lululemon athletica

Summary

- lululemon athletica inc.is principally a designer, distributor, and retailer of healthy lifestyle inspired athletic apparel and accessories.

- The company operated 521 stores in 17 countries across the globe.

- The company work with a group of approximately 40 vendors that manufacture its products and approximately 65 suppliers to provide the fabrics for its products.

Company Overview

Founded in Vancouver, Canada in 1998, lululemon athletica (NYSE:LULU, TSX:LULU) is a technical athletic apparel company for yoga, running, training and most other sweaty pursuits.1

lululemon athletica inc. is principally a designer, distributor, and retailer of healthy lifestyle inspired athletic apparel and accessories. lululemon has a vision to be the experiential brand that ignites a community of people through sweat, grow, and connect, which the company call "living the sweatlife." Since its inception, lululemon has fostered a distinctive corporate culture; the company promote a set of core values in its business which include taking personal responsibility, nurturing entrepreneurial spirit, acting with honesty and courage, valuing connection and inclusion, and choosing to have fun. These core values attract passionate and motivated employees who are driven to achieve personal and professional goals, and share its purpose "to elevate the world by unleashing the full potential within every one of it."2

Products

The company's healthy lifestyle inspired athletic apparel and accessories are marketed under the lululemon brand. The company offer a comprehensive line of apparel and accessories. The company's apparel assortment includes items such as pants, shorts, tops, and jackets designed for a healthy lifestyle including athletic activities such as yoga, running, training, and most other sweaty pursuits. The company also offer a range of products designed for being On the Move and fitness-related accessories. The company expect to continue to broaden its merchandise offerings through expansion across these product areas.

The company's design and development team continues to source technically advanced fabrics, with new feel and fit, and craft innovative functional features for its products. Through its vertical retail strategy and direct connection with its customers, who the company refer to as guests, lululemon is able to collect feedback and incorporate unique performance and fashion needs into its design process. In this way, the company believe lululemon is better positioned to address the needs of its guests, helping it advance its product lines and differentiate it from the competition.

During the second quarter of 2020, the company acquired Curiouser Products Inc., dba MIRROR. MIRROR is an in-home fitness company with an interactive workout platform that features live and on-demand classes. The acquisition of MIRROR bolsters its digital sweatlife offerings and brings immersive and personalized in-home sweat and mindfulness content to new and existing lululemon guests.

Segments

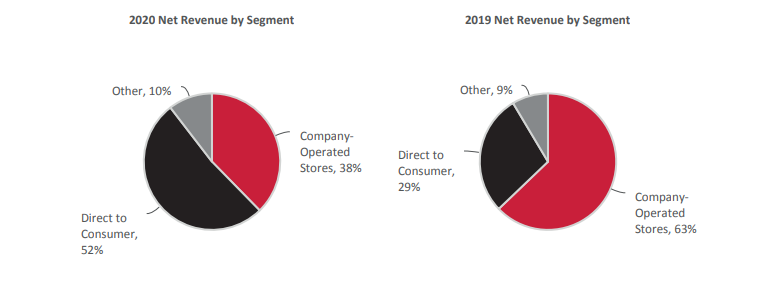

The company primarily conduct its business through two channels: company-operated stores and direct to consumer. The company also conduct business through MIRROR, operate outlets and temporary locations, serve certain wholesale accounts, have license and supply arrangements, and hold warehouse sales from time to time. The financial results of these operations are disclosed in Other.

Company-Operated Stores

At the end of 2020, the company operated 521 stores in 17 countries across the globe. In addition to being a venue to sell its products, its stores give it a direct connection to its guest, which the company view as a valuable tool in helping it build its brand and product line. The company's retail stores are located primarily on street locations, in lifestyle centers, and in malls.

| Number of stores by country | January31, 2021 | February02, 2020 |

| United States | 315 | 305 |

| Canada | 62 | 63 |

| People's Republic of China | 55 | 38 |

| Australia | 31 | 31 |

| United Kingdom | 16 | 14 |

| Germany | 7 | 6 |

| New Zealand | 7 | 7 |

| South Korea | 7 | 5 |

| Japan | 6 | 7 |

| Singapore | 4 | 4 |

| France | 3 | 3 |

| Malaysia | 2 | 2 |

| Sweden | 2 | 2 |

| Ireland | 1 | 1 |

| Netherlands | 1 | 1 |

| Norway | 1 | 1 |

| Switzerland | 1 | 1 |

| Total company-operated stores | 521 | 491 |

Sourcing and Manufacturing

The company do not own or operate any manufacturing facilities. The company rely on a limited number of suppliers to provide fabrics for, and to produce, its products. The following statistics are based on cost.

