Devon Energy Corp

Summary

- Devon Energy Corporation is a leading independent oil and natural gas exploration and production company.

- Devon's operations are focused onshore in the United States.

Devon Energy Corporation (NYSE: DVN, LSE: 0I8W) is a leading independent oil and natural gas exploration and production company. Devon's operations are focused onshore in the United States.

Devon's fourth quarter 2022 daily production was approximately 315,000 barrels of oil, about 150,000 barrels of natural gas liquids and more than 1 billion cubic feet of natural gas.

Recent Developments

Fervo Energy Announces Investment from US Oil and Gas Leader Devon Energy1

18 April 2023; Fervo Energy the next-generation leader in geothermal technology, today announced a $10 million strategic investment from Devon Energy Corporation (NYSE: DVN). The investment initiates a partnership between two technical leaders and applies Devon’s 50-plus years of innovation in oil and gas to Fervo’s advanced geothermal capabilities.

Fervo is the first geothermal company to successfully drill and complete a horizontal well pair for commercial geothermal production – leveraging technologies, skills and processes pioneered by Devon for oil and gas production.

Financial Highlights

Second-Quarter 2023 Results2

Oil production averaged 323,000 barrels per day in the second quarter, an increase of 8 percent from the year-ago period. This record-setting oil volume performance was driven by the company’s Delaware Basin asset and accretive bolt-on acquisitions that closed in second half of last year. Total production averaged 662,000 oil-equivalent barrels (Boe) per day for the quarter.

The company’s operating costs, which consists of production expenses, general and administrative (G&A) expenses and financing costs, totaled $14.75 per oil-equivalent barrel (Boe), a 6 percent improvement compared to the 2022 average. The improvement in per-unit costs resulted from a reduction in production taxes, financing expense and administrative costs.

Devon reported net earnings of $690 million, or $1.07 per diluted share, in the second quarter of 2023. Adjusting for items analysts typically exclude from estimates, the company’s core earnings were $755 million, or $1.18 per diluted share.

Devon’s operating cash flow totaled $1.4 billion in the second quarter. This level of cash flow funded all the company’s capital requirements and resulted in $326 million of free cash flow for the quarter.

At the end of the second quarter, the company had a cash balance of $488 million and an undrawn credit facility of $3 billion. Outstanding debt totaled $6.4 billion and the company’s net debt-to-EBITDAX ratio was 0.7 times. Subsequent to quarter-end, Devon retired $242 million of outstanding debt upon maturity.

Company Overview

Devon (NYSE: DVN) is an independent energy company engaged primarily in the exploration, development and production of oil, natural gas and NGLs. The company's operations are concentrated in various onshore areas in the U.S.3

On January 7, 2021, Devon and WPX completed an all-stock merger of equals. WPX was an oil and gas exploration and production company with assets in the Delaware Basin in Texas and New Mexico and the Williston Basin in North Dakota.

Devon Energy is a leading independent energy company engaged in finding and producing oil and natural gas. Based in Oklahoma City, the company operates in several of the most prolific oil and natural gas plays in the U.S. with an emphasis on achieving strong returns and capital-efficient cash-flow growth.

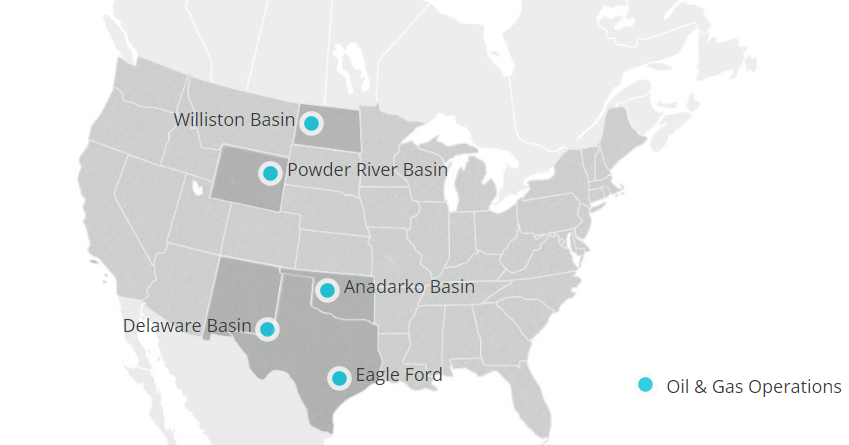

Devon's operations are focused in five core areas: the Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin and Williston Basin. The company's assets in these top-tier resource plays provide a deep inventory of opportunities.

Delaware Basin

The Delaware Basin is its largest and most active program in the portfolio with operations in southeast New Mexico and across the state line into west Texas. The company acquired additional acreage in the Delaware Basin through the Merger, creating an industry leading position in this basin. Through capital efficient drilling programs, it offers exploration and low-risk development opportunities from many geologic reservoirs and play types, including the oil-rich Wolfcamp, Bone Spring, Avalon and Delaware formations. With a significant inventory of oil and liquids-rich drilling opportunities that have multi-zone development potential, Devon has a robust platform to deliver high-margin drilling programs for many years to come. At December 31, 2022, the company had 16 operated rigs developing this asset in the Wolfcamp and Bone Spring formations. The Delaware Basin is its top funded asset and is expected to receive approximately 60% of its capital allocation in 2023.

