B&M

Summary

- B&M is the UK’s leading variety goods value retailer selling items across a range of Grocery and General Merchandise categories, at value prices.

- B&M was formed in 1978 and is now one of the leading variety retailers in the UK.

- B&M has over 685+ stores and employs over 35,000+ staff. The company attract over 4 million happy customers through its doors a week.

- B&M was admitted to the FTSE 100 index in September 2020

Company Overview

B&M European Value Retail S.A (LSE: BME, OTC: BMRPF) is the UK’s leading variety goods value retailer, providing customers with a limited assortment of the best selling items across a range of Grocery and General Merchandise categories, all at value prices.1

By adopting a simple, low-cost approach to sourcing products direct from manufacturers and leading brand household names, B&M is able to offer customers the products at compelling prices.

B&M was formed in 1978 and is now one of the leading variety retailers in the UK. From its first store in Blackpool, Lancashire, B&M has grown to over 685+ stores and employs over 35,000+ staff. B&M believes in selling top branded products at sensational prices. The company attract over 4 million happy customers through its doors a week.

| Year | Milestones |

| 1978 | The business was founded in 1978 with the first store opening in Blackpool. |

| 2004 | B&M was acquired by Simon and Bobby Arora in December 2004 from Phildrew Investments, at which time the Company traded from just 21 stores. |

| 2010 | The business moved into a new head office and modern 620,000 square foot distribution centre in Speke, Liverpool. |

| 2012 | B&M opened its 300th store in the UK. |

| 2013 | Clayton, Dubilier and Rice, one of the world’s leading private equity firms acquired a significant stake in B&M and Sir Terry Leahy was appointed and served as Chairman of B&M until March 2018. |

| 2014 | B&M lists on the London Stock Exchange as part of the next stage of its development. The listing is designed to support the Company’s ambitious growth plans, both in the UK and continental Europe. B&M opens an additional 500,000 square foot Distribution Centre at its head office in Speke, Liverpool. |

| 2015 | B&M was admitted to the FTSE 250 index in June 2015 |

| 2016 | B&M acquired two further Distribution Centres in the North West of the UK, with a combined 800,000 square foot additional capacity. B&M opened its 500th store in the UK. |

| 2017 | B&M acquired the total issued share capital of Heron Foods Group, a value convenience store chain in the UK offering frozen, chilled and ambient food. |

| 2018 | B&M opened its 600th store in the UK B&M acquired the Babou chain of variety goods stores in France |

| 2020 | A new 1 million square foot Distribution Centre in Bedford became fully operational in January 2020, supporting the continued roll out of new B&M stores in the South of England. B&M was admitted to the FTSE 100 index in September 2020 |

