Bank of New York Mellon

Summary

- BNY Mellon is one of America's oldest banks.

- BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation.

- BNY Mellon delivers investment and wealth management and investment services in 35 countries.

Established in 1784, BNY Mellon (NYSE: BK) is one of America's oldest bank and the first company listed on the New York Stock Exchange. BNY Mellon had $45.7 trillion in assets under custody and/or administration and $1.8 trillion in assets under management as of September 30, 2023. BNY Mellon has been named among Fortune's World's Most Admired Companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation.

Financial Highlights

Third Quarter 2023 Results1

Net income applicable to common shareholders was $956 million, or $1.22 per diluted common share, in the third quarter of 2023, including the impact of notable items. Notable items in the third quarter of 2023 include severance expense and litigation reserves. Excluding notable items, net income applicable to common shareholders was $992 million (Non-GAAP), or $1.27 (Non-GAAP) per diluted common share, in the third quarter of 2023. Net income applicable to common shareholders was $319 million, or $0.39 per diluted common share, in the third quarter of 2022, including the impact of notable items. Notable items in the third quarter of 2022 include goodwill impairment in the Investment Management reporting unit, a disposal gain (reflected in investment and other revenue), severance expense and litigation reserves. Excluding notable items, net income applicable to common shareholders was $983 million (Non-GAAP), or $1.21 (Non-GAAP) per diluted common share, in the third quarter of 2022.

Full Year 2022 Results

The company reported net income applicable to common shareholders of $2.4 billion, or $2.90 per diluted common share, in 2022, including the negative impact of notable items. Notable items in 2022 include goodwill impairment in the Investment Management reporting unit, a net loss from repositioning the securities portfolio, severance expense, litigation reserves, the accelerated amortization of deferred costs for depositary receipts services related to Russia and net gains on disposals (reflected in investment and other revenue). Excluding notable items, net income applicable to common shareholders was $3.7 billion (Non-GAAP), or $4.59 (Non-GAAP) per diluted common share, in 2022. In 2021, net income applicable to common shareholders of BNY Mellon was $3.6 billion, or $4.14 per diluted common share, including the negative impact of notable items. Notable items in 2021 include litigation reserves, severance expense and net gains on disposals (reflected in investment and other revenue). Excluding notable items, net income applicable to common shareholders was $3.6 billion (Non-GAAP), or $4.24 (Non-GAAP) per diluted common share, in 2021.

Company Overview

Established in 1784 by Alexander Hamilton, the company were the first company listed on the New York Stock Exchange (NYSE: BK). With a history of more than 235 years, BNY Mellon is a global company helping its clients manage and service their financial assets throughout the investment life cycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers investment and wealth management and investment services in 35 countries.2

On Nov. 1, 2022, the company completed the sale of BNY Alcentra Group Holdings, Inc. (together with its subsidiaries, “Alcentra”). At Oct. 31, 2022, Alcentra had $32 billion in AUM concentrated in senior secured loans, high yield bonds, private credit, structured credit, special situations and multi-strategy credit strategies.

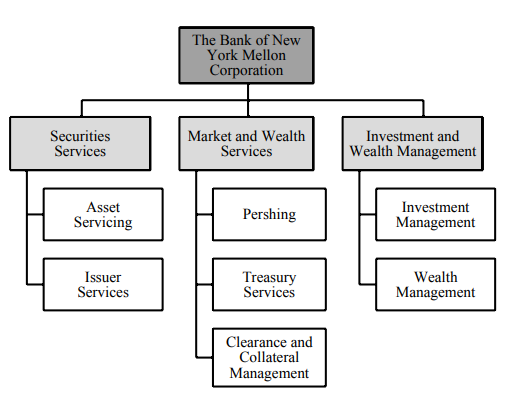

BNY Mellon has three business segments, Securities Services, Market and Wealth Services and Investment and Wealth Management, which offer a comprehensive set of capabilities and deep expertise across the investment lifecycle, enabling the Company to provide solutions to buy-side and sellside market participants, as well as leading institutional and wealth management clients globally.

Business Segments

Securities Services

The Securities Services business segment consists of two distinct lines of business, Asset Servicing and Issuer Services, which provide business solutions across the transaction lifecycle to its global asset owner and asset manager clients. BNY Mellon is one of the leading global investment services providers with $31.4 trillion of AUC/A at Dec. 31, 2022.

The Asset Servicing business provides a comprehensive suite of solutions. BNY Mellon is one of the largest global custody and front-to-back outsourcing partners. The company offer services for the safekeeping of assets in capital markets globally as well as fund accounting services, exchange-traded funds servicing, transfer agency, trust and depository, front-to-back capabilities as well as data and analytics solutions for its clients. The company deliver foreign exchange, and securities lending and financing solutions, on both an agency and principal basis. The company's agency securities lending program is one of the largest lenders of U.S. and non-U.S. securities, servicing a lendable asset pool of approximately $4.5 trillion in 34 separate markets. The company's market-leading liquidity services portal enables cash investments for institutional clients and includes fund research and analytics.

The Issuer Services business includes Corporate Trust and Depositary Receipts. The company's Corporate Trust business delivers a full range of issuer and related investor services, including trustee, paying agency, fiduciary, escrow and other financial services. BNY Mellon is a leading provider to the debt capital markets, providing customized and marketdriven solutions to investors, bondholders and lenders. The company's Depositary Receipts business drives global investing by providing servicing and valueadded solutions that enable, facilitate and enhance cross-border trading, clearing, settlement and ownership. BNY Mellon is one of the largest providers of depositary receipts services in the world, partnering with leading companies from more than 50 countries.

