UltraTech Cement Ltd

Summary

- UltraTech Cement Limited is the cement flagship company of the Aditya Birla Group.

- UltraTech is the only cement company globally (outside of China) to have 100+ MTPA of cement manufacturing capacity in a single country.

- UltraTech has a consolidated capacity of 116.8 million tonnes per annum (MTPA) of grey cement.

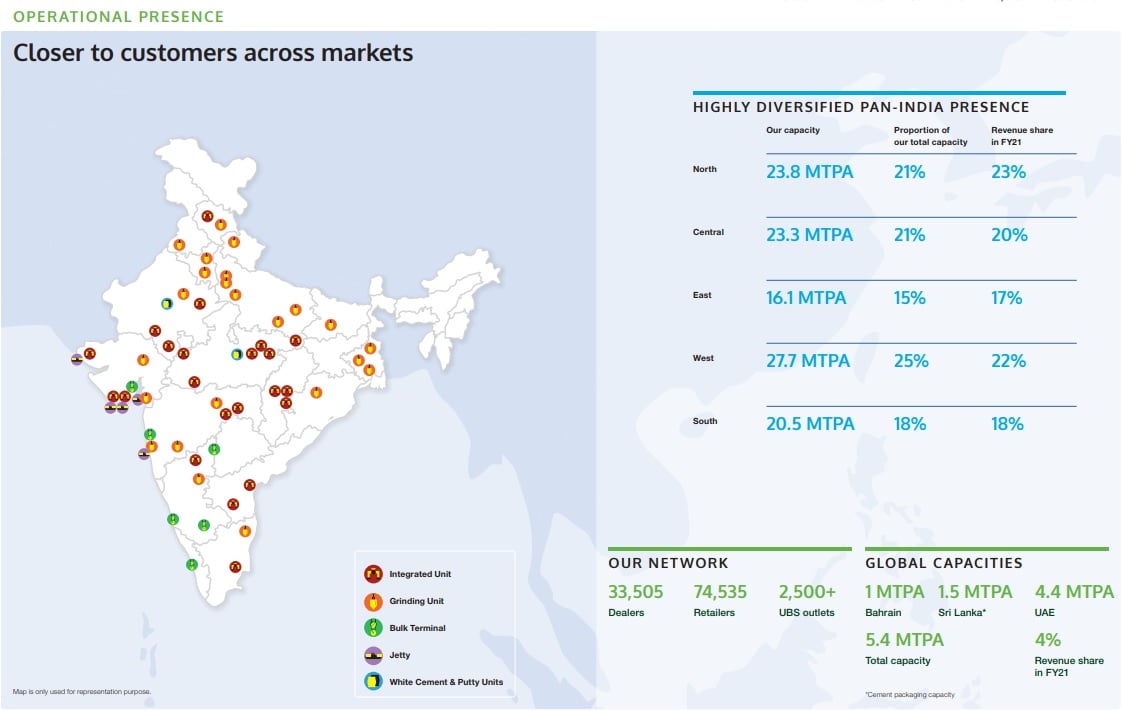

- The Company’s business operations span UAE, Bahrain, Sri Lanka and India.

Company Overview

UltraTech Cement Limited (NSE:ULTRACEMCO) is the cement flagship company of the Aditya Birla Group. A USD 5.9 billion building solutions powerhouse, UltraTech is the largest manufacturer of grey cement, ready mix concrete (RMC) and white cement in India. It is the third largest cement producer in the world, excluding China. UltraTech is the only cement company globally (outside of China) to have 100+ MTPA of cement manufacturing capacity in a single country. The Company’s business operations span UAE, Bahrain, Sri Lanka and India.1

UltraTech has a consolidated capacity of 116.8 million tonnes per annum (MTPA) of grey cement. UltraTech has 22 integrated manufacturing units, 27 grinding units, one clinkerisation unit and 7 bulk packaging terminals. UltraTech has a network of over one lakh channel partners across the country and has a market reach of more than 80% across India. In the white cement segment, UltraTech goes to market under the brand name of Birla White. It has one white cement unit and one wall care putty unit, with a current capacity of 1.5 MTPA. UltraTech has over 130 ready mix concrete (RMC) plants in 50 cities across India. It also has a slew of speciality concretes that meet specific needs of discerning customers. The company's Building Products business is an innovation hub that offers an array of scientifically engineered products to cater to new-age constructions. UltraTech pioneered the UltraTech Building Solutions (UBS) concept to provide individual home builders with a one-stop-shop solution for building their homes. Today, UBS is the largest single brand retail chain with over 2500 stores across India.

