Caterpillar Inc.

Summary

- Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives.

- The company operates in more than 190 countries around the world.

- Caterpillar has a portfolio of about 20 brands offering machines, engines, components, services and solutions

Caterpillar (NYSE: CAT) is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company operates in more than 190 countries around the world.

Recent Developments

Caterpillar Announces Investment in Lithos Energy Inc. to Further Battery Pack Development and Manufacturing1

January 6, 2023; Caterpillar Inc. announced the company is investing in Lithos Energy, Inc., a U.S.-based battery technology company that produces lithium-ion battery packs. Deal will help to accelerate the development of Caterpillar’s electrified product portfolio. Caterpillar’s investment in Lithos further demonstrates Caterpillar’s commitment to support customers in the energy transition with lower-carbon advanced power technologies for its hybrid and full-electric machines and power generation products. The company recently displayed four electric construction machine prototypes, including battery prototypes, at bauma 2022 in Munich, Germany and successfully demonstrated its first battery electric 793 large mining truck at its Tucson Proving Ground in Arizona.

Caterpillar Announces Collaboration with Luck Stone to Scale Autonomous Solutions to the Aggregates Industry2

December 15, 2022; Caterpillar Inc. announced today a collaboration with Luck Stone, the nation’s largest family-owned and operated producer of crushed stone, sand and gravel, to deploy Caterpillar’s autonomous solution to Luck Stone’s Bull Run Plant in Chantilly, Virginia. This will be Caterpillar’s first autonomous deployment in the aggregates industry and will expand the company’s autonomous truck fleet to include the 100-ton-class (90-tonne-class) Cat® 777.

Looking to accelerate autonomous solutions beyond mining, Caterpillar will implement its existing Cat® MineStar™ Command for Hauling system at the Bull Run quarry, on a fleet of 777G trucks. This will allow Caterpillar to gain greater insights on quarry operations in order to tailor the next generation of autonomous solutions specific to quarry and aggregate applications. This project supports the acceleration of autonomous technology for operations with fewer mobile assets to allow a step change in safety and productivity, as currently experienced at large mining operations.

The current autonomy solutions will be implemented in 2024. This project builds on Caterpillar’s long history in autonomy and automation. Caterpillar is recognized as the industry leader with the world’s largest fleet of autonomous haul trucks, now numbering more than 560 trucks. These trucks have traveled more than 187 million kilometers and autonomously moved more than 5.1 billion tonnes – most notably – all without a single zero lost-time injury.

Financial Highlights

The company's sales and revenues for 2022 were $59.427 billion, an increase of $8.456 billion, or 17 percent, compared with $50.971 billion for 2021. The increase was primarily due to favorable price realization and higher sales volume, partially offset by unfavorable currency impacts related to the euro, Australian dollar and Japanese yen. Profit per share was $12.64 in 2022, compared with profit per share of $11.83 in 2021. Profit was $6.705 billion in 2022, compared with $6.489 billion in 2021.

Operating profit was $7.904 billion in 2022, an increase of $1.026 billion, or 15 percent, compared with $6.878 billion in 2021. The increase was primarily due to favorable price realization and higher sales volume, partially offset by higher manufacturing costs, a goodwill impairment charge, higher SG&A/R&D expenses and higher restructuring costs.

In 2022, the company took a goodwill impairment charge of $925 million and restructuring costs of $193 million related to the Rail division, both primarily non-cash items. $180 million of the total Rail restructuring costs were recognized in the fourth quarter of 2022. The goodwill impairment charge is related to a lower outlook for the company’s locomotive offerings. The restructuring costs were primarily related to write-downs in the value of inventory.

Resource Industries’ total sales were $12.314 billion in 2022, an increase of $2.504 billion, or 26 percent, compared with $9.810 billion in 2021. The increase was due to higher sales volume and favorable price realization. The increase in sales volume was driven by the impact from changes in dealer inventories, higher sales of equipment to end users and higher sales of aftermarket parts. Dealers increased inventories during 2022, compared with a decrease during 2021.

Resource Industries’ profit was $1.827 billion in 2022, an increase of $598 million, or 49 percent, compared with $1.229 billion in 2021. The increase was mainly due to favorable price realization and higher sales volume, partially offset by unfavorable manufacturing costs and higher SG&A/R&D expenses. Unfavorable manufacturing costs largely reflected higher material costs and freight. The increase in SG&A/R&D expenses was primarily driven by investments aligned with strategic initiatives.

