Mirati Therapeutics

Overview

Mirati Therapeutics, Inc. (MRTX) is a clinical-stage oncology company developing product candidates to address the genetic, epigenetic and immunological promoters of cancer. The company's precision oncology clinical programs utilize next-generation genomic testing to identify and select cancer patients who are most likely to benefit from targeted drug treatment. In immuno-oncology, Mirati Therapeutics is advancing clinical programs where the ability of its product candidates to improve the immune environment of tumor cells may enhance and expand the efficacy of existing cancer immunotherapy medicines when given in combination. The company's preclinical programs include potentially first-in-class and best-in-class product candidates specifically designed to address mutations and tumors where few treatment options exist. The company approach each of its discovery and development programs with a singular focus: to translate its deep understanding of the molecular drivers of cancer into better therapies and better outcomes for patients.1

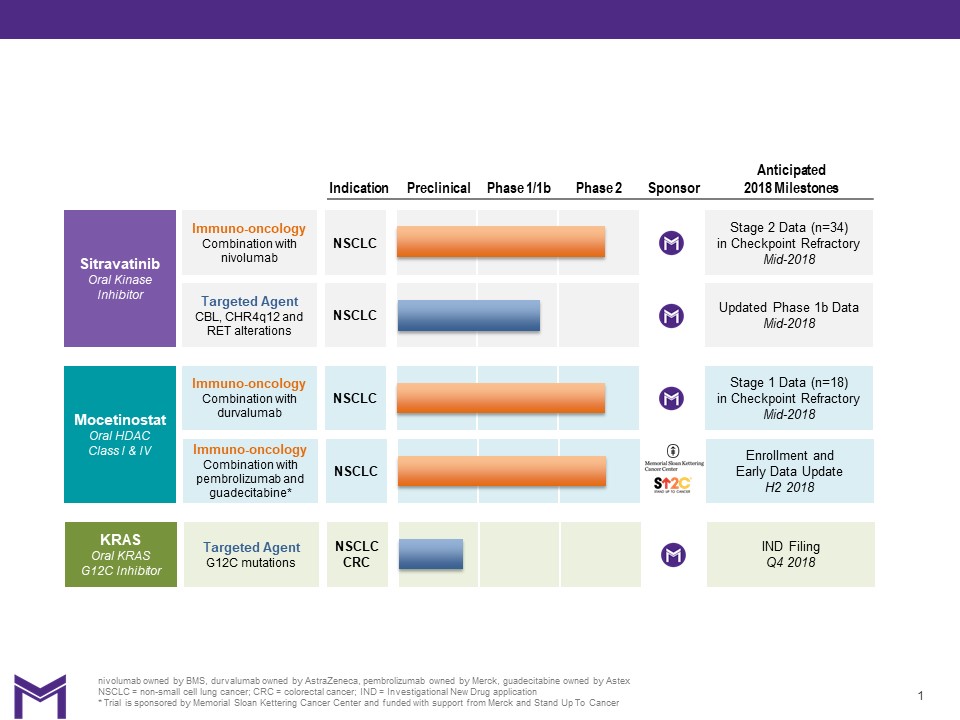

The company's clinical pipeline consists of two clinical-stage product candidates: sitravatinib and mocetinostat. The company also have a KRAS inhibitor program in preclinical development. The company's clinical and preclinical programs are summarized in the chart below:

Sitravatinib

Sitravatinib in Combination with Immune Checkpoint Inhibitors

Background

Sitravatinib is an oral, spectrum-selective kinase inhibitor that potently inhibits specific receptor tyrosine kinases (“RTKs”). RTKs are families of kinases involved in the transmission of signals that regulate cell growth, survival, and migration and include TAM family receptors (TYRO3, Axl, Mer), split family receptors (VEGFR2, KIT) and RET. Sitravatinib addresses cancer via two distinct mechanisms: directly, by targeting RTKs that drive tumor growth through mutation, and indirectly, by modulating immune regulatory cells to stimulate the body’s immune response to tumors. Sitravatinib’s potent inhibition of TAM and split family receptors may help overcome resistance to immune checkpoint inhibitors and stimulate the body’s immune response to help detect and destroy tumor cells. Blocking the signaling of these RTKs enhances the ability of T-cells (a type of white blood cell that is of key importance to the immune system) to recognize and eliminate tumor cells and modifies the tumor immune environment to enable a more productive immune response. The ability of sitravatinib to enhance the activity of immune checkpoint inhibitors was demonstrated in nonclinical cancer models.