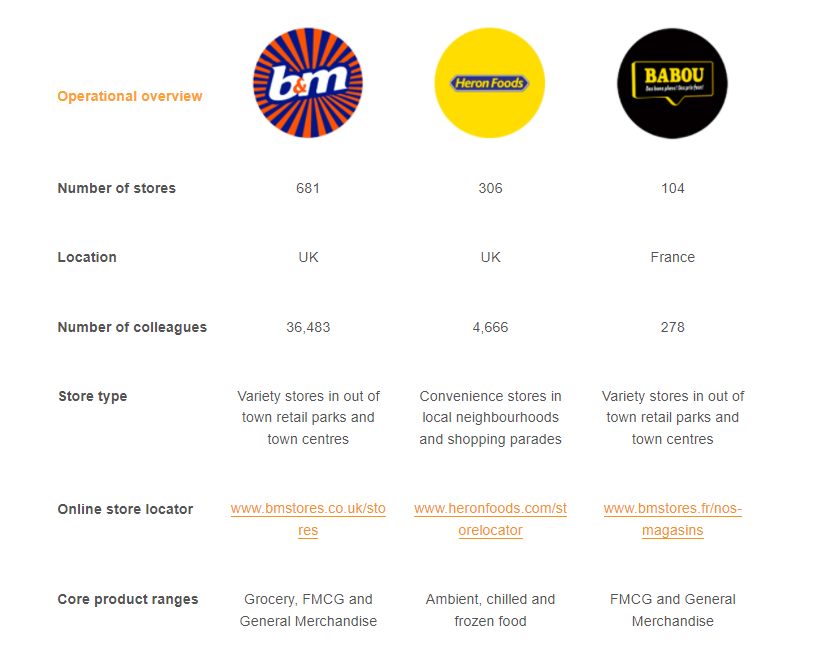

Brands

Across all of its B&M, Heron Foods, Babou and B&M stores in France, the company provide customers with a limited assortment of products including the best selling goods in its Grocery and General Merchandise ranges. They are mainly sourced directly from producers and manufacturers and include a number of leading household brands. This simple low cost sourcing approach allows it to constantly provide customers with great value all year round.

B&M has stores throughout England, Scotland, Wales and Northern Ireland.

Business Overview

General trends

The shift in retail demand towards much more value conscious consumers over the last decade is now an established feature of the market for Grocery and General Merchandise goods in the UK and France. 2

The company believe this pattern of consumer behaviour will continue for the foreseeable future, with increasing social acceptance of discount shopping. In light of the many consequences the Covid-19 pandemic has had on everyday life, the relevance of value and convenience has never been greater.

Whether consumers need to save money or just enjoy a bargain, the B&M model is designed to meet those requirements through its carefully selected ranges, value prices and convenient store locations.

Convenience food store shopping is also an important part of the UK market. Through its convenience store chain, Heron Foods, B&M is also able to take advantage of this opportunity.

Market positioning

At B&M, the company provide value and convenience across a wide range of Grocery and General Merchandise products. As such, the company aim to take a small amount of market share in each of the 15 chosen categories in which the company operate. The attraction for customers visiting its stores is that the company offer the best selling products and adjust its ranges to meet the changing demands of its customers for different types of products and for seasonal goods.

By spanning many different categories, customers are able to find a broad range of products in one visit. This serves customers particularly well with the current trend for consumers looking to reduce overall shopping visits during the Covid-19 pandemic.

Customers are typically looking for specific destination purchases, but they will often also make impulse purchases as they browse around a store. The desire for “treasure hunting” is supported by it constantly introducing new products in its stores. The company average around 100 new products per week, predominately within its General Merchandise categories. This provides customers with their everyday essential needs, while also giving them a fun and exciting shopping experience.

Territories and store estates

United Kingdom

The UK retail market in which the B&M and Heron Foods businesses operate is very large, with total store-based retail sales, covering both Grocery and General Merchandise, of c.£300 billion in 2017. Even though B&M has attracted a number of new customers during FY21, its share of this market remains small at c.1.5%, meaning there is still a significant opportunity for further growth across its chosen product categories.

The company believe that an estate of at least 950 B&M fascia stores in the UK is achievable, based on analysis carried out by an external consultancy in 2017. This target appears to it to be increasingly conservative given the performance and customer appeal of B&M in FY21. The B&M fascia business in the UK currently has 681 stores, leaving a long runway for growth ahead of it.

Heron Foods operates in the convenience sub-sector of the UK Grocery market, which in total was worth £160 billion in 2017. Heron Foods provides consumers with easy local access to everyday chilled, frozen and ambient food items. It has an attractive value proposition in a market which has been primarily dominated by the premium pricing models of other larger retailers. The company's model is to locate stores in communities close to where people live and provide them with value prices for frozen, chilled and ambient food.

The Heron Foods chain of 306 convenience stores has the potential to become multiple times larger as the company continue to roll out new stores both within and beyond the North of England heartland where most of its stores are located currently.

France

The French retail market is the second largest in continental Europe and shares a number of similar characteristics to that of the UK. The market has attractive dynamics including the overall market size, the popularity of the discount channel and healthy operating margins achieved by several of the incumbent operators.

There are two immediate priorities for its French business. The first is to complete the evolution of the product mix, replicating the direct sourcing and limited assortment SKU model of B&M in the UK. In particular, this has and continues to involve reducing the exposure to Clothing and Apparel, whilst introducing a modest amount of food and grocery products and increasing the General Merchandise ranges within its product mix. A lot of work in relation to that has now been completed, but there is still some refining of the mix and ranges to do while customer reaction is being carefully monitored. The response B&M has received so far from the French consumer to the new products sourced via the B&M supply chain has been positive, but it has been difficult to measure the strength of that demand over a sustained period of time in view of the French lockdown restrictions this year.

