Auto Trader Group

Summary

- Auto Trader is most trusted automotive marketplace. It’s the go-to destination for car buyers and has been for the past 40 years.

- Auto Trader has over 90% prompted brand awareness with consumers and attracts over 50 million cross platform visits each month. The audience is not only large but highly engaged with a 75% share of minutes spent across automotive platforms.

- The marketplace also hosts the largest pool of vehicle sellers (listing more than 485,000 cars each day) thanks to its partnership with more than 13,300 retailers.

- Auto Trader is a 100% digital business. Starting life as a local classified magazine in 1977.

Company Overview

Auto Trader (LSE:AUTO, OTC:ATDRY) is most trusted automotive marketplace. It’s the go-to destination for car buyers and has been for the past 40 years.1

Auto Trader has over 90% prompted brand awareness with consumers and attracts over 50 million cross platform visits each month. The audience is not only large but highly engaged with a 75% share of minutes spent across automotive platforms.

The marketplace also hosts the largest pool of vehicle sellers (listing more than 485,000 cars each day) thanks to its partnership with more than 13,300 retailers.

An overview of its business

Auto Trader exists to grow both its car buying audience and core advertising business. It will change how the UK shops for cars by providing the best online car buying experience, enabling all retailers to sell online. The company aim to build stronger partnerships with its customers, use its voice and influence to drive more environmentally friendly vehicle choices and create an inclusive and more diverse culture.

Auto Trader is a 100% digital business. Starting life as a local classified magazine in 1977, the company grown and evolved alongside its customers. In 2013, the company successfully completed the transition from a print title and became a fully digital marketplace. The company's rich history gives it nearly 40 years of brand heritage and trust - unusual among online companies.

Auto Trader listed on the London Stock Exchange in March 2015 and is now a member of the FTSE 100 Index.

Company History

The history of Auto Trader starts back in 19772

| Year | Milestones |

| 1977 | Entrepreneur John Madejski launched a small regional classified advertising magazine called Thames Valley Trader. He brought the idea to the UK after a visit to the US. |

| 1983 | Guardian Media Group (GMG) joined Auto Trader, as it had been considering launching a similar venture in the north of England. |

| 1988 | Became Auto Trader in 1988, after a short spell as Auto Mart & Trader. At this point Auto Trader Group had a number of regional magazines, which were all renamed. |

| 1995 | By 1995, Auto Trader titles covered the whole of the UK. The magazine also became available in Ireland for the first time. |

| 2000 | In 2000, the two separate parts of Auto Trader merged into a single company, called Trader Media Group. |

| 2011 | Began disposing of the parts of our business that addressed non-UK markets. This was completed in 2013, giving our team renewed focus. |

| 2014 | Created new working areas by moving staff to state-of-the-art offices in central Manchester and King’s Cross, London. |

| 2015 | On 24th March, Auto Trader listed on the London Stock Exchange. |

| 2017 | In April 2017 Auto Trader Group welcomed Motor Trade Delivery Ltd into the Auto Trader team, helping to grow our trade-to-trade proposition. |

| 2018 | Created a joint venture with Cox Automotive, Dealer Auction, to provide an innovative digital marketplace for wholesale vehicles. |

| 2020 | Acquired AutoConvert, a finance, insurance and compliance software platform with integrated customer relationship management solutions. |

| 2021 | Launched our Guaranteed Part-Exchange (‘GPX’) and Instant Offer products. GPX enables the consumer to get a guaranteed price for their part-exchange, while Instant Offer enables private sellers to sell their car at a guaranteed price. |

Business Overview

The automotive market is complex and often inefficient. There are multiple participants and unsurprisingly consumers can find the process of buying or selling a car overwhelming. Through Auto Trader products, services and partnerships, the company aim to significantly improve the car buying experience, as well as leverage its existing relationships to improve further parts of the value chain.3

Consumers

From desire, to research, to decision - Auto Trader makes the consumer journey easier.

The company's platform offers consumers an unparalleled selection of new and used car listings, enabling them to search from a marketplace of 485,000 cars including 47,000 new cars each month.

