Sorrento Therapeutics

Paragraph 1

At its core, Sorrento Therapeutics is an antibody-centric company and leverage its proprietary G-MAB™ library and targeted delivery modalities to generate the next generation of cancer therapeutics. The company's validated fully human antibodies include PD-1, PD-L1, CD38, CD123, CD47, c-MET, VEGFR2, CCR2, OX40, TIGIT and CD137 among others. The company's vision is to leverage these antibodies in conjunction with proprietary targeted delivery modalities to generate the next generation of cancer therapeutics. These modalities include proprietary antibody drug conjugates (“ADCs”), bispecific approaches, as well as TCR-like antibodies. With LA Cell, Inc. (“LA Cell”), its joint venture with City of Hope, its objective is to become the global leader in the development of antibodies against intracellular targets such as STAT3, mutant KRAS, MYC, p53 and TAU. Additionally, Sorrento Therapeutics has acquired and are assessing the regulatory and strategic path forward for its portfolio of late stage biosimilar/biobetter antibodies based on Erbitux®, Remicade®, Xolair®, and Simulect® as these may represent nearer term commercial opportunities.

Although the company intend to retain ownership and control of product candidates by advancing their development, the company regularly also consider, ![]() partnerships with pharmaceutical or biopharmaceutical companies and (ii) license or sale of certain products in each case, in order to balance the risks and costs associated with drug discovery, development and commercialization with efforts to maximize its stockholders’ returns. The company's partnering objectives include generating revenue through license fees, milestone-related development fees and royalties as well as profit shares or joint ventures to generate potential returns from its product candidates and technologies.

partnerships with pharmaceutical or biopharmaceutical companies and (ii) license or sale of certain products in each case, in order to balance the risks and costs associated with drug discovery, development and commercialization with efforts to maximize its stockholders’ returns. The company's partnering objectives include generating revenue through license fees, milestone-related development fees and royalties as well as profit shares or joint ventures to generate potential returns from its product candidates and technologies.

Strategy

The company's primary goal is to deliver clinically meaningful therapies to patients and their families, globally. In immuno-oncology, the company aim to deliver next generation therapeutics to transform cancer into a treatable or chronically manageable disease. Across all its programs, Sorrento Therapeutics is focused on addressing severe unmet medical needs where its therapies can change the natural course of disease or significantly improve a patient’s quality of life. The company's core strategic objectives and resources are focused on:

- Advancing its lead product candidates through the clinic. These include the initiation of Phase I, Phase II and potentially accelerated approval trials for its cellular therapies, oncolytic virus immunotherapy and RTX in oncology and/or hematology indications.

- Continuing the development of its preclinical programs with the aim of filing several new INDs over the next 5 years. These include moving its checkpoint inhibitors from its core antibody portfolio into the clinic with several of its strategic partners, while internally focusing on advancing its transformational intracellular targeting antibodies (“iTAbs”), with LA Cell.

- Collaborating with key opinion leaders and leading clinical and research institutes to enhance its preclinical and clinical development plans. The company currently have such agreements in place with the Karolinska Institute, The Scripps Research Institute (“TRSI”), the NIH, City of Hope, Tufts Medical School, and Roger Williams Medical Center, among others.

- Manufacturing its preclinical and clinical materials in-house. Sorrento Therapeutics has established a quality control and quality assurance program, which includes a set of standard operating procedures and specifications designed to ensure that its products are manufactured in accordance with current good manufacturing practices (“cGMPs”), and other applicable domestic and foreign regulations.

- Exploring strategic relationships to share in the risk reward of its core franchises and to derive near term value from its non-core franchise, such as its pain franchise. The company's partnering objectives include generating revenue through license fees, milestone-related development fees and royalties as well as profit shares or joint ventures to generate potential returns from its product candidates and technologies.

