Altria Inc.

Summary

- Altria Group, Inc. is a leading tobacco, alcohol, and cannabis company in the United States.

- Its most well-known brands include Marlboro, Copenhagen, Skoal, on!, and Black & Mild.

- Its wholly owned subsidiaries include Philip Morris USA Inc., U.S. Smokeless Tobacco Company LLC, John Middleton Co., Helix Innovations LLC, and NJOY Holdings, Inc

- Altria's tobacco products include cigarettes, moist smokeless tobacco, oral nicotine pouches, and heat-not-burn products.

Altria Group, Inc. (NYSE: MO, LSE: 0R31) is a leading tobacco, alcohol, and cannabis company in the United States. Its wholly owned subsidiaries include Philip Morris USA Inc., U.S. Smokeless Tobacco Company LLC, John Middleton Co., Helix Innovations LLC, and NJOY Holdings, Inc. Altria also has a minority stake in Anheuser-Busch InBev SA/NV, the world's largest brewer.

Altria's tobacco products include cigarettes, moist smokeless tobacco, oral nicotine pouches, and heat-not-burn products. Its most well-known brands include Marlboro, Copenhagen, Skoal, on!, and Black & Mild.

Recent Developments

NJOY Brings Sweeping Litigation Against Illicit Disposable Vapor Manufacturers1

10/19/2023; Altria Group, Inc. (Altria) announces its operating company NJOY, LLC (NJOY) has filed sweeping litigation against 34 foreign and domestic manufacturers, distributors and online retailers of illicit disposable e-vapor products that are unlawfully marketed and sold in the State of California and elsewhere. The suit alleges that these companies manufacture, distribute, market and sell products that violate California’s flavor ban law, are unlawful under federal law and subject to FDA action, and illegally compete against companies that comply with state and federal laws.

The suit seeks a nation-wide injunction against the import, marketing and sale of these illicit products and significant compensatory and punitive damages.

Altria Completes Acquisition of NJOY Holdings, Inc.2

6/1/2023; Altria Group, Inc. announces that Altria has completed its acquisition of NJOY Holdings, Inc.

The company funded the Transaction cash payments of approximately $2.75 billion through a combination of a $2 billion term loan, commercial paper and available cash.

The company expect to receive final payment of $1.7 billion (plus interest) from Philip Morris International Inc. (PMI) by July 15, 2023 as a part of its total $2.7 billion transition agreement for the IQOS Tobacco Heating System®. The company will use these proceeds to reduce the outstanding term loan balance.

Beginning in the second quarter of 2023, financial results for NJOY will be reported within the "All Other" category.

The company expect the Transaction to be accretive to cash flow in 2025 and accretive to adjusted diluted EPS in 2026. The company also expect the return on invested capital for the Transaction to exceed its current weighted-average cost of capital by 2027.

The previously announced Transaction terms also include up to $500 million in additional cash payments that are contingent upon regulatory outcomes with respect to certain NJOY products.

Financial Highlights

Third Quarter 2023 Results3

Net revenues decreased 4.1% to $6.3 billion, primarily driven by lower net revenues in the smokeable products segment. Revenues net of excise taxes decreased 2.5% to $5.3 billion.

Reported diluted EPS increased 100%+ to $1.22, primarily driven by its impairment of its investment in ABI in 2022 and 2022 charges related to its former investment in JUUL Labs, Inc. (JUUL) equity securities, partially offset by unfavorable income tax items.

Adjusted diluted EPS was unchanged at $1.28, as lower adjusted OCI was offset by fewer shares outstanding.

Full Year 2022 Results

Net revenues, which include excise taxes billed to customers, decreased $917 million (3.5%), due primarily to the sale of its wine business in October 2021 and lower net revenues in the smokeable products segment.

Cost of sales decreased $677 million (9.5%), due primarily to lower shipment volume in its smokeable products segment and the sale of its wine business, partially offset by higher manufacturing costs and higher per unit settlement charges.

Excise taxes on products decreased $494 million (10.1%), due primarily to lower shipment volume in its smokeable products segment.