Each advert features a good, great, fair, high, and low price indicator, dealer reviews and the ability to perform a free basic vehicle check. The company also offer a finance search tool allowing consumers to search by monthly budget as well as free car valuations and a variety of motoring services and advice to help consumers in their car buying journey.

Auto Trader has recently launched Retailer Stores to create a digital forecourt experience on Auto Trader for retailers to showcase their business, brand and stock, giving car buyers confidence to buy from them.

The company launched its Guaranteed Part-Exchange (‘GPX’) and Instant Offer products. GPX enables the consumer to get a guaranteed price for their part-exchange, while Instant Offer enables private sellers to sell their car at a guaranteed price.

Trade

From marketing, to finance, to deal - Auto Trader makes the retailer journey easier.

The company offer a range of products and services to its retailer customers to help them win in today’s digital automotive marketplace.

The company's core classified platform provides access to the UK’s largest car buying audience through different product packages which offer increasing levels of prominence in search.

Powered by both its own and third-party data, the company offer data intelligence solutions (Retail Accelerator and Retail Check) enabling retailers to buy the right stock, at the right price.

After gaining FCA authorisation, the company can now enable retailers to display their own finance calculator as standard on their full page adverts on Auto Trader. This allows retailers to show their finance offerings much earlier on in the car buying journey, increasing the opportunity for them to sell their own finance over a consumer sourcing finance from elsewhere.

The company acquired AutoConvert, a finance, insurance and compliance software platform with an integrated customer relationship management system. AutoConvert is a core finance component in the digital car buying journey. The company believe an online finance journey will help customers to increase finance penetration and also reduce processing costs through greater automation.

Every retailer customer receives monthly performance dashboard analytics and has access to a Market Insight tool to help them assess their performance, and free access to best practice events.

Manufacturers

From production, to advertising, to sale - Auto Trader makes the manufacturer journey easier.

The company's platform enables manufacturers to advertise to the UK’s largest car buying audience. The company's InSearch format allows brands to serve new car adverts within search results, and as 58% of car buyers used video to inform their recent purchase decision, the company introduced video format advertising.

Auto Trader has over 47,000 brand new car make/model variants on its marketplace. Make/model pages for all new cars improve the buying journey, and its extra content and annual New Car Awards enhances Auto Trader’s position in the new car market.

The company use its own data management platform (‘DMP’) to create highly targeted audience segments for advertising and give manufacturers a compelling proposition to reach new car buyers.

Financial Highlights

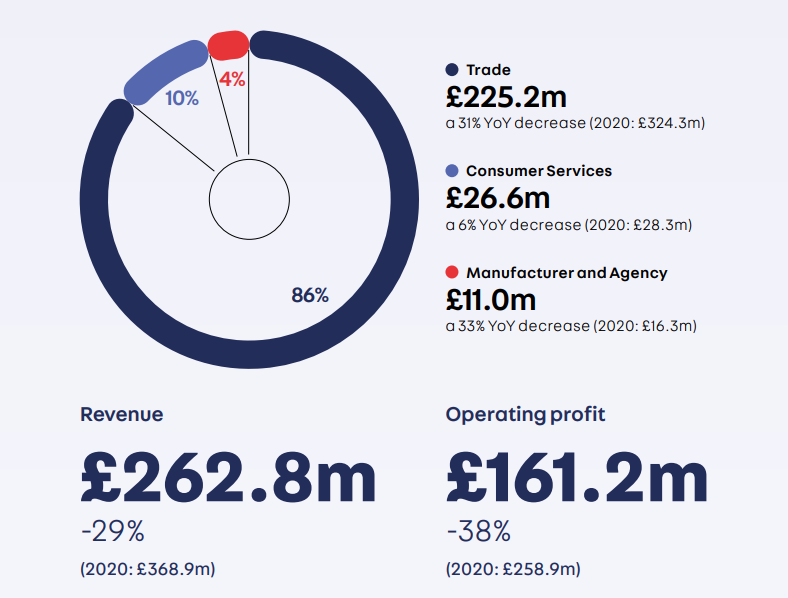

Revenue fell to £262.8m for the year ended 31March 2021 (2020: £368.9m), down 29% when compared to the prior year. Trade revenue, which comprises revenue from Retailers, Home Traders and other smaller revenue streams, decreased by 31% to £225.2m (2020: £324.3m).4

Retailer revenue fell by 32% to £211.9m (2020: £312.1m). Revenue was impacted by its decision to provide free advertising to its retailer customers in April, May, December and February, and at a 25% discount in June, due to the closure of their forecourts given COVID-19 lockdown restrictions.