At the end of FY21, the company had a total of 104 stores in France, with 55 of them branded as “B&M”. Early indications are that the re-branded stores are outperforming their Babou counterparts. Subject to monitoring the on-going performance of the re-branded stores, its second main priority is to re-brand the remaining stores as “B&M” by the end of 2021.

Given both the size of the French market and the small market share which Babou currently has, the opportunity exists for the French business to grow its store footprint multiple times over, which is its ultimate ambition in relation to that business.

Financial Highlights

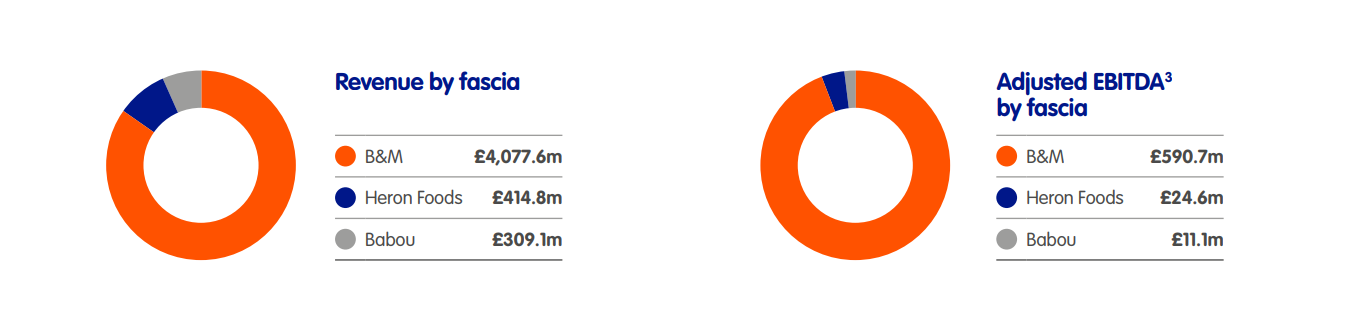

Total Group revenue in FY21 (52 weeks trading to 27 March 2021) was £4,801.4m (FY20: £3,813.4m), representing an increase of 25.9%. On a constant currency basis, revenues increased by 25.7%

Group adjusted gross margin was 36.7% (FY20: 33.8%), an increase of 292 bps on the prior year. Group adjusted operating costs, excluding depreciation and amortisation, grew by 20.1% to £1,137.1m (FY20: 946.9m). The growth in operating costs was lower than the growth in revenue due to the operating leverage delivered by the B&M UK businesses. Depreciation and amortization excluding the impact of IFRS16 and adjusting items) was £62.4m (FY20: £57.7m), an increase of 8.2% on the prior year and reflecting the ongoing investment in new stores across all fascias.

An adjusted EBITDA is reported to allow investors to better understand the underlying performance of the business. The adjusting items are detailed in of the financial statements, and totalled £(3.5)m in FY21 (FY20: £40.7m). Group adjusted EBITDA increased by 83.0% to £626.4m (FY20: £342.3m), driven by the strong performance of the core B&M UK business.

Group statutory profit before tax was £525.4m (FY20: 252.0m), representing an increase of 108.5%.

B&M UK

In the UK, total B&M revenues increased by 29.9% to £4,077.6m (FY20: £3,140.1m), largely driven by exceptional like-for-like (“LFL”) revenue growth of 23.8% (FY20: 3.3%). The annualisation of revenues from 36 net new store openings in FY20 and 25 net new store openings in FY21 also contributed a further £218.7m. In addition, there was £47.4m of wholesale revenue, an increase of £19.7m on the prior year.

A key driver behind the step up in LFL revenue was the number of new customers that shopped with B&M in FY21. The LFL performance was relatively consistent throughout the year, with Q4 representing the strongest quarter. Although there was an increase in demand across almost all product categories, General Merchandise categories such as Homewares, DIY and Gardening performed particularly well, as people spent more time in their homes during the coronavirus pandemic. This also meant that Out of Town locations, where stores stock the full range, out-performed Town Centre locations.