The company work with a group of approximately 40 vendors that manufacture its products, five of which produced 59% of its products in 2020, with the largest manufacturer producing 17%. During 2020, 33% of its products were manufactured in Vietnam, 20% in Cambodia, 12% in Sri Lanka, and 9% in the PRC, including 2% in Taiwan.

The company work with a group of approximately 65 suppliers to provide the fabrics for its products. In 2020, 65% of its fabrics were produced by its top five fabric suppliers, with the largest manufacturer producing 29%. During 2020, 45% of its fabrics originated from Taiwan, 18% from Mainland China, 16% from Sri Lanka, and the remainder from other regions.

The company also source other raw materials which are used in its products, including items such as content labels, elastics, buttons, clasps, and drawcords from suppliers located predominantly in the Asia Pacific region.

lululemon has developed long-standing relationships with a number of its vendors and take great care to ensure that they share its commitment to quality and ethics. The company do not, however, have any long-term term contracts with the majority of its suppliers or manufacturing sources for the production and supply of its fabrics and garments, and the company compete with other companies for fabrics, raw materials, and production. The company require that all of its manufacturers adhere to its vendor code of ethics regarding social and environmental sustainability practices. The company's product quality and sustainability teams partner with leading inspection and verification firms to closely monitor each supplier's compliance with applicable laws and its vendor code of ethics

Financial Highlights

Net revenue increased $422.6 million, or 11%, to $4.4 billion in 2020 from $4.0 billion in 2019. On a constant dollar basis, assuming the average exchange rates in 2020 remained constant with the average exchange rates in 2019, net revenue increased $412.7 million, or 10%.

Company-Operated Stores. The decrease in net revenue from its company-operated stores segment was primarily due to the impact of COVID-19. All of its stores in North America, Europe, and certain countries in Asia Pacific were temporarily closed for a significant portion of the first two quarters of 2020. Certain stores experienced temporary re-closures during the last two quarters of 2020. COVID-19 restrictions, including reduced operating hours and occupancy limits, reduced net revenue from company-operated stores that have reopened.

During 2020, the company opened 30 net new company-operated stores, including 18 stores in Asia Pacific, nine stores in North America, and three stores in Europe.

Direct to Consumer. Direct to consumer net revenue increased 101%, and increased 101% on a constant dollar basis. The increase in net revenue from its direct to consumer segment was primarily the result of increased traffic, and improved conversion rates, partially offset by a decrease in dollar value per transaction. The increase in traffic was partially due to COVID-19, with more guests shopping online instead of in-stores. During the second quarter of 2020, the company held an online warehouse sale in the United States and Canada which generated net revenue of $43.3 million. The company did not hold any warehouse sales during 2019.

First Quarter Fiscal 2021 Results

Calvin McDonald, Chief Executive Officer, stated: "The company's first quarter results reflected strength across all drivers of growth, fueled by the continued expansion in its e-commerce business and a rebound in brick and mortar stores. The company's strong performance across categories, channels and geographies demonstrates the momentum and strength of lululemon as the company shift into the new normal. All of it on the leadership team are grateful to its teams around the world who enabled these results, and who continue to focus on realizing growth."3

The fiscal year ending January 30, 2022 is referred to as "2021" and the fiscal year ended January 31, 2021 is referred to as "2020". The adjusted non-GAAP financial measures below exclude certain costs incurred in connection with the acquisition of MIRROR, and the related tax effects.

For the first quarter of 2021, compared to the first quarter of 2020:

• Net revenue increased 88% to $1.2 billion. On a constant dollar basis, net revenue increased 83%.

• Company-operated stores net revenue increased 106% to $536.6 million.

• Direct to consumer net revenue increased 55% to $545.1 million. On a constant dollar basis, direct to consumer net revenue increased 50%.

• Net revenue increased 82% in North America, and increased 125% internationally.

• Direct to consumer net revenue represented 44.4% of total net revenue compared to 54.0% for the first quarter of 2020.

• Gross profit increased 109% to $700.3 million and gross margin increased 580 basis points to 57.1%.

• Income from operations increased 492% to $193.8 million. Adjusted income from operations increased 479% to $201.5 million.

• Operating margin increased 1,080 basis points to 15.8%. Adjusted operating margin increased 1,110 basis points to 16.4%.

• Income tax expense increased 827% to $49.1 million. The effective tax rate for the first quarter of 2021 was 25.3% compared to 15.6% for the first quarter of 2020. The adjusted effective tax rate was 24.5% for the first quarter of 2021 compared to 14.7% for the first quarter of 2020.

• Diluted earnings per share were $1.11 compared to $0.22 in the first quarter of 2020. Adjusted diluted earnings per share were $1.16 compared to $0.23 in the first quarter of 2020.

• The Company repurchased 0.3 million shares of its own common stock at an average cost of $311.02 per share.

