certain intellectual property

specifically related to the AutoLap. In addition, the Company entered into a cross‑license agreement with GBIL to retain rights to use any AutoLap-related intellectual property sold to GBIL, and to non-exclusively license additional intellectual property to the Buyer.

In January 2020, the company submitted a 510(k) submission to the FDA for its Intelligent Surgical Unit that is designed to enable machine vision capabilities on the Senhance System. Such Intelligent Surgical Unit was developed using the MST image analytics technology that the company retained. The Company believes it is the first such FDA submission seeking clearance for machine vision technology in abdominal robotic surgery. On March 13, 2020, the Company announced that it has received FDA clearance for the Intelligent Surgical Unit.

Intellectual Property

As of December 31, 2019, the Company’s patent portfolio includes 40 United States patents and approximately 92 patents issued outside the United States, and more than 140 patent applications filed in the United States and internationally. The company own all right, title and interest in all but the 42 of its patents and patent applications that are exclusively licensed to it. The company also hold non-exclusive licenses to an additional 6 U.S. and 4 non-U.S. patents.

Several of its issued patents resulted from filings related to the Senhance System. These include 7 United States patents, and approximately 40 patents outside the United States. The earliest to expire U.S. and non-U.S. patents within this part of its portfolio will remain in force until 2027. The patent applications include over 90 that relate to the Senhance System or other features, instruments or components for robotic-assisted surgery. The company's patents and applications that the company acquired from MST relate to image analytics and robotic surgery, among other things. The company intend to continue to seek further patent and other intellectual property protection in the United States and internationally, where available and when appropriate, as the company continue its product development efforts.

Some of its issued patents and pending applications for the Senhance System, as well as associated technology and know-how, are exclusively licensed to TransEnterix Italia from the European Union. The license agreement with the European Union has a term which runs until the final licensed patent expires, unless the agreement is terminated earlier by mutual consent of the parties or for breach. The Company is currently in compliance with the terms of this license agreement.

Financial Highlights

In 2019, its revenue consisted of product and service revenue primarily resulting from the sale of a total of four Senhance Systems in Europe (one) and Asia (three), and related instruments, accessories and services for current and prior year system sales. The company also recognized $1.3 million during the year ended December 31, 2019 related to a 2017 system sale for which revenue was deferred until the first clinical use of the system, which occurred in the second quarter of 2019. In 2018, its revenue consisted of product and service revenue primarily resulting from the sale of a total of fifteen Senhance Systems in Europe (eleven), Asia (one) and the United States (three), and related instruments, accessories and services.

Product, instrument and accessory revenue for the year ended December 31, 2019 decreased to $7.1 million compared to $23.3 million for the year ended December 31, 2018. The $16.2 million decrease was the result of the revenue recognized on the sale of four Senhance Systems versus fifteen in the prior year, as well as instruments and accessories. Services revenue for the year ended December 31, 2019 increased to $1.4 million from $0.8 million for the year ended December 31, 2018 due to the increase in the number of Senhance Systems under service contracts.

For the year ended December 31, 2019, net loss was $154.2 million, or $8.69 per share, as compared to a net loss of $61.7 million, or $3.88 per share, in the year ended December 31, 2018.

Product cost for the year ended December 31, 2019 increased to $16.4 million as compared to $14.2 million for the year ended December 31, 2018. This $2.2 million increase over the prior year period was the result of the $7.4 million inventory write-down under its restructuring plan, increased personnel costs totaling $1.7 million, $0.6 million in increased standard cost variances, $0.3 million in increased travel, freight, and supplies costs, and a $1.5 million reserve for obsolete inventory offset by $9.1 million in lower product costs caused by decreased sales.

Service cost for the year ended December 31, 2019 increased to $4.3 million as compared to $2.0 million for the year ended December 31, 2018. This $2.3 million increase over the prior year period was the result of increased field service costs of $1.7 million for repairs and maintenance on a greater cumulative number of installed Senhance Systems, and a $0.6 million increase in personnel costs due to increased headcount.

R&D expenses for the year ended December 31, 2019 increased 3% to $22.5 million as compared to $21.8 million for the year ended December 31, 2018. The $0.7 million increase primarily relates to higher personnel costs totaling $1.6 million driven by higher headcount as a result of the MST acquisition offset by $0.5 million in lower technology fees, $0.2 million in lower consulting costs, and $0.2 million in lower testing and validation costs. R&D expenses for the year ended December 31, 2019 also include an impairment of IPR&D in the amount of $7.9 million that is presented separately in the consolidated statement of operations and comprehensive loss for the year ended December 31, 2019.