There were 43 gross new store openings in the year and 18 closures, with 5 of the closures being relocations. New store openings continue to deliver strong returns on investment. The B&M UK business also continues to take advantage of relocation opportunities. These are typically smaller early generation B&M stores that are replaced by modern, larger stores that provide customers access to the full product range, making such opportunities margin accretive.

B&M UK gross margin expanded by 333 bps, driven by both a mix shift towards higher margin Non-Grocery categories as noted above, and in particular an unusually strong sell-through across Seasonal ranges such as Outdoor Furniture and Christmas leading to minimal markdown activity than in previous years.

Adjusted operating costs, excluding depreciation and amortisation, grew by 24.4% to £913.8m. These costs represented 22.4% of revenues in the year (FY20: 23.4%), a reduction of 98 bps due to operating leverage achieved on the higher revenues generated and ongoing discipline around cost control. Included in these operating costs is approximately £75m of business rates, having voluntarily waived the relief offered by the UK government. The business again worked hard to absorb the impact of the minimum wage increase through efficiency savings, whilst at the same time investing in additional store colleague hours to help service the elevated customer demand in a safe manner. Rental costs remained relatively stable, with the existing rent-roll already being competitively positioned. Elsewhere, transport and distribution costs remained broadly flat as a percentage of revenues, where savings through optimisation of the transport network were offset by distribution inefficiencies, particularly at the Bedford distribution centre, as a consequence of introducing new protocols and procedures relating to social distancing.

Adjusted EBITDA for the B&M UK business increased by 84.7% to £590.7m (FY20: £319.8m), and the adjusted EBITDA margin increased by 430 bps to 14.5% (FY20: 10.2%) due to the exceptional LFL performance, increase in gross margin and disciplined cost control delivering operational leverage as explained above.

Heron Foods

The discount convenience chain, Heron Foods, grew revenues by 6.4% to £414.8m (FY20: £389.9m), with neighbourhood locations performing particularly well as consumers sought to shop locally for their everyday essentials. There were 13 net new stores opened in FY21, which also contributed to the increase in revenues.

Gross margin in Heron Foods remained broadly flat, reflecting a stable product mix.

Despite the inflationary pressures on store wages, operating costs were well controlled, increasing as a percentage of revenues by only 48 bps to 25.5% (FY20: 25.0%). Like the B&M UK business, Heron Foods waived the business rates relief, which was worth approximately £5m in FY21.

Heron Foods adjusted EBITDA decreased by 3.5% to £24.6m (FY20: £25.5m), and the adjusted EBITDA margin declined by 63 bps to 5.9% (FY20: 6.6%).

Babou

In the French business, total revenues increased by 9.1% to £309.1m (FY20: £283.4m), despite many stores being closed for up to 10 weeks throughout the year as a result of the French government’s response to the pandemic. For those stores that did remain open, they were restricted to selling “essential” items only and, therefore, generated significantly lower revenues during those weeks.

During the periods where the French stores were fully open, performance was strong. This was driven by a combination of both the continued range optimisation work and the positive impact from re-branding 35 stores from Babou to the B&M banner during FY21, all of which progressed well despite the disruption caused by multiple lockdowns.

Gross margin continued to improve, supported by a reduced exposure to Clothing and Apparel and a corresponding mix shift to higher margin other General Merchandise categories.

Operating costs were well controlled throughout the year, particularly during those periods where stores were either closed or restricted to selling a limited range of products.

Adjusted EBITDA was £11.1m (FY20: £(3.0)m), with an adjusted EBITDA margin of 3.6%. This represents encouraging progress in the French business, especially considering the mitigating factors outlined above.

Finance expense

Adjusted net finance charges for the year were £23.8m (FY20: £24.6m), representing a decrease of 3.1%. This included bank and high yield bond interest of £22.5m (FY20: £22.7m) and amortised fees of £1.7m (FY20: £2.1m), offset by interest income of £0.3m (FY20: £0.2m).

There was also a one-off exceptional interest charge of £4.5m relating to the Group refinancing that took place in July 2020. This represented unamortised fees on previous banking facilities being written off, breakage fees and redemption interest due to early repayment of the previous £250m High Yield Bond.