UltraTech is a founding member of Global Cement and Concrete Association (GCCA). It is a signatory to the GCCA Climate Ambition 2050, a sectoral aspiration to deliver carbon neutral concrete by 2050. UltraTech has adopted new age tools like Science Based Target Initiative (SBTi), Internal Carbon Price and Energy Productivity (#EP100) as part of its efforts to accelerate adoption of low carbon technologies and processes across its value chain and thus reduce carbon footprint over the life cycle. UltraTech is the first company in India and the second company in Asia to issue dollar-based sustainability linked bonds. As part of its CSR, UltraTech reaches out to nearly 2.1 million beneficiaries in over 500 villages across India covering areas of education, healthcare, sustainable livelihoods, community infrastructure and social causes.

Key Milestones

| 1980 | First cement plant set up for Grasim (Vikram Cement) and Indian Rayon (Rajashree Cement) |

| 1998 | Merger of cement business of Indian Rayon and Grasim Cement Capacity: 8.5 MTPA |

| 2004 | Acquisition of L&T's cement business: UltraTech Cement Ltd. Cement Capacity: 30.04 MTPA + 1.08 MTPA (SDCCL) |

| 2010 | Acquisition of Star Cement in the Middle East and greenfield expansions Cement Capacity – 52 MTPA |

| 2013 | New grinding unit capacity of 1.6 MTPA commissioned at Jharsuguda, Orrisa Acquired unit in Sewagram and GU in Wanakbori, Gujarat with a capacity of 4.8 MT Cement capacity - 62 MTPA |

| 2014 | Commissioned new grinding unit at Jharsuguda (1.6 MTPA) Acquired Sewagram and Wanakbori units from Jaypee Cement (4.8 MTPA) |

| 2017 | Acquires Jaypee Cement business (21.2 MTPA) Largest cement company in India, 4th in world (excluding China) Cement Capacity: 93 MTPA |

| 2018 | Commissioned integrated unit in Dhar (3.5 MTPA) Acquired cement business of Binani Cement (6.25 MTPA) Cement capacity: 102.75 MTPA |

| 2019 | Merger of cement business of Century Textiles & Industries Ltd with UltraTech Cement. UltraTech becomes the first cement company globally to have more than 100 MTPA capacity in a single country outside of China. Cement Capacity: 116.75 MTPA |

| 2021 | Successfully raised US$ 400 million in the form of sustainability-linked bonds. UltraTech is the first company in India and the second company in Asia to issue dollar-based sustainability linked bonds. |

Plant and Capacity

UltraTech Cement Limited is the largest cement company in India and among the leading producers of cement globally. It is also the country’s largest manufacturer of white cement and Ready Mix Concrete.

