Segro

Summary

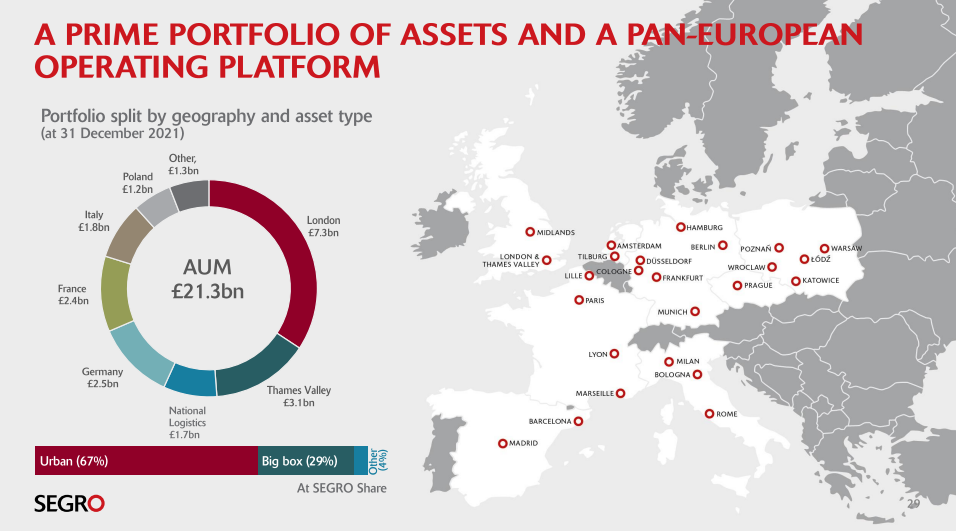

- SEGRO is a UK Real Estate Investment Trust (REIT)

- The company create and manage sustainable industrial spaces in prime locations.

- The company's portfolio located in and around cities and transport hubs across the UK and Europe

Company Overview

SEGRO (LSE:SGRO, OTC:SEGXF) is a UK Real Estate Investment Trust (REIT), and a leading owner, asset manager and developer of modern warehousing and industrial property.

The company provide its customers with modern warehouse facilities close to consumers, talent and transport. The company's big box sites offer flexible space to meet the needs of a wide range of sectors and operations, with the power to support automation and emerging technologies.1

These big box are complemented by smaller urban warehouses, strategically situated within easy reach of end-consumers to enable swift ‘last mile’ distribution.

Recent Developments

DHL Parcel UK takes space at SEGRO Park Coventry2

07 July 2022; DHL Parcel UK has become the customer at SEGRO Park Coventry after choosing the development as the location for a major new UK logistics hub

Alongside the pre-let deal, SEGRO plans to speculatively build two warehouses comprising 140,000 sq ft and 220,000 sq ft of space, to help meet market demand and capitalise on construction synergies and efficiencies.

DHL will occupy a 300,000 sq ft unit on a 25-year lease at the 200-acre industrial and logistics park in Warwick District, creating up to 600 jobs. Combined with the development of the two speculative units, it means one third of the 3.7m sq ft SEGRO Park Coventry development will be under construction ahead of completion of the infrastructure works next year. All three buildings are scheduled to be ready for occupation by summer 2023.

SEGRO continues to expand London footprint with acquisitions totalling £195m3

25 April 2022; SEGRO has completed £195m of investment in London, acquiring Grand Union Trade Park in Park Royal and growing its Inner London pipeline with the purchase of two assets in Wapping and Clapham, each measuring 2.6 acres in size and providing extensive coverage in east and west London.

Grand Union Trade Park comprises 100,000 sq ft of industrial space across more than four acres. The estate, which is fully let to a mix of trade suppliers, including Screwfix and Howdens, is adjacent to Tudor Industrial Estate and Premier Park, also owned by SEGRO, offering the potential for large-scale redevelopment in the medium to long-term. SEGRO has acquired Grand Union Trade Park from abrdn for an undisclosed fee.

Financial Highlights

Adjusted pre-tax profit of £356 million up 20 per cent compared with the prior year (2020: £296 million). Adjusted EPS is 29.1 pence, up 15 per cent (2020: 25.4 pence) including 1.1 pence relating to recognition of performance fees from its SELP joint venture.

Adjusted NAV per share up 40 per cent to 1,137 pence (31 December 2020: 814 pence) driven by portfolio valuation growth of 29 per cent, including ERV growth of 13.1 per cent (2020: 2.5 per cent), yield compression, portfolio asset management initiatives and development profits.

Strong occupier demand, its customer focus and active management of the portfolio generated £95 million of new headline rent commitments during the period (2020: £78 million), including £49 million of new pre-let agreements, and a 13 per cent average uplift on rent reviews and renewals

Net capital investment of £1.5 billion (2020: £1.3 billion) in asset acquisitions, development projects and land purchases, less disposals.