Energy & Transportation’s total sales were $23.752 billion in 2022, an increase of $3.465 billion, or 17 percent, compared with $20.287 billion in 2021. Sales increased across all applications and inter-segment sales. The increase in sales was primarily due to higher sales volume and favorable price realization, partially offset by unfavorable currency impacts related to the euro, British pound and Australian dollar.

Energy & Transportation’s profit was $3.309 billion in 2022, an increase of $505 million, or 18 percent, compared with $2.804 billion in 2021. Unfavorable manufacturing costs and higher SG&A/R&D expenses were more than offset by favorable price realization and higher sales volume. Unfavorable manufacturing costs largely reflected higher material costs, freight, period manufacturing costs and the impact of manufacturing inefficiencies. The increase in SG&A/R&D expenses was primarily driven by investments aligned with strategic initiatives and higher short-term incentive compensation expense.

Financial Products’ segment revenues were $3.253 billion for the year ended December 31, 2022, an increase of $180 million, or 6 percent, compared with $3.073 billion for the year ended December 31, 2021. The increase was primarily due to higher average financing rates across all regions and a favorable impact from returned or repossessed equipment in North America.

Financial Products’ segment profit was $864 million for the year ended December 31, 2022, a decrease of $44 million, or 5 percent, compared with $908 million for the year ended December 31, 2021. The decrease was mainly due to an unfavorable impact from equity securities in Insurance Services, partially offset by a favorable impact from returned or repossessed equipment.

Restructuring Costs

On February 1, 2023, the company closed on the divestiture of its Longwall business. As a result, the company recorded a pre-tax loss of approximately $600 million, of which $494 million was related to the release of accumulated foreign currency translation associated with this divestiture. This loss, primarily non-cash, will be included in its first quarter 2023 restructuring costs and is subject to the finalization of post-closing procedures. In addition, the company expect to incur about $100 million of restructuring costs in 2023 primarily related to strategic actions to address a small number of products.

The company expect that prior restructuring actions will result in an incremental benefit to operating costs, primarily Costs of goods sold and SG&A expenses of about $100 million in 2023 compared with 2022.

Company Overview

With 2022 sales and revenues of $59.427 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company principally operates through its three primary segments - Construction Industries, Resource Industries and Energy & Transportation - and also provides financing and related services through its Financial Products segment. Caterpillar is also a leading U.S. exporter.3