Program Update

Mirati Therapeutics is evaluating the potential of sitravatinib to enhance and expand the clinical efficacy of immune checkpoint inhibitors in a Phase 2 clinical trial in combination with nivolumab (Opdivo®), Bristol Myers Squibb’s anti-PD-1 inhibitor, in patients with non-small cell lung cancer (“NSCLC”). This clinical trial is designed to assess the potential of sitravatinib to inhibit several important immunosuppressive pathways that may be important in overcoming resistance to checkpoint inhibitor therapy. This clinical trial is enrolling patients who have relapsed after treatment with a checkpoint inhibitor, as well as checkpoint inhibitor-naïve patients. As previously reported at the IASLC 18th World Conference on Lung Cancer, as of August 10, 2017, three of 11 evaluable patients who had relapsed after previous checkpoint inhibitor treatment experienced a confirmed partial response and seven of the 11 evaluable patients were continuing to receive treatment in the clinical trial, with treatment duration ranging from four months to 10.5 months. Early safety data indicated an acceptable profile and manageable adverse events. Based on the data presented, the pre-defined criteria for expansion were met and the next stage will enroll a cumulative total of 34 patients. The company expect to report further data on checkpoint inhibitor refractory patients from this clinical trial in mid-2018. Based on sitravatinib’s mechanism of action, the company believe that there are multiple additional tumor types that would be attractive targets for further clinical development in combination with immune checkpoint inhibitors, including renal cell, liver and bladder cancers.

Sitravatinib as a Targeted Agent

Background

Dysregulation of RTKs through genetic alteration or uncontrolled expression is associated with multiple processes relating to human cancer, including tumor growth and metastatic progression, as well as tumor angiogenesis. Sitravatinib potently inhibits a subset of these RTKs, including the TAM and split family receptors and RET, which are key regulators of signaling pathways that direct cell growth and survival. Through the genetic selection of patients with tumors that are driven by one or more of these dysregulated RTKs, there are multiple opportunities to develop sitravatinib as a targeted agent.

Program update

Mirati Therapeutics is evaluating sitravatinib as a single agent in a Phase 1b expansion clinical trial (the “CITRINE Trial”), which is testing sitravatinib for the treatment of patients whose tumors harbor CBL, amplification of a genomic region located on chromosome 4q12 ("CHR4q12") and RET genetic alterations in NSCLC and other tumor types. Patients who have mutations in CBL, CHR4q12, or rearrangement of the RET gene are most likely to respond to sitravatinib because each of these mutations dysregulate different sitravatinib RTK targets. These mutations are estimated to be present in a total of 5.5% of all NSCLC patients. The company reported early data from this clinical trial in January 2017 showing that as of December 9, 2016, of the four evaluable patients with RET genetic alterations at the time, there was one patient with stable disease, one unconfirmed partial response and one confirmed partial response. In September 2017, the company presented a case study at the IASLC 2017 Chicago Multidisciplinary Symposium in Thoracic Oncology of an NSCLC patient with a CBL inactivating mutation. The case was the first evaluable NSCLC patient harboring a CBL mutation treated in the ongoing Phase 1b study of sitravatinib as a single agent. The confirmed partial response is the first example of clinical activity for sitravatinib in a patient with a CBL mutation. Inactivating mutations in CBL occur in approximately 1.5% of NSCLC patients and currently represent an unmet medical need. To date, sitravatinib safety data indicate an acceptable profile and manageable adverse events. The company expect to provide an update on this clinical trial in mid-2018.