The average number of retailer forecourts advertising on its platforms was broadly flat at 13,336 (2020: 13,345). The company had a reasonable decline in the first quarter, but subsequently saw a steady increase in the number of retailers advertising on its platform since June 2020.

Average Revenue Per Retailer (‘ARPR’) declined by 32% to £1,324 (2020: £1,949). The £625 decrease was heavily impacted by the COVID-19 related discounts previously mentioned. Excluding those discounts, ARPR grew by £87 year-on-year, as a decline in paid stock was offset by an increase in price and product:

- COVID-19 related discounts: The impact of discounts provided to support customers during the various lockdown periods contributed a decline of £712 to total ARPR (2020: £0).

- Price: The company's price lever contributed an increase of £50 (2020: £53) to total ARPR as the company executed its annual pricing event for all customers on 1 April 2020, which included additional products but also a like-for-like price increase.

- Stock: The number of cars advertised on Auto Trader increased by 1% to 485,000 (2020: 478,000), this was boosted by the growth in new cars seen on Auto Trader due to growing take up on its new car product. Used car stock marginally declined in the year as the company saw stock levels reduce through the second quarter, with the overall number of cars available to retail decreasing as a result of high demand and tightened supply. Stock levels recovered through the second half, although not enough to offset the decline. The year-on-year decline in the number of used cars live on site contributed to the decline in the levels of paid retailer stock resulting in a £52 decline in the stock lever (2020: decline of £30).

- Product: The company's product lever contributed an increase of £89 (2020: £82) to total ARPR. Much of this product growth was a result of its annual pricing event underpinned by three products: an upgraded Performance Dashboard, Retail Check and a new Market Insight tool. There was also growth in its new car advertising product with over 2,000 paying retailers at the end of March 2021 (March 2020: over 1,000). The penetration of its higher yielding advanced and premium packages also increased to 26% of retailer stock (March 2020: 23%), as retailers continue to recognise the value of receiving greater prominence within its search listings and took advantage of the free advertising offered in December and February. The company also saw a small contribution from its new Market Extension product.

Home Trader revenue declined by 24% to £6.3m (2020: £8.3m). Other revenue increased by £3.1m to £7.0m (2020: £3.9m) mainly through the acquisition of KeeResources and AutoConvert which contributed £3.7m (2020: £1.9m) and £1.1m (2020: £0.0m) to this revenue line respectively.

Consumer Services revenue decreased by 6% in the period to £26.6m (2020: £28.3m). Private revenue, which is generated from individual sellers who pay to advertise their vehicle on the Auto Trader marketplace, decreased to £16.6m (2020: £20.1m). This was offset by an increase in Motoring Services revenue, which was up 21% to £9.9m (2020: £8.2m) as a result of strong growth in both its insurance and finance offerings. The company also launched its new instant offer product in the year, which enables private sellers to sell their car at a guaranteed price, which contributed £0.1m to Private revenue.

Revenue from Manufacturer and Agency customers declined by 33% to £11.0m (2020: £16.3m). In addition to the impact of the pandemic, the company also removed standard format display advertising to improve the core search experience. This removal contributed £3.9m to the overall reduction in Manufacturer and Agency revenue.

Costs

The Group made the decision to reduce costs, mainly through the reduction of discretionary marketing spend, which led to total costs decreasing by 8% to £104.0m (2020: £113.2m).

People costs, which comprise all staff costs and third-party contractor costs, increased by 8% to £60.0m (2020: £55.8m). The increase in people costs was primarily driven by an increase in the average number of full-time equivalent employees (including contractors) to 909 (2020: 853), much of which was down to the acquisition of KeeResources and AutoConvert which contributed a combined 49 to the increase in the period.