Marketing, administration and research costs decreased $105 million (4.3%), due primarily to the sale of its wine business (including lower disposition-related costs), lower spending associated with the IQOS System heated tobacco business, lower general corporate expenses and acquisition-related costs in 2021 in its oral tobacco products segment, partially offset by higher costs in its smokeable products segment.

Operating income increased $359 million (3.1%), due primarily to higher operating results in its smokeable products segment and lower general corporate expenses.

Interest and other debt expense, net decreased $104 million (9.0%), due primarily to lower interest costs as a result of debt maturities and refinancing activities and higher interest income due to higher rates and interest associated with the sale of the IQOS System commercialization rights.

Adjusted net earnings attributable to Altria of $8,742 million increased $223 million (2.6%), due primarily to higher OCI and lower interest and other debt expense, net. Adjusted diluted EPS attributable to Altria of $4.84 increased by 5.0%, due to higher adjusted net earnings attributable to Altria and fewer shares outstanding.

Company Overview

Altria has a leading portfolio of tobacco products for U.S. tobacco consumers age 21+. The company's wholly owned subsidiaries include leading manufacturers of both combustible and smoke-free products. In combustibles, the company own Philip Morris USA Inc. (PM USA), the most profitable U.S. cigarette manufacturer, and John Middleton Co. (Middleton), a leading U.S. cigar manufacturer. The company's smoke-free portfolio includes ownership of U.S. Smokeless Tobacco Company LLC (USSTC), the leading global moist smokeless tobacco (MST) manufacturer, Helix Innovations LLC (Helix), a leading manufacturer of oral nicotine pouches, and NJOY, LLC (NJOY), currently the only e-vapor manufacturer to receive market authorizations from the U.S. Food and Drug Administration (FDA) for a pod-based e-vapor product.