Anadarko Basin

Anadarko Basin development, located primarily in western Oklahoma’s Canadian, Kingfisher and Blaine counties, provides long-term optionality through its significant inventory. The company's Anadarko Basin position is one of the largest in the industry, providing visible long-term production. Devon Energy has an agreement with Dow to jointly develop a portion of its Anadarko Basin acreage and, as of December 31, 2022 the company had a four operated rig program associated with this joint venture.

Williston Basin

The company acquired its position in the Williston Basin through the Merger in 2021. It is located entirely on the Fort Berthold Indian Reservation in North Dakota, and its operations are focused in the oil-prone Bakken and Three Forks formations. The company's Williston Basin asset is a high-margin oil resource located in the core of the play and generated substantial cash flow in 2022. In July 2022, the company acquired additional producing properties and leasehold interests in the Williston Basin that are complementary to its existing acreage, offer operational synergies and added high-quality inventory to its asset portfolio. At December 31, 2022, the company had two operated rigs developing this asset.

Eagle Ford

Eagle Ford operations are located in Texas' DeWitt and Karnes counties, situated in the economic core of this south Texas play. Its production is leveraged to oil and has low-cost access to premium Gulf Coast pricing, providing for strong operating margins. In September 2022, the company acquired additional producing properties and leasehold interests in the Eagle Ford that are complementary to its existing acreage, offer operational synergies and added high-quality inventory to its asset portfolio. At December 31, 2022, the company had two operated rigs developing this asset.

Powder River Basin

This asset is focused on emerging oil opportunities in Wyoming's Powder River Basin. Devon Energy is currently targeting several Cretaceous oil objectives, including the Turner, Parkman, Teapot and Niobrara formations. Recent drilling success in this basin has expanded its drilling inventory, and the company expect further growth as the company accelerate activity and continue to de-risk this emerging light-oil opportunity. At December 31, 2022, the company had one operated rig targeting the Turner, Parkman, Teapot and Niobrara formations in northern Converse County.

Company History

Devon Energy Corp. a Delaware corporation formed in 1971 and publicly held since 1988.4

| Year | Milestone |

| 1950 | Devon co-founder John Nichols creates the first public oil and gas drilling fund registered with the Securities and Exchange Commission. |

| 1988 | Devon becomes a public company, listing on the American Stock Exchange under the ticker symbol DVN. |

| 1989 | Devon pioneers the production of coalbed natural gas in the San Juan Basin |

| 1992 | Acquisition of Hondo Oil & Gas for $122 million sets the stage for a series of major acquisitions in the years to come. |

| 1996 | Devon acquires Kerr-McGee's North American onshore oil and gas properties for $250 million, increasing the company's reserves by 46% |

| 1998 | Devon acquires Northstar Energy Corporation for $750 million, creating a top 15 U.S. - based independent. |

| 1999 | Devon acquires Northstar Energy Corporation for $750 million, creating a top 15 U.S. - based independent. |

| 2000 | Devon merges with Santa Fe Snyder Corporation creating a top five U.S. - based independent. The $3.5 billion transaction expands Devon's international presence. |

| 2001 | Acquisition of Anderson Exploration Ltd. for $4.6 billion positions Devon as the third-largest independent gas producer in Canada. |

| 2002 | Devon acquires Mitchell Energy & Development Corp. for $3.5 billion, adding the prolific Barnett Shale in north Texas to its portfolio and establishing the company as a leading independent processor of natural gas and natural gas liquids. |

| 2003 | Devon's $5.3 billion merger with Ocean Energy Inc. creates the largest U.S. -based independent oil and gas producer with 4,000 employees worldwide. |

| 2004 | Devon declares a two-for-one stock split and transfers its common stock listing to the New York Stock Exchange. |

| 2006 | Devon acquires the oil and gas properties of Chief Holdings LLC. The $2.2 billion transaction expands Devon's dominant position in the Barnett Shale. |

| 2015 | Devon acquires the oil and gas properties of Chief Holdings LLC. The $2.2 billion transaction expands Devon's dominant position in the Barnett Shale. |

| 2016 | Devon completes its acquisition of Felix Energy for $1.9 billion. The transaction secures 80,000 net acres in the most economic portion of the STACK oil play in Western Oklahoma, further expanding the company’s development drilling inventory. |

| 2018 | Devon completes the sale of ownership interests in EnLink Midstream to Global Infrastructure Partners (GIP), a leading global, independent infrastructure fund manager for $3.125 billion. In conjunction with the EnLink transaction, Devon’s board of directors authorized an increase in the company’s share-repurchase program to $4 billion. |

| 2019 | Devon completes the sale of its Canadian business to Canadian Natural Resources, Ltd., for US $2.8 billion. This move is part of the company's transformation to a U.S. oil growth company. |

| 2021 | Devon Energy and WPX Energy combine in a merger of equals, creating a leading energy company. The combined company, named Devon Energy, benefits from enhanced scale, improved margins, higher free cash flow and the financial strength to accelerate the return of cash to shareholders through an industry-first “fixed plus variable” dividend strategy. |

References

- ^ https://www.devonenergy.com/news/2023/Fervo-Energy-Announces-Investment-From-US-Oil-and-Gas-Leader-Devon-Energy

- ^ https://s2.q4cdn.com/462548525/files/doc_financials/quarterly/2023/q2/Q2-2023-DVN-Earnings-Release.pdf

- ^ https://s2.q4cdn.com/462548525/files/doc_financials/2022/ar/dvn-2022-10-k-final.pdf

- ^ https://www.devonenergy.com/about-us/history