Avast

Summary

- Avast is a global leader in the consumer cybersecurity market with over 1,700 people in 18 locations around the world.

- The company has M&A approach for extended geographic markets. In 2016 the company acquired AVG Technologies

- The company's dedicated team of data scientists, threat researchers, and machine learning experts includes talent from some of the world’s top universities

Company Overview

Avast (OTC:AVASF, LSE:AVST) is a global leader in the consumer cybersecurity market. The company's proven strategy, including its pioneering freemium business model and diversified product portfolio with exposure to highly profitable segments, provides multiple avenues for long-term growth.1

Avast has a focused approach to M&A in order to maximize shareholder returns. Past acquisitions have extended its geographic markets, increased its user base, and brought in intellectual property that extends its core capabilities even further. The largest acquisition of its portfolio to date was completed in 2016, when the company acquired AVG Technologies.

Company History

Over its 30-year history, Avast has maintained its roots in the Czech Republic, fueled by a sense of fierce independence, a passion for protecting people’s right to security and privacy, and a strong engineering talent pool. Today, Avast has over 1,700 people in 18 locations around the world, and the company maintain its engineering culture and its commitment to the people who rely on its products to keep them safe online.2

| Year | Milestone |

| 1988 | Pavel Baudis defeats the Vienna virus, and he and Eduard Kucera establish the ALWIL cooperative to distribute and sell their newly created software. |

| 1991 | Following the fall of Communism after the Velvet Revolution of 1989, Pavel and Eduard break off from the rest of the cooperative, establishing ALWIL as a company. |

| 1997 | After refusing an offer to be acquired, Alwil instead licenses its Avast antivirus to McAfee, and watches its global distribution grow rapidly. |

| 2001 | Avast makes the defining decision to change the traditional antivirus business model and offers a fully featured, free antivirus to all. |

| 2010 | Summit Partners comes on board as an investor. Alwil is rebranded as Avast to match the name of our iconic software. |

| 2011 | Avast expands into business security, focusing on the SMB market. |

| 2015 | Avast opens its new Prague headquarters, bringing Silicon Valley style to the Czech Republic. |

| 2016 | Avast acquires fellow Czech-based cybersecurity giant AVG, doubling our total number of users and bringing in new talent and technologies. The acquisition gives Avast the largest and most advanced threat detection network, based on our massive user base, and further diversifies our product portfolio, geographic base, and revenue streams. |

| 2018 | In May 2018, Avast is listed on the London Stock Exchange. |

| 2020 | In 2020, Avast entered the FTSE 100 index, which tracks the stocks of the largest firms traded on the London Stock Exchange. |

| 2021 | Avast unveils a brand new look that reflects its wider purpose. On the same day, Avast One is released — an all-in-one flagship product combining robust threat detection with advanced privacy and performance features. |

