Vodafone Idea Ltd

Summary

- Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group partnership

- The Company provides pan India Voice and Data services across 2G, 3G and 4G platform.

- Vodafone Group has mobile operations in 22 countries, partners with mobile networks in 42 more, and fixed broadband operations in 17 markets

- The Aditya Birla Group is a leading Indian multinational in the league of Fortune 500.

Company Overview

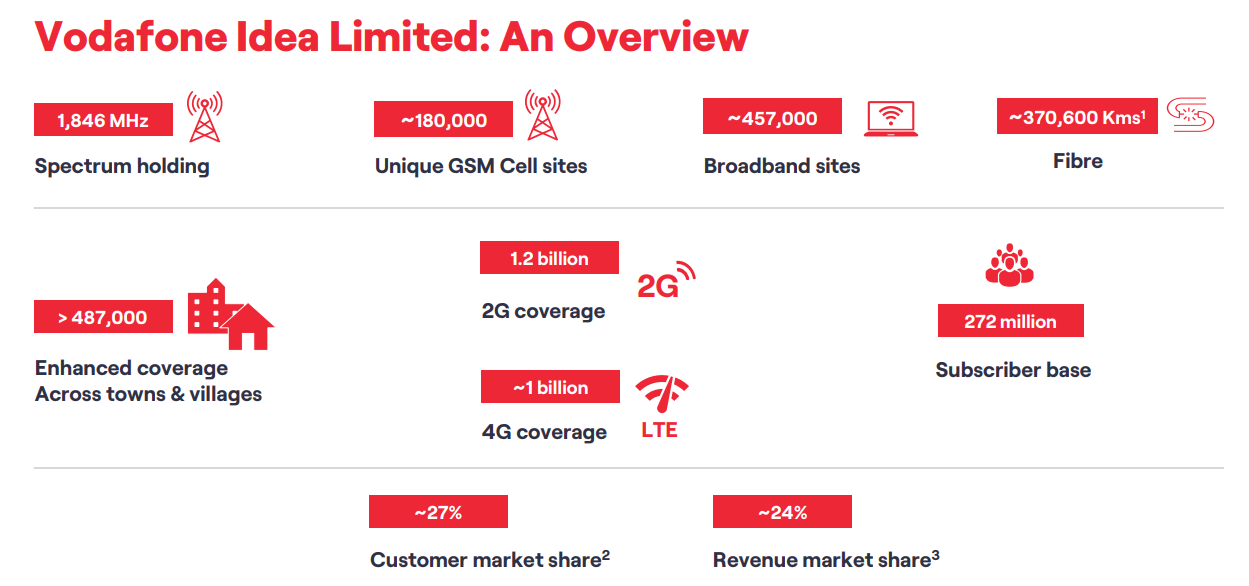

Vodafone Idea Limited (NSE:IDEA) is an Aditya Birla Group and Vodafone Group partnership. The Company provides pan India Voice and Data services across 2G, 3G and 4G platform. With the large spectrum portfolio to support the growing demand for data and voice, the company is committed to deliver delightful customer experiences and contribute towards creating a truly ‘Digital India’ by enabling millions of citizens to connect and build a better tomorrow. The Company is developing infrastructure to introduce newer and smarter technologies, making both retail and enterprise customers future ready with innovative offerings, conveniently accessible through an ecosystem of digital channels as well as extensive on-ground presence. The Company is listed on National Stock Exchange (NSE) and BSE in India.1

Promoters

Vodafone Group

Vodafone Group is one of the world’s largest telecommunications companies and provides a range of services including voice, messaging, data and fixed communications.2

Vodafone Group has mobile operations in 22 countries, partners with mobile networks in 42 more, and fixed broadband operations in 17 markets. As of 30 June 2020, Vodafone Group had approximately 625 million mobile customers, 27 million fixed broadband customers and 22 million TV customers, including all of the customers in Vodafone

Aditya Birla Group

The Aditya Birla Group is a leading Indian multinational in the league of Fortune 500. Anchored by an extraordinary force of over 120,000 employees, belonging to 42 nationalities. Over 50 per cent of its revenues flow from its overseas operations spanning 36 countries

The Aditya Birla Group was named the AON best employer in India for 2018 - the third time over the last 7 years. The Group was earlier ranked fourth in the world and first in Asia Pacific in the 'Top Companies for Leaders' study 2011, conducted by Aon Hewitt, Fortune Magazine and RBL (a strategic HR and leadership advisory firm). The Group has also topped the Nielsen's Corporate Image Monitor 2014-15 and emerged as the 'No.1 Corporate', the 'Best in Class', for the third consecutive year.

