LankaBangla Finance Limited

Company Overview

LankaBangla Finance Limited has started its journey in mid-1990s as a non-bank financial institution in Bangladesh. The company got registered with Bangladesh Bank in 1997 under Financial Institution Act-1993. The journey of the company began on November 5, 1996 as a joint-venture company. Currently, it is the leading non-bank financial institution (NBFI) in the country. It is listed in both Dhaka Stock Exchange and Chattogram Stock Exchange, two bourses of the country. LankaBangla Finance Limited (LBFL) has two subsidiaries – first of them LankaBangla Securities Limited (LBSL) got registered on July 3, 1997, and the second one LankaBangla Asset Management Company Limited (LBAMCL) got registered on July 16, 2007.1 However, there is another subsidiary of the company, commencement of which is not counted as a milestone in the company website, namely LankaBangla Investments Limited (LBIL) – a premier investment bank in Bangladesh providing corporate advisory, portfolio management services, and issue management. LankaBangla Securities Limited provides top-notch brokerage services, top-rated research information, cutting edge trading, and customer services. The other subsidiary provides asset management services to its customers. Apart from these operations, the first subsidiary of LankaBangla Finance Limited has two subsidiaries – LankaBangla Information Systems Limited (LBiSL) and BizBangla Media Limited (BizBangla).

Vision of the company is to be the most preferred financial service provider in creating, nurturing and maximizing value to the stakeholders, thereby, growing together. Mission of the company is to be a growth partner for the customers ensuring superior financing experience, to maintain a culture of meritocracy in the core of the company, to be sustainable and to ensure quality returns for the valued shareholders, and to place efforts to develop community.

The integrated service portfolio of the company includes retail financial services, corporate financial services, liability management, SME financial services, stockbroking, wealth management services, and corporate advisory. LankaBangla Finance received National Award for Best Published Accounts and Reports awarded by Institute of Chartered Accountants of Bangladesh (ICAB) for several consecutive years. It also received ‘Best Presented Annual Report’ award from South Asian Federation of Accountants (SAFA) for four consecutive years (2014-2017).

LankaBangla is the only financial institution (NBFI) in Bangladesh to operate credit card (MasterCard and VISA). The product portfolio along with their commencement date is given in the following table2 -

| Product/Service name | Commencement date |

| Lease agreement | March 30, 1998 |

| Credit card | August 16, 1998 |

| Mastercard | September 5, 2005 |

| Domestic finance | December 11, 2007 |

| Mortgage loan | February 18, 2008 |

| VISA card | November 24, 2009 |

| Contactless Mastercard | September 3, 2019 |

| Contactless VISA card | September 17, 2019 |

Following are the list of branches of the company along with their opening date –

| Branch Name | Launching date |

| Chattogram Branch | February 10, 2007 |

| Sylhet Branch | April 27, 2009 |

| Khatunganj Branch, Chattogram | March 8, 2012 |

| Narsingdi Branch | January 28, 2013 |

| Cumilla Branch | February 3, 2013 |

| Jashore Branch | February 13, 2013 |

| Banani Principal Branch | November 12, 2013 |

| Dhanmondi Branch | December 11, 2013 |

| Uttara Branch | March 3, 2014 |

| CDA Branch, Chattogram | May 25, 2014 |

| Motijheel Branch | December 23, 2014 |

| Mirpur Branch | January 29, 2015 |

| Bogura Branch | May 24, 2015 |

| Barishal Branch | June 24, 2015 |

| Mymensingh Branch | March 9, 2016 |

| Khulna Branch | March 14, 2016 |

| Rajshahi Branch | March 21, 2016 |

| Narayanganj Branch | July 31, 2016 |

| Chowmuhani Branch | July 31, 2016 |

| Keraniganj Branch | March 31, 2017 |

| Board Bazar, Gazipur Branch | April 27, 2017 |

| Dinajpur Branch | May 4, 2017 |

| Faridpur Branch | May 18, 2017 |

| Savar Branch | May 25, 2017 |

| Gulshan Branch | March 29, 2018 |

| Habiganj Branch | December 26, 2018 |

| Kushtia Branch | January 10, 2019 |

The company issued zero coupon bond first on December 15, 2014 and second on December 26, 2017. On December 31, 2020, outstanding balance of zero-coupon bond of the company is BDT 105 billion, which was BDT 389 billion a year earlier. The company paid off BDT 284 billion of zero-coupon bond. First subordinate bond of the company is issued on December 23, 2018. As of December 31, 2020, the company’s outstanding balance of subordinate bond is BDT 2,201 billion, which was BDT 1,533 billion a year earlier.3

