Arcosa, Inc.

Summary

- Arcosa, Inc. is a leading provider of infrastructure-related products and solutions, catering to construction, engineered structures, and transportation markets across North America.

- It operates through three primary segments: Construction Products, Engineered Structures, and Transportation Products.

- Arcosa provides its diverse range of infrastructure-related products and solutions primarily through direct sales, distribution channels, and strategic partnerships.

- Arcosa leverages wholesalers, retailers, and dealers to extend its market reach and accessibility for standard products.

- Main customers include freight and passenger railcar manufacturers, rail maintenance facilities, railroads, steel mills, and mining equipment manufacturers.

- In 2022, the company experienced growth in sales, with total sales reaching $2,242 million. This marked an increase of $205.6 million or 10.1% compared to the sales figure of $2,036.4 million in 2021.

- The company's gross profit for 2022 amounted to $422.4 million, reflecting a difference of $56.2 million or 15.3% from the gross profit of $366.2 million in the previous year, 2021.

- Additionally, the company's operating profit increased in 2022, totaling $160 million, which was higher by $49.8 million or 45.2% compared to the operating profit of $110.2 million in 2021.

- The net profit for the year 2022 was $244.8 million, representing an increase of $175.6 million or 253.6% compared to the net profit of $69.2 million in 2021.

- Moreover, the diluted earnings per share (EPS) for 2022 were reported as $5.05, which showed an increase of $3.63 or 255.6% compared to the diluted EPS of $1.42 in 2021.

Brief Company Overview

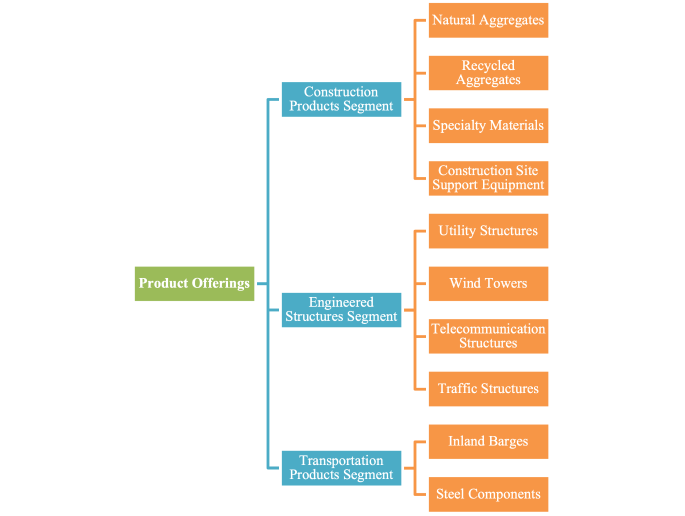

Arcosa, Inc. (NYSE: ACA), headquartered in Dallas, Texas, is a leading provider of infrastructure-related products and solutions, catering to construction, engineered structures, and transportation markets across North America. Established in 2018 following its separation from Trinity Industries, Inc., Arcosa operates as an independent, publicly-traded company listed on the New York Stock Exchange. It operates through three primary segments: Construction Products, which specializes in natural and recycled aggregates, specialty materials, and construction site support equipment; Engineered Structures, focused on manufacturing steel structures for various infrastructure needs, including utility structures, wind towers, and traffic structures; and Transportation Products, which manufactures and sells inland barges, fiberglass barge covers, and steel components for railcars and other transportation equipment.

Arcosa provides its diverse range of infrastructure-related products and solutions primarily through direct sales, distribution channels, and strategic partnerships. Their distribution channels encompass direct sales to customers in construction, engineered structures, and transportation markets, targeting critical infrastructure sectors with a broad spectrum of offerings. Additionally, Arcosa leverages wholesalers, retailers, and dealers to extend its market reach and accessibility for standard products. Strategic partnerships further enhance their distribution network and facilitate access to new markets. Main customers include freight and passenger railcar manufacturers, rail maintenance facilities, railroads, steel mills, and mining equipment manufacturers, with Arcosa serving a broad customer base in these industries by providing steel components for various applications.

