BRAC Bank Limited

Summary

- BRAC Bank Limited (BBL) was established on May 20, 1999, as a public limited company by Fazle Hasan Abed under the Companies Act, 1994, with the help of international partners Shore Cap and the IFC of The World Bank Group. BBL commenced operations on July 4th, 2001.

- BBL serves around 1.3 million customers. Brac Bank has 456 SME Unit Offices, 373 ATMs, 705 Agent Banking Outlets, 18 Premium lounges, 93 CDMs and 1900 Remittance Delivery Points.

- Dr. Ahsan H. Mansur is the Chairman and Selim R. F. Hussain is the Managing Director & CEO of BBL.

- The demand loan of FY21 was more than 28 billion. Total revenue increased by 15% to BDT 23,364 million which has led the net profit after tax to increase by 22% to BDT 5,547 million in the same period.

Company overview

BRAC Bank Limited (DSE:BRACBANK; CSE:BRACBANK) is a first-generation scheduled commercial bank in Bangladesh which started its journey in 1999, established by Bangladesh Rural Advancement Committee (BRAC). It is the only member of the Global Alliance for Banking on Values (GABV) from Bangladesh. The Global Alliance comprises 66 financial institutions operating in countries across Asia, Africa, Australia, Latin America, North America and Europe. The customer base of the bank consists of more than 60 million people. The combined asset size of the company is around $200 billion. The bank services are divided into four main areas: corporate banking, retail banking, Treasury, and small and medium-sized businesses (SME). In Bangladesh, BBL serves around 1.3 million customers. Brac Bank has 456 SME Unit Offices, 373 ATMs, 705 Agent Banking Outlets, 18 Premium lounges, 93 CDMs and 1900 Remittance Delivery Points.

Group Structure and Shareholders

BBL is listed in both DSE and CSE since 2007. Of the stock, 46.24% is held by the sponsors and directors and 53.56% of the shares is held by the general public. BRAC alone holds 46.165% shares. As of 19 September, 2022, the market capitalization of BBL is 57,619 million.

Share Market Insights

BBL entered Dhaka Stock Exchange and Chittagong Stock Exchange in 2007 under the trading code ‘BRACBANK’. The market category of BBL is A. Total number of securities outstanding is 1,392,172,399 with a Face value of each share BDT 10. The bank’s share price achieved a 25% growth from year-start to year-end, turning in a 31% growth in market capitalisation as on end of December 2021 vs. end of December 2020.

Financial Analysis

The accounting period of BBL starts on January 1 and ends on December 31. The demand loan of FY21 was more than 28 billion which was 13.5 million in the previous accounting period while the total loan and advances increased by 18% and the deposits increased by 9%. Total revenue increased by 15% to BDT 23,364 million which has led the net profit after tax to increase by 22% to BDT 5,547 million. Revenue expansion was driven by an increase in net interest income (NII), commissions, exchange and brokerage and other operating income. Also, BBL has access to low-cost sources of funds, like money at call, REPO, borrowings from other banks and FIs and so on, because of its high credit ratings. Cost-to-income ratio (CIR) declined by 5% to 53% while earnings per share (EPS) increased by 22% to BDT 3.98.

In FY21, total assets increased by 13% to BDT 449,084 million, of which BDT 400 million cost was incurred in procurement of hardware, software and technology, capitalised in the statement of financial position as an asset. A significant growth of BDT 8,238 million was reported in other assets, mainly because of a substantial fair value gain on equity investment in bKash due to issuance of preference shares by the company to SoftBank at a high premium. Another reason of the asset growth was the increased focus on the liquidity buffer.

The NPL increased to 3.90% in 2021, compared to 2.93% in the previous year. The reason of the increased NPL is the reclassification of a few big corporate accounts. However, NPL coverage ratio based on only specific provisions excluding write-offs stood at 82%; including general and floating provisions, it stood at 124%. Borrowings accounted for 11% of the bank’s funding profile during the year. The Board of Directors declared a 15% dividend for the year 2021, split equally between cash and stock. The loan portfolio has increased significantly by 18% in the year of 2021. The high growth was the result of suspended business activities in 2020 because of the pandemic.

