Boston Scientific Corporation

Summary

- Boston Scientific Corporation (NYSE:BSX) is a developer, manufacturer, and marketer of medical devices.

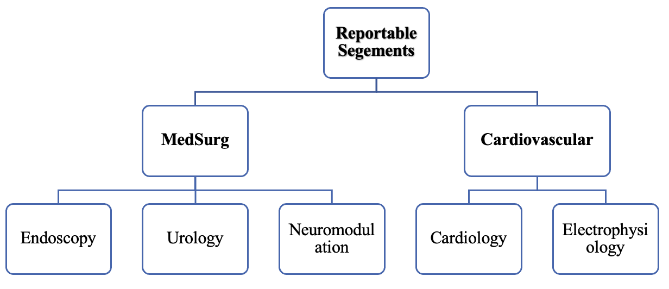

- The Company’s segments include MedSurg and Cardiovascular. The MedSurg segment includes Endoscopy and Urology and Neuromodulation.

- Its Endoscopy business develops and manufactures devices to diagnose and treat a range of gastrointestinal and pulmonary conditions.

- It’s Urology and Neuromodulation business develops and manufactures devices to treat various urological, neurological movement disorders and pelvic conditions.

- The Cardiovascular segment include Interventional Cardiology and Peripheral Interventions.

- In 2022, the company experienced growth in sales, with total sales reaching $12,682 million. This marked an increase of $794 million or 6.7% compared to the sales figure of $11,888 million in 2021.

- The company's gross profit for 2022 amounted to $8,679 million, reflecting a difference of $551 million or 6.8% from the gross profit of $8,128 million in the previous year, 2021.

- Additionally, the company's operating profit increased in 2022, totaling $2,033 million, which was higher by $191 million or 10.5% compared to the operating profit of $1,824 million in 2021.

- The net profit for the year 2022 was $642 million, representing a decrease of $343 million or 25.9% compared to the net profit of $985 million in 2021.

- Moreover, the diluted earnings per share (EPS) for 2022 were reported as $0.45, which showed a decrease of $0.24 or 34.8% compared to the diluted EPS of $0.69 in 2021.

Brief Company Overview

Boston Scientific Corporation (NYSE:BSX) is a developer, manufacturer, and marketer of medical devices. The Company’s segments include MedSurg and Cardiovascular. The MedSurg segment includes Endoscopy and Urology and Neuromodulation. Its Endoscopy business develops and manufactures devices to diagnose and treat a range of gastrointestinal and pulmonary conditions. It’s Urology and Neuromodulation business develops and manufactures devices to treat various urological, neurological movement disorders and pelvic conditions. Its Cardiac Rhythm Management develops and manufactures a variety of implantable devices that monitor the heart and deliver electricity to treat cardiac abnormalities. The Cardiovascular segment include Interventional Cardiology and Peripheral Interventions. Its Interventional Cardiology develops and manufactures technologies for diagnosing and treating coronary artery disease and structural heart conditions. Its product offerings include 360 Clips and RESONATE, among others.

The company has manufacturing facilities in the US, Ireland, Costa Rica, Brazil, Malaysia and Puerto Rico. It sells products directly and also through a network of distributors and dealers in Europe, the Middle East, Africa, Asia Pacific and the Americas. Large group purchasing organizations, hospital networks, and other buying groups have become increasingly crucial to the company's business, representing a substantial portion of its revenue. Each business within the company maintains dedicated teams, focusing on physicians specializing in the diagnosis and treatment of various medical conditions, as well as key hospital service line administrators. Additionally, a network of distributors and dealers offers its products in specific countries and markets. The company is utilizing third-party distributors in those markets where establishing or maintaining a direct presence is neither economical nor strategic.

As of January 2024, the company had a 52-week share price range of $61.46 to $45.57. The forwarding P/E ratio of the company is 27.40 times, the price-to-sales ratio (ttm) is 6.48 times, the profit margin is 8.93%, the operating margin is 17.27%, the return on assets (ttm) is 4.41%, the return on equity is 6.68%, and the diluted earnings per share (ttm) is $.82. The aggregate market value of the registrant’s common stock held by non-affiliates was approximately $53.2 billion based on the last reported sale price of $37.27 of the registrant’s common stock on the New York Stock Exchange on June 30, 2022. The number of shares outstanding of Common Stock, $0.01 par value per share, as of January 31, 2023 was 1,434,780,104.