Collaboration with BeiGene, Ltd. to Develop and Commercialize Sitravatinib in Certain Asian Territories

In January 2018, the company entered into a Collaboration and License Agreement (the “BeiGene Agreement”) with BeiGene, Ltd. (“BeiGene”), pursuant to which Mirati and BeiGene agreed to collaboratively develop sitravatinib in Asia (excluding Japan and certain other countries), Australia and New Zealand (the “Licensed Territory”). Under the BeiGene Agreement, Mirati granted BeiGene an exclusive license to develop, manufacture and commercialize sitravatinib in the Licensed Territory, with Mirati retaining exclusive rights for the development, manufacturing and commercialization of sitravatinib outside the Licensed Territory.

Under the BeiGene Agreement, BeiGene agreed to pay to Mirati an upfront fee of $10.0 million. BeiGene is also required to make milestone payments to Mirati of up to an aggregate of $123.0 million upon the first achievement of specified clinical, regulatory and sales milestones. Additionally, BeiGene is obligated to pay to Mirati royalties at tiered percentage rates ranging from mid-single digits to twenty percent on annual net sales of licensed products in the Licensed Territory, subject to reduction under specified circumstances.

Mocetinostat

Background

Mocetinostat is an oral, Class 1 selective histone deacetylase (“HDAC”) inhibitor. Mocetinostat acts through epigenetic mechanisms and has demonstrated in preclinical studies the ability to block the effects of immune suppressive cells that counter the immune system’s ability to fight tumors and reduce the effectiveness of treatment with checkpoint inhibitors. Epigenetics is the regulation of gene expression and resulting cellular phenotypes through mechanisms other than primary DNA sequence alterations. The epigenetic regulation of gene expression involves the regulation of DNA methylation and modification of certain histones via modulation of acetylation or methylation of specific amino acid residues. Epigenetic pathways can become dysregulated during cancer progression through a variety of mechanisms, including the genetic alteration of molecules that participate in DNA methylation and histone modification. The epigenetic mechanisms of HDAC inhibitors like mocetinostat have demonstrated efficacy in hematologic malignancies and have been approved as single agents and may be complementary with other epigenetic mechanisms.

Program update

Mirati Therapeutics is evaluating mocetinostat in a Phase 2 clinical trial in combination with durvalumab (IMFINZI™), MedImmune Limited’s anti-PD-L1 inhibitor, for the treatment of patients with NSCLC. The clinical trial is enrolling patients who have relapsed after treatment with a checkpoint inhibitor, as well as checkpoint inhibitor-naïve patients. Patients who have relapsed after previous treatment with a checkpoint inhibitor are stratified into two cohorts based upon their best response to prior checkpoint therapy. Stage 1 of the trial is currently enrolling nine patients in each cohort; one cohort has already met the prespecified criteria for expansion into stage 2 with at least one confirmed partial response. The company expect to provide an update on stage 1 of this trial in mid-2018.

In October 2017, the company announced that mocetinostat has been included in the SU2C Catalyst® program, a cutting-edge research initiative led by Stand up to Cancer (“SU2C”) designed to bring innovative cancer treatments to patients quickly through novel collaborations between industry and academia. The Phase 1/1b clinical trial, sponsored by Memorial Sloan Kettering Cancer Center, is designed to evaluate the potential of epigenetic agents to improve patient responses to immunotherapy in NSCLC which will combine mocetinostat, guadecitabine, a DNA methyltransferase inhibitor from Astex Pharmaceuticals, Inc., and pembrolizumab, a PD-1 checkpoint inhibitor from Merck & Co., Inc. (known as MSD outside the United States and Canada). The clinical trial enrolled its first patient in August 2017.