Marketing spend decreased by 43% to £9.8m (2020: £17.3m) as discretionary spend was reduced in response to the pandemic.

Other costs, which include data services, property related costs and other overheads, decreased by 17% to £27.9m (2020: £33.6m). The decrease was primarily due to lower overhead costs, including lower travel and office related costs. Depreciation and amortisation declined to £6.3m (2020: £6.5m) with the reduction coming from reduced software amortisation.

Operating profit

During the period Operating profit fell by 38% to £161.2m (2020: £258.9m). Operating profit margin decreased by nine percentage points to 61% (2020: 70%).

The company's share of profit generated by Dealer Auction, the Group’s joint venture, decreased to £2.4m (2020: £3.2m) in the period as a result of reduced auction activity during the periods of lockdown.

Profit before taxation

Profit before taxation decreased by 37% to £157.4m (2020: £251.5m). This decrease results from the Operating profit performance, partially offset by a reduction in net finance costs of £3.8m (2020: £7.4m).

Interest costs on the Group’s RCF totalled £2.9m (2020: £6.3m). The decrease reflects a reduced average drawn level through the period. At 31 March 2021 the Group had drawn £30.0m of the facility (31 March 2020: £313.0m). Amortisation of debt costs amounted to £0.6m (2020: £0.7m). Interest costs relating to leases totalled £0.3m (2020: £0.4m) and interest charged on deferred consideration was £0.1m (2020: £nil). This was offset by interest receivable on cash and cash equivalents of £0.1m (2020: £nil).

Taxation

The Group tax charge of £29.6m (2020: £46.4m) represents an effective tax rate of 19% (2020: 18%). After removing the impact of Dealer Auction, which is consolidated post-tax, this is in line with the average standard UK rate

Earnings per share

Basic earnings per share fell by 40% to 13.24 pence (2020: 22.19 pence) based on a weighted average number of ordinary shares in issue of 965,175,677 (2020: 924,499,320). Diluted earnings per share of 13.21 pence (2020: 22.08 pence) decreased by 40%, based on 967,404,812 shares (2020: 929,247,835) which takes into account the dilutive impact of outstanding share awards. The increase in the number of shares was due to the equity raise completed on 1 April 2020, which issued approximately 46 million shares.

Cash flow and net debt

Cash generated from operations decreased to £152.9m (2020: £265.5m) as a result of the reduction in Operating profit. Corporation tax payments decreased to £28.2m (2020: £69.8m), due to lower profit before taxation and due to the last financial year including two additional payments as a result of the changes to HMRC’s payment profile. Net cash generated from operating activities was £124.7m (2020: £195.7m).

As at 31 March 2021 the Group had net cash of £10.3m (31 March 2020: net debt of £282.4m), representing a net reduction of £292.7m. Net bank debt, which is Net debt before amortised debt fees and excluding accrued interest and amounts owed under lease arrangements, is in a net cash position of £15.7m (2020: net bank debt of £275.4m). At the year end, the Group had drawn £30.0m of the Syndicated revolving credit facility (31 March 2020: £313.0m) and held cash and cash equivalents of £45.7m (2020: £37.6m).

Leverage, defined as the ratio of Net bank debt to EBITDA, decreased to zero (2020: 1.0x) as the company exit the year in a net cash position. Interest paid on these financing arrangements was £3.0m (2020: £6.4m).

Half Year 30 September 2021 Results

11 November 2021; Auto Trader Group plc, the UK’s largest digital automotive marketplace, announces half year results for the six months ended 30 September 20215

Revenue grew by 82% to £215.4 million (H1 2021: £118.2 million). The abnormally high rate of growth principally reflects the COVID-related discounts the company gave to its retailer customers during the first wave of the pandemic early in calendar year 2020. A better comparison is that of two years ago, against which revenue grew by 15% (H1 2020: £186.7 million), with a greater number of customers using Auto Trader and choosing to spend more on its platform. Operating profit grew 121% to £151.7 million (H1 2021: £68.5 million), again with a better comparison being H1 2020 where growth was 15% (H1 2020: £131.4 million). Operating profit margin grew to 70% (H1 2021: 58%) and was consistent with the level seen in H1 2020.