Recent Developments

- On September 19, 2023, Boston Scientific Corporation (NYSE: BSX) officially announced its definitive agreement to acquire Relievant Medsystems, Inc., a privately held medical technology firm specializing in the development and commercialization of the Intracept® Intraosseous Nerve Ablation System for treating vertebrogenic pain.1

- Boston Scientific has initiated the AVANT GUARD clinical trial to evaluate the safety and effectiveness of the Farapulse pulsed field ablation (PFA) system as a first-line treatment for persistent atrial fibrillation (AF), the only trial to study the use of PFA as frontline therapy in patients with this form of AF.2

Recent Financing Activities

- In March 2022, American Medical Systems Europe B.V. (AMS Europe), an indirect, wholly owned subsidiary of Boston Scientific, completed a registered public offering (the Offering) of €3.000 billion in aggregate principal amount of euro dominated senior notes comprised of €1.000 billion of 0.750% Senior Notes due 2025, €750 million of 1.375% Senior Notes due 2028, €750 million of 1.625% Senior Notes due 2031 and €500 million of 1.875% Senior Notes due 2034 (collectively, the Eurobonds).3

Financial Performance Highlights

Q2 2023 Highlights

In the third quarter of 2023, the company reported sales of $3,527 million, reflecting an increase of $357 million or 11.3% compared to the third quarter of 2022, which had sales of $3,170 million. The net profit for the third quarter of 2023 was $505 million, showing an increase of $331 million or 190.2% when compared to the net profit of $174 million in the third quarter of 2022. Furthermore, the company's diluted earnings per share (EPS) for the third quarter of 2023 increased to $0.34, a positive change of $0.22 or 183.3% compared to the diluted EPS of $0.12 in the third quarter of 2022.

Annual Performance Highlights

In 2022, the company experienced growth in sales, with total sales reaching $12,682 million. This marked an increase of $794 million or 6.7% compared to the sales figure of $11,888 million in 2021. The company's gross profit for 2022 amounted to $8,679 million, reflecting a difference of $551 million or 6.8% from the gross profit of $8,128 million in the previous year, 2021. Additionally, the company's operating profit increased in 2022, totaling $2,033 million, which was higher by $191 million or 10.5% compared to the operating profit of $1,824 million in 2021. The net profit for the year 2022 was $642 million, representing a decrease of $343 million or 25.9% compared to the net profit of $985 million in 2021. Moreover, the diluted earnings per share (EPS) for 2022 were reported as $0.45, which showed a decrease of $0.24 or 34.8% compared to the diluted EPS of $0.69 in 2021.

In 2022, the company generated net sales, reflecting operational growth of 11.1 percent, alongside a negative impact of 440 basis points from foreign currency fluctuations. The operational net sales growth included a positive impact of 240 basis points from acquisitions, such as Preventice Solutions, Inc. (Preventice), Farapulse, Inc. (Farapulse), the global surgical business of Lumenis, LTD (Lumenis), and Baylis Medical Company Inc. (Baylis Medical).

Within the Endoscopy product category, net sales were influenced by a negative impact of 440 basis points from foreign currency fluctuations. These changes were primarily attributed to the biliary franchise, notably driven by the AXIOS™ Stent and Delivery System, and the single-use imaging franchise, including the EXALT™ D Single-use Duodenoscope, as well as the infection prevention and hemostasis franchises.

In the Cardiology business, there was a negative impact of 510 basis points from foreign currency fluctuations. Operational net sales growth in this segment included a positive impact of 400 basis points from the acquisitions of Preventice, Farapulse, and Baylis Medical. Organic sales growth was propelled by the ongoing market expansion of Left Atrial Appendage Closure (LAAC) procedures with the WATCHMAN™ FLX LAAC Device, along with the performance of cardiac diagnostics franchise, POLARx™, Farapulse™ ablation systems, and percutaneous coronary intervention guidance franchises.

In the Peripheral Interventions business, sales growth was primarily driven by the Ranger™ Drug-Coated Balloon and Eluvia™ Drug-Eluting Stent System, as well as the interventional oncology franchise led by the Therasphere™ Y-90 Radioactive Glass Microspheres.Top of Form

Operating Activities: In 2022, cash provided by (used for) operating activities decreased $344 million compared to 2021. This decrease was primarily due to changes in working capital, including higher levels of inventory and accounts receivable. Cash provided by (used for) operating activities included litigation-related payments of $282 million in 2022, related primarily to transvaginal mesh litigation.

