Aqua Metals

Overview

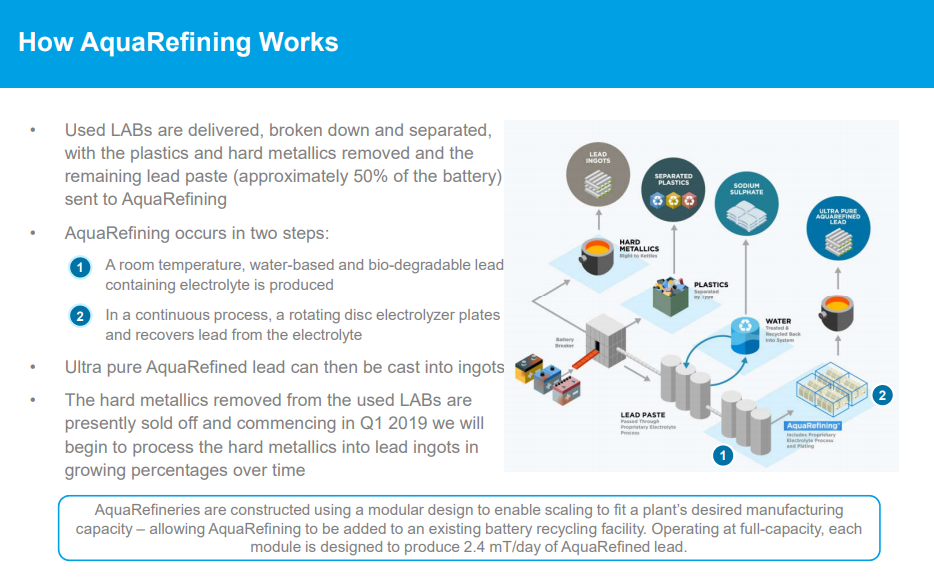

Aqua Metals (NASDAQ:AQMS) is engaged in the business of lead recycling through its novel, proprietary and patented AquaRefining™ technology. AquaRefining is a near room temperature, water and organic acid-based process that greatly reduces environmental emissions. The company believe its suite of patented and patent pending AquaRefining technologies, as well as trade secret advancements in battery breaking and separation, electrolyte digestion and management, and modular electrolyzer systems yielding high purity lead, will allow the lead-acid battery industry to simultaneously improve the environmental impact of lead recycling and scale recycling production to meet demand. Aqua Metals was formed as a Delaware corporation on June 20, 2014 and since its formation, Aqua Metals has focused its efforts on the development and testing of its AquaRefining process, the construction of its initial lead acid battery, or LAB, recycling facility at the Tahoe-Reno Industrial Center, or TRIC, located near McCarran, Nevada and commercializing the AquaRefining process.

The company completed the construction of its first LAB recycling facility at TRIC and commenced production during the first quarter of 2017. The TRIC facility is designed to produce recycled lead, consisting of high purity AquaRefined lead, lead bullion, alloys (for specific applications in batteries) and plastics derived from LABs. The company commenced the shipment of products for sale, consisting of lead compounds, metallic lead and plastics, in April 2017 and through March 31, 2018 all revenue was derived from the sale of lead compounds, metallic lead and plastics. In April 2018, the company began shipping cast lead bullion (mixture of lead purchased to prime the kettles and AquaRefined lead from its AquaRefining process) blocks in addition to lead compounds and plastics. In June 2018, the company began shipping high purity lead made solely from its AquaRefining process.

In June 2018, the company also began staffing its AquaRefining operations 24 hours per day and 4 days per week and subsequently scaled staffing its AquaRefining operations further in August to 24 hours per day and 7 days per week. Although operations are staffed 24 hours a day to produce the electrolyte that feeds its AquaRefining modules and to run modules, any given module is not running 24 hours a day. Rather, Aqua Metals is rotating through the 4 modules Aqua Metals has commissioned and running 1 to 2 modules at a time as many hours a day as possible with the goal of generally increasing the number of hours per day any given module is run. Since June, Aqua Metals has increased the average number of hours from under 10 of the 24 hours to regularly achieving 20+ of the 24 hours per module run resulting in 100 kilograms / hour of AquaRefined lead production per module, which the company announced in October 2018. From these experiences, Aqua Metals has continued making regular and minor improvements to improve module run hours and anticipate continued growth in module utilization in the coming weeks and months.