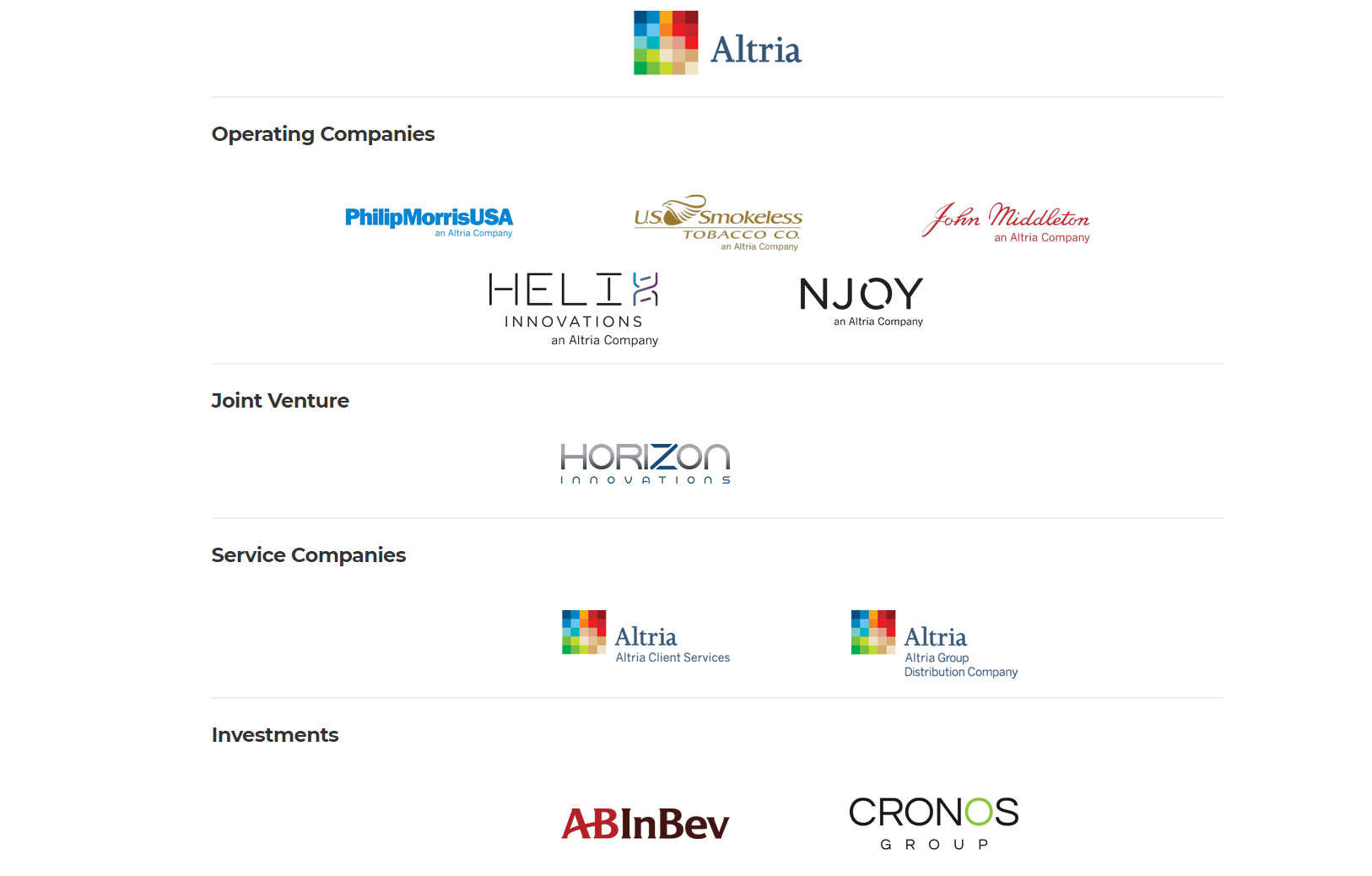

Companies

Altria operates through various companies.4

Operating Companies

Philip Morris USA

Philip Morris USA, the nation's leading cigarette manufacturer, is more than 175 years old. Philip Morris USA's cigarette retail share was 47.9 percent.

Philip Morris Brands

- Marlboro

- Basic

- Benson & Hedges

- Cambridge

- Chesterfield

- Commander

- Dave's

- English Ovals

- L&M

- Lark

- Merit

- Parliament

- Players

- Saratoga

- Virginia Slims

U.S. Smokeless Tobacco Company

It’s the most profitable smoke-free company in the U.S. with approximately one of every two moist smokeless tobacco consumers buying a USSTC. brand. In 2009, USSTC joined Altria Group.

Brands

- Copenhagen

- Cope

- Copenhagen Pouches

- Skoal

- Skoal Bandits

- Skoal Pouches

- Red Seal

- Husky

- Weyman's Best

John Middleton's

John Middleton's roots in tobacco date back to 1856 and today is a leading manufacturer and marketer of pipe tobacco and cigars. In December 2007, Middleton became a wholly-owned subsidiary of Altria Group.

Brands

- Black & Mild

- Middleton's Cherry Blend

- Gold & Mild

- Prince Albert

- Apple

- Black & Mild

- Carter Hall

- Middleton's Cherry Blend

- Gold & Mild

- Kentucky Club

- Prince Albert

- Royal Comfort

- Sugar Barrel

- Walnut

Helix Innovations

In 2019, Altria acquire 80% ownership of certain companies of Burger SÖhne HoldingAG, based in Switzerland, that commercialize on!® nicotine pouches globally. In December 2020 and April 2021, Altria subsidiaries closed the transactions to acquire the remaining 20% of the global on! business for a total of approximately $250 million.

NJOY

Altria acquired NJOY Holdings in 2023. NJOY ACE, currently the only pod-based e-vapor product with market authorization from the FDA.

Joint Venture

Horizon Innovations

Horizon Innovations is a majority-owned joint venture with JT Group, to market and commercialize JT’s heated tobacco stick products in the U.S.

Service Companies

Altria Client Services

Altria Client Services provides Altria Group and its companies services in a financially disciplined way.