KRAS G12C Inhibitor Program

Background

The RAS family of genes is the most commonly mutated oncogene and mutations in this gene family comprise up to 25% of all human cancers. Among the RAS family members, mutations most frequently occur in KRAS (85% of all RAS family mutations). Tumors characterized by KRAS mutations are commonly associated with poor prognosis and resistance to therapy. Nonclinical studies have demonstrated that cancer cells exhibiting KRAS mutations are highly dependent on KRAS function for cell growth and survival. Historically, KRAS has been extremely difficult to directly inhibit due to the absence of a tractable small molecule drug binding site. Recent findings have indicated that the KRAS G12C mutant variant may be targeted by irreversible small molecules that bind to a novel drug pocket and inhibit the function of KRAS. KRAS G12C driver mutations occur in approximately 14% of NSCLC adenocarcinoma patients, 5% of colorectal cancer patients and smaller percentages in other tumor types. Collectively, these patients have few treatment options. Mirati Therapeutics has selected a KRAS G12C mutant-selective clinical lead compound for advancement to an Investigational New Drug (“IND”) application. The clinical lead compound is an orally-available small molecule inhibitor of KRAS G12C with potency of approximately 10 nM (cellular IC50) and selectivity of greater than 1,000-fold for target inhibition in tumor cells harboring KRAS G12C mutations compared with cells exhibiting non-mutated forms of KRAS. In addition, the clinical lead compound demonstrated complete regression of KRAS G12C-positive tumors implanted in mice at well-tolerated dose levels.

Program Update

In November 2017, the company announced that IND-enabling preclinical studies were underway, and an IND submission for the KRAS G12C program is expected by the fourth quarter of 2018, with early clinical proof-of-concept data anticipated in 2019. The KRAS program emerged from a joint discovery collaboration with Array BioPharma, Inc., and Mirati has an exclusive license to further develop and commercialize products emerging from the collaboration.

Glesatinib

In November 2017, the company announced that, in light of superior investment opportunities in its pipeline, the company suspended further investment in glesatinib and will pursue opportunities to partner the program.

Market and Competition

Market

Non-Small Cell Lung Cancer

The National Cancer Institute estimates that in 2017, approximately 223,000 patients in the United States ("U.S.") were diagnosed with lung cancer and 156,000 died due to the disease. Lung cancer represents over 13% of all new cancer cases in the U.S., and 26% of all cancer deaths. Approximately 85% of lung cancers are NSCLC. The five-year survival rate for lung cancer patients is 18%, indicating a significant need for novel therapies to extend overall survival in this patient population.

Immuno-oncology Combinations

The prognosis for advanced NSCLC is poor, and the primary objective of treating late-stage disease is to prolong overall survival, delay disease progression and control symptoms. The treatment algorithm for advanced NSCLC has changed significantly following recent approvals and label expansions of immuno-oncology agents, specifically immune checkpoint inhibitors. In 2015, the U.S. Food and Drug Administration (“FDA”) approved Opdivo®, an anti-PD-1 monoclonal antibody, and the first immuno-oncology agent approved for the treatment of squamous NSCLC. The approval of Opdivo® in NSCLC was subsequently followed by FDA approval of two additional immuno-oncology agents in NSCLC, Keytruda® and Tecentriq®. These three agents, approved for indications including NSCLC, accounted for over $6 billion in global sales in 2016. The immune checkpoint inhibitor market is projected to grow to $46 billion by 2023(1).

Despite the advances in patient outcomes demonstrated by approved immuno-oncology therapies in NSCLC, a significant patient need remains. The percentage of patients who respond to approved immuno-oncology treatments is quite low, and of the patients that respond, the majority will still experience disease progression. The company believe that combinations of checkpoint inhibitors with other agents like sitravatinib and mocetinostat have the potential to improve efficacy outcomes and overcome resistance to checkpoint inhibitor therapy through complementary mechanisms.

Targeted Agents

NSCLC represents a heterogeneous patient population with diverse tumor histology and underlying genomic aberrations. Genetic alterations consisting of CBL mutations, CHR4q12 amplifications and RET gene rearrangements account for up to 5.5% of NSCLC patient cases annually in the U.S. KRAS G12C driver mutations occur in approximately 14% of NSCLC adenocarcinoma patients and 5% of colorectal cancer patients.

