FMC Corporation

Summary

- FMC Corporation is a global agricultural sciences company that was established as the Bean Spray Pump Company in Los Gatos, California, by John Bean, a chemist, in 1883.

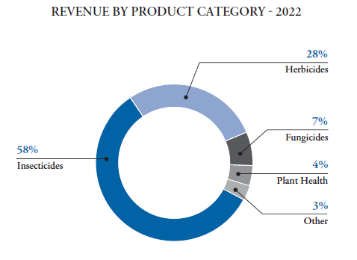

- FMC's portfolio is composed of three major pesticide categories: insecticides, herbicides, and fungicides. The majority of its product lines are dedicated to insecticides and herbicides.

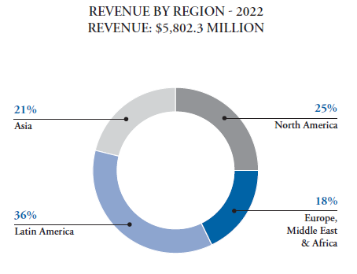

- The company operates its business in all the major regions including North America, Latin America, Asia, and EMEA (Europe, Middle East, and Africa).

- Several products within its portfolio are based on patent-protected active ingredients. It also owns many trademarks that enjoy recognition from customers and product end-users.

- In the year 2022, the company's sales reached a total of $5,802.3 million. This marked an increase of $757.1 million or 15% compared to the sales figure of $5,045.2 million recorded in 2021.

- The company's gross profit for 2022 stood at $2,326.8 million, reflecting a difference of $155.1 million or 7.1% from the gross profit of $2,171.7 million in the previous year.

- The company's operating income for the year amounted to $1,237.4 million, surpassing the operating income of $1,152.9 million in 2021 by $84.5 million or 7.3%.

- The net income for 2022 is $741.5 million and 2021 is $737.1 million.

Brief Company Overview

FMC Corporation (NYSE: FMC) is a global agricultural sciences company that assists growers in producing food, feed, fiber, and fuel. It provides products from its wholly owned five active ingredient plants, 16 formulation and packaging sites, and sells them in approximately 120 countries. The company operates a total of 21 manufacturing plants worldwide and has established its own manufacturing and distribution infrastructure, along with a supply chain1 that facilitates its operations. The company is headquartered in Philadelphia, Pennsylvania.

FMC Corporation (NYSE: FMC) is a global agricultural sciences company that assists growers in producing food, feed, fiber, and fuel. It provides products from its wholly owned five active ingredient plants, 16 formulation and packaging sites, and sells them in approximately 120 countries. The company operates a total of 21 manufacturing plants worldwide and has established its own manufacturing and distribution infrastructure, along with a supply chain1 that facilitates its operations. The company is headquartered in Philadelphia, Pennsylvania.

FMC's portfolio is composed of three major pesticide categories: insecticides, herbicides, and fungicides. The majority of its product lines are dedicated to insecticides and herbicides, with a growing portfolio of fungicides primarily utilized in high-value crop segments. The company possesses its own sales and marketing department and accesses the market through a combination of distributors, retailers, and co-ops across all four regions: North America, Latin America, Asia, and EMEA (Europe, Middle East, and Africa). Furthermore, FMC also directly sells to large growers in select countries through alliances and targeted marketing initiatives.

As of August 2023, the company had a 52-week share price range of $86.61 to $134.38. The trailing P/E ratio of the company is 15.51 times, the price-to-sales ratio (ttm) is 2.10 times, the profit margin is 11.60%, the operating margin is 19.87%, the return on assets (ttm) is 5.79%, the return on equity is 22.48%, and the diluted earnings per share (ttm) is $6.46. The aggregate market value of voting stock held by non-affiliates as on June 30, 2023 is $13,407,027,345. There were 125,110,804 of the registrant's common shares outstanding.

Recent Developments

- In 2022, FMC Ventures increased its investment in Micropep2, a startup developing short natural peptide molecules that target and regulate plant genes and proteins. The venture capital arm also agreed to an investment in Traive, an Ag-FinTech startup addressing working capital needs of growers in Brazil. FMC Ventures continues to scout for and invest in game changing innovations that shape the future of crop protection.

- On June 29, 2022, FMC announced a definitive agreement to acquire BioPhero ApS ("BioPhero")3 a Denmark-based pheromone research and production company. The acquisition adds state-of-the-art biologically produced pheromone insect control technology to its product portfolio and R&D pipeline. It is expected that pheromones and pheromone-based products will contribute approximately $1 billion in revenue at above company-average EBITDA margin by 2030. The purchase price of approximately $193 million was primarily paid at closing on July 19, 2022.