Upon completing and commissioning the infrastructure and operational improvements already underway in the facility which are intended to result in positive contribution margin for AquaRefined lead product, the company will then scale the plant and bring additional modules on line. These infrastructure and operational improvements allow it to recover and recycle its chemical feedstock much more efficiently thus improving its contribution margin. The company estimate Phase One of these improvements will take it up to 75% towards its target for electrolyte recapture and Phase Two will complete the remaining 25%. Aqua Metals has completed testing of Phase One of the system and have begun installing the equipment and remain on track to complete Phase One by the end of 2018. Aqua Metals has also begun testing Phase Two and are very pleased with the initial results.

Ultimately, its goal is to operate all 16 modules running on a continuous basis, however Aqua Metals has decided that the initial operation of fewer modules continuously will allow it to reach full scale operations in a more cost-effective manner. In addition, the company believe this operational strategy will allow it to synchronize the remaining components of the plant in support of increased AquaRefining. Once Aqua Metals has achieved positive contribution margin and are satisfied with the operation of the first four modules and the supporting infrastructure, additional modules will be brought into production. This process will be repeated until full production is reached with all 16 modules. However, due to the delays and unforeseen operational issues Aqua Metals has experienced to date, there can be no assurance that the company will be able to overcome the current production and performance issues in a timely manner or that the company will not encounter additional delays and issues.

Since January 1, 2018, Aqua Metals has engaged in the following non-routine transactions:

Amendments of Interstate Battery agreements. On June 24, 2018, the company entered into a series of agreements with Interstate Battery International, Inc. and its wholly-owned subsidiary (“Interstate Battery”), including an amendment to the Investor Rights Agreement dated May 18, 2016 with Interstate Battery pursuant to which, among other things, the company agreed to compensate Interstate Battery should either Stephen Clarke, its former chief executive officer, or Selwyn Mould, its current chief operating officer, no longer hold such positions or no longer devote substantially all of their business time and attention to its company, whether as a result of resignation, death, disability or otherwise (such an event referred to as a “key-man event”). Pursuant to the Investor Rights Agreement, the company agreed to pay Interstate Battery $2,000,000, per occurrence, if either officer was subject to a key-man event during the two years following May 18, 2016. The company also agreed to pay Interstate Battery $2,000,000 if either or both officers are subject to a key-man event during the third year following May 18, 2016. Pursuant to the amendment to the Investor Rights Agreement, Interstate Battery agreed to waive all payments under the key-man provisions of the Investor Rights Agreement with respect to the resignation of its former chief executive officer, Stephen Clarke. In addition, the parties agreed that Aqua Metals ,at its option, can elect to eliminate the key-man event and all related key-man payments associated with Mr. Mould by ![]() paying Interstate Battery a one-time fee of $0.5 million, payable by it in cash and (ii) agreeing to pay Interstate Battery $2.0 million, payable at its election in cash or shares of its common stock, should its current president, Stephen Cotton no longer serve as its president during the period ending May 18, 2019. Additionally:

paying Interstate Battery a one-time fee of $0.5 million, payable by it in cash and (ii) agreeing to pay Interstate Battery $2.0 million, payable at its election in cash or shares of its common stock, should its current president, Stephen Cotton no longer serve as its president during the period ending May 18, 2019. Additionally:

- With respect to a Credit Agreement dated May 18, 2016 between it and Interstate Battery, Interstate Battery waived the alleged breach of the Credit Agreement based on its acquisition of Ebonex IPR, Ltd.;

- The company adjusted the terms of a warrant to purchase 702,247 shares of its common stock issued to Interstate Battery in May 2016, pursuant to which the exercise price of the warrant was decreased from $7.12 per share to $3.33 per share and the expiration date of the warrant was extended to June 23, 2020; and

- Interstate Battery agreed to provide it with more favorable pricing and payment terms under the Supply Agreement dated May 18, 2016 pursuant to which the company buy used lead acid batteries from Interstate Battery.

