Dabur India Ltd

Overview

Dabur India Ltd. (NSE:DABUR) is one of India’s leading FMCG Companies with Revenues of over Rs 8,700 Crore & Market Capitalisation of over Rs 80,000 Crore. Building on a legacy of quality and experience of over 135 years, Dabur is today India’s most trusted name and the world’s largest Ayurvedic and Natural Health Care Company.1

Dabur India is also a world leader in Ayurveda with a portfolio of over 250 Herbal/Ayurvedic products. Dabur's FMCG portfolio today includes five flagship brands with distinct brand identities -- Dabur as the master brand for natural healthcare products, Vatika for premium personal care, Hajmola for digestives, Réal for fruit juices and beverages and Fem for fairness bleaches and skin care products.

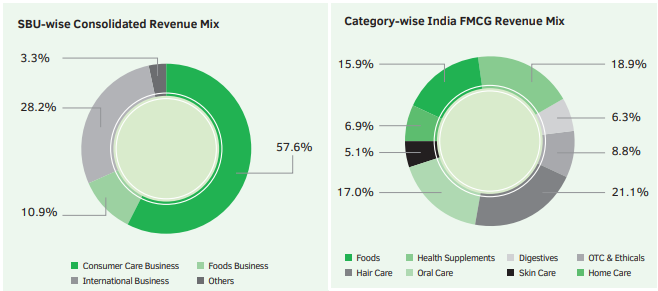

Dabur today operates in key consumer product categories like Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods. The ayurvedic company has a wide distribution network, covering 6.7 million retail outlets with a high penetration in both urban and rural markets.

Dabur's products also have huge presence in the overseas markets and are today available in over 100 countries across the globe. Its brands are highly popular in the Middle East, SAARC countries, Africa, US, Europe and Russia. Dabur's overseas revenue today accounts for over 27% of the total turnover.

The 135-year-old ayurvedic company, promoted by the Burman family, started operating in 1884 as an Ayurvedic medicines company. From its humble beginnings in the bylanes of Calcutta, Dabur India Ltd has come a long way today to become one of the biggest Indian-owned consumer goods companies with the largest herbal and natural product portfolio in the world. Overall, Dabur has successfully transformed itself from being a family-run business to become a professionally managed enterprise. What sets Dabur apart from the crowd is its ability to change ahead of others and to always set new standards in corporate governance & innovation.

Products

Dabur is home to over 400 trusted products and over 1,000 SKUs. In order to provide adequate focus and investment to key brands, Dabur has put in place a Power Brand strategy.2

Dabur has identified 9 Power Brands – Dabur Chyawanprash, Dabur Honey, Dabur Lal Tail, Dabur Honitus, Dabur Pudin Hara, Dabur Red Paste, Dabur Amla Hair Oil, Vatika and Réal fruit juice – that account for more than 70% of its total Sales.

A majority of these Power Brands fall in the Health Care space, where Dabur – as the country’s leading Natural and Ayurvedic Healthcare Company – has the right to win. With this strategy, Dabur seeks to not just grow the categories where it is currently a market leader, but also sizeably increase its presence and market share in some large categories where its brands are relatively smaller in size.

Manufacturing

Dabur has manufacturing facilities spread across 12 locations in India and 8 overseas. Known as the original custodian of Ayurveda, Dabur has been at the forefront of innovation to make the traditional knowledge of Ayurveda more contemporary and in sync with the changing needs and aspirations of millennials and centennials.3

Indian

- Alwar

- Baddi

- Jammu - Unit I , II & III

- Katni

- Narendrapur

- Newai

- New Jalpaiguri

- Nashik

- Pant Nagar - Unit I, Unit II

- Pithampur

- Sahibabad - Unit I,II & III

- Silvassa - Unit I & II

Overseas

- Dubai, UAE

- Egypt

- Bangladesh

- Nigeria

- London, United Kingdom

- United States

- Nepal

- Turkey

Industry Overview

Indian FMCG Sector

The Fast-moving Consumer Goods (FMCG) sector is the 4th largest sector of the Indian economy. During FY2019-20, the sector witnessed growth of 7.2% as per AC Nielsen, which is almost half of the 14% growth reported in FY2018-19.