Service Offerings

For Consumer

Welcome to the world of Vodafone Idea Limited, where its millions of customers are at the heart of everything that the company do.

The company use the power of technology to enhance its customers’ lives – through ubiquitous presence and connectivity through its PAN India urban and rural coverage, a continuously expanding 4G LTE network, integrated worry free propositions and some of the best entertainment on mobile – all packaged into a completely unmatched customer experience.

The company's innovative and truly differentiated offerings – be it its Prepaid Unlimited propositions, RED Postpaid plans, Truly Unlimited International Roaming products and many others - reflect the passion with which the company aim to serve its customers, always!

For Enterprise

Vodafone Idea Business Services is committed to being the most trusted and valued partner helping businesses succeed in a digital world. The company's Total Communications solutions empower global and Indian corporations, public sector & government bodies, small & medium enterprises and start-ups.

From market-leading Enterprise Mobility, robust Connectivity and world-class IoT Solutions, to superior Business Communication & Cloud and insightful Business Analytics & Enabling Solutions, the company bring the smartest and newest technologies to serve businesses in the digital era.

The company's global expertise and deep local knowledge makes it the preferred digital enablement partner of enterprises across India. No matter which sector you operate in and regardless of your size and scale, business is better when Vodafone Idea is together.

Subsidiaries and Joint Venture

Subsidiaries

- Vodafone Idea Manpower Services Limited (VIMSL) erstwhile Idea Cellular Services Limited

- Vodafone M-pesa Limited (VMPL)

- Vodafone Idea Business Services Limited (VIBSL) erstwhile Vodafone Business Services Limited

- Vodafone Idea Communication Systems Limited (VICSL) erstwhile Mobile Commerce Solutions Limited

- Connect (India) Mobile Technologies Private Limited (CIMTPL)

- Vodafone Foundation (VF)

- Vodafone Idea Telecom Infrastructure Limited (VITIL) erstwhile Vodafone Towers Limited

- Vodafone Idea Shared Services Limited (VISSL) erstwhile Vodafone India Ventures Limited

- Vodafone Idea Technology Solutions Limited (VITSL) erstwhile Vodafone Technology Solutions Limited

- You Broadband India Limited (YBIL)

- You System Integration Private Limited (YSIPL)

Joint Venture Company

- Indus Towers Limited (Indus)

- Firefly Networks Limited

Associate Company

- Aditya Birla Idea Payments Bank Limited (ABIPBL)

Industry Overview

Indian Wireless Sector

The telecom industry continues to grapple with hypercompetition as all the operators have been selling heavily discounted unlimited voice plans with bundled data, in order to defend their subscriber base. The significant ARPU erosion, despite the multifold growth in volume of voice and data usage over the last several years has led to persistent financial stress for the operators. The increasing penetration of unlimited bundled plans has also necessitated continuing capex and spectrum investments to expand 4G coverage and capacity. Resultantly, none of the Indian telcos are making reasonable returns on their capital employed.3

After several years of hyper competition which led to tariff decline, in FY20, all the operators increased pre-paid tariffs in December 2019 across all price points for both unlimited plans as well as combo voucher plans. While the tariff hike was a step in the right direction, ARPU recovery still has a long way to go and the industry continues to provide unsustainably low tariffs. India continues to have the lowest tariffs globally, while the proliferation of unlimited data bundles have led to India having one of the highest data usage (per subscriber) in the world. Further, FY21 ARPU is lower in comparison to historic trends, despite the fact that the consumer gets much more value in terms of unlimited voice and daily data allowances, compared to five years ago. It may be noted that in China the operators do not have to pay for spectrum, whereas for VIL, Spectrum represents more than half of capital employed in the business. Despite that China’s ARPU is almost 4x of Indian ARPU.

As the operators continue to expand their 4G coverage and capacity, India witnessed an impressive growth in wireless broadband subscriber (>512 kbps), up from 258 million in March 2017 to 755 million in March 2021, an addition of 497 million subscribers in 5 years. As of March 2021, the wireless broadband subscribers base of 755 million in India was almost 33 times compared to 23 million wired broadband subscribers (source: TRAI). While the industry continues to witness robust broadband subscriber addition, at 64% broadband penetration, it’s still lower compared to developed countries and will remain an incremental opportunity for the Indian telecom operators.

