Descartes Systems

Summary

- Descartes is the global leader in providing on-demand, software-as-a-service solutions.

- Descartes primarily focused on logistics and supply chain management business processes.

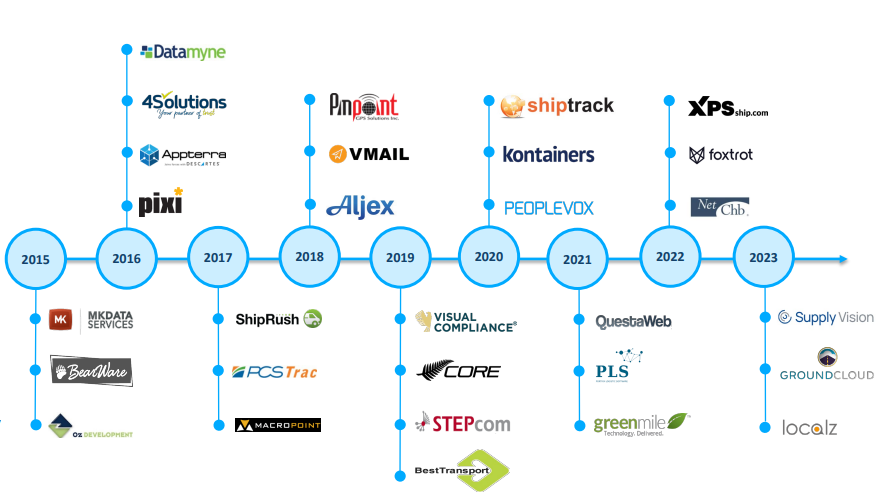

- The company is growing rapidly by constantly acquiring other companies.

Descartes (Nasdaq: DSGX) (TSX: DSG) is the global leader in providing on-demand, software-as-a-service solutions focused on improving the productivity, security, and sustainability of logistics-intensive businesses. Headquarter in Waterloo, Ontario, Canada and Descartes has offices and partners around the world.

Recent Developments

Arctic Glacier has improved its distribution network efficiency.1

February 6, 2024 -- Descartes Systems Group announced that Arctic Glacier has improved its distribution network efficiency, its fleet performance and the customer experience by using Descartes’ strategic route planning solution to optimize ice distribution from over 100 facilities and 1,000 vehicles to 75,000 customer locations across the U.S. and Canada.

Part of its routing, mobile and telematics solution suite, Descartes’ strategic route planning solution is designed to optimize distribution networks by determining the best combination of resources (e.g., distribution centers, fleet size and drivers) to meet customer service and financial targets while considering service policies and operational practices. With strategic route planning, fleet operators can understand and optimize delivery and customer service policies changes, acquisition consolidation strategies, introduction of new vehicle types, and other distribution network business decisions before executing them. The solution’s advanced single-pass optimization technology streamlines the strategic route planning process to produce faster and better results than conventional sales and territory planning solutions.

Descartes’ Study Reveals 76% of Supply Chain and Logistics Operations are Experiencing Notable Workforce Shortages2

January 30, 2024 -- Descartes Systems released findings from its study How Bad Is the Supply Chain and Logistics Workforce Challenge?, which indicates that 76% of the supply chain and logistics leaders surveyed are experiencing notable workforce shortages in their operations. What’s more, 37% of respondents would characterize the resource shortage they face as high to extreme. While the issue is affecting companies’ financial, peak season and logistics partner performance, the survey also showed it’s taking a toll on customer service performance, with 58% specifying that workforce shortages have negatively impacted service levels.

While the competition for supply chain and logistics resources is widespread, the acuteness of the workforce challenge varies by organizational function. According to survey results, the areas suffering the most from resource shortages were transportation operations (61%) and warehouse operations (56%). While these areas are admittedly highly labor-intensive, findings also revealed that 55% of supply chain and logistics leaders said knowledge workers are the hardest to hire—and they are becoming increasingly important as supply chain and logistics operations become more technology-enabled and data-driven.