The clinical and commercial success of leading targeted agents across multiple indications, including NSCLC, demonstrates the potential of new targeted treatments for cancer. The following table lists global sales figures for selected small molecule kinase inhibitors in NSCLC and other indications.

2016 Worldwide Retail Sales Figures of Selected Small Molecule Kinase Inhibitors

| Brand Name | 2016 Worldwide Sales(2) (in millions) |

|---|---|

| Tarceva | 1039 |

| Tafinlar + Mekinist | 672 |

| Xalkori | 561 |

| Tagrisso | 423 |

| Alecensa | 186 |

Competition

Sitravatinib in Combination with Immune Checkpoint Inhibitors

There are several immune checkpoint inhibitors currently approved for use as single agents to treat multiple tumor types, including NSCLC. To augment the efficacy of these agents, combination studies are being conducted with a variety of potentially synergistic mechanisms, including inhibitors of CTLA-4, IDO1, LAG3, and CSF-1R. Most of these combination studies are being conducted in patients who are naïve to immune checkpoint inhibitor therapy. A competitor whose agent is being evaluated in combination with checkpoint inhibitors in NSCLC patients that are naïve to immune checkpoint inhibitor therapy is Nektar Therapeutics (CD-122 agonist). Competitors whose agents are being evaluated in combination with checkpoint inhibitors in NSCLC patients who failed previous immune checkpoint inhibitor therapy include Corvus Pharmaceuticals, Inc. (Adenosine A2Ar inhibitor), Bristol-Myers Squibb (GITR inhibitor and LAG3 inhibitor) and Syndax, Inc. (HDAC inhibitor). Direct mechanistic competitors to sitravatinib in immunotherapy include Cabometryx (Exelixis, Inc.), an anti-VEGF agent that also inhibits MET and other RTKs. The company expect that additional agents and mechanisms will be evaluated in immunotherapy combinations, and the company will continue to monitor these competitors in relation to its own immunotherapy combination programs.

Sitravatinib as a Targeted Agent

A large number of multi-targeted kinase inhibitors are currently commercially available or in clinical trials, with many more in the early research stage. Biotechnology and pharmaceutical companies are also developing monoclonal antibodies to inhibit kinase targets and their ligands.

Companies with RET inhibitors believed to be in late preclinical or clinical development include, but are not limited to, Blueprint Medicines, Inc., Ignyta, Inc., and Loxo Oncology, Inc. For CBL and CHRq12 alterations, Mirati Therapeutics is not aware of any other companies with programs that specifically target these patient populations.

Mocetinostat

The company believe that a key differentiating feature of mocetinostat is its spectrum of activity covering only isoforms 1, 2, 3 and 11, which are the most relevant HDAC isoforms in human cancers. Other companies that are developing spectrum-selective HDAC inhibitors include, but are not limited to, Acetylon Pharmaceuticals, Inc., Chroma Therapeutics Ltd., Huya Bioscience International, Shenzen Chipscreen Biosciences Ltd. and Syndax Pharmaceuticals Inc.

Companies with Pan-HDAC inhibitors, which are HDAC inhibitors that have an effect across a broader range of HDAC isoforms and are therefore not as selective as molecules like mocetinostat, include but are not limited to: Celgene Corporation, Curis Inc., MEI Pharma Inc., Merck & Co Inc., Novartis, Pharmacyclics Inc. and others. The company expect that these and other companies may continue to pursue research and development in relation to HDAC inhibitors. The company continue to monitor these and other companies in order to be aware of any third-party products and/or intellectual property rights relevant to its products.

KRAS G12C

Mirati Therapeutics is aware of one company with a competing direct KRAS G12C inhibitor program: Araxes Pharma, which partnered its KRAS G12C program with Janssen Biotech in 2013. It is likely that other companies are also researching KRAS G12C inhibitors. In November 2017, its first patent application covering its KRAS G12C inhibitor program was published. Based upon this and other publicly available information, the company believe that its program is the most advanced. The company will continue to monitor scientific and patent publications for the emergence of other potential competitors.