Brands

Technology expertise

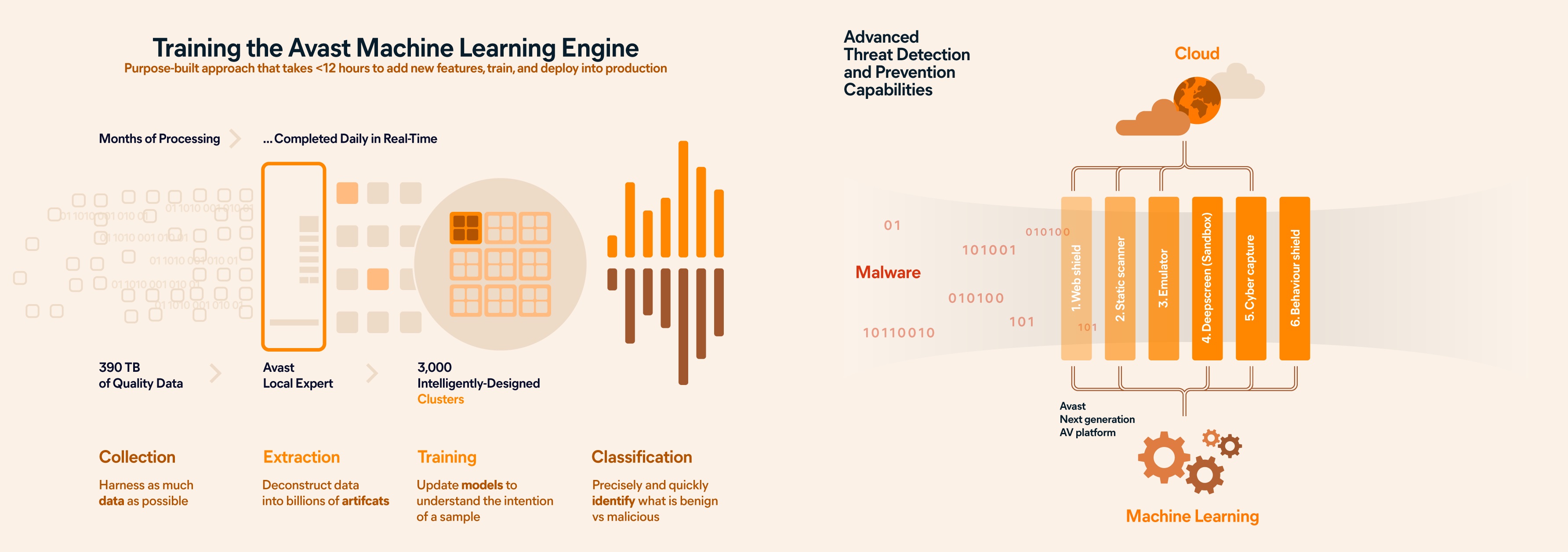

Avast leverages machine learning and artificial intelligence to efficiently eliminate known malware, while its massive set of threat data gives it the scale, speed, and accuracy to quickly discover, classify, and protect against any new threat.3

The company's dedicated team of data scientists, threat researchers, and machine learning experts includes talent from some of the world’s top universities – Stanford, UC Berkeley, MIT, and Charles University. Combining this talent with access to massive amounts of data and bespoke cloud-based infrastructure is what gives it its competitive edge.

Automatic threat detection and malware eradication

The company's ability to defend against varied attacks is based on its state of the art infrastructure and its access to immense amounts of security data – gathered directly from hundreds of millions of devices worldwide, across multiple platforms and geographies. In practice, the agent software Avast has installed on users’ devices is there not only to protect the user, but also to look for any suspicious behaviours and report back when anything happens. In this way, we've built the world’s largest security sensor network.

The company eradicate known threats quickly and automatically, while unknown or suspicious objects are subjected to a multi-layer defense engine that relies on multiple, advanced detection methods working in tandem. Once any new threat is identified, its cloud-based network is updated immediately so that the threat can be eliminated proactively the next time it appears. An updated definition can be sent to its entire user base within minutes - something vital for offline processing.

This next-gen security technology along with the data from its massive user base, gives it a clear advantage against hackers – and competitors. These are the technologies that have allowed it to automatically protect all of its users against WannaCry, BadRabbit, and NotPetya ransomware as well as Emotet crypto-mining attacks - all without requiring a single product update.

Multi-layer protection against malware and cyber attacks

Avast Web Shield: Processes full traffic coming over HTTP and encrypted HTTPS connections, using URL detection algorithms to protect against phishing and malware attacks as well as full content filtering to thwart malware.

Static Scanner: Analyzes code and binary objects prior to execution, using machine learning and various detection methods, including PE structure analysis, linker analysis unpacking/de-obfuscation, and similarity, fuzzy, and algorithmic matching.

Emulators: Two emulators (one for scripts and one for binary files) protect against zero-day malware and vulnerabilities, and increase resilience against malware sample modifications. These provide full emulation of the native computing environment, including a virtual CPU, virtual RAM, and virtual OS including its subsystems.

Avast CyberCapture: Activates automatically, when necessary, to prevent the rarest and most sophisticated malware from infiltrating a user’s machine. Locks down and submits potentially malicious files, including all the associated metadata, to the clean-room environment of its Threat Labs, while informing the user and keeping them engaged throughout the process. Both advanced algorithms and human experts inspect the suspicious files in this most advanced layer of security.

Behaviour Shield: Monitors the system for suspicious activities while programs are already running. Captures unusual behaviour on a device, such as attempts to terminate the Windows Update or Firewall services, inject system-level processes, or use the camera without user-initiated activity. Once evaluated as malicious, Behaviour Shield is able to automatically stop the activity, undo the operation and quarantine the objects in question.

