Canada Goose Holdings Inc.

Summary

- Canada Goose is a luxury outerwear, apparel, footwear and accessories brand.

- Across all channels, Canada Goose is sold in 62 countries.

- During its Fall / Winter 2022 season, the company sold through over 1,500 wholesale points of distribution.

Canada Goose Holdings Inc. (NYSE: GOOS, TSX: GOOS, LSE: 0UNA) is a Canadian holding company that designs, manufactures, distributes, and sells luxury apparel. It is most famous for its parkas, which are designed to withstand extreme cold weather. The company also produces other outerwear, including jackets, vests, and gloves, as well as footwear and accessories.

Recent Developments

Canada Goose Acquires First European Manufacturing Facility1

November 28, 2023; Canada Goose announces the acquisition of the operating assets of Paola Confectii Manufacturing. Building upon its existing network of seven facilities across Canada, this acquisition marks the company’s first European facility, and supports its Strategic Growth Plan, specifically expanding existing categories and increasing year-round relevance.

Based in Romania, Paola Confectii has been a trusted partner in manufacturing luxury knitwear for Canada Goose since its launch in 2017, producing a range of best-selling styles including the HyBridge Knit Jacket. Knitwear is one of the leading segments of its growing Apparel category, which exceeded $70 million in annual sales in fiscal 2023. This closer partnership is expected to enhance product margins and supply control, while deepening in-house product expertise.

Financial Highlights

Third Quarter Fiscal 2024 Results

February 1, 2024; Canada Goose Holdings Inc. announced financial results for the third quarter of fiscal 2024, which ended December 31, 2023.2

Total revenue increased 6% to $609.9m compared to the prior year period, up 5% on a constant currency basis.

DTC revenue grew 14% to $514.0m, up 14% on a constant currency basis, driven by growth of in-store retail sales. Sales from DTC channels increased as part of the total revenue mix to 84% from 78% in the same reporting period last year. DTC comparable sales decreased 1.6% year-over-year due to lower e-commerce sales, partially offset by higher comparable in-store sales compared to the same period in the prior year.

Wholesale revenue decreased (28)% or (30)% on a constant currency basis primarily due to a planned lower order book value resulting from lower orders from existing customers, compared to the same period in the prior year, and the ongoing streamlining of wholesale relationships as the company optimize for greater DTC sales. In addition, the company estimated higher returns from its wholesale partners as the company proactively manage its inventory.

Revenue grew by 62% year-over-year in Asia Pacific with higher sales across all channels. Revenue was down (26)% in EMEA and (14)% in North America year-over-year primarily due to the decline in e-commerce and wholesale revenue, partially offset by contribution from new stores.

Gross profit grew 8% to $449.7m, compared to the prior year period. Gross margin for the quarter expanded to 73.7% compared to 72.2% in the third quarter of fiscal 2023, primarily due to pricing, partially offset by higher product costs due to input cost inflation.

Selling, general and administrative (SG&A) expenses were $250.9m, compared to $225.7m in the prior year period. The increase in SG&A was primarily due to its expanded retail network and set-up costs related to its Transformation Program.

Operating income was $198.8m, compared to $190.7m in the prior year period. The increase in operating income was attributable to higher gross profit, partially offset by higher SG&A costs.

Adjusted EBIT was $207.2m, compared to $197.1m in the prior year period. Net Income attributable to shareholders was $130.6m, or $1.29 per diluted share, compared with a net income attributable to shareholders of $134.9m, or $1.28 per diluted share in the prior year period. Adjusted net income to shareholders was $138.6m, or $1.37 per diluted share, compared with an adjusted net income of $134.5m, or $1.27 per diluted share in the prior year period.

Fiscal Year 2023 Results

Revenue for the year ended April 2, 2023 increased by $118.6m, or 10.8%, to $1,217.0m from $1,098.4m for the year ended April 3, 2022. Revenue generated from its DTC channel represented 66.3% of total revenue for the year ended April 2, 2023 compared to 67.4% for the year ended April 3, 2022.

Revenue from its DTC segment for the year ended April 2, 2023 was $807.3m compared to $740.4m for the year ended April 3, 2022. The increase of $66.9m or 9.0% was attributable largely to continued retail expansion and comparative period new store openings operating for the full duration of the year ended April 2, 2023. During the year ended April 2, 2023, the company opened 10 permanent stores compared to 13 permanent stores during the year ended April 3, 2022 and ended the period with 51 permanent stores compared to 41 permanent stores at the end of the comparative period.

Gross profit and gross margin for the year ended April 2, 2023 were $815.2m and 67.0%, respectively, compared to $733.6m and 66.8%, respectively, for the year ended April 3, 2022. The increase in gross profit of $81.6m was attributable to higher revenue as noted above and gross margin expansion.

Operating income and operating margin were $135.5m and 11.1%, respectively, for the year ended April 2, 2023 compared to $156.7m and 14.3%, respectively, for the year ended April 3, 2022.