Market and Wealth Services

The Market and Wealth Services business segment consists of three distinct lines of business, Pershing, Treasury Services and Clearance and Collateral Management, which provide business services and technology solutions to entities including financial institutions, corporations, foundations and endowments, public funds and government agencies. For information on the drivers of the Market and Wealth Services fee revenue.

Pershing provides execution, clearing, custody, business and technology solutions, delivering operational support to broker-dealers, wealth managers and registered investment advisors (“RIAs”) globally.

The company's Treasury Services business is a leading provider of global payments, liquidity management and trade finance services for financial institutions, corporations and the public sector.

The company's Clearance and Collateral Management business clears and settles equity and fixed-income transactions globally and serves as custodian for tri-party repo collateral worldwide. BNY Mellon is the primary provider of U.S. government securities clearance and a provider of non-U.S. government securities clearance. The company's collateral services include collateral management, administration and segregation. The company offer innovative solutions and industry expertise which help financial institutions and institutional investors with their financing, risk and balance sheet challenges. BNY Mellon is a leading provider of tri-party collateral management services with an average of $5.3 trillion serviced globally including approximately $4.2 trillion of the U.S. tri-party repo market at Dec. 31, 2022.

Investment and Wealth Management

The company's Investment and Wealth Management business segment consists of two distinct lines of business, Investment Management and Wealth Management, which have a combined AUM of $1.8 trillion as of Dec. 31, 2022.

BNY Mellon Investment Management is a leading global asset manager and consists of its seven specialist investment firms and global distribution network to deliver a highly diversified portfolio of investment strategies to institutional and retail clients globally.

The company's Investment Management model provides specialized expertise from seven respected investment firms offering solutions across every major asset class, with backing from the proven stewardship and global presence of BNY Mellon. Each investment firm has its own individual culture, investment philosophy and proprietary investment process. This approach brings its clients clear, independent thinking from highly experienced investment professionals.

BNY Mellon Wealth Management provides investment management, custody, wealth and estate planning, private banking services, investment servicing and information management. BNY Mellon Wealth Management has $269 billion in client assets as of Dec. 31, 2022, and more than 30 offices in the U.S. and internationally.

Wealth Management clients include individuals, families and institutions. Institutions include family offices, charitable gift programs and endowments and foundations. The company work with clients to build, manage and sustain wealth across generations and market cycles.

Locations

| Europe, Middle East & Africa | Asia Pacific | Latin America and the Caribbean | North America |

| Belgium | Australia | Bermuda | Canada |

| Denmark | China | Brazil | United States |

| Egypt | Hong Kong | Chile | |

| England | India | Grand Cayman | |

| France | Indonesia | Mexico | |

| Germany | Japan | ||

| Ireland | Malaysia | ||

| Italy | Philippines | ||

| Jersey | Singapore | ||

| Luxembourg | South Korea | ||

| Netherlands | Taiwan | ||

| Poland | Thailand | ||

| Russia | |||

| Saudi Arabia | |||

| Scotland | |||

| Spain | |||

| Sweden | |||

| Switzerland | |||

| Turkey | |||

| United Arab Emirates |

Company History

Alexander Hamilton founded the Bank of New York.3

| Year | Milestone |

| 1784 | The Bank of New York opens for business with $500,000 in capital. Alexander Hamilton, financial leader and respected New York lawyer, singlehandedly writes its constitution and becomes one of the bank's directors. |

| 1792 | The New York Stock Exchange opens. The Bank of New York is the first company traded. |

| 1804 | The Bank of New York becomes depositary for what is believed to be the nation's first trust, established to provide for Alexander Hamilton's family after his death. |

| 1832 | The Bank of New York begins managing funds for private clients. |

| 1922 | The Bank of New York merges with the New York Life Insurance and Trust company, introducing trust and custody services to the Bank's core offerings a space the Bank dominates today. |

| 1948 | After a new acquisition, the bank becomes The Bank of New York and Fifth Avenue Bank. By 1952, it is agreed the merger name is a mouthful and is simplified back to the Bank. |

| 1955 | Mellon becomes one of the first national banks to acquire and install a computer. In 1958, The Bank of New York installs an IBM Type 650 Electronic Data Processing System to speed up bookkeeping. Three years later they upgrade to an IBM 7070-401. |

| 1958 | The Bank of New York furthers its expansion to Hong Kong. Today BNY Mellon is located in 35 countries worldwide. |

| 1988 | The Bank of New York merges with Irving Trust after a challenging yearlong struggle. With their $42 billion assets combined, the merged banks became the 12th largest bank in the U.S. |

| 1993 | Mellon acquires the Boston Company. Opened in 1964 with a focus on equity research, Boston Company Asset Management, LLC was later established in 1970. |

| 1994 | Mellon Bank Corporation merges with the Dreyfus Corporation. Established in 1951, the Dreyfus Corporation manages approximately $264 billion in mutual funds and separately managed accounts today. |

| 1995 | The Bank of New York acquires JP Morgan's Global Custody business. Today BNY Mellon is the world's largest provider of custody and safekeeping services. |

| 1998 | The acquisition of Irving Trust, Ralph Walker's art-deco masterpiece at One Wall Street becomes headquarters for The Bank of New York. |

| 2000 | the acquisition of Irving Trust, Ralph Walker's art-deco masterpiece at One Wall Street becomes headquarters for The Bank of New York. |

| 2003 | The Bank of New York acquires Pershing. Opened in 1939 with just $200,000 in capital, Pershing has a long history of Wall Street innovation. |

| 2006 | In exchange for its retail banking business, The Bank of New York acquires all of J.P. Morgan's corporate trust assets. |