Segment Information and Financial Information about Geographic Areas

Sorrento Therapeutics has determined that the company operate in one operating segment. See Note 3 to the notes to its consolidated financial statements accompanying this Form 10-K for further information. All of its revenues from continuing operations are essentially attributed to the United States. All of its long-lived assets are essentially located within the United States.

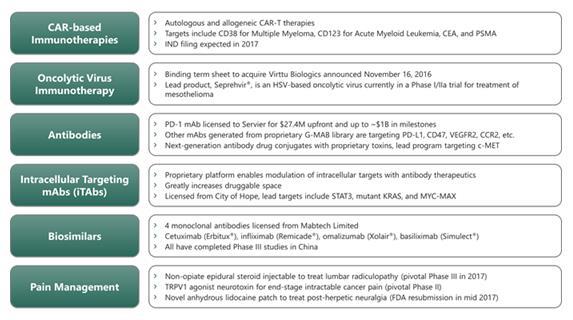

Pipeline and Product Candidates An overview of its core programs is provided in the table below:

Recent Developments

Binding Term Sheet Regarding Acquisition of Semnur Pharmaceuticals, Inc.

On August 15, 2016, the Company’s subsidiary, Scintilla Pharmaceuticals, Inc. (“Scintilla”) and Semnur Pharmaceuticals, Inc. (“Semnur”) entered into a binding term sheet (the “Semnur Binding Term Sheet”) setting forth the terms and conditions by which Scintilla will, through a subsidiary, purchase all of the issued and outstanding equity of Semnur (the “Semnur Acquisition”). The Semnur Binding Term Sheet provides that, contingent upon the execution of a definitive agreement between the parties (the “Definitive Agreement”) and subject to certain conditions, Scintilla will, at the closing of the Semnur Acquisition (the “Semnur Closing”), make an initial payment of $60.0 million (the “Initial Consideration”) to the equityholders of Semnur in exchange for all of the issued and outstanding equity of Semnur. The Initial Consideration will consist of $40.0 million in cash and $20.0 million in shares of its common stock (the “Semnur Stock Consideration”). The Semnur Binding

Term Sheet also provides that the number of shares of its common stock comprising the Semnur Stock Consideration will be calculated based on the volume weighted average closing price of its common stock for the 30 consecutive trading days ending on the date that is three days prior to the execution of the Definitive Agreement. $6.0 million of the Semnur Stock Consideration will be placed into escrow, a portion of which will be held for a period of up to six or 12 months to secure certain obligations of Semnur and its equityholders in connection with the Semnur Acquisition. At the Semnur Closing, the company will enter into a registration rights agreement with certain of Semnur’s equityholders, pursuant to which the company will agree to seek the registration for resale of the shares of its common stock comprising the Semnur Stock Consideration.

In addition to the Initial Consideration, Scintilla may pay additional consideration of up to $140.0 million to Semnur’s equityholders upon Scintilla’s completion of certain clinical studies and trials, receipt of certain regulatory approvals and the achievement of certain sales targets following the Semnur Closing.

Under the Semnur Binding Term Sheet, either party may terminate the Semnur Binding Term Sheet.

As of June 30, 2017, the Semnur Acquisition had not closed. The final terms of the Semnur Acquisition are subject to the negotiation and finalization of the Definitive Agreement and any other agreements relating to the Semnur Acquisition, and the material terms of the Semnur Acquisition are expected to differ from those set forth in the Semnur Binding Term Sheet. In addition, the Semnur Closing will be subject to various customary and other closing conditions.

A member of its board of directors is Semnur’s Chief Executive Officer and a member of Semnur’s Board of Directors and currently owns approximately 5.5% of Semnur’s total outstanding capital stock. Joseph Gunnar & Co., LLC provided an opinion to its board of directors opining that the consideration to be paid by Scintilla in the Semnur Acquisition is fair, from a financial point of view, to its stockholders.

