UPL Ltd

Summary

- UPL is a global leader in global food systems and rank 5th largest agrochemical company in the world

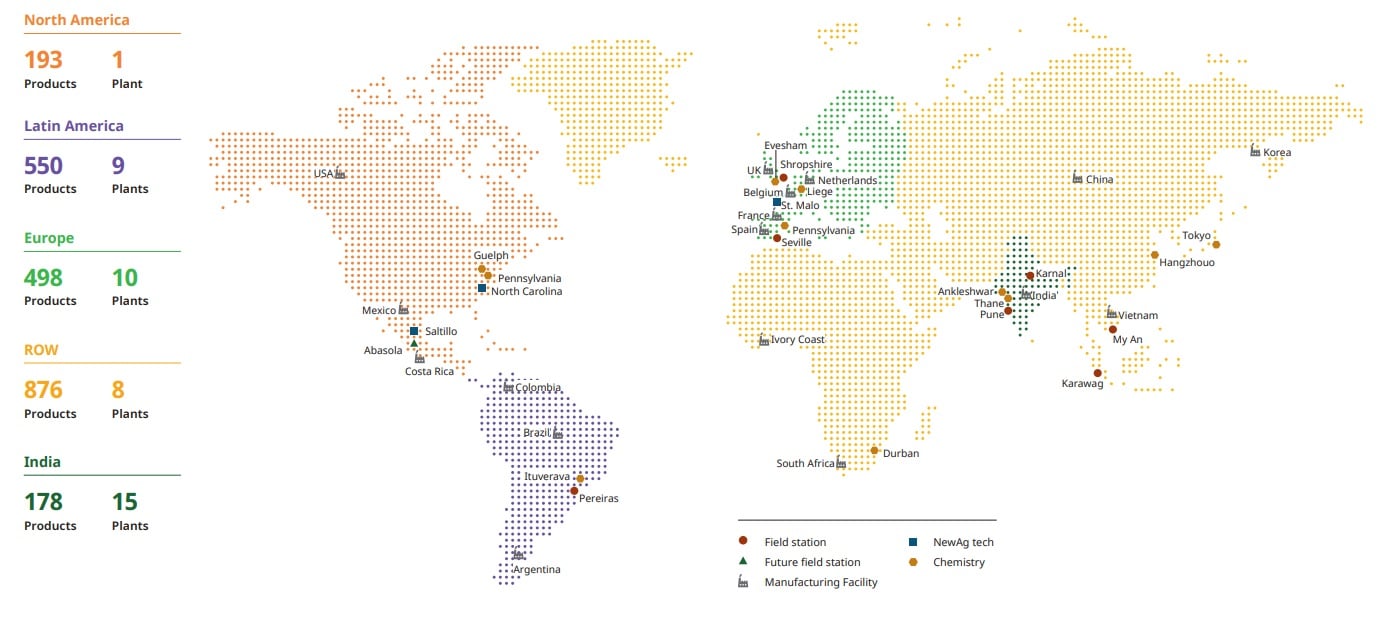

- With a revenue of US$5,040 Million, UPL is now present in 138+ countries and have market access to 90% of the world’s food basket.

- UPL has 43 plants across the globe of which 15 plants are in India.

Company Overview

UPL Ltd (NSE:UPL) is a global leader in global food systems. After the acquisition of Arysta LifeScience its become 5th largest agrochemical company in the world.1

With a revenue of US$5,040 Million, UPL is now present in 138+ countries. UPL has market access to 90% of the world’s food basket and are focused on ushering growth and progress for the complete agricultural value chain including growers, distributors, suppliers and innovation partners.

As a new company, the company offer an integrated portfolio of both patented and post-patent agricultural solutions for various arable and specialty crops, including biological, crop protection, seed treatment and post-harvest solutions covering the entire crop value chain.

UPL leads the agri-solutions space through differentiated products, biosolutions, and collaborations across the food value chain to create sustainable food systems. The company's offerings enhance the resilience of farmers against climate risks and ensure maximum farm yield at affordable costs, thereby growing their incomes.

