Walton Group

Summary

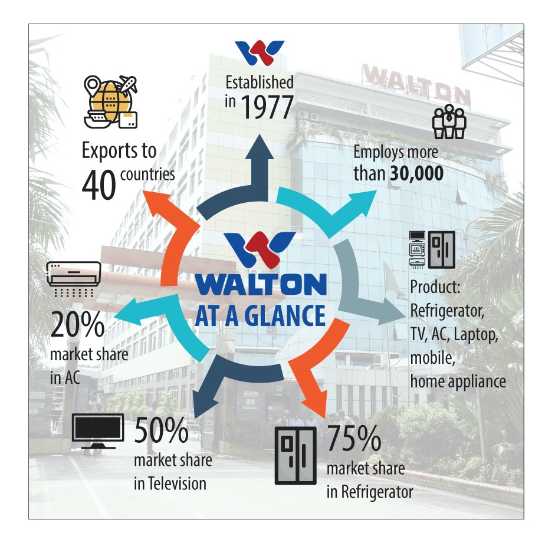

- Walton Group (DSE: WALTONHIL, CSE:WALTONHIL) is a tech-manufacturing giant leading in the market of refrigerator, air conditioner, television, and home appliances.

- Walton is the only local manufacturer in Bangladesh that exports to more than 40 countries around the world.

- The company has entered the capital market to raise Tk 1.0 billion capital by selling 0.97% of its total shares. Of the total shares, 1.55 million has been sold to the general investors and 1.38 million to the institutional investors.

- Walton Hi-Tech Industries Limited has made its debut on the secondary market on September 23, 2020. On the first day of trading, a public hype has caused the stock to raise in price up to the ceiling of a 50% increase.

- The company share has been upgraded to ‘A’ category from ‘N’ category by the country’s capital market on January 18, 2021.

Company Background

Walton is a multinational company headquartered in Bangladesh. The company was established back in 1977 as Rezvi & Brothers and got registered as R. B. Groups of Companies Limited in 2001. The group of companies produces electricals, electronics, automobiles, smartphones, and other appliances under the brand name “Walton”.

The company is equipped with largest R&D facilities and has a substantial market share in both domestic and international markets. According to the company website, Walton is a professional manufacturer with high reputation and unbeatable capacity of producing what it produces in the most competitive way in terms of cost, quality, innovation and design. The company has 22 production bases in 680+ acres of land employing 20,000+ employees.

Walton belongs to the R.B. Group, which is a local business conglomerate that produces and markets the products under the brand name “Walton”. Therefore, the group is known as Walton Group. The conglomerate has 8 sister concerns including Walton Hi-Tech Industries Limited, Walton Micro-Tech Corporation, Walton Digi-Tech Industries Limited, and Walton Motors.1

Major products of the company are refrigerator, television, air conditioner, laptops, mobile phones and a latest addition is elevator. The company also had started producing motorcycles initially. Currently, it has become the tech giant in Bangladesh as it holds 66% share of refrigerator market, 50% share of television market and 33% share of the air conditioner market. The business of the company in technological sector started in 1997 when Walton started importing and marketing black-and-white television sets. The company later on started importing parts of television and motorcycles to start assembling them. The assembling business continued until 2010 when the management found that it can start manufacturing the products locally. Imported products were not meeting the need of the consumers in the local market. Upon establishment of Walton Hi-Tech Industries Limited in 2006, the company started producing refrigerator and motorcycles that got huge response from the consumers owing to the competitive pricing and high quality. The company then moved to produce air conditioner.

The distribution channel of the company is extensive throughout the country. It has a market coverage using more than 13,000 POS (Point of Sale) and different distribution channels such as Walton Plaza, Dealers, Walton E-Plaza, Distributors, Sub-Dealers, Corporate Sales, International Business Unit (IBU), Original Equipment Manufacturer (OEM), and Original Design Manufacturer (ODM).

