Air Products and Chemicals, Inc.

Summary

- Air Products and Chemicals, Inc. is a Delaware corporation originally founded in 1940, stands as a globally renowned industrial gases company.

- In the realm of industrial gases, the company delivers essential gases, along with related equipment and applications expertise, to customers spanning numerous industries. These include refining, chemicals, metals, electronics, manufacturing, medical, and food.

- The organization offers a comprehensive portfolio of products and services designed to empower customers in enhancing their environmental performance, product quality, and overall productivity.

- Air Products operates through two primary segments: its industrial gases business and the execution of projects that contribute to the development of world-scale clean hydrogen. These include refining, chemicals, metals, electronics, manufacturing, medical, and food.

- In 2023, the company experienced decline in sales, with total sales reaching $12,600 million. This marked a decrease of $98.6 million or 0.8% compared to the sales figure of $12,698.6 million in 2022.

- The company's gross profit for 2023 amounted to $3,767 million, reflecting an increase of $407 million or 12.1% from the gross profit of $3,360 million in the previous year, 2022.

- Additionally, the company's operating profit increased in 2023, totaling $2,739 million, which was higher by $326.5 million or 13.5% compared to the operating profit of $2,412.5 million in 2022.

- The net profit for the year 2023 was $2,300 million, representing a decrease of $44 million or 1.9% compared to the net profit of $2,256 million in 2022.

- Moreover, the diluted earnings per share (EPS) for 2023 were reported as $10.33, which showed an increase of $0.19 or 1.9% compared to the diluted EPS of $10.14 in 2022.

Brief Company Overview

Air Products and Chemicals, Inc. (NYSE: APD), a Delaware corporation originally founded in 1940, stands as a globally renowned industrial gases company. The organization with a specific focus on catering to energy, environmental, and emerging markets, Air Products offers a comprehensive portfolio of products and services designed to empower customers in enhancing their environmental performance, product quality, and overall productivity. Air Products operates through two primary segments: its industrial gases business and the execution of projects that contribute to the development of world-scale clean hydrogen. In the realm of industrial gases, the company delivers essential gases, along with related equipment and applications expertise, to customers spanning numerous industries. These include refining, chemicals, metals, electronics, manufacturing, medical, and food. Furthermore, Air Products plays a pivotal role in the advancement of clean hydrogen projects, reinforcing its commitment to supporting the transition towards low- and zero-carbon energy in both the heavy-duty transportation and industrial sectors. The organization is offering turbomachinery, membrane systems, and cryogenic containers on a global scale.

The company employs various supply modes to distribute gases to its industrial gas customers, selecting options based on factors like customer volume requirements and location. The two primary supply modes include On-Site Gases, tailored for industries with constant and high-volume gas demands, often governed by 15- to 20-year contracts. This involves constructing or acquiring large facilities near customers or using pipeline systems. The other mode, Merchant Gases, deals with liquid bulk and packaged gas products, transported via tanker or tube trailer. Liquid bulk sales operate under three- to five-year contracts, while packaged gas products are delivered in smaller quantities through cylinders or dewars. The company strategically manages inventory for timely product supply in Europe, Asia, and Latin America, with a focus on crude helium, specialty gases, and other industrial gases within the merchant gases supply mode.

As of January 2024, the company had a 52-week share price range of $ 320.90 to $ 251.63. The forwarding P/E ratio of the company is 20.28 times, the price-to-sales ratio (ttm) is 4.65 times, the profit margin is 18.26%, the operating margin is 22.44%, the return on assets (ttm) is 5.60%, the return on equity is 15.88%, and the diluted earnings per share (ttm) is $ 10.29. The aggregate market value of the voting stock held by non-affiliates of the registrant on 31 March 2023 was approximately $63.6 billion. For purposes of the foregoing calculations, all directors and/or executive officers have been deemed to be affiliates, but the registrant disclaims that any such director and/or executive officer is an affiliate. The number of shares of common stock issued and outstanding as of 31 October 2023 was 222,207,726.