The interest charge relating to lease liabilities under IFRS16 was £61.4m (FY20: £57.2m).

Profit before tax

Statutory profit before tax was £525.4m (FY20: £252.0m). An adjusted profit before tax is also reported to allow investors to better understand the operating performance of the business. Adjusted profit before tax4 for the year increased by 107.7% to £540.1m (FY20: £260.0m).

The impact of IFRS16 on the Group financial statements was to decrease statutory profit before tax by £6.6m.

Taxation

The tax charge in FY21 was £97.3m (FY20: £57.2m), representing an effective tax rate of 18.5%. The company expect the tax rate going forward to reflect the blended rate of taxes in the countries in which the company operate, currently being 19% in the UK and 28.5% in France.

As a Group B&M is committed to paying the right tax in the territories in which the company operate. In the B&M UK business the total tax paid in FY21 was £440.1m, including £227.8m relating to those taxes borne directly by the company such as corporation tax, customs duties, business rates, employer’s national insurance contributions and stamp duty and land taxes. The balance of £212.3m are taxes the company collect from customers and employees on behalf of the UK Exchequer, which includes Value Added Tax, Pay As You Earn and employee national insurance contributions.

Profit after tax and earnings per share

Statutory profit after tax from continuing operations was £428.1m (FY20: £194.8m) and the statutory diluted earnings per share from continuing operations was 42.7p (FY20: 19.5p).

In the prior year, statutory profit after tax including the loss from discontinued operations was £80.9m, with a diluted earnings per share of 9.0p

Adjusted profit after tax, which the company consider to be a better measure of performance due to the reasons outlined above, was £434.5m (FY20: £203.0m), and the adjusted fully diluted earnings per share was 43.4p (FY20: 20.3p).

Net debt and cash flow

The Group continues to be strongly cash generative, with cash generated from operations increasing by 75.0% to £944.0m (FY20: £539.5m).

Such cash generation reflects the growth in adjusted EBITDA during FY21, attractive paybacks generated from new stores and a working capital inflow.

The strong performance and high cash generation have enabled the Group to pay dividends totalling £697m in FY21. This included the £150m special dividend relating to the sale and leaseback of the Bedford facility declared in FY20, and a further £450m of special dividends declared and paid in FY21.

Net debt5 (on a pre-IFRS16 basis), increased to £519.8m (FY20: £347.5m). The net debt to adjusted EBITDA leverage ratio was 0.8x (FY20: 1.0x), comfortably within its 2.25x leverage ceiling

FY22 Interim Results

11 November 2021; B&M European Value Retail S.A today announces its interim results for the 26 weeks to 25 September 2021.3

Simon Arora, Chief Executive, said,

“The Group has performed strongly throughout the first half of its financial year, with customers continuing to be drawn to its value for money offer.

B&M has responded decisively to supply chain challenges by leveraging its strong supplier relationships and B&M has improved in-store execution. As a consequence, B&M is fully stocked heading into the Golden Quarter, with stores already showcasing its excellent Christmas ranges. To colleagues across the Group, I express my gratitude for their dedication, skill and commitment, which have made these results possible.

Although the pathway to a ‘new normal’ remains uncertain and the industry faces a number of supply and inflationary pressures as the company enter the second half of the financial year, B&M is very confident that the B&M Group is well positioned to navigate these and will continue to be successful both in the UK and in France.”

Financial performance

The Group financial statements have been prepared in accordance with IFRS16, however underlying figures presented before the impact of IFRS16 continue to be reported where they are relevant to understanding the performance of the Group.

Group revenues for the 26 weeks ended 25 September 2021 grew by +1.2% to £2,268.0m and by +1.4% on a constant currency basis. On a two-year basis versus H1 FY20, Group revenues were +26.8% higher.

B&M UK

In the B&M UK fascia2 business, revenues grew by +1.3% to £1,909.5m (H1 FY21: £1,885.4m). On a one-year basis, like-for-like3 ("LFL") sales decreased (5.0)%, which was relatively consistent across H1 with Q1 (4.4)% and Q2 (5.6)% despite the weekly volatility of the prior year comparatives. Two-year LFL sales in H1 were +16.8%, representing a significant increase in pre-pandemic store sales densities.