- In 2022, the company launched Onsuva™ fungicide which is based on the Fluindapyr active in Argentina and Paraguay. Onsuva™ fungicide targets diseases in soy and peanut crops.

Recent Financing Activities

- On June 17, 2022, FMC amended their Revolving Credit Facility. Amendment primarily increased the borrowing capacity from $1.5 billion to $2 billion and extended the maturity date by an additional year to 2027. As of

- Outstanding commercial paper increased from $244.1 million at December 31, 2021 to $370.5 million at December 31, 2022.

Financial Performance Highlights

Q2 2023 Highlights

In the second quarter of 2023 ended in 29 June 2023, FMC reported sales of $1,014.5 million, compared to $1,452.3 million in the same period of 2022. Net income for the second quarter of 2023 amounted to $52 million, a decrease from $145 million in the second quarter of 2022. Diluted earnings per share (EPS) were $0.24 in the second quarter of 2023, down from $1.06 in the same quarter of 2022. Despite a 3 percent increase in price, FMC's sales were impacted by a 2 percent foreign currency headwind, contributing to the drop in overall sales. Notably, the demand for the company's innovative products showed resilience. Among FMC's product portfolio, branded diamides outperformed other products, although a decrease in partner sales primarily drove the decline in diamide volumes. The negative impact from the volume decrease outweighed the gains made from improved year-over-year prices and cost management. On a positive note, costs became a positive driver of net income for the first time since 2020, which contributed to the company's financial performance. However, foreign exchange (FX) rates posed a headwind to both adjusted net income and EPS, impacting the company's earnings.

Annual Performance Highlights

In the year 2022, the company's sales demonstrated substantial growth, reaching a total of $5,802.3 million. This marked a significant increase of $757.1 million or 15% compared to the sales figure of $5,045.2 million recorded in 2021. The company's gross profit for 2022 stood at $2,326.8 million, reflecting a difference of $155.1 million or 7.1% from the gross profit of $2,171.7 million in the previous year, 2021. Furthermore, the company's operating income exhibited an upward trend in 2022. The operating income for the year amounted to $1,237.4 million, surpassing the operating income of $1,152.9 million in 2021 by $84.5 million or 7.3%. The net income for 2022 is $741.5 million and 2021 is $737.1 million. Moreover, the diluted earnings per share (EPS) for the year 2022 were reported as $5.81. This figure represented an increase of $2.19 or 60.4% compared to the diluted EPS of $3.62 recorded in 2021.

Revenue of $5,802.3 million increased $757.1 million, or approximately 15 percent versus the prior year period. The increase was driven by higher volumes, which accounted for an approximate 11 percent increase, as well as favorable pricing which accounted for an approximate 7 percent increase. Volume growth was primarily driven by Latin America and North America. Foreign currency tailwinds had an unfavorable impact of approximately 3 percent on revenue. Excluding foreign currency impacts, revenue increased approximately 18 percent.

Gross margin of $2,326.8 million increased by $165.5 million, or approximately 8 percent versus the prior year period. The increase was primarily due to top line revenue growth which was partially offset by higher costs due to rising input costs from inflationary pressures and foreign currency headwinds. Gross margin percent of approximately 40 percent decreased from 43 percent in the prior year period, driven by significant cost headwinds, primarily due to input cost inflation, and foreign currency headwinds.

Net income increased to $741.5 million from $737.1 million. The higher results were driven by higher revenues and margins. However, these increases were mainly offset by higher selling, general and administrative costs, interest expense, income taxes, and discontinued operations expenses.

The cash required by operating activities of discontinued operations in 2022 is primarily attributed to environmental spending of $47.0 million and $30.6 million for other postretirement benefit liabilities, self-insurance, and long-term obligations related to legal proceedings. This spending trend was similar in 2021. Moving to investing activities, cash provided (required) by investing activities of continuing operations was $(266.4) million in 2022 and $(131.7) million in 2021. In 2022, this usage of cash primarily stems from capital expenditures for increased capacity and the consideration paid for the BioPhero acquisition, with increased capital expenditures due to capacity expansion, offset by proceeds from the disposition of land from a previously shutdown manufacturing facility. Similarly, in 2021, cash required is linked to capital expenditures and contract manufacturing arrangements, with reduced payments related to the completion of the SAP system implementation. Cash provided (required) by financing activities was $(237.4) million in 2022, reflecting changes driven by lower share repurchases under the publicly announced program and lower repayments on long-term debt. In 2021, cash required by financing activities was $(747.9) million, primarily influenced by higher share repurchases and debt repayments.