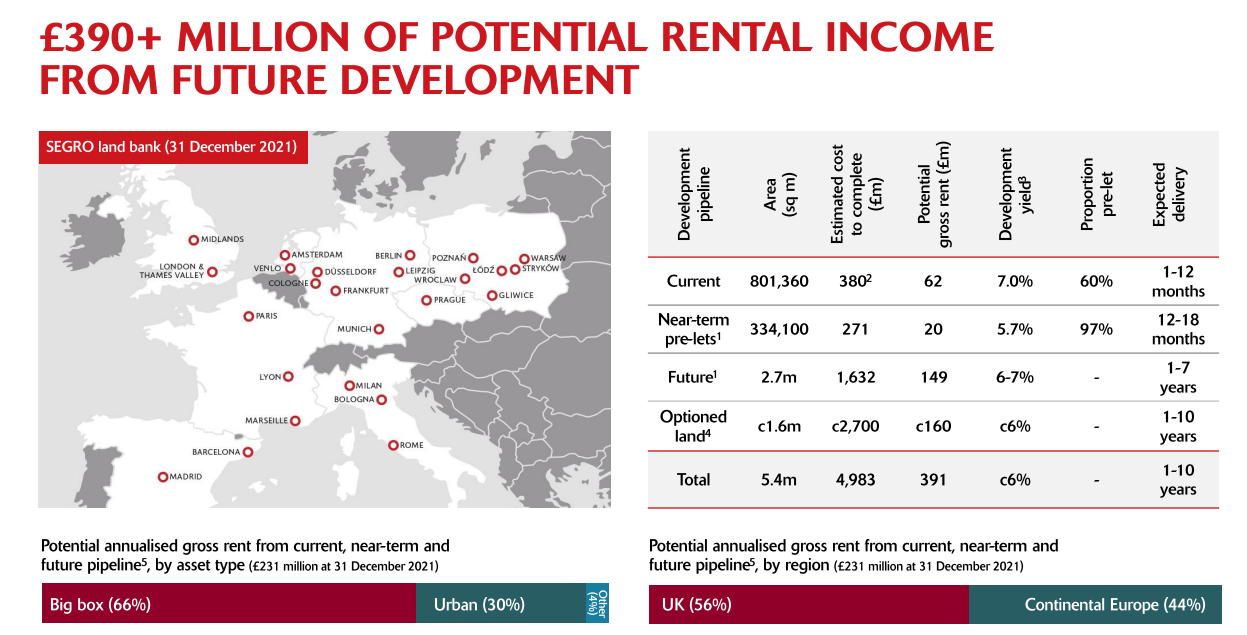

Continued momentum in the development pipeline with 1.1 million sq m of projects under construction or in advanced pre-let discussions equating to £82 million of potential rent, of which 70 per cent has been pre-let, providing growth in earnings this year and next.

Balance sheet well positioned to support further, development-led growth with access to £1.1 billion of available liquidity and an LTV of 23 per cent at 31 December 2021 (31 December 2020: 24 per cent).

2021 full year dividend increased 10 per cent to 24.3 pence (2020: 22.1 pence). Final dividend increased by 11 per cent to 16.9 pence (2020: 15.2 pence).

Products

The company's portfolio includes a variety of modern industrial assets located in and around cities and key transport hubs across the UK and Europe. The company's big box developments offer scale as well as location and connectivity, while urban warehouse estates enable Last Mile Delivery.4

Big Box

Big box warehouses are typically used for storage and processing of goods for regional, national and international distribution by larger trucks or by rail. They are typically used by retailers, third party logistics and transport companies, manufacturers, distributors and wholesalers.

The requirement for large land plots means that they tend to be located some distance from the ultimate customer, but on major transport routes (mainly motorways, ports, rail freight terminals and airports) to allow rapid transit.

Urban Warehouses

Urban warehouses are located in or close to population centres and business districts. They are used by a wide variety of customers, including retailers and supermarkets, parcel delivery companies, food preparation companies, data centre operators, air cargo handling companies and wholesalers who need rapid access to their own customers for last mile delivery.

Urban warehouses tend to be smaller and they are often clustered in estates which can comprise terraces of smaller units (typically less than 3,500 sq m) and larger detached single-let warehouses (typically larger than 3,500 sq m), or a combination of these. They are also ideal for office space, car showrooms, self storage facilities and trade counters.

References

- ^ https://www.segro.com/about/our-business

- ^ https://www.segro.com/media/news/2022/70722-dhl-parcel-uk-takes-first-space-at-segro-park-coventry

- ^ https://www.segro.com/media/news/2022/250422-segro-continues-to-expand-london-footprint-with-acquisitions-totalling-195m

- ^ https://www.segro.com/about/our-products