4G penetration has seen significant growth in the last 5 years and now stands at more than 50%. 4G penetration is estimated to further increase to 73% by 2025, as per GSMA intelligence. This is backed by factors like high growth in the number of smartphone users, including growth in rural areas, due to usage of OTT platforms, social media, e-learning, and companies leaning towards hybrid/ flexi working models. The strong growth in smartphone users and the evolving capabilities of 4G and 5G networks open a much larger addressable market for sectors where internet is needed.

Business Overview

Mobile Business

The company, an Aditya Birla Group and Vodafone Group partnership, is a major telecommunication operator in India, offering Voice, Data, and other Value Added Services (“VAS”), business connectivity services including IoT, Cloud, managed services etc. The company is continuously engaged in developing world-class infrastructure to introduce newer and smarter technologies for its both retail and enterprise customers. The company aims to offer future ready technologies with innovative offerings that can be accessed conveniently through an ecosystem of digital channels as well as extensive presence on the ground.

Voice Services

The company offers Voice services in all 22 service areas. The company now covers more than 1.2 billion Indians in over 487,000 census towns and villages with its Voice services. The company also provides 4G VoLTE across all 22 circles to provide enhanced voice experience to its 4G subscribers. During FY21, the company also introduced Voice over WIFI (VoWiFi) calling feature for its subscribers. Currently, VoWiFi is being provided in select circles which will soon be rolled out to other circles in a phased manner.

Broadband Services

The company provides broadband data services on 3G and 4G platforms in all 22 service areas of India. The company’s broadband coverage is available in over 331,000 census towns and villages, covering more than a billion of the Indian population. The population coverage on 4G is more than 1 billion as well, as of March 31, 2021. During FY21, the company has started to shutdown its 3G network, while it continues to focus on expansion of its 4G network.

With Pan India broadband presence, and improving coverage and capacity post consolidation, the company has seen a steady rise in broadband subscriber penetration (as a percentage of reported subscribers) increasing from 40.3% in Q4FY20 to 46.2% in Q4FY21 and 4G penetration increasing from 36.3% to 42.5% in the same period. As the company continues to focus on 4G network expansion, 4G subscriber penetration should further improve in the coming years.

Content and Digital Offerings

The company has launched several digital initiatives to address the changing requirements of today’s digital society enabling individuals and enterprises to get a range of benefits and value-adds. Vi will offer not just enriched connectivity but also an array of digital products and services to complement the core business.

To provide best in class content to its customers through the application Vi Movies and TV, the company has tied up with various content creators and OTT apps like Voot Select, Fireworks, Sun NXT, Shemaroo Me, Hoichoi, Lionsgate Play, Hungama, TV Today, Discovery and others. The app provides a range of content including Movies, Live TV, TV shows, latest originals and short formats videos in 16+ languages. Additionally, the company has tie ups with leading content providers like Amazon Prime, Disney+Hotstar, Zee5 and Netflix for its premium customers

Large Subscriber Base

The company has 267.8 million subscribers as of March 31, 2021, of which 123.6 million were broadband subscribers. As the company is expanding its 4G coverage and capacity, this large subscriber base provides a great platform to upgrade voice only customers to users of data services and digital content.

Long Distance Services and ISP

The company holds licenses for NLD, ILD, ISP and IP-1 services. These licenses are used to carry inter-circle voice traffic of the company and also bring incoming voice traffic from top international carriers across the globe in to India. The company also sends all of the outgoing International Voice traffic on its own network and the interconnections with these licenses enable it. These licenses also help the company to offer various Enterprise Fixed Voice and Data Services to external customers like Enterprise, Government and Wholesale customers. Vodafone Idea ISP currently handles all captive subscriber traffic requirements.

Business Services

The company through Vodafone Idea Business Services provides total communication solutions to empower global and Indian corporations, public sector & government bodies, small & medium enterprises and start-ups. With robust enterprise mobility and fixed line connectivity, world-class IoT solutions and insightful business analytics & digital solutions, the company brings the smartest and newest technologies to serve businesses in the digital era. With the advantage of its global expertise and knowledge of local markets, Vi business endeavours to be a trusted and valued partner for businesses in a digital world.