These areas include:

- Advanced Analytics

- Compliance

- Consumer & Market Insights

- Corporate Citizenship

- Digital Marketing Services

- Engineering

- Finance

- Investor Relations

- Communications

- Government Affairs

- Human Resources

- Information Technology

- Legal

- Packaging Design & Innovation

- Procurement

- Product Development

- Regulatory Affairs

- Safety, Health and Environmental

Altria Group Distribution Company

Altria Group Distribution Company provides sales, distribution and consumer engagement services to Altria's tobacco companies.

Investments

Anheuser-Busch InBev

AB InBev is now the largest global brewer – provides it with substantial income, cash flow and a strong asset on its balance sheet.

Cronos Group Inc.

In 2019, Altria acquired a 45 percent equity stake in Cronos Group Inc., a leading global cannabinoid company, headquartered in Toronto, Canada. The cannabis is poised for rapid growth over the next decade.

Company History

The company founded when George Weyman opened his tobacconist shop in Pittsburgh in 18225

| Year | Milestone |

| 1982 | Philip Morris Credit Corporation (now Philip Morris Capital Corporation) is incorporated. |

| 1985 | Philip Morris Cos. is incorporated, and becomes the publicly-held holding company and parent of Philip Morris Inc. Philip Morris Cos. acquires General Foods Corp. |

| 1988 | Philip Morris Cos. acquires Kraft Foods Inc. |

| 1989 | Kraft and General Foods combine to form Kraft General Foods. |

| 2002 | Miller Brewing Company merges with South African Breweries to form SABMiller plc., the world's second-largest beer company, with Philip Morris Cos. retaining a continuing interest in the enlarged group. |

| 2003 | Philip Morris Cos. is renamed The Altria Group Inc., and remains the parent company of Kraft Foods Inc., Philip Morris International, Philip Morris USA and Philip Morris Capital Corporation. |

| 2007 | Altria spins off Kraft Foods, distributing all shares owned by Altria to Altria's shareholders. Altria acquires John Middleton. |

| 2008 | Altria relocates its headquarters to Richmond, Va., and completes the spin-off of Philip Morris International. |

| 2009 | Altria Group acquires UST Inc., a holding company whose primary businesses manufacture and market moist smokeless tobacco products through U.S. Smokeless Tobacco Company, and premium wines through Ste. Michelle Wine Estates. |

| 2009 | The Family Smoking Prevention and Tobacco Control Act is signed into law, giving FDA the authority to regulate the manufacturing, distribution and marketing of tobacco products. |

| 2016 | Anheuser-Busch InBev SA/NV (AB InBev) merges with SAB Miller plc, becoming the world's largest drink and brewing holdings company. |

| 2017 | Altria Group acquires Sherman Group Holdings, LLC and its subsidiaries (Nat Sherman). |

| 2019 | Altria Group makes a significant investment in The Cronos Group, a global cannabinoid company. |

| 2019 | With an agreement to acquire 80% ownership of certain Burger Söhne Holding AG to commercialize and distribute on!, an oral tobacco-derived nicotine pouch product. |

| 2021 | In December 2020 and April 2021, Altria subsidiaries closed transactions to acquire the remaining 20% of the global on! business for a total of approximately $250 million. |

| 2022 | On April 5, Altria announces progress towards climate goals with a signed virtual power purchase agreement for energy produced by a wind farm in Texas, to address the emissions from 100 percent of Altria’s annual purchased electricity demand across all U.S. facilities. |

References

- ^ https://investor.altria.com/press-releases/news-details/2023/NJOY-Brings-Sweeping-Litigation-Against-Illicit-Disposable-Vapor-Manufacturers/default.aspx

- ^ https://investor.altria.com/press-releases/news-details/2023/Altria-Completes-Acquisition-of-NJOY-Holdings-Inc.-Updates-2023-Full-Year-Earnings-Guidance/default.aspx

- ^ https://investor.altria.com/press-releases/news-details/2023/Altria-Reports-2023-Third-Quarter-and-Nine-Months-Results-Narrows-2023-Full-Year-Earnings-Guidance/default.aspx

- ^ https://www.altria.com/about-altria/our-companies?src=topnav

- ^ https://www.altria.com/en/about-altria/our-heritage