Polycab India Limited

Overview

Polycab India (NSE:POLYCAB) is engaged in the business of manufacturing and selling wires and cables and fast moving electrical goods ‘FMEG’ under the ‘POLYCAB’ brand. Apart from wires and cables, the company manufacture and sell FMEG products such as electric fans, LED lighting and luminaires, switches and switchgear, solar products and conduits & accessories.1

The company's promoters collectively have more than four decades of experience among them. The company's Company was incorporated as ‘Polycab Wires Private Limited’ on January 10, 1996 at Mumbai as a private limited company.

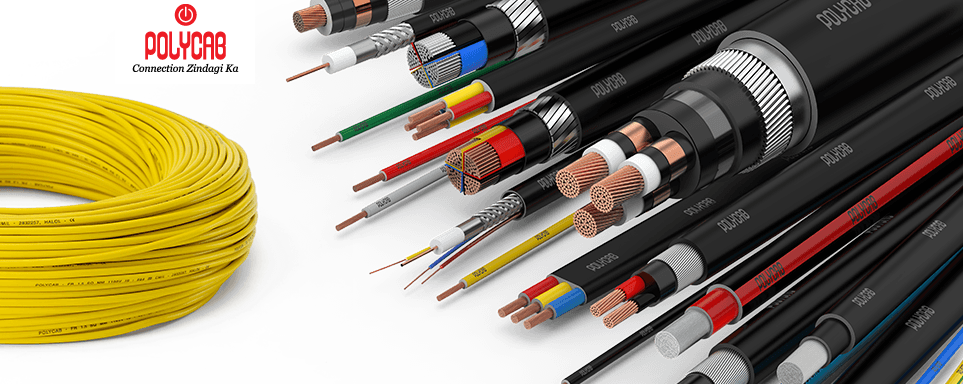

The company manufacture and sell a diverse range of wires and cables and its key products in the wires and cables segment are power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, flexible/single multi core cables, communication cables and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires. In 2009, the company diversified into the engineering, procurement and construction ‘EPC’ business, which includes the design, engineering, supply, execution and commissioning of power distribution and rural electrification projects. In 2014, the company diversified into the FMEG segment and its key FMEG products are switches and switchgear and conduits & accessories.

Polycab India has 25 manufacturing facilities, including its two joint ventures with Techno and Trafigura, located across the states of Gujarat, Maharashtra and Uttarakhand and the union territory of Daman and Diu. Three of these 25 manufacturing facilities are for the production of FMEG, including a 50:50 joint venture with Techno, a Gujarat-based manufacturer of LED products. In 2016, the company entered into a 50:50 joint venture with Trafigura, a commodity trading company, to set up a manufacturing facility in Halol, India to produce copper wire rods (the ‘Ryker Plant’). The company strive to deliver customized and innovative products with speed and quality service. The company's production process is designed to ensure quality while delivering the ability to produce complex electrical products on short timeframes to meet its customers’ needs. Most of its manufacturing facilities are accredited with quality management system certificates for compliance with ISO 9001, ISO 14001 and OHSAS 18001 requirements. The company's central quality and test laboratory in Halol is accredited by NABL and its central test laboratory, also located in Halol, for all flexible wires and cables is approved by Underwriters Laboratories ‘UL’. Certain of its products are also certified to be compliant with various national and international quality standards including Bureau of Indian Standards ‘BIS’, British Approvals Service for Cables ‘BASEC’, UL and international electrotechnical commission ‘IEC’.

The company's research and development ‘R&D’ capabilities, emphasis on upgrading the technology used in its production process, customer-centric R&D efforts and its R&D center located in Halol, assist its sales and marketing team in understanding its customers’ requirements. In addition, Polycab India has adopted automation systems in its manufacturing process such as the manufacturing excellence system ‘MES’, which is an automated sensor base system for recording the actual consumption of raw materials in production, as well as enterprise resource planning ‘ERP’ systems. Polycab India has also adopted the Maynard Operation Sequence Technique ‘MOST’ to drive productivity and optimize capacity utilization.

