WPP plc

Summary

- WPP is a Leader among Global Marketing Service providers.

- WPP Plc is a creative transformation company offers creative services including advertising, marketing, and brand strategies and campaigns across all media.

- Recently WPP acquired Corebiz, a leading Latin American ecommerce agency specialising in VTEX implementation

WPP Plc (NYSE:WPP, LSE:WPP) is a creative transformation company offers creative services including advertising, marketing, and brand strategies and campaigns across all media.

Recent Developments

WPP named a Leader in new analysis of Global Marketing Service Providers.1

10 Aug 2022; WPP has been named a Leader among Global Marketing Service providers in The Forrester Wave™: Global Marketing Services, Q3 2022 report. The research evaluated a field of 10 of the most significant service providers, which were invited to participate in the evaluation.

WPP acquires leading ecommerce agency Corebiz2

18 Jul 2022; WPP announces that it is acquiring Corebiz, a leading Latin American ecommerce agency specialising in VTEX implementation, one of the largest enterprise digital commerce platforms in the region.

Founded in 2013, Corebiz employs over 600 people across Latin America, with the majority of its headcount based in its São Paulo and Franca offices in Brazil. The Brazilian operations of the company will join the VMLY&R COMMERCE global network, with further regional outposts of the business coming onboard over the course of the coming year. This acquisition reflects WPP’s ongoing investment into strengthening its commerce offer for clients as consumer needs continue to change.

Financial Highlights

2022 Interim Results

- H1 reported revenue up 10.2%, LFL revenue 8.7% (Q2 9.3%)3

- H1 revenue less pass-through costs up 12.5%, LFL revenue less pass-through costs up 8.9% (up 9.4% on H1 2019)

- Q2 LFL revenue less pass-through costs up 8.3%: US 10.4%, UK 6.2%, Germany 11.5%, China (6.1)% (affected by lockdowns), Australia 3.2%

- Strong new business performance: $3.4 billion net new billings in H1

- H1 headline operating profit margin 11.6%, down 0.5pt on prior year as expected, as a result of higher personnel costs and a return to business travel

- Trade working capital cash outflow £232 million year-on-year; still expected to be around flat year-on-year at year-end

- Adjusted net debt at 30 June 2022 £3.1 billion, up £1.6 billion year-on-year after £1.1 billion of share buybacks since June 2021

2021 Full Year

Reported billings were £50.7 billion, up 8.0%, from £46.9 billion in 2020 and up 14.4% on a like-for-like basis compared to last year.4

Reported revenue from continuing operations was up 6.7% at £12.8 billion compared to £12.0 billion in 2020. Revenue on a constant currency basis was up 11.6% compared with last year. Net changes from acquisitions, disposals and other adjustments had a negative impact of 1.7% on growth.

Like-for-like revenue growth for 2021, excluding the impact of currency, acquisitions and disposals, and the other adjustments, was 13.3%, as compared to 2020.

Operating profit was up 18.5% to £1.5 billion. Rerating profit was up 18.5% to £1.5 billion. The significant growth in profitability year-on-year reflects the strong recovery from the impact of Covid-19 on revenue less pass-through costs, as well as improvement in its competitive performance and the progress on its transformation programme, with £245 million of gross savings towards its 2025 annual run rate target of £600 million.

Reported profit before tax was £951 million, compared to a loss of £2.8 billion in 2020, reflecting principally the £3.1 billion of impairment charges and investment write-downs and £313 million of restructuring and transformation costs during the prior period.

Reported profit after tax was £721 million compared to a loss in 2020 of £2.9 billion.

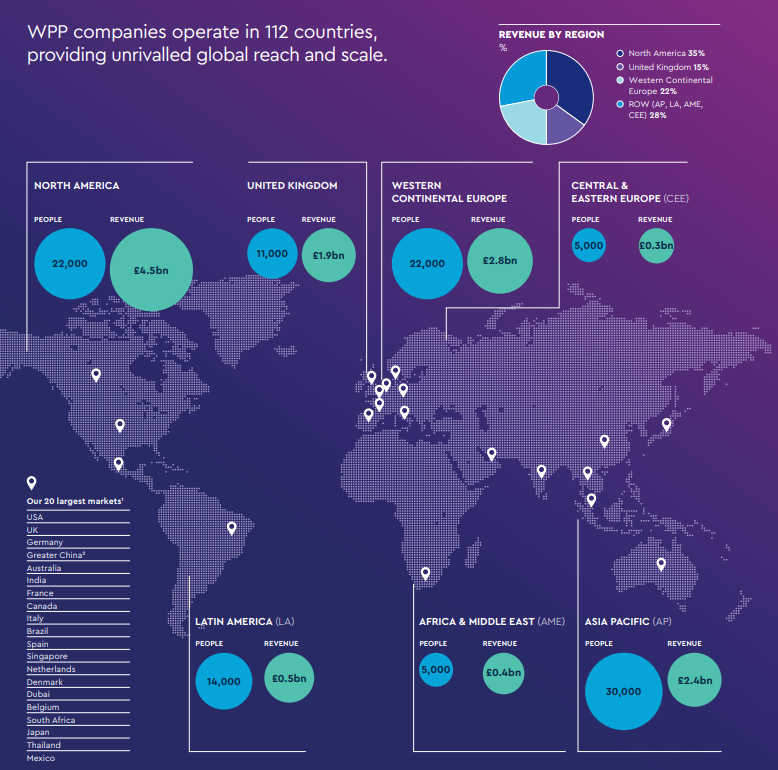

North America like-for-like revenue less pass-through costs was up 9.7%, and up 3.3% on a two-year basis. The USA and Canada performed strongly in the year, led by GroupM, VMLY&R and Hogarth. Headline operating profit was up £44 million to £656 million in 2021 from £612 million in 2020.