Public Offering of Common Stock

On April 13, 2017, the company entered into an underwriting agreement (the “Underwriting Agreement”) with Cantor Fitzgerald & Co., as representative of the several underwriters named therein (the “Underwriters”), relating to an underwritten public offering (the “Offering”) of 23,625,084 shares of its common stock. The public offering price was $2.00 per share of its common stock and the Underwriters agreed to purchase the shares of its common stock pursuant to the Underwriting Agreement at a price of $1.8571 per share. Under the terms of the Underwriting Agreement, the company also granted to the Underwriters an option, exercisable in whole or in part at any time for a period of 30 days from the date of the closing of the Offering, to purchase up to an additional 3,543,763 shares of its common stock at the public offering price.

On April 19, 2017, the Offering was completed and resulted in net proceeds of approximately $43.5 million (excluding any sale of shares of common stock pursuant to the option granted to the Underwriters), after deducting underwriting discounts and commissions and estimated Offering expenses payable by it.

Acquisition of Virttu Biologics Limited

On April 27, 2017, the company entered into a Share Purchase Agreement (the “Virttu Purchase Agreement”) with TNK Therapeutics, Inc., its majority-owned subsidiary (“TNK”), Virttu Biologics Limited (“Virttu”), the shareholders of Virttu (the “Virttu Shareholders”) and Dayspring Ventures Limited, as the representative of the Virttu Shareholders, pursuant to which, among other things, TNK acquired from the Virttu Shareholders 100% of the outstanding ordinary shares of Virttu (the “Virttu Acquisition”).

Virttu focuses on the development of oncolytic viruses that infect and selectively multiply in and destroy tumor cells without damaging healthy tissue. Its lead oncolytic virus candidate, Seprehvir, infects and replicates in cancer cells selectively, leaving normal cells unharmed.

Under the Virttu Purchase Agreement, the total amount of the consideration payable to the Virttu Shareholders in the Virttu Acquisition is equal to $25 million, less Virttu’s net debt (the “Virttu Base Consideration”). An additional $10 million contingent consideration is payable upon the achievement of certain regulatory milestones (as described below) (the “Regulatory Approval Consideration”).

At the closing of the Virttu Acquisition (the “Closing”), the company issued to the Virttu Shareholders consideration valued at approximately $2.2 million, which consisted primarily of an aggregate of 797,081 shares (the “Virttu Closing Shares”) and approximately $557,000 in cash (the “Cash Consideration”). The issuance of the Closing Shares and the payment of the Cash Consideration satisfied TNK’s obligation to pay 20% of the Virttu Base Consideration at the Closing. Under the terms of the Virttu Purchase Agreement, the company agreed to provide additional consideration to the Virttu Shareholders, as follows:

Upon a financing resulting in gross proceeds (individually or in the aggregate) to TNK of at least $50.0 million (a “Qualified Financing”), TNK will issue to the Virttu Shareholders an aggregate number of shares of its capital stock (“TNK Capital Stock”) as is equal to the quotient obtained by dividing 80% of the Virttu Base Consideration by the lowest per share price paid by investors in the Qualified Financing (the “TNK Financing Consideration”); provided, however, that 20% of the TNK Financing Consideration shall be held in escrow until April 27, 2018 (the “Financing Due Date”), to be used to, among other things, satisfy the indemnification obligations of the Virttu Shareholders. In the event that a Qualified Financing does not occur, then on the Financing Due Date, the company will issue to the Virttu Shareholders an aggregate number of shares of its common stock as is equal to the quotient obtained by dividing 80% of the Virttu Base Consideration, by $5.55 (as adjusted, as appropriate, to reflect any stock splits or similar events affecting its common stock after the Closing). Within 45 business days after Virttu becomes aware that certain governmental bodies in the United States, the European Union, the United Kingdom or Japan have approved for commercialization, on or before October 26, 2024, Seprehvir (or any enhancement, combination or derivative thereof) as a monotherapy or in combination with one or more other active components (each of the first two such approvals by a governmental body being a “Regulatory Approval”), TNK shall pay half of the Regulatory Approval Consideration to the Virttu Shareholders, in a combination of (a) up to $5.0 million in cash (the “Regulatory Approval Cash”) and/or (b) ![]() such number of shares of its common stock as is equal to the quotient obtained by dividing $5.0 million less the Regulatory Approval Cash (the “Regulatory Approval Share Value”) by the 30 Day VWAP (as defined below) of one share of its common stock; (ii) if TNK has completed its first public offering of TNK Capital Stock, the number of shares of TNK Capital Stock as is equal to the quotient obtained by dividing the Regulatory Approval Share Value by the 30 Day VWAP of one share of TNK Capital Stock; or (iii) such number of shares of common stock of a publicly traded company as is equal to the quotient obtained by dividing the Regulatory Approval Share Value by the volume weighted average price of the relevant security, as reported on the Nasdaq Capital Market (or other principal stock exchange or securities market on which the shares are then listed or quoted) for the thirty trading days immediately following the receipt of Regulatory Approval (the “30 Day VWAP”), with the composition of the Regulatory Approval Consideration to be at TNK’s option. In order for a second regulatory approval to qualify as a Regulatory Approval under the Purchase Agreement, the second approval must be granted by a different governmental body in a different jurisdiction than that which granted the first Regulatory Approval.