Passive Infrastructure Services (Indus Towers)

On April 25, 2018, the merger of Bharti Infratel and Indus towers was announced to create a listed Pan-India tower Company. On November 19, 2020, the merger of Indus and Infratel got completed. The company has sold its 11.15% stake in Indus on completion of the merger for a cash consideration of Rs 37.6 billion in accordance with the terms of agreement. Out of the consideration received from Infratel, the company had made a prepayment of Rs 24 billion to the merged tower entity, which has been completely adjusted in line with terms of the agreement.

Financial Highlights

Revenues

Revenue from operations for the Financial Year ended March 31, 2021 decreased by Rs 30,053 Mn and stood at Rs 419,522 Mn for Financial Year ended March 31, 2021 as compared to Rs 449,575 Mn for Financial Year ended March 31, 2020, primarily due to decrease in IUC rates effective January 1, 2021 and reduction in Postpaid Revenue.

Other Income comprising of Interest Income, Gain on investments in mutual funds and others stood at Rs 1,742 Mn for Financial Year ended March 31, 2021 as compared to Rs 10,393 Mn for Financial Year ended March 31, 2020. The decrease is mainly on account of decrease in interest income amounting to Rs 6,143 Mn, decrease in gain on investment in mutual funds by Rs 2,479 Mn and decrease in others by Rs 29 Mn.

Operating Expenses

Total operating expenditure for the Financial Year ended March 31, 2021 decreased by Rs 50,385 Mn to Rs 250,065 Mn from Rs 300,450 Mn incurred for Financial Year ended March 31, 2020.

Employee benefit expenses for the Financial Year ended March 31, 2021 decreased by Rs 1,343 Mn to Rs 20,300 Mn from Rs 21,643 Mn incurred for Financial Year ended March 31, 2020 due to reduction in head count.

Network Expense and IT Outsourcing Cost decreased by Rs 13,978 Mn from Rs 109,916 Mn for the year ended March 31, 2020 to Rs 95,938 Mn for the year ended March 31, 2021 primarily due to decrease in power and fuel expenses, repairs and maintenance-plant and machinery expenses and IT outsourcing expenses to Rs 55,385 Mn, Rs 25,407 Mn and Rs 7,650 Mn for the year ended March 31, 2021 from Rs 60,842 Mn, Rs 28,236 Mn and Rs 11,343 Mn for the year ended March 31, 2020 respectively.

Subscriber Acquisition and Servicing Expenditure, decreased by Rs 11,622 Mn from Rs 29,299 Mn for Financial Year ended March 31, 2020 to Rs 17,677 Mn for Financial Year ended March 31, 2021 primarily due to contract cost capitalisation under Ind AS 115 with effect from October 1, 2020 and reduction in Subscriber Acquisition.

Advertisement, Business Promotion Expenditure and Content Cost decreased by Rs 3,899 Mn from Rs 11,774 Mn for Financial Year ended March 31, 2020 to Rs 7,875 Mn for Financial Year ended March 31, 2021 primarily due to reduction in Advertisement and Business Promotion Expenditure.

Other expenses decreased by Rs 5,277 Mn from Rs 19,321 Mn for Financial Year ended March 31, 2020 to Rs 14,044 Mn for Financial Year ended March 31, 2021 primarily due to reduction in Travelling and conveyance, Legal and professional charges and Support service charges.

EBITDA

The EBITDA has increased by Rs 11,681 Mn from Rs 159,518 Mn for Financial Year ended March 31, 2020 to Rs 171,199 Mn for Financial Year ended March 31, 2021. EBITDA as a percentage of total income increased to 40.6% compared to 34.7% for Financial Year ended March 31, 2020.

Depreciation and Amortisation expenses decreased by Rs 7,179 Mn from Rs 243,564 Mn for Financial Year ended March 31, 2020 to Rs 236,385 Mn for Financial Year ended March 31, 2021. The depreciation charge for the year has decreased by Rs 7,067 Mn from Rs 152,080 Mn for Financial Year ended March 31, 2020 to Rs 145,013 Mn for Financial Year ended March 31, 2021, primarily as a result of assets impaired and lower one day impact. The amortisation charge for the year has decreased by Rs 112 Mn from Rs 91,484 Mn for Financial Year ended March 31, 2020 to Rs 91,372 Mn for Financial Year ended March 31, 2021, primarily as a result of lower one day impact off set by change in useful life of Brand.

