Bank of America

Summary

- Bank of America is one of the world's largest financial institutions.

- Bank of America Corporation is a bank holding and a financial holding company.

- The bank serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 16,000 ATMs

Bank of America Corporation (NYSE:BAC) is a bank holding and a financial holding company. Bank of America is one of the world's largest financial institutions, serving individual consumers, small- and middle-market businesses, institutional investors, large corporations and governments with a full range of banking, investing, asset management and other financial and risk management products and services.

Financial Highlights

Third-Quarter 2022 Results1

- Net income of $7.1 billion, or $0.81 per diluted share

- Pretax income declined 7% to $8.3 billion reflecting a reserve build compared to a reserve release in Q3-21

- Revenue, net of interest expense, increased 8% to $24.5 billion

- Provision for credit losses of $898 million increased $1.5 billion

- Noninterest expense increased $863 million, or 6%, to $15.3 billion and included $354 million related to the settlement of legacy monoline insurance litigation

- Average loan and lease balances up $114 billion, or 12%, to $1.0 trillion led by strong commercial loan growth as well as higher credit card balances

- Average deposits up $20 billion, or 1%, to $2.0 trillion

- Average Global Liquidity Sources of $941 billion

- Return on average common shareholders' equity ratio of 10.8%; return on average tangible common shareholders' equity ratio of 15.2%

Consumer Banking

- Net income of $3.1 billion

- Client balances of $1.6 trillion, up 1%

- Average deposits of more than $1 trillion, up $68 billion, or 7%

- Combined credit/debit card spend of $218 billion, up 9%

Global Wealth and Investment Management

- Net income of $1.2 billion

- Client balances of $3.2 trillion, down 12%, driven by lower market valuations, partially offset by net client flows

- Pretax margin of 29%

Global Banking

- Net income of $2.0 billion

- Total investment banking fees (excl. self-led) of $1.2 billion, decrease of 46%, reflecting weaker industry-wide underwriting activity this year

- No. 3 in investment banking fees

Global Markets

- Net income of $1.1 billion

- Sales and trading revenue up 13% to $4.1 billion, including net debit valuation adjustment (DVA) losses of $14 million; Fixed Income Currencies and Commodities (FICC) revenue of $2.6 billion and Equities revenue of $1.5 billion

- Excluding net DVA(H), sales and trading revenue up 13% to $4.1 billion; FICC up 27% to $2.6 billion; Equities down 4% to $1.5 billion

- Zero days of trading losses in Q3-22

Business Overview

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 16,000 ATMs and award-winning digital banking with approximately 56 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries.2