Polycab India has an established supply chain comprising its network of authorized dealers, distributors and retailers. This network supplies its products across India. The company's distribution network in India comprise over 3464 authorized dealers and distributors and 29 warehouses as at March 31, 2018. The company supply its products directly to its authorized dealers and distributors who in turn supply its products to over 100,000 retail outlets in India. The company manage its sales and marketing activities through its corporate office, three regional offices and 20 local offices in various parts of India as at June 30, 2018. In addition, in Fiscal 2018, the company exported its products to over 40 countries.

Plant and Products

Polycab has 25 manufacturing facilities at seven locations, which are designed to secure a complete supply chain for its product range, starting from raw materials to end-products. 4 out of these 25 facilities manufacture FMEG products. A comprehensive backward integration of operation remains a key priority for the Company and has helped Polycab to build manufacturing facilities for all key raw materials, including aluminium rods, copper rods, and various grades of PVC, rubber, XLPE compounds, GI wire and strip.2

The Company recently acquired the remaining 50% stake in Ryker from Trafigura making Ryker a whollyowned subsidiary of PIL. Ryker was started as a 50:50 JV with the Singapore-headquartered commodity trading company Trafigura in FY 16, to set up a copper rod manufacturing facility in Waghodia, Gujarat. However, post Trafigura’s global strategic decision to exit from value-add manufacturing businesses in India, PIL decided to buyout their stake. The plant started commercial operation in 1QFY20 with an annual capacity of 2,25,000 tonnes.

Production Capacity

| Product | Location | Annual Capacity |

| Wires & Cables | Halol/Daman | 3.7 million kms |

| Lighting & Luminaires | Chhani | 18.2 million units |

| Switchgears | Nashik | 7.2 million units |

| Fans | Roorkee | 3.1 million units |

| Copper Rods | Waghodia | 2,25,000 tonnes |

Polycab operates a pan-India distribution network with 3,500+ authorised dealers and distributors who directly cater to over 1,25,000 retail outlets as on 31 March 2020. The Company has three key segments of business.

Wires and Cables

PIL manufactures and sells a diverse range of wires and cables for both retail and industrial applications, and its products are supplied to various industries like Power, Real Estate, Telecom, Cement, Mass Transportation, Oil and Gas, Mining, Auto, Signalling Communication, Building Electrification, etc. The Company has a diverse portfolio of offerings and is present in almost all segments of wires and cables in the Indian market.

Fast-Moving Electrical Goods (FMEG)

The FMEG business, which was started in FY 14, has made Polycab one of the fastest-growing FMEG brands in India. The Company’s key FMEG products include Electric Fans, LED Lighting and Luminaires, Switches and Switchgears, Solar Products, Pumps and Conduits and Accessories.

The Company has two manufacturing facilities in Maharashtra for Switchgears and Water Heaters, one in Uttarakhand for Ceiling Fans, and a 50:50 JV owned facility in Gujarat for LED products. Polycab also has third-party arrangements with manufacturers for some of its other FMEG products.

Polycab’s FMEG revenue has been steadily growing year-on-year registering a CAGR of about 47% during the past five years.

Considering the changing market trends and growth potential, Polycab has been consistently investing to strengthen its market position in FMEG in India, utilising its brand recognition, distribution network, diverse customer base, and manufacturing capabilities to its advantage.

Other (EPC and Subsidiaries)

Other segments in Polycab’s consolidated business includes Engineering, Procurement and Construction (EPC) and contribution from other subsidiaries. Started in 2009, the EPC business is the forward integration in Polycab’s wires and cables business and provides project-based turnkey solutions. It offers design, engineering, supply, execution, and commissioning of large-scale transmission and distribution projects for various government utilities in India and benefits from the in-house supply of wires and cables, which form a considerable share of the EPC contracts. The Company adopts a prudent approach in choosing projects. It uses an internal framework to evaluate and select projects with higher component of wires and cables supply in project value, optimal return of capital and up to acceptable risk levels.

Industry Overview

Wires and Cables

Typically, wires consist of single conductor and cables are assembly of one or more conductors that are used for the transmission of electricity, data or signals. Types of wires and cables include:

- Power Cables - used for the transmission and distribution of electricity from power generators (thermal, solar and wind solar plants) to sub-stations and thereon for power supply to end-user segments, such as residential, commercial (airports, metro, hospitals, etc.) and industrial units.