Finance Charges for Financial Year ended March 31, 2021 increased by Rs 26,061 Mn from Rs 153,920 Mn to Rs 179,981 Mn, primarily due to increase in interest on deferred payment obligation pursuant to AGR judgement during the year by Rs 33,763 Mn and increase in interest on deferred payment liability towards spectrum due to availment of moratorium by approximately Rs 7,000 Mn partially offset by decrease in forex loss by Rs 10,095 Mn and decrease in interest on lease liability by Rs 5,346 Mn.

Exceptional Items

Exceptional Items for the year ended March 31, 2021 amounting to Rs 199,681 Mn comprises of ![]() charge towards AGR matters Rs 194,405 Mn, (ii) integration and merger related costs Rs 9,892 Mn, (iii) Gain due to cancellation of lease contract on network re-alignment Rs 1,696 Mn (iv) accelerated depreciation/impairment of assets on account of network re-alignment/re-farming Rs 5,745 Mn, (v) One Time Spectrum Charges Rs 5,027 Mn, (vi) Impairment of Brand Rs 7,246 Mn, (vii) Gain on sale of stake in Indus Rs 21,189 Mn and (viii) others Rs 251 Mn.

charge towards AGR matters Rs 194,405 Mn, (ii) integration and merger related costs Rs 9,892 Mn, (iii) Gain due to cancellation of lease contract on network re-alignment Rs 1,696 Mn (iv) accelerated depreciation/impairment of assets on account of network re-alignment/re-farming Rs 5,745 Mn, (v) One Time Spectrum Charges Rs 5,027 Mn, (vi) Impairment of Brand Rs 7,246 Mn, (vii) Gain on sale of stake in Indus Rs 21,189 Mn and (viii) others Rs 251 Mn.

Profits and Taxes

The loss before tax for the Financial Year ended March 31, 2021 stood at Rs 442,534 Mn as compared to a loss of Rs 617,970 Mn for Financial Year ended March 31, 2020. The loss after tax for Financial Year ended March 31, 2021 stood at Rs 442,331 Mn as compared to a loss of Rs 738,781 Mn for Financial Year ended March 31, 2020.

Capital Expenditure

During the Financial Year 2020-21, the capital expenditure (including capital advances and excluding RoU assets and Spectrum) incurred was Rs 37,981 Mn. Further to the above, the Company has incurred Rs 3,552 Mn towards Bandwidth and Rs 5,747 Mn towards the upfront payment for the unassigned spectrum.

Cash Flow

The cash generated from operations of Rs 156,397 Mn (net of Rs 10,000 Mn paid towards the AGR matter), cash realized on sale of current investments amounting to Rs 37,472 Mn, proceeds of short term investment in fixed deposits amounting to Rs 16,477 Mn, Net sale of current investments amounting to Rs 4,952 Mn, interest received of Rs 1,797 Mn, and Dividend received from Indus Rs 1,115 Mn was primarily used for net repayment of lease liabilities and borrowings of Rs 139,058 Mn, payment towards capital expenditure (net of sale proceeds) Rs 45,315 Mn, payment of interest and finance charges Rs 28,256 Mn, Payment towards Spectrum and Licenses - Upfront payment of Rs 5,747 Mn. Consequently, Cash and Cash Equivalents as at March 31, 2021 stood at Rs 3,503 Mn

Q2FY22 results

Highlights for the Quarter

Revenue grew by 2.8% QoQ to Rs. 94.1 billion supported by the gradual resumption of economic activity post severe second wave of COVID, which had negatively impacted Q14

Continued network capacity expansion supported by spectrum refarming and network upgrade to 4G

Vi powered by GIGAnet is India’s fastest mobile network as verified by Ookla

VIL has the best voice quality for 9 out of 11 months between November 2020 and September 2021, as per TRAI ‘MyCall’ App

Cost optimization underway with 80% savings achieved as of Q2FY22 on a run rate basis against a target of Rs. 40 billion annualized opex savings

Ravinder Takkar, MD & CEO, Vodafone Idea Limited, said “The company welcome the Government’s landmark reform package which addresses several industry concerns and provides immediate relief to the financial stress in the sector. The company also appreciate the Government’s recognition of the telecom sector’s contribution in keeping the country connected during the pandemic. During the last quarter, the company witnessed a recovery in its operating momentum as the economy has started to gradually open up aided by the ongoing rapid vaccination drive. The company continue to improve its 4G subscriber base on the back of superior data and voice experience on Vi GIGAnet, India’s fastest mobile network, which is testified through consistent top rankings in Ookla and TRAI. The company continue to focus on executing its strategy to improve its competitive position and win in the marketplace.”