Business Overview

FMC engages in the production and distribution of insecticides, herbicides, and fungicides, alongside biologicals, crop nutrition, seed treatment products under the plant health category, and digital precision agriculture solutions. It also maintains direct relationships with major growers in specific countries to offer customized solutions and agro production support. For providing customized products and services, it sometimes utilizes distributors, retailers, and co-operatives as part of its collaboration-based approach. Its operations are divided into four basic regions, namely North America, Latin America, Asia, and EMEA (Europe, Middle East, and Africa). Due to the differing climates, agricultural natures, and challenges of agro based product production, FMC provides region-specific products for revenue generation.

The company's crop protection chemicals, seed treatments, and digital agriculture solutions are popular in North America. Latin America's agricultural markets often require solutions that address tropical climates, varied pest pressures, and a range of crops. FMC's presence in this region is characterized by offering tailored solutions and collaborating closely with local partners. The EMEA region encompasses diverse agricultural systems, and for this region, FMC offers the widest range of products. Asia-Pacific is home to some of the world's most populous and agriculturally significant countries. FMC provides products in this region that combat pests and enhance plant health.

Its portfolio comprises three pivotal pesticide categories: insecticides, herbicides, and fungicides. The following illustration depicts the relative popularity of each segment.

Insecticides: Insecticides serve to control a broad spectrum of pests. FMC's insecticide product portfolio highlights two pivotal diamide-class molecules—Rynaxypyr® (chlorantraniliprole) and Cyazypyr® (cyantraniliprole) actives—with a combined annual revenue of approximately $2.1 billion in 2022. These molecules stand as industry leaders due to their exceptional performance, combining highly effective low dose rates with fast-acting, systemic, and long-lasting control. The attributes of these molecules swiftly established Rynaxypyr® as the foremost insect control technology globally, with expectations of its continued robust growth despite the composition of matter patents for Rynaxypyr® expiring in certain countries as of late 2022. FMC's Cyazypyr® active, a second-generation diamide, is on a rapid growth trajectory as it secures more product registrations. The company anticipates strong ongoing growth for Cyazypyr® active, even as its composition of matter patents start expiring in the mid-2020s. This projection is founded on the patent estate, key patent milestones timing, and other essential factors that will facilitate FMC's continued profitable expansion of the diamide franchise well beyond these patent expirations. Critical elements supporting diamide growth include registration and data protection, strategic commercial approaches, brand recognition, and the intricacies of manufacturing and supply chain management.

Herbicide: FMC's herbicide portfolio is chiefly aimed at addressing a diverse range of challenging-to-manage weeds. Its innovative crop protection solutions empower growers, crop advisors, turf specialists, and herb management professionals to effectively tackle their most formidable obstacles in a cost-efficient manner. This segment contributes significantly to FMC's revenue, accounting for approximately one-fourth of the total. In 2022, herbicides accounted for 28% of FMC's revenue, making it a prominent contributor across all operational regions, particularly notable in North America.

Fungicide and others: Fungicides are substances, either chemical or biological, employed to control or prevent the proliferation and spread of fungi on plants, crops, and other materials. Fungi can lead to a variety of plant diseases, resulting in diminished crop yields, quality degradation, and economic losses. Fungicides assume a pivotal role in agricultural and horticultural practices by effectively managing fungal infections and upholding plant health. Notably, flower producers, orchard proprietors, and commercial vegetable growers constitute the primary purchasers of these products. The demand for FMC's fungicides is on the rise, notably in Latin America and North America. Additionally, FMC offers a comprehensive Plant Health program encompassing biologicals, crop nutrition, and seed treatment products. The biological technologies developed by FMC's dedicated R&D team in Denmark exhibit impressive sustainability profiles, serving as robust complements to synthetic products. FMC's biologicals are characterized by attributes such as high stability, extended shelf life, minimal usage rates, and compatibility with other chemical agents.

In 2022, FMC achieved a balanced revenue distribution across its regions. Latin America led with 36% of total revenue, showcasing a substantial 28% growth due to strong volumes and price increases, notably in Brazil and Argentina. Asia contributed 21% despite a slight decline, but excluding currency effects, it grew by about 5%. North America accounted for 25% and experienced significant 29% growth, driven by effective pricing and robust sales of herbicides, insecticides, and fungicides. EMEA contributed 18%, with approximately 12% growth after excluding currency impacts, driven by strong pricing, volume growth in Northern Europe, and demand for selective herbicides and diamides.