The company's interventions span the entire lifecycle of a diverse crop base worldwide. The company's wide product portfolio comprises patented and post-patent agricultural solutions, including crop protection, BioSolutions and seed treatment, for various row and specialty crops.

The company aim to transform agriculture through OpenAg, an agriculture network that feeds sustainable growth for all. No limits, no borders. This transformation has been accelerated through its early adoption of digitisation.

Global Reach

The company provide complete agri-solutions across different geographies. UPL is focusing on the product chain for the farmers at all stages, from seeds to postcrop care, leading to a wider reach and range compared to its global peers. Through OpenAg, the company address specific needs of the farmers in different parts of the world, thereby increasing the total addressable market.

Product and services

Agricultural Solutions

The company's focus on speciality applications and locally tailored applications in high-growth agricultural regions provide it with a higher competitive advantage while maintaining lower exposure to commodity grain prices. Speciality applications include crop protection solutions for niche and speciality crops; products for underserved or hard-to-control pests; alternative application methods like seed and soil applied technologies; and bio-based products.2

Seeds

The company's Advanta division provides innovative high-quality seeds to ensure sustainable crop production and profitability for the farmers. With the help of one biotech and research stations, the company develop disease resistant and high-yielding seed varieties. The company's key differentiators include superior germplasm combined with technology and bioscience credibility helping it achieve ace position across several crop seeds.

Key attributes

- High-quality oil

- High yield

- Disease and pest resistant

- Drought and salinity tolerance

Crop Protection

UPL is among the foremost players of crop protection products with an aim to upgrade crop adaptability and ensure food security. The company customise best-in-class formulation technology as per localised needs to offer products meeting its customer requirements. The company's pervasive product portfolio addresses issues across the lifecycle of a crop. The company's carefully created solutions are developed after identifying the key pain points of its farmers for a more effective outcome.

Biosolutions

UPL’s extensive Plant Stress & Stimulation (PSS) pipeline signals the dawn of a new era in sustainable agriculture as a key part of integrated crop production intensification programs.

UPL's PSS portfolio supports crop stimulation, nutrition as well as protection and when combined with conventional products, improves crop resilience to weather risks and biotic stress for improved yield, quality and consequent grower financial wellbeing in a sustainable way.

Post Harvest

At UPL the company strive to reduce post-harvest losses through its differentiated products and solutions. The company's innovative solutions are aimed at reducing crop wastage and enhancing income of its farmers.

Key offerings

- Grain storage

- Fruit storage

- Potato storage

- Research and developments

- Innovation

Soil & Water Technologies

UPL Zeba™ is a patented, granular, free flowing technology in the category of soil conditioner / amendment, intended for in furrow application with a proven history in its ability to positively manage soil solution water whilst having a constructive impact on soil health parameters.

Enabling growers to directly increase the efficiency of the water they use, along with soil solution nutrition, for the benefit of plants, soil and the environment. Being degradable Zeba leaves no residues across a wide range of applications.

Aquatics

Invasive aquatic plants and algae present a challenge to all water users, as well as resource managers. At UPL, UPL is committed to protecting its waterbodies; including lakes, ponds, reservoirs, streams, rivers and canals against their impacts. The product portfolio comprises solutions for aquatic plant and algae management. UPL has developed digital tools ( UPL Aquatics app and Cascade Teton) to help find its customers the right aquatic solutions.

ProNutiva

ProNutiva® is an exclusive program that integrates natural biosolutions (bioprotection, biostimulants and bionutrition) with conventional crop protection products to meet or exceed the real-world needs of today’s growers. The integration of biosolutions with conventional plant protection products answers the latest challenges in agriculture by:

- Supporting sustainable agricultural practices

- Improving grower economics

- Meeting evolving food chain requirements

Farmer Engagement

The field of agriculture is rapidly evolving. Staying updated with the latest advancements is a challenge especially for the far flung or marginal farmers. UPL addresses this challenge by working on a local level continuously and ensuring that the latest in farming practices is easily accessible to them at appropriate times which includes mechanised spraying, soil testing, crop advisory, among others.