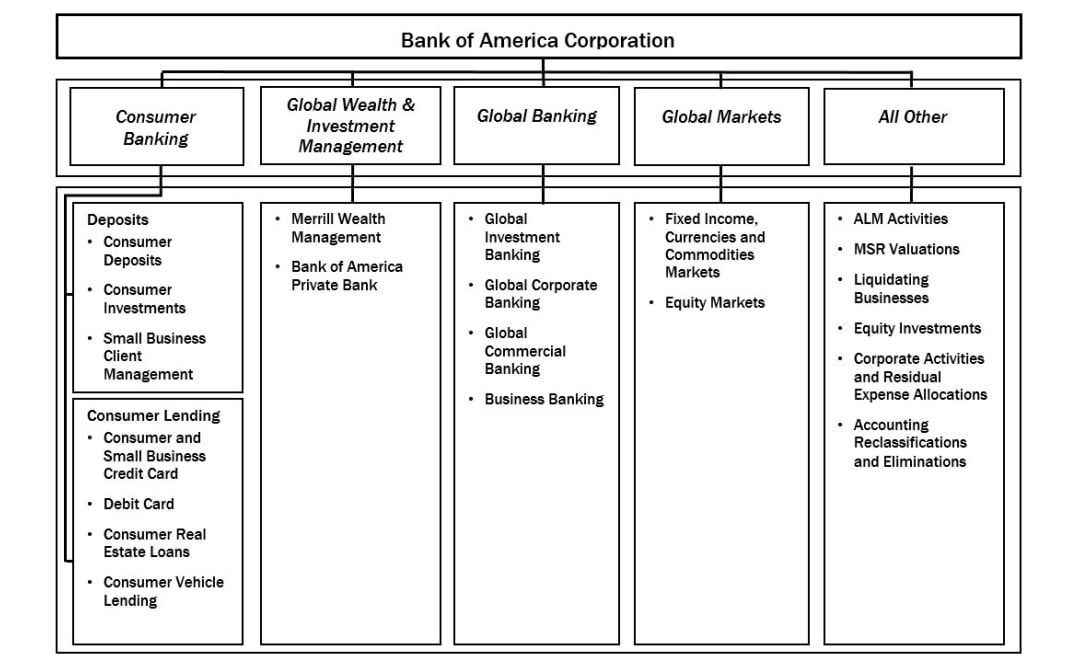

Business Segments

The company report its results of operations through the following four business segments: Consumer Banking, GWIM, Global Banking and Global Markets, with the remaining operations recorded in All Other.

Consumer Banking

Consumer Banking, comprised of Deposits and Consumer Lending, offers a diversified range of credit, banking and investment products and services to consumers and small businesses. Deposits and Consumer Lending include the net impact of migrating customers and their related deposit, brokerage asset and loan balances between Deposits, Consumer Lending and GWIM, as well as other client-managed businesses. The company's customers and clients have access to a coast-to-coast network including financial centers in 38 states and the District of Columbia. As of December 31, 2021, its network includes approximately 4,200 financial centers, approximately 16,000 ATMs, nationwide call centers and leading digital banking platforms with more than 41 million active users, including approximately 33 million active mobile users.

Global Wealth & Investment Management

GWIM consists of two primary businesses: Merrill Wealth Management (MWM) and Bank of America Private Bank.

MWM's advisory business provides a high-touch client experience through a network of financial advisors focused on clients with over $250,000 in total investable assets. MWM provides tailored solutions to meet clients' needs through a full set of investment management, brokerage, banking and retirement products.

Bank of America Private Bank, together with MWM's Private Wealth Management business, provides comprehensive wealth management solutions targeted to high net worth and ultra high net worth clients, as well as customized solutions to meet clients' wealth structuring, investment management, trust and banking needs, including specialty asset management services.

Global Banking

Global Banking, which includes Global Corporate Banking, Global Commercial Banking, Business Banking and Global Investment Banking, provides a wide range of lending-related products and services, integrated working capital management and treasury solutions, and underwriting and advisory services through its network of offices and client relationship teams. The company's lending products and services include commercial loans, leases, commitment facilities, trade finance, commercial real estate lending and asset-based lending. The company's treasury solutions business includes treasury management, foreign exchange, short-term investing options and merchant services. The company also provide investment banking products to its clients such as debt and equity underwriting and distribution, and merger-related and other advisory services. Underwriting debt and equity issuances, fixed-income and equity research, and certain market-based activities are executed through its global broker-dealer affiliates, which are its primary dealers in several countries. Within Global Banking, Global Corporate Banking clients generally include large global corporations, financial institutions and leasing clients. Global Commercial Banking clients generally include middle-market companies, commercial real estate firms and not-for-profit companies. Business Banking clients include mid-sized U.S.-based businesses requiring customized and integrated financial advice and solutions.

Global Markets

Global Markets offers sales and trading services and research services to institutional clients across fixed-income, credit, currency, commodity and equity businesses. Global Markets product coverage includes securities and derivative products in both the primary and secondary markets. Global Markets provides market-making, financing, securities clearing, settlement and custody services globally to its institutional investor clients in support of their investing and trading activities. The company also work with its commercial and corporate clients to provide risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income and mortgage-related products. As a result of its market-making activities in these products, the company may be required to manage risk in a broad range of financial products including government securities, equity and equity-linked securities, high-grade and high-yield corporate debt securities, syndicated loans, MBS, commodities and asset-backed securities. The economics of certain investment banking and underwriting activities are shared primarily between Global Markets and Global Banking under an internal revenue-sharing arrangement. Global Banking originates certain deal-related transactions with its corporate and commercial clients that are executed and distributed by Global Markets.

All Other

All Other primarily consists of ALM activities, liquidating businesses and certain expenses not otherwise allocated to a business segment. ALM activities encompass interest rate and foreign currency risk management activities for which substantially all of the results are allocated to its business segments.