Financial Highlights

The Group's Billings increased by $13.5m to $482.7m in the half year ended 30 June 2021, mostly driven by the core Consumer Direct business. This represented a 2.9% increase at actual rates and organic growth of 0.9%. Subscription billings represented 88.8% of the Group’s total Billings in H1 2021 (87.3% in H1 2020).4

The Group’s Revenue increased by $38.1m to $471.3m in the half year ended 30 June 2021, which represents a 8.8% increase at actual rates and organic growth of 10.4%. Revenue included $322.2m from the release of prior-period deferred revenue. The deferred revenue balance at the end of the period was $507.7m, comprising $470.8m that will be recognised within 12 months of the balance sheet date. This compares to $504.7m, of which $448.6m was to be recognised within 12 months, at the same time last year. The average subscription length in the half year ended 30 June 2021 was 13 months, which represents slight YoY decrease (H1 2020: 14 months) reflecting the Group’s transition from multi-year to single year subscriptions

Profitability was driven by the Group’s scale and operating leverage. Adjusted EBITDA increased 11.9% to $270.2m, 14.4% excluding FX, resulting in Adjusted EBITDA margin of 57.3%. Considering expected higher spend in the second half of the year related to increased user and customer acquisition costs and materially higher marketing spend around the Avast One rollout, this is in line with full year guidance of broadly flat (55.5% EBITDA margin in FY 2020).

The reported Operating Profit increased by $92.2m to $226.7m. The increase was driven by higher revenue of $38.2m, lower amortisation of acquisition intangibles of $28.2m and lower operating costs of $24.2m. The decrease in operating costs was caused by lower exceptional costs vs H1 2020 of $40.9m, disposal of Family Safety business impact of $4.5m and Jumpshot operating costs in H1 2020 before wind-down of $3.6m, partially offset by higher share-based payments costs of $(7.3)m, investment into sales and marketing of $(7.9)m and other investments and FX impact of $(9.6)m.

Adjusting for disposal of Family Safety mobile business and wind-down of Jumpshot, the increase in adjusted cost of revenues is $(2.7)m. The increase was driven by higher sales commissions related to higher revenue of $(1.3)m, investment into customer support of $(1.6)m, partially offset by FX impact and other savings of $0.2m. Adjusted Cost of Revenues represent the Group’s cost of revenues adjusted for depreciation and amortisation charges, share-based payments charges and exceptional items.

The Group’s reported Cost of revenues decreased by $29.8m to $(74.8)m primarily due to the lower amortisation of acquisition intangibles as the amortisation of significant acquisition intangibles from AVG acquisition is running out. Acquisition intangibles represent intangible assets acquired through business combinations.

The increase in Group’s Adjusted Operating costs excluding impact of disposal of Family Safety mobile business and wind-down of Jumpshot operations is $(17.7)m. This increase is driven mainly by investment into sales and marketing personnel and non-personnel costs of $(7.9)m, investment into information security of $(1.1)m, investment into research and development of new technologies of $(1.1)m and negative YoY FX impact and other investments of $(7.7)m. Adjusted Operating costs represent the Group’s operating costs adjusted for depreciation and amortisation charges, share-based payments charges and exceptional items.

The decrease in the Group’s reported Operating costs of $24.2m, from $(194.0)m to $(169.8)m, reflects primarily the decrease in exceptional items of $40.9m driven by 2020 donations to research and development initiatives related to Covid-19 (H1 2020: $22.7m) and exceptional costs related to wind-down of Jumpshot operation (H1 2020: $22.2m, additional $2.5m were included in costs of revenues), partially offset by higher share-based payments costs of $(7.3)m resulting from RSUs granted to all employees in the beginning of 2021.

Adjusted finance expense on a net basis was $(7.4)m in H1 2021, $14.2m lower compared to $(21.6)m in H1 2020. The decrease in adjusted finance expense is related to lower loan interest costs of $4.1m resulting from the repayment of debt of $200.0m on top of mandatory repayments in 2020, one-off realised FX gain on repayment of prior loan of $5.6m and favorable impact of other FX and other finance costs of $4.5m.

The Group’s reported net finance costs decreased by $27.6m resulting in income of $8.4m in H1 2021 caused by the decrease in adjusted finance costs described above and higher unrealised foreign exchange gains from the Euro denominated debt.

In the half year ended 30 June 2021, the Group reported an income tax expense of $(63.5)m, compared to the $(28.8)m in the half year ended 30 June 2020.

Income tax was impacted by the tax benefit from the foreign exchange movements on intercompany loans arising in the statutory accounts of the subsidiary concerned of $0.9m (tax benefit of $3.7m in H1 2020).

The tax impact of IP transfer represents amortisation of the net tax impact of the transfer of AVG E-comm web shop to Avast Software B.V. (“Avast BV”) on 1 May 2018 („IP transfer“), when the former Dutch AVG business of Avast BV (including the web shop) was sold to Avast Software s.r.o. The total net impact of this transaction was $94.4m, which was treated as an exceptional item in 2018. The transferred IP is amortised for tax purposes over 15 years.