OpenAg

A model that brings together all the different players in the food system – from farmers to food producers to supermarkets to consumers – with a new purpose.3

OpenAg Farm launched in Brazil in an area of 25,000 ha divided into 7 farms, partnering with multiple growers to optimise plant health and sustainability

The OpenAg Farm aims to seamlessly connect its R&D to farming and experience farmer challenges. The company launched a 25,000 hectare OpenAg farm in the state of Mato Grosso in Brazil. The company partnered with various farmers and farming companies and through this collaboration, the company identify challenges at the farm level and devise adequate solutions for sustainable agricultural practices.

Industry Overview

Global crop protection market

The crop protection market is directly correlated to agricultural production. While most industries were severely impacted by the pandemic, given the essential nature of food production the agrochemical industry was largely sheltered from the brute force of the pandemic. Agricultural inputs manufacturing and supply was primarily excluded from the lockdown restrictions across the world, though the industry faced challenges arising from reduced availability of migrant farm labour and concerns around shipment delays in ports. Demand side pressure was seen on a few crops, because of reduced cotton consumption in the textile industry, vegetable production in North America due to limited operations around the hospitality sector and reduced demand for maize in biofuels. While currency headwinds in a few geographies also had a detrimental impact on performance, favourable pricing environment and improved weather across key markets kept the sector afloat.4

The global market for conventional crop protection products is estimated to have grown by 2.7% in 2020 to US$62 billion. Nearly all major key crops witnessed strong price gains despite the challenges. The sector is expected to have another positive year with favourable macrofactors for agriculture like encouraging crop price trends and weather projections.

In terms of exports, China which accounts for over half of the global production for many off-patent products, experienced pressure when the pandemic first took badgered the country, with exports of pesticides declining in January and February by 12.8% y-o-y. However, this was overcompensated with robust growth in the latter months, with the country witnessing an overall export of ~2.5 mn tonnes, a 71% increase for 2020.

Herbicide market

Increased global soybean and maize sowing areas and favourable monsoon conditions in India and Southeast Asia were the key enablers of growth in the segment. Reduced migrant workforce availability due to lockdowns posed challenges in addressing increasing demand. Australia affected by weed pressure and prolonged drought in previous year saw an uptick with comparatively better weather conditions during the year. While, in the Americas, a key, upcoming trend was the increased adoption of alternative GM traits, demand shift from glyphosate tolerance to the more expensive herbicide technologies, such as glufosinate, dicamba and 2 and 4-D primarily due to resistance issues as well as regulatory challenges.

Insecticide market

Despite regulatory pressures in Europe and India, the surge in fall armyworm and pest attacks in the Middle East, Africa and Asia led to a continued increase in demand. Measures taken to control the devastating locust attacks, which plagued India and Pakistan in 2020 also contributed to widening demand growth.

Fungicide market

Despite dry weather conditions across Europe and Australia, currency headwinds in Latin America and lower prices of generics caused the fungicide market to grow, as farm areas continued to expand for most key crops and strong monsoon conditions in Indo-China region encouraged fastet bounce back.

Indian crop protection market

The agrochemicals industry is buoyed by the acceleration in agricultural activities due to normal monsoons and lucrative prices. Production of agrochemicals (technical grade) grew by over 10% in FY 2021. There was a gradual shift from generics towards speciality products because of higher effectiveness and increasing affordability, with the latter now estimated to contribute 20-25% of India’s current agrochemical sales.

Domestic Consumption

Despite the pandemic, vibrancy within the rural markets can be attributed to the two consecutive good monsoon seasons and a respectable sowing season, resulting in production multiplication. The favourable monsoon also enabled the record high kharif sowing season. There were positive indications, including increased production and strong bounce back in agricultural product exports

On the supply side, new product launches, proactive raw material handling planning along with efficient capacity utilisation supported the increased manufacturing of agrochemicals. Although in the third quarter, industry growth was halted by two cyclones and prolonged rainfall especially in Southern India, which resulted in lower insecticides consumption. However, herbicide and fungicide categories continued are projected to do well and overall strong growth was recorded at the end of the year, aided by a good rabi season and higher liquidity levels among farmers.