Investing Activities: In 2022, cash provided by (used for) investing activities primarily included net cash payments of $1.542 billion for the acquisitions of Baylis Medical and Obsidio, Inc, as well as Purchases of property, plant and equipment and internal use software of $588 million partially offset by Proceeds from settlements of hedge contracts of $56 million and Proceeds from royalty rights of $70 million.

Financing Activities: During the second quarter of 2022, the company completed a public offering, generating €3.000 billion in euro-dominated senior notes. The Offering yielded $3.270 billion in cash proceeds, net of investor discounts and issuance costs. The net proceeds were utilized to fund a tender offer and early redemption of $3.275 billion in certain outstanding senior notes, along with payment for accrued interest, tender premiums, fees, and expenses. In 2022, cash provided by financing activities also encompassed $335 million in payments for contingent consideration established in purchase accounting and $250 million in payments on short-term borrowings.

Business Overview

The company's core businesses are organized into two reportable segments: MedSurg and Cardiovascular, each offering innovative products and new developments.

MedSurg

Endoscopy

The Endoscopy business focuses on developing devices for diagnosing and treating gastrointestinal and pulmonary conditions with less invasive technologies. Key product offerings include Resolution 360™ Clips, WallFlex™ Biliary Stent Systems, AXIOS™ Stents, SpyGlass™ DS II Direct Visualization Systems, EXALT™ Model D Single-Use Duodenoscopes, Acquire™ Endoscopic Ultrasound Fine Needle Biopsy Devices, and infection prevention solutions.

Urology

The Urology business addresses urological and pelvic conditions with products such as stone management devices, LithoVue™ Single-Use Digital Flexible Ureteroscopes, Lumenis Pulse™ Holmium Laser Systems, Prosthetic Urology portfolio, GreenLight XPS™ Laser System, and SpaceOAR™ Hydrogel Systems.

Neuromodulation

The Neuromodulation business focuses on treating neurological movement disorders and chronic pain with products like Precision Montage™ and WaveWriter Alpha™ Spinal Cord Stimulator Systems, G4™ Generator for Radiofrequency Ablation, Vercise Gevia™ and Vercise Genus™ Deep Brain Stimulation Systems, and Superion™ Indirect Decompression Systems.

Cardiovascular

Cardiology

Under the Interventional Cardiology Therapies (ICTx), products include OptiCross™ IVUS Imaging Catheters, SYNERGY™ Everolimus-Eluting Stent Systems, ACURATE neo2™ Aortic Valve Systems, and SENTINEL™ Cerebral Embolic Protection Systems.

Watchman

WATCHMAN FLX™ Left Atrial Appendage Closure (LAAC) Devices are designed to close the left atrial appendage, offering a non-pharmacologic alternative for patients with non-valvular atrial fibrillation.

Cardiac Rhythm Management

The CRM business offers implantable devices for monitoring and treating cardiac abnormalities, including RESONATE™ ICDs and CRT-Ds, EMBLEM™ MRI S-ICD System, and LATITUDE™ Remote Patient Management Systems.

Electrophysiology

Products in Electrophysiology include Rhythmia™ Mapping Systems, Farapulse™ Pulsed Field Ablation Systems, and Intracardiac ultrasound catheters. The acquisition of Baylis Medical in 2022 expanded the portfolio.

Peripheral Interventions

Peripheral Interventions provides products for diagnosing and treating peripheral arterial and venous diseases and various forms of cancer. Notable offerings include EPIC™ and Innova™ Self-Expanding Stent Systems, Eluvia™ Drug Eluting Vascular Stent Systems, and TheraSphere™ Y-90 radioactive glass microspheres.

The following table provides net sales by reportable segment and business unit

| Particulars | 2022 (In million) | Percentage |

| Endoscopy | 2,221 | 17.51% |

| Urology | 1,773 | 13.98% |

| Neuromodulation | 917 | 7.23% |

| MedSurg | 4,911 | 38.72% |

| Cardiology | 5,932 | 46.78% |

| Peripheral Interventions | 1,899 | 14.97% |

| Cardiovascular | 7,831 | 61.75% |

| Other | (60) | -0.47% |

| Net Sales | 12,682 | 100% |

The table presents a comprehensive overview of the company's net sales in 2022, categorizing revenue by its core business segments. In the MedSurg segment, Endoscopy contributes $2,221 million (17.51%), Urology contributes $1,773 million (13.98%), and Neuromodulation contributes $917 million (7.23%), totaling $4,911 million (38.72%). The Cardiovascular segment includes Cardiology at $5,932 million (46.78%) and Peripheral Interventions at $1,899 million (14.97%), summing up to $7,831 million (61.75%). The "Other" category shows a negative contribution of ($60) million (-0.47%). The overall net sales for the company amount to $12,682 million, with Cardiovascular and MedSurg being the predominant contributors, comprising 61.75% and 38.72% of the total, respectively.