Global Operation

Walton has become the first local electronic company of Bangladesh to export its products in more than 40 countries around the world, mainly in the Middle-East and African countries as well as some European countries such as Romania and Germany.2 Primary products of export are televisions, air conditions, and mobile phones. The brand maintains international representative offices located in Qatar, China, Nepal, India, Thailand, and USA. The company has started exporting smartphones to the USA market and air conditioner to the Indian market. The company also plans to invest $500,000 in the USA through Walton Corporation United States of America.3

Subsidiaries

Walton Hi-Tech Industries Limited

Walton Hi-Tech Industries Limited (WHIL) is the top subsidiary of R.B. Group. It came into existence on April 17, 2006 by being incorporating as a private limited company. Operation of the company started in 2008. On May 14, 2018, the company got registered as a public limited company with Registrat of Joint Stock Companies and Firms (RJSC) as per Company Act 1994. WHIL is the first complete manufacturer of Electrical & Electronic (E&E) products in Bangladesh. The company produces refrigerator, air conditioner, freezer, compressor, television and home electrical appliances.

WHIL received many awards which indicates the success of the company operation. Some awards are listed below –

- Best Brand Award Bangladesh – 2014

- DHL-Daily Star Bangladesh Business Award – 2014

- Global Brand Excellence Awards – 2014

- The Golden Globe Tigers Summit Awards – 2015

- “Highest VAT Payer in Dhaka International Trade Fair (DITF)” for the consecutive last twelve years till 2018

- Bangladesh Master Brand Award – 2018

- 8th HSBC Export Excellence Award – 2018

- National Environment Award – 2018

WHIL is the subsidiary through which Walton Group has exposed its operation to the capital market. The subsidiary issued IPO through book building method in Dhaka Stock Exchange (DSE) in 2020. IPO subscription begun on August 8, 2020 and lottery results published on 06 September, 2020. The company raised Tk 100 crore from the offering.

Walton Micro-Tech Corporation

This subsidiary of Walton Group is situated beside WHIL in Chandra, Gazipur, Bangladesh. The company was established separately to facilitate production of small electronics such televisions (LED, CRT), blender, induction cooker, rice cooker, hair dryer, fan, air cooler, LED lights, electric motor, mobile phones and so on.

Walton Digi-Tech Industries Limited

Walton Digi-Tech Industries Limited, located beside WHIL, is a sister concern of Walton Group.4 This subsidiary of the company produces laptops, mobile, PCB/PCBA, software, server infrastructure, and software application.5 The company wants to provide innovative solutions to the customers and become a top computer manufacturer by 2022 with the tag ‘Made in Bangladesh’. Walton Digi-Tech Industries Limited is primarily concerned with laptop production of Walton Group.

The Stock Market Debut, 2020

Walton Group has made its stock market debut in 2020 by offloading 0.97% shares of its subsidiary Walton Hi-Tech Industries Limited. Of the 0.97% shares, 0.46% is allocated to the institutional investors and 0.51% to the general public. The rest 99.03% shares are held by the sponsor-directors. The IPO (initial public offering) received its go-ahead on June 23, 2020 from the authority. IPO subscription has been open between August 9 and August 16 of the same year. The lottery was held on September 06, 2020.

AAA Finance and Investment Limited was the issue manager of the IPO. The target of the offering was to raise a capital equal to Tk 1.0 billion. The company has its authorised capital of Tk 6.0 billion, while the pre-IPO paid-up capital was Tk 3.0 billion. Under book building method, electronic bidding was conducted due to Covid-19 and the price was fixed at Tk 315 each share for the eligible institutional investors, who have received 1.38 million shares. Besides the statutory discount of 10%, the company has granted an additional 10% discount, making it 20%, for the general investors; thus, the price for the general investors including non-resident Bangladeshis was Tk 252 each share. The number of shares sold at this discounted price is 1.55 million.

There has been a general hype about the tech giant in the country going public. The stock made its debut trading on both the stock markets, Dhaka Stock Exchange (DSE) and Chattagram Stock Exchange (CSE), on September 23, 2020. The public hype has caused a stellar 50% increase, which is the ceiling, in the price of the stock on the first day of trading in both exchanges.

The Stock Market Debut, 2020

Walton Group has made its stock market debut in 2020 by offloading 0.97% shares of its subsidiary Walton Hi-Tech Industries Limited. Of the 0.97% shares, 0.46% is allocated to the institutional investors and 0.51% to the general public. The rest 99.03% shares are held by the sponsor-directors. The IPO (initial public offering) received its go-ahead on June 23, 2020 from the authority. IPO subscription has been open between August 9 and August 16 of the same year. The lottery was held on September 06, 2020.

