Osisko Gold Royalties

Summary

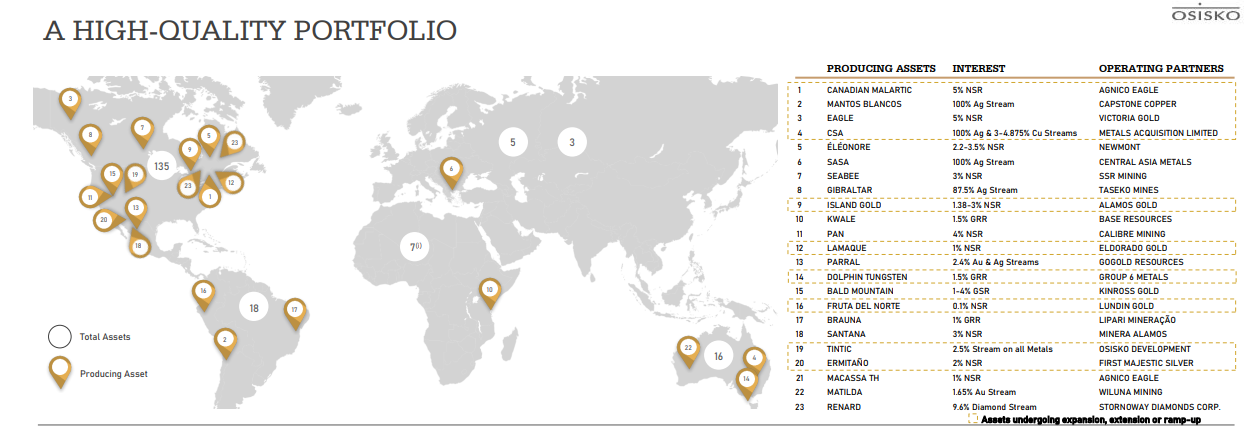

- Osisko is an intermediate precious metal royalty company focused on the Americas.

- Osisko is investing in high quality mining assets by acquiring and managing royalties.

- Osisko holds a portfolio of over 180 royalties, streams and precious metal offtakes.

Osisko Gold Royalties (NYSE: OR, TSX: OR, LSE: 0VBE) is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 180 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 3-5% net smelter return royalty on the Canadian Malartic mine, one of Canada’s largest gold mines.

Recent Developments

Osisko Gold Royalties Announces Sale of Common Shares of Osisko Mining1

Dec. 13, 2023; Osisko Gold Royalties Ltd announced that it has sold 50,023,569 common shares of Osisko Mining Inc. (“Osisko Mining”) (OSK: TSX) pursuant to a bought block trade with National Bank Financial and BMO Capital Markets for aggregate gross proceeds of approximately C$132,000,000.

Following the transaction the Corporation no longer holds any common shares of Osisko Mining. The Corporation continues to hold its 2.0 to 3.0% NSR royalty on the Windfall Gold Project and the surrounding property, held by a 50/50 joint-venture partnership between Osisko Mining and Gold Fields Limited.

Financial Highlights

Q3 2023 Results

Nov. 08, 2023; announced its consolidated financial results for the third quarter of 2023.2

- 23,292 gold equivalent ounces (“GEOs1”) earned (23,850 GEOs in Q3 2022);

- Revenues from royalties and streams of $62.1 million ($53.7 million in Q3 2022);

- Cash flows generated by operating activities2 of $43.5 million ($51.1 million in Q3 2022);

- Net loss2 of $20.0 million, $0.11 per basic share (net earnings of $28.0 million, $0.15 per basic share in Q3 2022), mostly as a result of a non-cash impairment charge and a write-off on assets related to the Renard diamond mine, together totaling $32.4 million ($26.2 million, net of income taxes);

- Adjusted earnings3 of $22.4 million, $0.12 per basic share3 (of $25.8 million, $0.14 per basic share in Q3 2022);

- Acquisition of a 3% gold net smelter return (“NSR”) royalty and 1% copper NSR royalty on the Costa Fuego copper-gold project held by Hot Chili Limited for US$15.0 million ($19.9 million);

- Quarterly dividend of $0.06 per common share paid on October 16, 2023 to shareholders of record as of the close of business on September 29, 2023.

Full Year 2022 Results

Revenues from royalties and streams increased to $217.8 million in 2022 compared to $199.6 million in 2021. Gross profit amounted to $150.4 million in 2022 compared to $138.9 million in 2021. Cost of sales decreased in 2022 to $16.1 million mostly as a result of the conversion of the Parral offtake into a stream in 2021, partially offset by increased deliveries. Depletion increased from $48.4 million to $51.4 million in 2022, mostly as a result of increased deliveries.3

Business development expenses increased from $4.2 million to $5.4 million in 2022, mostly as a result of increased activities and general inflation in professional services.

In 2022, the Company generated net earnings from continuing operations of $85.3 million compared to $76.6 million in 2021. The increase in net earnings is mostly the result of a higher gross profit, a gain on foreign exchange and higher interest income, partially offset by a non-cash net loss on investments (mainly on warrants held from public companies). In 2021, the Company had recorded a non-cash net gain on investments. Adjusted earnings were higher at $111.3 million in 2022, compared to $94.4 million in 2021.

Cash flows provided by operating activities from continuing operations in 2022 were $175.1 million compared to $153.2 million in 2021. The increase was mainly the result of increased revenues from higher deliveries in 2022 and increased interest income.

Company Overview

Osisko Gold Royalties Ltd is engaged in the business of investing in high quality mining assets by acquiring and managing royalties, streams and similar interests on precious metals and other commodities. The Company owns a portfolio of royalties, streams, offtakes, options on royalty/stream financings and exclusive rights to participate in future royalty/stream financings on various projects. The Company’s cornerstone asset is a 5% net smelter return royalty on the Canadian Malartic mine, located in Canada. Osisko held an interest of 44.1% in a mining exploration Osisko Development Corp.4

Asset Portfolio

Company History

Osisko Gold Royalties Ltd. was created following the friendly $4.3B acquisition of Osisko Mining Corporation by Agnico Eagle and Yamana Gold in June 2014.5

Osisko can also rely on the Éléonore royalty, acquired following the business combination between Osisko and Virginia in February 2015.

References

- ^ https://osiskogr.com/en/osisko-gold-royalties-announces-sale-of-common-shares-of-osisko-mining-for-gross-proceeds-of-c132-million/

- ^ https://osiskogr.com/en/osisko-reports-q3-2023-results/

- ^ https://fintel.io/doc/sec-osisko-gold-royalties-ltd-1627272-40f-2023-march-30-19446-5768

- ^ https://fintel.io/doc/sec-osisko-gold-royalties-ltd-1627272-ex991-2023-march-30-19446-313

- ^ https://osiskogr.com/en/history/