Recent Developments

- The company Signed $1 billion investment agreement with the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own and operate a natural gas-to-syngas processing facility within Uzbekneftegaz JSC's multi-billion dollar gas-to-liquids facility, one of the most advanced energy plants in the world; brought project on-stream in October 2023, which is expected to be accretive to earnings in fiscal 2024.1

- Announced major liquefied natural gas (LNG) technology and equipment project wins, including: Petronas LNG Complex (Bintulu, Sarawak, Malaysia), Qatargas (North Field South Project, Ras Laffan, the State of Qatar), Bechtel Energy Inc. (NextDecade’s Rio Grande LNG Phase I project, Port of Brownsville, Texas), and Technip Energies’ Xi’An LNG project with Shaanxi LNG Reserves & Logistics Company Ltd. (Shaanxi Province, China); increased equipment winding capacity at LNG manufacturing facility in Port Manatee, Florida.2

Recent Financing Activities

- Air Products and Chemicals, Inc. Issued inaugural green bonds in concurrent $600 million and €700 million debt offerings in March, making Air Products the first U.S. chemical company to qualify green and blue hydrogen projects as an eligible expenditure category concurrent $600 million and €700 million debt offerings in March agreement with the Republic of Uzbekistan.3

- In May 2023, NEOM Green Hydrogen Project Financing (NGHC) secured non-recourse project financing of approximately $6.1 billion, which is expected to fund approximately 73% ofthe NEOM Green Hydrogen Project and will be drawn over the construction period. At the same time, NGHC secured additional non-recourse credit facilities totaling approximately $500 primarily for working capital needs. As of 30 September 2023, the joint venture hadborrowed $1.4 billion of the available financing.4

Financial Performance Highlights

Q2 2023 Highlights

In the third quarter of 2023, the company reported sales of $3,191.3 million, reflecting a decrease of $378.7 million or 10.6% compared to the third quarter of 2022, which had sales of $3,570 million. The net profit for the third quarter of 2023 was $694.4 million, showing an increase of $101.4 million or 17.1% when compared to the net profit of $593 million in the third quarter of 2022. Furthermore, the company's diluted earnings per share (EPS) for the third quarter of 2023 increased to $3.11, a positive change of $0.49 or 18.7% compared to the diluted EPS of $2.62 in the third quarter of 2022.

Annual Performance Highlights

In 2023, the company experienced decline in sales, with total sales reaching $12,600 million. This marked a decrease of $98.6 million or 0.8% compared to the sales figure of $12,698.6 million in 2022. The company's gross profit for 2023 amounted to $3,767 million, reflecting an increase of $407 million or 12.1% from the gross profit of $3,360 million in the previous year, 2022. Additionally, the company's operating profit increased in 2023, totaling $2,739 million, which was higher by $326.5 million or 13.5% compared to the operating profit of $2,412.5 million in 2022. The net profit for the year 2023 was $2,300 million, representing a decrease of $44 million or 1.9% compared to the net profit of $2,256 million in 2022. Moreover, the diluted earnings per share (EPS) for 2023 were reported as $10.33, which showed an increase of $0.19 or 1.9% compared to the diluted EPS of $10.14 in 2022.

In fiscal year 2023, the company reported sales of $12.6 billion, reflecting a 1% decrease of $98.6 million. This decline was primarily attributed to a 6% reduction in energy cost pass-through to customers and an unfavorable currency impact of 3%, offset to some extent by a 5% increase in pricing and a 3% rise in volumes. Lower natural gas prices in the Americas and Europe segments contributed to the reduced energy cost pass-through to on-site customers, while unfavorable currency effects were driven by the strengthening of the U.S. Dollar against the Chinese Renminbi. Sales were buoyed by pricing actions in the merchant business, with volume improvement primarily attributable to the on-site business in the Americas and Asia segments. Cost of sales decreased by 5%, reaching $8.8 billion, driven by lower energy cost pass-through to customers and a favorable currency impact, despite higher costs associated with sales volumes and unfavorable other costs. The gross margin increased to 29.9%, up 340 basis points from the prior year, primarily due to favorable pricing and lower energy cost pass-through, partially offset by higher costs. The company recorded a charge of $244.6 million in 2023 for strategic actions aimed at optimizing costs and focusing resources on growth projects, including noncash charges related to exited projects and expenses for severance and restructuring. Operating income increased by 7%, propelled by positive pricing and higher volumes, although partially offset by increased costs and an unfavorable currency impact. Higher costs were attributed to inflation, planned maintenance, incentive compensation, and project development costs aligned with the growth strategy.

Operating Activities: In fiscal year 2023, the company generated cash provided by operating activities amounting to $3,205.7 million. Business and asset actions, totaling $244.6 million, encompassed noncash charges related to the write-off of assets associated with the exit from specific projects under construction, as well as expenses for severance and other benefits. Details regarding these actions can be found in Note 4, Business and Asset Actions, within the consolidated financial statements. The impacts of operating leases were reflected in "Other adjustments," including a lump-sum payment of $209 for a land lease linked to the NGHC joint venture. Working capital accounts resulted in a net use of cash amounting to $424.8 million. This included a cash use of $213.3 million within payables and accrued liabilities, primarily driven by lower natural gas purchase prices, a decrease in the value of derivatives hedging intercompany loans, and payments for incentive compensation under the fiscal year 2022 plan.