United Kingdom like-for-like revenue less pass-through costs was up 15.0%, and up 2.9% on a two-year basis. AKQA Group and VMLY&R were the strongest performers. Headline operating profit was up £43 million to £181 million in 2021 from £138 million in 2020.

Western Continental Europe like-for-like revenue less pass-through costs was up 14.5%, and up 5.2% on a two-year basis. The strongest performers in the year were Italy, the Netherlands and Germany. Headline operating profit was up £90 million to £289 million in 2021 from £199 million in 2020.

In Asia Pacific, Latin America, Africa & the Middle East and Central & Eastern Europe, like-for-like revenue less pass-through costs was up 12.3%, and up 0.7% on a two-year basis. Latin America was boosted by a very strong performance in Brazil, while Asia Pacific continued to be negatively impacted by Covid-related restrictions in Australia. Headline operating profit was up £56 million to £368 million in 2021 from £312 million in 2020.

In 2021, net cash outflow was £256 million, compared to a £1.0 billion inflow in 2020. The main drivers of the cash flow performance year-on-year were the higher operating profit and continued improvements in working capital, offset by increased spend on acquisitions, growth in the dividend and the significant increase in the share buyback.

As at 31 December 2021 the company had cash and cash equivalents of £3.5 billion and total liquidity, including undrawn credit facilities, of £5.5 billion. Average adjusted net debt in 2021 was £1.6 billion, compared to £2.3 billion in the prior year, at 2021 exchange rates. On 31 December 2021 adjusted net debt was £0.9 billion, against £0.7 billion on 31 December 2020, an increase of £0.2 billion at 2021 exchange rates.

Business Overview

WPP is the creative transformation company. The company offer clients a comprehensive range of communications, experience, commerce and technology services.

WPP clines includes 317 of the Fortune Global 500, 62 of the FTSE 100, and all 30 of the Dow Jones 30.

The company provide services to clients through integrated creative agencies and media agencies, public relations agencies and specialist agencies.

Global Integrated Agencies

The company's creative services include advertising, marketing and brand strategies and campaigns across all media. WPP is increasing its share in targeted fast-growth areas including digital communications, healthcare, ecommerce, experience, marketing technology and production.

The company's media offer includes the full range of media planning and buying services, delivered primarily through GroupM, the world’s leading media investment company, and its agencies. Targeted growth segments are digital media (search, social and programmatic), new business models such as Xaxis and Finecast, and data and technology.

Public Relations

The company's PR firms help clients communicate with their stakeholders, from consumers and investors to governments and NGOs. Purpose and reputation, sustainability and digital and social media are key growth areas.

Specialist Agencies

The company's specialist agencies provide services by region or type. Brand experience and identity, and specialist, targeted services are the principal growth segments.

WPP companies operate in 112 countries,

Industry Overview

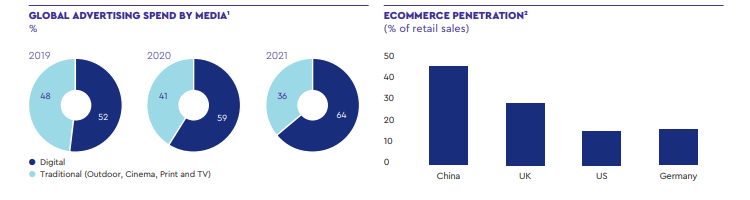

2021 was an extraordinary year for its industry. Growth in spend was supported by a stronger-than-expected macroeconomic environment, a consumption boost from pent-up saving and structural growth in digital channels. According to GroupM estimates, global advertising spending grew by 22.5% in 2021, a considerably better outcome than the 12.3% forecast in December 2020.

The pace of growth in digital advertising has continued to accelerate, reflecting the seismic shift in the way people consume media. GroupM estimates that global digital advertising spend grew by 30.5% in 2021, and now accounts for 64.4% of total spend, up from 59.3% in 2020.

Ecommerce Demand is Exploding

Within digital, one of the big drivers of growth has been the explosion in ecommerce. The pandemic accelerated a widespread shift towards shopping online, amplifying the number of opportunities for brands to connect with consumers on digital channels, while also levelling the playing field for challenger brands. GroupM estimates that global retail ecommerce advanced 20.4% in 2021.

Growing Tv Market

By medium, TV had a strong year with global advertising spend on TV growing by 11.7% in 2021, as advertisers invested in their brand-building strategies. It also reflects the growth of connected TV and the increased targeting and measurement potential this brings to advertisers. Despite restrictions on mobility, spend on outdoor also grew, supported by the increasing availability of digital screens and programmatic options. Audio also saw some growth reinforced by podcasting, while cinema has been slower to recover. Print was the only medium to decline, reflecting the trends in circulation.

Country Trends

The UK, United States and China remain the largest contributors to growth in advertising spend, spurred by their exposure to digital. Based on GroupM findings, the UK has been the fastest growing among major markets, growing 35.7%, while spend in the US, excluding political advertising, grew by 28.4%. China saw growth in advertising spend of 18.8% in the year, against a tougher comparative, with digital accounting for nearly 90% of the market. The company's fastest-growing Western European market was France where advertising spend grew by 19.0%. Germany’s growth was tempered by lingering Covid-19 restrictions and less favourable comparatives, with advertising spend advancing 10.5%.

References

- ^ https://www.wpp.com/news/2022/08/wpp-named-a-leader-in-new-analysis-of-global-marketing-service-providers

- ^ https://www.wpp.com/news/2022/07/wpp-acquires-leading-ecommerce-agency-corebiz

- ^ https://www.wpp.com/news/2022/08/2022-interim-results

- ^ https://www.wpp.com/-/media/project/wpp/files/investors/2022/annual-report-2021/wpp-annual-report-2021---.pdf