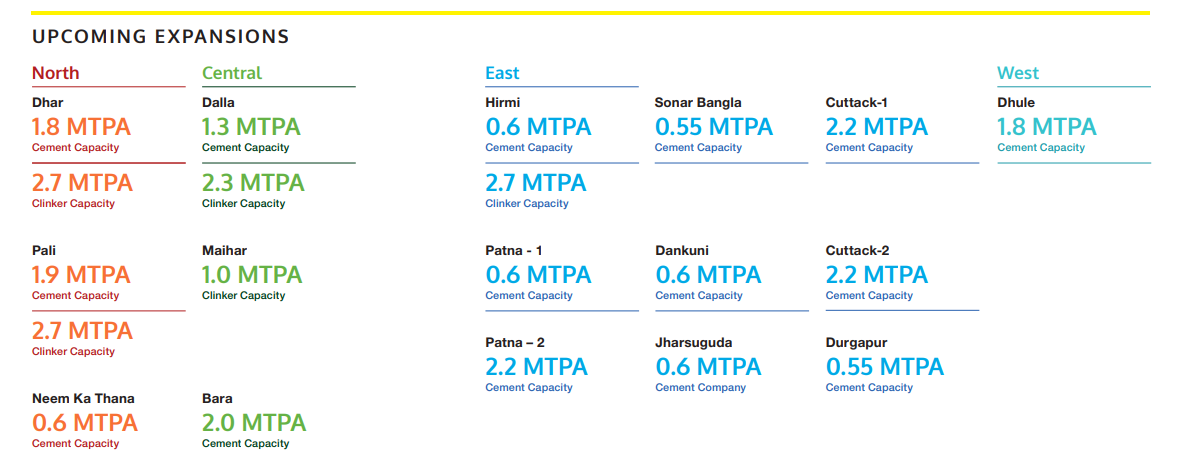

The company has consolidated capacity of 116.75 Million Tonnes Per Annum (MTPA) of grey cement. UltraTech Cement has 23 integrated plants, 1 clinkerisation unit, 26 grinding units, 7 bulk terminals, 1 white cement plant, 2 WallCare putty plants and more than 100+ RMC plants – spanning India, UAE, Bahrain and Sri Lanka. UltraTech Cement is also India's largest exporter of cement and clinker reaching out to meet demand in countries around the Indian Ocean, Africa, Europe and the Middle East.