Business Segments

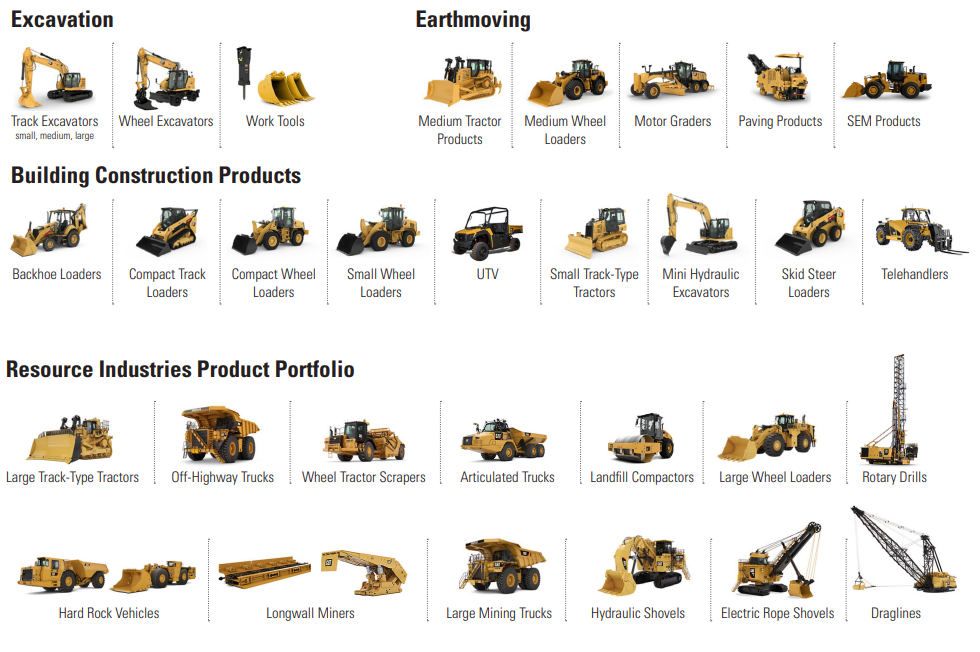

Construction Industries

The company's Construction Industries segment is primarily responsible for supporting customers using machinery in infrastructure, forestry and building construction. The majority of machine sales in this segment are made in the heavy and general construction, rental, quarry and aggregates markets and mining. The nature of customer demand for construction machinery varies around the world. Customers in developing economies often prioritize purchase price in making their investment decisions, while customers in developed economies generally weigh productivity and other performance criteria that contribute to lower owning and operating costs over the lifetime of the machine. To meet customer expectations in developing economies, Caterpillar developed differentiated product offerings that target customers in those markets, including its SEM brand machines. The company believe that these customer-driven product innovations enable it to compete more effectively in developing economies. The majority of Construction Industries' research and development spending in 2022 focused on the next generation of construction machines.

Resource Industries

The Resource Industries segment is primarily responsible for supporting customers using machinery in mining and heavy construction and quarry and aggregates. Caterpillar offers a broad product range and services to deliver comprehensive solutions for its customers. The company develop and manufacture high productivity equipment for both surface and underground mining operations around the world, as well as provide hydraulic systems, electronics and software for Caterpillar machines and engines. The company's equipment is used to extract and haul copper, iron ore, coal, oil sands, aggregates, gold and other minerals and ores, as well as a variety of heavy construction applications. In addition to equipment, Resource Industries also develops and sells technology products and services to provide customers fleet management systems, equipment management analytics and autonomous machine capabilities.

Energy & Transportation

The company's Energy & Transportation segment supports customers in oil and gas, power generation, marine, rail and industrial applications, including Caterpillar machines. The product and services portfolio includes reciprocating engines, generator sets, integrated systems and solutions, turbines and turbine-related services, electrified powertrain and zero-emission power sources and service solutions development, the remanufacturing of Caterpillar engines and components and remanufacturing services for other companies, diesel-electric locomotives and other rail-related products and services and product support of on-highway vocational trucks for North America.

Financial Products Segment

The business of its Financial Products Segment is primarily conducted by Cat Financial, Insurance Services and their respective subsidiaries and affiliates. Cat Financial is a wholly owned finance subsidiary of Caterpillar Inc. and it provides retail and wholesale financing to customers and dealers around the world for Caterpillar products and services, as well as financing for vehicles and power generation facilities that, in most cases, incorporate Caterpillar products. Retail financing is primarily comprised of installment sale contracts and other equipment-related loans, working capital loans, finance leases and operating leases. Wholesale financing to Caterpillar dealers consists primarily of inventory and rental fleet financing. In addition, Cat Financial purchases short-term wholesale trade receivables from Caterpillar. The various financing plans offered by Cat Financial are designed to support sales of Caterpillar products and services and generate financing income for Cat Financial. A significant portion of its activity is conducted in North America and Caterpillar has additional offices and subsidiaries in Latin America, Asia/Pacific, Europe and Africa.

Global Locations

Caterpillar's global reach and presence is unmatched in the industry. Headquartered in Irving, Texas, U.S., the company serve customers around the globe. The company's manufacturing, marketing, logistics, services, research and development (R&D) and related facilities, along with its dealer locations, total more than 500 locations worldwide.

| EUROPE | ASIA PACIFIC | AMERICAS | AFRICA | MIDDLE EAST |

| Belgium | Australia | Brazil | South Africa | United Arab Emirates |

| Czech Republic | China | Mexico | ||

| Eurasia & Russia | India | United States of America | ||

| France | Indonesia | |||

| Germany | Japan | |||

| Hungary | Republic of Singapore | |||

| Italy | South Korea | |||

| Netherlands | Thailand | |||

| Poland | ||||

| Spain | ||||

| Switzerland | ||||

| United Kingdom |

Caterpillar Brands

Caterpillar Inc. has a portfolio of about 20 brands offering machines, engines, components, services and solutions to meet the unique needs of a variety of industries and customers around the world.

The Caterpillar brand represents the whole corporation and its people. Cat® is the flagship brand of products and services with customers served by its independently owned and operated global Cat dealer network.