Investing Activities: In fiscal year 2023, the company reported cash used for investing activities amounting to $5,916.4 million. The primary drivers of this cash use included capital expenditures totaling $4,626.4 million for additions to plant and equipment, including long-term deposits. Additionally, investments in and advances to unconsolidated affiliates accounted for $912.0 million, while investments in financing receivables amounted to $665.1 million. Further details on capital expenditures are available in the Capital Expenditures section below. On the positive side, maturities of time deposits and short-term treasury securities provided cash of $897.0 million, surpassing purchases of investments, which amounted to $640.1 million.

Financing Activities: In fiscal year 2023, the company reported cash provided by financing activities amounting to $1,609.6 million. The primary sources of cash were long-term debt proceeds totaling $3,516.2 million and an increase in commercial paper and short-term borrowings of $268.2 million. These positive cash inflows were partially offset by dividend payments to shareholders of $1,496.6 million and payments on long-term debt amounting to $615.4 million. The long-term debt proceeds included funds from the issuance of inaugural multi-currency green bonds, involving U.S. Dollar- and Euro-denominated fixed-rate note offerings with aggregate principal amounts of $600 million and €700 million, respectively.

Business Overview

Air Products stands as a globally renowned industrial gases enterprise, with a primary emphasis on energy, environmental, and emerging markets. At the core of its operations, Air Products delivers an extensive range of products and services, encompassing atmospheric gases, process and specialty gases, equipment, and associated services to clientele across numerous industries. The principal activities generating sales from contracts with customers.

Regional Industrial Gases: The regional industrial gases businesses are engaged in the production and sale of atmospheric gases like oxygen, nitrogen, and argon (primarily recovered through cryogenic distillation of air) and process gases such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas, and specialty gases. Gas distribution to customers is carried out through various supply modes, depending on factors such as customer volume requirements and location. The supply modes include:

- On-site Gases: This mode caters to customers with substantial gas volume needs and consistent demand. Gases are produced and supplied by large facilities either on or near the customer's facilities or through pipeline systems from centrally located production facilities. Contracts associated with this supply mode generally extend over 15 to 20 years. Smaller quantities are also delivered through small on-site plants, typically under 10- to 15-year sale of gas contracts. These contracts often involve fixed monthly charges, minimum purchase requirements, and price escalation provisions based on external indices.

- Merchant Gases: This supply mode serves liquid bulk and packaged gases customers. Liquid bulk customers receive product delivery in liquid or gaseous form, stored at their site for vaporization. Packaged gases customers receive smaller quantities in cylinders or dewars. Contracts for liquid bulk and packaged gases sales, governed by customer requirements, typically have terms of five years or less. Performance obligations under this supply mode are satisfied at a point in time upon customer receipt and control of the product, usually upon delivery.

Variable components of consideration, particularly relevant to on-site contracts, are treated as constrained due to potential impacts from significant events such as plant outages, possibly occurring at the contract's end. Contract modifications are evaluated individually, with prospective accounting treatment applied. Energy and natural gas price risk is mitigated through contractual mechanisms such as pricing formulas, surcharges, and cost pass-through arrangements.

Equipment: The company designs and manufactures equipment for various purposes, including air separation, hydrocarbon recovery and purification, natural gas liquefaction, and liquid helium and hydrogen transport and storage. The Corporate and other segment serves customers for the sale of equipment. Sale of equipment contracts generally involves a single performance obligation, where promised goods or services are integrated or dependent on each other for a unified customer output.

Contracts are satisfied at the point in time when the customer gains control of the equipment, determined based on shipping terms. Contract modifications under the sale of equipment contracts are typically part of the existing contract and are recognized as a cumulative adjustment for the inception-to-date effect of the change. Changes in estimates for projects using the cost incurred input method are also recorded as cumulative adjustments for the inception-to-date effect. Notably, unfavorable changes in project estimates impacted operating income by approximately $115, $30, and $19 in fiscal years 2023, 2022, and 2021, respectively.

