Crescent Point Energy

Summary

- Crescent Point Energy is a leading North American oil producer focused on the sustainable development.

- Recently Crescent Point Completed acquisition of Hammerhead Energy and Alberta Montney.

Crescent Point Energy (NYSE: CPG, TSX: CPG, LSE: 0UR7) is a leading North American oil producer focused on the sustainable development of high-quality assets.

Recent Developments

Crescent Point Completes acquisition of Hammerhead Energy and Alberta Montney.1

December 21, 2023; Crescent Point Energy Corp. announce that it has successfully completed its previously announced strategic acquisition of Hammerhead Energy Inc., an oil and liquids-rich Alberta Montney producer. The Company is also providing its formal 2024 guidance and five-year plan, which are significantly enhanced as a result of the Transaction.

Crescent Point's annual production is forecast to grow to approximately 260,000 boe/d in 2028 under its five-year plan, driven by the Company's Alberta Montney and Kaybob Duvernay assets, with cumulative after-tax excess cash flow of approximately $4.7 billion at US$70/bbl WTI and $3.35/Mcf AECO. Under this five-year plan, the Company expects to generate excess cash flow per share growth of seven percent on a compounded annual basis, or 15 percent including the benefit from expected share repurchases.

Financial Highlights

Q3 2023 Results

Nov. 2, 2023; Crescent Point Energy Corp. is pleased to announce its operating and financial results for the quarter ended September 30, 2023.2

The Company achieved strong third-quarter financial results with adjusted funds flow from operations of $687.1 million and adjusted net earnings from operations of $315.5 million. The Company generated $321.6 million of excess cash flow and reduced net debt by $124.5 million during the quarter, exiting the third quarter of 2023 with net debt of $2.88 billion. Crescent Point continued to execute on its return of capital framework, returning approximately 60 percent of its excess cash flow to shareholders through share repurchases and dividends. Crescent Point repurchased 11.4 million shares for $124.5 million during the third quarter, accounting for the largest allocation of the return of capital.

The Company achieved average production of 180,581 boe/d and 158,448 boe/d for the three and nine months ended September 30, 2023, respectively, representing an increase of 36 percent and 20 percent from the 2022 comparative periods. This growth is primarily attributable to the acquisitions of the Alberta Montney assets in May 2023 and additional Kaybob Duvernay assets in January 2023, along with organic growth in the Kaybob Duvernay and North Dakota properties as a result of the Company's successful development program.

Company Overview

Crescent Point is to carry on the business of acquiring, developing and holding interests in petroleum and natural gas properties and assets related thereto through a general partnership and wholly owned subsidiaries.3

Operations

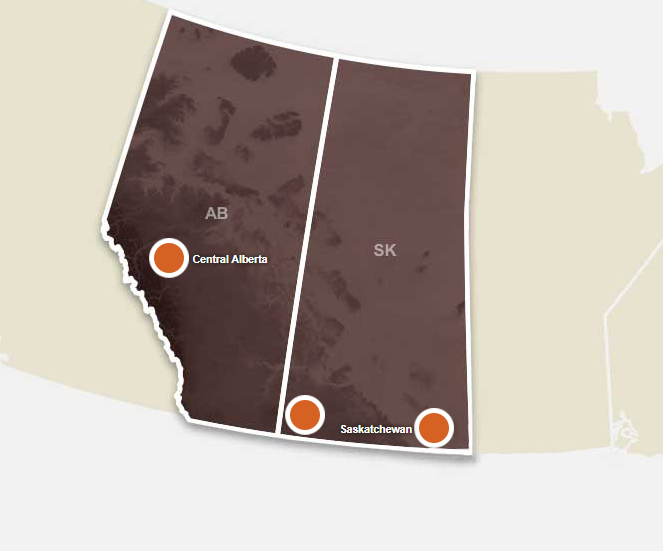

Viewfield Bakken

The Viewfield Bakken light oil pool in Saskatchewan is its largest and longest producing resource play. The company own a significant portion of this high-return oil pool, which contributes a significant portion of its free cash flow. The company's Viewfield waterflood development program continues to enhance recovery factors and moderate decline rates.

Flat Lake

The company's Flat Lake play is a multi-zone resource play located in southeast Saskatchewan and is an extension of its North Dakota properties. Based on its success in similar resource pools, Crescent Point has successfully developed this high-netback light oil pool since 2012 while also improving its cost structure through realized efficiencies and new infrastructure. This play provides an increasing free cash flow profile and is further enhanced through waterflood development.

Shaunavon

The company's Shaunavon resource play is located in southwest Saskatchewan. The company own a significant portion of this oil pool, which provides low-risk growth and free cash flow. The company's Shaunavon waterflood and enhanced oil recovery programs are expected to provide additional benefits over the long-term.

Kaybob Duvernay

Situated in the heart of the condensate rich fairway and providing significant low risk drilling inventory with attractive economics, the company entered the Kaybob Duvernay play in 2021. The assets also enhance its free cash flow generation and benefit from having significant infrastructure in place, reducing the need for future capital requirements.

Alberta Montney

The company's Alberta Montney assets sit adjacent to its Kaybob Duvernay lands, possessing similar resource characteristics including pay thickness and permeability in the volatile oil fairway of the reservoir. The company's consolidated position is composed primarily of crown land and a high average working interest. The assets generate attractive netbacks and significant excess cash flow.

Five-Year Plan

Crescent Point's annual production is forecast to grow to approximately 260,000 boe/d in 2028 under its five-year plan, driven by the Company's Alberta Montney and Kaybob Duvernay assets, with cumulative after-tax excess cash flow of approximately $4.7 billion at US$70/bbl WTI and $3.35/Mcf AECO. Under this five-year plan, the Company expects to generate excess cash flow per share growth of seven percent on a compounded annual basis, or 15 percent including the benefit from expected share repurchases.

This enhanced profile highlights the strong contribution of the newly acquired Alberta Montney assets, which are expected to provide the Company with a combination of growing production and lower capital expenditure requirements to sustain production in later years. On a per share basis, Crescent Point's cumulative excess cash flow under its five-year plan has increased by approximately 20 percent as a result of the Transaction.

In 2024, the recently acquired Montney assets are expected to produce 56,000 boe/d, growing to 80,000 boe/d by 2026, then remaining flat thereafter. During this same period, development capital expenditures are expected to gradually decline from $400 million in 2024 to $300 million toward the end of the five-year plan, resulting in significant excess cash flow generation.

Crescent Point's combined Alberta Montney and Kaybob Duvernay assets are expected to represent 80 percent of the Company's total production in 2028. Crescent Point's disciplined capital allocation, in combination with its low-decline, long-cycle assets, is expected to allow the Company to also moderate its base decline rate from 30 percent in 2024 to 27 percent toward the end of its five-year plan. During this period, Crescent Point expects to reduce its reinvestment ratio, or capital expenditures as a percentage of funds flow, by nearly 10 percent.

References

- ^ https://www.crescentpointenergy.com/invest/news/crescent-point-completes-strategic-alberta-montney-consolidation-and-provides-improved

- ^ https://www.crescentpointenergy.com/invest/news/crescent-point-announces-q3-2023-results

- ^ https://fintel.io/doc/sec-crescent-point-energy-corp-1545851-ex993-2023-march-02-19418-5952