Recent Acquisitions

Localz Pty Ltd.

On April 20, 2023, Descartes acquired substantially all of the assets of Localz Pty Ltd. (“Localz”), a cloud-based customer engagement platform for day-of-service interaction and order management. The purchase price for the acquisition was approximately $5.9 million, net of cash acquired, which was funded from cash on hand.

Windigo Logistics, Inc.

On February 14, 2023, Descartes acquired all of the shares of Windigo Logistics, Inc., doing business as GroundCloud (“GroundCloud”), a cloud-based provider of final-mile carrier solutions and road safety compliance tools. The purchase price for the acquisition was approximately $138.0 million, net of cash acquired, which was funded from cash on hand, plus potential performance-based contingent consideration of up to $80.0 million based on GroundCloud achieving revenue-based targets over the first two years post-acquisition.

Trans-Soft, LLC

On January 5, 2023, Descartes acquired all of the shares of Trans-Soft, LLC, doing business as Supply Vision (“Supply Vision”), a provider of shipment management solutions for North American logistics services providers. The purchase price for the acquisition was approximately $12.0 million, net of cash acquired, which was funded from cash on hand, plus potential performance-based contingent consideration of up to $3.0 million based on Supply Vision achieving revenue-based targets over the first two years post-acquisition.

XPS Technologies, LLC

On June 3, 2022, Descartes acquired all of the shares of XPS Technologies, LLC (“XPS”), a provider of ecommerce multi-carrier parcel shipping solutions. The purchase price for the acquisition was approximately $61.1 million, net of cash acquired, which was funded from cash on hand, plus potential performance-based contingent consideration of up to $75.0 million based on XPS achieving revenue-based targets over the first two years post-acquisition.

Foxtrot, Inc.

On April 21, 2022, Descartes acquired substantially all of the assets of Foxtrot, Inc. (“Foxtrot”), a provider of machine learning-based mobile route execution solutions. The purchase price for the acquisition was approximately $4.2 million, net of cash acquired, which was funded from cash on hand.

NetCHB, LLC

On February 9, 2022, Descartes acquired all of the shares of NetCHB, LLC (“NetCHB”), a provider of customs filing solutions in the US. The purchase price for the acquisition was approximately $38.7 million, net of cash acquired, which was funded from cash on hand, plus potential performance based contingent consideration of up to $60.0 million based on NetCHB achieving revenue-based targets over the first two years post-acquisition.

Financial Highlights

Third Quarter Fiscal 2024 Results

Total revenues were $424.7 million and $360.9 million for the first three quarters of 2024 and 2023, respectively. The increase in revenues in the first three quarters of 2024 compared to the same period of 2023 was primarily due to growth in services revenues from new and existing customers which contributed an incremental $30.0 million in revenue in the first three quarters of 2024. Revenues were also positively impacted by the partial period of contribution from the acquisitions completed in 2024 (GroundCloud and Localz, which contributed an incremental $27.0 million in revenue in the first three quarters of 2024.3

For the third quarter of 2024 and 2023, its total revenues were $144.7 million and $121.5 million, respectively. The increase in revenues in the third quarter of 2024 compared to the same period of 2023 was primarily due to growth in services revenues from new and existing customers which contributed an incremental $10.6 million in revenue in the third quarter of 2024. Revenues were also positively impacted by the contribution from the 2024 Acquisitions, which contributed an incremental $9.9 million in revenue in the third quarter of 2024.

The company's license revenues were $3.8 million and $6.7 million for the first three quarters of 2024 and 2023, respectively, representing 1% and 2% of total revenues in the first three quarters of 2024 and 2023, respectively. For the third quarter of 2024 and 2023, its license revenues were $1.5 million and $1.1 million, respectively, representing 1% of total revenues in both the third quarter of 2024 and 2023, respectively.