| Integrated Units: | |

| Aditya Cement Works | Adityapuram,Rajasthan |

| Andhra Pradesh Cement Works | Bhogasamudram,Andhra Pradesh |

| Awarpur Cement Works | P.O. Awarpur,Maharashtra |

| Baga Cement Works | Village Baga, P.O. Kandhar,Himachal Pradesh |

| Baikunth Cement Works | P.O. Baikunth,Chhattisgarh |

| Balaji Cement Works | Vill. + Post Budawada Mandal, Andhra Pradesh |

| Bela Cement Works | Jaypee Puram,Madhya Pradesh |

| Dalla Cement Works | Post: Dalla,Uttar Pradesh |

| Dhar Cement Works | Village: Tonki;District: Dhar,Madhya Pradesh |

| Gujarat Cement Works | P.O. Kovaya,Gujarat |

| Hirmi Cement Works | Village & Post: Hirmi,Chhattisgarh |

| Jafrabad Cement Works | Village: Babarkot,Taluka: Jafrabad,Gujarat |

| Kotpuli Cement Works | Tehsil: Kotputli,District: Jaipur,Rajasthan |

| Maihar Cement Works | Sarla Nagar,Tehsil Maihar,Madhya Pradesh |

| Manikgarh Cement Works | At post Gadchandur,Maharashtra |

| Rajashree Cement Works | Adityanagar, Malkhed Road,Karnataka |

| Rawan Cement Works | Village: Rawan,Chhattisgarh |

| Reddipalayam Cement Works | Reddipalayam P.O.,Tamil Nadu |

| Sewagram Cement Works | Village: Vayor, Taluka Abdasa,Gujarat |

| Sidhi Cement Works | Aditya Vihar, Majhigawan,Madhya Pradesh |

| Vikram Cement Works | Vikram Nagar, P.O. Khor,Madhya Pradesh |

| Grinding Units: | |

| Aligarh Cement Works | Village: Kasimpur,Uttar Pradesh |

| Arakkonam Cement Works | Chitteri post,Tamil Nadu |

| Bagheri Cement Works | Village - Pandiyana,Himachal Pradesh |

| Bara Cement Works | Village : Lohgara,Uttar Pradesh |

| Bathinda Cement Works | Behind G.H.T.P,Punjab |

| Dadri Cement Works | Village: Ranuali,Uttar Pradesh |

| Dankuni Cement Works | Village: Panchghara,West Bengal |

| Ginigera Cement Works | Gangavathi Road,Karnataka |

| Hotgi Cement Works | Village/ Post: Hotgi Station,Maharashtra |

| Jhajjar Cement Works | Village: Jharli,Haryana |

| Jharsuguda Cement Works | Near Dhutra Railway Station,Odisha |

| Magdalla Cement Works | Magdalla Port,Gujarat |

| Nagpur Cement Works | Village: Ashti,Maharashtra |

| Panipat Cement Works | Village: Karad,Haryana |

| Patliputra Cement Works | Village: Shajahnapur,Patna, Bihar |

| Ratnagiri Cement Works | MIDC Indl. Estate,Maharashtra |

| Roorkee Cement Works | Village - Nalheri Dehviran,Uttarakhand |

| Sikandarabad Cement Works | Post: Sikandrabad,Uttar Pradesh |

| Sonar Bangla Cement Works | Village-Dhalo, P.O. Gankar Block,West Bengal |

| Tanda Cement Works | Post: Hussainpur Sudhana Tanda,Uttar Pradesh |

| Wanakbori Cement Works | Village: Sangol,Gujarat |

| West Bengal Cement Works | Near EPIP Plot,P.O. - Rajbandh,West Bengal |

Products

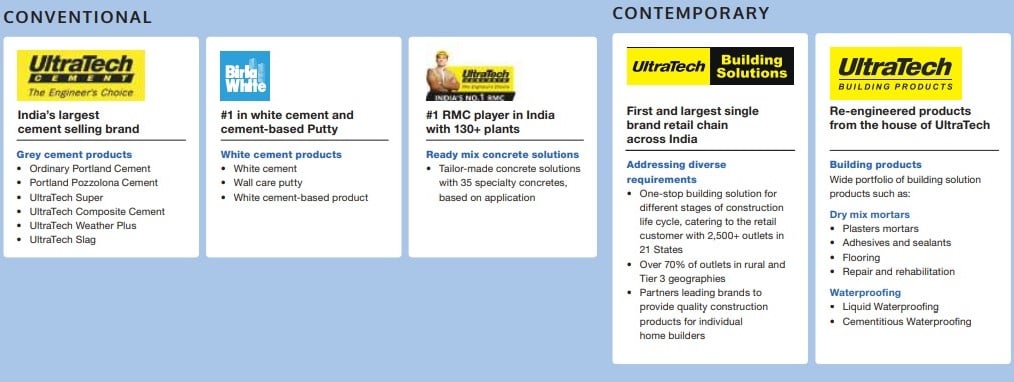

In the white cement segment, UltraTech goes to market under the brand name of Birla White. It has a white cement plant with a capacity of 0.68 MTPA and 2 WallCare putty plants with a combined capacity of 0.85 MTPA.

With 100+ Ready Mix Concrete (RMC) plants in 35 cities, UltraTech is the largest manufacturer of concrete in India. It also has a slew of speciality concretes that meet specific needs of discerning customers.

UltraTech's products include Ordinary Portland cement, Portland Pozzolana cement and Portland blast-furnace slag cement.

UltraTech cement is the ultimate 360° building materials destination, providing an array of products ranging from grey cement to white cement, from building products to building solutions and an assortment of ready mix concretes catering to the varied needs and applications.

Business Overview

The year 2020 saw mayhem around the world as COVID-19 threatened all that humanity had come to take for granted – mobility, safety and a normal life itself. This, in turn, posed the most formidable economic challenge to India and to the world. Bereft of a cure or a vaccine, the public health system in every country faced enormous pressure trying to tackle this allpervasive crisis. The imperative of flattening the disease curve was entwined with the threat of an imminent recession and job losses, given the restrictions on economic activities enforced by the lockdown to contain the spread of the virus. In other words, all containment measures had to consider a trade-off between lives and livelihood.2

Despite the severe economic contraction of ~3.3% in 2020, the International Monetary Fund now projects global growth at 6% in 2021, which would moderate to 4.4% in 2022. This is the result of the additional fiscal support provided by governments in a few large economies, the anticipated vaccine-powered recovery in the second half of 2021, and the continued adaption of economic activity to restricted mobility. However, there is uncertainty around this outlook, and much will depend on the path of the pandemic, the effectiveness of policy support in shoring up the vaccine-powered normalisation, and how the financial conditions of countries eventually shape up.