Air Products and Chemicals, Inc. owns its principal administrative offices situated at the Company's new global headquarters and co-located research and development facility in Allentown, Pennsylvania. Additionally, it owns regional offices in Hersham, England; Medellin, Colombia; and Santiago, Chile. The company leases the principal administrative offices in Shanghai, China; Pune, India; Vadodara, India; and Dhahran, Saudi Arabia. Administrative offices in the United States, Canada, Spain, Malaysia, and China are also leased, primarily for the Finance and Business Services organization. It is noted that these facilities are used to support the operations of the company's five business segments.

Americas

The American segment of the company operates from around 450 production and distribution facilities situated across North and South America. Among these facilities, roughly 25% are positioned on properties owned by the company. Adequate property rights and permits are in place to ensure the continuous operation of the pipeline systems in key regions, including the Gulf Coast, California, and Arizona in the United States, as well as Alberta and Ontario in Canada. The management and sales support functions are centralized in the company's offices in Allentown, Medellin, and Santiago, as mentioned earlier, along with operations at approximately 20 leased properties spread across North and South America.

In the fiscal year ending on September 30, 2023, the Americas segment demonstrated a nuanced financial performance with total sales amounting to $5,369.3 million, marking a marginal increase of $0.4 million or 0% from the previous fiscal year. Despite a positive 6% growth in both volume and pricing, particularly notable in the on-site business driven by increased demand for hydrogen, these gains were offset by an 11% reduction in energy cost pass-through to customers and a 1% unfavorable currency impact, resulting in overall flat sales of $5.4 billion.

Asia

The Asia segment of the company operates from around 300 production and distribution facilities within the region, with approximately 35% of these facilities located on owned property or under long-duration term grants. The company holds adequate property rights and permits for the continuous operation of its pipeline systems in various countries, including China, South Korea, Taiwan, Malaysia, Singapore, and Indonesia. Management and sales support for the Asia segment are centralized in Shanghai, China, and Kuala Lumpur, Malaysia, along with approximately 35 leased office locations spread across the region.

In the fiscal year ending on September 30, 2023, the Asia segment showcased commendable financial performance with a 2% increase in sales, reaching $3,216.1 million, marking a significant improvement of $72.8 million from the prior year. The positive trajectory was influenced by a 3% growth in both volume and pricing, along with a 2% rise in energy cost pass-through to customers. However, these gains were partially counteracted by a 6% unfavorable currency impact. Notably, the volume surge was driven by successful operations in new industrial gas plants in the on-site business, although economic challenges in China and reduced activity in the electronics manufacturing industry posed mitigating factors. The region effectively managed higher power costs through strategic merchant pricing actions, particularly in the on-site business.

Europe

The Europe segment of the company operates from around 210 production and distribution facilities situated in Europe, with approximately 35% of these facilities situated on owned property. The company possesses adequate property rights and permits for the continuous operation of its pipeline systems in key European countries, including the Netherlands, the United Kingdom, Belgium, France, and Germany. Management and sales support for the Europe segment are centralized in Hersham, England; Barcelona, Spain; and across 15 leased regional office sites and 10 leased local office sites throughout the region.

In the fiscal year ending on September 30, 2023, the Europe segment displayed a notable financial performance characterized by a 4% decline in sales, amounting to $2,963.1 million compared to $3,086.1 million in the prior year, primarily attributed to a 9% decrease in energy cost pass-through to customers and a 2% unfavorable currency impact, partially offset by a 7% increase in pricing. The diminished energy cost pass-through, reflective of lower natural gas prices, and adverse currency effects from the strengthened U.S. Dollar against the Euro and the British Pound Sterling were counterbalanced by positive pricing trends in the merchant business. Volumes remained flat, with increased demand for hydrogen in the on-site business offset by reduced demand for merchant products.

Middle East and India

The Middle East and India segment of the company operates from approximately 15 production and distribution facilities spread across the region, all of which are leasehold properties. Management and sales support for this business segment are centralized in Dhahran, Saudi Arabia; Dubai, United Arab Emirates; and Pune, India. Additionally, the segment utilizes approximately 10 leased local office sites throughout the region.

In the fiscal year ending on September 30, 2023, the Middle East and India segment demonstrated notable financial dynamics, with sales increasing by 25% to $162.5 million compared to $129.5 million in the prior year, reflecting a substantial growth of $33.0 million driven by higher merchant volumes. Despite the surge in sales, the operating income experienced a 20% decrease, reaching $16.9 million, with a decline of $4.2 million primarily attributed to elevated costs related to business development and planned maintenance. This increase was notably influenced by an additional investment made in the JIGPC joint venture in January 2023, which completed the second phase of the asset purchase associated with the Jazan gasification and power project. The resulting higher contribution from JIGPC was partially offset by a net benefit recognized in the prior year for the remaining deferred profit associated with air separation units previously sold to Jazan Gas Project Company, net of other project finalization costs. In summary, while sales saw substantial growth, the operating income decline was mitigated by increased equity affiliates' income, emphasizing the complexity of financial dynamics in the Middle East and India segment.