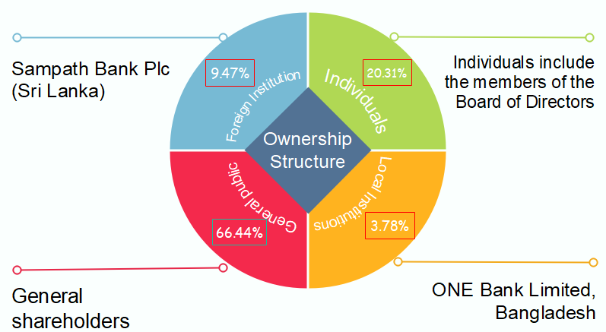

As on December 31, 2019, total paid-up shares of the company were 513,179,641, BDT 10 each, thus paid-up capital of BDT 5,131,796,410. The shares of the company are owned by foreign institutions, local institutions, individuals, and general public. Sampath Bank PLC of Sri Lanka owns 9.47% of the company, ONE Bank Limited of Bangladesh owns 3.78% of the company, Directors of the company holds another 20.31% of the company. Thus, sponsors and/or directors hold 33.56% of the total share of the company.

LankaBangla Finance has a total of 37 branches in 18 cities across the country. It has total 1,449 employees. The NBFI has a digital call centre through which it claims to have received 400,000+ calls and served 45,000+ customers. The company has deposited BDT 900.85 million in the Government exchequer as Tax, VAT, and excise duty.

Business overview

The portfolio of services of LankaBangla involves the services of all its five subsidiaries and of the parent company. Over the span of its business, the company has developed service areas which cover almost every corner of the financial services arena.

Products of LankaBangla Finance: Corporate financial services division

LankaBangla Finance provides 360-degree financial service coverage to its clients. The product and service units of LankaBangla are as follows –

- Large corporate

- Emerging corporate

- Supply chain finance

- Project, structured & sustainable finance

- Corporate liability

Large corporate

This service division provides loans to the large corporate houses in order for them to realize their vision and strategic goals. The division has expanded its footprints in the industries like Food Production and Processing, Light Engineering, Steel & Engineering, Plastic, Cables, Real Estate, Cement, RMG, Footwear and so on. The products offered by the large corporate unit are listed below –

- Lease finance

- Term finance

- Short-term finance

- Revolving finance

- Loan against TDR

- Work order finance

- Club finance

- Bridge finance

Emerging corporate

Emerging corporate unit of the company has started operation in 2019 and is working to provide services to meet the needs of emerging corporate clients. The business unit serves the clients including emerging manufacturing industries, MNCs, EPZ and EZ customer, supply chain concerns, and project developers. The service portfolio under this segment is same as that of the large corporate unit.

Project, structured & sustainable finance

Major products offered under this unit of business of LankaBangla Finance is listed below –

- Project finance

- Alternative modes of capital raising (i. e. bond, preference shares etc.)

- Offshore/DFI/low-cost structured solutions

- Green/sustainable finance

- Islamic Shariah Compliant financing solutions

- Corporate Advisory Services

Supply chain finance

This division strives to provide working capital to the businesses. Short-term working capital finance helps the businesses keep their cash management efficient. The products offered by this unit include working capital solutions against receivables, confirmed payables, credit advisory, lifting orders, collections and so on. Below are the services offered by this unit –

- Factoring finance

- Distributor finance

- Reverse factoring

Corporate liability

This unit is basically concerned with collecting corporate deposits. This constructs liability side of the balance sheet. Following are the products offered by this unit –

- Actual days deposit

- Corporate classic TDR

- Shahoj Sanchay

- Periodic return

- Earn first

- Double money deposit

- Triple money deposit

- Money builder

Products of LankaBangla Finance: Retail financial services division

This division provides financing services to the individuals. There are three difference sectors namely loan unit, card centre, and deposit. The division delivers services through 6 (six) units namely –

- Auto loan

- Home and mortgage loan

- Personal loan

- Credit card

- Retail liability

- Alternative business delivery channel

Auto loan

The auto loan unit specializes in car financing for individuals and institutions. It deals all sales, marketing, business promotional activities, and relationship management with individuals, corporate customers and auto dealers.