Income tax expense was $24.6m for the year ended April 2, 2023 compared to $23.1m for the year ended April 3, 2022. For the year ended April 2, 2023, the effective and statutory tax rates were 26.3% and 25.3%, respectively, compared to 19.6% and 25.4% for the year ended April 3, 2022, respectively. Given its global operations, the effective tax rate is largely impacted by its profit or loss in taxable jurisdictions relative to the applicable tax rates.

Net income for the year ended April 2, 2023 was $68.9m compared to $94.6m for the year ended April 3, 2022.

Company Overview

Founded in 1957 in a small warehouse in Toronto, Canada, Canada Goose is a lifestyle brand and a leading manufacturer of outerwear and apparel. Every collection is informed by the rugged demands of the Arctic, ensuring a legacy of functionality is embedded in every product from parkas and rainwear to apparel and accessories.3

Across all channels, Canada Goose is sold in 62 countries as of April 2, 2023. During its Fall / Winter 2022 season, the company sold through over 1,500 wholesale points of distribution.

In December 2013, the company partnered with Bain Capital through a sale of a 70% equity interest in its business (the “Acquisition”). In connection with such sale, Canada Goose Holdings Inc. was incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on November 21, 2013. The initial public offering of its subordinate voting shares in the United States and Canada was completed on March 21, 2017.

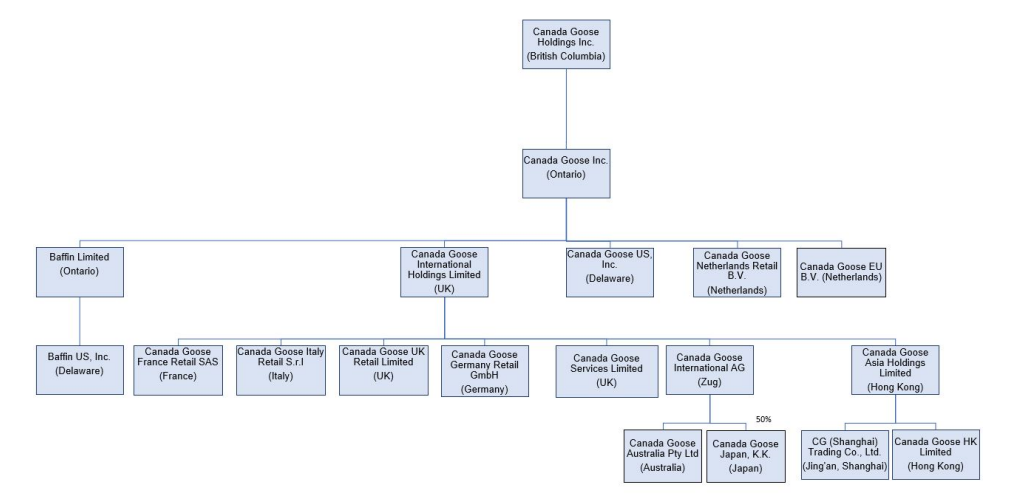

Organizational Structure

Company History

Founded in 1957 in a small warehouse in Toronto, Canada Goose has grown into one of the world’s leading manufacturers of performance luxury apparel.4

- 1957: Canada Goose was founded in a small warehouse in Toronto, Canada, by Sam Tick, under the name "Metro Sportswear Ltd."

- 1970s: The company begins producing jackets and other cold-weather gear for extreme weather conditions, focusing on functionality and durability.

- 1980s: Canada Goose starts manufacturing custom outerwear for various government agencies, including the Canadian Rangers and police forces, further establishing its reputation for quality and reliability in extreme conditions.

- 1990s: The company expands its product line to include a wider range of outerwear, including vests, gloves, and accessories. It also begins to gain popularity among outdoor enthusiasts and adventurers.

- 2001: Dani Reiss, the grandson of the company's founder, becomes CEO and starts to rebrand and expand Canada Goose globally.

- 2004: Canada Goose launches its first flagship store in Toronto, Canada.

- 2007: The company introduces the "Expedition Parka," a highly durable and warm jacket designed for scientists working in Antarctica.

- 2010s: Canada Goose continues to grow its international presence, opening stores in major cities worldwide. The brand becomes increasingly popular among celebrities, further boosting its global recognition.

- 2013: The company opens its first international office in Stockholm, Sweden, marking its expansion into European markets.

- 2017: Canada Goose goes public with an initial public offering (IPO) on the Toronto Stock Exchange and the New York Stock Exchange.

- 2018: Canada Goose acquires Baffin Inc., a Canadian designer and manufacturer of performance outdoor and industrial footwear. Canada Goose expands into China, with an e-commerce channel and its first stores in Beijing and Hong Kong.

- 2022: Canada Goose joins forces with long-time partner, Sazaby League Ltd., to create the joint venture Canada Goose Japan.

References

- ^ https://investor.canadagoose.com/news/news-details/2023/Canada-Goose-Acquires-First-European-Manufacturing-Facility/default.aspx

- ^ https://investor.canadagoose.com/news/news-details/2024/Canada-Goose-Reports-Third-Quarter-Fiscal-2024-Results/default.aspx

- ^ https://fintel.io/doc/sec-canada-goose-holdings-inc-1690511-20f-2023-may-18-19495-9896

- ^ https://www.canadagoose.com/ca/en/our-history.html