Company History

The Origins of Boston Scientific: Founded in June 29, 1979, by John Abele and Pete Nicholas, Boston Scientific embarked on a pioneering journey in the field of interventional medicine, laying the groundwork for a transformative presence in the medical technology industry. The company's inception marked a significant departure from conventional medical approaches, with a clear vision to introduce less-invasive medical options to patients. John Abele, with a background in Medi-Tech, and Pete Nicholas, aspiring to build an enterprise, established Boston Scientific to create new markets for innovative medical solutions. Their shared purpose was to benefit public health by providing accessible, lower-cost, and lower-trauma medical options, setting the tone for the company's culture.

Innovative Beginnings (1970s): The 1970s saw the introduction of pioneering products by Medi-Tech, including the Zavala Lung Model and a contamination-free lung cytology brush. These innovations laid the foundation for Boston Scientific's focus on combining technology with physician input. Notably, John Abele's collaboration with Andreas Gruentzig, a pioneer in percutaneous transluminal coronary angioplasty (PTCA) procedures, played a pivotal role. The decade's emphasis on education and innovation set the stage for Boston Scientific's future trajectory.

Strategic Growth (1980s): In the 1980s, Boston Scientific experienced strategic growth under the leadership of Pete Nicholas. Acquisitions like Kimray Medical Associates and Endo-Tech bolstered the company's presence in cardiology and gastrointestinal fields. Nicholas established a preeminent sales force known as an "educational powerhouse," emphasizing the importance of education in the medical field. International expansion, with subsidiaries in Germany, France, and Japan, reinforced Boston Scientific's global footprint.

Public Offering and Technological Advancements (1990s): Boston Scientific went public through an IPO on May 19, 1992, responding to changes in the U.S. healthcare landscape. The company pursued a "strategic mass" strategy, making targeted acquisitions and alliances. The acquisition of SCIMED brought leadership in cardiology and international markets, further solidifying Boston Scientific's global force in coronary angioplasty and nonvascular therapy.

Transformative Acquisitions (2000s): The 2000s were marked by transformative acquisitions, notably the 2004 acquisition of Advanced Bionics, entering the field of Neuromodulation. The game-changing acquisition of Guidant in 2006, the largest in company history, positioned Boston Scientific as a global leader in cardiovascular medicine and one of the world's largest medical device companies. The launch of the TAXUS Express2 paclitaxel-eluting coronary stent system in 2004 highlighted Boston Scientific's prowess in innovation.

Global Expansion and Recent Achievements (2010s-2020s): In the 2010s, Boston Scientific continued its global expansion, focusing on products that fulfilled unmet needs and aligning with technology strengths. Strategic alliances and acquisitions complemented organic growth. The company's commitment to innovation was evident with the launch of products like Promus Element stent and S-ICD System. The leadership transition in 2012 under CEO Mike Mahoney marked a period of sustained growth and investment, with significant acquisitions such as Vertiflex, Axonics, and Relievant Medsystems in the following years.

Ongoing Impact and Future Outlook: As of January 2024, Boston Scientific remains a prominent force in the medical technology industry, continually innovating and addressing unmet clinical needs. Its impact is not only measured in financial success but also in its ability to improve patient care globally. The history of Boston Scientific serves as a testament to its founders' vision, adaptability, and commitment to delivering value in the medical field. The company's trajectory from its founding to a global leader exemplifies its ability to resonate with healthcare professionals, adapt to changing landscapes, and thrive as a pioneer in the industry. As Boston Scientific continues to redefine norms in medical technology, its enduring impact remains profound, providing a blueprint for companies aiming to innovate and thrive in the evolving healthcare sector.

References

- ^ https://www.prnewswire.com/news-releases/boston-scientific-announces-agreement-to-acquire-relievant-medsystems-inc-301931674.html

- ^ https://cardiacrhythmnews.com/avant-guard-clinical-trial-of-farapulse-pfa-system-begins/

- ^ https://www.prnewswire.com/news-releases/boston-scientific-announces-completion-of-3-0-billion-offering-of-senior-notes-301498276.html