Oncology

In addition to companies that have kinase inhibitors or HDAC inhibitors addressing its targets of interest, its competition also includes hundreds of private and publicly traded companies that operate in the area of oncology but have therapeutics with different mechanisms of action. The oncology market in general is highly competitive, with over 1,000 molecules currently in clinical development. Other important competitors, in addition to those mentioned above, are small and large biotechnology companies, including, but not limited to, Amgen, Inc. and Gilead Sciences Inc., and specialty and regional pharmaceutical companies and multinational pharmaceutical companies, including but not limited to Astellas Pharma Inc., Bayer-Schering Pharmaceutical, Boehringer Ingelheim AG, Bristol-Myers Squibb, Eisai Co. Ltd., Eli Lilly and Company, F. Hoffmann- LaRoche Ltd., GlaxoSmithKline, Johnson & Johnson, Merck KGaA, Novartis AG, Taiho and Takeda Pharmaceutical Co.

Many companies have filed, and continue to file, patent applications which may or could affect its program if and when they issue, either because they protect a product that may compete with its product candidates, or because they protect intellectual property rights that are necessary for it to develop and commercialize its product candidates. These companies include, but are not limited to: Bristol-Myers Squibb, Exelixis, GlaxoSmithKline, Novartis and Pfizer. Since this area is competitive and of strong interest to pharmaceutical and biotechnology companies, the company expect that these and other companies will continue to publish and file patent applications in this space in the future, as well as pursuing research and development programs in this area. The company continue to monitor these and other companies in order to be aware of any third-party products and/or intellectual property rights relevant to its product candidates.

Intellectual Property

The company's goal is to obtain, maintain and enforce patent protection wherever appropriate for its product candidates, formulations, processes, methods and any other proprietary technologies both in the United States and in other countries. The company typically file for patents in the United States with counterparts in certain countries in Europe and certain key market countries in the rest of the world, thereby covering the major pharmaceutical markets. As of December 31, 2017, the company own or co-own U.S. patents and patent applications and their foreign counterparts, including 28 issued U.S. patents as reflected in the following table:

| Description | Granted | Pending | Expiration |

|---|---|---|---|

| Sitravatinib and other kinase inhibitor compounds | 11 | 0 | 2026-2029 |

| Mocetinostat and other HDAC inhibitors | 17 | 0 | 2022-2035 |

| KRAS inhibitors | 0 | 3 | 2036-2037 |

| Total | 28 | 3 | ' |

Manufacturing

The company do not own or operate manufacturing facilities for the production of any of its product candidates, nor do the company plan to develop its own manufacturing operations in the foreseeable future. The company currently depend on third-party contract manufacturers for all of its required raw materials and finished products for its preclinical and clinical trials.

Manufacturers of its products are required to comply with applicable FDA manufacturing requirements contained in the FDA's Current Good Manufacturing Practices (“cGMP”) regulations. cGMP regulations require, among other things, quality control and quality assurance as well as corresponding maintenance of records and documentation. Pharmaceutical product manufacturers and other entities involved in the manufacture and distribution of approved pharmaceutical products are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain cGMP compliance. Discovery of problems with a product after approval may result in restrictions on a product, manufacturer or holder of an approved new drug applications ("NDA"), including withdrawal of the product from the market. In addition, changes to the manufacturing process generally require prior FDA approval before being implemented.

Liquidity Overview

At March 31, 2018, the company had $148.7 million of cash, cash equivalents and short-term investments compared to $150.8 million at December 31, 2017. In January 2018 the company received an upfront fee of $10.0 million in connection with the BeiGene Agreement. Mirati Therapeutics has not generated any revenue from product sales. To date, Mirati Therapeutics has funded its operations primarily through the sale of its common stock and pre-funded warrants to purchase its common stock and through up-front payments, research funding and milestone payments under collaborative arrangements. To fund future operations, the company will likely need to raise additional capital.