• The Company opened two net new company-operated stores during the quarter, ending with 523 stores.

The consolidated statement of operations for the first quarter of 2019 is included in the tables at the end of this release for reference. For the first quarter of 2021, compared to the first quarter of 2019:

• Net revenue increased by $444.2 million, or 57%, representing a two-year compound annual growth rate of 25%.

• Gross margin increased 320 basis points.

• Operating margin decreased 70 basis points. Adjusted operating margin decreased 10 basis points.

• Diluted earnings per share were $1.11 compared to $0.74 in the first quarter of 2019. Adjusted diluted earnings per share were $1.16 in the first quarter of 2021.

Meghan Frank, Chief Financial Officer, stated: "lululemon is very pleased with its Q1 results, which reflect significant growth in the business compared to both 2020 and 2019. The company's momentum remains strong as the company enter the second quarter, and lululemon is raising its estimates for the year accordingly. The strength of its financial position allows it to continue to deliver against the Power of Three growth strategies, while the company leverage both near- and long-term opportunities."

Balance sheet highlights

The Company ended the first quarter of 2021 with $1.2 billion in cash and cash equivalents and the capacity under its committed revolving credit facilities was $397.3 million. Inventories at the end of the first quarter of 2021 increased 17% to $732.9 million compared to $625.8 million at the end of the first quarter of 2020.

2021 Outlook

For the second quarter of 2021, the company expect net revenue to be in the range of $1.300 billion to $1.330 billion. Diluted earnings per share are expected to be in the range of $1.05 to $1.10 for the quarter and adjusted diluted earnings per share are expected to be in the range of $1.10 to $1.15.

For 2021, the company expect net revenue to be in the range of $5.825 billion to $5.905 billion. Diluted earnings per share are expected to be in the range of $6.52 to $6.65 for the year and adjusted diluted earnings per share are expected to be in the range of $6.73 to $6.86.

Recent developments

Lululemon Brings MIRROR To Canada

Oct 7, 2021; lululemon athletica inc. announced that MIRROR, its popular nearly invisible interactive home gym, will be offered in nearly 40 lululemon stores across Canada and available for purchase in-store and online beginning on November 22. Guests in Canada will now have direct access to engage with MIRROR’s digital community and experience the platform’s best-in-class content for all levels. This expansion in Canada will increase MIRROR’s in-store presence to almost 200 lululemon locations in North America and help propel lululemon’s vision to strengthen its community connection through the platform.4

“Community is at the heart of lululemon—and bringing MIRROR to Canada will enable more guests to interact with its growing collective and experience a digital sweatlife offering like never before,” said Celeste Burgoyne, President, Americas and Global Guest Innovation at lululemon. “lululemon has seen rapid growth and strong engagement for MIRROR since launching in the United States and look forward to deepening its roots at home in Canada.”

lululemon acquired MIRROR in July 2020 and the launch in Canada strengthens and enhances its omni guest experiences with cutting-edge digital and interactive capabilities. With best-in-class content and a versatile platform powered by advanced camera technology and a personal performance dashboard, MIRROR extends lululemon’s digital sweat and mindful offerings and community engagement to new and existing Canadian guests.

MIRROR offers new live classes daily led by lululemon MIRROR Ambassadors – and thousands of on-demand workouts available 24/7 – including boxing, barre, cardio, strength, yoga, meditation and more, in addition to inclusive offerings for family and prenatal/postnatal. Certified trainers provide expert instruction, motivation and live feedback in classes spanning 50+ genres, ranging from 5- to 60-minute sessions for beginner to expert levels.

The idea of connected community comes to fruition through MIRROR’s features including:

• Camera On: Members can connect with friends in the MIRROR community to create an immersive sweat experience.

• Face Offs: Members can compete one-on-one with friends in MIRROR classes. Points are earned when target heart rate zones are maintained.

• High Fives: Members can send emojis to motivate friends in classes.

• Friending: Members can find and follow friends in the MIRROR community.

• Recommended for You: Members can receive a set of workouts each week based on their individual profile.

Guests are invited to experience MIRROR in-store and speak with a dedicated MIRROR Lead to receive a personalized demonstration. Starting November 22, MIRROR is expected to be available for purchase online and in Canadian lululemon stores. Guests interested in purchasing MIRROR are expected to have the opportunity to sign up for a limited time offer in-store from October 7 to November 21.

References

- ^ https://info.lululemon.com/about

- ^ https://investor.lululemon.com/static-files/56e3c4a1-b6d7-49b6-bbd8-953a4019ed98

- ^ https://investor.lululemon.com/news-releases/news-release-details/lululemon-athletica-inc-announces-first-quarter-fiscal-2021-0

- ^ https://investor.lululemon.com/news-releases/news-release-details/lululemon-brings-mirror-canada