| Ratio | 2021 | 2020 |

| Percentage of NPLs to total loans and advances | 3.90% | 2.93% |

| NPL coverage ratio | 82% | 114% |

| Return on investment | 6.04% | 5.79% |

| Total capital to risk-weighted asset ratio (CRAR) | 14.36% | 14.55% |

| Growth in deposits | 9% | 8% |

| Growth in loan portfolio | 18% | 3% |

History

Bangladesh Rural Advancement Committee (BRAC) is the founding organization of Brac Bank Limited. BRAC is a separate entity, or the mother entity, of the bank. The bank is named after BRAC. BBL was established on May 20, 1999, as a public limited company by Fazle Hasan Abed under the Companies Act, 1994, with the help of  international partners Shore Cap and the IFC of The World Bank Group. BBL commenced operations on July 4th, 2001. BBL is headquartered in Dhaka, Bangladesh. It is mainly operated by BRAC which is also founded by Fazle Hasan Abed. The main focus of the foundation as well as BBL is the small and medium enterprises. BRAC was established in 1972 in Sumangonj. In 1998, BRAC's Dairy and Food project was commissioned. BRAC launched an Information Technology Institute the following year along with BBL.

international partners Shore Cap and the IFC of The World Bank Group. BBL commenced operations on July 4th, 2001. BBL is headquartered in Dhaka, Bangladesh. It is mainly operated by BRAC which is also founded by Fazle Hasan Abed. The main focus of the foundation as well as BBL is the small and medium enterprises. BRAC was established in 1972 in Sumangonj. In 1998, BRAC's Dairy and Food project was commissioned. BRAC launched an Information Technology Institute the following year along with BBL.

On July 31, 2009, BRAC Bank acquired 51% shares of Equity Partners Limited which was renamed as BRAC EPL Stock Brokerage. On March 01, 2010, BRAC Bank established bKash Limited, a private company limited providing mobile financial services (MFS) in the country under the rules and regulations of Bangladesh Bank. BRAC Bank currently holds 51% equity shares in bKash. In 2011, BBL acquired 25% shares of BRAC EPL Investment which has increased to 99.945% by 2019. On April 09, 2013, BRAC Bank acquired 51% shares of BRAC IT Services Limited, a private company limited by shares under the Companies Act, 1994.

Objective, Mission and Vision

Objectives of the bank

- Building a strong customer focus and relationship based on integrity, superior service.

- To creating an honest, open and enabling environment

- To value and respect people and make decisions based on merit

- To strive for profit & sound growth

- To value the fact that they are the members of the BRAC family – committed to the creation of employment opportunities across Bangladesh.

Mission

- Sustainable growth in Small & Medium Enterprise sector;

- Continuous low-cost deposit Growth with controlled growth in retail assets;

- Corporate Assets to be funded through self-liability mobilization;

- Growth in Assets through syndications and investment in faster growing sectors;

- Continuous endeavor to increase non-funded income;

- Keep our debt charges at 2% to maintain a steady profitable growth

- Achieve efficient synergies between the bank's branches, SME unit offices and BRAC field offices for delivery of remittance and the bank's other products and services;

- Manage various lines of business in a full controlled environment with no compromise compliance and on service quality;

- Keep a diverse, far-flung team fully motivated and driven towards materializing the bank's vision into reality

Vision

Building a profitable and socially responsible financial institution focused on Markets and Businesses with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free” Bangladesh.

Business Overview

Business Model

In the year of 2021, the operating income was BDT 23.3 billion which was 20.3 billion in the previous fiscal year. It was mainly brought by the increased loans in 2021. The funds collected is mainly invested in various sources. As of 2021, 70% of the funds come from the deposits, 11% comes from the borrowings and around 3% from the paid-up capital. The rest is covered by money at call, reserve and other liabilities. Of the investment mix of BBL, 85% was treasury bond (around BDT 43,971 million), 9% was mutual funds and ordinary shares, 6% was pre-IPO investments and the rest was invested in treasure bill, sukuk bonds and so on. The value creation is supported by over 380 suppliers of BBL. It has around 1.2 million deposit-holders, 0.4 million SME clients, 7,000 corporate clients, 0.9 million retail clients and 0.2 million registered Astha app users.

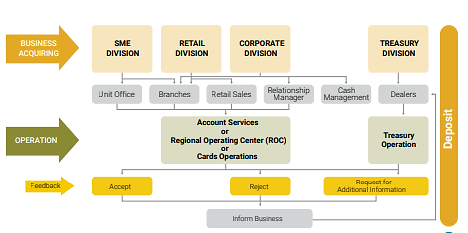

The bank collects deposit through all the three divisions – SME, retail, and corporate. The three divisions are subdivided into unit offices, branches, retail sales unit, or relationship managers. The collection of deposits work through account services, regional operating center, or card operations.