The FMCG sector saw a sharp slowdown during the year on account of moderation in economic activity, low farm incomes and weak rural wage growth, liquidity crunch in the system, high unemployment levels and downtrading across categories. By March 2020, the sectoral growth dropped to 3.3% in value terms and 0.5% in volume terms.

The Corona virus pandemic has further impacted the sector since March 2020 due to restrictions on movement of goods, supply side bottlenecks and impact on consumption. Consumers have been stocking up essential products such as packaged foods, staples, tea, coffee, milk, detergents, and other products of daily usage. During this phase, demand has also surged for health and hygiene products as these aspects came into sharp focus. There was a surge in demand for hygiene products like sanitizers and disinfectants in addition to immunity building OTC and healthcare products. However, discretionary and nonessential items have seen weak demand as the focus during the lockdown has been on food and hygiene.

Outlook

Currently the path to recovery is still uncertain as the curve of infection has not yet flattened and there are more than 3,500 containment zones across the country.

The FMCG landscape is undergoing a sea change with the emergence of COVID-19, which is also impacting consumer behavior across markets and geographies. The company expect the following consumer trends to pick up in the post-COVID world:

- Increased consumer focus on healthcare, particularly preventive healthcare, with a preference for Ayurvedabased solutions that boost immunity

- Greater focus on Personal Hygiene with demand for hand and home sanitisers expected to grow exponentially

- Movement towards financial security to gain momentum

- Technology to act as a catalyst for convenient, safe and enhanced consumer experiences

The company also expect the industry to undergo recalibration of the supply chain and distribution network, with channels like e-commerce and Direct to Consumer gaining salience. Local kirana (grocery) stores have seen a resurgence as proximity and availability of products came into prominence. These retail outlets may become more organized, digitally enabled, and serviced directly. Recently, India’s Top 12 consumer goods companies, including Dabur India Ltd, have partnered with the government to convert millions of neighbourhood kirana stores into sanitised and safe retail outlets selling daily essentials. These kiranas will be called Suraksha Stores and linked to the government’s Aarogya Setu app. The companies, in addition to registering these outlets as Suraksha Stores, will help the kirana staff implement safety norms such as social distancing and sanitisation, and supply them sanitisers, masks and gloves. The government is targeting to bring 1 million stores under this category in the first phase. This is the one of the several steps that FMCG companies are taking to push demand and ensure that retail shelves remain stocked in the eventuality of the lockdown and its impact on trade channels persisting.

According to Nielsen, the effects of the disruptions caused by COVID-19 would linger on for the rest of the year, prompting the market researcher to slash its 2020 growth outlook for India’s FMCG sector to 5-6% from its earlier projection of 9-10%. It further stated said that the long-term effects of the pandemic will have widespread impact in the months to come. However, FMCG sector is one of those which will be less impacted than others as demand for consumer staples is expected to revive as situation begins to normalize.

Health Care Industry

In view of Covid-19 pandemic, the need to build immunity and fight illnesses has gained prominence, not just in consumer mind space but also among the medical fraternity.

The demand for Ayurvedic products has been on the rise for a few years now. As per a report by IMARC, released prior to the COVID pandemic spread, Indian Ayurvedic products market is expected to grow at a CAGR of 14% during 2019-2024.

A key factor driving the Indian ayurvedic products market is increasing popularity of natural and herbal medicines and their benefits among the consumers. Factors such as rising health concerns and awareness about the side-effects of western medicines is further driving the consumer preference for Ayurvedic products in the country. Furthermore, the distribution network of ayurvedic products have improved significantly, increasing the accessibility of these products across both urban and rural regions.

The spread of the COVID-19 pandemic has led to a sharper resurgence in consumer interest, awareness and demand for Ayurvedic therapies and medicines. Within a month of the outbreak, ‘Immunity’ became one of the most searched words on Google, reflecting the shift in consumer preference. The word ‘Immunity’ saw a 500% increase while ‘Vitamin C’ searches went up by over 150% in 2020. There is today a significant interest towards immunity building, health and hygiene products and the adoption rates are improving as well. The government through the Ministry of AYUSH has been encouraging citizens of India to use Ayurvedic products and practice Yoga to build immunity. As per an advisory issued on 31st March 2020, the AYUSH Ministry had, among other measures, recommended the following to boost immunity to fight illnesses:

- Take Chyawanprash 10gm (1tsp) in the morning. Diabetics were advised to take sugar free Chyawanprash.