- Building Wires - used for electrical wiring of residential and commercial buildings such as metro, hospitals, offices, etc.

- Telecom Cables - used for transmission of voice and data.

- Control and Instrumentation Cables - used for process control applications.

- Optical fibre cables - Cables with glass fibre core used for long distance telecommunication, providing a high-speed data connection etc.

- Other types of cables - flexible cables used for industrial sectors of consumer appliances, automotive, railways, mining, etc., specialty cables for marine, oil and gas offshore/ onshore, anti-theft cables, etc.

Major users of power cables are the power sector (central, state, and private electricity utilities) and sectors like petrochemicals, mining, steel, non-ferrous, shipbuilding, cement, railway, and defence. The performance and durability of cables depend on the quality of raw materials. Specialised applications require superior chemical, mechanical, thermal, and electrical performance from cables, resulting in usage of high-performance materials in cable construction.

Wires and cables make approximately 40-45% of the electrical industry. Domestic wires and cables industry is estimated to be over Rs 500 billion declining in mid double digits in FY 20 marred by challenges on various fronts. Sluggish macroeconomic conditions, lower infrastructure investments and weak consumer sentiment, as highlighted in previous section, resulted in poor growth for end-user industries thereby hurting demand for wires and cables. Softening commodity costs further reduced the value realisation of all large players. Outbreak of COVID-19 and subsequent nationwide lockdown impacted the industry significantly as March month typically tends to be prime sales period.

Having said that, wires and cables, being playing a vital part in all major sectors including power, housing, real estate, urban development, transport, roads, telecommunication, industrial and rural development, is likely to see a pickup in demand with the normalisation of economic activities. Government of India is consistently placing strong emphasis on making India self reliant with numerous supportive measures. It has made infrastructure, rural and industrial growth as its prime focus. Government also has a long-term strategy for boosting electricity generation and per capita consumption, which will be achieved through expansion of transmission and distribution networks and universal electrification programme. Demand will further be driven by urbanisation, affordable housing and electrification of transport systems and digital India mission. Further to that, retail business of wires is booming because of growing consumer involvement, brand consciousness, safety awareness and pan-India distribution network of organised market players.

Global cables market is estimated to be around USD 145 billion, with Asia-Pacific region contributing about 40% of the total, followed by Western Europe and North America. Of the total, about USD 38-40 billion of cables is currently imported from various countries. With Government’s rejuvenated efforts to promote local manufacturing and exports, Indian companies with robust manufacturing and supply capabilities to serve the sizeable global demand could be key beneficiaries.

Fast-Moving Electrical Goods (FMEG)

Fast-Moving Electrical Goods (FMEG), which refers to consumer electrical goods, is an emerging sector in the present Indian electrical market. It includes commodity products like lights, luminaires, switches, switchgears, fans etc. and is traditionally sold through retail trade network. Over the years, this industry has evolved with growing participation of organised players and emphasis on branding. Macro factors like changes in demography, consumer behaviour, awareness have catapulted the growth of an organised FMEG sector in India. For Polycab, the growth in FMEG segment offers a scope for natural product diversification, allowing it to leverage the advantages of common raw materials (for production) and economies of scale, and thereby achieve cost-savings in production, logistics and distribution.

50% of India’s population is under the age of 25 years. The increasing number of young consumers who live in nuclear families and are supported by growing incomes, thereby enabling higher spending per household, have been contributing significantly to the growth of FMEG sector. This was reinforced by the rising and an increasing number of working women. Together, these factors, along with digital penetration, online influence, e-shopping and a growing trend among Indian consumers to buy branded products at a premium in exchange of better service, safety, convenience and quality, were driving key demand for the sector. Government of India programmes like Housing for All and Smart Cities, and improved availability of electricity to urban and rural consumers were adding further impetus.