such number of shares of its common stock as is equal to the quotient obtained by dividing $5.0 million less the Regulatory Approval Cash (the “Regulatory Approval Share Value”) by the 30 Day VWAP (as defined below) of one share of its common stock; (ii) if TNK has completed its first public offering of TNK Capital Stock, the number of shares of TNK Capital Stock as is equal to the quotient obtained by dividing the Regulatory Approval Share Value by the 30 Day VWAP of one share of TNK Capital Stock; or (iii) such number of shares of common stock of a publicly traded company as is equal to the quotient obtained by dividing the Regulatory Approval Share Value by the volume weighted average price of the relevant security, as reported on the Nasdaq Capital Market (or other principal stock exchange or securities market on which the shares are then listed or quoted) for the thirty trading days immediately following the receipt of Regulatory Approval (the “30 Day VWAP”), with the composition of the Regulatory Approval Consideration to be at TNK’s option. In order for a second regulatory approval to qualify as a Regulatory Approval under the Purchase Agreement, the second approval must be granted by a different governmental body in a different jurisdiction than that which granted the first Regulatory Approval.

Celularity Transaction

On November 1, 2016, the company loaned $5.0 million to Celularity, Inc., a research and development company (“Celularity”), pursuant to a promissory note issued by it to Celularity, as amended (as so amended, the “Celularity Note”), in connection with the entry into a nonbinding term sheet by it, TNK and Celularity. Pursuant to the terms of the Celularity Note, the loan will be due and payable in full on the earlier of November 1, 2017 and the occurrence of an event of default under the Celularity Note (the “Maturity Date”). In the event that Celularity meets certain minimum financing conditions prior to the Maturity Date, all outstanding amounts under the Celularity Note shall be forgiven and converted to equity. On May 31, 2017, the company loaned an additional $2.0 million to Celularity pursuant to the terms of the Celularity Note. On June 14, 2017, the company loaned an additional $1.0 million to Celularity. Additionally, on July 7, 2017, the company loaned an additional $2.0 million to Celularity.

On June 12, 2017, the company entered into a Contribution Agreement (the “Contribution Agreement”) with TNK and Celularity, pursuant to which, among other things, the company and TNK agreed to contribute certain intellectual property rights related to its proprietary chimeric antigen receptor (“CAR”) constructs and related CARs to Celularity in exchange for shares of Celularity’s Series A Preferred Stock equal to 25% of Celularity’s outstanding shares of capital stock, calculated on a fully-diluted basis. The contribution will be made pursuant to a License and Transfer Agreement to be entered into by and among it, TNK and Celularity.

As of June 30, 2017, the transactions contemplated by the Contribution Agreement had not closed.