Public Offering. On June 18, 2018, the company completed a public offering of 10,085,500 shares of its common stock, at the price of $2.85 per share, for gross proceeds of $28.7 million. After the payment of underwriter discounts and offering expenses the company received net proceeds of approximately $26.6 million.

In January 2018, the company issued 1,072,500 shares of common stock upon exercise of the overallotment option related to the December 2017 public offering, netting proceeds to it of $2.1 million.

Plan of Operations

The company's plan of operations for the 12-month period following the date of this report, in the event that the company achieve positive contribution margin, is to complete the commercial roll-out of all 16 AquaRefining modules installed at TRIC and to ramp up the production of AquaRefined lead.

The company expect to achieve the full previously negotiated premium value for ongoing shipments of AquaRefined lead from its partner Johnson Controls in the near future and, as previously announced in October, Aqua Metals has its ingot casting line in production, which enables it to ship its key product in final ingot form directly to battery manufacturing facilities and be compatible with the equipment in those facilities. Aqua Metals is also working with other prospective buyers in the lead industry who are seeking ultra-pure lead for both offtake diversity and an average higher premium than we’ve negotiated with Johnson Controls. In 2019, in addition to batteries being made from AquaRefined lead, Aqua Metals is also exploring non-battery products such as radiation mitigation and structural isolation systems to be made incorporating AquaRefined lead which could improve performance of such products and possibly further improve the brand value of AquaRefined lead and AquaRefining technologies.

Additionally, the company plan to further improve the plant economics by processing a growing proportion of the metallic lead the company recover from breaking batteries within the AquaRefinery and have begun to commission the remaining 4 of its 6 kettles in the refining area. The company anticipate the success of this planned program will unlock additional contribution margin in early 2019 by enabling it to finish a growing proportion of these materials in house, thus realizing a continually improving margin and positioning it for earning a premium later in 2019 by refining alloys in house. Aqua Metals is in the process of commissioning three to four of the already purchased kettles as a key part of its project to enable its capability to process this material. Aqua Metals is also developing what the company believe to be industry leading know how and other intellectual property that Aqua Metals is making every effort to secure and add to its suite of smelting-free lead recycling technologies that the company believe the company can in turn monetize by licensing.

In parallel with its efforts to commercialize its existing AquaRefining operations and test further the premiums the company can receive for its ultra-pure AquaRefined lead, its 12-month plan of operations also includes its proposal to license its technology, either through a co-processing arrangement whereby the company operate its technology in conjunction with an existing smelter or its licensee operates directly utilizing its technology, and provide planning, engineering, technical assistance, equipment and other services in support of the addition of an AquaRefining facility to a battery recycling facility owned by Johnson Controls. This proposed work is expected to produce a blueprint for further additions of AquaRefining facilities under a proposed definitive development agreement with Johnson Controls pursuant to which the company will collaborate with Johnson Controls for the deployment of AquaRefining technologies within Johnson Controls’ and certain strategic partners of Johnson Controls existing lead smelters to a lead recycling process utilizing its proprietary AquaRefining technology and equipment, know-how and services. However, there can be no assurance that the company will be able to conclude a definitive development agreement with Johnson Controls on terms that benefit it, if at all.

The company's 12-month plan of operations includes the pursuit and evaluation of additional strategic relationships and the licensing of its technology and the provision of equipment and services to other potential strategic partners. There can be no assurance that the company will be able to acquire the necessary funding, if necessary, on commercially reasonable terms or at all to effect any of these additional partnerships in the future. There can also be no assurance the company will be able to conclude the proposed development agreement with Johnson Controls by April 2019.

How Aqua Metals works