However, FMEG sector growth in FY 20 was soft due to weak consumer sentiment led by a challenging macroeconomic scenario. Tight liquidity conditions, slowdown in industrial and real estate activities also had a reaching impact. Further, higher competitive intensity kept prices lower, especially in segments like lighting, which has been witnessing price erosion from past few years. Finally, the COVID-19 outbreak in Q4FY20 caused significant impact on overall economic activity, demand and supply chain disruption. It also impacted sales of seasonal summer products like fans, air coolers etc. However, over the medium-to-long term, FMEG sector is well poised to grow in high single digit on the back of structural drivers mentioned above.

Business Segments

Wires and Cables

In FY20, Wires and Cables revenue increased by 9% to Rs 75,192 million, compared to Rs 69,295 million in FY19. It accounted for 85% of total sales for the year under review. Segmental operating profit increased by 11% to Rs 9,255 million on account of change in sales mix and expansion in contribution.

Domestic business remained muted due to persistent and sluggish economic conditions, especially in 2HFY20, coupled with disruption of business operations in the month of March due to COVID-19 outbreak across the world, including India. FY20 witnessed a poor aggregate demand on the consumption side which translated into poor economic activity, evident from contracting Gross Fixed Capital Formation (GFCF) investment indicator since Q2FY20. Even the landmark relief to the corporates in terms of a tax cut was not able to stimulate the private investment in FY20. Increasing illiquidity in the market adversely affected the private as well as Government capital expenditures which has slowed down substantially.

Growth in the Wires and Cables segment during FY20 was driven primarily by healthy business from exports and new product categories. Exports share in overall revenue increased from 3.1% in FY19 to 12.3% in FY20, largely driven by partial execution of a large export order for a project in Nigeria and increased traction seen in select developed geographies. Healthy traction in wires business in the first nine months was dented by softening commodity prices and severe impact of COVID-19 in last quarter. During the year, many of its products were rigorously tested and certified by various national and international bodies with frequent factory audits and are a result of Company’s strong R&D and manufacturing capability. Polycab India is also in the process of developing customised cables for the machine automation and marine segments.

Despite the challenging economic conditions, the Company focussed on stabilising profitability in B2B businesses, increasing penetration across the market and exploring new geographies. The Company improved its logistics and expanded distribution, which increased availability of its products across India. In-house manufactured Optical fibre cable (OFC) saw good traction while the new Green wires garnered good response from customers and strengthened the overall offering.

Outlook

With India’s wires and cables sector growth projected to grow in healthy double digit over the next five years, Polycab is well positioned to cater to the growing demand and boost its revenue and profitability. As discussed in the Growth Drivers section, continuous investments in various infrastructure segments and other end-user industries will drive demand for cables and wires. Further, the Government’s aim to make India self reliant with indigenous manufacturing is likely to drive demand. The Indian Electrical Equipment Industry Mission Plan, to make India the country of choice for production of electrical equipment, will be a big impetus for Polycab. Favourable Government regulations to improve quality and safety of wires and cables should drive superior growth for organised sector.

Considering the current COVID-19 pandemic scenario, the industry is expected to take some time to recover and normalcy in business would take few quarters or perhaps more. Any outlook at this point of time is heavily contingent upon the intensity, spread and duration of the pandemic. The pandemic has driven increased focus on health which could lead to higher share of investments in healthcare infrastructure and pharmaceutical industry. This presents a good near-term opportunity for the Company as these developments will drive demand for wires and cables in these sectors. Unorganised trade is likely to face significant liquidity pressure and labour shortage constraints. This could benefit large organised players, especially in segments like wires, where unorganised make nearly half of market. Polycab also intends to enhance and strengthen its leadership in wires and cables market by exploring new geographies in smaller districts, cities and towns, and providing customised solutions to customer’s problems.

Fast-moving electrical goods (FMEG)

Polycab is broadening its distribution network for FMEG while mapping new areas for geographical expansions. The Company is also focussing on value-added FMEG products such as premium and super premium Fans, a wider range of Table, Pedestal, Wall Fans, Smart Fans, and Professional Luminaires which are margin accretive and enables deeper penetration into these segments

FMEG revenue grew at 47% CAGR during the period from FY 15 to FY 20, boosting its contribution to the group performance. In FY 20, FMEG revenue stood at Rs 8,356 million, compared to Rs 6,433 million in FY19. For FY20, this segment registered sales growth of 30% against FY19. It accounted for 9.4% of total sales for the year under review, up from merely 2.6% five years back. Segmental operating profit increased by 126% to Rs 168 million on account of change in sales mix, pricing action and judicious cost management.