As of February 2024, the company had a 52-week share price range of $55.47 to $84.90. The forwarding P/E ratio of the company is 24.10 times, the price-to-sales ratio (ttm) is 1.81 times, the profit margin is 12.88%, the operating margin is 7.74%, the return on assets (ttm) is 3.06%, the return on equity is 13.19%, and the diluted earnings per share (ttm) is $5.88. At January 13, 2023 the number of shares of common stock outstanding was 48,441,548

Recent Developments

- In the second quarter of May 2022, Arcosa, Inc. finalized the stock acquisition of Recycled Aggregate Materials Company, Inc. ("RAMCO"), a leading producer of recycled aggregates in the Los Angeles metropolitan area. The acquisition, which amounted to a total purchase price of $75.6 million, was seamlessly integrated into Arcosa's Construction Products segment. This strategic move underscores Arcosa's commitment to expanding its market presence and enhancing its product portfolio to better serve its customers in key regions.1

- In the fourth quarter of 2022, Arcosa, Inc. finalized the sale of its storage tanks business to Black Diamond Capital Management, LLC for $275 million in cash. Following the sale, the company intends to utilize a portion of the net proceeds to repay outstanding borrowings under its revolving credit facility, while concurrently assessing potential organic initiatives and acquisition opportunities for future growth and strategic development.2

Recent Financing Activities

- In 2022, the company borrowed a net sum of $30.0 million, earmarked specifically to finance the acquisition of RAMCO. As of September 30, 2022, the company anticipates that $3.3 million of outstanding letters of credit will expire within the year, while the remaining portion is set to expire in 2023.3

- During the year ended December 31, 2022, Arcosa, Inc. repurchased 298,629 shares at a total cost of $15.0 million. This initiative falls under the company's share repurchase program, enabling Arcosa to buy back its own shares. Such actions often signify that the company perceives its stock as undervalued or aims to return capital to shareholders. It's important to note that the execution of share repurchase programs can influence the company's stock price and overall capital structure.4

Financial Performance Highlights

Q3 2023 Highlights

In the third quarter of 2023, the company reported sales of $591.7 million, reflecting a decrease of $12.2 million or 2.0% compared to the third quarter of 2022, which had sales of $603.9 million. The net profit for the third quarter of 2023 was $35.5 million, showing an increase of $3.5 million or 10.9% when compared to the net profit of $32 million in the third quarter of 2022. Furthermore, the company's diluted earnings per share (EPS) for the third quarter of 2023 increased to $0.72, a positive change of $0.06 or 9.1% compared to the diluted EPS of $0.66 in the third quarter of 2022.

Annual Performance Highlights

In 2022, the company experienced growth in sales, with total sales reaching $2,242 million. This marked an increase of $205.6 million or 10.1% compared to the sales figure of $2,036.4 million in 2021. The company's gross profit for 2022 amounted to $422.4 million, reflecting a difference of $56.2 million or 15.3% from the gross profit of $366.2 million in the previous year, 2021. Additionally, the company's operating profit increased in 2022, totaling $160 million, which was higher by $49.8 million or 45.2% compared to the operating profit of $110.2 million in 2021. The net profit for the year 2022 was $244.8 million, representing an increase of $175.6 million or 253.6% compared to the net profit of $69.2 million in 2021. Moreover, the diluted earnings per share (EPS) for 2022 were reported as $5.05, which showed an increase of $3.63 or 255.6% compared to the diluted EPS of $1.42 in 2021.