Financial highlights

Revenue for the quarter was Rs. 94.1 billion, an improvement of 2.8% QoQ, aided by pick up in the economic activities and easing of lockdown/restrictionsinduced by severe second wave of COVID, which impacted Q1FY22. On a reported basis, EBITDA for the quarter improved to Rs. 38.6 billion, up 4.2% QoQ, aided by improvement in revenue which was partially offset by increase in customer acquisition costs due to higher gross additions during the quarter and other inflationary cost increases. EBITDA margins were 41.1% vs 40.5% in Q1FY22. EBITDA excluding IndAS 116 impact was Rs. 15.6 billion, compared to Rs. 13.8 billion in Q1FY22. Capex spend for Q2FY22 was Rs. 13.0 billion vs Rs. 9.4 billion in Q1FY22.

The total gross debt (excluding lease liabilities and including interest accrued but not due) as of September 30, 2021 stands at Rs. 1,947.8 billion, comprising of deferred spectrum payment obligations of Rs. 1,086.1 billion, AGR liability of Rs. 634.0 billion that are due to the Government and debt from banks and financial institutions of Rs. 227.7 billion. Cash & cash equivalents were Rs. 2.5 billion and net debt stood at Rs. 1,945.3 billion.

Operational highlights

The company continue to invest in 4G to increase its coverage and capacity. During the quarter, the company added ~10,800 4G FDD sites primarily through refarming of 2G/3G spectrum (shutdown ~9,600 3G sites) to expand its 4G coverage and capacity. The company's overall broadband site count stood at 450,481, compared to 447,114 in Q1FY22. Till date, Vodafone Idea has deployed over 65,000 TDD sites in addition to the deployment of ~13,850 Massive MIMO sites and ~13,000 small cells. The company continue to expand its LTE 900 presence in 12 circles at multiple locations, including through dynamic spectrum refarming, to improve customer experience. The company's 4G network covers over 1 billion Indians as of September 30, 2021 (4G coverage is the population reached/covered by VIL with its 4G network).

These network investment initiatives continue to deliver a significant capacity uplift with its data capacity now over 2.8x compared to September 2018. The company's relentless pursuit to have a superior 4G network in the country, through integration and incremental network investments post-merger, are clearly visible through its top rankings on 4G speeds in various external reports. Vi powered by GIGAnet is India’s fastest mobile network* as verified by Ookla®. The company also have the highest rated voice quality in the country as per TRAI’s “MyCall” app data for 9 out of 11 months between November 2020 and September 2021.

The company's unified brand “Vi”, celebrated its first anniversary in September 2021, and has already garnered strong awareness and continues to build brand affinity across all customer segments in the country. The subscriber base now stands at 253.0 million vs 255.4 million in Q1FY22, a decline of 2.4 million. However, the 4G subscriber base saw healthy addition of 3.3 million, with overall 4G base now at 116.2 million. Subscriber churn has also improved to 2.9% in Q2FY22 vs 3.5% in Q1FY22. As Q1FY22 witnessed significantly higher data usage during the lockdown, the QoQ data volume growth remained moderate at 0.4%. On a YoY basis, data volumes have witnessed strong growth of 27.1%. Data usage per 4G subscriber is now at 14.5 GB/month vs 11.8 GB/month a year ago.

ARPU improved to Rs. 109, up 5.3% QoQ vs Rs. 104 in Q1FY22. This quarter the company had taken certain pricing initiatives to improve ARPU, in line with its stated strategy. The company increased the entry level prepaid pricing plan from Rs. 49 to Rs. 79, in a phased manner, as well as increased the tariffs in some postpaid plans.

The company conducted 5G trials on Government allocated spectrum bands like 26 GHz and 3.5 GHz in Pune (Maharashtra) and Gandhinagar (Gujarat). Vodafone Idea has demonstrated peak speeds of 4.2 Gbps on 26 GHz band and 1.5 Gbps on 3.5 GHz. The company also tested E band backhaul spectrum where the company demonstrated the peak speeds of 9.8 Gbps.