Exports

Of the total export out of India, top five countries constitute 50%, comprising mainly of Brazil and USA followed by Vietnam, France, Japan and others. Benign weather patterns across key exporting markets of Brazil, USA, Andean and parts of the European Union led to positive export performance, as reinforced by supportive crop prices and an improved supply chain.

India Outlook

The agri-input sector is on a growth trajectory, owing to normal monsoon for two consecutive years. Despite concerns and challenges birthed by the pandemic, the government’s support to farmers through higher procurement at Minimum Support Prices further helped in propelling demand for agri-inputs. In FY 2022, domestic tailwinds from strong liquidity among farmers and a normal monsoon will be the drivers in sustaining double-digit industry growth.

In line with the growth of the overall agri-input sector, higher acreages and crop prices as well as the government’s focus on expanding production, the demand for agrochemicals is expected to witness robust growth over the next few years. Relatively lower agricultural yields, high losses due to diseases and pests and rising labour costs are expected to structurally drive increasing agrochemical usage.

The year is slated to see another harvest, in addition to the farming community’s liquidity provisions for spending on safeguarding their crop from pests and diseases. Conducive monsoon expected for the third straight year, robust reservoir levels, expansion in summer crop area and 4-5% increase in MSPs for key crops will support healthy agrichemical volume offtake over the near term. Agrochemical exports are expected to remain steady as agronomic conditions across most markets of the world improve compared to last year and crop prices remain buoyant, boding well for farmer profitability.

The government is expected to bring a production-linked incentive (PLI) scheme for the promotion of domestic manufacturing of agrochemicals providing a well-timed opportunity to further increase global market share as customers increasingly diversify their supplies away from China. The industry is also focusing on increasing backward integration capacities for the manufacturing of technical grade pesticides, in a bid to become selfsufficient and reduce reliance on China.

Financial Highlights

UPL anchored its growth by fast adapting to constantly changing situations, offering innovative products and solutions , tapping new growth markets and opportunities, differentiated products, bio-solutions, and collaborations across the food value chain. During the year, UPL’s consolidated revenue from operations increased by 8% to Rs 38,694 crores from Rs 35,756 crores in FY 2020, and EBITDA increased by 15% to Rs 8,559 crores from Rs 7,452 crores in FY2020. During the year, the Company continued to deliver on its commitment to deleverage its balance sheet and reduce the Gross Debt by Rs 5,039 crores and Net Debt by Rs 3,140 crores. The Gross Debt and Net Debt as at March 31, 2021 stood at Rs 23,774 crores and Rs 18,922 crores respectively. For more details of the financial performance please refer to the Management Discussion and Analysis Report.

June 2021 Result

UPL Consolidated June 2021 Net Sales at Rs 8,515.00 crore, up 8.71% Y-o-Y5

August 03, 2021; Reported Consolidated quarterly numbers for UPL are:

Net Sales at Rs 8,515.00 crore in June 2021 up 8.71% from Rs. 7,833.00 crore in June 2020.

Quarterly Net Profit at Rs. 677.00 crore in June 2021 up 22.87% from Rs. 551.00 crore in June 2020.

EBITDA stands at Rs. 1,822.00 crore in June 2021 down 4.05% from Rs. 1,899.00 crore in June 2020.

UPL EPS has increased to Rs. 8.08 in June 2021 from Rs. 7.20 in June 2020.

References

- ^ https://www.upl-ltd.com/our-story

- ^ https://www.upl-ltd.com/solutions

- ^ https://www.upl-ltd.com/in/open-ag

- ^ https://www.upl-ltd.com/financial_result_and_report_pdfs/q2ONYSqsyyUMZiO8xDLwoVu7aO1aCapPAlNhAxER/UPL-Annual-Report-2020-21.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/upl-consolidated-june-2021-net-sales-at-rs-8515-00-crore-up-8-71-y-o-y-7268031.html