In addition to strong LFL performance versus H1 FY20, the new store opening programme also contributed to revenue growth, with the annualisation of 43 gross new stores opened last year plus 14 gross new openings in H1 FY22. The performance of recent openings continues to be very strong, with both the FY21 and H1 FY22 cohorts of new stores delivering a higher store contribution margin than the company average. New stores do not require a maturity period to achieve profitability, due to the disruptive nature of the retail offer and a capital light model, making the new store payback economics highly attractive.

B&M UK revenues also included £24.0m of wholesale revenues (H1 FY21: £20.4m), the majority of which represented sales made to the associate Centz Retail Holdings Limited, a chain of 38 variety goods stores in the Republic of Ireland.

Gross margins improved 153 bps year-on-year to 37.3% (H1 FY21: 35.8%), which was above initial expectations at the start of the year. The performance of higher margin General Merchandise and Seasonal categories was particularly strong, with high sell-through rates leading to limited end of season markdowns. Although there were favourable tailwinds in terms of consumer demand once again in H1 FY22, the improved execution of categories such as Homewares and Gardening has supported the sales mix shift seen in the B&M UK business since the start of FY21.

Operating costs, excluding depreciation and amortisation, increased by 13.8% to £454.8m (H1 FY21: £399.7m), representing 23.8% of revenues. On a comparable basis versus H1 FY20, when operating costs were 24.6% of revenues, this is an improvement of 76 bps. In H1 FY21, the B&M UK business initially recognised the benefit of UK Government business rates relief, amounting to c.£37m of operating costs not included in the prior year figure above. In December 2020 the business decided to forgo this relief, meaning a full year business rates charge was incurred in H2 FY21.

Transport and distribution costs, store colleague costs and rent were all managed effectively as a percentage of revenues despite the slightly negative LFL sales performance, as the business worked hard to retain much of the operating leverage delivered in the prior year. The business has a long-standing shipping partner for goods sourced out of Asia, with freight rates fixed at contracted rates and service levels and availability remaining strong throughout H1.

Adjusted EBITDA decreased by (6.3)% to £257.4m (H1 FY21: £274.7m), with adjusted EBITDA margin decreasing by (109) bps to 13.5% (H1 FY21: 14.6%). When compared to H1 FY20, adjusted EBITDA has increased 87.4% with a margin expansion of 405 bps over that two-year period, driven by higher sales densities, a sales mix shift towards General Merchandise and unusually limited markdown activity versus pre-pandemic levels as noted above.

Heron Foods

The discount convenience chain, Heron Foods, generated revenues of £203.1m (H1 FY21: £216.2m). This performance was satisfactory given the elevated comparatives from H1 FY21 and average transaction values normalising.

Adjusted EBITDA decreased by (26.7)% to £13.4m (H1 FY21: £18.3m) with an adjusted EBITDA margin of 6.6%, down (186) bps year-on-year (H1 FY21: 8.5%). On a two-year basis versus H1 FY20, the adjusted EBITDA margin has remained stable, actually improving slightly by 6 bps.

France

In France, revenues increased by 10.6% to £155.4m (H1 FY21: £140.6m). This represented a strong performance given there were 6 weeks of 'soft lockdown' restrictions in force at the start of the financial year. These restrictions were lifted in full on 19 May 2021, with encouraging LFL revenue growth since then.

Gross margin increased by 390 bps to 45.8% (H1 FY21: 41.9%), driven by a strong performance of General Merchandise categories such as Homewares and Seasonal, alongside the ongoing reduction in Clothing and Footwear sales.

Adjusted EBITDA increased significantly to £11.4m (H1 FY21: £2.7m), representing an adjusted EBITDA margin of 7.3%.

At the end of H1 FY22 the French estate consisted of 104 stores in total, of which 100 were under the B&M banner. The performance of the re-branded locations continues to be encouraging, and the local team remain focused on maintaining recent momentum in H2 FY22, subject to any potential Covid-19 restrictions which may be re-introduced.