Some of its brands include:

- Anchor

- AsiaTrak

- Cat

- Cat Financial

- Cat Lift Trucks

- Cat Reman

- Cat Rental Store

- FG Wilson

- Hindustan

- MWM

- MaK

- Perkins

- Progress Rail

- SEM

- SPM Oil & Gas

- Solar Turbines

- Turner Powertrain Systems

Manufacturing Facilities

Manufacturing of products for its Construction Industries, Resource Industries and Energy & Transportation segments is conducted primarily at the locations listed below.

| Segment | U.S. Facilities | Facilities Outside the U.S. |

| Construction Industries | Arkansas: North Little Rock | Brazil: Campo Largo, Piracicaba |

| Georgia: Athens | China: Suzhou, Wujiang, Xuzhou, Qingzhou | |

| Illinois: Decatur, East Peoria | France: Grenoble, Echirolles | |

| Kansas: Wamego | Hungary: Godollo | |

| Minnesota: Brooklyn Park | India: Hosur, Thiruvallur | |

| North Carolina: Clayton, Sanford | Italy: Minerbio, Cattolica | |

| Texas: Victoria | Japan: Akashi | |

| Mexico: Torreon | ||

| Netherlands: Den Bosch | ||

| Poland: Janow, Sosnowiec | ||

| Russia: Tosno | ||

| Thailand: Rayong | ||

| United Kingdom: Desford, Stockton | ||

| Resource Industries | Illinois: Decatur, East Peoria | China: Qingzhou, Wuxi |

| South Carolina: Sumter | Germany: Dortmund, Lunen | |

| Texas: Denison | India: Thiruvallur | |

| Wisconsin: South Milwaukee | Indonesia: Batam | |

| Italy: Jesi | ||

| Mexico: Acuna, Monterrey, Reynosa | ||

| Russia: Tosno | ||

| Thailand: Rayong | ||

| United Kingdom: Peterlee | ||

| Energy & Transportation | Alabama: Albertville, Montgomery | Australia: Cardiff, Perth, Redbank, Revesby |

| California: San Diego | Brazil: Curitiba, Hortolandia, Piracicaba, Sete Lagoas | |

| Georgia: Griffin, Patterson | China: Tianjin, Wuxi | |

| Illinois: East Peoria, Mossville, Mapleton, Pontiac | Czech Republic: Zatec, Zebrak | |

| Indiana: Lafayette, Muncie | Germany: Kiel, Mannheim, Rostock | |

| Kentucky: Decoursey, Mayfield | India: Aurangabad, Hosur | |

| Oklahoma: Broken Arrow | Italy: Pistoria | |

| North Carolina: Winston-Salem | Mexico: San Luis Potosi, Tijuana | |

| Texas: Channelview, DeSoto, Fort Worth, Mabank, San Antonio, Schertz, Seguin, Sherman | United Kingdom: Larne, Peterborough, Sandiacre, South Queensferry, Springvale, Stafford, Wimborne |

Company History

The company's history dates back to the late 19th century.4

- 1890, Benjamin Holt, a California-based inventor, built his first steam-powered tractor, which he called the "Caterpillar." The tractor's tracks were inspired by the design of a caterpillar's legs, which enabled it to traverse soft and uneven terrain.

- 1925: Caterpillar Tractor Company is formed through the merger of the Holt Manufacturing Company and the C. L. Best Tractor Company.

- 1931: Caterpillar introduces its first diesel engine, the Model Sixty.

- 1940s: Caterpillar's production shifts to support the war effort, producing military equipment such as tanks and bulldozers.

- 1950s: Caterpillar expands globally, establishing manufacturing facilities and distribution networks around the world.

- 1963: The company changes its name from Caterpillar Tractor Company to Caterpillar Inc.

- 1970s: Caterpillar faces significant challenges due to increased competition and economic recession.

- 1980s: Caterpillar restructures its operations and focuses on improving efficiency and profitability.

- 1990s: Caterpillar expands its product line to include electric power generation equipment and industrial gas turbines.

- 2000s: Caterpillar acquires several companies, including Perkins Engines, Solar Turbines, and Bucyrus International, to expand its product offerings and global reach.

- 2010s: Caterpillar launches initiatives to promote sustainability and reduce its environmental impact, including the development of hybrid and electric-powered machines.

- 2020: Caterpillar announces plans to consolidate its manufacturing facilities and reduce its workforce as part of a cost-cutting strategy.

References

- ^ https://www.caterpillar.com/en/news/corporate-press-releases/h/lithos-energy-investment.html

- ^ https://www.caterpillar.com/en/news/corporate-press-releases/h/luck-stone-collaboration.html

- ^ https://fintel.io/doc/sec-caterpillar-inc-18230-10k-2023-february-15-19403-8138

- ^ https://www.caterpillar.com/en/company/history.html