Adjusted income tax is $(45.8)m for H1 2021, resulting in an adjusted effective tax rate of 18.2% (H1 2020: 18.8%). The Adjusted effective tax rate is the Adjusted Income tax percentage of adjusted profit before tax of $251.6m (defined as adjusted net income of $205.8m before the deduction of adjusted income tax of $(45.8)m.)

On 22 March 2021, the Group successfully completed a complete refinancing of its debt, decreasing the margin on both tranches by 25bps and extending the repayment period further 5 years from the prior expiry date in September 2023 to September 2028. The new term loan was drawn with a USD and EUR tranche of USD 480m and EUR 300m respectively. As of 30 June 2021, the total Gross debt12 of the Group was $884.6m and the total Net debt12 was $527.0m. The decrease in gross debt since 31 December 2020 is attributable to the repayment of old loan of $(827.6)m, new loan drawn of $843.6m, quarterly repayment of borrowings of $(10.6)m, decrease in lease liabilities of $(6.0)m and a positive unrealised FX gain of $(15.8)m on the EUR tranche of the loan.

Recent developments

Avast to Acquire Evernym

December 9, 2021 — Avast (LSE:AVST), a global leader in digital security and privacy, today announced the acquisition of Evernym. The US company was instrumental to the invention of self-sovereign identity, with leading contributions from their Chief Trust Officer, Drummond Reed, and others in the company working within the industry standards community. This work has enabled the development of innovative products and services based on decentralized digital credentials, leading to a more trustworthy online experience.5

Evernym’s groundbreaking approach to digital identity provides consumers with autonomy over their online presence by keeping their personal information with them and out of centralized databases. Awarded ‘Technology Pioneer 2021’ by the World Economic Forum, Evernym is already embedded in industries such as travel and finance where Evernym’s technology is at the heart of the IATA (International Air Transport Association) Travel Pass, and also powers Bonifi’s ‘MemberPass’ solution for community financial institutions.

Ondrej Vlcek, CEO Avast, said, “Consumer trust in the online world has been critically compromised. Over 60% of the world’s population has internet access today yet we don’t have adequate provisions in place for these people to prove who they are online. The result is that identity theft, online fraud and account takeovers are growing rapidly, as does mass-scale digital tracking and surveillance. Our vision for digital freedom is to enable people to manage and retain control over their personal data so that they can interact and transact safely, privately and with confidence. Decentralized digital identities are a key component of that vision. Adding Evernym’s groundbreaking self-sovereign identity technology to our offering enables us to address this area and is a huge step forward in the realization of a digital world where decentralized, portable identities are available universally and globally.”

In a self-sovereign or decentralized identity model, the individual retains all of their data and chooses what data they consent to share in any transaction and who they share it with, removing the need for passwords, individual accounts, and other traditional tools which are vulnerable to being hacked, phished, and intercepted. This protects their data from being monetized by third parties, compromised in a breach, or abused for analytics. Giving the user control over their personal data is a critical part of rebuilding trust in digital services, and will enable growth in areas as diverse as online commerce, gig economy, travel, healthcare, and banking and finance, among other applications.

Charles Walton, SVP and General Manager Identity, Avast, said, “Our identity vision is for a truly inclusive, global digital society. Our services will bridge from the existing digital world, where identities and data are stored in a centralized or federated model, to the new digital world where people are in control of their data and set the rules of engagement for online providers. We think of this as decentralizing identity, meaning individuals retain their personal information while being able to digitally interact with each other in a trustworthy manner. This reusable digital identity approach removes the friction and frustration of online transactions, guarantees safety and privacy for users, and empowers people to engage more deeply in today’s rapidly developing digital economy. Evernym is a recognized leader and innovator in this area and will complement our more than thirty years’ experience in security and privacy as we focus on delivering our breakthrough identity products.”

Steve Havas, CEO Evernym, said, “Since its founding, Evernym has been a major catalyst in the global movement towards decentralized identity. We have led the development of new identity standards, built the world’s first decentralized identity network, and launched a globally leading platform for enabling individuals to securely share their personal information. Combining our decentralized identity leadership with Avast’s globally trusted reputation for protecting individuals is a perfect combination to help bring back privacy and trust in everyone’s digital interactions everywhere, every time.”

The acquisition is expected to close in mid-December and the general availability of the products based on the Evernym technology will follow in 2022.