Retailer revenue increased by 94% to £183.3m (H1 2021: £94.5m). Revenue in H1 2021 was impacted by a 100% discount for retailers in April 2020 and May 2020 as the company supported customers who were required to close their forecourts due to COVID-19. This was followed by a 25% discount for customers in June 2020 as initial restrictions were lifted. There have been no discounts in relation to COVID-19 in H1 2022.

The average number of retailer forecourts advertising on its platform increased 6% to 13,892 (H1 2021: 13,056), with lower cancellations in the period. Average Revenue Per Retailer (‘ARPR’) increased by 82% to £2,199 (H1 2021: £1,206). Much of the increase came from COVID related discounts which were offered to customers in the prior year and due to their absence in 2022 contributed £640 of growth.

The company's audience performance has strengthened with average monthly cross platform visits increasing by 20% to 68.7 million per month (H1 2021: 57.3 million). Engagement, which the company measure by total minutes spent on site, was also strong with an increase of 14% to an average of 633 million minutes per month (H1 2021: 557 million minutes). Auto Trader has maintained its position as the UK’s largest and most engaged automotive marketplace for new and used cars, with over 75% of all minutes spent on automotive classified sites spent on Auto Trader (H1 2021: over 75%) and grew to be almost 9x larger than its nearest competitor (H1 2021: 7x).

The average number of retailer forecourts advertising on its platform increased by 6% to 13,892 (H1 2021: 13,056). The increase in the number of forecourts was due to lower levels of cancellation, partly due to favourable market conditions and the current strength of its position and standing with customers. Levels of new customer acquisition were largely consistent with prior periods.

Total live stock on site decreased by 9% to an average of 436,000 cars (H1 2021: 478,000). Part of the decline was due to a fall in the volume of new car stock, which averaged 39,000 (H1 2021: 46,000) due to the well documented shortage of new car supply. Used car stock was also impacted by supply shortages, particularly amongst its larger, lower yielding customers. Despite this supply pressure, the year on year decline in used car live stock was due to a stock offer in the previous year, where customers could advertise more than their contracted amounts without charge, which wasn’t repeated this year.

The UK car market

As the UK emerged from the most recent national lockdown in June 2021, demand for both new and used cars has been particularly strong. This demand has been fuelled by a catch up in transactions that didn’t happen in 2020 due to COVIDrelated lockdowns, increased consumer interest in car ownership and good levels of consumer confidence. These factors, combined with limited supply, give it confidence that favourable market conditions are likely to remain for some time to come.

New car registrations, whilst seeing year on year growth of 17% versus H1 2021, were still 23% below H1 2020 levels as semi-conductor shortages impacted the supply of new cars. These constraints have also impacted used cars, particularly for its larger customers, as lower new car sales have meant fewer part-exchanges and a lower volume of cars sent to auction from wholesalers. High levels of demand combined with constrained supply have led to significant levels of price growth, with its used car price index seeing an 11% year on year increase in prices across the period.

Despite these unusual conditions most of its customers have been able to trade profitably, with some customers at record levels, making significantly more profit per vehicle and selling those vehicles significantly faster. In the medium to long term the financial health of its customers is clearly important, however short-term these conditions have been less favourable for Auto Trader given the direct impact on its business model of fewer cars being advertised for less time.

The company's core marketplace

In April 2021, the company successfully executed its annual pricing event including the launch of Retailer Stores, which offers retailers their own dedicated, customisable location on Auto Trader. Auto Trader has seen over 28m visits to these pages in H1 2022. As the company build its digital retailing journey, the company envisage these becoming an area that customers can use as part of their own e-commerce journey.

The company's new car proposition has been impacted by supply shortages created by the challenge sourcing semi-conductors. This has seen the number of new cars advertised decrease to 39,000 (H1 2021: 46,000). However due to its “all you can eat” charging model Auto Trader has not seen this directly impact revenue and the number of paying dealers ended the half at c.2,100 (H1 2021: over 1,500). Despite lower stock levels, awareness that Auto Trader is a destination for new cars continues to grow with 1.5m unique visitors viewing a new car on average each month across the period.