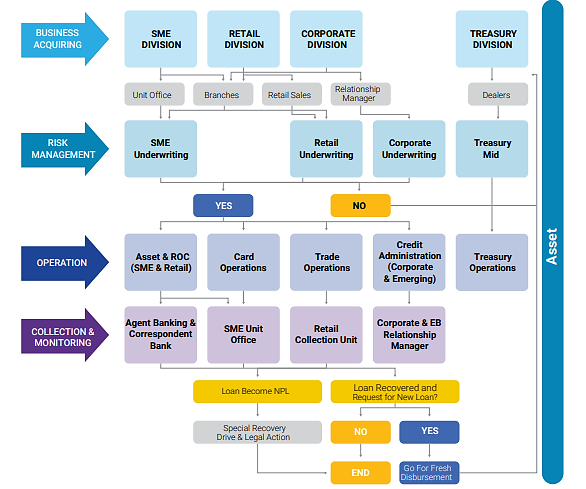

Also, BBL has a distinctive model for disbursing the loan. According to the risk management analysis of BBL, 62.7% risk comes from the fixed term loan while 24.7% risk comes from the demand loan. Rest of the risk comes from continuous loan, stuff loan and agriculture loans.

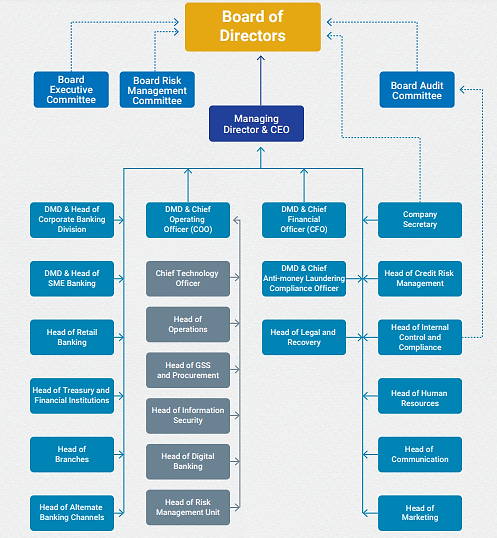

BBL follows functional organizational structure while the board of the committee consists of different committees like risk management committee, audit committee and so on.

Subsidiaries

BRAC EPL Investment: This entity was incorporated in Bangladesh on April 19, 2000, as a private limited company under the Companies Act, 1994, and was subsequently renamed as "BRAC EPL Investments Limited". BRAC Bank acquired an additional 25% shares in the entity in 2011 and a further 18.57% in 2016. In 2017, the bank acquired an additional 5.275% in the entity. During 2019, the bank acquired another 0.10%, thus taking the total shareholding to 99.945% at the end of the year 2019. During the year 2021, BRAC EPL Investment Limited achieved a 458% growth in profitability (2021: BDT 247 mn vs 2020: BDT 44 mn).

BRAC EPL Stock Brokerage: BRAC Bank acquired 51% shares of Equity Partners Securities Limited on July 31 2009. Equity Partners Securities Limited was incorporated in Bangladesh on May 16, 2000 as a private limited company under the Companies Act, 1994. Subsequently, the management decided to rename Equity Partners Securities Limited as BRAC EPL Stock Brokerage Limited. In the year 2011, the bank acquired an additional 39% shares of BRAC EPL Stock Brokerage Limited. As a result, the bank's controlling interest rose to 90% in the company. BRAC EPL Stock Brokerage Limited has remained a consistent performer over the years. In 2021, the company reported a 60% (BDT 97 mn) growth in net profit.

bKash Limited: BRAC Bank established bKash Limited, a private company limited by shares that was incorporated on March 01, 2010 under the Companies Act, 1994. bKash was established to launch mobile financial services in Bangladesh. The bank has obtained a license from Bangladesh Bank for bKash for rendering mobile financial services. BRAC Bank currently holds 51% equity shares in the company. bKash Limited experienced a BDT 1,234 mn loss (excluding other comprehensive income) in 2021 due to continued investments in infrastructure development and capacity-building

BRAC SAAJAN Exchange Limited: BRAC Bank acquired 75%+1 shares (249,992 shares out of the total share 333,333) of "Saajan Worldwide Money Transfer Limited" (SWMTL) in the UK. Bangladesh Bank granted the necessary approvals of GBP 500,000 to acquire SWMTL and set up two new branches in Luton and Bradford in the UK.