In 2022 compared to 2021, Arcosa witnessed significant operational advancements across its segments, driving notable changes in revenue, operating profit, gross profit, net income, and diluted EPS. Revenue growth of 10.1% was propelled by augmented pricing and increased volumes, particularly in the Construction Products segment, buoyed by acquisitions. Enhanced pricing in the Engineered Structures segment contributed to soaring revenues, with a substantial portion of the operating profit increase attributed to the $189.0 million gain from the sale of the storage tanks business. Excluding this gain, operating profit still surged by $52.7 million, or 49.1%, reflecting robust performance. Transportation Products segment revenues were lifted by higher steel component deliveries, supporting increased operating profit with improved margins. Despite inflationary-related cost escalations in the Construction Products segment, such as diesel and cement, Arcosa's operational strides underscored a year of notable growth and profitability enhancements. The revenue increase was driven by recent acquisitions, strong pricing gains across product lines, and increased revenues from trench shoring and aggregates businesses. The significant increase in operating profit was primarily due to the gain on the sale of the storage tanks business within the Engineered Structures segment, with improved margins, higher volumes, and pricing across various product lines also contributing. The gross profit margin likely improved due to increased pricing gains, higher volumes, and improved margins in different segments of the business. The substantial increase in net income can be attributed to the higher operating profit, improved margins, and the gain on the sale of the storage tanks business, surging from $69.6 million in 2021 to $245.8 million in 2022. The increase in net income and potentially a decrease in the number of outstanding shares could have led to a higher diluted EPS for 2022 compared to 2021, reflecting the company's profitability and potential growth prospects during the period.

In 2022, net cash provided by operating activities increased to $174.3 million compared to $166.5 million in 2021, primarily influenced by changes in current assets and liabilities, driven by increased receivables and inventories due to heightened volumes and higher steel prices. Meanwhile, net cash provided by investing activities improved substantially to $90.7 million in 2022 from a significant cash requirement of $570.3 million in 2021. This improvement was attributed to increased capital expenditures, proceeds from the sale of the storage tanks business, and higher proceeds from the sale of property, plant, and equipment. In contrast, net cash required by financing activities decreased to $177.5 million in 2022 from net cash provided of $380.9 million in 2021. Notably, proceeds from borrowings under the revolving credit facility and the sale of the storage tanks business partially financed acquisitions, while dividends paid and share repurchases contributed to cash outflows.

Business Overview

Arcosa operates in three principal business segments, each contributing to its diversified portfolio. The Construction Products segment focuses on producing and selling natural and recycled aggregates, specialty materials, and construction site support equipment, catering to infrastructure and construction markets. Engineered Structures, another key segment, manufactures steel structures for infrastructure, including utility structures, wind towers, traffic structures, and telecommunication structures. Lastly, the Transportation Products segment manufactures and sells inland barges, fiberglass barge covers, winches, marine hardware, and steel components for railcars and other transportation equipment, serving various industries such as marine transportation, rail transportation, and industrial markets. Arcosa’s product offerings include:

Construction Products Segment: Arcosa's Construction Products segment offers a range of materials and equipment essential for construction projects.

- Natural Aggregates: These include sand, gravel, limestone, and other materials used in various construction applications such as roads, concrete production, and drainage projects. Arcosa operates primarily in Texas and several other states, serving both public infrastructure and private construction markets.

- Recycled Aggregates: Produced from reclaimed concrete, recycled aggregates serve as a sustainable alternative to natural aggregates. They are used for road bases, erosion control, and building foundations, among other purposes.

- Specialty Materials: This category encompasses lightweight aggregates, select natural aggregates, and processed building and agricultural products. These materials find applications in diverse industries, including construction, agriculture, and manufacturing.

- Construction Site Support Equipment: Arcosa manufactures trench shields and shoring products vital for underground construction activities such as water and sewer installations, utility work, and pipeline construction.

Engineered Structures Segment: Arcosa's Engineered Structures segment focuses on manufacturing steel structures for various infrastructure sectors.

- Utility Structures: This includes tapered steel and lattice structures for electricity transmission and distribution, as well as pre-stressed concrete poles. These products support grid reliability and renewable energy initiatives.

- Wind Towers: Arcosa is a leading manufacturer of structural wind towers, catering to the growing demand for wind energy generation.

- Traffic Structures: The company produces steel structures for traffic management, including overhead sign structures, tolling gantries, and mast arms, primarily serving highway and road systems.

- Telecommunication Structures: Arcosa manufactures telecom structures such as lattice towers and monopoles, supporting wireless communication networks across North America.

Transportation Products Segment: Arcosa's Transportation Products segment specializes in manufacturing components for marine and rail transportation.

- Inland Barges: Arcosa manufactures a variety of barges used for transporting dry cargo, liquids, and oversized cargo. These barges play a crucial role in the transportation of commodities along inland waterways.

- Steel Components: The segment produces axles, circular forgings, and coupling devices for railcars, supporting the freight, passenger, and industrial rail transportation sectors.