Costs

In H1 2021, the Group made the decision to reduce costs, mainly through discretionary marketing spend, whilst its retailer customers were closed in the first quarter of 2021. With a return to more normal levels in 2022, total costs increased by 29% to £65.4m (H1 2021: £50.8m), which was a 15% increase versus H1 2020.

People costs, which comprise all staff costs and third-party contractor costs, increased by 16% to £35.0m (H1 2021: £30.2m). The increase in people costs was primarily driven by an increase in the average number of full-time equivalent employees (including contractors) to 941 (H1 2021: 893). This increase was partly driven by the acquisition of AutoConvert in July 2020 accounting for an increase of 18. The average cost per employee increased by 10% due to an increase in performance related pay and as a result of the Executive Directors and the Board foregoing 50% or more of their salary and fees for the period of April to June 2020, as well as annual pay reviews resuming in July 2021 having not occurred last financial year. Underlying salary costs continue to increase as the company invest in the best digital talent.

Marketing spend increased by 203% in H1 2022 to £10.6m (H1 2021: £3.5m) as discretionary spend was reduced in response to the pandemic in H1 2021 but has since resumed. However, as a percentage of revenue at 4.9%, it remains below the 5.4% seen in H1 2020.

Profit from the share in joint ventures

The company's share of profit generated by Dealer Auction, the Group’s joint venture, increased 55% to £1.7m (H1 2021: £1.1m) in the period as a result of higher auction activity following a reduction through H1 2021 due to lockdown restrictions. During the period, Operating profit increased by 121% to £151.7m (H1 2021: £68.5m). Operating profit margin increased by twelve percentage points to 70% (H1 2021: 58%) and is back in line with H1 2020 levels.

Net finance costs

Net finance costs decreased to £1.7m (H1 2021: £2.3m). Interest costs on the Group’s RCF totalled £0.9m (H1 2021: £2.0m), with a reduction in interest payable being offset by higher amortised debt issue costs. At 30 September 2021 the Group had drawn £nil of its available facility (30 September 2020: £89.5m). Amortisation of debt issue costs amounted to £0.8m (H1 2021: £0.3m) with the increase driven by an acceleration of amortisation following the reduction of the Syndicated Revolving Credit Facility (‘RCF’) commitments as referenced below. Interest costs relating to leases totalled £0.1m (H1 2021: £0.1m). This was offset by interest receivable on cash and cash equivalents of £0.1m (H1 2021: £0.1m).

Taxation

Profit before taxation increased by 127% to £150.0m (H1 2021: £66.2m). The Group tax charge of £28.3m (H1 2021: £12.4m) represents an effective tax rate of 18.9% (H1 2021: 18.7%) in line with the average standard UK rate.

Earnings per share

Basic earnings per share increased by 126% to 12.63 pence (H1 2021 5.58 pence) based on a weighted average number of ordinary shares in issue of 963,162,476 (H1 2021: 964,532,317). Diluted earnings per share of 12.61 pence (H1 2021: 5.55 pence) increased by 127%, based on 965,070,560 shares (H1 2021: 969,927,775) which takes into account the dilutive impact of outstanding share awards.

Cash flow

Cash generated from operations increased to £169.9m (H1 2021: £66.1m) as a result of the growth in Operating profit. Corporation tax payments increased to £27.8m (H1 2021: £18.0m). Cash generated from operating activities was £142.1m (H1 2021: £48.1m).

For H1 2022, the Board has declared an interim dividend of 2.7 pence per share. The interim dividend will be paid on 28 January 2022 to members on the register on 7 January 2022.

References

- ^ https://plc.autotrader.co.uk/who-we-are/about-us/

- ^ https://plc.autotrader.co.uk/who-we-are/our-history/

- ^ https://plc.autotrader.co.uk/who-we-are/what-we-do/

- ^ https://plc.autotrader.co.uk/media/2269/aut-ar2021-web.pdf

- ^ https://plc.autotrader.co.uk/media/2363/half-year-financial-results-press-release-fy22-final.pdf