Group

Group adjusted EBITDA decreased (4.6)% to £282.2m (H1 FY21: £295.6m5), representing an adjusted EBITDA margin of 12.4% (H1 FY21: 13.2%), a reduction of just (75) bps year-on-year despite the prior period not having UK business rates charges. When compared to pre-pandemic levels of H1 FY20, Group adjusted EBITDA has increased 86.4% with a margin expansion of 398 bps over that two-year period.

Depreciation and amortisation expenses, excluding the impact of IFRS16, grew by 6.7% to £32.1m (H1 FY21: £30.1m). This was due to continued investment in new stores across all fascias, with 38 more stores year-on-year across the Group at the end of H1.

In relation to finance costs, excluding IFRS16, the adjusted net interest charge increased slightly to £12.0m (H1 FY21: £11.9m). The IFRS16 lease interest charge for the period was £29.9m (H1 FY21: £30.6m).

The Group's adjusted profit before tax decreased by (6.2)% to £238.0m (H1 FY21: £253.6m), whilst statutory profit before tax increased by 2.4% to £241.4m (H1 FY21: £235.6m). The impact of IFRS16 on the Group interim financial statements was to decrease profit before tax by £6.6m.

Capital expenditure, cashflow and leverage

Group net capital expenditure7, excluding IFRS16 right-of-use asset additions, was £43.0m (H1 FY21: £31.5m). This included £12.2m spent on 23 new stores opened in the first half across the Group (H1 FY21: £14.2m on 20 stores), £18.4m on maintenance works to ensure that its existing store estate and warehouses are appropriately invested (H1 FY21: £9.0m), and a total of £12.4m on infrastructure projects and 3 opportunistic freehold acquisitions to support the continued growth of the business (H1 FY21: £8.3m).

Cash generated from operations was £201.7m (H1 FY21: £403.2), reflecting a strong EBITDA performance and the impact on working capital of an earlier build of inventory compared to the prior period.

The Group remains comfortably within its stated leverage ceiling of 2.25x, with a net debt8 to last-twelve-months adjusted EBITDA ratio of 1.1x at the end of H1 FY22 (H1 FY21: 0.7x), calculated on a pre-IFRS16 basis. The current leverage and cash position continues to be evaluated in line with the Group's capital allocation framework.

Outlook

Having performed strongly in H1 FY22, the B&M UK fascia business will annualise even higher comparatives from FY21 in H2. In the first six weeks of Q3, one-year LFL sales have been (8.9)%, with the prior year six week period seeing highly elevated sales due to unusually early Christmas trading. On a two-year basis versus pre-pandemic levels of FY20, LFL sales have been +14.7%. Inventory levels and in-store availability remain good, having taken receipt of imported goods earlier than normal in direct response to the well-reported supply chain constraints and shipping disruption in both Asia and the UK. As such, the business remains focused on maintaining a very strong two-year performance for the second half of the financial year.

In terms of gross margin, although the return of Seasonal markdown activity did not materialise as expected in H1, it is too early to accurately predict the extent to which this remains a feature in H2. It will largely be determined by demand levels for Seasonal products seen over the peak Christmas period, and this will be a key driver of the full year outturn. Like the retail sector as a whole, the Group faces a number of potential cost headwinds and inflationary pressures heading into 2022, but considers itself well positioned to navigate these challenges due to its agile business model, strong supplier relationships and customer value proposition. Given the strong adjusted EBITDA margin of 12.4% delivered in H1, the Group is confident of maintaining profit margins materially above historical levels.

The new store pipeline for the B&M fascia in the UK remains healthy, although there is a risk that up to 5 stores included in the original expectation of 45 gross new stores for FY22 may be delayed until next financial year. The Heron Foods business remains on track to open 15 gross new stores this financial year, whilst in France the company will continue to focus on strong operational execution and laying the foundations for future growth.

References

- ^ https://www.bandmretail.com/about-us/overview

- ^ https://staticcontents.investis.com/html/b/bandmretail/annual-report-and-accounts-2021/publication/contents/media/1365748/pdfs/Full_Annual_Report_and_Accounts_2021.pdf

- ^ https://www.bandmretail.com/sites/bmstores/files/reports/2021/fy22-interim-results-announcement.pdf