In summary, Arcosa's diverse product portfolio across its three segments caters to the essential needs of the construction, infrastructure, transportation, and energy industries, offering a wide range of materials and equipment vital for various projects and applications.

Net Revenue by Product Family: Arcosa operates in three principal business segments: Construction Products, Engineered Structures, and Transportation Products.

| Product family | Net revenue in 2022 (in Million $) | Percentage of total revenue |

| Construction Products | 923.5 | 41.17% |

| Engineered Structures | 1,002.0 | 44.68% |

| Transportation Products | 317.3 | 14.15% |

| Total | 2,242.8 | 100% |

In the fiscal year 2022, Arcosa's net revenue distribution across its business segments was as follows: Construction Products contributed $923.5 million, representing 41.2% of the total revenue. Engineered Structures generated $1,002.0 million, accounting for 44.7% of the total revenue. Transportation Products yielded $317.3 million, constituting 14.1% of the total revenue. In summary, Arcosa's total net revenue for the year 2022 was $2,242.8 million.

Other Business Information

Arcosa's involvement in environmental remediation matters presents a critical issue that could significantly impact the company's financial standing and decision-making processes. The ongoing investigations and cleanup activities related to environmental issues at certain facilities pose potential financial risks and liabilities that may affect Arcosa's financial condition and results of operations. The uncertainty surrounding the eventual costs and liabilities associated with environmental remediation could have far-reaching implications on the company's overall financial performance and strategic planning.

Company History

In 1933, Trinity Industries began its journey as a Dallas-based manufacturer specializing in small butane tanks. Over the years, the company expanded its offerings, catering to diverse sectors such as energy, chemical, agriculture, transportation, and construction. By the early 1990s, Trinity Industries Inc. started focusing on producing construction products, setting the stage for its eventual evolution into Arcosa Inc.

In November 2018, Trinity underwent a significant transformation by spinning off its infrastructure-related business into a separate entity, Arcosa Inc. This newly formed public company, headquartered in Dallas, boasted three divisions: Construction Products, Energy Equipment, and Transportation Products.

Arcosa Inc.'s construction materials portfolio, rooted in its history, includes natural aggregates, recycled aggregates, and specialty materials like sand, gravel, and limestone base. With operations spanning more than 11 locations, the company emerged as one of North America's leading producers of rotary kiln expanded shale and clay lightweight aggregate.

The year 2019 marked a pivotal moment for Arcosa Inc. as it made strategic acquisitions, including Cherry Industries and ACG Materials, further strengthening its position in the market. The Cherry acquisition, completed in January, brought 12 Houston area locations under Arcosa's umbrella, significantly expanding its footprint in Texas and the Gulf Coast region. With this move, Arcosa solidified its commitment to growth and innovation in the construction materials sector.

Arcosa's focus on growth through mergers and acquisitions (M&A) has been instrumental in its expansion journey. By actively pursuing opportunities in natural aggregates, recycled aggregates, and specialty materials industries, the company has significantly increased its revenues over the years. Moreover, Arcosa's organic growth strategy, marked by investments in greenfield plants and capacity expansions, has enabled it to meet evolving customer needs and market demands.

Looking ahead, Arcosa remains dedicated to its long-term vision, centered around growing in attractive markets, reducing business cyclicality, improving returns on invested capital, and integrating environmental, social, and governance (ESG) initiatives into its strategy. With a strong foundation built on decades of industry experience and a forward-thinking approach, Arcosa Inc. is poised to continue its trajectory as a leading supplier of aggregates and construction materials in North America.

References

- ^ https://globallegalchronicle.com/arcosas-75-million-acquisition-of-recycled-aggregate-materials-co/

- ^ https://www.theglobeandmail.com/investing/markets/stocks/ACA-N/pressreleases/10540719/arcosa-inc-completes-sale-of-its-storage-tanks-business/

- ^ https://www.marketscreener.com/quote/stock/ARCOSA-INC-46661541/news-press-releases/

- ^ https://www.businesswire.com/news/home/20230223005800/en/Arcosa-Inc.-Announces-Fourth-Quarter-and-Full-Year-2022-Results