Home & mortgage loan

Under different terms and conditions, LankaBangla home & mortgage unit provides housing solution to the customers. The activities include sales, marketing, business promotions, and relationship management with the real estate sector.

Personal loan

The company has different products under the category of personal loan. It offers personal loan for salaried person (Bandhan), Doctor’s loan, Teacher’s Loan (Beacon), Govt. Employee Loan (Hope), personal loan for businessman loan (Bonik), and short-term loan against lien of deposits (SOD).

Credit card

LankaBangla is the only financial institution to offer cards through its own CMS. Following are the name of the cards offered by the company –

- Master Titanium

- Master Gold

- Master Classic

- VISA Platinum

- VISA Gold

- VISA Classic

Retail Liability

This unit of the company focuses on retail deposits. Since the financial institutions cannot accept deposits like banks, they need to collect deposits through other means such as from the autonomous, government or private bodies. Below are some retail liability products listed by the company –

- Classic TDR

- Shohoj Sanchoy

- Earn First

- Periodic Return Term Deposit

- Money Builder

- Flexi Deposit

- Double Money

- Triple Money

- Quick Sanchoy

- Protiva Deposit

- Swasti Deposit

Apart from abovementioned divisions and products, LankaBangla Finance also has SME financial services division for handling CMSME (Cottage, Micro, Small, and Medium enterprise) operations. The treasure & FI division handles the money market operation, maintenance of CRR & SLR, dealings with government fixed income securities, and all other regular treasury and finance operations.

Services of LankaBangla Securities

LankaBangla Securities Limited (LBSL) is a subsidiary of LankaBangla Finance Limited. Through this subsidiary, the company runs its capital market operations. Following are some specialized services of this subsidiary.

LankaBangla Securities Limited provides brokerage services in both Dhaka and Chittagong Stock Exchange. The company provides “Trade Execution Service” for the customers. Also, this brokerage service segment includes trading in portfolio accounts maintained with LankaBangla Investments Limited and IDLC Investments Ltd, margin trading services through credit facility.

A NITA (Non-Resident Investor’s Taka Account) account in Bangladesh is an account opened for channelling foreign currency to buy and sell shares and repatriate sale proceeds. LankaBangla Securities provides NITA trading services to the non-resident Bangladeshis.

LankaBangla Securities also provides CDBL services to the clients; alongside their BO Account Opening and Maintenance services, the company provides Dematerialization and Rematerialization services.

Research services is another strong service-wing of LankaBangla Securities. It helps the clients take knowledge-based investment decisions. This research division of the company provides research reports and insights on company, industry, country and corporate valuation. The company has a dedicated wing for research which it calls Capital Market Research Department. This department issues a magazine named “Market Pulse” which is kind of popular to the readers.

Internet-based services of LankaBangla Securities has provided the customers with the option to trade remotely and trade on their discretion. The company has been running Order Management System (OMS) with the Chittagong Stock Exchange through API to provide Direct Market Access (DMA) to the dealers as well as investors. This is the first time in Bangladesh to provide DMA through Broker House instead of exchange provided application. It offers multichannel e-trading to its customers (web, mobile, client server) and advantages of Multi Asset Class (Equity, Derivatives, Bond, Commodity, etc) trading option, smart order routing, multiple exchanges and Cross Border supported application, MIS & centralized risk management. It has ability to create interfaces to other systems such as accounting systems, banking solutions and depository systems; and real time access charting with strategies, indicators and patterns.

To facilitate real-time strategies and trade execution, LankaBangla has developed multiple platforms including LankaBangla Financial Portal. This portal contains all the information regarding share prices and macroeconomic information.

Internet trading department of the company is charged with facilitating online based trading to all the B/O (beneficiary owner) account holders of LBSL. The company has two trading platforms to this effect – LankaBangla TradeXpress and DSE Mobile app. Recently, the company has switched from DSE Mobile app of Dhaka Stock Exchange to their own platform TradeXpress.

- ^ https://www.lankabangla.com/milestone/#milestone

- ^ https://www.lankabangla.com/milestone/#milestone

- ^ Annual Report, 2020, p.134