AAA Finance and Investment Limited was the issue manager of the IPO. The target of the offering was to raise a capital equal to Tk 1.0 billion. The company has its authorised capital of Tk 6.0 billion, while the pre-IPO paid-up capital was Tk 3.0 billion. Under book building method, electronic bidding was conducted due to Covid-19 and the price was fixed at Tk 315 each share for the eligible institutional investors, who have received 1.38 million shares. Besides the statutory discount of 10%, the company has granted an additional 10% discount, making it 20%, for the general investors; thus, the price for the general investors including non-resident Bangladeshis was Tk 252 each share. The number of shares sold at this discounted price is 1.55 million.

There has been a general hype about the tech giant in the country going public. The stock made its debut trading on both the stock markets, Dhaka Stock Exchange (DSE) and Chattagram Stock Exchange (CSE), on September 23, 2020. The public hype has caused a stellar 50% increase, which is the ceiling, in the price of the stock on the first day of trading in both exchanges.

Business Overview of WHIL

The business activity of WHIL is usually referred to as the business of Walton Group. Therefore, by the word ‘Walton’, usually WHIL is referred. Mission of the company is to ensure customer satisfaction through innovation, latest technologies, better services and superior quality. The vision of the company is to become an influential global brand by 2022 and reach the milestone of becoming one of the top 5 global brands within 2030 in the Electrical & Electronics Products sector.

The main product of the company is refrigerator, the demand of which has increased significantly from 300,000 pieces in 2008 to 1,700,000 pieces in 2019-20. Price per piece also came down from Tk 60,000 to Tk 25,000 during the same period. The market size of refrigerator in Bangladesh is about Tk 6,000 crore per annum, of which Walton holds 75%. The company is also becoming dominant in the air conditioner industry by selling 78,000 pcs in 2019-20 and holding 20% market share. Apart from that the company is excelling in the TV (50% market share), home appliances, elevator, and electrical appliances industry.

Walton has made Tk 7.26 billion in profit after tax in the FY 2019-20 down from Tk 13.76 billion in FY 2018-19. A closer inspection of the income statement reveals that the sale of refrigerator and air conditioner has declined significantly from Tk 47.78 billion to Tk 31.24 billion. Although sales of TV and other appliances have increased by about Tk 6 billion, the decline in sales of the aforementioned category has shoot down total revenue by Tk 10 billion. Due to the Covid-19 pandemic in the year 2020, the company remained shut from 25 March, 2020 to 30 May, 2020. Amid the lockdown, the company observed two festivals, and after the lockdown, it has run business only at a limited scale. The peak season for sale of refrigerator and air conditioner is Aril-June. Since the company remained shut in that period, and the consumers feared a financial crisis, the company faced business loss in the form of declined sales.

Apart from the decline in revenue, the profit after tax has decreased because of increase in the costs such as administrative expenses, financial expenses, and non-operating expenses. Basic earnings per share of the company for FY 2019-20 is Tk 24.21 while it was 45.87 a year earlier. The company has a net asset value (NAV) of Tk 264.48 for FY 2019-20 which was Tk 243.16 a year earlier. It can be noted that the company has entered the stocks market with highest NAV ever as a company in Bangladesh. Both non-current and current assets of the company have increased over the year; shareholder’s equity and liabilities has also increased. Current liabilities of the company have increased and it has paid some long-term loans; all these things amounted to the increase in the NAV.

Recent development

- The company share has been upgraded to ‘A’ category from ‘N’ category by the country’s capital market on January 18, 2021.

- Walton has launched Walcart, an e-commerce platform on 19/12/2021. This is a major step is the expansion of the business of Walton.6

- ^ https://www.risingbd.com/english/education/news/743

- ^ https://www.dhakatribune.com/business/2021/05/24/walton-to-go-global-through-us-branch

- ^ https://www.dhakatribune.com/business/2021/05/24/walton-to-go-global-through-us-branch

- ^ https://www.linkedin.com/company/walton-digitech/about/

- ^ http://digi-tech.com.bd/

- ^ https://www.thedailystar.net/business/economy/e-commerce/news/walton-launches-e-commerce-company-walcart-2921481