The Indian economy witnessed a contraction in H1FY21, followed by a subdued but positive growth in the second half. Higher capital expenditure of the government budgeted for FY22, expectation of a third consecutive normal monsoon and continued normalisation of economic activities following the progress of vaccination augur well for the Indian economy. However, recovery will not be easy, given that the scars of the pandemic run deep and there are uncertainties around the massive second wave of COVID-19 infections, which has registered a sharper spike than the first wave.

The cement industry witnessed de-growth of 10-12% due to the COVID-19 pandemic. However, in H2FY21 the industry began to show signs of early recovery. Lockdown-led demand disruption was the highest in Q1FY21 on account of suspension of production, stalled construction activities and mass exodus of labour. The total lockdown period from late March to end-April 2020, was a huge challenge for all manufacturing industries. But with the central and state governments taking measured steps towards the opening up of the economy, some encouraging trends were seen from the latter part of May 2020, driven largely by a better-than-expected pick-up in cement consumption in the rural markets. Amidst the pandemic, cement consumption witnessed strong growth in the rural, semi-urban and retail markets. In rural India, better labour availability, increase in construction of rural infrastructure and low-cost housing drove cement demand. Demand is also getting influenced by the resumption of construction work related to institutional infrastructure projects such as road and metro rail networks.

Cement demand is closely linked to the housing and infrastructure sector. The industry has been on a volume growth path, motivated by the government’s ‘Housing for All by 2022’ mission and large infrastructure projects in the pipeline. Government spending on infrastructure projects and affordable housing schemes such as the Pradhan Mantri Awas Yojana (“PMAY”) with enhanced budgetary allocations will be the primary drivers of growth for the cement industry. Going forward, prospects for the industry in FY22 look bright.

Financial Highlights

Cement production at 79.70 million tonnes in FY21 was higher by 4% as compared to the previous year. This is despite the lower cement consumption during Q1FY21 due to the outbreak of the pandemic across the country. Capacity utilisation was higher at 71% as compared to 69% last year.

Domestic sales volume registered a growth of 5%, after registering a 32% de-growth in Q1FY21. Cement consumption started improving from Q2FY21 on the back of consistent rural demand and pick-up in infrastructure activities during H2FY21.

PBIDT for the year at Rs 11,754 crores is 25% higher than the previous year. Operating margin improved on account of volume growth and better sales realisation.

At Rs 2,434 crores, depreciation for the year is lower by Rs 21 crores over the previous year, mainly on account of few assets being fully depreciated.

Reduction in finance cost from Rs 1,704 crores to Rs 1,259 crores was mainly on account of lower borrowings and interest rates during the financial year.

June 2021 Results

July 26, 2021; Reported Consolidated quarterly numbers for UltraTech Cement are:3

Net Sales at Rs 11,829.84 crore in June 2021 up 54.97% from Rs. 7,633.75 crore in June 2020.

Quarterly Net Profit at Rs. 1,702.63 crore in June 2021 up 113.51% from Rs. 797.43 crore in June 2020.

EBITDA stands at Rs. 3,512.36 crore in June 2021 up 49.25% from Rs. 2,353.41 crore in June 2020.

UltraTechCement EPS has increased to Rs. 59.02 in June 2021 from Rs. 27.65 in June 2020.

References

- ^ https://www.ultratechcement.com/about-us/overview

- ^ https://www.ultratechcement.com/content/dam/ultratechcementwebsite/pdf/financials/annual-reports/AnnualReport2020-21.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/ultratechcement-consolidated-june-2021-net-sales-at-rs-11829-84-crore-up-54-97-y-o-y-2-7222861.html