The company's services revenues were $385.3 million and $322.3 million for the first three quarters of 2024 and 2023, respectively, representing 91% and 89% of total revenues in the first three quarters of 2024 and 2023, respectively. The increase in the first three quarters of 2024 compared to the same period of 2023 was primarily due to growth in services revenues from new and existing customers, which contributed an incremental $30.0 million in revenues. For the third quarter of 2024 and 2023, its services revenues were $130.4 million and $110.1 million, respectively, representing 90% and 91% of total revenues in the third quarter of 2024 and 2023, respectively.

The company's professional services and other revenues were $35.6 million and $31.9 million for the first three quarters of 2024 and 2023, respectively, representing 8% and 9% of total revenues for the first three quarters of 2024 and 2023, respectively. For the third quarter of 2024 and 2023, its professional services and other revenues were $12.8 million and $10.3 million, respectively, representing 9% and 8% of its total revenues in the third quarter of 2024 and 2023, respectively.

Operating expenses, consisting of sales and marketing, research and development and general and administrative expenses, were $157.2 million and $130.9 million for the first three quarters of 2024 and 2023, respectively. For the third quarter of 2024 and 2023, operating expenses were $53.0 million and $44.3 million, respectively. Operating expenses were higher in the third quarter of 2024 compared to the same period of 2023 primarily due to a partial period of costs from the 2024 Acquisitions, and increased headcount trelated costs.

Research and development expenses consist primarily of salaries, stock-based compensation and other personnel-related costs of technical and engineering personnel associated with its research and 15 product development activities, as well as costs for third-party outsourced development providers. The company expensed all costs related to research and development in the first three quarters of 2024 and 2023. Research and development expenses were $62.9 million and $52.1 million for the three quarters half of 2024 and 2023, respectively, representing 15% and 14% of total revenues in the first three quarters of 2024 and 2023, respectively. For the third quarter of 2024 and 2023, research and development expenses were $21.1 million and $17.4 million, respectively, representing 15% and 14% of total revenues in the third quarter of 2024 and 2023, respectively.

Net income was $84.1 million and $72.5 million for the first three quarters of 2024 and 2023, respectively and $26.6 million and $26.5 million in the third quarter of 2024 and 2023, respectively. Net income in the first three quarters and third quarter of 2024 compared to the same periods of 2023 was positively impacted by the growth in services revenues partially offset by an increase in other charges.

Cash. The company had $279.6 million and $276.4 million in cash as at October 31, 2023 and January 31, 2023, respectively. All cash was held in interest-bearing bank accounts, primarily with major Canadian, US and European banks. The cash balance increased from January 31, 2023 to October 31, 2023 by $3.2 million primarily due to cash generated from operations partially offset by cash used for acquisitions.

Company Overview

Descartes is primarily focused on logistics and supply chain management business processes. The company's solutions are predominantly cloud-based and are focused on improving the productivity, performance and security of logistics-intensive businesses.

Customers use its modular, software-as-a-service (“SaaS”) and data solutions to route, schedule, track and measure delivery resources; plan, allocate and execute shipments; rate, audit and pay transportation invoices; access and analyze global trade data.

The company's pricing model provides its customers with flexibility in purchasing its solutions either on a subscription, transactional or perpetual license basis. The company's primary focus is on serving transportation providers (air, ocean and truck modes), logistics service providers (including third-party logistics providers, freight forwarders and customs brokers) and distribution-intensive companies for which logistics is either a key or a defining part of their own product or service offering, or for which its solutions can provide an opportunity to reduce costs, improve service levels, or support growth by optimizing the use of assets and information.

References

- ^ https://www.descartes.com/resources/news/arctic-glacier-enhances-north-american-distribution-performance-descartes-strategic

- ^ https://www.descartes.com/resources/news/descartes-study-reveals-76-supply-chain-and-logistics-operations-are-experiencing

- ^ https://www.descartes.com/sites/default/files/media/documents/2024-01/Q3FY24-Shareholder-Report-Final.pdf