BBL also has an associate named BRAC IT Services Limited. BRAC IT Services Ltd. (bITS) was initially founded as Documenta™ Ltd, a digital archiving firm, in 1999. BRAC IT Services was then formed in April 2013 through the merger of Documenta™ and the IT Division of BRAC Bank. BRAC Bank acquired 51% shares of BRAC IT Services Limited, a private company limited by shares under the Companies Act, 1994, incorporated on April 09, 2013. It currently operates as an IT services company. In the year 2017, BRAC Bank reduced its holding in BRAC IT Services Limited from 51% to 48.67% by selling 1,034 shares to BRAC. However, due to new investment by BRAC in 2020, the holding percentage of BRAC Bank further reduced to 12.92% by the end of the year 2020.

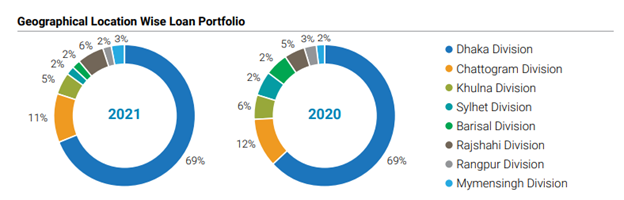

Location

BBL is present in all of the division of Bangladesh. BBL has 89 branches in Dhaka Division, 38 in Chattogram, 15 in Khulna, 14 in Rajshahi, 13 in Sylhet, 7 in Rangpur, 6 in Barishal and 5 in Mymensingh.

Products and Services

BBL has mianly 3 segments named SME, retail and corporate banking. Of the total loans, 47% of the portfolio of BBL is covered by SME, 33% is covered by corporate banking and rest of the portofolio is composed by retail banking. Total portfolio in 2021 was BDT 312,212 million.

Small and medium Enterprises (SME)

SME portfolio amount is around BDT 150,749 million in 2021. There are some sub-categories under SME. One of these is TARA SME Finance. As of 31 December 2021, the cumulative portfolio of TARA SME Finance stood at BDT 523 crore with 5,126 customers. In 2021, NPL of TARA SME financing stood 2.23% which was 2.76% in 2020. BDT 135 billion loan has been disbursed in 2021 with growth of 11.61%. Another part of SME is Micro Finance Institutions (MFI) which started in 2011. The bank has partnered with 24 MFIs for agriculture and rural credit disbursement. MFI disbursements stood at BDT 17,361 million and BDT 14,755 million, respectively, in the year 2020 and 2021. AGRI is another sub-division of SME. As of December 2021, BRAC Bank’s Agri-loan outstanding to end borrowers through its own network and MFI linkage stood at BDT 1,838 million and BDT 1,870 million, respectively. The bank disbursed a sum total of BDT 1,878 million through direct financing during the year. In 2021, BRAC Bank engaged in a multi-stakeholder collaboration to offer cattle well-being services. The bank, in partnership with Phoenix Insurance and Adorsho Pranisheba, launched the 3-year project named “Khamari” to boost livestock rearing and welfare amongst marginalized farmers through the Pranisheba app- a digital cattle monitoring platform. BRAC Bank and Sheba Platform signed an agreement and marked the official kickoff of “SME Bondhu” – a SME Banking initiative that aims to facilitate MSME’s inclusion in the ever-growing digital commerce. Under the agreement, Sheba Platform will offer its sManager solution, where SMEs can conduct their business online and avail inclusive services. BRAC Bank’s SME customers will get a 5% discount on subscription, while Women Banking TARA customers will be able to use it for free.

Retail lending

This segment of the business includes Merchant Acquiring Business, Payment and Partnership Business and others. In 2021, the bank saw a 42% of growth in retail loan which amount to BDT 66,350 million. In personal loans, BBL saw a 92% growth which grew to BDT 37,554 million. The RMG sector accounts for 21% of the loan and textile industry covered 16% retail lending.