- Drink herbal tea / decoction (Kadha) made from Tulsi (Basil), Dalchini (Cinnamon), Kalimirch (Black pepper), Shunthi (Dry Ginger) and Munakka (Raisin) - once or twice a day. Add jaggery (natural sugar) and / or fresh lemon juice to your taste, if needed.

- Golden Milk- Half tea-spoon Haldi (turmeric) powder in 150 ml hot milk - once or twice a day. (Source: Ministry of Ayush)

Home & Personal Care Industry

India’s home and personal care industry encompasses home care products like household cleaners, detergents, toilet cleaners and air fresheners and personal care products like hair oils, oral care products, skin care and cosmetics. With downtrading increasing across categories, most of the subsegments like Hair Care and Oral Care saw low single-digit growth in the full year 2019-20. India’s household care industry, on the other hand saw high single-digit growths on the back on rising awareness about health and hygiene.

Ever since the COVID outbreak, the consumer need for hygiene products – ranging from hand sanitisers to household disinfectants – has gone up significantly. According to Nielsen India, demand for such products jumped by nearly three-fold. To cater to this growing need, companies across sectors diversified into manufacturing hygiene products for sanitizing hands and personal spaces within homes. Dabur also advanced the launch of its hand sanitizer by nearly a quarter to mid-March, in order to meet the emerging need gap. Dabur has since expanded this portfolio with the introduction of air sanitisers, all-purpose disinfectants and sanitizing floor cleaners. This increasing awareness on personal hygiene, coupled with the rise in adoption of digital media, social media and e-commerce, consumption of home and personal care products is likely to sustain. Going forward, in the Covid-19 world, the company might see consumers spending more on essential personal care products and lesser on discretionary personal care products. Consumers are likely to increase focus on value for money with premium category likely to see a moderation. However, some of these trends may be temporary in nature and a rebound is likely to happen post Covid.

Foods Industry

The Food sector, which contributes to 57% of the overall FMCG market, comprises broad categories like packaged Atta, rice, edible oil, dairy products, beverages, baby food etc. During the year, this category witnessed growth of 8-9%. While the Food sector, riding on demand for consumer staples, has been growing at a good pace, the Juices & Nectars segment saw some pressure over the past year on account of downtrading by the consumers to lower priced alternatives such as milk-based and carbonated beverages/drinks. That said, the Juices & Nectars market is still heavily underpenetrated and has a huge headroom for growth by capitalizing on innovations both in formats and extensions.

Due to the extended lockdown in India, cooking at home was a big theme due to which convenience foods and cooking ingredients were in high demand. Dabur’s Culinary portfolio under the Hommade brand tapped the ‘Chef within households’ during the lockdown with a range of easy-to-prepare online recipes. These trends may get strengthened going forward as Covid effect is expected to last for a while.

Financial Overview

During fiscal 2019-20, the company recorded Consolidated Revenue from Operations of Rs 8,703.6 crore, compared to Rs 8.533.1 crore in fiscal 2018-19. In the nine months ended 31st December 2019, the growth in consolidated revenue from operations was 6.8%. The business was impacted in the last quarter of the year due to Covid-19 and the consequent lockdown which led to significant loss of sales in the second half of March ‘20.

Material cost in fiscal 2019-20 decreased by 40 bps primarily on account of material deflation. The advertisement and publicity expenditure for the year stood at 7.5% as against 7.1% in the previous year. Employee cost was steady at 10.9% of revenue from operations. Other expenses were also steady at 11.0% of revenue from operations.

The company’s operating profit grew by 3.0% to reach Rs 1,792.4 crore. The operating margins continue to remain healthy at 20.6% as against 20.4% in the previous year. Profit After Tax (PAT) was Rs 1,445 crore in fiscal 2019-20. Excluding the exceptional items in fiscal 2019-20 and fiscal 2018-19, growth in PAT was 5.8%. Diluted EPS for fiscal 2019-20 was at Rs 8.15.