Other Business Information

The majority of the company's sales are denominated in foreign currencies as they originate outside the United States. Consequently, changes in foreign currency rates will have an impact on financial results. The Chinese Renminbi and the Euro constitute the most significant exposures in terms of foreign earnings. It is estimated that a 10% reduction in the value of either the Chinese Renminbi or the Euro against the U.S. Dollar would result in an approximate decrease of $55 and $20, respectively, in annual operating income. The primary currency pairs for which the company faces exchange rate exposure are the Euro and U.S. Dollar, as well as the Chinese Renminbi and U.S. Dollar. To mitigate risks, the company employs foreign currency debt, cross-currency interest rate swaps, and foreign exchange-forward contracts in countries where it conducts business. This strategy serves to minimize net asset exposure. Additionally, foreign exchange-forward contracts and cross-currency interest rate swaps are utilized to hedge against firm and highly anticipated foreign currency cash flows.

Company History

1940s - The Founding Years: In 1940, Leonard Parker Pool, along with his associate Pavlis, successfully developed a functioning generator. Pool's determination led him to quit his job, liquidate assets, and borrow money to establish Air Products Inc. The company found its humble beginnings in a former mortuary. The economic climate during the Great Depression posed challenges for Air Products, but World War II brought an opportunity. The company thrived by manufacturing mobile oxygen generators for the armed services and heavy industry.

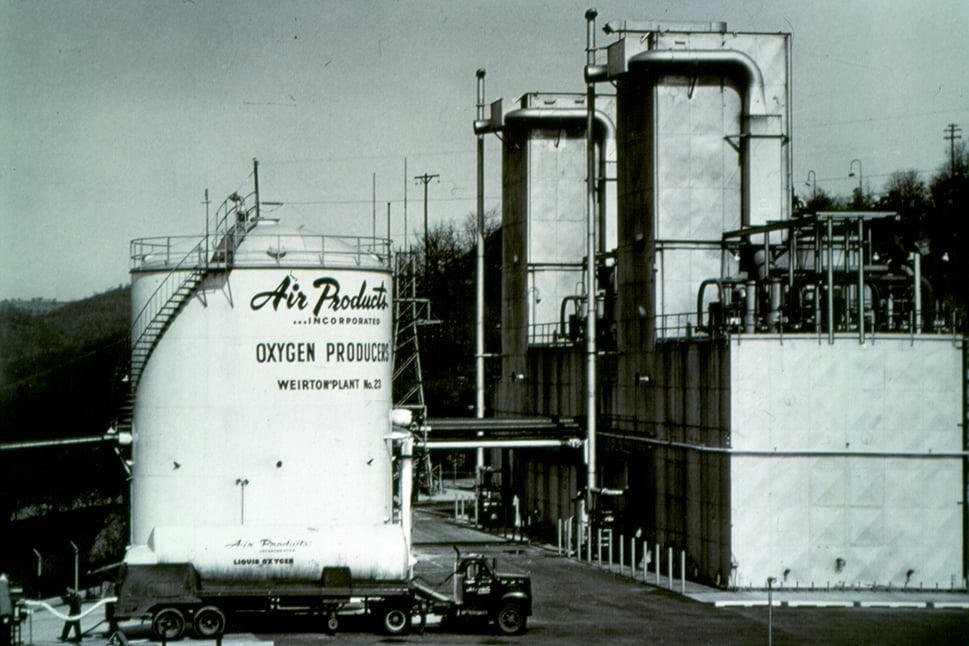

Post-War Era - Challenges and Growth: After the war, Air Products faced difficulties as it lost clients and had to aggressively pursue new accounts. Despite offering cost-effective oxygen solutions, customers were slow to adopt the new system. Pool's perseverance and a strategic sales technique secured a major contract with Weirton Steel. The company's success in the post-war period was also attributed to a group of aggressive young engineers known as the 'tiger pack.'

1950s - Cold War Ventures and Expansion: In the 1950s, Air Products capitalized on the Cold War era by supplying liquid hydrogen for the U.S. defense department's needs. The company expanded into new areas of chemistry, including fluorine chemistry and cryogenics. It transitioned from leasing generators to building multi-million dollar operations near major customers.