Corporate banking

BRAC Bank established its Corporate Banking Division in 2009 and over a period of 12 years, BBL has established a number of segments. Corporate banking has grown 16% in loan and advances, 13% in deposits and 52% in trade business. BBL has 705 agent banking outlets, more than 142,016 agents, 373 ATMSs and 93 CDMs. 79% of the cash transactions of BBL is executed through branches and the rest of the transactions by ATMs. BBL also showed 66% growth in the online banking. This growth was mainly contributed by the pandemic where many businesses turned their business operation online.

CSR Activities

BBL spent 205 million in CSR activites in the year of 2021. Some of the major CSR activities is as follows-

- Spending BDT 3 million for tree plantation initiative in BEZA

- Installing solar plants in SME unit offices and office buildings, wherever feasible

- Stated intent to become carbon neutral by 2023

- Spending BDT 45 million for food support to 30,267 Covid-affected families

- Contributing BDT 50 mn to Bangabandhu Memorial Trust for Ashrayan project

- Free-meal initiative of Mehmankhana, with meals served to 2,000 people daily and dispatch of 400 packets to households

- Contributing 51,000 blankets to backward households during the harsh winter

- Providing cost of treatment of 24 young thalassemia patients at Bangladesh Thalassemia Samity Hospital

- Contributing BDT 50 million to the PM’s Relief and Welfare Fund

Industry Overview

Since declaring independence in 1971, Bangladesh's banking sector began with six nationalized commercial banks, two state-owned special banks, and three foreign banks. The entry of private banks into the market throughout the 1980s led to a major expansion of the banking sector. Competition in the domestic banking industry is very high now with 61 scheduled banks, 5 non-scheduled banks and 34 financial institutions (FIs) competing for share of a highly concentrated market. Non-differentiated products and services among competitors, insignificant brand loyalty of customers and high exit barriers induce greater competitive intensity.

Over the last five years, sectoral loans and advances have grown steadily with a CAGR of 13.2%. Deposits also saw growth, growing at a CAGR of 10.8%. In March 2022, the loan to deposit ratio for the banking industry was 89.4%, up from 87.6% in FY'21. In the previous five years, this ratio fluctuated between 83% and 90%, which is close to the necessary ADR ratio established by the Bangladesh Bank, which is 92% for Islamic banks and 87% for conventional banks.

Domestic credit growth moderated to 10.1% in FY21 from 14.0% in FY20. Private sector credit grew by 8.3% (compared to 8.6% in 2020), as economic activity had limited momentum during the period. In FY22, domestic credit growth picked up to 12.4% during July-December from 9.9% a year ago. Private credit growth increased from 8.4% in December 2020 to 10.7% in December 2021 while the public sector credit growth rose from 18.6% to 21.0%.

Loans and advances constituted 64% of total assets of the banking industry. In 2021, assets increased by about 1.3% compared to 4.6% and 1.4% in the last 2 years. This growth is largely attributed to increase in the investment portfolio of state-owned banks. NPL ratio of the banking industry increased slightly to 7.93% in 2021 compared to 7.66% in 2020. Moreover, net NPL ratio decreased to -0.43% from maintenance of loan loss provision and accumulation of higher amount of interest suspense, compared to a net NPL ratio of -1.18% in 2020. In 2021, the required provision increased considerably to BDT 806.5 billion compared to BDT 648.0 billion in 2020. In contrast, provision maintained increased marginally from BDT 646.8 billion to BDT 666.5 billion. As a result, provision shortfall increased significantly from BDT 1.2 billion to BDT 140.1 billion. In terms of profitability, return-on-assets declined sharply from 0.42% in Q1’21 to 0.25% in Q4’21, while return-on-equity declined from 6.70% to 4.44% during the same period. Moreover, ROA of most banks remained below 2% and ROE remained below 5% for a large number of banks in 2021.

Recent development

- Establishment of EB Foreign Mission Desk representing a dedicated queue in North Gulshan Branch to extend dedicated services to expats and other senior embassy officials

- Launch of Expat Salary Accounts comprising customised salary accounts to cater to the specific requirements of expats

- Forged relationships with 10 new exchange houses/banks

- Completed system integration with Ripple, a blockchain-based global payment network

- Partnered with Payoneer, a USA-based international payment operator

- Onboarded 100k new customers across digital remittance channels

- BRAC Bank’s project “Cashless Remittance” won the Honorable Mention as “The Fintech Innovation of the Year”