Working capital employed in the business remained steady at 29.7 days during the year. There was a slight increase in Inventories from 55.6 days to 57.9 days and reduction in Trade Receivables from 35.7 days to 33.9 days. Trade Payables were steady at 62.1 days.

ROIC and Return on Net Worth decreased on account of the investment base increasing at a faster pace compared to the profits during the year.

The business generated Net Cash flow from Operations of Rs 1,613 crore in fiscal 2019-20. Capital Expenditure of Rs 377 crore was incurred during the year which includes the expenditure on domestic as well as overseas manufacturing facilities. The net cash available with the company as on 31st March 2020 was Rs 3,802 crore and the total debt amounted to Rs 335 crore. Table 4 reflects the cash and debt position of the company.

In fiscal 2019-20, the company declared annual dividend of Rs 3.0 per share. Total dividend payout during the year including dividend tax for the year was Rs 580.98 crore which takes the dividend payout ratio to 40.2%.

Outlook

FY 2019-20 started on a strong footing with double digit growth in the first quarter but the slowdown in key categories through the year impacted full year growths. This was further exacerbated by the lockdown imposed by the government in the second half of March 2020 to curtail the spread of Covid-19.

At this point of time, the company see the FY 2020-21 revenue and profitability being impacted on account of weak first quarter due to the continued lockdowns in the first two months of the current fiscal. The company is seeing signs of recovery emerging in the month of June, but the situation is too volatile and dynamic at this point of time to be able to extrapolate the full year.

Recent developments

November 3, 2020; Dabur India Q2 2020-21 FMCG Revenue Surges 19.8%.4

The Board of Directors of Dabur India Ltd (DIL) met here today to consider the unaudited financial results of the company for the quarter ended September 30th, 2020.

Dabur India Ltd reported a strong growth in its performance for the second quarter of 2020-21, backed by sustained efforts in driving demand for its Ayurvedic Healthcare, Hygiene and Nutrition products, coupled with strong innovation to meet the emerging consumer needs in the wake of the COVID pandemic. Dabur ended Q2 2020-21 with a 13.7% growth in Consolidated Revenue at Rs 2,516 Crore, up from 2,212 Crore a year earlier. This is the highest Revenue growth reported by the Company in the last couple of years.

Consolidated Net Profit for Q2 of 2020-21 surged 19.5% to Rs 481.7 Crore as against Rs 403 Crore a year earlier.

Dabur’s India FMCG Business led the growth with a 19.8% surge, with an underlying FMCG Volume Growth of 16.8% during the Second Quarter of 2020-21. Dabur’s Standalone Net Profit grew 20.6% to Rs 392.7 Crore as against Rs 325.5 Crore a year earlier.

“While COVID-19 continues to impact people around the world, Dabur India Ltd’s strategic business transformation exercise to develop and implement aggressive growth strategies in the core business areas and successfully address the emerging challenges helped it deliver a healthy topline growth accompanied by an expansion in Margin. The company's domestic Healthcare business reported a strong 49% growth, with the recent consumer-relevant innovations contributing to around 5-6% of its Revenue. The company's International Business has also staged a smart recovery and reported a growth of 5.5% despite the key GCC market continuing to face macro-economic headwinds,” Dabur India Limited Chief Executive Officer Mr. Mohit Malhotra said.

Dabur, Mr. Malhotra said, continued to focus on strengthening its core Healthcare portfolio with the introduction of new innovations, coupled with heavy investments behind its Power Brands and expanding its distribution might. This has enabled the Company to grow ahead of categories and gain market share across the portfolio. As Dabur continued to move forward on its distribution expansion strategy in the hinterland, rural demand grew ahead of urban. Favourable Monsoon and enhanced stimulus announced by the Government as part of its overall thrust on boosting rural Economy is expected to further drive rural demand in the coming months. The e-commerce business for Dabur grew by over 200% in Q2 of 2020-21 and today has a saliency of 6% as compared to 2.1% a year earlier.

Category growths

“Healthcare, particularly the portfolio of its immunity-boosting products, continues to be the outperformer for Dabur. This is also in line with its strategy of focusing on the Consumer Health categories. The Home & Personal care business also reported a recovery, growing by high single digits, while the domestic Foods Business saw a strong revival with in-home consumption returning to near normal levels. However, this category was impacted by the continued closure of Hotels, Restaurants and Institutional businesses,” Mr. Malhotra said.