Other Business Information

FMC is also among the world's patent-based agrochemical producers. Several products within its portfolio are based on patent-protected active ingredients. It also owns many trademarks that enjoy recognition from customers and product end-users. Unlike patents, ownership rights in trademarks can be perpetuated indefinitely, as long as the trademarks are properly utilized and renewal fees are paid. FMC actively monitors and manages its patents and trademarks to uphold its rights in these assets.

The FMC diamide insect control patent estate comprises numerous patent families covering various aspects: Composition of matter – including active ingredients and specific intermediates; Manufacturing processes – spanning both active ingredients and certain intermediates; Formulations; Uses; and Applications. As of December 31, 2022, FMC had 33 families with granted patents filed in up to 76 countries. The total count of active granted patents reached 727, along with numerous pending patent applications.

FMC's process patents encompass the manufacturing processes for both active ingredients – chlorantraniliprole and cyantraniliprole – as well as key intermediates used in creating the final products. Chlorantraniliprole's production involves a complex molecule, necessitating 16 distinct steps; FMC holds granted patents covering many of these 16 process steps and several intermediate chemicals. Additional facets of the manufacturing processes are protected through trade secrets. Cyantraniliprole follows a similar pattern, with a comparable scope of intellectual property protection. Numerous intermediate process patents extend well beyond the expiration of the composition of matter patents, some even stretching until the end of this decade. Furthermore, FMC possesses formulation patents that encompass the application of chlorantraniliprole or cyantraniliprole in specific formulations integral to commercially significant end-use products.

During the third quarter of 2022, FMC made certain accounting policy changes for inventory costing and net periodic pension plan cost. The effects of these changes in accounting principle have been retrospectively applied to all periods presented and as such certain prior period amounts have been adjusted. Impacts to its Consolidated Statements of Income (Loss) were not material.

Company History

FMC Corporation, headquartered in Philadelphia, Pennsylvania, is an American chemical manufacturing company that traces its origins back to its establishment as an insecticide producer in 1883. Presently, FMC's operations span across all continents. Many widely recognized insecticides, herbicides, and fungicides are exclusively patented by this corporation.

Founded in 1883 as the Bean Spray Pump Company in Los Gatos, California, by chemist John Bean, the company's initial product was a piston pump designed for spraying insecticide on the numerous fruit orchards in the vicinity. Notably, in 1901, John Bean, at the age of 82, developed the Magic Pump, a vertical pump that surpassed other pumps on the market in terms of pressure.

Key Milestones:

In 1904, the Bean Spray Pump Company was incorporated.

By 1928, the company had been renamed the John Bean Manufacturing Company, and its stock was introduced on the San Francisco Exchange. It became the world's largest food machinery manufacturer after acquiring Anderson-Barngrover Co. and Sprague-Sells.

In 1943, FMC entered the chemical business through the acquisition of Niagara Sprayer & Chemical Co., specializing in insecticides and fungicides.

In 1948, FMC underwent a significant transformation, acquiring Westvaco Chemical Corp., a move that facilitated its production of organic insecticides and pesticides.

In 1958, FMC expanded its operations globally, forming joint ventures in Japan and Brazil for the manufacture of hydrogen peroxide and obtaining licenses for chemical production in Argentina and petroleum equipment production in Mexico and Japan.

In 1961, the company adopted its current name, FMC Corporation, and later restructured its chemical businesses into three divisions: Inorganic, Organic, and Niagara.

Reaching a significant milestone, FMC's revenues surpassed $1 billion in 1966.

Throughout the years, FMC continued to diversify its business, entering the lithium, agricultural, and pharmaceutical sectors, among others.

In 2001, FMC underwent a restructuring, dividing into two separate publicly traded companies: FMC Technologies (machinery business) and FMC Corporation (chemicals business).

In 2010, Pierre Brondeau became President and CEO, later elected as Chairman in 2011.

Notable acquisitions include select Bayer fungicides, Cheminova A/S, and DuPont's crop protection assets, all of which contributed to the expansion and enhancement of FMC's global presence.

In 2018, FMC focused on becoming an Agricultural Sciences Company, initiating the separation of its Lithium business.

References

- ^ https://gcaptain.com/fmc-improves-container-data-sharing-to-address-supply-chain-bottlenecks/

- ^ https://www.nasdaq.com/articles/fmc-micropep-technologies-in-deal-to-co-develop-bioherbicide-solutions

- ^ https://www.prnewswire.com/news-releases/fmc-corporation-completes-acquisition-of-biophero-aps-301589023.html