Sales and marketing expenses for the year ended December 31, 2019 increased 9% to $28.0 million compared to $25.7 million for the year ended December 31, 2018. The $2.3 million increase was primarily related to increased personnel related costs of $0.8 million, increased travel of $0.8 million and increased product demonstration and trade show costs of $0.7 million as the company increased its U.S, sales and marketing efforts as the company focused on the commercialization of the Senhance System.

General and administrative expenses for the year ended December 31, 2019 increased 35% to $18.8 million compared to $13.9 million for the year ended December 31, 2018. The $4.9 million increase was primarily due to increased personnel costs of $1.5 million, increased consulting and outside services costs of $1.3 million, increased taxes, licenses, and fees of $0.4 million, increased facilities costs of $0.2 million, decreased travel costs of $0.1 million and a bad debt charge of $1.6 million. The Company recorded the bad debt charge due to uncertainty regarding collectability on a 2018 system sale in North Africa.

During the fourth quarter of 2019, the company announced the implementation of a restructuring plan to reduce operating expenses as the company continue the global market development of the Senhance platform. Under the restructuring plan, the company reduced headcount primarily in the sales and marketing functions and determined that the carrying value of its inventory exceeded the net realizable value due to a decrease in expected sales. The restructuring charges amounted to $8.8 million, of which $7.4 million was an inventory write down and was included in cost of product revenue and $1.4 million related to employee severance costs and was included as restructuring and other charges in the consolidated statements of operations and comprehensive loss, during the fourth quarter of 2019.

During March 2020, the company continued its restructuring with additional headcount reductions which resulted in $0.8 million related to severance costs which are expected to be paid in 2020 and 2021.

Interest income for the year ended December 31, 2019 was $0.6 million compared to $1.4 million for the year ended December 31, 2018. The decrease of $0.8 million was due to less cash and short-term investments on hand during the year ended December 31, 2019 earning less interest.

Income tax benefit consists primarily of taxes related to the amortization of purchase accounting intangibles in connection with the Italian taxing jurisdiction for TransEnterix Italia as a result of the acquisition of the Senhance System. The company recognized $3.1 million and $3.4 million of income tax benefit for the years ended December 31, 2019 and 2018, respectively.

Recent developments

Financial Results for the Third Quarter 2020 4

For the three months ended September 30, 2020, the Company reported revenue of $0.8 million as compared to revenue of $2.0 million in the three months ended September 30, 2019. Revenue in the third quarter of 2020 included $0.2 million in system leasing, $0.2 million in instruments and accessories, and $0.4 million in services.

For the three months ended September 30, 2020, total operating expenses were $14.6 million, as compared to $96.4 million in the three months ended September 30, 2019.

For the three months ended September 30, 2020, net loss attributable to common stockholders was $15.1 million, or $0.15 per share, as compared to a net loss of $97.8 million, or $5.55 per share, in the three months ended September 30, 2019.

For the three months ended September 30, 2020, the adjusted net loss attributable to common stockholders was $11.9 million, or $0.12 per share, as compared to an adjusted net loss of $20.6 million, or $1.17 per share in the three months ended September 30, 2019. Adjusted net loss is GAAP net loss adjusted in the third quarter of 2020 for the following items: goodwill impairment, change in fair value of contingent consideration, intangible asset impairment, amortization of intangible assets, change in fair value of warrant liabilities, loss from sale of SurgiBot assets, acquisition related costs, restructuring and other charges, deemed dividend related to beneficial conversion feature of the preferred stock, and deemed dividend related to the conversion of preferred stock into common stock. Adjusted net loss attributable to common stockholders is a non-GAAP financial measure. A reconciliation from GAAP to Non-GAAP Measures can be found at the end of this earnings release.

The Company had cash and cash equivalents and restricted cash of approximately $21.1 million as of September 30, 2020.

As a result of the restructuring completed in the first quarter of 2020, cost optimization efforts, and recent equity financing, together with anticipated cash received from operating activities, including cash from system sales and leases, instruments and accessories, and services, the company believe that cash on hand will be sufficient to meet its anticipated cash needs into the second quarter of 2021.