The Health Supplements business for Dabur reported a 70.8% growth during Q2 of 2020-21. The Ayurvedic OTC range grew by over 56% while the Ayurvedic Ethicals business ended Q2 with an over 26% growth. While the traditional Skin Care business continued to face headwinds, the strong demand for its newly launched Personal Hygiene products range helped the overall category end the quarter with an over 38% growth. Dabur’s Oral Care Sales was up over 24% with its flagship Dabur Red Paste reporting strong double-digit growth. The Shampoo business, on the back of strong demand for Vatika Shampoo, grew by nearly 18% in Q2.

Dividend

The Board of Directors of Dabur India Ltd declared an interim dividend of 175% for 2020-21. “Continuing with its payout policy, the Board has declared an interim dividend of Rs 1.75 per share, aggregating to a total payout of Rs 309.30 Crore,” Dabur India Ltd Chairman Amit Burman said.

The Board of Directors also announced the appointment of Mr. Mukesh Hari Butani as an additional director in the category of Non-Executive Independent Director on the Board of Dabur India Ltd with effect from January 01, 2021, for a term of five years. Mr. Butani is the founder of BMR Legal Advocates, an independent law firm specializing in Tax Policy, Advocacy & Disputes.

October 22, 2020: Dabur Honey appoints Ritabhari Chakraborty as its Brand Ambassador. 5

Dabur India Ltd today announced the signing of Tollywood Diva Ritabhari Chakraborty as the new Regional Brand Ambassador for its iconic brand Dabur Honey, the World’s No. 1 Honey brand.

Dabur Honey has also unveiled a new campaign “Aaj theke shudhu, chini noy, madhu”, featuring Ritabhari Chakraborty, featuring a famous Bengali song by Asha Bhonsle “Jaabo ki jaabo na”. The campaign, in an endearing manner, aims to create awareness about the importance of Honey for health and promotes Dabur Honey – with 18% less calories, its immunity boosting properties and the presence of Antioxidants and Minerals – as a healthier alternative to sugar.

“Dabur is excited to have Ritabhari Chakraborty as Dabur Honey’s new regional face. This is a step forward by the brand in move to regionalize its content for different markets, basis regional consumer insights. Bengalis love their “Mishti”, so the company want to nudge the consumers to make their Mishti healthier with Dabur Honey. Dabur Honey has always stood for health and has constantly nudged the consumer to adopt Honey in their daily diet, be it by way of having Dabur Honey with warm water everyday morning or as an additive in food and breakfast items or as a replacement for sugar. Dabur Honey not only helps in reducing calories but also helps in boosting immunity. With Ritabhari Chakraborty’s association with the brand, the company hope that more and more consumers will get inspired by her healthy lifestyle and adopt Dabur Honey in their lives,” Dabur India Ltd Category Head Mr. Kunal Sharma said.

Commenting on her association with the brand, Ritabhari Chakraborty said: “I am very happy start this association with Dabur Honey. I have been a regular user of Dabur Honey since a long time and it is an integral part of my daily routine. In current times, it is important that the company all adopt healthier alternatives of food in its life hence I found this new campaign by Dabur to be something that I would want to communicate to Bengali consumers.”

As part of this campaign, Dabur Honey is also collaborating with many mishti shops in Kolkata during this Durga Puja to sell Honey-based mishti range from their outlets. These shops include Nalin Chandra Das & Sons, Balaram Mullick & Radharaman Mullick, Hindustan Sweets, Ganguram Sweets and several others. The company will be sampling these healthy Dabur honey-based mishti so that consumers can taste these first and then purchase the same.

References

- ^ https://www.dabur.com/in/en-us/about/aboutus/dabur-ayurvedic-company

- ^ https://www.dabur.com/img/upload-files/3244-Dabur-IR-2019-20.pdf

- ^ https://www.dabur.com/in/en-us/about/Contact-Information/Factories

- ^ https://www.dabur.com/in/en-us/media/dabur-india-q2-2020-21-fmcg-revenue-surges-19-8

- ^ https://www.dabur.com/in/en-us/media/dabur-honey-appoints-ritabhari-chakraborty-as-its-brand-ambassador