Dutch-Bangla Bank Limited

Summary

- Bangladesh's first scheduled joint venture private commercial bank, Dutch-Bangla Bank Limited started its journey in 1996.

- It is serving more than 8.3 million people with 220 branches in 8 districts, 4,917 ATMs, 1,342 Fast Tracks and 5,803 Agent banking outlet.

- Mr. Sayem Ahmed is the chairman and Ms. Sadia Rayen Ahmed is the director of the bank.

- The deposit of the Bank increased by 10.7% while loans and advances increased by 16.9% on FY 2021 compared to the previous fiscal year.

Company overview

Dutch-Bangla Bank Limited, known as DBBL started its journey in 1996 as the Bangladesh's first scheduled joint venture private commercial bank. It was established mainly by M Sahabuddin Ahmed (founder chairman) and the Dutch company FMO. Since then, the bank opened 220 branches in 8 districts, 4,917 ATMs, 1,342 Fast Tracks and 5,803 Agent banking outlets. Its head office is situated in Dhaka. 7722 people work for the company with turnover rate of 4.27%. It has a customer base of more than 8.3 million clients. By 2021, the deposits of the bank grew to BDT 362,611 million which is more than 16.60% higher than that of in 2020.

Group Structure and Shareholders

The bank got listed in both DSE and CSE in 2001. 85% of the shares are held by the sponsors, 5% by instituions and 10% by the general public. As on 4th October of 2022, the market capitalisation of the company was BDT 45.02 billion.1

Share Market Insights

The bank has been listed in both DSE and CSE since 2001 with the trading code names DUTCHBANGL. It is under the market category ‘A’. The outstanding numbers of share is 632,500,000 with paid up capital of 6,325 million, share price of BDT 64.90 and market capital of more than 45 billion (As of October 4, 2022). It declared 15% of cash and stock dividend each and 0.15 bonus share against 1 existing share of Taka 10 each in 2020. In 2021, the EPS of the bank was BDT 8.8 and NAV of 58.4.

Financial Analysis

The accounting period of DBBL starts on January 1 and ends on December 31. Operating profit increased by 10.5% from BDT 10,501.3 million to BDT 11,607.2 million in 2021 and net profit after tax increased from BDT 5,498.7 million to BDT 5,561.1 million in 2021 showing a growth of 1.1%.2 During the year 2021, the net interest income of the Bank increased by BDT 1,394.5 million (9.9%) from Taka 14,129.7 million of the previous year. Net interest income increased mainly due to lower cost of deposits in 2021. Yield on loans and advances decreased by 0.5% to 7.7% in 2021 from 8.2% of previous year mainly due to un-sustained lower interest rate on loans advances prevailing in the market. During the year 2021, the investment income of the Bank increased by 2.9% to BDT 7,351.3 million compared to that of in the previous year. Investment income increased mainly due to increased investments in government treasury bills and bonds portfolio in 2021. Total expenses have increased around 3% which is attributable to expansion of branch, sub-branch, Fast Track and ATM network; mobile and agent banking operation, operation of IT platform and online banking and so on. Twelve new branches and 76 sub-branches were opened in 2021 and 152 new Fast Tracks & 55 ATM units were installed in 2021. Commission and exchange income increased by 11.4% mainly due to higher volume of import and export business and higher remittance inflow during FY2021.

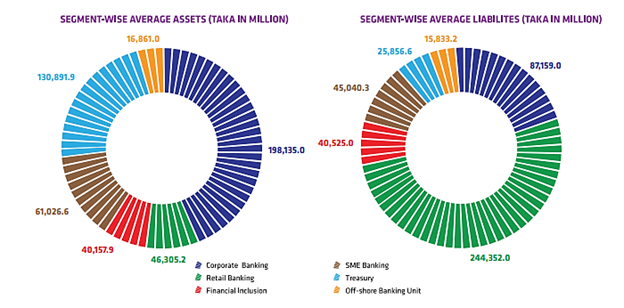

The deposit of the Bank increased by 10.7% from BDT 362,611.0 million in 2020 to Taka 401,500.3 million in 2021, loans and advances increased by 16.9% from BDT 273,382.9 million to Taka 319,448.1 million in 2021 while export business of the Bank increased by 43.6% and import business increased by 39.8%. At the end of 2021, DBBL’s total retail loan portfolio was Taka 44,830.2 million which is more than 14.0% of total loan portfolio and total SME loan portfolio stood at BDT 43,395.3 million which is more than 13.6% of total loan portfolio. Total assets of the Bank as at 31 December 2021 stood at BDT 514,399.8 million compared to BDT 472,355.4 million of 2020 registering a growth of 8.9%. Loans and advances is the largest component of assets followed by investments. As at 31 December 2021, cash in hand and balances with Bangladesh Bank and its agent banks (including foreign currencies) stood at BDT 35,716.8 million registering a negative growth of 12.6%.