1960s - Period of Thriving Diversification: Air Products thrived throughout the 1960s, experiencing a substantial increase in sales and earnings. The company successfully entered the merchant gas market, capitalizing on the demand for oxygen-fired furnaces in the steel-making industry. Nitrogen, another specialty, found applications as a refrigerant. Diversification into chemicals began in 1962 with acquisitions like Houdry Chemicals.

1970s - Navigating Energy Crisis and Economic Challenges: The 1970s brought challenges with the energy crisis and a recession. Despite the chemical division's erratic performance, Air Products sustained growth through its industrial gases, especially oxygen. The company invested in synthetic fuels, facing setbacks but remaining committed to energy development.

1980s - Focus on Safety and Environmental Initiatives: In the 1980s, Air Products embraced safety initiatives such as 'Responsible Care' while challenging industry regulations. The company embarked on a strategic plan, adding environment-energy as a core business. Globalization became a focus, with significant investments in Europe and Asia. Air Products diversified into environmental projects, including a tire recycling program.

1990s - Continued Global Expansion and Restructuring: Continued global expansion marked the 1990s. Investments in Europe and Asia, acquisitions, and joint ventures enhanced the company's position. The 'Responsible Care' objectives evolved, emphasizing safety, environmentalism, and health. In 1992, Harold A. Wagner assumed leadership, overseeing a restructuring of the chemical business.

Late 1990s and 2000s - Consolidation and Strategic Shifts:

During the late 1990s and early 2000s, the industrial gases industry underwent a phase of consolidation, and Air Products strategically responded to the changing market dynamics. The company recognized the importance of aligning with market expectations, prompting a shift in focus towards its core businesses. This period was marked by a strategic reassessment, leading to the divestment of slower-growing ventures.

One significant transformation was the expansion into the healthcare sector through targeted acquisitions. Air Products strategically identified healthcare as a key growth area and capitalized on opportunities to strengthen its presence in this sector. This move allowed the company to diversify its portfolio and leverage its expertise in gases and related technologies to meet the evolving needs of the healthcare industry.

2010s - New Leadership and Strategic Vision:

In 2014, a pivotal moment occurred for Air Products with the appointment of Seifi Ghasemi as Chairman, President, and CEO. Under Ghasemi's leadership, the company introduced a comprehensive strategic framework known as the Five-Point Plan. This plan likely encompassed key initiatives and objectives aimed at repositioning the company for sustained success.

The strategic vision during this period involved not only optimizing existing operations but also expanding globally through securing contracts with major players like Saudi Aramco in 2015. These global ventures likely aimed at enhancing Air Products' market share and strengthening its position as a leading player in the industrial gases sector.

Another notable shift during this time was the decision to become a pure-play industrial gases company in 2017. This involved divesting the Performance Materials Division, streamlining the company's focus on its core competency of providing industrial gases and related services. Such strategic moves were likely aimed at ensuring operational efficiency and concentrating resources on areas with the highest growth potential.

2020s - Sustainable Growth and New Headquarters:

In the 2020s, Air Products continued its trajectory of strategic evolution. The announcement of plans for a new global headquarters in 2021 reflected the company's commitment to sustainability. This decision not only signified a physical move but also underscored the importance of integrating sustainable practices into its corporate identity.

The company's commitment to sustainable growth likely involves incorporating environmentally responsible practices in its operations, products, and services. This aligns with the broader global trend of companies prioritizing sustainability as a core value.

Throughout the 2020s, Air Products maintained its pivotal role in the industrial gases sector, emphasizing a diverse portfolio of products and services. This diversified approach ensures that the company remains adaptable to changing market demands while continuing to provide essential solutions to a global customer base.

References

- ^ https://www.reuters.com/business/energy/air-products-signs-1-bln-deal-processing-facility-uzbekistan-2023-05-25/

- ^ https://www.euro-petrole.com/air-products-lng-liquefaction-technology-and-equipment-selected-for-nextdecades-rio-grande-lng-project-n-i-25902

- ^ https://www.prnewswire.com/news-releases/air-products-issues-inaugural-green-bonds-across-600-million-and-700-million-debt-offerings-301762979.html

- ^ https://www.prnewswire.com/news-releases/neom-green-hydrogen-company-completes-financial-close-at-a-total-investment-value-of-usd-8-4-billion-in-the-worlds-largest-carbon-free-green-hydrogen-plant-301830653.html