Commercial and Clinical Update

During the quarter, three clinical Senhance programs were started and one new agreement was signed. Year to date in 2020, the Company has installed eight Senhance systems globally.

There is one additional system pending installation in Japan.

On August 4, 2020, the Company announced that it had filed its 510(k) submission with the FDA for a general surgery indication expansion. Upon clearance, this is expected to add approximately 800,000 general and bariatric procedures to the Company’s addressable market.

On September 14, 2020, the Company announced that it established the first training center for the Senhance in the Asia-Pacific region in Japan at the Saitama Medical University International Medical Center in the Greater Tokyo Area. The Japanese Training Center is expected to drive increased utilization of its seven system installations in the Asia-Pacific region and encourage further adoption of its technology in additional hospitals.

On September 23, 2020, the Company announced it completed its first surgical procedures using the ISU at Hackensack Meridian Health Pascack Valley Medical Center in New Jersey. The ISU adds augmented intelligence to the Senhance. Currently, the ISU enables machine vision driven control of the camera which allows the System to recognize certain objects and locations in the surgical field, and provides seamless sharing of the surgeon console’s view across all members of the operating room team in real-time, all the while allowing the surgeon to maintain full control. These initial capabilities are foundational to planned future augmented intelligence features such as scene cognition and surgical image analytics that are expected to further enhance the digital laparoscopic experience with Senhance.

On October 13, 2020, the Company announced the first pediatric patient procedures at Maastricht University Medical Center+ in the Netherlands. This is the first pediatric surgical program in the world to utilize the Senhance and integrate digital laparoscopy with instruments as small as 3 mm into their standard of surgical care. The Senhance is the only robotic-assisted surgical system in the world to provide fully reusable 3 mm instruments.

Underwritten Public Offering

On July 6, 2020, the Company announced the closing of an underwritten common stock offering, raising gross proceeds of $15.0 million, which included the full exercise of the underwriter’s over-allotment option to purchase additional shares.

TransEnterix Announces Approval of Senhance® Surgical System in Russian Federation 5

December 16, 2020; TransEnterix, Inc. announced that the Senhance® Surgical System has received its registration certificate by Roszdravnadzor, the Russian medical device regulatory agency allowing for its sale and utilization throughout the Russian Federation.

“Russian regulatory approval is an important milestone for TransEnterix, and this is an underserved market for robotic surgery,” said Anthony Fernando, President and Chief Executive Officer of TransEnterix. “Russia has rapidly developed expertise and adoption of minimally invasive surgery over the past 10 years, but robotic surgery remains extremely limited in the region due to high per-procedure costs and the success of laparoscopic approaches. Senhance helps address these adoption hurdles. TransEnterix has worked with BOWA previously to launch four Senhance programs in the Commonwealth of Independent States (CIS) region, and look forward to partnering to leverage this recent success in entering the largest CIS market.”

TransEnterix has been partnering with BOWA-electronic GmbH & Co. KG (BOWA), based in Germany, to commercialize the Senhance Surgical System in the CIS region over the past three years. BOWA, together with it’s wholly-owned subsidiary OOO “BOWA Eurasia”, have an established commercial and support presence in this region . They are well equipped to drive medical device sales and provide aftersale support to hospitals in the CIS region, including Russia, for the Senhance and BOWA’s own complementary surgical device portfolio of products.

The Senhance Surgical System is the first and only digital laparoscopic platform designed to maintain laparoscopic minimally invasive surgery standards while providing digital benefits such as haptic feedback, robotic precision, comfortable ergonomics, advanced instrumentation including 3 mm microlaparoscopic instruments, eye-sensing camera control, and reusable standard instruments to help maintain per-procedure costs similar to traditional laparoscopy. TransEnterix also recently launched the first machine vision system in robotic surgery in the US. This first-of-its-kind augmented intelligence capability is powered by the new Intelligent Surgical Unit™ on the Senhance Surgical System. Not all features are currently available in every market.

References

- ^ https://transenterix.com/about/our-history

- ^ https://ir.transenterix.com/node/12691/html#sE63D0255CB41538F88C4C2832E4883CA

- ^ https://ir.transenterix.com/node/13106/html

- ^ https://ir.transenterix.com/news-releases/news-release-details/transenterix-inc-reports-operating-and-financial-results-third-2

- ^ https://ir.transenterix.com/news-releases/news-release-details/transenterix-announces-approval-senhancer-surgical-system