| Ratio | 2021 | 2020 |

| Loan deposit ratio | 71.8% | 67.5% |

| ROA | 1.1% | 1.3% |

| Return on risk weighted assets | 1.8% | 2.2% |

| NPL to total loan | 3.7% | 2.2% |

| Cost to income ratio | 58.8% | 60.5% |

| Debt to equity ratio | 32.5% | 43.4% |

Business Overview

Classified loan as a percentage of total loan portfolios increased to 3.7% at the end of 2021. Most of the loans of the bank is concentrated on corporate banking.

At the end of 2021, total equity stood at BDT 36,966.4 million as compared to BDT 32,256.7 million in 2020. As of 31 December 2021, Capital to risk-weighted asset Ratio (CRAR) under Basel III stood 16.4% (Tier 1 capital 11.0% and Tier 2 capital 5.4%) against the Bangladesh Bank minimum requirement of 12.5%.

75% of the credit exposures comes from Dhaka division while 8.5% come from the Chattogram division. Bank maintains 26 nostro accounts in 11 major currencies with international banks across the globe. The bank showed a 26% growth in receiving remittance.

Location

The Bank opened 12 new branches, which at the end of 2021 stood at 220 compared to the 208 of the previous year. 55 ATMs were installed in 2021 to reach 4,917 ATMs at the end of 2021 and 152 new Fast Tracks were inaugurated in 2021 to reach 1,342 Fast Tracks. In addition, the Bank opened 76 sub-branches in 2021. They also have opened 5,803 Agent banking outlets up to 2021 and have a target to reach at 6,300 by 2022. BBL has six SME/Agriculture branch mainly in rural areas as of 2021.

Services

Agent banking: These services was introduced in 2015. This is deposit based service of DBBL branches. 5803 Agent outlets covering 487 Upazilas under 64 District were operating at the end of Dec 2021 to serve the agent banking customers. A total of 531 Master Agents were engaged in providing re-balancing service to the Agent outlets.

NexusPay: It works with all bank cards including Nexus, Visa, MasterCard, Dutch-Bangla Bank Agent Banking and Rocket Mobile Banking. Numbers of Merchants accepting DBBL NexusPay stood at 23966 at the year ended 2021. Numbers of DBBL NexusPay users stood 4,396,817 in 2021.

E-payment gateway: It is a service where the user can shop, pay bills and others through online without being a DBBL customers. There are 5,608 e-Com merchants registered who can use MasterCard, Visa and Nexus cards to pay.

Fast Track: Fast Track was introduced in 2010 to expand the ATM services. DBBL have 1342 Fast Track comprised of ATMs, Deposit Kiosks, and Customer Service help desk officers. The Fast Track and ATM network was further expanded in 2021. Cash Receiving Machine (CRM) was added in 2021 in the Fast Track and Branches for providing more services to the depositors.

Point of Sale: DBBL started its ATM/POS service back in 2004. Number of ATM of the bank stood 4917 in 2021. In 2021, the number of POS was 17,890 with total transaction of BDT 33.45 million.

VIP Banking: The bank decided to introduce “VIP Banking” for the existing and new high net worth customers. The first VIP lounge was opened in the bank’s Gulshan branch on 14 March 2017. As on December 2021, the bank has total 10 VIP banking lounges, 5 VIP zones and 9,650 VIP customers with a total amount of deposit of BDT 37,956.5 million.

Mobile banking service: It was introduced by DBBL in 2011 that was first mobile banking in the country. Mobile service was rebranded as “ROCKET” in 2016. It is further strengthened in 2021 to cover the entire Bangladesh. The main purpose of mobile banking is to provide services to the clients through mobile phones and multiple delivery channels. Rocket is serving 26.65 million customers now.

Strategies

- Concentrating more on earning non-interest income increasing loan portfolio in low-risk-segments for reducing NPL & increasing effective interest yield.

- Long term strategy for loan portfolio is Corporate: SME: Retail as 40%:30%:30%.

- Maximum utilization of AD ratio by providing fresh loan to borrower with good credit rating.

- operating cost will be rationalized by using modern software, digitizing the filing, documentation and working process, improving productivity of resources, improving internal control system and reducing duplication of process, wastage and pilferage and also taking measures to control operation cost