Fans & Appliances

The total market size for fans in India is valued at about Rs 93 billion, which grew at 8% in FY20. Polycab Fans and Appliances business witnessed strong momentum in FY20, largely driven by distribution expansion and penetration, product expansion and diversification and growing share of premium fans. However, nationwide lockdown following COVID-19 outbreak severely impacted demand during key stocking period of summer products. During the year, the Company forayed into few adjacent categories and expanded aggressively in the existing categories to reach more counters and fulfil different product needs of customers under Polycab brand. Strategic pricing interventions were taken to improve profitability and product positioning. Despite that, all FMEG products continued to have high demand. Fans portfolio was augmented with additional SKUs to offer variety of products in terms of design and price points. During the year, growth in unorganised sector was muted. Implementation of GST and star rating becoming mandatory further hampered the unorganised trade thereby reducing price pressure for organised players. Ceiling fans category, which occupy the maximum share of the overall Fans market, is witnessing a noticeable shift from the economy category to the premium category. Accordingly, the Company is continuously reworking its portfolio and share of premium fans in FY20 improved compared to last year. Factors such as rising disposable incomes, changing consumer preferences and the increased availability of electricity across the country have provided the demand impetus for players to improve on aspects such as aesthetics, design, efficiency and technology, even in the case of standardised product categories such as electric fans. With strong commitment for providing quality products, alluring designs and advanced features at reasonable prices, the Company aims to be a strong player in Fans market and hoping to be in top 5 brands nationally over the coming years.

Lighting & Luminaires

The lighting industry was valued at about Rs 223 billion in FY20 and is characterised as a very competitive market, particularly on the price front, due to aggressive pricing by some large players and subsequent retaliation by others. Though, later part of the year saw some respite with albeit reduced pricing intensity. Polycab’s lighting segment reported a reasonable growth primarily driven by Government’s initiative to promote LED for both outdoors (Street Lighting, etc.) and indoors (Home, Office Lighting etc.). Strong volume growth was offset by price erosion. While the industry witnessed substantial price reduction across product categories, it also led to a faster adoption of the LED products by consumers and there is now a complete shift with a myriad of LED applications available as per the consumers’ requirement and taste. Lower pricing impacted many smaller players significantly but also led to deeper penetration and adoption of LED products in hinterlands. During the year, Company adopted a two-pronged strategy to outpace the market. Firstly, on the product side, Polycab reconstructed its product mix by focussing on more profitable and stable categories like Panels and Down lighters. Secondly, it narrowed its focus on specific high potential geographies like Eastern region where the brand success projections were higher. As a result of above-mentioned initiative coupled with other branch, channel and product-related corrections helped it see through a relatively tough year. Investments in developing new product pipeline continued with focus on IoT and the Company’s plans to get steady contribution to turnover from new products every year going ahead. Polycab will continue to focus on improving product mix and also renew its focus on the B2B segment.

Switches & Switchgear

The domestic switchgear industry is currently valued at about Rs 210 billion and the switches industry is about Rs 46 billion. Both the categories registered an estimated growth of 7% YoY in FY20 partly impacted by slump in the residential and commercial real estate market. Notwithstanding the stress, Polycab’s switches & switchgear segment also posted muted growth in FY20 compared to the previous year

Having said that, the Company focussed on building alternate channels such as panel builders, OEMs, and large institutions during the year which showed some early success. Polycab also strategically identified and focussed on high potential micro markets and cross-selling. The Company launched MCB changeover switch during the financial year and plans to enter new product categories to ensure availability of complete range of switchgear. In the switches category, the Company introduced new coloured plate range, infrared sensor and touch feel products and switches in both economical and premium category named Evina and Levana Plus. It also continued to invest in manufacturing capabilities and branding activities.

Outlook

FMEG industry is expected to grow high single digit over the next five years while the organised market is likely to grow at a faster pace given rising consumer awareness, stringent Government regulations and overall formalisation of economy. Polycab’s FMEG business promises a tremendous growth potential over the long term, considering its small share in the industry currently. The Company expects value-added products which features energy-efficiency, premium quotient and technology to lead demand in the medium and long term and is likely to gain from the declining share of unorganised players in the FMEG sector.

Universal electrification, housing development, increasing consumer income, nuclear families, and preference for branded products and modular switches are likely to drive demand for innovative products in the FMEG category. Consumer awareness for safety and Government energy schemes like UJALA and EEP will drive demand for LED bulbs and energy-efficient fans. Polycab’s growth in this segment will primarily be catapulted by its quality products with attractive designs, advanced energy saving and safety features and competitive prices.

Though the sudden outbreak of COVID-19 pandemic in the last quarter of FY20 has hit the industry hard and led to temporary halt in sales, the Company expects demand to surge slowly once the economic activities move towards normalcy. As the markets open up, Polycab estimates a pending demand at the consumers end and is gearing up to tap on this as well as the future opportunities.

Other (EPC+ Subsidiaries)

The Other segment revenue grew in double digit over the past five years, boosting its contribution to the group performance. In FY20, Other segment revenue stood at Rs 5,230 million from Rs 4,637 million in FY19, registering a growth of 13% YoY, and attributing to higher segmental operating profitability. For the same year, this segment registered EBIT of Rs 797 million against Rs 198 million in the previous year, registering a growth of 303%. It accounted for 5.9% of total sales for the year under review. The BharatNet Phase II project is at present under execution in several states. The Company with its consortium partner helped connect over 4,700 Gram Panchayats (GP) in states of Gujarat and Bihar during 10 months of FY20. Each GP is provided with 100mbps of bandwidth which can be scaled up to 1 Gbps without changing any hardware configuration.

Outlook

Polycab is actively pursuing infrastructure projects including digital through the EPC model. As an established leader in manufacturing domain providing electrical infrastructure, the Company envisages to replicate its project management skills across large digital infrastructure projects including Smart Cities, Surveillance, BharatNet and Digital Village.

Financial Highlights

October 24, 2020; Polycab India reports its Q2 FY21 results.

Polycab India reported 14% increase in consolidated net profit to Rs 221.6 crore on 6% decline in revenue to Rs 2,113.7 crore in Q2 FY21 over Q2 FY20.3

The revenue surged 116.43% in Q2FY21 compared with Rs 976.60 in Q1FY21. Improving overall business environment with staggered unlocking led to better performance sequentially.

On the segmental front, wires and cables business declined 7% year-on-year (YoY) to Rs 1,740.8 crore in Q2FY21 from Rs 1,881.1 crore in Q2FY20. "The business saw improving momentum with resumption of economic activities. Business-to-consumer (B2C) wires and exports sustained the strong traction," the company said.

Fast Moving Electrical Goods (FMEG) business grew 25% YoY to Rs 244 crore in Q2FY21 from Rs 195.60 crore in Q2FY20. Polycab said that growth was resilient across most categories and regions. Profitability in Q2 improved sharply despite rising input costs on account of calibrated pricing actions, premiumisation and working capital interventions, it added.

Profit before tax (PBT) in Q2 September 2020 stood at Rs 288 crore, up by 25% from Rs 230.30 crore in Q2 September 2019.

As of 30 September 2020, net cash position increased to Rs 627.6 crore. Return on capital employed (ROCE) stood at 26.6% in Q2FY21.

Commenting on the performance, Inder T. Jaisinghani, chairman and managing director, Polycab India, said: "I'm delighted with its Q2 performance given the context of current challenging business environment. Overall demand trends are encouraging and many of its consumer facing businesses have started seeing growth compared to last year. At the same time, Polycab India has tightened its belts to improve profitability without bargaining on long term brand development and innovation initiatives.

While the company remain optimistic of robust economic potential over mid to long term, government initiatives and reviving consumer sentiment should support demand in months to come. The company remain focussed on augmenting its brand positioning in the Electricals space and creating long term shareholder value."